Gift Novelty Souvenir Shop Business Plan

Yeti Card & Gifts is an established retail business that offers a wide range of cards and gifts. Yeti opened two years ago as a retail gift store specializing in Asian gifts and home decor. Yeti quickly out-grew its original space and is now located in the Wigman Hospital/Physicians & Surgeons South Building, open Monday through Saturday 10 am – 6 pm. Yeti is currently finishing tenant improvements on their second location in University Heights, with the grand opening slated for July 4th.

The Market

Yeti has successfully appealed to two target market segments. The first is university students who are looking to use their disposable income for fun and functional products. There are over 38,833 potential customers in this segment. The second segment is comprised of university faculty, staff, Wigman Hospital staff, and the greater Cleveland Heights/University Heights community, who want a safe and friendly atmosphere that provides a sense of nostalgia mixed with youthful excitement. This segment has over 191,590 potential customers.

Competitive Edge

Yeti’s competitive edge lies in their ability to effectively serve both market segments. They achieve this through a wide product selection that appeals to both target markets and by maintaining a high level of customer service. This combination creates an atmosphere that is edgy but comfortable, making all customers feel welcome and catered to.

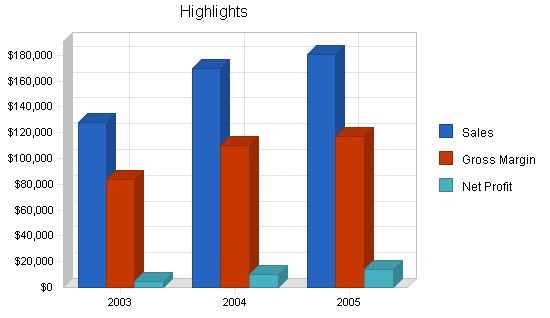

Having been open for almost two years, Yeti Cards & Gifts has proven successful in meeting the needs of two distinct customer segments. The Yeti concept is led by the husband and wife team of Dan and Ishada Gordon, who bring a wealth of experience and skills to the company. Yeti is preparing for the grand opening of their second location, and sales forecasts indicate promising growth with revenue of $169,000 in Year 3 and $180,000 in Year 4, along with net profit percentages of 5.96% and 7.59% respectively.

Mission

Yeti Cards & Gifts’ goal is to provide new and exciting products in a fun and friendly environment, with customer service as their top priority.

Keys to Success

The keys to success include offering unique high-quality products, targeted advertising and promotion, and continuously reviewing and adjusting inventory levels.

Objectives

Yeti has two objectives for the organization:

1. Open a second store in the University Heights community to increase visibility and sales potential.

2. Open a third store in Year 4.

Yeti Card & Gifts is a retail store specializing in cards, health and beauty products, novelty items, candy, beverages, and Japanese products. Yeti has two locations, their current store at the Wigman Hospital/Physicians & Surgeons South Building, and a soon-to-open store in the University Heights community, located in the Madison Plaza between Starbucks and Noah’s Bagels.

Yeti Cards & Gifts is a single member Ohio registered L.L.C. owned by Dan Gordon.

Yeti was founded two years ago and quickly became popular. The business moved to the Wigman Hospital/Physicians & Surgeons South Building to take advantage of the highly visible 1,144 square foot retail space and the dense population. The Wigman Hospital is the largest employer in Cuyahoga County and is located near The Case Western Reserve, the state’s largest private university with over 20,933 students, faculty, and employees. The move to the Wigman building also coincided with the closure of Jabberwocky Cards & Gifts.

Yeti is currently in the process of opening a second store in University Heights, which will be an 800 square foot store in the Madison Plaza, situated between Starbucks and Noah’s Bagel. This location was chosen due to its high traffic counts (1,800) and its proximity to nationally known tenants.

Yeti’s products can be grouped into five categories: cards, health and beauty, novelty, candy and beverages, and Japanese products. Some examples of the products they offer include:

– Cards (vendors include: Winking Moon Press, Tetter Saw Cards, Mik Wright, Clayboys, Mojo Ryzen, Image Connection, Unusual Cards, Cara Scissoria, Shag/Roger La Borde, Paper Troupe, Palm Breeze, Smart Alex, and Classico San Francisco):

– Birthday (boy, girl, romantic)

– Blank

– Wedding

– New baby

– Get well

– General humor

– I love you

– Engagement

– Missing you

– Friendship

– Encouragement

– Sympathy

– Postcards

– Health and Beauty (vendors include: Blue Q, Fridge Fun, San-X, Tsukineko, T-n-T Candles):

– Hand soap

– Body wash/detergent

– Shampoo

– Moist towelettes

– Lip balm

– Moisturizer

– Bubble bath

– Body powder

– Glitter ball/lotion

– Compact mirror

– Foot/hand/body cream

– Large & small tampon case

– Air freshener

– Tweezers

– Temporary body tattoos

– Candles

– Novelty (vendors include: Accoutrements, Hobbs & Dobbs, San-X, Lantor, Dark Horse, Blue Q, O.R.E., Three by Three, Lucy Lu, Hot Properties, Fridge Fun):

– Stationary

– Wigs

– Glasses

– Picture frames

– Hats

– Coffee mugs

– Bags

– Purses

– Clocks

– CD cases

– String lights

– Bookmarks

– Action figures

– Antenna toppers

– Magnets

– Key chains

– Toothpick/toothbrush holders

– Mist makers

– Toilet seats

– Stickers

– Clothes hampers

– Whoopee cushions

– Squirt guns

– Candy and Beverages (vendors include: Garvey, Hobbs & Dobbs, Golden Pacific, JFC Trading):

– Hello Kitty Hi-Chew & Jelly candy

– Gummi Bears/Army Guys/Hamburgers/French Fries/Donuts

– Now & Later

– Big Hunk

– Bottle caps

– Jolly Rancher

– Blow Pops

– Sugar Daddy

– Nerds

– Tangy Taffy

– Sweet Tarts

– Smarties

– Sixlets

– Dorks

– Shock Tarts

– Ducle de Leche

– Abba Zabba

– Sour Patch

– Rocky Road

– Runts

– Spree

– Gum

– Soft drinks

– Jones

– Suntory-CC Lemon

– CC Grape

– Natchan (honey lemon, apple, grape, fruit punch flavors)

– Woolong tea

– Asahi cold asian tea drinks

– Kirin cold tea drinks (milk tea, lemon tea)

– Milk, coffee

– Otsuka Pocari Sweat

– Sokenbi-cha

– JT peach water

– Sapporo fruit & milk

– Cream melon soda

– Caffe latte

– Citrus mix

– Green tea

– Chinese tea

– Japanese products (vendors include: San-X, Masudamasu, Enadi, Kitamura, Tokyo-Inn, Etoile Kaito, Okutani):

– Stickers

– Plush toys

– Bottle caps

– Movie merchandise

– Mouse pads

– Cell phone accessories

– Zipper pulls

– Patches

– Animation fun packs

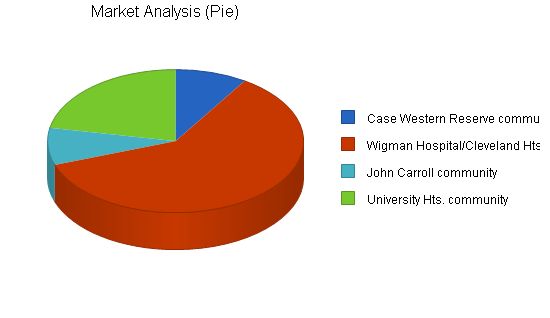

Yeti has identified two distinct market segments for each of their stores. For the Cleveland Heights location, they cater to Case Western Reserve University students and the Wigman Hospital/Cleveland Heights community. For the University Heights location, they target John Carroll University students and the University Heights community. Age is a significant factor in differentiating between these segments, with the student segments being generally younger than the surrounding communities.

Cleveland Heights Store:

– Case Western Reserve community: 20,044 students total. Largest private university in Ohio.

– Female students: 53.6% of student population (10,747)

– Male students: Infrequent shoppers, need to be converted into impulse buyers.

– Wigman Hospital community/Cleveland Heights community: Wigman Hospital is the county’s largest employer.

– Wigman Hospital community: Total population 2,700. Higher income levels than students.

– Age breakdown:

– 15-19: 11,585 (8.4%)

– 20-24: 17,390 (12.6%)

– 25-34: 20,591 (14.9%)

– 35-44: 18,656 (13.5%)

– 45-54: 20,184 (14.6%)

– 55-59: 5,864 (4.3%)

University Heights Store:

– John Carroll University community: 18,789 students total.

– Female students: 47.6% (8,937)

– Male students: Infrequent shoppers, need to be converted into impulse buyers.

– University Heights community: Total population 51,040.

– Age breakdown:

– 15-19: 5,662 (11.5%)

– 20-24: 9,896 (20.1%)

– 25-34: 7,317 (14.8%)

– 35-44: 5,991 (12.1%)

– 45-54: 5,570 (11.3%)

– 55-59: 1,603 (3.3%)

| Market Analysis | |||||||

| 2003 | 2004 | 2005 | 2006 | 2007 | |||

| Potential Customers | Growth | CAGR | |||||

| Case Western Reserve community | 2% | 20,933 | 21,435 | 21,949 | 22,476 | 23,015 | 2.40% |

| Wigman Hospital/Cleveland Hts. community | 2% | 140,550 | 143,361 | 146,228 | 149,153 | 152,136 | 2.00% |

| John Carroll community | 1% | 19,619 | 19,815 | 20,013 | 20,213 | 20,415 | 1.00% |

| University Hts. community | 1% | 51,040 | 51,550 | 52,066 | 52,587 | 53,113 | 1.00% |

| Total | 1.74% | 232,142 | 236,161 | 240,256 | 244,429 | 248,679 | 1.74% |

Contents

- 0.1 4.2 Target Market Segment Strategy

- 0.2 4.3 Industry Analysis

- 0.3 4.3.1 Competition and Buying Patterns

- 1 Strategy and Implementation Summary

- 1.1 5.1 Competitive Edge

- 1.2 5.2 Marketing Strategy

- 1.3 5.3 Sales Strategy

- 1.4 5.3.1 Sales Forecast

- 1.5 6.1 Website Marketing Strategy

- 1.6 6.2 Development Requirements

- 1.7 7.1 Personnel Plan

- 1.8 8.1 Important Assumptions

- 1.9 8.2 Break-even Analysis

- 1.10 8.4 Projected Profit and Loss

- 1.11 Pro Forma Profit and Loss

- 1.12 Projected Balance Sheet

- 1.13 Business Ratios

- 2 Appendix

- 3 Business Plan Outline

4.2 Target Market Segment Strategy

The market segments were chosen for two specific reasons: location/proximity and customer demographics, specifically age:

Location/Proximity

- Cleveland Heights: The store is within walking distance of a large university campus, making it convenient for students. For the Wigman Hospital community, Yeti is located below their offices, allowing customers to easily access the store.

- University Heights: The store is located near the campus and Madison Plaza, a premier shopping area. Yeti’s proximity to Starbucks and Noah’s Bagel attracts a large number of customers.

Customer Demographics

- University communities: Students have a high rate of disposable income and are drawn to Yeti for their products.

- Surrounding communities, both Cleveland Heights and University Heights: Yeti appeals to both the younger and older demographic in these communities, offering a wide product selection and excellent customer service.

4.3 Industry Analysis

Gift and card shops typically fall into two categories: trendy shops that appeal to a younger crowd, and conservative stores that appeal to an older audience. Yeti successfully appeals to both categories.

4.3.1 Competition and Buying Patterns

Competitor #1

Pros: Massive purchasing power; good location; guaranteed customers from the sale of textbooks. Cons: Little to no parking; poor customer service; difficulty selling non-conservative merchandise.

Competitor #2

Pros: Good location next to Case Univ.; good selection of women’s apparel; established customer base. Cons: Little to no parking; very poor customer service; lack of diversity in customer base.

Competitor #3

Pros: Chagrin River Center tenant; plenty of parking; a national chain. Cons: Primary customers are 12-19 year olds; too loud background sound system; little to no advertising.

Competitor #4

Pros: Capitol Mall tenant; plenty of parking; national chain; large selection of movie paraphernalia. Cons: Poor customer service; poor merchandise selection; distance from Case Univ. requires transportation.

Competitor #5

Pros: Eighth St. Market tenant; average amount of parking; established customer base. Cons: Poor customer service; poor merchandise selection.

Competitor #6

Pros: Two stores within walking distance of John Carroll Univ.; established customer base; large merchandise selection. Cons: Merchandise selection focused on older customers; overcrowded aisles.

Competitor #7

Pros: Large national chain with ample parking; large selection of goods; average customer service. Cons: Cannot respond to customer requests and the latest trends; focused on general merchandise, not cards and gifts; distance from John Carroll Univ. requires transportation.

Strategy and Implementation Summary

Yeti’s competitive edge is their ability to appeal to both younger and older customers through their product selection and excellent customer service. Yeti will use print advertising in The Cleveland Weekly and flash-based TV commercials to raise awareness. Extensive employee training will be undertaken to assist customers with a wide range of products.

5.1 Competitive Edge

Yeti’s competitive edge is being "risque, not raunchy," appealing to a wide range of customers without being offensive. Exemplary customer service supports their product selection, treating every customer with respect and creating a pleasant experience.

5.2 Marketing Strategy

Yeti will use print advertising in The Cleveland Weekly and TV commercials to raise awareness of their products.

5.3 Sales Strategy

Yeti’s sales strategy focuses on comprehensive employee training to provide customers with the information they need. Good customer service and product knowledge contribute to increased sales.

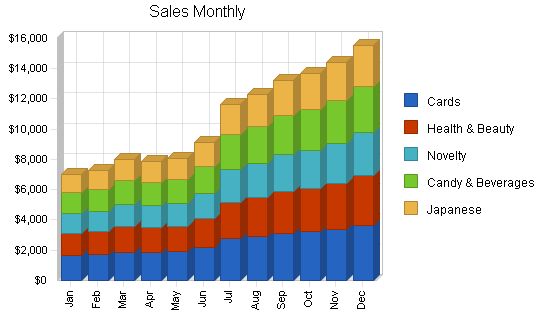

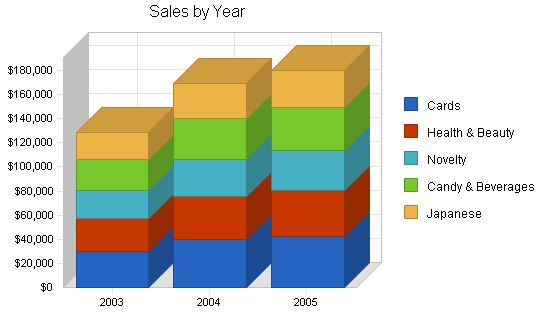

5.3.1 Sales Forecast

Yeti has adopted a conservative sales forecast based on historical numbers to ensure accuracy.

Sales Forecast

[table]

[tr]

[td]Year[/td]

[td]Cards[/td]

[td]Health & Beauty[/td]

[td]Novelty[/td]

[td]Candy & Beverages[/td]

[td]Japanese[/td]

[td]Total Sales[/td]

[/tr]

[tr]

[td]2003[/td]

[td]$30,181[/td]

[td]$26,861[/td]

[td]$23,541[/td]

[td]$25,352[/td]

[td]$22,334[/td]

[td]$128,269[/td]

[/tr]

[tr]

[td]2004[/td]

[td]$39,887[/td]

[td]$35,499[/td]

[td]$31,112[/td]

[td]$33,505[/td]

[td]$29,516[/td]

[td]$169,520[/td]

[/tr]

[tr]

[td]2005[/td]

[td]$42,455[/td]

[td]$37,785[/td]

[td]$33,115[/td]

[td]$35,662[/td]

[td]$31,417[/td]

[td]$180,434[/td]

[/tr]

[/table]

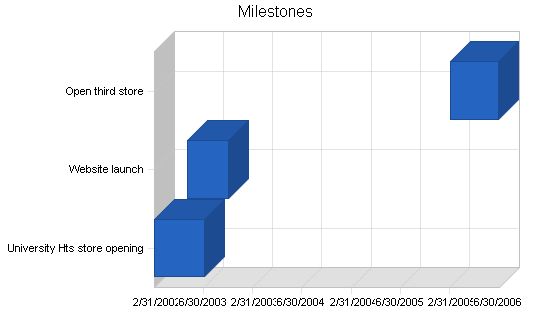

5.4 Milestones

Yeti has milestones to guide the organization to success. See table and chart below.

Milestones:

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| University Hts store opening | 1/1/2003 | 7/4/2003 | $0 | Dan | Marketing |

| Website launch | 5/1/2003 | 10/1/2003 | $0 | Dan | Department |

| Open third store | 1/1/2006 | 6/30/2006 | $0 | Dan | Department |

| Totals | $0 | ||||

Web Plan Summary:

Yeti is producing a website as an abbreviated catalog of the items the company sells. It is not feasible to have every product on the site.

6.1 Website Marketing Strategy

Yeti will market the website by including the Web address on all of Yeti’s correspondence and advertising. Additionally, the site will be submitted to popular search engines. This will benefit Internet users searching for "gifts + Cleveland Heights" as Yeti’s website will appear in the search results.

6.2 Development Requirements

Yeti will hire a computer science student to assist with website development.

Management Summary:

Yeti, owned and managed by Dan Gordon, has a wealth of retail experience. Dan began his sales career over 13 years ago and has since gained experience in various positions. He is responsible for managing the Cleveland Heights store, as well as purchasing, sales, advertising, maintenance, computer technology, and business development.

Yeti is also supported by Ishada Gordon, who has sales and client service experience from both Japan and the United States. Ishada brings excellent office management skills to Yeti and has been instrumental in business development activities and developing vendor relationships with Japanese companies.

7.1 Personnel Plan

Dan will manage both stores, overseeing sales, purchasing, marketing, advertising, business development, computer technology, and employee training.

Ishada’s responsibilities include office management, employee training, and human resources.

The Cleveland Heights store will have two part-time employees responsible for sales, display organizing, restocking, and light cleaning.

| Personnel Plan | |||

| 2003 | 2004 | 2005 | |

| Dan | $14,400 | $16,000 | $17,000 |

| Ishada | $14,400 | $16,000 | $17,000 |

| Part-time employee | $3,864 | $6,624 | $6,624 |

| Part-time employee | $3,864 | $6,624 | $6,624 |

| Part-time employee | $3,864 | $6,624 | $6,624 |

| Total People | 5 | 5 | 5 |

| Total Payroll | $40,392 | $51,872 | $53,872 |

The following sections provide important financial information.

8.1 Important Assumptions

The following table details important financial assumptions.

| General Assumptions | |||

| 2003 | 2004 | 2005 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

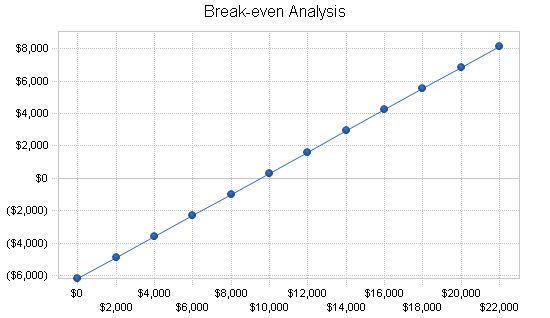

8.2 Break-even Analysis

The Break-even Analysis shows that $9,500 in monthly revenue is needed to reach the break-even point.

Break-even Analysis:

Monthly Revenue Break-even: $9,500

Assumptions:

Average Percent Variable Cost: 35%

Estimated Monthly Fixed Cost: $6,175

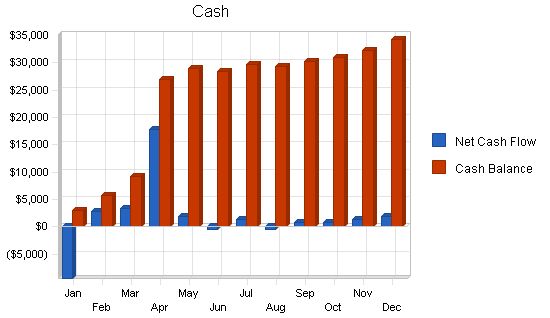

Projected Cash Flow:

The chart and table below display projected cash flow.

Pro Forma Cash Flow:

| Pro Forma Cash Flow | |||

| 2003 | 2004 | 2005 | |

| Cash Sales | $128,269 | $169,520 | $180,434 |

| New Long-term Liabilities | $20,000 | $0 | $0 |

| Subtotal Cash Received | $148,269 | $169,520 | $180,434 |

| Cash Spending | $40,392 | $51,872 | $53,872 |

| Bill Payments | $68,546 | $107,359 | $110,062 |

| Subtotal Spent on Operations | $108,938 | $159,231 | $163,934 |

| Long-term Liabilities Principal Repayment | $2,464 | $3,180 | $3,180 |

| Purchase Long-term Assets | $15,000 | $0 | $0 |

| Subtotal Cash Spent | $126,402 | $162,411 | $167,114 |

| Net Cash Flow | $21,867 | $7,109 | $13,320 |

| Cash Balance | $34,230 | $41,339 | $54,659 |

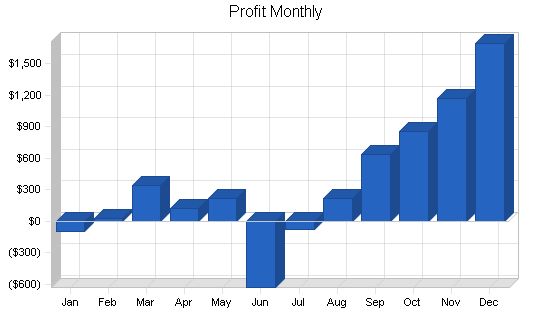

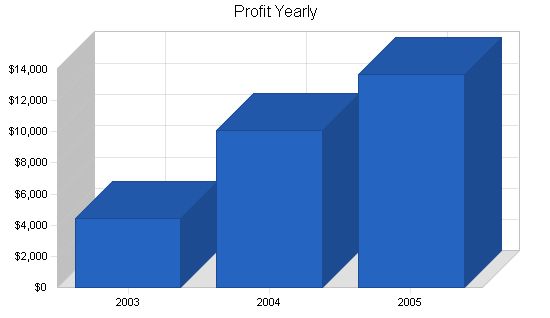

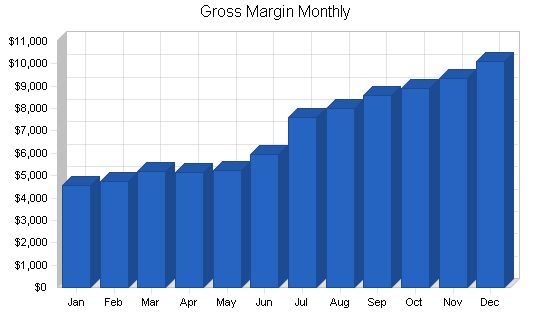

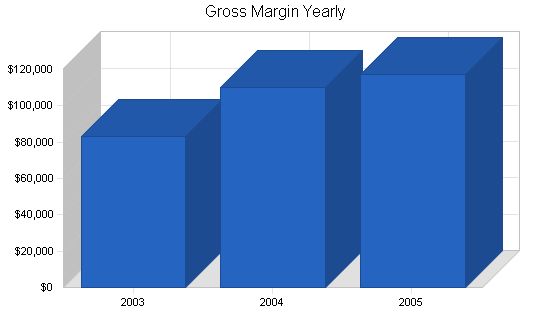

8.4 Projected Profit and Loss

The table and charts below illustrate the projected profit and loss.

Pro Forma Profit and Loss

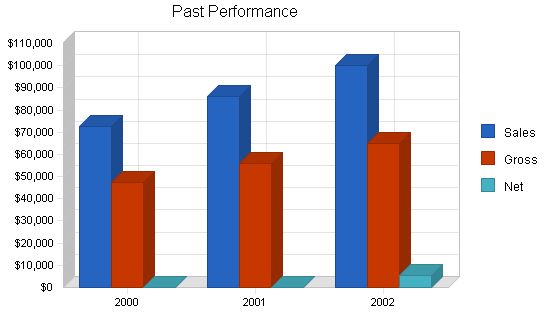

| Sales | $128,269 | $169,520 | $180,434 |

| Direct Cost of Sales | $44,894 | $59,332 | $63,152 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $44,894 | $59,332 | $63,152 |

| Gross Margin | $83,375 | $110,188 | $117,282 |

| Gross Margin % | 65.00% | 65.00% | 65.00% |

| Expenses | |||

| Payroll | $40,392 | $51,872 | $53,872 |

| Sales and Marketing and Other Expenses | $6,000 | $6,000 | $6,000 |

| Depreciation | $2,751 | $3,000 | $3,000 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $3,300 | $4,200 | $4,200 |

| Insurance | $4,200 | $5,400 | $5,400 |

| Rent | $10,200 | $13,200 | $13,200 |

| Payroll Taxes | $6,059 | $7,781 | $8,081 |

| Other | $1,200 | $1,200 | $1,200 |

| Total Operating Expenses | $74,101 | $92,653 | $94,953 |

| Profit Before Interest and Taxes | $9,274 | $17,535 | $22,329 |

| EBITDA | $12,024 | $20,535 | $25,329 |

| Interest Expense | $2,898 | $3,095 | $2,777 |

| Taxes Incurred | $1,913 | $4,332 | $5,866 |

| Net Profit | $4,463 | $10,108 | $13,687 |

| Net Profit/Sales | 3.48% | 5.96% | 7.59% |

Projected Balance Sheet

The following table presents the projected balance sheet.

| Assets | 2003 | 2004 | 2005 |

| Current Assets | |||

| Cash | $34,230 | $41,339 | $54,659 |

| Inventory | $5,982 | $7,906 | $8,415 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $40,212 | $49,245 | $63,074 |

| Long-term Assets | |||

| Long-term Assets | $20,000 | $20,000 | $20,000 |

| Accumulated Depreciation | $5,502 | $8,502 | $11,502 |

| Total Long-term Assets | $14,498 | $11,498 | $8,498 |

| Total Assets | $54,711 | $60,743 | $71,572 |

Business Ratios

The following table shows standard business ratios for Yeti Cards and Gifts. Industry Profile ratios are shown for comparison. Our Standard Industrial Classification (SIC) industry class and code are: Gift, novelty, and souvenir shop – 5947.

| Ratio Analysis | 2003 | 2004 | 2005 | Industry Profile |

| Sales Growth | 28.00% | 32.16% | 6.44% | 3.34% |

| Percent of Total Assets | ||||

| Inventory | 10.93% | 13.02% | 11.76% | 40.42% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 23.99% |

| Total Current Assets | 73.50% | 81.07% | 88.13% | 80.29% |

| Long-term Assets | 26.50% | 18.93% | 11.87% | 19.71% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | $9,646 | $8,750 | $9,073 | |

| Current Borrowing | $0 | $0 | $0 | |

| Other Current Liabilities | $0 | $0 | $0 | |

| Subtotal Current Liabilities | $9,646 | $8,750 | $9,073 | |

| Long-term Liabilities | $32,536 | $29,356 | $26,176 | |

| Total Liabilities | $42,182 | $38,106 | $35,249 | |

| Paid-in Capital | $0 | $0 | $0 | |

| Retained Earnings | $8,066 | $12,529 | $22,637 | |

| Earnings | $4,463 | $10,108 | $13,687 | |

| Total Capital | $12,529 | $22,637 | $36,324 | |

| Total Liabilities and Capital | $54,711 | $60,743 | $71,572 | |

| Net Worth | $12,529 | $22,637 | $36,324 |

Appendix

| Sales Forecast | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Sales | |||||||||||||

| Cards | 0% | $1,654 | $1,715 | $1,878 | $1,854 | $1,901 | $2,154 | $2,745 | $2,898 | $3,112 | $3,225 | $3,389 | $3,656 |

| Health & Beauty | 0% | $1,472 | $1,526 | $1,671 | $1,650 | $1,692 | $1,917 | $2,443 | $2,579 | $2,770 | $2,870 | $3,016 | $3,254 |

| Novelty | 0% | $1,290 | $1,338 | $1,465 | $1,446 | $1,483 | $1,680 | $2,141 | $2,260 | $2,427 | $2,516 | $2,643 | $2,852 |

| Candy & Beverages | 0% | $1,389 | $1,441 | $1,578 | $1,557 | $1,597 | $1,809 | $2,306 | $2,434 | $2,614 | $2,709 | $2,847 | $3,071 |

| Japanese | 0% | $1,224 | $1,269 | $1,390 | $1,372 | $1,407 | $1,594General Assumptions: | ||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Pro Forma Profit and Loss:

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Sales | $7,030 | $7,289 | $7,982 | $7,880 | $8,079 | $9,155 | $11,666 | $12,317 | $13,226 | $13,706 | $14,403 | $15,538 |

| Direct Cost of Sales | $2,460 | $2,551 | $2,794 | $2,758 | $2,828 | $3,204 | $4,083 | $4,311 | $4,629 | $4,797 | $5,041 | $5,438 |

| Other Production Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Cost of Sales | $2,460 | $2,551 | $2,794 | $2,758 | $2,828 | $3,204 | $4,083 | $4,311 | $4,629 | $4,797 | $5,041 | $5,438 |

| Gross Margin | $4,569 | $4,738 | $5,188 | $5,122 | $5,252 | $5,950 | $7,583 | $8,006 | $8,597 | $8,909 | $9,362 | $10,100 |

| Gross Margin % | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% |

Pro Forma Cash Flow:

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Cash Received | $7,030 | $7,289 | $7,982 | $7,880 | $8,079 | $9,155 | $11,666 | $12,317 | $13,226 | $13,706 | $14,403 | $15,538 |

| Subtotal Cash from Operations | $7,030 | $7,289 | $7,982 | $7,880 | $8,079 | $9,155 | $11,666 | $12,317 | $13,226 | $13,706 | $14,403 | $15,538 |

| Additional Cash Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Received | $7,030 | $7,289 | $7,982 | $27,880 | $8,079 | $9,155 | $11,666 | $12,317 | $13,226 | $13,706 | $14,403 | $15,538 |

| Expenditures from Operations | $2,400 | $2,400 | $2,400 | $2,400 | $2,400 | $4,056 | $4,056 | $4,056 | $4,056 | $4,056 | $4,056 | $4,056 |

| Bill Payments | $4,071 | $2,097 | $2,150 | $2,321 | $3,552 | $5,313 | $5,976 | $8,395 | $8,063 | $8,640 | $8,747 | $9,220 |

| Subtotal Spent on Operations | $6,471 | $4,497 | $4,550 | $4,721 | $5,952 | $9,369 | $10,032 | $12,451 | $12,119 | $12,696 | $12,803 | $13,276 |

| Additional Cash Spent | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Spent | $16,471 | $4,497 | $4,550 | $9,986 | $6,219 | $9,638 | $10,303 | $12,725 | $12,395 | $12,975 | $13,084 | $13,559 |

| Net Cash Flow | ($9,441) | $2,792 | $3,431 | $17,894 | $1,860 | ($484) | $1,363 | ($408) | $831 | $732 | $1,319 | $1,979 |

| Cash Balance | $2,922 | $5,714 | $9,145 | $27,038 | $28,898 | $28,414 | $29,777 | $29,369 | $30,200 | $30,932 | $32,251 | $34,230 |

Pro Forma Balance Sheet

| Pro Forma Balance Sheet | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $12,363 | $2,922 | $5,714 | $9,145 | $27,038 | $28,898 | $28,414 | $29,777 | $29,369 | $30,200 | $30,932 | $32,251 | $34,230 |

| Inventory | $12,455 | $9,995 | $7,444 | $4,650 | $3,034 | $3,111 | $3,524 | $4,492 | $4,742 | $5,092 | $5,277 | $5,545 | $5,982 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $24,818 | $12,916 | $13,157 | $13,795 | $30,072 | $32,009 | $31,939 | $34,269 | $34,111 | $35,292 | $36,209 | $37,796 | $40,212 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $5,000 | $15,000 | $15,000 | $15,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 |

| Accumulated Depreciation | $2,751 | $2,918 | $3,085 | $3,252 | $3,502 | $3,752 | $4,002 | $4,252 | $4,502 | $4,752 | $5,002 | $5,252 | $5,502 |

| Total Long-term Assets | $2,249 | $12,082 | $11,915 | $11,748 | $16,498 | $16,248 | $15,998 | $15,748 | $15,498 | $15,248 | $14,998 | $14,748 | $14,498 |

| Total Assets | $27,067 | $24,998 | $25,073 | $25,543 | $46,570 | $48,257 | $47,937 | $50,017 | $49,609 | $50,541 | $51,207 | $52,545 | $54,711 |

| Liabilities and Capital | |||||||||||||

| Current Liabilities | |||||||||||||

| Accounts Payable | $4,001 | $2,025 | $2,074 | $2,205 | $3,376 | $5,117 | $5,695 | $8,127 | $7,775 | $8,349 | $8,441 | $8,887 | $9,646 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $4,001 | $2,025 | $2,074 | $2,205 | $3,376 | $5,117 | $5,695 | $8,127 | $7,775 | $8,349 | $8,441 | $8,887 | $9,646 |

| Long-term Liabilities | |||||||||||||

| Long-term Liabilities | $15,000 | $15,000 | $15,000 | $15,000 | $34,735 | $34,468 | $34,199 | $33,928 | $33,654 | $33,378 | $33,100 | $32,819 | $32,536 |

| Total Liabilities | $19,001 | $17,025 | $17,074 | $17,205 | $38,111 | $39,585 | $39,894 | $42,054 | $41,429 | $41,727 | $41,540 | $41,706 | $42,182 |

| Paid-in Capital | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Retained Earnings | $2,612 | $8,066 | $8,066 | $8,066 | $8,066 | $8,066 | $8,066 | $8,066 | $8,066 | $8,066 | $8,066 | $8,066 | $8,066 |

| Earnings | $5,454 | ($93) | ($68) | $272 | $393 | $606 | ($23) | ($103) | $114 | $747 | $1,601 | $2,773 | $4,463 |

| Total Capital | $8,066 | $7,973 | $7,998 | $8,338 | $8,459 | $8,672 | $8,043 | $7,963 | $8,180 | $8,813 | $9,667 | $10,839 | $12,529 |

| Total Liabilities and Capital | $27,067 | $24,998 | $25,073 | $25,543 | $46,570 | $48,257 | $47,937 | $50,017 | $49,609 | $50,541 | $51,207 | $52,545 | $54,711 |

| Net Worth | $8,066 | $7,973 | $7,998 | $8,338 | $8,459 | $8,672 | $8,043 | $7,963 | $8,180 | $8,813 | $9,667 | $10,839 | $12,529 |

Business Plan Outline

- Executive Summary

- Company Summary

- Products

- Market Analysis Summary

- Strategy and Implementation Summary

- Web Plan Summary

- Management Summary

- Financial Plan

- Appendix

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!