Personal Insurance Agent Business Plan

Plynthe Insurance, an independent personal insurance brokerage, will operate in Peristyle Gardens and cater to the town’s adult population by offering insurance advice, various policy types, and access to a multitude of insurance providers. Founded by Kolem Plynthe, a newly licensed insurance agent, the business will initially be home-based but will eventually expand to a small office where Plynthe can collaborate with associate agents. With a strong sales background, Plynthe is well-positioned for success in the insurance industry.

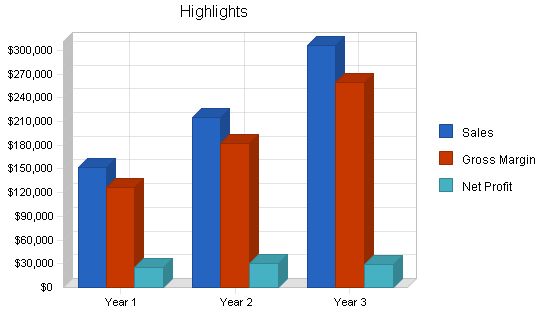

Plynthe Insurance aims to be a profitable enterprise, providing both a salary and dividends to its sole owner, Kolem Plynthe. The salary and profits will experience gradual and moderate growth. The business will be launched using Plynthe’s personal savings and borrowings, without the need for external investment or loans. However, to finance the expansion to an office, Plynthe Insurance will require a long-term loan in its second year of operation.

Contents

Objectives

Plynthe Insurance aims to:

- Quickly build revenues in the first year.

- Establish an office and hire an associate insurance agent in the second year.

- Double revenues in the third year with a reasonable net profit.

Mission

Plynthe Insurance’s mission is to provide property, casualty, and life insurance to Peristyle Gardens residents from various sources.

Keys to Success

To achieve its objectives, Plynthe Insurance will:

- Remain independent of direct affiliations with specific insurance providers.

- Consider all potential risks in clients’ lives holistically.

- Maintain a reputation of care, fairness, empathy, and expertise.

Company Summary

Plynthe Insurance is a local, independent insurance agent founded by Kolem Plynthe. It offers personal insurance products to residents of Peristyle Gardens and neighboring towns. The business will start as a home-based venture with Kolem Plynthe as the sole owner and employee. As the business grows, an office will be established and associate agents will be hired to better serve the community. Kolem Plynthe is an experienced salesperson and newly certified insurance agent. The business will broker insurance purchases for property insurance, personal liability, and life insurance.

Company Ownership

Plynthe Insurance is wholly owned by Kolem Plynthe. It is currently incorporated as a sole proprietorship with a registered DBA. However, it will be reincorporated as an LLC when additional employees are hired and an office is opened.

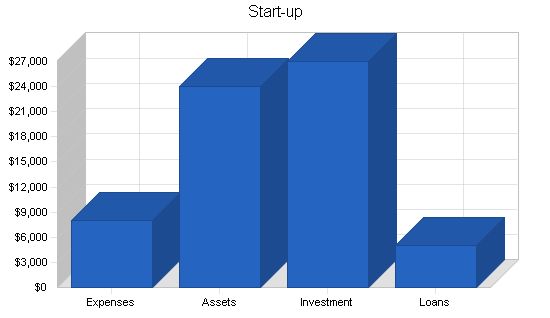

Start-up Summary

Plynthe Insurance requires minimal start-up funding, primarily for licenses, business insurance, stationery, and a basic website. Rent will not be necessary initially, as the business will operate from a home office. Most of the start-up funding will be allocated towards covering operating expenses until the business breaks even, which is expected midway through the first year of operation.

Start-up Requirements

Start-up Expenses

Legal (license and permits) $2,000

Stationery $2,000

Insurance $1,000

Rent $0

Computer $2,000

Website $1,000

Total Start-up Expenses $8,000

Start-up Assets

Cash Required $24,000

Other Current Assets $0

Long-term Assets $0

Total Assets $24,000

Total Requirements $32,000

Services

Plynthe Insurance offers personal insurance products:

1. Home and Contents:

– Homeowner’s Insurance

– Condo Insurance

– Cooperative Insurance

– Renter’s Insurance

– Seasonal and Secondary Locations

– Flood Insurance

2. Valuable Items:

– Jewelry

– Fine Art

– Silver

– Furs

– Other Collectible Items

3. Personal Liability

4. Life Insurance

– Term Life

– Variable Life

– Whole Life

– Second-to-Die

5. Long-term Care

6. Long-term Disability

All of these products are offered to individuals, not businesses. The insurance products are provided by major insurance providers, including smaller providers specializing in niche insurance products.

While offering these products, Plynthe Insurance provides the following services:

– Consult with clients on insurance needs and determine a course of action

– Assist existing clients with insurance claims and policy understanding

– Refer clients to additional providers who can reduce their risk (locksmiths, security professionals, etc.)

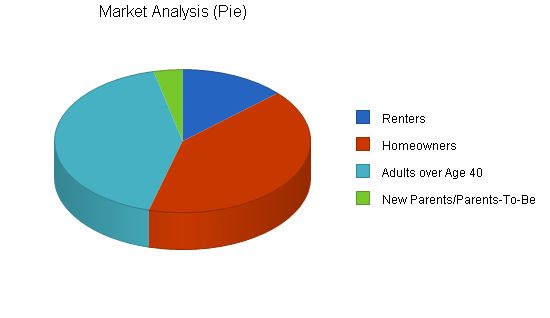

Market Analysis Summary

The market for personal insurance consists of all adult individuals in Peristyle Gardens. In 2008, the adult population (18 and older) was estimated at 57,500. The town has an annual growth rate of 2% due to new developments and an aging population with increasing life expectancies.

Within this target market, Plynthe Insurance focuses on the following market segments:

– Renters

– Homeowners

– Individuals over 40 years of age

– New parents/parents-to-be

Market Segmentation

The described market segments overlap. For example, many adults over 40 are also homeowners and the rest are renters. The new parent segment consists of homeowners or renters. Each segment has different insurance product needs, and those in multiple segments require multiple products.

Market Analysis

Potential Customers Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Renters 2% 11,000 11,220 11,444 11,673 11,906 2.00%

Homeowners 1% 34,000 34,340 34,683 35,030 35,380 1.00%

Adults over Age 40 3% 35,000 36,050 37,132 38,246 39,393 3.00%

New Parents/Parents-To-Be 2% 3,000 3,060 3,121 3,183 3,247 2.00%

Total 2.02% 83,000 84,670 86,380 88,132 89,926 2.02%

Target Market Segment Strategy

Plynthe Insurance will focus its initial marketing on the younger end of the spectrum, including renters and new parents/parents-to-be. The strategy will be to begin by selling renter’s insurance and life insurance to clients and then earn their ongoing trust to sell additional insurance policies as new needs arise. Younger clients will serve as a longer annuity as insurance policies are renewed.

As these clients age, their needs for homeowner’s insurance, valuable items insurance, life insurance, and eventually long-term care and long-term disability will increase.

Service Business Analysis

The United States Department of Labor summarizes the insurance industry as follows:

"Most people have their first contact with an insurance company through an insurance sales agent. These workers help individuals, families, and businesses select insurance policies that provide the best protection for their lives, health, and property. Insurance sales agents sell one or more types of insurance, such as property and casualty, life, health, disability, and long-term care. Property and casualty insurance agents sell policies that protect individuals and businesses from financial loss resulting from events such as automobile accidents, fire, theft, storms, and others. For businesses, property and casualty insurance can also cover workers’ compensation, product liability, or medical malpractice claims." Life insurance agents specialize in selling policies that pay beneficiaries when a policyholder dies. Depending on the policyholder’s circumstances, a cash-value policy can provide retirement income, funds for children’s education, or other benefits. Life insurance agents also sell annuities that promise retirement income. Health insurance agents sell policies that cover medical care costs and income loss due to illness or injury. They may also sell dental insurance and short-term and long-term disability insurance policies. Agents may specialize in any of these product areas or function as generalists, providing multiple products. Many insurance agents offer comprehensive financial planning services, including retirement and estate planning and assistance with setting up pension plans for businesses. Agents are also increasingly involved in "cross-selling" or "total account development" by offering insurance, mutual funds, variable annuities, and other securities. Insurance sales agents prepare reports, maintain records, seek new clients, and help policyholders settle claims. Some agents also offer financial analysis and risk-minimization advice. Agents working for one insurance company are called captive agents, while independent agents or brokers represent several companies and match insurance policies to clients. Technology has made the insurance business more efficient and has given agents the ability to take on more clients. Agents’ computers are linked to insurance carriers via the Internet, allowing faster price quotes, application processing, and service requests. The growing use of the Internet has changed the agent-client relationship, with clients obtaining insurance quotes online and then purchasing policies directly from companies. Agents also obtain many new accounts through referrals and maintain regular contact with clients to meet their financial needs."

Competition and Buying Patterns

Customers seek insurance through referrals, trusted brand names of national companies, and local office locations. Individuals with greater insurance needs are more likely to seek local offices for in-person discussions. For the target markets of renters and new parents/parents-to-be in Peristyle Gardens, primary competition will come from national insurance carriers rather than other independent agents.

Strategy and Implementation Summary

To implement its launch in Peristyle Gardens, Plynthe Insurance will target younger clients to build a long-term client base. This target market is overlooked by other local independent agents, making it easier to establish a foothold. Implementation will include advertising to new parents/parents-to-be and renters, selling additional policies as clients’ needs change, and maintaining high policy renewal and client retention rates through excellent service.

Competitive Edge

Plynthe Insurance will establish its competitive edge by focusing solely on personal insurance. By being an expert in personal insurance products and providers, Plynthe Insurance will be a one-stop-shop for individuals looking to minimize risk for themselves and their families. Plynthe Insurance will continue training, stay updated with industry publications, and learn about specific risks in Peristyle Gardens to better serve residents.

Plynthe Insurance will focus its marketing efforts on renters and new parents/parents-to-be. Renters need renter’s insurance and valuable items insurance, while new parents require life insurance. Advertising tactics will include parent newsletters, flyers at apartment buildings, direct mail, basic website development, search engine marketing for renter’s and life insurance keywords, and Yellow Pages listing.

Sales Strategy

The sales strategy of Plynthe Insurance will be aggressive, profiling and targeting individuals in the initial target market. Kolem Plynthe will have initial phone conversations and meet clients at their homes or offices. He will bring his laptop to search for insurance options on the spot. A CRM database will manage potential and existing clients, generating reminders for follow-ups and next steps. Kolem Plynthe will encourage referrals and offer incentives for clients who refer others.

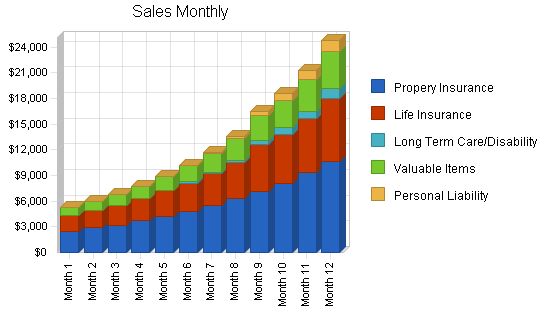

Property insurance and life insurance will drive business. Cost of sales is low as revenues come from insurance providers as commissions on policies sold and renewed. Commissions range from 4% to 7%, with an estimated average of 5%. Cost of sales includes paperwork fees and travel costs directly attributed to sales calls. Travel costs are estimated at 16% in the first year and will decrease to 15% in subsequent years. By building business through sales efforts and adding an associate, revenue streams are expected to significantly grow, especially among younger clients in the first three years.

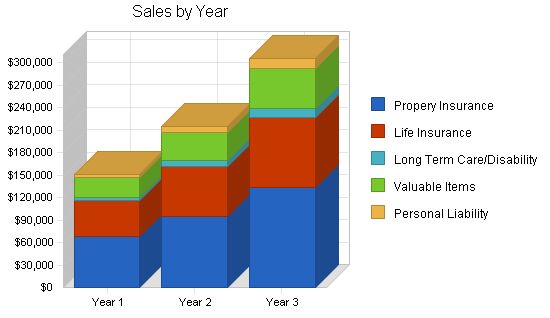

Sales Forecast

Sales

Year 1 Year 2 Year 3

Unit Sales

Propery Insurance 682 955 1,336

Life Insurance 318 445 624

Long Term Care/Disability 26 46 80

Valuable Items 363 509 712

Personal Liability 57 100 175

Total Unit Sales 1,446 2,055 2,927

Unit Prices

Year 1 Year 2 Year 3

Propery Insurance $100.00 $100.00 $100.00

Life Insurance $150.00 $150.00 $150.00

Long Term Care/Disability $150.00 $150.00 $150.00

Valuable Items $75.00 $75.00 $75.00

Personal Liability $75.00 $75.00 $75.00

Sales

Propery Insurance $68,200 $95,500 $133,600

Life Insurance $47,700 $66,750 $93,600

Long Term Care/Disability $3,900 $6,900 $12,000

Valuable Items $27,225 $38,175 $53,400

Personal Liability $4,275 $7,500 $13,125

Total Sales $151,300 $214,825 $305,725

Direct Unit Costs

Year 1 Year 2 Year 3

Propery Insurance $16.00 $15.00 $15.00

Life Insurance $24.00 $22.50 $22.50

Long Term Care/Disability $24.00 $22.50 $22.50

Valuable Items $12.00 $11.25 $11.25

Personal Liability $12.00 $11.25 $11.25

Direct Cost of Sales

Propery Insurance $10,912 $14,325 $20,040

Life Insurance $7,632 $10,013 $14,040

Long Term Care/Disability $624 $1,035 $1,800

Valuable Items $4,356 $5,726 $8,010

Personal Liability $684 $1,125 $1,969

Subtotal Direct Cost of Sales $24,208 $32,224 $45,859

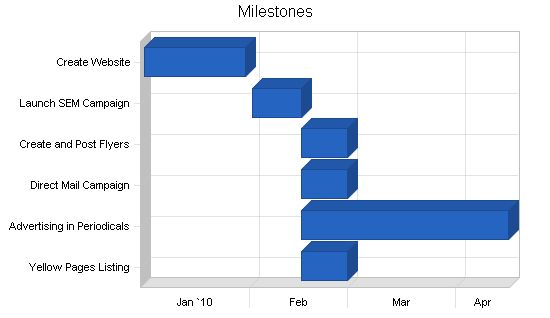

Milestones

The marketing activities listed in the Milestones Table aim to establish an initial client base through low-cost methods. These activities are intended as one-time actions, except for search engine marketing, which will continue with a dedicated monthly budget of $500. Additionally, advertising in parent periodicals may continue with a monthly budget of $500 after the launch.

"Milestones"

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Create Website | 1/1/2010 | 1/30/2010 | $1,000 | KP | Owner |

| Launch SEM Campaign | 2/1/2010 | 2/15/2010 | $500 | KP | Owner |

| Create and Post Flyers | 2/15/2010 | 2/28/2010 | $500 | KP | Owner |

| Direct Mail Campaign | 2/15/2010 | 2/28/2010 | $1,000 | KP | Owner |

| Advertising in Periodicals | 2/15/2010 | 4/15/2010 | $500 | KP | Owner |

| Yellow Pages Listing | 2/15/2010 | 2/28/2010 | $100 | KP | Owner |

| Totals | $3,600 | ||||

Management Summary

Kolem Plynthe will be the sole employee of Plynthe Insurance in its first year. He will direct the company and bring on an associate agent in the second year. The associate agent will prospect, sell, fulfill policy requests, and answer client questions. Plynthe will manage marketing, finances, training, and education guidelines.

Personnel Plan

Kolem Plynthe’s salary will increase as the year progresses. The associate agent will receive a base salary, a 5% commission on sales, and a percentage of net profits based on performance. The associate agent’s initial salary is $50,000 per year and will be hired partway into the second year.

Training for the associate agent will begin with direct, on-the-job training by Kolem Plynthe on sales calls. Ongoing training will include required coursework to maintain certification, as well as community events, conferences, and reading material.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Kolem Plynthe | $49,000 | $50,000 | $75,000 |

| Associate Agent | $0 | $35,000 | $75,000 |

| Total People | 1 | 2 | 2 |

| Total Payroll | $49,000 | $85,000 | $150,000 |

Financial Plan

The business will finance its growth from the free cash flows generated and a loan taken out in the second year to move to a small office space in Peristyle Gardens. Additional growth will be possible by adding more agents and moving to a larger office space when necessary.

The business is not well positioned for sale as it relies on the expertise of Kolem Plynthe. However, profits may increase when the business expands to offer additional personal insurance products or financial advisory services.

Start-up Funding

Plynthe Insurance will be launched using Kolem Plynthe’s own resources, including credit card debt, personal savings, and credit extended by vendors.

| Start-up Funding | |

| Start-up Expenses to Fund | $8,000 |

| Start-up Assets to Fund | $24,000 |

| Total Funding Required | $32,000 |

| Assets | |

| Non-cash Assets from Start-up | $0 |

| Cash Requirements from Start-up | $24,000 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $24,000 |

| Total Assets | $24,000 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $4,000 |

| Long-term Liabilities | $0 |

| Accounts Payable (Outstanding Bills) | $1,000 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $5,000 |

| Capital | |

| Planned Investment | |

| Owner | $27,000 |

| Investor | $0 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $27,000 |

| Loss at Start-up (Start-up Expenses) | ($8,000) |

| Total Capital | $19,000 |

| Total Capital and Liabilities | $24,000 |

| Total Funding | $32,000 |

Important Assumptions

This plan assumes:

- That younger residents of Peristyle Gardens will value the personal attention and best-priced insurance offered by Plynthe Insurance.

- That enough young residents will remain in Peristyle Gardens and grow families to make the focus on young residents worthwhile in the long run.

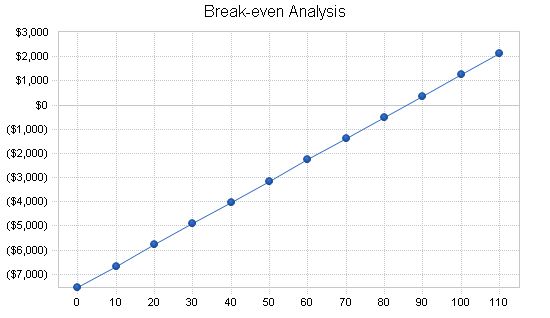

Break-even Analysis

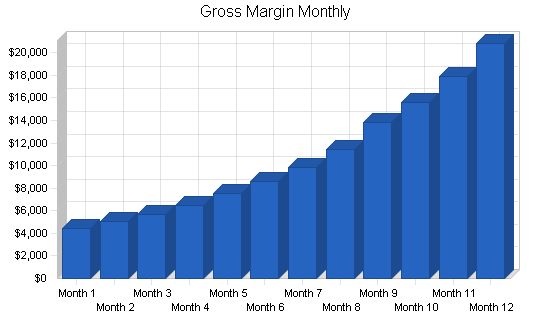

The low monthly break-even point leads to profitability in the ninth month of operation.

Break-even Analysis:

Monthly Units Break-even: 86

Monthly Revenue Break-even: $8,983

Assumptions:

Average Per-Unit Revenue: $104.63

Average Per-Unit Variable Cost: $16.74

Estimated Monthly Fixed Cost: $7,546

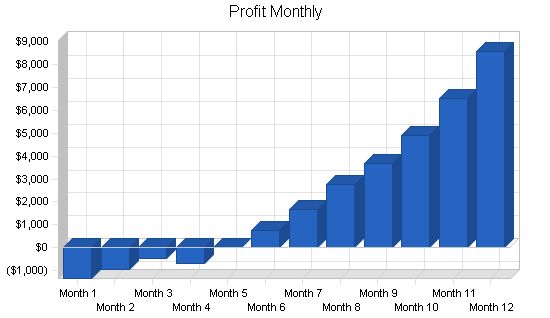

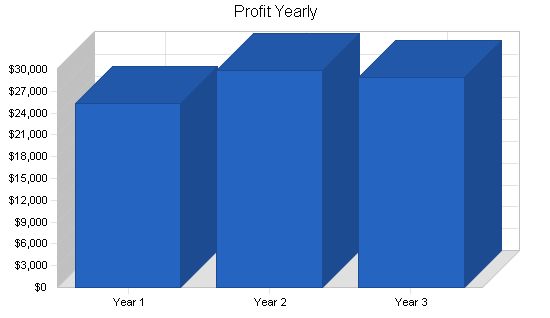

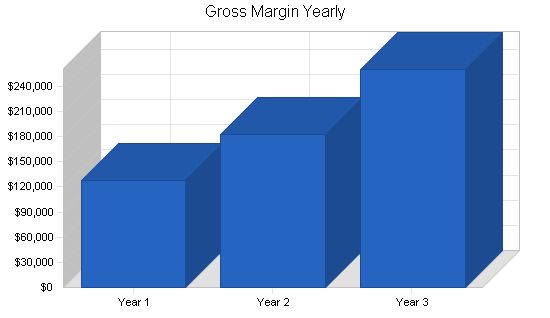

Projected Profit and Loss:

Net profit will be on top of a healthy salary for Kolem Plynthe, showing that the business will be well worth the small initial investment to launch. Gross margins are very high for the insurance brokerage industry and overhead is rather low. The main costs will be payroll for the insurance agents. Lower salaries can be paid in the future for new associate agents as less experienced, but malleable, agents are brought into the business.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Sales | $151,300 | $214,825 | $305,725 |

| Direct Cost of Sales | $24,208 | $32,224 | $45,859 |

| Other Costs of Sales | $0 | $0 | $0 |

| Total Cost of Sales | $24,208 | $32,224 | $45,859 |

| Gross Margin | $127,092 | $182,601 | $259,866 |

| Gross Margin % | 84.00% | 85.00% | 85.00% |

| Expenses | |||

| Payroll | $49,000 | $85,000 | $150,000 |

| Marketing/Promotion | $24,000 | $15,000 | $15,000 |

| Depreciation | $0 | $5,000 | $5,000 |

| Rent | $2,400 | $12,000 | $12,600 |

| Utilities | $600 | $1,800 | $1,890 |

| Insurance | $2,400 | $3,000 | $3,500 |

| Payroll Taxes | $7,350 | $12,750 | $22,500 |

| Education | $4,800 | $5,000 | $7,500 |

| Total Operating Expenses | $90,550 | $139,550 | $217,990 |

| Profit Before Interest and Taxes | $36,542 | $43,051 | $41,876 |

| EBITDA | $36,542 | $48,051 | $46,876 |

| Interest Expense | $327 | $350 | $550 |

| Taxes Incurred | $10,864 | $12,810 | $12,398 |

| Net Profit | $25,350 | $29,891 | $28,928 |

| Net Profit/Sales | 16.75% | 13.91% | 9.46% |

Projected Cash Flow

The projected cash flow shows the business investing in additional assets (furniture, computers, equipment) in the second and third year to equip the office. While the cash balance of the business is low, the salary paid to Kolem Plynthe will act as a safety valve and can be reduced if the cash is not currently available.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $0 | $0 | $0 |

| Cash from Receivables | $105,935 | $195,778 | $278,470 |

| Subtotal Cash from Operations | $105,935 | $195,778 | $278,470 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $10,000 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $105,935 | $205,778 | $278,470 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $49,000 | $85,000 | $150,000 |

| Bill Payments | $67,097 | $97,984 | $119,589 |

| Subtotal Spent on Operations | $116,097 | $182,984 | $269,589 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $4,000 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $3,000 | $3,000 |

| Purchase Other Current Assets | $0 | $5,000 | $5,000 |

| Purchase Long-term Assets | $0 | $15,000 | $5,000 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $120,097 | $205,984 | $282,589 |

| Net Cash Flow | ($14,162) | ($206) | ($4,119) |

| Cash Balance | $9,838 | $9,632 | $5,513 |

Projected Balance Sheet

The balance sheet reflects that assets will not need to be purchased until the second year when the business moves from the home office of Kolem Plynthe to a small commercial office space in Peristyle Gardens.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Cash | $9,838 | $9,632 | $5,513 |

| Accounts Receivable | $45,365 | $64,412 | $91,667 |

| Other Current Assets | $0 | $5,000 | $10,000 |

| Total Current Assets | $55,203 | $79,044 | $107,180 |

| Long-term Assets | $0 | $15,000 | $20,000 |

| Accumulated Depreciation | $0 | $5,000 | $10,000 |

| Total Long-term Assets | $0 | $10,000 | $10,000 |

| Total Assets | $55,203 | $89,044 | $117,180 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $10,853 | $7,803 | $10,011 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $10,853 | $7,803 | $10,011 |

| Long-term Liabilities | $0 | $7,000 | $4,000 |

| Total Liabilities | $10,853 | $14,803 | $14,011 |

| Paid-in Capital | $27,000 | $27,000 | $27,000 |

| Retained Earnings | ($8,000) | $17,350 | $47,241 |

| Earnings | $25,350 | $29,891 | $28,928 |

| Total Capital | $44,350 | $74,241 | $103,169 |

| Total Liabilities and Capital | $55,203 | $89,044 | $117,180 |

| Net Worth | $44,350 | $74,241 | $103,169 |

The business ratios for Plynthe Insurance are compared here against insurance agencies and brokerages (NAISC industry code 534210, SIC code 6411) of under $500,000 annual revenue. The accounts receivable ratio for the business is higher than the industry average as all accounts will be paid out of commissions from insurance providers after the policies have been processed and bills put through their systems. Also, the fact that the industry average S G & A expense and Advertising expense is much lower (as a percentage of sales) than that of Plynthe Insurance shows that the business can grow to a much greater scale, spreading its current relatively fixed costs over more agents and becoming more profitable in the process. As the business grows, this will be possible.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | n.a. | 41.99% | 42.31% | 1.02% |

| Percent of Total Assets | ||||

| Accounts Receivable | 82.18% | 72.34% | 78.23% | 8.34% |

| Other Current Assets | 0.00% | 5.62% | 8.53% | 76.12% |

| Total Current Assets | 100.00% | 88.77% | 91.47% | 84.46% |

| Long-term Assets | 0.00% | 11.23% | 8.53% | 15.54% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 10.853 | 7.803 | 10.011 | .87 |

| Current Borrowing | $0 | $0 | $0 | |

| Other Current Liabilities | $0 | $0 | $0 | |

| Subtotal Current Liabilities | $10,853 | $7,803 | $10,011 | |

| Long-term Liabilities | $0 | $7,000 | $4,000 | |

| Total Liabilities | $10,853 | $14,803 | $14,011 | |

| Net Worth | $44,350 | $74,

Sales Forecast Unit Sales Propery Insurance 25 29 32 37 42 48 55 63 71 81 93 106 Life Insurance 12 13 15 17 20 22 25 28 37 38 42 49 Long Term Care/Disability 0 0 0 0 0 1 1 2 3 5 6 8 Valuable Items 13 15 17 20 23 26 29 33 38 43 49 57 Personal Liability 0 0 0 0 0 0 2 4 7 11 15 18 Total Unit Sales 50 57 64 74 85 97 112 130 156 178 205 238 Unit Prices Propery Insurance $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 Life Insurance $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 Long Term Care/Disability $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 Valuable Items $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 Personal Liability $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 $75.00 Sales Propery Insurance $2,500 $2,900 $3,200 $3,700 $4,200 $4,800 $5,500 $6,300 $7,100 $8,100 $9,300 $10,600 Life Insurance $1,800 $1,950 $2,250 $2,550 $3,000 $3,300 $3,750 $4,200 $5,550 $5,700 $6,300 $7,350 Long Term Care/Disability $0 $0 $0 $0 $0 $150 $150 $300 $450 $750 $900 $1,200 Valuable Items $975 $1,125 $1,275 $1,500 $1,725 $1,950 $2,175 $2,475 $2,850 $3,225 $3,675 $4,275 Personal Liability $0 $0 $0 $0 $0 $0 $150 $300 $525 $825 $1,125 $1,350 Total Sales $5,275 $5,975 $6,725 $7,750 $8,925 $10,200 $11,725 $13,575 $16,475 $18,600 $21,300 $24,775 Direct Unit Costs Propery Insurance 16.00% $16.00 $16.00 $16.00 $16.00 $16.00 $16.00 $16.00 $16.00 $16.00 $16.00 $16.00 Life Insurance 16.00% $24.00 $24.00 $24.00 $24.00 $24.00 $24.00 $24.00 $24.00 $24.00 $24.00 $24.00 Long Term Care/Disability 16.00% $24.00 $24.00 $24.00 $24.00 $24.00 $24.00 $24.00 $24.00 $24.00 $24.00 $24.00 Valuable Items 16.00% $12.00 $12.00 $12.00 $12.00 $12.00 $12.00 $12.00 $12.00 $12.00 $12.00 $12.00 Personal Liability 16.00% $12.00 $12.00 $12.00 $12.00 $12.00 $12.00 $12.00 $12.00 $12.00 $12.00 $12.00 Direct Cost of Sales Propery Insurance $400 $464 $512 $592 $672 $768 $880 $1,008 $1,136 $1,296 $1,488 $1,696 Life Insurance $288 $312 $360 $408 $480 $528 $600 $672 $888 $912 $1,008 $1,176 Long Term Care/Disability $0 $0 $0 $0 $0 $24 $24 $48 $72 $120 $144 $192 Valuable Items $156 $180 $204 $240 $276 $312 $348 $396 $456 $516 $588 $684 Personal Liability $0 $0 $0 $0 $0 $0 $24 $48 $84 $132 $180 $216 Subtotal Direct Cost of Sales $844 $956 $1,076 $1,240 $1,428 $1,632 $1,876 $2,172 $2,636 $2,976 $3,408 $3,964 Personnel Plan Kolem Plynthe $3,000 $3,000 $3,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $5,000 $5,000 $5,000 $5,000 Associate Agent $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total People 1 1 1 1 1 1 1 1 1 1 1 1 1 Total Payroll $3,000 $3,000 $3,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $5,000 $5,000 $5,000 $5,000 Pro Forma Profit and Loss Sales $5,275 $5,975 $6,725 $7,750 $8,925 $10,200 $11,725 $13,575 $16,475 $18,600 $21,300 $24,775 Direct Cost of Sales $844 $956 $1,076 $1,240 $1,428 $1,632 $1,876 $2,172 $2,636 $2,976 $3,408 $3,964 Other Costs of Sales $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Cost of Sales $844 $956 $1,076 $1,240 $1,428 $1,632 $1,876 $2,172 $2,636 $2,976 $3,408 $3,964 Gross Margin $4,431 $5,019 $5,649 $6,510 $7,497 $8,568 $9,849 $11,403 $13,839 $15,624 $17,892 $20,811 Gross Margin % 84.00% 84.00% 84.00% 84.00% 84.00% 84.00% 84.00% 84.00% 84.00% 84.00% 84.00% 84.00% Expenses Payroll $3,000 $3,000 $3,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $5,000 $5,000 $5,000 $5,000 Marketing/Promotion $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 Depreciation $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Rent $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 Utilities $50 $50 $50 $50 $50 $50 $50 $50 $50 $50 $50 $50 $50 Insurance $200 $200 $200 $200 $200 $ Pro Forma Cash Flow |

||

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $0 | ||||||||||||

| Cash from Receivables | $0 | $176 | $5,298 | $6,000 | $6,759 | $7,789 | $8,968 | $10,251 | $11,787 | $13,672 | $16,546 | $18,690 | |

| Subtotal Cash from Operations | $0 | $176 | $5,298 | $6,000 | $6,759 | $7,789 | $8,968 | $10,251 | $11,787 | $13,672 | $16,546 | $18,690 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | |||||||||||||

| New Other Liabilities (interest-free) | |||||||||||||

| New Long-term Liabilities | |||||||||||||

| Sales of Other Current Assets | |||||||||||||

| Sales of Long-term Assets | |||||||||||||

| New Investment Received | |||||||||||||

| Subtotal Cash Received | $0 | $176 | $5,298 | $6,000 | $6,759 | $7,789 | $8,968 | $10,251 | $11,787 | $13,672 | $16,546 | $18,690 | |

| Expenditures | |||||||||||||

| Expenditures from Operations | |||||||||||||

| Cash Spending | $3,000 | $3,000 | $3,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $5,000 | $5,000 | $5,000 | $5,000 | |

| Bill Payments | $1,121 | $3,626 | $3,913 | $4,218 | $4,451 | $4,934 | $5,460 | $6,090 | $6,857 | $7,849 | $8,729 | $9,848 | |

| Subtotal Spent on Operations | $4,121 | $6,626 | $6,913 | $8,218 | $8,451 | $8,934 | $9,460 | $10,090 | $11,857 | $12,849 | $13,729 | $14,848 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $175 | $218 | $238 | $259 | $282 | $307 | $335 | $365 | $398 | $434 | $473 | $516 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $4,296 | $6,844 | $7,151 | $8,477 | $8,733 | $9,241 | $9,795 | $10,455 | $12,255 | $13,283 | $14,202 | $15,364 | |

| Net Cash Flow | ($4,296) | ($6,668) | ($1,853) | ($2,477) | ($1,974) | ($1,452) | ($828) | ($204) | ($468) | $388 | $2,344 | $3,326 | |

| Cash Balance | $19,704 | $13,036 | $11,183 | $8,706 | $6,732 | $5,280 | $4,452 | $4,248 | $3,779 | $4,168 | $6,512 | $9,838 | |

Pro Forma Balance Sheet

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | |||||||||||||

| Current Assets | |||||||||||||

| Cash | $24,000 | $19,704 | $13,036 | $11,183 | $8,706 | $6,732 | $5,280 | $4,452 | $4,248 | $3,779 | $4,168 | $6,512 | $9,838 |

| Accounts Receivable | $0 | $5,275 | $11,074 | $12,501 | $14,251 | $16,417 | $18,827 | $21,585 | $24,909 | $29,598 | $34,526 | $39,280 | $45,365 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $24,000 | $24,979 | $24,110 | $23,684 | $22,957 | $23,149 | $24,107 | $26,037 | $29,157 | $33,377 | $38,694 | $45,792 | $55,203 |

| Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Assets | $24,000 | $24,979 | $24,110 | $23,684 | $22,957 | $23,149 | $24,107 | $26,037 | $29,157 | $33,377 | $38,694 | $45,792 | $55,203 |

| Liabilities and Capital | |||||||||||||

| Current Liabilities | |||||||||||||

| Accounts Payable | $1,000 | $3,496 | $3,773 | $4,070 | $4,287 | $4,753 | $5,258 | $5,863 | $6,596 | $7,559 | $8,402 | $9,473 | $10,853 |

| Current Borrowing | $4,000 | $3,825 | $3,607 | $3,369 | $3,110 | $2,828 | $2,521 | $2,186 | $1,821 | $1,423 | $989 | $516 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $5,000 | $7,321 | $7,380 | $7,439 | $7,397 | $7,581 | $7,779 | $8,049 | $8,417 | $8,982 | $9,391 | $9,989 | $10,853 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $5,000 | $7,321 | $7,380 | ||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!