Tennis Master Pro Shops, Inc. operates retail tennis stores under the brand name Tennis Master Pro Shops. Each location markets indoor tennis instruction and custom racket fitting, both of which are high-profit and low-inventory services. Custom fitted rackets are made on-site and sold under the "Tennis Master" brand. Tennis instruction and training are conducted by in-store staff under the direction of a USTA professional.

Each Tennis Master Pro Shop spans 5,000 square feet and includes two virtual reality tennis simulators, two computer swing analysis systems, a racket fitting analysis system, and four additional practice court and net combinations. The product mix also includes private label and brand name tennis merchandise.

Tennis Master plans to grow from 15 stores to a total of 380 stores in the next three years. Ten stores will be company owned, while the rest will be franchised. They aim to achieve this high growth rate by selling forty "Master Franchise" licenses to qualified regional marketers.

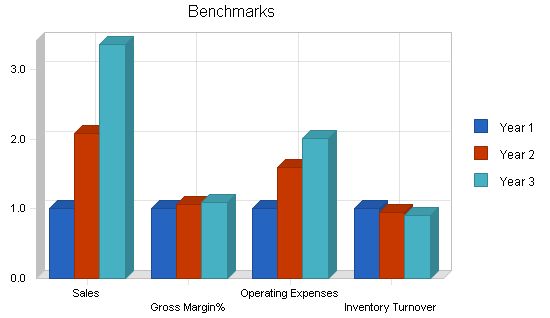

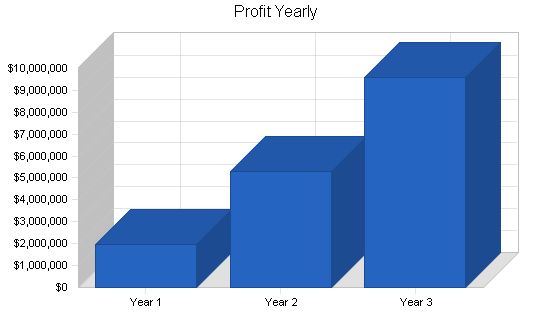

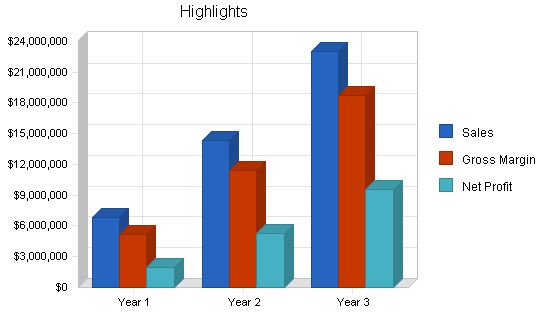

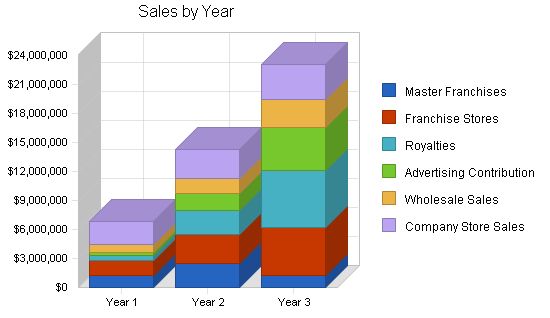

All Tennis Master franchise operations and company-owned stores will fall under the corporate umbrella of Tennis Master Pro Shops, Inc. Combined revenues are projected to be $6.8 million in Year 1, $14.3 million in Year 2, and $23 million in Year 3. Profits are expected to increase from $1.8 million in Year 1 to $5 million in Year 2, and $9.3 million in Year 3. Margins will also rise from 26.7% to 40.3% over the same period. These key points of the plan are illustrated in the chart below:

Contents

1.1 Objectives

Tennis Master aims to become the nation’s largest retail indoor training facility, with a target of 400 retail locations. We plan to achieve this through the following roll-out:

- Year 1: 10 Master Franchises and 60 retail stores.

- Year 2: 20 Master Franchises and 120 retail stores (Cumulative: 30 Master Franchises and 180 retail stores).

- Year 3: 10 Master Franchises and 200 retail stores (Cumulative: 40 Master Franchises and 380 retail stores).

For a table illustrating this expansion plan, please refer to Appendix "D".

The overall retail objective for each store is to achieve 25% utilization of available training time. All projections in this plan are based on timed growth up to the 25% utilization level. This level of utilization will generate highly profitable retail stores, which combined with successful franchise sales, will be essential to the plan’s success.

1.2 Mission

Tennis Master Pro Shops, Inc. strives to offer the finest indoor tennis training available, promoting the enjoyment of the game for tennis enthusiasts of all levels. This will be achieved through individual instruction in tennis fundamentals and personalized equipment fitting, conveniently offered at times and locations that suit our customers.

Tennis Master Pro Shops, Inc. commits to providing an outstanding business opportunity to our franchisees and delivering the training and ongoing support outlined in our franchise program.

1.3 Keys to Success

The keys to success for Tennis Master’s business are:

- Achieving store expansion goals (company stores and franchise stores).

- Maintaining a minimum of 25% utilization of training time in each retail location.

- Securing initial capitalization.

- Implementing franchise marketing program.

- Executing retail marketing program.

- Converting existing stores to training/racket fitting format.

- Considering economic and tennis playing demographics when selecting store locations.

- Effectively managing both company and franchise stores.

- Maintaining cash flow, franchise sales pace, and obtaining additional investment in year one to support company-owned store expansion.

Company Summary

Tennis Master Pro Shops are positioned to meet the growing need for tennis instruction among new and existing tennis enthusiasts in the U.S. Our stores offer computerized swing analysis, indoor tennis practice and simulation on real tennis courts, and ongoing tennis lessons and instruction for players seeking to improve their game.

Our stores provide custom racket fitting for "Tennis Master" tennis rackets, as well as popular national name brand rackets, ensuring that players have equipment best suited to their game.

All Tennis Master stores are clean, well-merchandised, and attractive. They serve as tennis centers where players of all abilities feel welcome and comfortable, encouraging them to spend time in the store and return repeatedly.

2.1 Company Ownership

Tennis Master Pro Shops, Inc. is a privately held Cascade State "C" corporation founded by John Jones. Other stockholders include Doug Smith, James Brown, and Jeff Clark.

Tennis Master Pro Shops, Inc. has previously operated the original flagship store in Anytown, WA, and has sold approximately 15 franchise locations (not all of which have opened yet). Revenues to date total approximately $1 million, with minimal profit.

For the purpose of this plan, Tennis Master Pro Shops, Inc. treats the expansion as a start-up, including all previous assets and operations in this plan.

Tennis Master Pro Shops, Inc. currently seeks to extend ownership via a Private Placement to additional investors.

2.2 Start-up Summary

The next generation of computer training combines the "computer coach" concept with a simulator. This technology is currently being developed and initial marketing is underway as a joint venture between Tennis Training Systems, Inc. and [name omitted]. The new simulation training system, called [name omitted], is currently priced at $500,000 per system, which exceeds the scope of Tennis Master’s retail concept at this time. However, as these technologies further develop, their cost tends to decrease.

Our management will maintain a working relationship with [name omitted] to stay informed about product development and cost reduction. At present, the extra benefits of these systems may be excessive for all but the most serious tennis enthusiasts. There is a need in tennis training to keep it simple, and it is debatable if consumers are willing to invest in this system under its current cost structure. Nevertheless, the capabilities of this system surpass anything currently available.

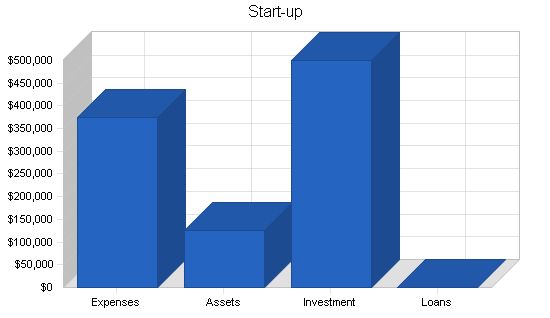

Start-up Funding

Start-up Expenses to Fund: $374,000

Start-up Assets to Fund: $126,000

Total Funding Required: $500,000

Assets

Non-cash Assets from Start-up: $36,000

Cash Requirements from Start-up: $90,000

Additional Cash Raised: $0

Cash Balance on Starting Date: $90,000

Total Assets: $126,000

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $0

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $0

Capital

Planned Investment

Owner: $0

Investor: $0

Additional Investment Requirement: $500,000

Total Planned Investment: $500,000

Loss at Start-up (Start-up Expenses): ($374,000)

Total Capital: $126,000

Total Capital and Liabilities: $126,000

Total Funding: $500,000

Start-up

Requirements

Start-up Expenses

Legal: $20,000

Franchise Marketing Materials: $25,000

Investment Offering Costs: $15,000

Consultants: $12,500

Insurance: $1,500

Rent & Deposits: $15,000

Store Build-out: $50,000

Expensed Equipment: $5,000

Simulator (1): $40,000

Swing Analysis Systems (2): $30,000

Racket Fitting Analysis System: $10,000

Existing Debt Retirement: $150,000

Total Start-up Expenses: $374,000

Start-up Assets

Cash Required: $90,000

Start-up Inventory: $36,000

Other Current Assets: $0

Long-term Assets: $0

Total Assets: $126,000

Total Requirements: $500,000

2.3 Company Locations and Facilities

Tennis Master Pro Shops, Inc. is presently located at: 1234 Main Street, Anytown, WA. 98000. The phone # is ….

The new retail location planned at the launch of this expansion plan will be in one of several spots already investigated. Retail space is expected to lease at approx. $12 per square foot in the most desirable Anytown locations. Build-out costs will be approx. $50,000.

The warehouse and distribution facility (which will also house corporate offices) will be approx. $6 per square foot with $100,000 build-out costs.

Products

The following sub-sections describe our products and services.

3.1 Product Description

The products and services discussed in section 2.0 are all geared to the demands of today’s active and busy tennis player. Many tennis enthusiasts would practice more or spend more on lessons if they had the available time. With leisure time at a premium, most tennis enthusiasts seldom take lessons and many don’t practice at all. The primary obstacle is work and available daylight. This forces most tennis enthusiasts to play on weekends when courts are most crowded. In addition, bad weather sometimes forces tennis enthusiasts to miss play or practice on the only days they have available. Tennis Master Pro Shops will be open seven days per week, rain or shine, and until 10 or 11 PM depending on demand.

One fear sighted by new tennis enthusiasts as an obstacle to taking lessons is the fear of embarrassment. Most tennis courts and teaching facilities are out-of-doors and open to the view of many. A Tennis Master Pro Shop will offer these tennis enthusiasts a more private and secure atmosphere for their instruction. Our instructors, as well as our concept of “In Tune with Your Game,” will promise training that is both fun and effective.

Information on products and services in Tennis Master’s mix are included in appendix “B” (Note: This is a customer-included appendix; not part of a standard plan).

3.2 Competitive Comparison

Tennis retailing is dominated by the “discount tennis” chain stores. Examples are [name omitted], [name omitted], and [name omitted]. These stores predominantly sell tennis equipment. An individual store may carry as much as $750,000 in inventory at any given time. No lessons or training are offered, and even though a partial swing analysis may be performed, rackets are not custom fitted. The rackets sold are always “off the shelf.”

Our research identified scores of small businesses doing “custom racket fitting” from components. The Internet has thirty or forty companies that offer this service, some with proprietary equipment, others with “clones” of name brand rackets. The common denominator in all of these businesses is that they are local businesses, many with one retail outlet, that are attempting to do national “mail order” or “electronic marketing.” They do not have the economic power or the media strength to build a national identity. Another common focus of these businesses is their focus on “price” as their marketing centerpiece. They seem to be saying “get rackets as good as these other ones for less than half the price.” Certainly there is no focus on product quality, brand loyalty, or building a business identity.

Indoor tennis training, our other primary business segment, is not a new concept. Once again, there are many local businesses and some small multi-store sites in operation. Once again, there is no national identity. Our management is aware of one previous franchising effort in indoor training. “Great Tennis Learning Centers” grew quickly to 18 stores but the franchise company was undercapitalized and didn’t have a workable retail marketing program. Many of the stores continue in successful operation but the franchise is defunct.

There are currently several franchise or licensed operations in the custom fitted racket area. The two most noteworthy are [name omitted] Tennis which sells through court-side pro shops at tennis complex locations. [Name omitted] offers its own proprietary frames at a high price. Another new franchise is [name omitted]. [name omitted] has about 40 stores mostly located in the Western U.S. at present. [Name omitted]’s marketing focus is on price. The stores are located in “outlet” retail or semi-industrial areas with low rent. They offer ONLY custom fitted rackets (their proprietary racket frames) at low price. Because of their retail location philosophy, they must be able to generate significant advertising funding in order to succeed.

More discussion is included later in this plan on competitive businesses.

Tennis Master intends to position itself as the only national chain that combines custom fitted rackets with indoor training. The training aspect is in constant demand by tennis enthusiasts. It doesn’t require inventory and the marketing task is not one of selling rackets to new tennis enthusiasts or replacement rackets to existing tennis enthusiasts. Hence, it becomes the marketing focus and the primary profit center of a Tennis Master store. Our management believes that racket sales will flow from building a training and practice base of customers, both new and experienced, who can then be converted to the concept of custom fitted rackets as they come to realize that using those rackets will enhance their enjoyment of the game of tennis.

Certainly the Tennis Master concept is identifiable. The name of Tennis Master is perhaps the single best name in tennis retailing. Brand identity and awareness are only a function of successfully marketing our identity. More discussion of our “marketing identity” follows later in this plan.

3.3 Sales Literature

Tennis Master is currently finalizing all new product literature. This includes brochures for retail and franchise marketing. There are two primary retail brochures. One focuses on training programs, facilities, and technology. The other focuses on custom racket fitting, explaining the concept, procedures, components, and benefits of using custom fitted rackets.

The franchise marketing materials will include our flagship store in Anytown as a model. The franchise marketing materials will stress the “fun” of being in the tennis business on a full-time basis.

3.4 Sourcing

The primary sources for Tennis Master are as follows:

– [details omitted].

– [details omitted].

– [details omitted].

Product literature from most of these companies is included in Appendix “B” (Note: This is a customer-included appendix; not part of a standard plan).

3.5 Technology

The technologies used by Tennis Master are not patented or owned by Tennis Master. They are readily available in the marketplace. Both computer swing analysis and tennis simulation experience have been proven by others to be profitable and marketable concepts. In addition, there are several manufacturers of competing products in each segment.

The key advantage of the Computer Coach is its association with the [details omitted] name – the premier name in tennis instruction today. Also, we can store and catalogue customer’s swings – a repeat marketing tool.

The simulator experience complements training (i.e., the swing and “net” time can be transferred to the simulator to see the ball flight). The simulator is highly accurate with respect to ball velocity, distance, and flight path.

3.6 Future Products

Each product or service in the Tennis Master mix fills a need or demand created by:

– The growing number of tennis participants.

– The overcrowded conditions at current tennis facilities.

– The demand for tennis experience in non-traditional hours (i.e., at night, in quick day-time breaks, or in bad weather).

– The shortage of teaching pros available to non-club members or at non-traditional times.

– The availability of new technologies in training methods.

– The desire for privacy in instruction.

– A non-threatening teaching environment.

The [details omitted].

The tennis simulator [details omitted].

Lessons are geared for individual instruction. They [details omitted].

Tennis instruction may often lead to [details omitted].

National name brand rackets [details omitted].

Name brand tennis [details omitted].

Also, the [details omitted].

Market Analysis Summary

In order to effectively analyze our markets, it is necessary to look at both the consumer’s needs and the retail and distribution environment in the tennis industry. Much data and information is available in both areas.

Most of the research and statistics included in this plan are from a survey conducted by the National Tennis Foundation called “Tennis Consumer Spending in the U.S.” and additional information is from a database survey of tennis enthusiasts by market called “Tennis in America.”

Over-all consumer spending on tennis equipment and tennis activities exceeds $16 billion annually. $2.3 billion is spent on equipment (primarily rackets), $2.9 billion on other merchandise (court bags, balls, shoes, and apparel), $947 million on accessories, and $10.1 billion is spent on playing fees (reserved court time fees, club memberships, and miscellaneous fees).

A gap in available data exists in the area of spending on tennis lessons and instruction. The National Tennis Foundation is conducting a survey to determine these expenditures. The problem with gathering this data is that much of the spending on tennis instruction, for example, is cash “off the books.” While no one currently knows the exact level of spending on tennis instruction, everyone agrees that the actual figure may well be in the hundred million dollar range. With more than 20 million tennis enthusiasts, that would amount to only $5.00 per tennis player.

4.1 Market Segmentation

Tennis Master’s market segment as a whole is the entire tennis playing population of the U.S., currently more than 20 million tennis enthusiasts and growing by approximately 10% a year. That is, there are two million new tennis enthusiasts in this country each year. This segment alone needs equipment and lessons. However, two million customers is not sufficient to sustain Tennis Master’s national expansion plan. We must also be successful in marketing to existing tennis enthusiasts, which will extend our total segment to more than 20 million current potential customers.

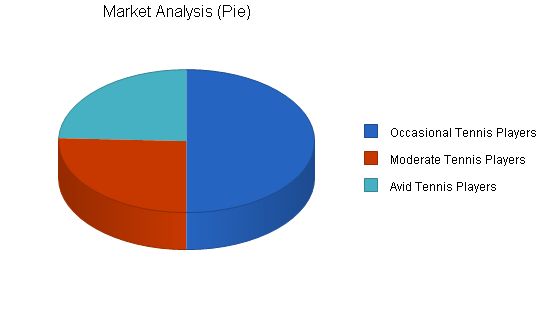

The National Tennis Foundation has developed extensive demographic data on buying patterns by sub-dividing tennis related purchases into the segments of occasional, moderate, and avid tennis enthusiasts. These three groups have distinctively different needs and buying patterns. This is discussed in more detail in the Market Analysis section 4.3 of this plan.

Market Analysis:

Year 1 Year 2 Year 3 Year 4 Year 5

Potential Customers Growth CAGR

Occasional Tennis Players 11% 11,341,000 12,588,510 13,973,246 15,510,303 17,216,436 11.00%

Moderate Tennis Players 10% 5,813,000 6,394,300 7,033,730 7,737,103 8,510,813 10.00%

Avid Tennis Players 6% 5,518,000 5,849,080 6,200,025 6,572,027 6,966,349 6.00%

Total 9.58% 22,672,000 24,831,890 27,207,001 29,819,433 32,693,598 9.58%

The tennis industry can be divided into the following segments:

1. Tennis Retailers.

2. Tennis Racket Manufacturers (National Brands).

3. Tennis Racket Assemblers (Components) and their suppliers.

4. Tennis Instruction & Training (Indoor).

4.2.1 Industry Participants

In tennis racket manufacturing, the "Big 3" companies dominate the market, while other manufacturers struggle to be profitable. Tennis Master will not focus on manufacturing rackets, but rather on custom-fitting rackets for our training clientele. We will also not compete with discount racket makers.

In component racket assembly, there are many small companies marketing primarily on price. Major suppliers dominate the market at the wholesale level.

In tennis retailing, we will not compete with the retail giants due to their price advantage, group purchasing power, and media exposure. We do not want to be burdened by high inventory levels.

Tennis instruction and training is not always readily available when customers desire it. Tennis Master seeks to dominate this market opportunity by providing national indoor tennis training centers.

4.2.2 Distribution Patterns

Distribution of Tennis Master’s products is secondary to the success of our training programs. Most tennis rackets are purchased from major retailers, followed by sporting goods stores, courtside pro shops, mass merchants, and catalog/mail order/other channels.

To effectively distribute our training programs, we will use demographic data to identify the best locations for our retail stores based on tennis playing demographics. We will also utilize the internet, direct mail, and catalog marketing to reach tennis enthusiasts in areas where we do not have stores.

Tennis Master has no plans to expand the distribution of its rackets to other retail outlets. International expansion is not discussed in this plan, but it is a long-term goal for the company.

Strategy and Implementation Summary

This is sample text only. The original was very proprietary, describing the company strategy in detail.

This is sample text only. The original was very proprietary, describing the company strategy in detail.

5.1.1 Promotion Strategy

This is sample text only. The original was very proprietary, describing the company strategy in detail.

5.1.2 Distribution Strategy

This is sample text only. The original was very proprietary, describing the company strategy in detail.

5.1.3 Pricing Strategy

This is sample text only. The original was very proprietary, describing the company strategy in detail.

5.2 Sales Strategy

This is sample text only. The original was very proprietary, describing the company strategy in detail.

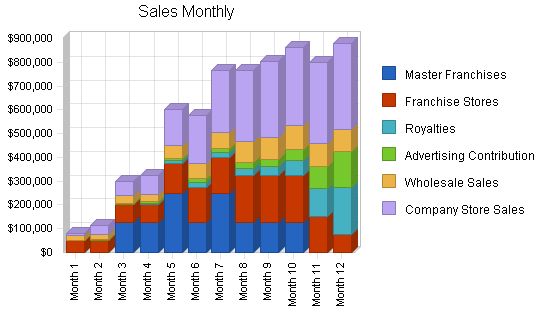

5.2.1 Sales Forecast

Tennis Master’s sales forecasts are based on certain assumptions:

1. A new store will attain the projected sales level within one year of opening.

2. The timing of new store openings aligns with Tennis Master’s expansion plan.

3. Revenue projections only consider 50% of stores added during a given year, and revenue is projected at 80% of target on those stores only.

The following table shows the effect of staggered franchise sales and corresponding retail revenue growth and royalty growth. Unit costs and franchise sales commissions are included in the calculations.

Note: The remaining text is sample text only and not related to the task.

Sales Forecast

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Unit Sales | |||

| Master Franchises | 10 | 20 | 10 |

| Franchise Stores | 60 | 120 | 200 |

| Royalties | 518,750 | 2,419,200 | 5,875,200 |

| Advertising Contribution | 389,062 | 1,814,400 | 4,406,400 |

| Wholesale Sales | 761,850 | 1,577,395 | 2,916,531 |

| Company Store Sales | 2,450,000 | 3,000,000 | 3,600,000 |

| Total Unit Sales | 4,119,732 | 8,811,135 | 16,798,341 |

| Unit Prices | Year 1 | Year 2 | Year 3 |

| Master Franchises | $125,000.00 | $125,000.00 | $125,000.00 |

| Franchise Stores | $25,000.00 | $25,000.00 | $25,000.00 |

| Royalties | $1.00 | $1.00 | $1.00 |

| Advertising Contribution | $1.00 | $1.00 | $1.00 |

| Wholesale Sales | $1.00 | $1.00 | $1.00 |

| Company Store Sales | $1.00 | $1.00 | $1.00 |

| Sales | |||

| Master Franchises | $1,250,000 | $2,500,000 | $1,250,000 |

| Franchise Stores | $1,500,000 | $3,000,000 | $5,000,000 |

| Royalties | $518,750 | $2,419,200 | $5,875,200 |

| Advertising Contribution | $389,062 | $1,814,400 | $4,406,400 |

| Wholesale Sales | $761,850 | $1,577,395 | $2,916,531 |

| Company Store Sales | $2,450,000 | $3,000,000 | $3,600,000 |

| Total Sales | $6,869,662 | $14,310,995 | $23,048,131 |

| Direct Unit Costs | Year 1 | Year 2 | Year 3 |

| Master Franchises | $12,500.00 | $12,500.00 | $12,500.00 |

| Franchise Stores | $5,000.00 | $5,000.00 | $5,000.00 |

| Royalties | $0.00 | $0.00 | $0.00 |

| Advertising Contribution | $0.00 | $0.00 | $0.00 |

| Wholesale Sales | $0.70 | $0.70 | $0.70 |

| Company Store Sales | $0.30 | $0.30 | $0.30 |

| Direct Cost of Sales | |||

| Master Franchises | $125,000 | $250,000 | $125,000 |

| Franchise Stores | $300,000 | $600,000 | $1,000,000 |

| Royalties | $0 | $0 | $0 |

| Advertising Contribution | $0 | $0 | $0 |

| Wholesale Sales | $533,295 | $1,104,177 | $2,041,572 |

| Company Store Sales | $735,000 | $900,000 | $1,080,000 |

| Subtotal Direct Cost of Sales | $1,693,295 | $2,854,177 | $4,246,572 |

Management Summary

This section presents the credentials and experience of Tennis Master’s management team, the future personnel needs of the company, projections of personnel costs, and the gaps in management that need to be filled.

6.1 Organizational Structure

Tennis Master’s franchise and general management team will be headquartered in Anytown, Washington. Company-owned stores will report to the Corporate Store Operations Manager. Each store will be staffed as follows:

1. General Manager (USTA Pro) and head instructor.

2. Sales Manager/Assistant General Manager.

3. Two to four Trainers/Operators (according to demand).

4. Receptionist/Administrator/Scheduler.

5. Racket maker/repair.

The payroll of individual stores is included in Appendix "E" (Note: this is a customer-included appendix and not part of a standard plan).

6.2 Management Team

The key management personnel of Tennis Master Pro Shops, Inc. are as follows:

John Jones, Jr. (34) – Chairman, CEO

John Jones is the founder of Tennis Master. He has been responsible for originating the concept, operating the Anytown retail store, and marketing the franchises to date. Previously, Mr. Jones founded a Home Medical Equipment Company which he sold to a national firm. Prior to that, he spent 11 years with [name omitted], Inc., a regional human resource company, advancing to Vice President of Industrial Services. Mr. Jones is active in numerous civic, church, and political organizations. He has a BBA in Marketing from Anytown College (1985).

Doug Smith (48) – Secretary, General Counsel, and Director

Mr. Smith is also a founder of Tennis Master. He is a partner of Smith, Doe, & Johnson, P.C. of Anytown, Washington. Mr. Smith is active in civic, business, and professional organizations. He is a member of the Forum on Health Law of the American Bar Association and the National Health Lawyers Association. Mr. Smith also serves on the board of governors of the State Bar of Washington and is a member of the National Association of Bond lawyers. Mr. Smith holds Bachelor of Business Administration (1970) and Juris Doctor (1973) degrees from the University of Washington.

James J. Clark (48) – Vice-President, Corporate Development

Mr. Clark is the principal and founder of [name omitted], an investment advisory firm in Anytown, Washington. He also serves as Chief Operating Officer of [name omitted], Inc. Mr. Clark’s background includes middle management positions in Sales and Marketing with [name omitted] Company and the [name omitted], Inc. in both Chicago and New York. He has also held senior management positions with three different development stage companies with responsibility for P & L, Strategic Planning, and Capitalization. Mr. Clark has a BBA in Marketing from the [name omitted].

6.3 Management Team Gaps

The following management personnel will need to be added to our team to effectively grow at the projected rate. Some candidates have already been identified for these positions.

– Controller/Systems Administrator

– Director of Marketing

– Chief Financial Officer

– Store Operations Manager

– Training Manager

– Warehouse/Distribution Manager

– Franchise Sales Director

6.4 Personnel Plan

The following table illustrates the personnel needs and salary projections for the next three years. Company-owned store salaries are grouped together as one entry. All positions are phased in as needed. The personnel burden for taxes and benefits is 22%.

Personnel Plan

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Production Personnel | |||

| Wholesale Distribution Mgr. | $25,000 | $30,000 | $32,000 |

| Distribution Asst. | $7,500 | $15,000 | $16,500 |

| Customer Service | $15,000 | $18,000 | $19,500 |

| Subtotal | $47,500 | $63,000 | $68,000 |

| Sales and Marketing Personnel | |||

| Franchise Sales Dir. | $44,000 | $48,000 | $48,000 |

| Franchise Salesperson | $22,500 | $30,000 | $0 |

| Director of Marketing | $30,000 | $36,000 | $40,000 |

| Subtotal | $96,500 | $114,000 | $88,000 |

| General and Administrative Personnel | |||

| CEO | $72,000 | $84,000 | $90,000 |

| VP Corp. Dev. | $60,000 | $66,000 | $72,000 |

| CFO | $0 | $72,000 | $76,000 |

| Controller/Systems Admin. | $40,000 | $48,000 | $54,000 |

| Store Operations Mgr. | $33,000 | $42,000 | $48,000 |

| Training Mgr. | $25,000 | $33,000 | $36,000 |

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $6,869,662 | $14,310,995 | $23,048,131 |

| Direct Cost of Sales | $1,693,295 | $2,854,177 | $4,246,572 |

| Production Payroll | $47,500 | $63,000 | $68,000 |

| Other Costs of Sales | $0 | $0 | $0 |

| Total Cost of Sales | $1,740,795 | $2,917,177 | $4,314,572 |

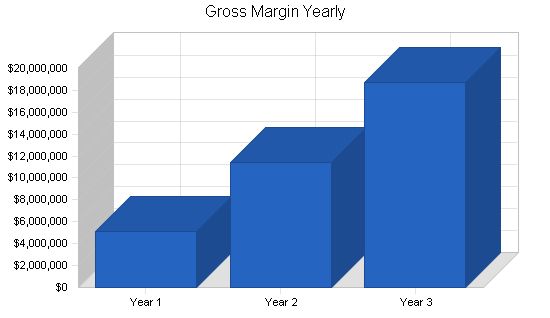

| Gross Margin | $5,128,867 | $11,393,819 | $18,733,559 |

| Gross Margin % | 74.66% | 79.62% | 81.28% |

| Sales and Marketing Payroll | $96,500 | $114,000 | $88,000 |

| Advertising/Promotion | $686,969 | $715,550 | $1,152,407 |

| Travel/Entertainment | $36,000 | $66,000 | $80,000 |

| Marketing Materials | $50,000 | $60,000 | $60,000 |

| Total Sales and Marketing Expenses | $869,469 | $955,550 | $1,380,407 |

| Sales and Marketing % | 12.66% | 6.68% | 5.99% |

| General and Administrative Payroll | $245,000 | $363,000 | $395,500 |

| Depreciation | $41,650 | $99,960 | $119,952 |

| Leased Equipment | $87,360 | $105,200 | $126,240 |

| Utilities | $47,000 | $62,000 | $68,000 |

| Telephone/Fax | $33,200 | $38,000 | $40,000 |

| Insurance | $38,800 | $44,000 | $48,000 |

| Rent | $178,000 | $468,000 | $540,000 |

| Total General and Administrative Expenses | $671,010 | $1,180,160 | $1,337,692 |

| General and Administrative % | 9.77% | 8.25% | 5.80% |

| Other Payroll | $518,400 | $1,296,000 | $1,620,000 |

| Consultants | $75,000 | $0 | $0 |

| Legal | $55,000 | $60,000 | $60,000 |

| Total Other Expenses | $648,400 | $1,356,000 | $1,680,000 |

| Other % | 9.44% | 9.48% | 7.29% |

| Total Operating Expenses | $2,188,879 | $3,491,710 | $4,398,099 |

| Profit Before Interest and Taxes | $2,939,988 | $7,902,109 | $14,335,460 |

| EBITDA | $2,981,638 | $8,002,069 | $14,455,412 |

| Taxes Incurred | $970,196 | $2,607,696 | $4,730,702 |

| Net Profit | $1,969,792 | $5,294,413 | $9,604,758 |

| Net Profit/Sales | 28.67% | 37.00% | 41.67% |

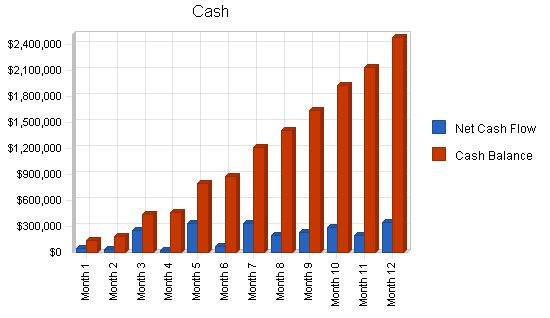

7.5 Projected Cash Flow

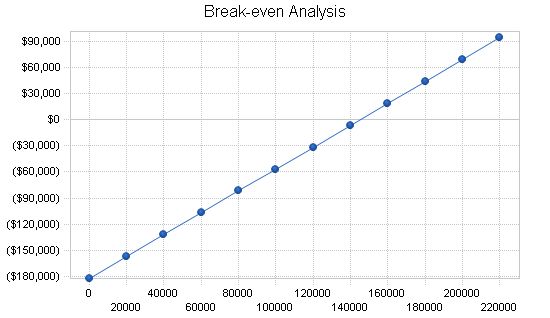

The critical time for cash flow for Tennis Master is the first half of 1997. During this period, substantial cash-out is needed to establish both the flagship Anytown store and the new corporate headquarters and warehouse. These cash expenditures are all hard cash out to be recouped by depreciation. Flow-in of investment funds is also critical. The only way to survive through this period is to curtail expansion if necessary. Additional capital would need to be raised later in 1997 if franchise sales fall far behind expectations.

Given the above assumptions, the following table and chart show that there will be sufficient cash to execute the plan. With successful execution, the company would have a hefty cash balance at the end of 1997 and a stable and enviable cash position at the end of 1999.

Pro Forma Cash Flow

Year 1 Year 2 Year 3

Cash Received

Cash from Operations

Cash Sales $6,869,662 $14,310,995 $23,048,131

Subtotal Cash from Operations $6,869,662 $14,310,995 $23,048,131

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $0 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $100,000 $0 $0

Subtotal Cash Received $6,969,662 $14,310,995 $23,048,131

Expenditures

Year 1 Year 2 Year 3

Expenditures from Operations

Cash Spending $907,400 $1,836,000 $2,171,500

Bill Payments $3,677,812 $7,072,012 $10,984,735

Subtotal Spent on Operations $4,585,212 $8,908,012 $13,156,235

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $0 $0 $0

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $0 $0 $0

Purchase Other Current Assets $0 $0 $0

Purchase Long-term Assets $0 $0 $0

Dividends $0 $0 $0

Subtotal Cash Spent $4,585,212 $8,908,012 $13,156,235

Net Cash Flow $2,384,450 $5,402,983 $9,891,896

Cash Balance $2,474,450 $7,877,433 $17,769,329

7.6 Projected Balance Sheet

The following table projects our balance sheet for the next three years:

Pro Forma Balance Sheet

Year 1 Year 2 Year 3

Assets

Current Assets $206,448 $347,984 $517,746

Total Current Assets $2,680,898 $8,225,417 $18,287,074

Long-term Assets ($41,650) ($141,610) ($261,562)

Total Long-term Assets ($41,650) ($141,610) ($261,562)

Total Assets $2,639,248 $8,083,807 $18,025,512

Liabilities and Capital

Current Liabilities $443,456 $593,602 $930,549

Total Liabilities $443,456 $593,602 $930,549

Paid-in Capital $600,000 $600,000 $600,000

Retained Earnings ($374,000) $1,595,792 $6,890,205

Earnings $1,969,792 $5,294,413 $9,604,758

Total Capital $2,195,792 $7,490,205 $17,094,963

Total Liabilities and Capital $2,639,248 $8,083,807 $18,025,512

Net Worth $2,195,792 $7,490,205 $17,094,963

7.7 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 5941, Sporting Goods and Bicycle Shops, are shown for comparison.

Ratio Analysis

Year 1 Year 2 Year 3 Industry Profile

Sales Growth 0.00% 108.32% 61.05% 6.95%

Percent of Total Assets

Inventory 7.82% 4.30% 2.87% 37.09%

Other Current Assets 0.00% 0.00% 0.00% 24.95%

Total Current Assets 101.58% 101.75% 101.45% 90.45%

Long-term Assets -1.58% -1.75% -1.45% 9.55%

Total Assets 100.00% 100.00% 100.00% 100.00%

Current Liabilities

Accounts Payable 16.80% 7.34% 5.16% 41.65%

Long-term Liabilities 0.00% 0.00% 0.00% 6.78%

Total Liabilities 16.80% 7.34% 5.16% 48.43%

Net Worth 83.20% 92.66% 94.84% 51.57%

Percent of Sales

Sales 100.00% 100.00% 100.00% 100.00%

Gross Margin 74.66% 79.62% 81.28% 23.50%

Selling, General & Administrative Expenses 45.99% 42.62% 39.61% 12.36%

Advertising Expenses 10.00% 5.00% 5.00% 1.21%

Profit Before Interest and Taxes 42.80% 55.22% 62.20% 1.91%

Main Ratios

Current 6.05 13.86 19.65 1.97

Quick 5.58 13.27 19.10 0.97

Total Debt to Total Assets 16.80% 7.34% 5.16% 54.68%

Pre-tax Return on Net Worth 133.89% 105.50% 83.86% 4.99%

Pre-tax Return on Assets 111.39% 97.75% 79.53% 11.02%

Additional Ratios

Year 1 Year 2 Year 3

Net Profit Margin 28.67% 37.00% 41.67% n.a

Return on Equity 89.71% 70.68% 56.18% n.a

Activity Ratios

Inventory Turnover 10.91 10.30 9.81 n.a

Accounts Payable Turnover 9.29 12.17 12.17 n.a

Payment Days 27 26 25 n.a

Total Asset Turnover 2.60 1.77 1.28 n.a

Debt Ratios

Debt to Net Worth 0.20 0.08 0.05 n.a

Current Liab. to Liab. 1.00 1.00 1.00 n.a

Liquidity Ratios

Net Working Capital $2,237,442 $7,631,815 $17,356,525 n.a

Interest Coverage 0.00 0.00 0.00 n.a

Additional Ratios

Year 1 Year 2 Year 3

Assets to Sales 0.38 0.56 0.78 n.a

Current Debt/Total Assets 17% 7% 5% n.a

Acid Test 5.58 13.27 19.10 n.a

Sales/Net Worth 3.13 1.91 1.35 n.a

Dividend Payout 0.00 0.00 0.00 n.a

Appendix

Sales Forecast

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Unit Sales

Master Franchises 0 0 1 1 2 1 2 1 1 1 0 0

Franchise Stores 2 2 3 3 5 6 6 8 8 8 6 3

Royalties 0 2,500 3,750 7,500 12,500 20,000 22,500 30,000 37,500 62,500 120,000 200,000

Advertising Contribution 0 1,875 2,812 5,625 9,375 15,000 16,875 22,500 28,125 46,875 90,000 150,000

Wholesale Sales 20,000 20,780 31,170 32,340 53,900 66,240 67,020 89,360 91,700 99,500 97,440 92,400

Company Store Sales 10,000 40,000 60,000 80,000 150,000 200,000 260,000 300,000 320,000 330,000 340,000 360,000

Total Unit Sales 30,002 65,157 97,736 125,469 225,782 301,247 366,403 441,869 477,334 538,884 647,446 802,403

Unit Prices

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Master Franchises $125,000 $125,000 $125,000 $125,000 $125,000 $125,000 $125,000 $125,000 $125,000 $125,000 $125,000 $125,000

Franchise Stores $25,000 $25,000 $25,000 $25,000 $25,000 $25,000 $25,000 $25,000 $25,000 $25,000 $25,000 $25,000

Royalties $1 $1 $1 $1 $1 $1 $1 $1 $1 $1 $1 $1 $1

Advertising Contribution $1 $1 $1 $1 $1 $1 $1 $1 $1 $1 $1 $1 $1

Wholesale Sales $1 $1 $1 $1 $1 $1 $1 $1 $1 $1 $1 $1 $1

Company Store Sales $1 $1 $1 $1 $1 $1 $1 $1 $1 $1 $1 $1 $1

Sales

Master Franchises $0 $0 $125,000 $125,000 $250,000 $125,000 $250,000 $125,000 $125,000 $125,000 $0 $0

Franchise Stores $50,000 $50,000 $75,000 $75,000 $125,000 $150,000 $150,000 $200,000 $200,000 $200,000 $150,000 $75,000

Royalties $0 $2,500 $3,750 $7,500 $12,500 $20,000 $22,500 $30,000 $37,500 $62,500 $120,000 $200,000

Advertising Contribution $0 $1,875 $2,812 $5,625 $9,375 $15,000 $16,875 $22,500 $28,125 $46,875 $90,000 $150,000

Wholesale Sales $20,000 $20,780 $31,170 $32,340 $53,900 $66,240 $67,020 $89,360 $91,700 $99,500 $97,440 $92,400

Company Store Sales $10,000 $40,000 $60,000 $80,000 $150,000 $200,000 $260,000 $300,000 $320,000 $330,000 $340,000 $360,000

Total Sales $80,000 $115,155 $297,732 $325,465 $600,775 $576,240 $766,395 $766,860 $802,325 $863,875 $797,440 $877,400

Direct Unit Costs

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Master Franchises $0 $0 $12,500 $12,500 $25,000 $12,500 $25,000 $12,500 $12,500 $12,500 $0 $0

Franchise Stores $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000

Royalties $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Advertising Contribution $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Wholesale Sales $0.70 $0.70 $0.70 $0.70 $0.70 $0.70 $0.70 $0.70 $0.70 $0.70 $0.70 $0.70

Company Store Sales $0.30 $0.30 $0.30 $0.30 $0.30 $0.30 $0.30 $0.30 $0.30 $0.30 $0.30 $0.30

Subtotal Direct Cost of Sales $27,000 $36,546 $67,319 $74,138 $132,730 $148,868 $179,914 $205,052 $212,690 $221,150 $200,208 $187,680

Personnel Plan

Production Personnel

Wholesale Distribution Mgr. $0 $0 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500

Distribution Asst. $0 $0 $0 $0 $0 $0 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250

Customer Service $0 $0 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500

Subtotal $0 $0 $4,000 $4,000 $4,000 $4,000 $5,250 $5,250 $5,250 $5,250 $5,250 $5,250 $5,250

Sales and Marketing Personnel

Franchise Sales Dir. $0 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000

Franchise Salesperson $0 $0 $0 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500

Director of Marketing $0 $0 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000

Subtotal $0 $4,000 $7,000 $9,500 $9,500 $9,500 $9,500 $9,500 $9,500 $9,500 $9,500 $9,500 $9,500

General and Administrative Personnel

CEO $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000 $6,000

VP Corp. Dev. $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000

CFO $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Controller/Systems Admin. $0 $0 $4,000 $4,000 $4,000 $4,

Pro Forma Profit and Loss

Sales: $80,000, $115,155, $297,732, $325,465, $600,775, $576,240, $766,395, $766,860, $802,325, $863,875, $797,440, $877,400

Direct Cost of Sales: $27,000, $36,546, $67,319, $74,138, $132,730, $148,868, $179,914, $205,052, $212,690, $221,150, $200,208, $187,680

Production Payroll: $0, $4,000, $4,000, $4,000, $4,000, $4,000, $5,250, $5,250, $5,250, $5,250, $5,250, $5,250

Other Costs of Sales: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Total Cost of Sales: $27,000, $36,546, $71,319, $78,138, $136,730, $152,868, $185,164, $210,302, $217,940, $226,400, $205,458, $192,930

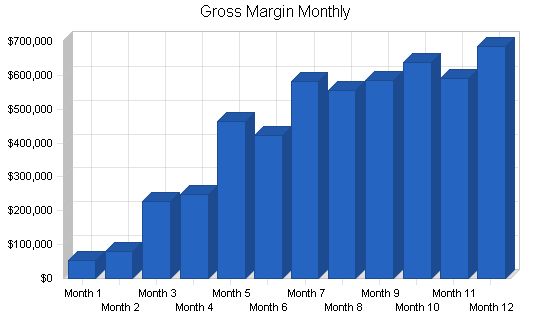

Gross Margin: $53,000, $78,609, $226,413, $247,327, $464,045, $423,372, $581,231, $556,558, $584,385, $637,475, $591,982, $684,470

Gross Margin %: 66.25%, 68.26%, 76.05%, 75.99%, 77.24%, 73.47%, 75.84%, 72.58%, 72.84%, 73.79%, 74.24%, 78.01%

Operating Expenses:

Sales and Marketing Expenses: $0, $4,000, $7,000, $9,500, $9,500, $9,500, $9,500, $9,500, $9,500, $9,500, $9,500, $9,500

Advertising/Promotion: $8,000, $11,516, $29,773, $32,547, $60,078, $57,624, $76,640, $76,686, $80,233, $86,388, $79,744, $87,740

Travel/Entertainment: $2,000, $2,000, $2,000, $3,000, $3,000, $3,000, $3,500, $3,500, $3,500, $3,500, $3,500, $3,500

Marketing Materials: $0, $15,000, $10,000, $5,000, $2,500, $2,500, $2,500, $2,500, $2,500, $2,500, $2,500, $2,500

Other Sales and Marketing Expenses: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Total Sales and Marketing Expenses: $10,000, $32,516, $48,773, $50,047, $75,078, $72,624, $92,140, $92,186, $95,733, $101,888, $95,244, $103,240

Sales and Marketing %: 12.50%, 28.24%, 16.38%, 15.38%, 12.50%, 12.60%, 12.02%, 12.02%, 11.93%, 11.79%, 11.94%, 11.77%

General and Administrative Expenses:

General and Administrative Payroll: $11,000, $11,000, $22,300, $22,300, $22,300, $22,300, $22,300, $22,300, $22,300, $22,300, $22,300, $22,300

Marketing/Promotion: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Depreciation: $0, $0, $2,499, $3,332, $3,332, $4,165, $4,165, $4,165, $4,998, $4,998, $4,998, $4,998

Leased Equipment: $2,830, $2,830, $2,830, $5,660, $5,660, $8,490, $8,490, $8,490, $10,520, $10,520, $10,520, $10,520

Utilities: $1,000, $1,000, $2,500, $3,500, $3,500, $4,500, $4,500, $4,500, $5,500, $5,500, $5,500, $5,500

Telephone/Fax: $1,500, $2,000, $2,500, $2,500, $2,500, $3,000, $3,000, $3,000, $3,300, $3,300, $3,300, $3,300

Insurance: $1,500, $1,500, $3,000, $3,000, $3,000, $3,600, $3,600, $3,600, $4,000, $4,000, $4,000, $4,000

Rent: $4,000, $4,000, $9,000, $13,000, $13,000, $17,000, $17,000, $17,000, $21,000, $21,000, $21,000, $21,000

Payroll Taxes: 22%, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Other General and Administrative Expenses: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Total General and Administrative Expenses: $21,830, $22,330, $44,629, $53,292, $53,292, $63,055, $63,055, $63,055, $71,618, $71,618, $71,618, $71,618

General and Administrative %: 27.29%, 19.39%, 14.99%, 16.37%, 8.87%, 10.94%, 8.23%, 8.22%, 8.93%, 8.29%, 8.98%, 8.16%

Other Expenses:

Other Payroll: $16,200, $16,200, $16,200, $32,400, $32,400, $48,600, $48,600, $48,600, $64,800, $64,800, $64,800, $64,800

Consultants: $0, $0, $25,000, $0, $25,000, $0, $25,000, $0, $0, $0, $0, $0

Legal: $0, $0, $20,000, $0, $20,000, $0, $15,000, $0, $0, $0, $0, $0

Total Other Expenses: $16,200, $16,200, $61,200, $32,400, $77,400, $48,600, $88,600, $48,600, $64,800, $64,800, $64,800, $64,800

Other %: 20.25%, 14.07%, 20.56%, 9.95%, 12.88%, 8.43%, 11.56%, 6.34%, 8.08%, 7.50%, 8.13%, 7.39%

Total Operating Expenses: $48,030, $71,046, $154,602, $135,739, $205,770, $184,279, $243,795, $203,841, $232,151, $238,306, $231,662, $239,658

Profit Before Interest and Taxes: $4,970, $7,563, $71,811, $111,588, $258,275, $239,093, $337,436, $352,717, $352,234, $399,169, $360,320, $444,812

EBITDA: $4,970, $7,563, $74,310, $114,920, $261,607, $243,258, $341,601, $356,882, $357,232, $404,167, $365,318, $449,810

Interest Expense: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Taxes Incurred: $1,640, $2,496, $23,698, $36,824, $85,231, $78,901, $111,354, $116,397, $116,237, $131,726, $118,906, $146,788

Net Profit: $3,330, $5,067, $48,113, $74,764, $173,044, $160,192, $226,082, $236,320, $235,997, $267,443, $241,414, $298,024

Net Profit/Sales: 4.16%, 4.40%, 16.16%, 22.97%, 28.80%, 27.80%, 29.50%, 30.82%, 29.41%, 30.96%, 30.27%, 33.97%

Pro Forma Cash Flow:

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Cash Sales | $80,000 | $115,155 | $297,732 | $325,465 | $600,775 | $576,240 | $766,395 | $766,860 | $802,325 | $863,875 | $797,440 | $877,400 |

| Subtotal Cash from Operations | $80,000 | $115,155 | $297,732 | $325,465 | $600,775 | $576,240 | $766,395 | $766,860 | $802,325 | $863,875 | $797,440 | $877,400 |

| Additional Cash Received | ||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $100,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Received | $80,000 | $115,155 | $397,732 | $325,465 | $600,775 | $576,240 | $766,395 | $766,860 | $802,325 | $863,875 | $797,440 | $877,400 |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 |

| Expenditures from Operations | ||||||||||||

| Cash Spending | $27,200 | $31,200 | $49,500 | $68,200 | $68,200 | $84,400 | $85,650 | $85,650 | $101,850 | $101,850 | $101,850 | $101,850 |

| Bill Payments | $1,439 | $44,711 | $94,124 | $229,977 | $194,469 | $418,136 | $349,882 | $484,106 | $468,360 | $468,916 | $496,465 | $427,228 |

| Subtotal Spent on Operations | $28,639 | $75,911 | $143,624 | $298,177 | $262,669 | $502,536 | $435,532 | $569,756 | $570,210 | $570,766 | $598,315 | $529,078 |

| Net Cash Flow | $51,361 | $39,244 | $254,108 | $27,288 | $338,106 | $73,704 | $330,863 | $197,104 | $232,115 | $293,109 | $199,125 | $348,322 |

| Cash Balance | $141,361 | $180,605 | $434,713 | $462,001 | $800,107 | $873,811 | $1,204,674 | $1,401,778 | $1,633,893 | $1,927,003 | $2,126,128 | $2,474,450 |

Pro Forma Balance Sheet:

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash | $90,000 | $141,361 | $180,605 | $434,713 | $462,001 | $800,107 | $873,811 | $1,204,674 | $1,401,778 | $1,633,893 | $1,927,003 | $2,126,128 | $2,474,450 |

| Inventory | $36,000 | $29,700 | $40,201 | $74,051 | $81,552 | $146,003 | $163,755 | $197,905 | $225,557 | $233,959 | $243,265 | $220,229 | $206,448 |

| Total Current Assets | $126,000 | $171,061 | $220,806 | $508,764 | $543,553 | $946,110 | $1,037,566 | $1,402,580 | $1,627,335 | $1,867,852 | $2,170,268 | $2,346,357 | $2,680,898 |

| Accumulated Depreciation | $0 | $0 | $0 | ($2,499) | ($5,831) | ($9,163) | ($13,328) | ($17,493) | ($21,658) | ($26,656) | ($31,654) | ($36,652) | ($41,650) |

| Total Long-term Assets | $0 | $0 | ($2,499) | ($5,831) | ($9,163) | ($13,328) | ($17,493) | ($21,658) | ($26,656) | ($31,654) | ($36,652) | ($41,650) | |

| Total Assets | $126,000 | $171,061 | $220,806 | $506,265 | $537,722 | $936,947 | $1,024,238 | $1,385,087 | $1,605,677 | $1,841,196 | $2,138,614 | $2,309,705 | $2,639,248 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $41,731 | $86,409 | $223,754 | $180,448 | $406,628 | $333,727 | $468,494 | $452,764 | $452,286 | $482,260 | $411,937 | $443,456 |

| Subtotal Current Liabilities | $0 | $41,731 | $86,409 | $223,754 | $180,448 | $406,628 | $333,727 | $468,494 | $452,764 | $452,286 | $482,260 | $411,937 | $443,456 |

| Total Liabilities | $0 | $41,731 | $86,409 | $223,754 | $180,448 | $406,628 | $333,727 | $468,494 | $452,

General Assumptions: Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 Plan Month 1 2 3 4 5 6 7 8 9 10 11 12 Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Tax Rate 33.00% 33.00% 33.00% 33.00% 33.00% 33.00% 33.00% 33.00% 33.00% 33.00% 33.00% 33.00% Other 0 0 0 0 0 0 0 0 0 0 0 0

Business Plan Outline

|

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!