Small Business Insurance Explained—Types and How to Buy

Starting a business involves challenges and risks. As a business owner, you need to minimize and overcome them.

Creating a forecast helps navigate financial threats. Applying for patents and trademarks protects intellectual property. And business insurance acts as a safety net against liabilities.

In this guide, we’ll break down business insurance basics, options, and how to make informed choices for your business’s security.

*Disclaimer: The information provided in this guide is for informational purposes only and should not be construed as legal advice. Consult a qualified professional or legal counsel regarding business insurance needs or concerns.

What is small business insurance?

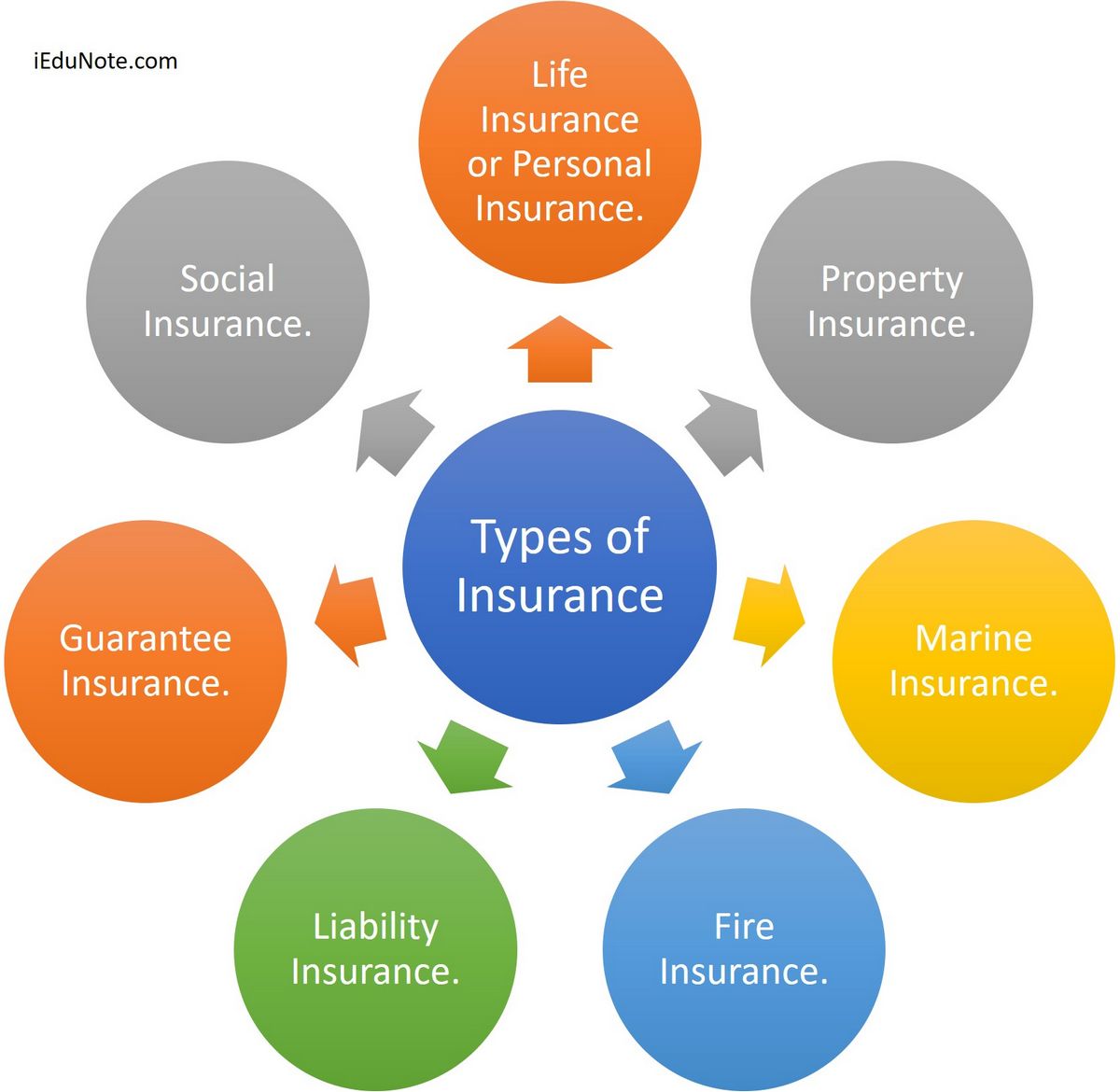

Small business insurance protects your business from accidents and risks out of your control. There is no general business insurance package, and instead your coverage will be a compilation of insurance types in an individual policy.

The types of coverage vary depending on your business operations and needs. Instead of separate policies, you can create customizable coverage with insurance companies.

Types of small business insurance

While you may want to consider the options on this list, consult a broker to ensure you choose the right insurance.

1. General liability insurance

Protects businesses against claims resulting from third-party injuries or property damages.

For instance, if a customer gets injured in your office, this insurance would cover the costs.

2. Tools and equipment insurance

Specifically designed to cover the tools and equipment involved in business operations.

Examples:

– Specialized camera gear

– Culinary equipment

3. Product liability insurance

Protects against claims arising from injuries or damages caused by your products.

For example, if a customer experiences an allergic reaction to a food product you sell, this insurance would cover the expenses.

4. Workers’ compensation insurance

An essential policy for businesses with employees—it covers medical expenses and lost wages if an employee gets injured on the job. In many regions, this insurance is legally mandated.

5. Commercial auto insurance

Designed for businesses that operate vehicles. Whether you run a delivery service or operate a fleet of food trucks, this insurance covers damages resulting from vehicular accidents during business operations.

6. Liquor liability insurance

A specialized policy for businesses that manufacture, sell, or serve alcohol. It protects against claims arising from damages or injuries caused by patrons who consumed alcohol at your establishment.

7. Damage to premises rented insurance

Ideal for businesses that operate in rented spaces. It covers property damage, ensuring incidents like fires or structural damages don’t lead to hefty expenses.

8. Cyber liability and cybercrime insurance

This policy protects businesses from cyber threats. Whether it’s a data breach, ransomware attack, or phishing scam, this insurance covers the recovery costs, ensuring business continuity in the digital age.

9. Errors & omissions (E&O) insurance

Also known as professional liability insurance, it’s designed for professionals offering services or advice. It covers claims arising from alleged negligence, undelivered services, or misrepresentation, ensuring that a mistake doesn’t lead to a financial setback.

10. Commercial property insurance

A comprehensive policy covering a business’s physical assets, from the building to the contents inside, such as machinery, stock, and furniture. It ensures that fires, thefts, or natural disasters don’t ruin business operations.

11. Directors & officers (D&O) insurance

Liability coverage for company leaders against lawsuits arising from managerial actions. It protects personal assets of directors and the business itself.

12. Umbrella insurance

Extra liability coverage beyond standard policies, activating when primary policy limits are exceeded. It safeguards against significant liability claims.

Why you need business insurance

Here are a few reasons why insurance is a worthwhile investment.

1. Saves money

In a study by Insureon, they discovered that 32.5% of small businesses experience an incident that insurance would cover every year.

For example, if you work as a massage therapist, you face daily risks simply because you work closely with others. A client could slip and fall in your office, the oils or lotions you use could lead to allergic reactions, or your table could break, leading to costly claims.

Without insurance, you could incur thousands of dollars in costs. Proper coverage can handle some or all of these costs—providing you with a financial safety net.

Insurance is also a requirement for business funding. Banks may ask for a certificate or proof of insurance when you seek a loan or line of credit. Providing that documentation helps establish credibility.

2. Protects your business

No matter how safe you are, accidents happen. Insurance acts as a protective barrier, ensuring your business remains secure.

General liability, professional liability, tools and equipment, and cyber liability insurance provide broad protection. Industry-specific coverage may be available.

3. Often required by law

In many cases, insurance is a legal requirement.

If you have a business loan, lease, or rent a property for your business, you will likely need insurance. Additional laws may be specific to your industry or products/services. For example, if you own a restaurant and sell alcohol, liquor liability insurance is required by your state’s law.

Make sure you understand what insurance you need.

4. Provides peace of mind

Running a business comes with challenges and stress. Insurance alleviates one concern: financial liability from unexpected events.

With the right insurance, business owners can focus on operations and customers, knowing they have protection from financial setbacks.

5. Increases professionalism

Having insurance elevates your business’s credibility. It signals to clients and partners how prepared you are for challenges.

For example, the Food Liability Insurance Program (FLIP) found that 30% of their insured businesses gained clients due to their insured status. Their customers get a badge to place on their site, letting customers know they are an insured business.

How to buy business insurance

Buying insurance can be overwhelming. Identify the coverage you need, consider limits, inclusions, and exclusions. Understand the process to avoid buying inadequate coverage.

Here are four tips to navigate the commercial insurance process:

1. Understand your risk exposure

Understand your business’s specific risks. Different industries have varied exposures; for instance, a financial consultant might need more professional liability insurance than a landscaping firm.

Research common claims in your sector and use them as a starting point. Implement protective measures, like encryption, to lower premiums. Consult your broker for tailored risk management advice.

2. Connect with a licensed agent and shop around

Don’t rush into the first policy you find. Explore various providers, weighing offerings, costs, and reputations.

A licensed agent can be invaluable. Their expertise helps grasp policy nuances, and industry ties can streamline the buying process, potentially securing discounts.

3. Calculate your policy limits

This is the maximum your insurer will pay after a loss. Envision your business’s worst-case scenario and calculate the recovery cost, factoring in overhead, stock, and equipment.

While it’s tempting to insure only a fraction of your business, remember that premiums are based on the likelihood of partial losses, with a portion reserved for total losses.

4. Review and adjust your policy

Don’t settle. Ensure you’re adequately covered and understand any exclusions. If a significant risk for your business isn’t covered, reconsider the policy.

Remember, quality trumps cost. Existing policyholders should review coverage annually. Have your broker clarify any limits or restrictions to make informed decisions.

Insurance guides

Dig deeper into specific insurance types, including options and how to eliminate unnecessary expenses.

Important Factors to Consider When Offering Health Insurance to Employees

Before offering health insurance as an employee benefit, consider these factors.

How to save on health insurance coverage

Concerned about paying too much for health insurance coverage? Learn how to lower costs and retain comparable coverage.

Protect your business from the start

Business insurance is not always legally required. But investing in the right coverage can save you from unexpected accidents, lawsuits, or losses that would otherwise sink your business.

Connect with a provider, research, and find the right insurance. Complete the other requirements to make your business legally compliant.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!