The Outsourced Computer Support Business Plan by Austin Kinetic is a concise and impactful document that highlights the company’s strong position in the IT consulting industry. With a focus on customer satisfaction and a favorable market in Austin, the company is well-positioned to succeed. The plan emphasizes the expertise of the management team, which has extensive experience in service operations management and information technology support. Overall, Austin Kinetic is primed to capitalize on the growing demand for IT infrastructure improvements and emerge as a leading player in the industry.

1.1 Objectives

Austin Kinetic’s objectives for the first five years:

– Establish and maintain at least twenty-four full-time service contract customers.

– Establish an office in Austin, TX.

– Break the Big M revenue mark.

1.2 Mission

Austin Kinetic is an innovative business technology company founded on the belief that one company can change the face of business.

1.3 Keys to Success

– Depth of knowledge.

– Breadth of ability.

– Development of strong business relationships with customers to understand their needs.

– Ability to network in the industry.

Austin Kinetic is incorporated in Nevada with an operating office in Austin, Texas. Initial staff will consist of experienced computer engineers with skills and experience covering a broad segment of the open systems’ distributed client/server field. The company’s initial focus will be installation and configuration projects that will develop into ongoing support contracts.

2.1 Company Ownership

Austin Kinetic is incorporated. The major shareholders are Adam Authortisement, Bob Borgware, Cary Curry, Dean Dri, and Edgar Extension.

2.2 Start-up Summary

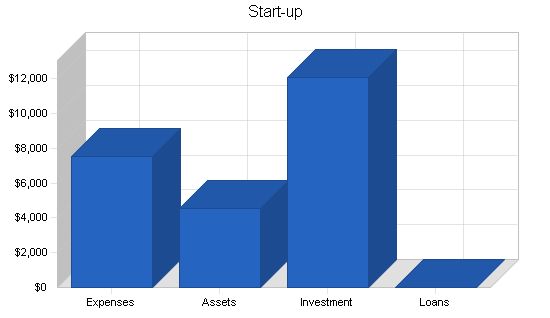

The start-up costs for the company are detailed in the table below and will be funded by the founders’ personal funds. There will be only small initial equipment costs as the company will depend on its founders’ resources. Each employee will initially cover the cost of transportation, cell phone, and incidentals. The company will begin covering those costs as revenue streams are generated. Specific guidelines and policies will be developed prior to the sixth operating month.

Start-up Funding

Start-up Expenses to Fund: $7,550

Start-up Assets to Fund: $4,550

Total Funding Required: $12,100

Assets

Non-cash Assets from Start-up: $0

Cash Requirements from Start-up: $4,550

Additional Cash Raised: $0

Cash Balance on Starting Date: $4,550

Total Assets: $4,550

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $0

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $0

Capital

Planned Investment

John Butler: $2,500

Eddie Hodges: $2,400

Sidney Johnson: $2,400

Darren Galatas: $2,400

Johnathan & Grace Panepinto: $2,400

Additional Investment Requirement: $0

Total Planned Investment: $12,100

Loss at Start-up (Start-up Expenses): ($7,550)

Total Capital: $4,550

Total Capital and Liabilities: $4,550

Total Funding: $12,100

Services

Austin Kinetic will offer several support options, including hourly support services, with the option to buy in blocks of 40 hours at a discounted rate. Blocks purchased will be valid for 180 days from the date of purchase. Additionally, semi-annual service contracts will be available. Contract pricing will be negotiated on a per-contract basis.

– Project work will be billed and estimated on a per-project basis.

– Web and ASP hosting will be billed on a per-system basis.

Operating systems supported (limited to current and three previous revisions):

– Windows

– Novell NetWare

– Solaris

– Red Hat Linux

Hardware supported (hardware configurations must be validated by OEM):

– All open desktop, server, storage, and network systems

– Dell, ADIC, Storagetech, and HP tape drives and libraries

– Additional hardware will be reviewed on a per-case basis

Software packages supported (Restricted to implementation and initial configuration):

– Microsoft Exchange

– Lotus Notes/Domino

– SUS Messaging Center

– Microsoft SQL Server

– Oracle DBS

– Veritas Backup Exec / Net Backup

– Legato Networker

– Arcserve

– Site Scope

– SMS

– Additional packages will be reviewed on a per-case basis

Service Offerings:

Austin Kinetic has several pre-set packages available for general monitoring of a customer’s network equipment and applications. The packages are categorized by the type and use of equipment to be monitored. An initial one-time setup fee of $500 will be required per physical site at the onset of any service agreement. This amount is not affected by the number of systems to be monitored at the designated physical site. The customer will be required to provide Internet access to the monitoring server. Out-of-band notification can be added for an additional $50 per month plus a one-time, per-physical-site, $150 initial setup fee.

Basic Server Management: $350 per month

Austin Kinetic provides professional management of operating systems, including Windows, NetWare, Red Hat Linux, and Solaris. This service is perfect for companies that want to manage their applications but not deal with the ongoing hassle of tuning, securing, and maintaining the operating system. We will take the burden of ensuring you get the proper services for your specific server and operating system.

– A system audit to document your architecture and suggest improvements

– 24/7 technical support of the server and operating system from experienced engineers

– Security and bug patch notification for the operating system, and when approved, a service call will be scheduled for installation

– Monitoring the network availability of one IP

– Monitoring the server’s disk usage, processor usage, and load average

– Visibility into Austin Kinetic’s trouble ticket system via a secure portal

Application Server Management Services: $450 per month

Ensuring your applications are available and running at peak efficiency is a 24/7 responsibility. Austin Kinetic offers comprehensive application monitoring and management so your customers and employees will be able to use your applications without significant unscheduled interruption. We offer a complete range of management services tailored to remove the burden of ensuring your applications are up and getting the proper maintenance.

– A system audit to document your architecture and suggest improvements

– 24/7 technical support of the server, operating system, and applications from experienced engineers

– Security and bug patch notification for the operating system and applications, and when approved, installation

– Monitoring application and network availability

– Monitoring application response time

– Monitoring the server’s disk usage, processor usage, and load average

– Visibility into Austin Kinetic’s trouble ticket system via a secure portal

– Periodic activity reports

Database Server Management Services: $500 per month

Ensuring your Oracle, MySQL, and MS SQL 2000 databases are configured and maintained properly is a time-consuming task for IT departments. Austin Kinetic can augment your internal skillset with comprehensive database server management. We offer a broad range of management services and will take the burden of ensuring you get the proper services for your specific server and databases.

– A system audit to document your architecture and suggest improvements

– 24/7 technical support of the server, operating system, and database from experienced engineers

– Security and bug patch notification for the operating system and database, and when approved, installation

– Monitoring database and network availability

– Monitoring database response time

– Monitoring the server’s disk usage, processor usage, and load average

– Visibility into Austin Kinetic’s trouble ticket system via a secure portal

– Periodic activity reports

Network Device Management Services: $450 per month

Network devices – firewalls, load balancer, routers, switches, and hubs – must be properly configured and maintained to ensure network security and reliable operation. Austin Kinetic offers a broad range of network management services and will take the burden of ensuring you get the proper services for your specific network.

– A network audit to document your topology and addressing scheme

– 24/7 technical support of the network devices from experienced engineers

– Security and bug patch notification, and when approved, installation

– Maintaining the security of firewalls

– Monitoring bandwidth usage

– Monitoring network device availability and performance

– Visibility into Austin Kinetic’s trouble ticket system via a secure portal

Benefits of Security Management Services (Priced determined on a per-site basis)

Maintaining the security of your Internet-based systems is more important and more time-consuming than ever. Austin Kinetic removes the burden of protecting your systems by offering 24/7 security management that combines intrusion detection and vulnerability scanning. We also will not burden your existing hardware as a pre-configured 1U server is installed in your network to handle the intrusion detection and vulnerability task.

– Identify misconfigured firewalls

– Catch attacks that firewalls legitimately allow through (such as attacks against Web servers)

– Document hacker attempts that fail

– Watch for insider hacking

– Identify users installing unsecured software on their machines

– Recognize unauthorized machines using the network

– See incorrect IP space utilization

Austin Kinetic will ensure your intrusion detection and vulnerability scanning system is properly installed and maintained. This includes configuring the system, testing the pattern matching, updating scanning profiles, monitoring 24/7, reporting suspicious activities or vulnerability, and providing a monthly report.

Data Backup: $50 plus a one-time setup fee of $150 per backup server. There will be an additional $100 per-site, per-month charge if tapes are required to be kept off-site.

Protecting your organization’s data is critical. Austin Kinetic will manage your data protection system to ensure that your data is protected by tape backup. While Austin Kinetic cannot be held responsible for lost data, we will ensure that validated and tested backups occur on a regularly scheduled basis. The customer will be responsible for procuring and installing the necessary hardware. Austin Kinetic will configure and monitor the backup software, monitor and test backup jobs, and perform needed file restoration.

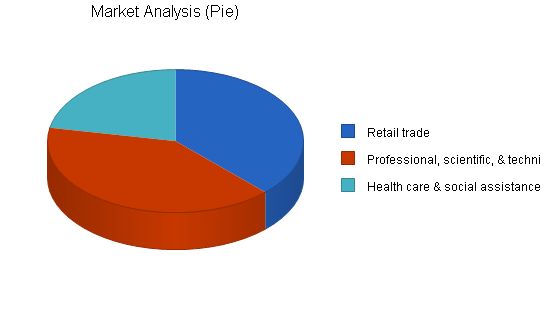

Market Analysis Summary

The Information and Technology Service industry is expected to grow at 8.58% per year through 2010.

– U.S. Department of Labor (2003)

We will primarily focus on mid-sized companies with 500 or fewer employers. These companies typically do not have large internal IT departments and could benefit greatly from our offerings.

Market Segmentation

The information in the market analysis table is gained from the U.S. Census Bureau. Though the data is based upon 1997 data, it is representative of the local market’s potential.

Market Analysis

Retail trade – 2,925 (Year 1), 3,159 (Year 2), 3,412 (Year 3), 3,685 (Year 4), 3,980 (Year 5), Growth: 8%, CAGR: 8.00%

Professional, scientific, & technical services – 3,128 (Year 1), 3,378 (Year 2), 3,648 (Year 3), 3,940 (Year 4), 4,255 (Year 5), Growth: 8%, CAGR: 8.00%

Health care & social assistance – 1,705 (Year 1), 1,841 (Year 2), 1,988 (Year 3), 2,147 (Year 4), 2,319 (Year 5), Growth: 8%, CAGR: 7.99%

Total – 7,758 (Year 1), 8,378 (Year 2), 9,048 (Year 3), 9,772 (Year 4), 10,554 (Year 5), Growth: 8.00%, CAGR: 8.00%

4.2 Target Market Segment Strategy

Austin Kinetic aims to serve companies that benefit from IT investment but lack their own IT staff. The market analysis table includes the largest groups in our target area.

4.3 Service Business Analysis

Austin Kinetic satisfies companies’ IT infrastructure needs, offering various levels of service from consulting to installation. Services are sold on a per-customer/case basis with heavy personal interaction between sales representatives and customers.

4.3.1 Competition and Buying Patterns

Word of mouth and reputation are key in this industry. While some focused marketing is effective, most contracts come from social contacts and networking.

Strategy and Implementation Summary

Austin Kinetic’s funding comes from founders’ personal funds. Word-of-mouth and industry networking will bring in clients. Customer service and satisfaction are crucial for success and referral business.

5.1 Competitive Edge

Austin Kinetic distinguishes itself with over 20 years of cumulative experience in the IT field and a strong focus on customer service and satisfaction.

To develop good business strategies, perform a SWOT analysis of your business. Learn how with our free guide and template.

Initial marketing will rely on word-of-mouth and industry group networking. Building local market recognition will be a challenge. Involvement in industry-specific organizations will provide access to potential customers.

5.3 Sales Strategy

Sales will focus on demonstrating Austin Kinetic’s competencies and skills to build customer confidence. The key question is, "how can Austin Kinetic best meet a customer’s IT needs?" Clear, concise proposals with competitive pricing will be crucial for closing deals.

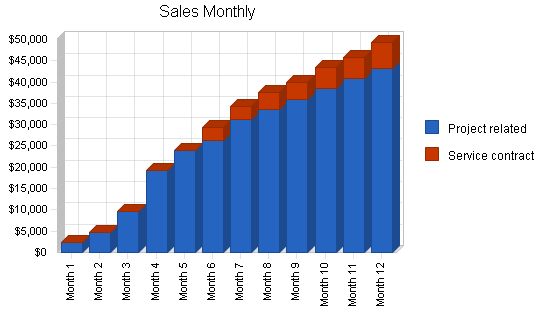

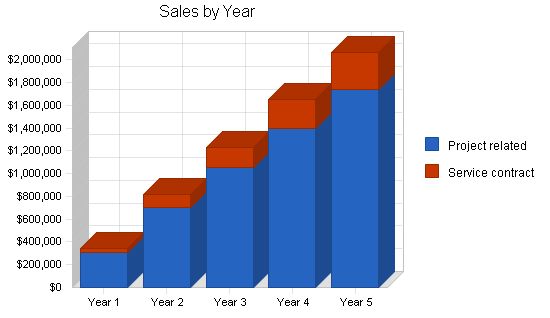

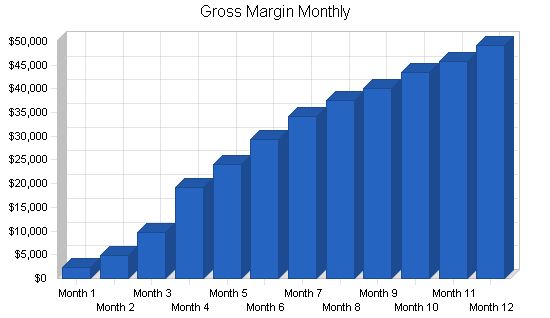

5.3.1 Sales Forecast

Sales will initially focus on short-term projects to build reputation and brand name. Within six months, Austin Kinetic aims to sign three annual service contracts, doubling that by the end of the year and each subsequent semi-annual period. Sales contracts will be set period contracts paid in monthly installments.

As a service business, our only direct costs are related to employee time spent on customer needs. Employees are paid a set salary, so there are no direct costs of sales. Employee salaries can be found in the Personnel Plan.

Sales Forecast

Year 1 Year 2 Year 3 Year 4 Year 5

Sales

Project related $309,600 $705,600 $1,051,200 $1,396,800 $1,742,400

Service contract $30,000 $108,000 $180,000 $252,000 $324,000

Total Sales $339,600 $813,600 $1,231,200 $1,648,800 $2,066,400

Direct Cost of Sales

Year 1 Year 2 Year 3 Year 4 Year 5

Technician Salary $0 $0 $0 $0 $0

Other $0 $0 $0 $0 $0

Subtotal Direct Cost of Sales $0 $0 $0 $0 $0

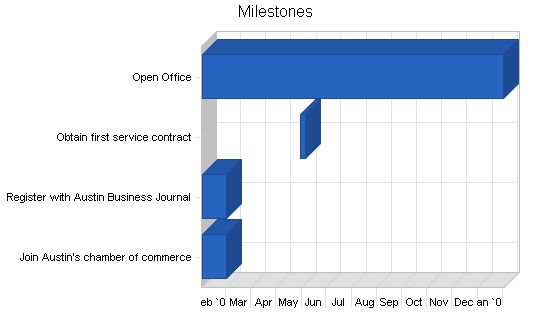

5.4 Milestones

Austin Kinetic will have simple marketing milestones focused on industry networking and building name recognition.

Milestones:

– Milestone

– Start Date

– End Date

– Budget

– Manager

– Department

– Join Austin’s chamber of commerce

– 2/1/2004

– 3/1/2004

– $0

– Adam

– Marketing

– Register with Austin Business Journal

– Obtain first service contract

– 5/30/2004

– 6/5/2004

– $0

– Bob and Dean

– All

– Open Office

– 2/1/2004

– 2/1/2005

– $3,500

– Edgar

– Operations

– Totals

– $3,500

Web Plan Summary:

Austin Kinetic’s Web presence will not only serve as a medium for the company’s marketing message, but also as an important tool for customers. They can manage and monitor their accounts from anywhere with Internet access. Consultants can track time and work journals through the site and develop and print job estimates.

Website Marketing Strategy:

Austin Kinetic’s Web presence will assist the company’s overall marketing strategy. It will serve as a point of reference for information about the company and its services, lending credibility to the marketing message.

Development Requirements:

Austin Kinetic’s site will utilize a two-tier environment. A back-end database will manage customer data. The site will be developed with the assistance of a contracted professional developer.

Management Summary:

At the outset, Austin Kinetic will maintain five part-time employees, its founders. These employees will be responsible for all aspects of the business and serve in both managerial and technical roles. Additional engineers will be hired as the business grows. By the fourth year, the original five employees will focus solely on management responsibilities. At this time, Austin Kinetic will look to hire a full-time sales and marketing manager.

Personnel Plan:

Austin Kinetic will maintain a staff of five engineers through most of FY 2007. A secretary will be hired at the start of FY 2006 to assist with telephone and office management. At the end of FY 2007, an additional engineer will be brought on board as workload dictates. Beginning FY 2008, the original founding members will transition from field work to management, replaced by additional engineers. Additionally, a full-time marketing/sales representative will be hired.

Compensation projections include annual merit increases of 5% for staff and 15% for the founders. A profit sharing plan will start in the second year, based on 5% of the previous year’s net profits. These bonuses will be divided equally among staff members, including owners.

Personnel Plan:

– Year 1

– Year 2

– Year 3

– Year 4

– Year 5

– Profit Sharing – 5% net profits

– $0

– $0

– $0

– $0

– $0

– Adam Authortisement (CEO)

– $14,400

– $55,000

– $63,000

– $73,000

– $83,600

– Edgar Extension (COO)

– Cary Curry (CIO)

– Dean Dri (CFO)

– Bob Borgware (CTO)

– Secretary

– $0

– $30,000

– $31,500

– $33,000

– $34,700

– Sales/Marketing

– $0

– $0

– $0

– $70,000

– $73,500

– Technician-1

– $0

– $0

– $13,750

– $55,688

– $58,472

– Technician-2

– Technician-3

– Technician-4

– Technician-5

– Technician-6

– Technician-7

– Technician-8

– Technician-9

– Total People

– 5

– 6

– 7

– 15

– 16

– Total Payroll

– $72,000

– $305,000

– $360,250

– $853,688

– $1,022,839

Austin Kinetic will initially grow with project work, building service contracts from the six-month point forward. The company will increase project work to 2,560 man hours per month and service contract count by six each year. The initial growth will be financed primarily by the founders. The company will fund all growth from the cash flow of the business, remaining debt-free.

Important Assumptions:

At the onset, the founding members of Austin Kinetic will take on most of the financial burden. There will be no dedicated office space until FY 2006 when an office is expected to open in Austin. Until then, Austin Kinetic will compensate for travel-related expenses. The only recurring expenses will be voice mail services, marketing, insurance, Internet access, and Web presence. Funds will be held by Austin Kinetic to develop cash reserves for future expansion and buffer against business climate changes.

Customers will be billed $120 per hour. Engineers will be paid a salary plus $25 per hour for on-call and overtime. Employees who establish new projects/contracts will receive a 5% bonus. Business call time on cell phones will be reimbursed.

General Assumptions:

– Year 1

– Year 2

– Year 3

– Year 4

– Year 5

– 1

– 2

– 3

– 4

– 5

– Current Interest Rate

– 10.00%

– 10.00%

– 10.00%

– 10.00%

– 10.00%

– Long-term Interest Rate

– Tax Rate

– 30.00%

– 30.00%

– 30.00%

– 30.00%

– 30.00%

– Other

– 0

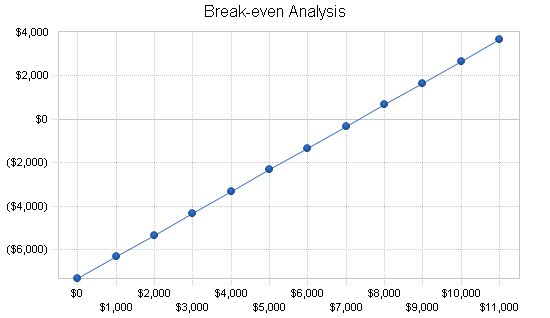

Break-even Analysis:

As a service business, Austin Kinetic has no direct cost of sales. The break-even point in the first year is equal to the amount needed to cover operating expenses, including payroll. Break-even is expected to be reached in the third month.

| Break-even Analysis | |

| Monthly Revenue Break-even | $7,325 |

| Assumptions: | |

| Average Percent Variable Cost | 0% |

| Estimated Monthly Fixed Cost | $7,325 |

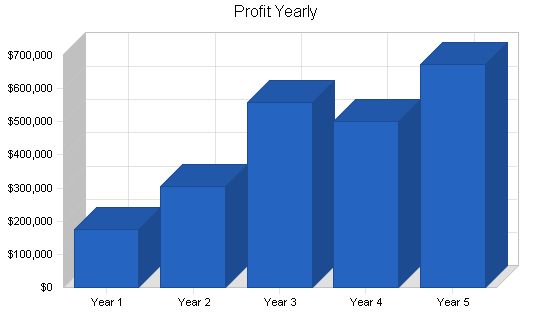

8.3 Projected Profit and Loss

In the first year, we will be based out of the founders’ homes. Adam Authortisement has renovated his garage for use as a meeting space and general office, when we need to get together as a group. Utilities in the first year represent the cost of home high-speed Internet access for all five employees ($45 each per month). This access is necessary for communications between personnel and for file transmission for all project and service work.

After the first year, it will be more cost-effective and attuned to our growth to rent a space in downtown Austin, where we can consolidate equipment, combine utilities, and have a central location for our work and our secretary. Office space rented beginning FY 2006 is forecast to be $2,500 per month.

The Profit and Loss also includes a provision for charity donations, which we have deemed important to our mission, as well as to marketing and outreach in the community. Starting in the second year, 5% of net profits each will be set aside for charity on an annual basis based upon the previous year’s performance.

After the first month, Marketing and Promotion expenses are set at 5% of the previous month’s and year’s sales.

Pro Forma Profit and Loss

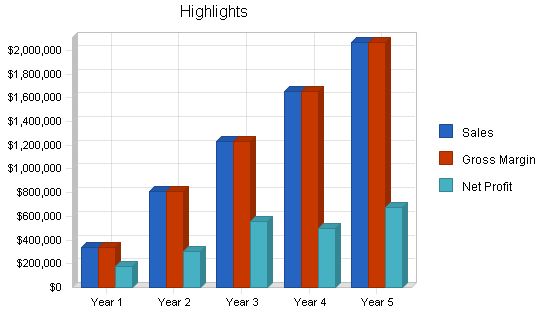

Sales:

Year 1: $339,600

Year 2: $813,600

Year 3: $1,231,200

Year 4: $1,648,800

Year 5: $2,066,400

Direct Cost of Sales:

Year 1-5: $0

Other Costs of Sales:

Year 1-5: $0

Total Cost of Sales:

Year 1-5: $0

Gross Margin:

Year 1: $339,600

Year 2: $813,600

Year 3: $1,231,200

Year 4: $1,648,800

Year 5: $2,066,400

Gross Margin %:

Year 1-5: 100.00%

Expenses:

Payroll:

Year 1: $72,000

Year 2: $305,000

Year 3: $360,250

Year 4: $853,688

Year 5: $1,022,839

Marketing/Promotion:

Year 1: $200

Year 2-5: $0

Depreciation:

Year 1: $0

Year 2: $714

Year 3: $2,038

Year 4: $2,464

Year 5: $3,540

Rent:

Year 1-2: $0

Year 3-5: $45,000

Moving Expenses:

Year 1: $5,000

Year 2-5: $0

Utilities:

Year 1: $2,700

Year 2: $2,000

Year 3: $2,500

Year 4: $2,500

Year 5: $3,000

Insurance:

Year 1: $3,000

Year 2-5: $10,000

Payroll Taxes:

Year 1-5: $0

Expensed Computer Equipment:

Year 1: $5,000

Year 2-5: $15,000

Charity (5% of previous year net profit):

Year 1-5: $0

Total Operating Expenses:

Year 1: $87,900

Year 2: $377,714

Year 3: $434,788

Year 4: $933,652

Year 5: $1,104,379

Profit Before Interest and Taxes:

Year 1: $251,700

Year 2: $435,886

Year 3: $796,412

Year 4: $715,148

Year 5: $962,021

EBITDA:

Year 1: $251,700

Year 2: $436,600

Year 3: $798,450

Year 4: $717,612

Year 5: $965,561

Interest Expense:

Year 1-5: $0

Taxes Incurred:

Year 1: $75,510

Year 2: $130,766

Year 3: $238,924

Year 4: $214,544

Year 5: $288,606

Net Profit:

Year 1: $176,190

Year 2: $305,120

Year 3: $557,488

Year 4: $500,604

Year 5: $673,415

Net Profit/Sales:

Year 1: 51.88%

Year 2: 37.50%

Year 3: 45.28%

Year 4: 30.36%

Year 5: 32.59%

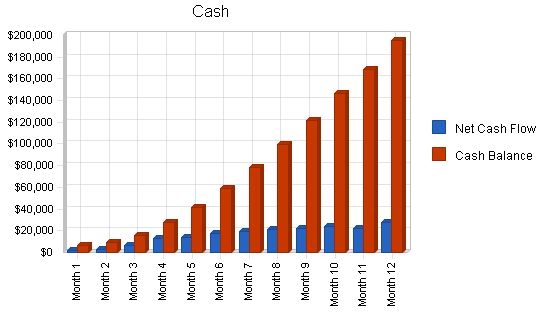

8.4 Projected Cash Flow

We have no sales on credit; all service accounts and projects are paid in advance, in installments. We anticipate no problems with our cash flow. By staying debt-free and keeping expenses down, we expect a significant positive cash balance by the end of the first year.

Pro Forma Cash Flow

Year 1 Year 2 Year 3 Year 4 Year 5

Cash Received

Cash from Operations

Cash Sales $339,600 $813,600 $1,231,200 $1,648,800 $2,066,400

Subtotal Cash from Operations $339,600 $813,600 $1,231,200 $1,648,800 $2,066,400

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0 $0 $0

New Current Borrowing $0 $0 $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0 $0 $0

New Long-term Liabilities $0 $0 $0 $0 $0

Sales of Other Current Assets $0 $0 $0 $0 $0

Sales of Long-term Assets $0 $0 $0 $0 $0

New Investment Received $0 $0 $0 $0 $0

Subtotal Cash Received $339,600 $813,600 $1,231,200 $1,648,800 $2,066,400

Expenditures

Year 1 Year 2 Year 3 Year 4 Year 5

Expenditures from Operations

Cash Spending $72,000 $305,000 $360,250 $853,688 $1,022,839

Bill Payments $76,482 $201,028 $302,493 $293,637 $360,478

Subtotal Spent on Operations $148,482 $506,028 $662,743 $1,147,325 $1,383,317

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0 $0 $0

Principal Repayment of Current Borrowing $0 $0 $0 $0 $0

Other Liabilities Principal Repayment $0 $0 $0 $0 $0

Long-term Liabilities Principal Repayment $0 $0 $0 $0 $0

Purchase Other Current Assets $0 $0 $0 $0 $0

Purchase Long-term Assets $0 $5,000 $10,000 $5,000 $10,000

Dividends $0 $0 $0 $0 $0

Subtotal Cash Spent $148,482 $511,028 $672,743 $1,152,325 $1,393,317

Net Cash Flow $191,118 $302,572 $558,457 $496,475 $673,083

Cash Balance $195,668 $498,240 $1,056,697 $1,553,172 $2,226,255

8.5 Projected Balance Sheet

Our Balance Sheet is quite solid. We will build our asset base slowly over the first five years, expensing most of our computer and hardware equipment to offset taxes, since they will need replacing every two to three years.

Pro Forma Balance Sheet

Year 1 Year 2 Year 3 Year 4 Year 5

Assets

Current Assets

Cash $195,668 $498,240 $1,056,697 $1,553,172 $2,226,255

Other Current Assets $0 $0 $0 $0 $0

Total Current Assets $195,668 $498,240 $1,056,697 $1,553,172 $2,226,255

Long-term Assets

Long-term Assets $0 $5,000 $15,000 $20,000 $30,000

Accumulated Depreciation $0 $714 $2,752 $5,216 $8,756

Total Long-term Assets $0 $4,286 $12,248 $14,784 $21,244

Total Assets $195,668 $502,526 $1,068,945 $1,567,956 $2,247,499

Liabilities and Capital

Year 1 Year 2 Year 3 Year 4 Year 5

Current Liabilities

Accounts Payable $14,928 $16,666 $25,596 $24,004 $30,132

Current Borrowing $0 $0 $0 $0 $0

Other Current Liabilities $0 $0 $0 $0 $0

Subtotal Current Liabilities $14,928 $16,666 $25,596 $24,004 $30,132

Long-term Liabilities $0 $0 $0 $0 $0

Total Liabilities $14,928 $16,666 $25,596 $24,004 $30,132

Paid-in Capital $12,100 $12,100 $12,100 $12,100 $12,100

Retained Earnings ($7,550) $168,640 $473,760 $1,031,249 $1,531,852

Earnings $176,190 $305,120 $557,488 $500,604 $673,415

Total Capital $180,740 $485,860 $1,043,349 $1,543,952 $2,217,367

Total Liabilities and Capital $195,668 $502,526 $1,068,945 $1,567,956 $2,247,499

8.6 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 7379.02, Computer Related Consulting Services, are shown for comparison.

Ratio Analysis

Year 1 Year 2 Year 3 Year 4 Year 5 Industry Profile

Sales Growth 0.00% 139.58% 51.33% 33.92% 25.33% 16.45%

Percent of Total Assets

Other Current Assets 0.00% 0.00% 0.00% 0.00% 0.00% 61.43%

Total Current Assets 100.00% 99.15% 98.85% 99.06% 99.05% 87.72%

Long-term Assets 0.00% 0.85% 1.15% 0.94% 0.95% 12.28%

Total Assets 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

Current Liabilities

Accounts Payable 7.63% 3.32% 2.39% 1.53% 1.34% 34.35%

Long-term Liabilities 0.00% 0.00% 0.00% 0.00% 0.00% 20.47%

Total Liabilities 7.63% 3.32% 2.39% 1.53% 1.34% 54.82%

Net Worth 92.37% 96.68% 97.61% 98.47% 98.66% 45.18%

Percent of Sales

Sales 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

Gross Margin 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

Selling, General & Administrative Expenses 47.42% 59.67% 73.67% 70.43% 69.19% 76.51%

Advertising Expenses 0.21% 0.09% 0.17% 0.15% 0.17% 1.17%

Profit Before Interest and Taxes 74.12% 53.57% 64.69% 43.37% 46.56% 1.40%

Main Ratios

Current 13.11 29.90 41.28 64.71 73.88 1.85

Quick 13.11 29.90 41.28 64.71 73.88 1.53

Total Debt to Total Assets 7.63% 3.32% 2.39% 1.53% 1.34% 61.46%

Pre-tax Return on Net Worth 139.26% 89.71% 76.33% 46.32% 43.39% 2.74%

Pre-tax Return on Assets 128.64% 86.74% 74.50% 45.61% 42.80% 7.10%

Additional Ratios

Year 1 Year 2 Year 3 Year 4 Year 5

Net Profit Margin 51.88% 37.50% 45.28%

Sales Forecast

Sales

Project related

0% $2,400 $4,800 $9,600 $19,200 $24,000 $26,400 $31,200 $33,600 $36,000 $38,400 $40,800 $43,200

Service contract

0% $0 $0 $0 $0 $0 $3,000 $3,000 $4,000 $4,000 $5,000 $5,000 $6,000

Total Sales

$2,400 $4,800 $9,600 $19,200 $24,000 $29,400 $34,200 $37,600 $40,000 $43,400 $45,800 $49,200

Direct Cost of Sales

Technician Salary

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Other

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Subtotal Direct Cost of Sales

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Personnel Plan

Profit Sharing – 5% net profits

5% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Adam Authortisement (CEO)

0% $100 $200 $400 $800 $1,000 $1,250 $1,450 $1,600 $1,700 $1,850 $1,950 $2,100

Edgar Extension (COO)

0% $100 $200 $400 $800 $1,000 $1,250 $1,450 $1,600 $1,700 $1,850 $1,950 $2,100

Cary Curry (CIO)

0% $100 $200 $400 $800 $1,000 $1,250 $1,450 $1,600 $1,700 $1,850 $1,950 $2,100

Dean Dri (CFO)

0% $100 $200 $400 $800 $1,000 $1,250 $1,450 $1,600 $1,700 $1,850 $1,950 $2,100

Bob Borgware (CTO)

0% $100 $200 $400 $800 $1,000 $1,250 $1,450 $1,600 $1,700 $1,850 $1,950 $2,100

Secretary

0% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Sales/Marketing

0% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Technician-1

0% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Technician-2

0% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Technician-3

0% $0 $0 $0 $0 $0 $0 $0 $0 $0

Pro Forma Cash Flow:

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $2,400 | $4,800 | $9,600 | $19,200 | $24,000 | $29,400 | $34,200 | $37,600 | $40,000 | $43,400 | $45,800 | $49,200 | |

| Subtotal Cash from Operations | $2,400 | $4,800 | $9,600 | $19,200 | $24,000 | $29,400 | $34,200 | $37,600 | $40,000 | $43,400 | $45,800 | $49,200 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Received | $2,400 | $4,800 | $9,600 | $19,200 | $24,000 | $29,400 | $34,200 | $37,600 | $40,000 | $43,400 | $45,800 | $49,200 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $500 | $1,000 | $2,000 | $4,000 | $5,000 | $6,250 | $7,250 | $8,000 | $8,500 | $9,250 | $9,750 | $10,500 | |

| Bill Payments | $35 | $1,057 | $1,511 | $2,689 | $4,931 | $6,074 | $7,316 | $8,444 | $9,232 | $9,926 | $13,980 | $11,291 | |

| Subtotal Spent on Operations | $535 | $2,057 | $3,511 | $6,689 | $9,931 | $12,324 | $14,566 | $16,444 | $17,732 | $19,176 | $23,730 | $21,791 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Spent | $535 | $2,057 | $3,511 | $6,689 | $9,931 | $12,324 | $14,566 | $16,444 | $17,732 | $19,176 | $23,730 | $21,791 | |

| Net Cash Flow | $1,865 | $2,743 | $6,090 | $12,512 | $14,070 | $17,076 | $19,635 | $21,156 | $22,269 | $24,224 | $22,070 | $27,409 | |

| Cash Balance | $6,415 | $9,158 | $15,248 | $27,759 | $41,829 | $58,905 | $78,539 | $99,695 | $121,964 | $146,188 | $168,258 | $195,668 | |

Pro Forma Balance Sheet:

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $4,550 | $6,415 | $9,158 | $15,248 | $27,759 | $41,829 | $58,905 | $78,539 | $99,695 | $121,964 | $146,188 | $168,258 | $195,668 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0

Business Plan Outline

|

|

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!