Funeral Home Business Plan

Ceremonial practices around death in U.S. funeral homes leave a growing population feeling poorly served. This plan outlines the strategy of the Evergreen Life Memorial Center (the Center) to define and dominate a new category of funeral provider in AnyCounty, Oregon. It also details how the acquired financing will be used.

The Center will be formed as an LLC in the Anytown metropolitan area, solely owned by Stan Peters, an experienced funeral home director and embalmer involved in nonprofit and community activities.

Establishment of the Evergreen Life Memorial Center will provide Anytown and the surrounding area with a way to celebrate the life of the individual when it ends and gather social support for closure and moving forward. Its cornerstone will be a reception area for social gatherings after the funeral that fosters human connection and uplifting remembrance, which is preferred by aging Baby Boomers. This facility will also be the foundation of the Center’s community involvement strategy, rapidly building the reputation needed to attract business and benefit charities. Digitized photos will be used for the reception and website to extend the celebration of the individual’s life beyond the funeral.

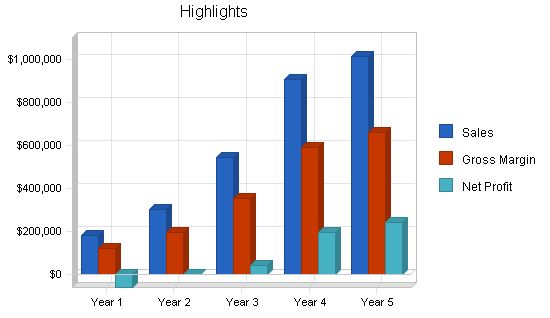

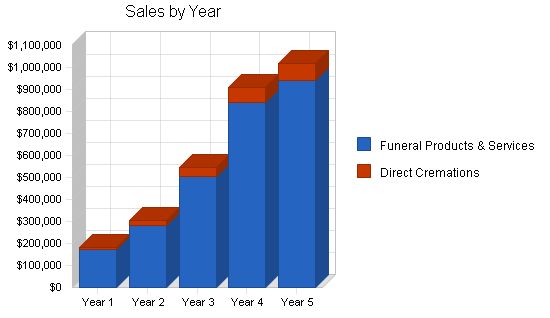

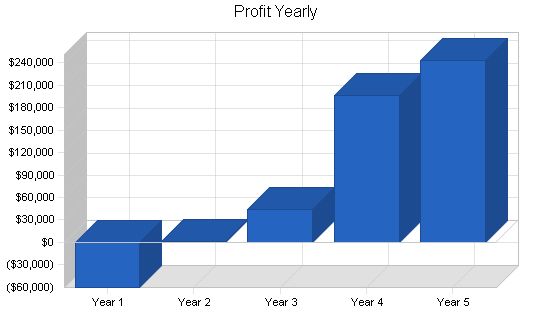

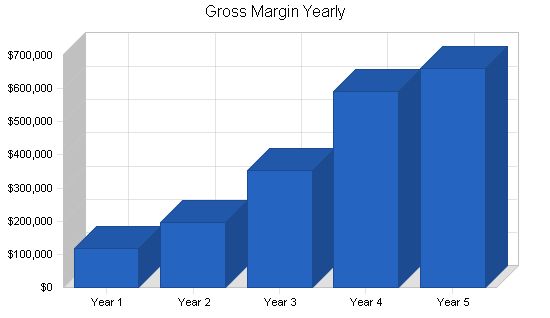

Based on recent nationwide average prices, the Center has the potential to attain a market share of $768,213 within four years. At the Center’s current prices, its market share is worth $841,412. The industry average gross margin for a funeral home is 62.5 percent. The requested funding of $225,000 in this plan is projected to result in an annual net profit of approximately $194,000 in the Center’s fourth year of operation, with subsequent annual increases due to inflation.

With the establishment of the Evergreen Life Memorial Center, those who lose someone to death will, for the first time in our era, be integrated into the community of life instead of stigmatized and marginalized. There will be a new center for community involvement, allowing the Boomer generation to go out the way it lived.

1.1 Objectives

The Evergreen Life Memorial Center aims to become a renowned and uplifting place for Baby Boomers to celebrate their lives upon death. The center will provide facilities that bring families and communities together to commemorate the deceased and strengthen social bonds. Digitized photos and films of the deceased will be accessible in the reception room and on the website. Furthermore, the center will collaborate with nonprofit organizations to integrate the community, enhance its reputation, and support the owner’s goal of improving society. The owner, Stan Peters, will also take on a leadership position in a local nonprofit that aids children with life-threatening conditions, such as the Make-A-Wish Foundation. Additionally, the center will offer a funeral planning guide for estate attorneys to distribute to their clients. These efforts will be complemented by a publicity campaign to establish the center as the pioneer in this new category of funeral providers – Evergreen Life Memorial Center, where people remember people.

1.2 Mission

The mission of the Evergreen Life Memorial Center is to bring people together to celebrate life after death and encourage them to move forward. The center’s facilities will foster family and community unity, allowing them to reminisce about the deceased and strengthen social connections. It will also serve as a focal point for nonprofit activities aimed at improving the local community.

1.3 Keys to Success

Given that 71 percent of people choose a funeral home based on reputation, the key to success is quickly establishing the Evergreen Life Memorial Center as the uplifting venue for Baby Boomers to celebrate life upon death. The center’s reception facilities will play a crucial role in promoting positive interactions and serving nonprofit organizations. This will not only create an uplifting environment but also connect the center to the community, generate publicity, and position it as a center for the living. The reception room and website will showcase digital photos and films of the individuals being commemorated, allowing people to participate in the celebration even after the funeral and reception have ended. Additionally, offering a wide selection of quality caskets will solidify the center’s reputation as the premier choice for commemorating locally prominent individuals – fostering publicity and establishing our reputation.

The Evergreen Life Memorial Center will revolutionize the funeral home industry by providing a combination of life celebration and social support. The center will offer post-funeral reception facilities where people can gather in an uplifting environment, surrounded by digitized photos and films of the lives being celebrated. The facilities will include intimate gathering areas as well as private meeting rooms. Furthermore, these spaces will be open to nonprofit organizations, further integrating the center into the community.

This unique approach aligns with the preferences of the Baby Boomer generation, who are now involved in making funeral arrangements for their parents and will soon face their own growing number of funerals. It is projected that the number of Boomer funerals will significantly increase over time. The center will be located in a former church building in central Eugene or a neighboring community without funeral home services, ideally surrounded by evergreen trees.

2.1 Company Ownership

The Evergreen Life Memorial Center will be a limited liability company (LLC) solely owned by Stan Peters. Stan is a professional funeral director and embalmer with 10 years of experience and a B.S. in funeral science. He chose this field because of his interest in biological sciences and his desire to make a positive impact on people during their time of need. Stan has been actively involved in nonprofit organizations, including the Make-A-Wish Foundation in California.

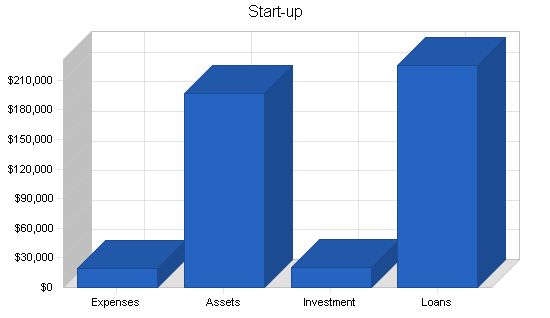

2.2 Start-up Summary

The total start-up requirements amount to $216,700, covering start-up expenses of $19,700 and assets worth $197,000. In addition to the requested funding of $245,000, the owner will invest an additional amount, resulting in $90,000 in cash for working capital.

The assets to be purchased with the funding include $27,000 for display caskets, $7,000 for display urns, and various embalming chemicals and supplies.

The long-term assets to be financed are as follows:

– Building Improvements (including permits) – $20,000

– Reception Room Furnishings – $15,000

– Crematory Equipment – $15,000

– Refrigeration Unit – $5,000

– Embalming Equipment – $15,000

– Computer – $5,000

– Software – $5,000

The total capital expenditure amounts to $80,000. A church structure in the Anytown area is being considered for purchase at an estimated price of $400,000. The down payment of $80,000 will be financed separately by the owner’s family. Mortgage payments will be included as operating expenses.

For a detailed breakdown of start-up expenses, please refer to the following table and chart (not provided).

Start-up Requirements

Start-up Expenses

– Inserted Row: $0

– Licenses: $500

– Legal: $500

– Stationery etc.: $1,500

– Insurance: $1,000

– Mortgage Payments (First Month): $3,200

– Corporate Identity and Website: $8,000

– Other: $5,000

– Total Start-up Expenses: $19,700

Start-up Assets

– Cash Required: $90,000

– Other Current Assets: $27,000

– Long-term Assets: $80,000

– Total Assets: $197,000

Total Requirements: $216,700

Products and Services

Evergreen Life Memorial Center is a place to celebrate the life of the departed and support those who must live without them. The Center will provide services demanded by the Baby Boom generation who want to celebrate life together. To achieve this, the Center will offer facilities and services for the living and the community.

The Center’s cornerstone product is the Reception Facility. Funerals bring people together who haven’t seen each other in years, even decades. The Center will capture the opportunity to bring people together, celebrate life, and re-form lines of support. The Center will offer:

– Reception hall for catered meals and refreshments

– Electronic presentation and projection of photos and films of the deceased, available on the website

– Soft background music selected by the family, if requested

– Discreet areas for intimate discussions

– Two rooms with couches and chairs for private meetings

– Children’s playroom, supervised if requested

– Easy wheelchair accessibility

Use of the Chapel for funeral services.

Professional Services of the Director and staff. One person will guide the family through the entire process.

Caskets and Urns. The Center will offer a wide selection of caskets and urns. It will provide the industry standard caskets as well as more interesting and diverse options, including:

– Legacy Custom Caskets: handcrafted caskets made with the finest materials for impressive appearances

– Cowboy’s Last Ride: unfinished pine caskets with denim or horse blanket liners

– Specialized metal and fiberglass caskets with emblems painted on the inside for firefighting, police, military, and fraternal organizations

– Other specialty caskets with unique features emphasizing the individuality of the deceased

– Selection of low-cost caskets by independent providers

Remembrance Products, including paper and electronic products to celebrate the life of the deceased. Digital photographs and films will be used during the reception and posted on the website, if desired.

Transportation, including the use of the hearse. Limousines will be contracted, if desired.

Refrigeration required for viewing the body beyond 72 hours after death without embalming. With the growing demand for cremation and increasing environmental sensitivity, greater use of refrigeration is expected in the future.

Embalming services. Embalming is not required by federal law, but it will be available at the Center for those who prefer it.

Cremation services. Cremation is the fastest growing segment of the death care industry.

Market Analysis Summary

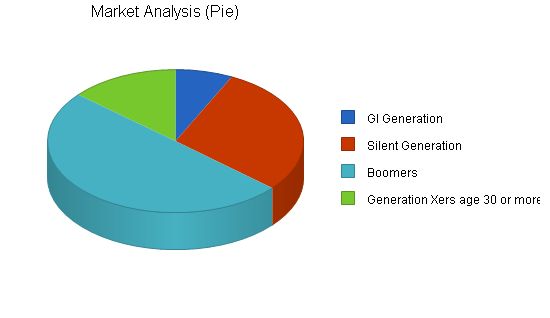

Defining the customer for a funeral home is complicated. Most people leave the decisions to surviving family members. The market for the Center is divided by the generations of decision-makers over age 30:

– The GI Generation (born 1901-1924): This generation is age 79 or older and makes up only 3.9 percent of Lane County. Funeral arrangements are likely made by their Baby Boomer children.

– The Silent Generation (born 1925-1945): This age segment generally has the most money. It composes 15.9 percent of the local population.

– Baby Boomers (born 1946-1964): This is the largest demographic making funeral decisions. It comprises 27.2 percent of the Eugene-Springfield MSA.

– Generation X (born 1965-1980): This generation has the least input into funeral decisions, comprising only 7.9 percent of Lane County.

The Eugene-Springfield MSA closely aligns with Lane County, with the majority living in the Anytown metropolitan area.

Market Analysis

Potential Customers Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

GI Generation -12% 12,650 11,081 9,707 8,503 7,449 -12.40%

Silent Generation -2% 51,618 50,586 49,574 48,583 47,611 -2.00%

Boomers 0% 87,984 87,720 87,457 87,195 86,933 -0.30%

Generation Xers 10% 24,128 26,541 29,195 32,115 35,327 10.00%

Total 0.13% 176,380 175,928 175,933 176,396 177,320 0.13%

4.2 Target Market Segment Strategy

The target market for the Center is the Baby Boom generation, which comprises over 50% of the funeral decision makers in Lane County. The Silent Generation, comprising 29% of funeral decision makers, is also a target market. The GI Generation’s decisions are likely to be made by younger generations, including Boomers. Baby Boomers, born between 1946 and 1964, are increasingly making funeral choices for their elderly parents and are expected to significantly increase the number of deaths in the coming years. The Center aims to offer individualized and celebratory funerals to target this generation.

Some 71% of people choose a funeral home based on reputation. The Center aims to establish a reputation rapidly through community involvement and publicity, attracting those who want to celebrate life rather than host a traditional funeral.

Capturing this market will also position the Center for long-term growth as the Baby Boom Generation ages and the number of deaths increases.

4.3 Service Business Analysis

There are relatively few alternatives available when someone dies to take care of the remains and bring closure. Funeral homes usually provide services such as funeral service, embalming, preparation of remains, transportation, funeral products, immediate burial, and cremation. 75% of people nationwide choose burials involving the services of a funeral home.

4.3.1 Competition and Buying Patterns

Choosing a funeral home is often based on location, reputation, and past family experiences. Price is a relatively moderate factor in decision-making. The funeral industry is conservative, with many successful funeral homes operated by the same family for generations. Metropolitan Anytown has ten funeral homes serving over two-thirds of Lane County’s population. There has been a steady growth in the market for cremation, with three providers specializing in immediate cremations in Anytown.

Strategy and Implementation Summary

The Center aims to establish a reputation as a unique and uplifting funeral provider that offers celebration and social support. Traditional funeral homes have not focused on providing social support, which is important for the living to move forward and complete the grieving process. The Center will be structured to meet this need and appeal to the Baby Boomer generation.

Competitive Edge

The Evergreen Life Memorial Center is a new category of funeral provider in the Anytown area, offering celebration of the individual and social support for closure. It aims to be the place for Baby Boomers to celebrate life in a more uplifting and social atmosphere than traditional funeral homes.

The three purposes of a funeral are bringing closure, providing social support, and celebrating life. The Center will focus on these purposes and offer services and amenities that traditional funeral homes may not provide.

The Center will establish a reputation as the place for Baby Boomers to celebrate life when it ends. This will be achieved through hosting nonprofit activities, community involvement, and gaining publicity. Location will support this focus, ideally with a purchased church and recreation room surrounded by Ponderosa pine or Douglas fir.

Sales Strategy

Sales will be accomplished through implementing the sales process and employing a full-time sales professional in year three. Networking, speech opportunities, and pre-need business promotion will be key in attracting customers. The sales professional will prospect, qualify, make presentations, write proposals, and close sales. They will be compensated with a base pay and commissions.

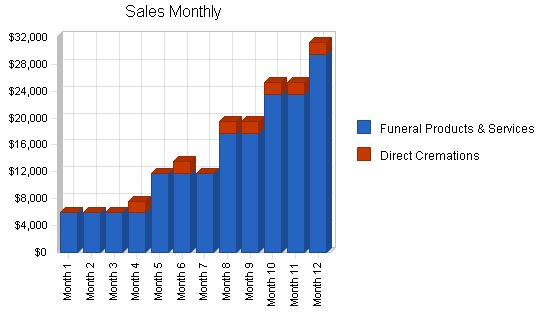

Sales forecasts are based on market share projections and the standard business growth curve. The average market share in Lane County is $768,213. The Center’s average funeral price is projected to be $5,884, resulting in sales of 29 funerals in the first year, 48 funerals in the second year, 86 funerals in the third year, and 143 funerals in the fourth year. Immediate cremations are also projected based on market share and average price.

In order to achieve these sales goals, the Center will develop publicity, establish community involvement, and implement an effective sales program.

Overall, the Center aims to establish itself as a unique and preferred funeral provider for the Baby Boomer generation by offering individualized and celebratory funerals with social support.

Sales Forecast

Sales

Year 1 Year 2 Year 3 Year 4 Year 5

Funeral Products & Services $170,665 $280,471 $504,847 $841,412 $942,381

Direct Cremations $12,425 $22,265 $40,078 $66,796 $74,812

Total Sales $183,090 $302,736 $544,925 $908,208 $1,017,193

Direct Cost of Sales

Year 1 Year 2 Year 3 Year 4 Year 5

Funeral Products & Services $59,733 $98,165 $176,696 $294,494 $329,833

Direct Cremations $4,349 $8,349 $14,027 $23,379 $26,184

Subtotal Direct Cost of Sales $64,082 $106,514 $190,724 $317,873 $356,018

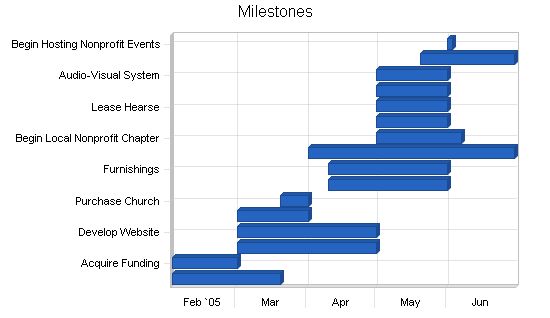

5.4 Milestones

The following table lists program milestones, including dates, managers, and budgets. The milestone schedule highlights our focus on implementation planning. The key programs involve nonprofit activities to establish our reputation in the community, as described in previous sections.

Milestones:

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Make Offer on Church | 2/1/2005 | 3/20/2005 | $0 | Stan Peters | Owner |

| Acquire Funding | 2/1/2005 | 3/1/2005 | $0 | Stan Peters | Owner |

| Corporate Identity | 3/1/2005 | 5/1/2005 | $4,000 | Marketing | Contractor |

| Develop Website | 3/1/2005 | 5/1/2005 | $4,000 | Marketing | Contractor |

| Permits & Licenses | 3/1/2005 | 4/1/2005 | $1,000 | Stan Peters | Staff |

| Purchase Church | 3/20/2005 | 4/1/2005 | $0 | Stan Peters | Owner |

| Building Improvements | 4/10/2005 | 6/1/2005 | $19,000 | Construction | Contractor |

| Furnishings | 4/10/2005 | 6/1/2005 | $10,000 | Interior Design | Contractor |

| Network with Nonprofits | 4/1/2005 | 6/30/2005 | $200 | Stan Peters | Sales |

| Begin Local Nonprofit Chapter | 5/1/2005 | 6/7/2005 | $200 | Stan Peters | Owner |

| Setup Embalming Room | 5/1/2005 | 6/1/2005 | $200 | Stan Peters | Owner |

| Lease Hearse | 5/1/2005 | 6/1/2005 | $200 | Stan Peters | Staff |

| Setup Casket Showroom | 5/1/2005 | 6/1/2005 | $2,000 | Stan Peters | Sales |

| Audio-Visual System | 5/1/2005 | 6/1/2005 | $5,000 | A-V Systems | Contractor |

| Start Publicity Campaign | 5/20/2005 | 6/30/2005 | $2,000 | Marketing | Contractor |

| Begin Hosting Nonprofit Events | 6/1/2005 | 6/3/2005 | $500 | Stan Peters | Sales |

| Totals | $48,300 |

Web Plan Summary

Our website will play a significant role in our marketing efforts targeted towards the tech-savvy Baby Boom generation. It will also help us achieve our mission of celebrating individuals’ lives online and in-person, while promoting our nonprofit work that connects us with the community. These uses of the website will attract more visitors and enhance its marketing potential.

6.1 Website Marketing Strategy

Our target market, the Internet-active Baby Boomers, will be effectively reached through various strategies outlined in the following section. These strategies will not only add value for our clients and the community but also drive more traffic to our website.

Digitized pictures and films of the individuals we celebrate will be available on our website and in our reception room. This will enable people who cannot attend funerals to participate in remembering and celebrating the lives of their loved ones. The website will also collect memories about the individuals for display. By using the website, the social support gathered during the funeral and reception can continue even after the ceremonies are over, reaching those who couldn’t attend.

Our website will also serve as an integral part of the Center’s activities. It will showcase photos and memories of individuals whose families have used our facilities. Additionally, our nonprofit work and articles about the Center will be featured on the website, along with an online newsletter produced by our public relations firm. This exposure will not only benefit the nonprofits we support but also raise awareness of the Center itself.

6.2 Development Requirements

Initially, the Evergreen Life Memorial Center’s website will be developed and hosted by our public relations firm. They will provide technical support and train the owner and staff on adding regular content. The website will be a crucial component of the Center’s operations, as we aim to celebrate life and use digitized photos and films to enhance the funeral experience. These photos and films will also be available on the website for families who prefer to access them online. During receptions, people will be encouraged to write their remembrances, which can be posted on the website. Families will be given a dedicated section on our website for a year, and they can choose to restrict access with a code to maintain privacy.

Providing these capabilities on the website will allow families to continue the remembrance celebration beyond the funeral, involve those unable to attend, download images, share remembrances via email, and access social support. These features will also contribute to the marketing of the Center by driving active engagement with our website.

The Center’s supported nonprofit causes will also have their presence on our website. In the future, we plan to maintain a directory of community nonprofit organizations’ websites, making the Center a virtual hub for charitable activities in the community. Our website will showcase our facility illustrations, inspiring visitors to consider using our Center when the need arises.

Management Summary

The Center’s management comprises an experienced funeral director and embalmer who has been actively involved in managing funeral homes for 10 years.

A policy manual and job descriptions have been developed and are ready for implementation. During the initial years, sales are expected to be low as the Center establishes its reputation. The owner will personally handle sales and administrative functions, with assistance from family members experienced in the funeral home industry. Staffing will be implemented based on sales demand.

Our business is designed to be responsive to clients’ needs while maintaining a lean and efficient operation.

7.1 Personnel Plan

Our personnel plan is as follows:

– The owner will serve as the funeral director, embalmer, and cremator. In the first two years, the owner will also handle sales and administrative tasks. The owner’s salary requirement is $60,000 per year, with a three percent increase annually after the first fiscal year.

– The salesperson will be responsible for executing the marketing and sales plan, actively participating in nonprofit activities. The salesperson’s salary will start at $31,830 in year three, increasing by three percent annually.

– The administrative assistant will work half-time from year three, handling bookkeeping, invoicing, bill payment, payroll, and other administrative tasks. The hourly rate for the assistant will be $13.42. Starting from July 2007, the assistant’s hours will double to a full-time position.

– From July 2007, we will begin hiring staff members to support the funeral director and clients. Starting with one half-time staff member and expanding to two in July 2008, the staff members will drive the hearse, assist in funerals, and provide necessary support. The salary for the first staff position will be $13,200 annually, increasing to full-time in July 2008 with a three percent annual raise. The second staff position will start in July 2008 at $25,750, with a three percent increase per year.

Personnel Plan:

| Personnel Plan | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Owner | $60,000 | $61,800 | $63,654 | $65,564 | $67,531 |

| Salesperson | $0 | $0 | $31,830 | $32,785 | $33,768 |

| Administrative Assistant | $0 | $0 | $13,688 | $28,195 | $29,040 |

| Staff Member | $0 | $13,200 | $53,000 | $54,600 | $56,235 |

| Total People | 1 | 2 | 5 | 5 | 5 |

| Total Payroll | $60,000 | $75,000 | $162,172 | $181,144 | $186,574 |

Our financial plan is based on securing a loan of $225,000, with the owner providing $20,000 of personal investment as well as an $80,000 down payment for a church or similar building.

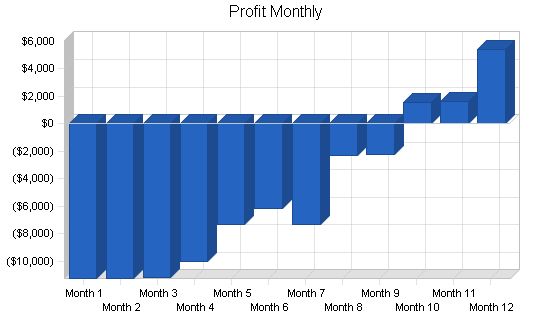

We anticipate profitability within just over two years and an annual net profit of approximately $196,000 in the Center’s fourth year of operation. Subsequent annual increases are projected due to inflation. These figures are conservative, reflecting a slow market penetration until the Center establishes its reputation and reaches full market share in year four.

8.1 Start-up Funding

We require start-up expenses of $19,700 and asset purchases of $197,000. These will be partially financed by the owner’s personal investment of $20,000 and a $225,000 loan. Details are provided in the following table and chart.

Start-up Funding:

| Start-up Funding | |

| Start-up Expenses to Fund | $19,700 |

| Start-up Assets to Fund | $197,000 |

| Total Funding Required | $216,700 |

| Assets | |

| Non-cash Assets from Start-up | $117,000 |

| Cash Requirements from Start-up | $90,000 |

| Additional Cash Raised | $28,300 |

| Cash Balance on Starting Date | $118,300 |

| Total Assets | $235,300 |

| Liabilities and Capital | |

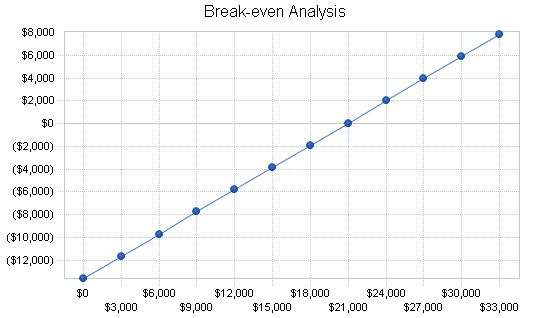

| Break-even Analysis | |

| Monthly Revenue Break-even | $20,932 |

| Assumptions: | |

| Average Percent Variable Cost | 35% |

| Estimated Monthly Fixed Cost | $13,606 |

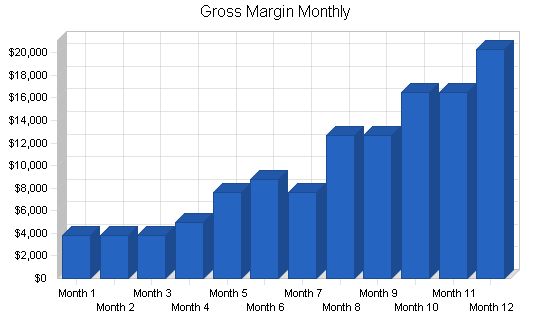

8.4 Projected Profit and Loss

In March 2006, profitability is realized. However, in the second fiscal year, there is a slight profit margin due to the need to hire and train staff ahead of the growth curve. When initially hiring staff, it is expected that the time required to train each employee may exceed the time it would take for the owner to complete the tasks themselves. Nonetheless, having prepared and capable staff is vital to our growth strategy and fulfilling our service commitments made in our marketing efforts.

Appendix includes month-by-month assumptions for profit and loss.

Pro Forma Profit and Loss:

Year 1 Year 2 Year 3 Year 4 Year 5

Sales $183,090 $302,736 $544,925 $908,208 $1,017,193

Direct Cost of Sales $64,082 $106,514 $190,724 $317,873 $356,018

Other Costs of Sales $0 $0 $0 $0 $0

Total Cost of Sales $64,082 $106,514 $190,724 $317,873 $356,018

Gross Margin $119,009 $196,222 $354,201 $590,335 $661,175

Gross Margin % 65.00% 64.82% 65.00% 65.00% 65.00%

Expenses:

Payroll $60,000 $75,000 $162,172 $181,144 $186,574

Marketing/Promotion $24,000 $24,000 $24,000 $24,000 $24,000

Depreciation $12,672 $12,672 $12,672 $12,672 $12,672

Mortgage Payments $38,400 $38,400 $38,400 $38,400 $38,400

Utilities $3,600 $3,600 $3,600 $3,600 $3,600

Insurance $1,200 $1,200 $1,200 $1,200 $1,200

Payroll Taxes $9,000 $11,250 $24,326 $27,172 $27,986

Auto Expenses $12,000 $12,000 $12,000 $12,000 $12,000

Supplies $2,400 $2,600 $3,000 $3,000 $3,000

Total Operating Expenses $163,272 $180,722 $281,370 $303,187 $309,432

Profit Before Interest and Taxes ($44,264) $15,500 $72,831 $287,148 $351,743

EBITDA ($31,592) $28,172 $85,503 $299,820 $364,415

Interest Expense $16,180 $12,960 $10,800 $7,020 $3,600

Taxes Incurred $0 $762 $18,609 $84,038 $104,443

Net Profit ($60,443) $1,778 $43,422 $196,090 $243,700

Net Profit/Sales -33.01% 0.59% 7.97% 21.59% 23.96%

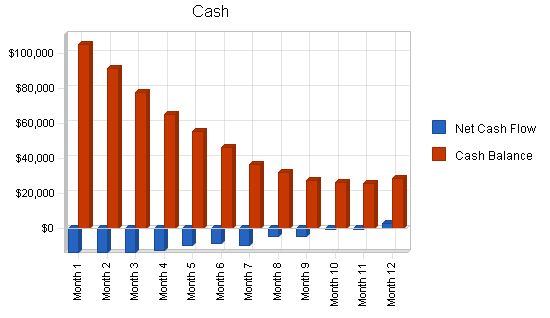

8.5 Projected Cash Flow:

A cash reserve is built into the plan to allow for unforeseen contingencies. Our minimum credit line available projected during this five-year period is over $45,000.

The company’s estimated cash flow analysis is outlined in the following table.

The Evergreen Life Memorial Center’s pro forma cash flow for Years 1 to 5 is presented in the table below. The cash received from operations includes cash sales, totaling $183,090 in Year 1 and increasing to $1,017,193 in Year 5. Additional cash received, such as sales tax and new borrowing, is not reported. On the expenditure side, cash spending on operations is $230,862 in Year 1, rising to $760,821 in Year 5. Other cash spent, such as taxes and loan repayments, is not included. The net cash flow is negative in Year 1 at ($89,772), it improves over the years and reaches $214,372 in Year 5. The cash balance at the end of each year ranges from $28,529 in Year 1 to $396,207 in Year 5.

The projected balance sheet for the Evergreen Life Memorial Center is shown below for Years 1 to 5. Current assets consist of cash, starting at $28,529 in Year 1 and growing to $396,207 in Year 5. Other current assets remain steady at $27,000 throughout the period. Total current assets amount to $55,529 in Year 1 and reach $423,207 in Year 5. Long-term assets, such as equipment, start at $80,000 and remain unchanged over the years. Accumulated depreciation increases each year to a total of $63,360 in Year 5. The total assets increase steadily from $122,857 in Year 1 to $439,847 in Year 5.

The liabilities and capital section of the balance sheet shows current liabilities of $183,000 in Year 1, decreasing to $15,000 in Year 5. Long-term liabilities are not reported. The total liabilities remain constant at $183,000 throughout the years. Paid-in capital amounts to $20,000, while retained earnings start negative in Year 1 and increase to $161,146 in Year 5. Earnings start negative in Year 1 and reach $243,700 in Year 5. Overall, the total capital improves from ($60,143) in Year 1 to $424,847 in Year 5. The total liabilities and capital balance to match the total assets at each year-end.

Finally, the business ratios indicate that the Evergreen Life Memorial Center is more profitable than average in its industry due to value-added services, slightly higher prices, and a lean operation. Sales expenses remain constant throughout the five-year period. The table provides ratios for various financial metrics, such as sales growth, profitability, asset turnover, and liquidity. These ratios can be used to compare the company’s performance against industry averages.

In the long-term, the Evergreen Life Memorial Center plans to achieve and maintain market share. The funeral service industry is projected to grow significantly due to the aging Baby Boom generation and population increases in the Lane County area. The center anticipates capturing this growth and serving generations to come.

(Note: The provided text has been condensed and modified for conciseness and clarity.)

Sales Forecast

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Funeral Products & Services | $5,884 | $5,884 | $5,884 | $5,884 | $11,768 | $11,768 | $11,768 | $17,652 | $17,682 | $23,536 | $23,535 | $29,420 | |

| Direct Cremations | $0 | $0 | $0 | $1,775 | $0 | $1,775 | $0 | $1,775 | $1,775 | $1,775 | $1,775 | $1,775 | |

| Total Sales | $5,884 | $5,884 | $5,884 | $7,659 | $11,768 | $13,543 | $11,768 | $19,427 | $19,457 | $25,311 | $25,310 | $31,195 | |

Personnel Plan

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Owner | 3% | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 |

| Salesperson | 3% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Administrative Assistant | 3% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Staff Member | 3% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total People | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $5,884 | $5,884 | $5,884 | $7,659 | $11,768 | $13,543 | $11,768 | $19,427 | $19,457 | $25,311 | $25,310 | $31,195 | |

| Direct Cost of Sales | $2,059 | $2,059 | $2,059 | $2,681 | $4,119 | $4,740 | $4,119 | $6,799 | $6,810 | $8,859 | $8,859 | $10,918 | |

| Other Costs of Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $2,059 | $2,059 | $2,059 | $2,681 | $4,119 | $4,740 | $4,119 | $6,799 | $6,810 | $8,859 | $8,859 | $10,918 | |

| Gross Margin | $3,825 | $3,825 | $3,825 | $4,978 | $7,649 | $8,803 | $7,649 | $12,628 | $12,647 | $16,452 | $16,452 | $20,277 | |

| Gross Margin % | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | |

| Expenses | |||||||||||||

| Payroll | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | |

| Marketing/Promotion | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | |

| Depreciation | $1,056 | $1,056 | $1,056 | $1,056 | $1,056 | $1,056 | $1,056 | $1,056 | $1,056 | $1,056 | $1,056 | $1,056 | |

| Mortgage Payments | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | |

| Utilities | $300 | $300 | $300 | ||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $5,884 | $5,884 | $5,884 | $7,659 | $11,768 | $13,543 | $11,768 | $19,427 | $19,457 | $25,311 | $25,310 | $31,195 | |

| Subtotal Cash from Operations | $5,884 | $5,884 | $5,884 | $7,659 | $11,768 | $13,543 | $11,768 | $19,427 | $19,457 | $25,311 | $25,310 | $31,195 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $5,884 | $5,884 | $5,884 | $7,659 | $11,768 | $13,543 | $11,768 | $19,427 | $19,457 | $25,311 | $25,310 | $31,195 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $16,086 | $16,063 | $16,039 | $16,637 | $18,052 | $18,650 | $18,005 | $20,663 | $20,650 | $22,676 | $22,652 | $24,688 | |

| Subtotal Spent on Operations | $16,086 | $16,063 | $16,039 | $16,637 | $18,052 | $18,650 | $18,005 | $20,663 | $20,650 | $22,676 | $22,652 | $24,688 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $19,586 | $19,563 | $19,539 | $20,137 | $21,552 | $22,150 | $21,505 | $24,163 | $24,150 | $26,176 | $26,152 | $28,188 | |

| Net Cash Flow | ($13,702) | ($13,679) | ($13,655) | ($12,478) | ($9,784) | ($8,607) | ($9,737) | ($4,736) | ($4,693) | ($865) | ($842) | $3,007 | |

| Cash Balance | $104,598 | $90,919 | $77,264 | $64,785 | $55,001 | $46,394 | $36,657 | $31,921 | $27,228 | $26,364 | $25,522 | $28,529 |

Pro Forma Balance Sheet

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $118,300 | $104,598 | $90,919 | $77,264 | $64,785 | $55,001 | $46,394 | $36,657 | $31,921 | $27,228 | $26,364 | $25,522 | $28,529 |

| Other Current Assets | $27,000 | $27,000 | $27,000 | $27,000 | $27,000 | $27,000 | $27,000 |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!