Gymnastics Jump-Start, located in the Detroit Metropolitan area, aims to help children enhance discipline, focus, and overall health. While our main focus is gymnastics, we also offer dance and total body conditioning. Our facility is equipped with Olympic gymnastic equipment for both boys and girls.

We start by teaching students the core elements of gymnastics, followed by total body conditioning and more advanced tricks. Our unique teaching methods combine repetition and variation to set us apart from our competitors. We believe that for effective learning, children must have fun and enjoy what they are doing. Our teachers are trained in methods that have a positive physical and mental impact on the children. Parents can observe their children’s progress, but in a confined area for safety.

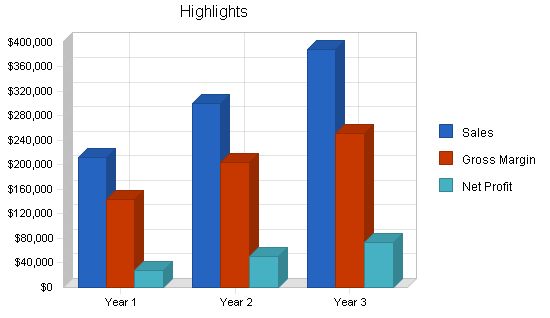

Gymnastics Jump-Start expects to become profitable within the first year of business. As our classes grow, we will hire additional teachers to meet demand. We value our strong relationships with our customers and will do whatever it takes to ensure their loyalty. While our prices are lower than competitors, our business will still yield excellent profits.

Owners Wanda Bounce and Bea Flip have extensive experience as competitive gymnasts and have worked in both private and public gyms. With a combined coaching experience of over 25 years, we understand our customers’ wants and needs, having learned from the mistakes our teachers made during our own gymnastics competitions. We recognize the need for private gyms in Oakland County, having grown up there and faced the inconvenience of traveling long distances for lessons. Our experience working in various gymnastics facilities in the Detroit Metropolitan area gives us confidence in the success of our gym.

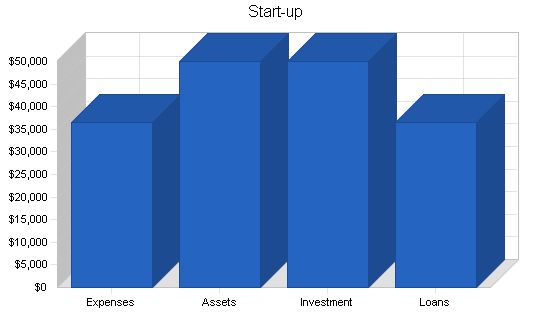

To fund the start-up costs, each owner will invest $25,000, and we are also seeking a seven-year loan of $36,600 for initial equipment purchases. Details regarding repayment can be found in the financial plan.

1.1 Keys to Success

Our keys to success include:

- Maintaining a reputable reputation in the community

- Competitive pricing

- Flexible hours

- Ample and secure parking

- Easy access

- Target high traffic areas for public exposure

- Design facilities to curb overcrowding

- Seasoned management team

- Personalized relationships with customers

We can minimize risk factors by:

- Initial capitalization of the company to sustain operations through year one

- Low overhead through the use of multi-skilled employees and continual training

- Strong customer base through aggressive marketing

- Strong community ties and involvement

- Eliminate collection costs by establishing cash/credit/debit-card-only facilities

1.2 Mission

Gymnastics Jump-Start offers a place where people can learn gymnastics, meet new people, have fun and feel comfortable. We offer a varied gymnastics and conditioning program with price options for all levels of interest, but with greater emphasis on group classes. Our instructors have access to continual training with top professional coaches, providing our students with up-to-date tricks and techniques. Gymnastics Jump-Start welcomes a diversity of people and maintains a non-smoking and alcohol/drug-free environment.

1.3 Objectives

The objectives of Gymnastics Jump-Start are:

- Exceed 60% class capacity by the end of the first year of operation.

- Acquire 300+ participants by the end of the first year of operation.

- Increase membership by 20% by the end of the second year of operation.

- Provide gymnastics training for students at all levels, from beginner to advanced.

- Provide continual training, benefits, and incentives for staff to encourage long-term commitment.

Company Summary

Gymnastics Jump-Start, located in Bouncetown, Michigan, provides the community with a comfortable, friendly environment to learn all levels of gymnastics. Gymnastics Jump-Start offers private gymnastics instruction, group classes, birthday parties, sleepovers, drop-in clinics, cheerleading classes, and conditioning classes. Gymnastics has become increasingly popular worldwide due to exposure from the Summer Olympics. As a result, the gym expects an increase in children’s numbers, especially during the next Summer Olympics. Most customers are expected to come from Oakland County, but some business is also anticipated from Macomb and Wayne County. Gymnastics Jump-Start appeals to the 1-18-year-old age group, all abilities and backgrounds, and children seeking creative self-expression, exercise, and social opportunities through gymnastics.

2.1 Company Ownership

Gymnastics Jump-Start is a privately owned limited liability partnership with each principal officer holding an equal share in the company. Gymnastics Jump-Start is owned and operated by Wanda Bounce and Bea Flip.

2.2 Start-up Summary

The start-up expenses for Gymnastics Jump-Start primarily focus on equipment and padded floor surfaces for the classes. We are buying $40,000 worth of equipment as long-term assets, and another $30,000 as expensed equipment that will need replacement every three to four years.

Start-up Requirements:

In today’s business world, start-up expenses are an important consideration for entrepreneurs. When someone decides to start a new business, it is important to take into account the various costs involved. These costs typically include legal fees, expenses for stationery, insurance, rent, and the purchase of necessary equipment. Understanding these start-up expenses and the total requirements is crucial for planning and budgeting purposes.

To give you an idea of the financial aspects involved, let me break it down for you. Legal fees for setting up a business can amount to around $1,000. Expenses for supplies such as stationery can add up to about $500. Insurance coverage may cost around $1,000. Rent for a suitable location is often the biggest expense, with an average of $2,000. Buying a computer for business operations may cost around $100. If you are starting a gymnastics gym, you will also need to invest in gymnastics equipment, which can amount to $30,000. Other miscellaneous costs may amount to about $2,000. Altogether, the total start-up expenses can reach up to $36,600.

Start-up Assets:

When it comes to start-up assets, you need to consider the cash required and other current and long-term assets. Cash required for day-to-day operations may total around $10,000. Other current assets may not be needed initially, but should still be taken into account. Long-term assets, such as property and equipment, are essential for the long-term success of the business. These assets may cost approximately $40,000. Overall, the total assets needed for the start-up phase can amount to $50,000.

Services:

At Gymnastics Jump-Start, our mission is to make gymnastics accessible and affordable for residents of Oakland County. We offer a wide range of gymnastics classes, catering to both individuals and groups. By offering various options, we can meet the unique needs and budgets of our students.

Private Lessons:

For those seeking personalized instruction, our private lessons offer the best value. Working one-on-one with an experienced instructor allows students to progress at their own pace. With immediate feedback and tailored guidance, both beginners and advanced students can achieve faster and easier progress. The cost of private lessons varies depending on the instructor’s experience.

Parent & Tot:

Designed for children aged 16 months to 3 years, our Parent & Tot class focuses on developing motor, listening, and social skills through fun gymnastics activities. Active participation of an adult is required. This class runs for 45 minutes and costs $75 for a 10-week session.

Preschool:

Our hour-long Preschool class introduces children aged 3 to kindergarten to basic gymnastics skills. With 5 levels of achievement, students learn tumbling, the low bar, floor beam, and motor skills. Classes for 3-year-olds have a maximum of 6 students per instructor, while classes for 4-year-olds through kindergarten have 8 students per instructor. The price for a 10-week session is $100. We also offer an advanced preschool class for children who receive instructor approval. This 90-minute class costs $128.

Girls:

Girls aged 1st grade to 12 years old can join our 90-minute class, which covers basic, intermediate, and advanced gymnastics skills. With 6 levels to achieve, students can master vault, bars, beam, tumbling, trampoline, and dance. There are 8 students per instructor, and the price for a 10-week session is $128.

Boys:

Our 90-minute boys’ class is designed for boys aged 6 years old and up. They can learn basic, intermediate, and advanced gymnastics skills, including single bar, rings, parallel bars, tumbling, vault, and trampoline. Similar to the girls’ class, there are 8 students per instructor, and the price for a 10-week session is $128.

Tumbling:

Our tumbling class is suitable for boys and girls aged 6 years old and up. Students learn a range of tumbling skills, including handstands, cartwheels, round-offs, back handsprings, and back tucks. With 8 students per instructor, this 75-minute class costs $115 for a 10-week session.

Cheernastics:

For cheer squads of 8 or more, we offer a specialized 60-minute tumbling class with a focus on back handsprings. Cheer coaches can contact our office to schedule a class for their squad. The price will depend on the number of participants.

Cheer:

Our 60-minute cheer class is open to individuals interested in learning basic, intermediate, or advanced cheer techniques. The class covers flexibility training, jumps, and stunts. The cost for a 10-week session is $100, and it is available for a variety of age groups.

Adult Gymnastics:

Our adult gymnastics class is perfect for anyone interested in learning or relearning basic to intermediate tumbling skills. With 8 students per instructor, this 75-minute class costs $115 for a 10-week session.

Birthday Parties:

We also offer birthday party packages, providing a unique way to celebrate a child’s special day. The party includes 60 minutes of games, trampoline fun, and gymnastics activities, followed by 30 minutes for refreshments and gifts. We provide the party room, decorations, and clean-up. The maximum number of children per party is 20, and the cost is $150.

Field Trips:

For groups interested in experiencing basic gymnastics skills, we offer 60-minute field trips. The price varies depending on the size of the group.

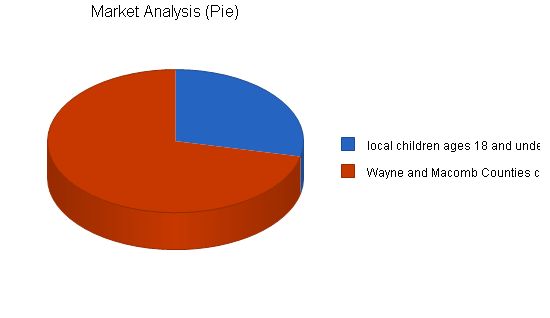

Market Analysis Summary:

In today’s fast-paced world, a business like Gymnastics Jump-Start has become essential. With the rise in obesity rates among both adults and children, it is evident that people need to take care of their health. Overweight children face not only physical health issues but also social challenges. Being inactive and relying on technology for entertainment has contributed to this problem. Consequently, there is a growing need for private gymnastics gyms to encourage physical activity and combat the negative effects of a sedentary lifestyle.

Our target market mainly consists of children aged 18 and under in Oakland County. While the majority of our customers will come from this county, we also anticipate some customers from Macomb and Wayne County, though they will make up less than 30% of our client base.

Market Analysis

| Market Analysis | |||||||

| 1 | 2 | 3 | 4 | 5 | |||

| Potential Customers | Growth | CAGR | |||||

| local children ages 18 and under | 1% | 304,383 | 307,427 | 310,501 | 313,606 | 316,742 | 1.00% |

| Wayne and Macomb Counties children ages 18 and under | 1% | 764,219 | 771,861 | 779,580 | 787,376 | 795,250 | 1.00% |

| Total | 1.00% | 1,068,602 | 1,079,288 | 1,090,081 | 1,100,982 | 1,111,992 | 1.00% |

4.2 Service Business Analysis

I decided to open Gymnastics Jump-Start in Oakland County because there are no private gyms in the area. There is one private gym on the opposite side of Oakland County from Bouncetown, but I wanted to create a more centralized business. In this industry, there are two options: public gyms and private gyms. The public gyms are city recreation centers, YMCA’s, and YWCA’s. Most recreation centers or cities have some sort of gymnastics program, but it may be as basic as a preschool program.

4.2.1 Competition and Buying Patterns

Public programs are cheaper but have lower-quality equipment compared to private gyms. Children who reach a certain point in public centers must go to a private gym for advanced training. Private gyms typically have better trained staff and higher quality equipment. A child serious about becoming a competitive gymnast should attend a private gym. Private gyms are more expensive but offer smaller classes and higher skill levels. If a child is doing gymnastics for fun and not serious about competing, a public gym is sufficient. In a private gym, the child can still benefit from the social aspect. There is no need to pay the expensive price of a private gym if the main desire is the social aspect and not high-level gymnastics.

4.3 Target Market Segment Strategy

Gymnastics Jump-Start targets children 18 years old and under in Oakland, Macomb, and Wayne County. We do not expect customers from other counties due to the distance. Gymnastics is rough on the body, and by the age of 18, most gymnasts lose interest or get burned out. However, there is still a large number of children who want to participate in gymnastics during their youth.

Strategy and Implementation Summary

Gymnastics Jump-Start will offer a safe, fun environment for children to learn gymnastics with personalized attention from trained teachers. The goals of the gym are:

- To make parents feel good about the environment and benefits their children gain.

- To create a safe, educational, and fun experience for the child.

5.1 Competitive Edge

Gymnastics Jump-Start’s competitive advantage is its focus on low-level competitive gymnastics. We prioritize teaching the basics correctly to ensure that children develop strong skills. Unlike most private gyms that focus on high-level competitive gymnastics, we emphasize beginning classes. In high-level competitive gyms, beginning classes are often pushed aside for the convenience of competitive gymnasts. Building strong relationships with children and their families is another priority, as it helps retain customers.

To develop good business strategies, perform a SWOT analysis of your business. Learn how to perform a SWOT analysis

5.2 Marketing Strategy

Our customers range from ages 16 months to 18 years old, male and female, from all races, income levels, and local and connected county residents. Our marketing plan focuses on creating a fun and enjoyable environment for children to participate in gymnastics. Public relations is vital in gathering information about the desired types of classes and maintaining community engagement.

5.3 Sales Strategy

Gymnastics Jump-Start will make a profit by providing excellent teaching and care for children. Despite charging less than other private gyms, the company expects to see profit within the first year through word-of-mouth advertising. We also anticipate attracting customers from the private gym and public recreation center where both Wanda Bounce and Bea Flip currently work. The company aims to double its clientele every six months for the first 18 months.

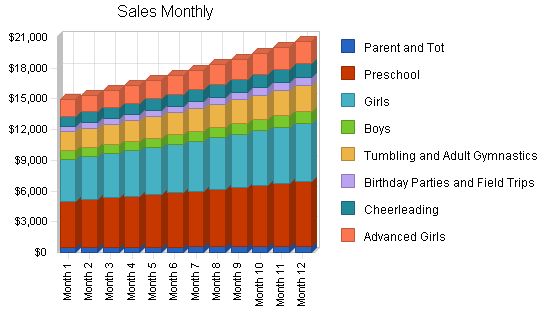

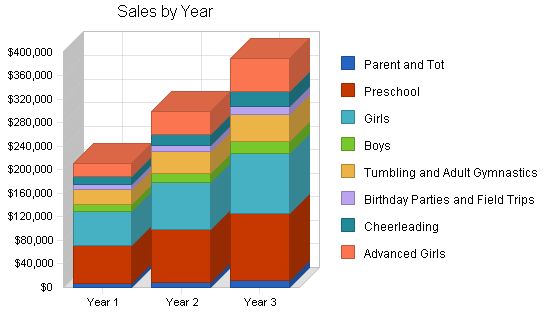

5.3.1 Sales Forecast

This sales forecast is based on the numbers from a private gym where I currently work. It is assumed that our business will consistently grow in the number of students for the first 3 years. The first year’s forecast is based on half the current clientele of the private gym. We expect our numbers to exceed those of the private gym over time.

Our cost of sales includes hourly wages paid to teachers and the owners. These costs vary based on the number of children attending each session. Bea and Wanda, the owners, will teach many of these classes for a small, flat salary. The salaries are listed separately in the Personnel table. The sales forecast table below shows projected sales of $211,603 in 2008, with a direct cost of sales of $64,809.

Sales Forecast

Year 1 Year 2 Year 3

———————————

Sales

Parent and Tot $6,386 $8,818 $11,250

Preschool $64,829 $89,515 $114,200

Girls $58,131 $80,266 $102,400

Boys $11,637 $16,059 $20,480

Tumbling and Adult Gymnastics $26,113 $36,057 $46,000

Birthday Parties and Field Trips $7,806 $10,778 $13,750

Cheerleading $14,192 $19,596 $25,000

Advanced Girls $22,509 $39,255 $56,000

Total Sales $211,603 $300,344 $389,080

Direct Cost of Sales

Year 1 Year 2 Year 3

———————————

Preschool gymnastics teachers $21,365 $29,500 $50,180

Beginner girls, boy, and tumbling teachers $28,764 $39,715 $50,664

Advanced girls teachers $14,680 $23,540 $32,400

Subtotal Direct Cost of Sales $64,809 $92,755 $133,244

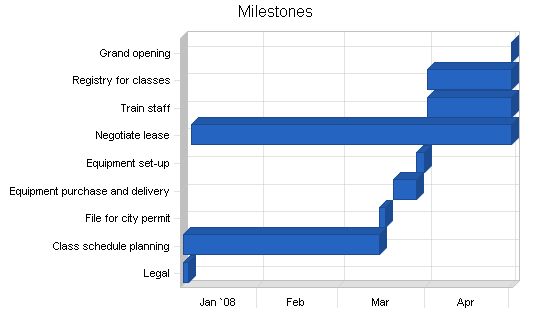

5.4 Milestones

The Milestones table provides detailed information about the necessary functions for setting up the gym on schedule for the Grand Opening. Each function is scheduled and assigned to a specific manager based on their expertise.

Milestones:

– Legal: 1/5/2008 – 1/7/2008, $1,000, Manager: Both, Department: Department

– Class schedule planning: 1/5/2008 – 3/15/2008, $0, Manager: Wanda, Department: Department

– File for city permit: 3/15/2008 – 3/17/2008, $200, Manager: Wanda, Department: Department

– Equipment purchase and delivery: 3/20/2008 – 3/28/2008, $70,000, Manager: Both, Department: Department

– Equipment set-up: 3/28/2008 – 3/31/2008, $0, Manager: Both, Department: Department

– Negotiate lease: 1/8/2008 – 5/1/2008, $0, Manager: Both, Department: Department

– Train staff: 4/1/2008 – 5/1/2008, $4,000, Manager: Bea, Department: Department

– Registry for classes: 4/1/2008 – 5/1/2008, $0, Manager: Bea, Department: Department

– Grand opening: 5/1/2008 – 5/1/2008, $2,000, Manager: Both, Department: Department

– Totals: $77,200

Management Summary:

The two principals, Wanda Bounce and Bea Flip, have impressive credentials in this industry. This will benefit Gymnastics Jump-Start in two ways:

1. Clients will be brought from previous employers.

2. Their experience will attract new clients.

Bea Flip has extensive sales and marketing experience in the private and public gymnastics industry. Wanda Bounce has extensive management, finance, and administration experience, also in the private and public gymnastics industry.

Personnel Plan:

Bea Flip will teach full-time (20 classes/week) and handle managerial duties. Wanda Bounce will teach 5-6 classes per week and manage administrative and accounting functions, in coordination with our receptionist. Both owners will take a reduced salary in the first year.

Most personnel costs are listed in the Sales Forecast, under Direct Cost of Sales. Teachers are paid hourly wages based on the number of students attending each session. Gymnastics Jump-Start expects to gradually invest in gymnastic teachers over the next three years, considering the number of children in classes and the number of teachers able to teach multiple classes in a week.

Personnel Plan:

– Receptionist: $17,280 (Year 1), $20,000 (Year 2), $21,120 (Year 3)

– Wanda Bounce: $12,000 (Year 1), $24,000 (Year 2), $30,000 (Year 3)

– Bea Flip: $12,000 (Year 1), $24,000 (Year 2), $30,000 (Year 3)

– Total People: 8 (Year 1), 9 (Year 2), 9 (Year 3)

– Total Payroll: $41,280 (Year 1), $68,000 (Year 2), $81,120 (Year 3)

Financial Plan:

The following sections outline the Financial Plan of Gymnastics Jump-Start.

Start-up Funding:

Total start-up expenses and assets required will be funded as shown in the table below. Wanda Bounce will invest $25,000. Bea Flip will also invest $25,000. In addition, the gym will secure a $36,600 long-term loan (7 years at 10% interest).

Start-up Funding:

– Start-up Expenses to Fund: $36,600

– Start-up Assets to Fund: $50,000

– Total Funding Required: $86,600

Important Assumptions:

– We assume steady growth from the 3 counties we service.

– We assume adequate funding to sustain us during start-up.

– We assume that the popularity of gymnastics does not decrease.

– We assume that there will be no other private gyms starting up near us.

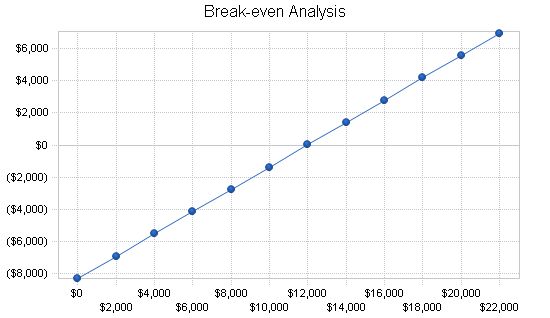

Break-even Analysis:

Table 7.3 summarizes the break-even analysis. The Break-even Analysis is based on the first-year average figures for total sales and operating expenses. Our variable costs are relatively low, and our main operating costs are teacher salaries.

Break-even Analysis:

Monthly Revenue Break-even: $11,973

Assumptions:

– Average Percent Variable Cost: 31%

– Estimated Monthly Fixed Cost: $8,306

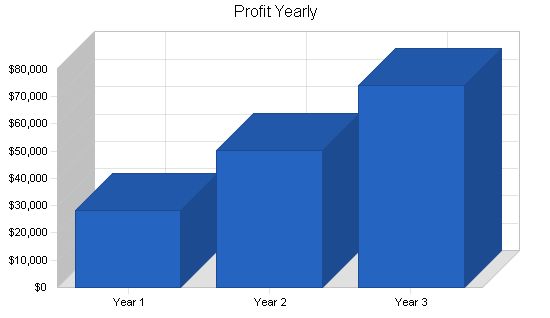

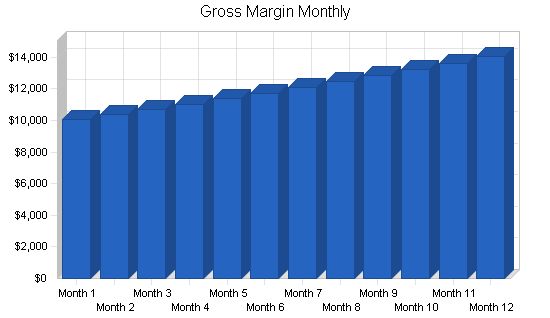

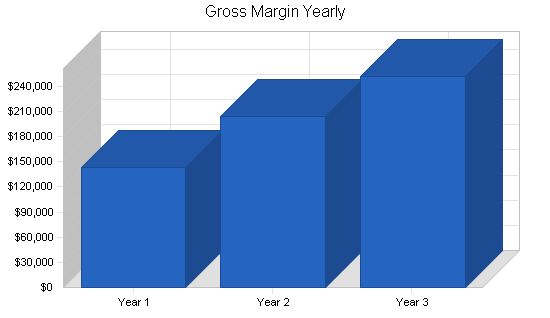

Projected Profit and Loss:

The company expects to continue growing its profitability over the next three years of operations. Aside from payroll, Rent and Insurance are the largest expenses. The chosen studio’s rent is reasonable considering the square footage, allowing for multiple classes or classes and birthday parties simultaneously. Dealing with young children and physical activity entails high insurance costs, but the owners’ prior experience keeps these costs affordable.

Payroll taxes are based on wages and salaries for all employees, including hourly teachers (shown as direct cost of sales).

Pro Forma Profit and Loss:

Year 1 Year 2 Year 3

Sales $211,603 $300,344 $389,080

Direct Cost of Sales $64,809 $92,755 $133,244

Other Costs of Sales $3,360 $3,840 $4,320

Total Cost of Sales $68,169 $96,595 $137,564

Gross Margin $143,434 $203,749 $251,516

Gross Margin % 67.78% 67.84% 64.64%

Expenses

Payroll $41,280 $68,000 $81,120

Marketing/Promotion $5,000 $5,000 $5,000

Depreciation $4,000 $4,000 $4,000

Rent $24,000 $24,000 $24,000

Utilities $3,600 $3,700 $3,800

Insurance $19,992 $21,992 $22,992

Payroll Taxes $0 $0 $0

Other $1,800 $2,100 $2,500

Total Operating Expenses $99,672 $128,792 $143,412

Profit Before Interest and Taxes $43,762 $74,957 $108,104

EBITDA $47,762 $78,957 $112,104

Interest Expense $3,377 $2,876 $2,353

Taxes Incurred $12,116 $21,624 $31,725

Net Profit $28,270 $50,457 $74,026

Net Profit/Sales 13.36% 16.80% 19.03%

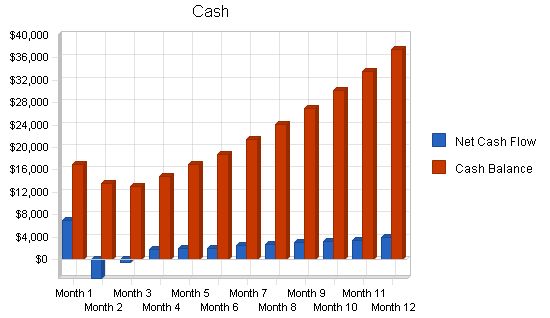

7.5 Projected Cash Flow:

The cash flow projection shows that provisions for ongoing expenses are adequate to meet the needs of the company as the business generates sufficient cash flow to support operations. The table shows the planned repayment of our long-term loan over seven years.

Pro Forma Cash Flow

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $158,702 | $225,258 | $291,810 |

| Cash from Receivables | $42,899 | $70,891 | $93,076 |

| Subtotal Cash from Operations | $201,601 | $296,149 | $384,886 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $201,601 | $296,149 | $384,886 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $41,280 | $68,000 | $81,120 |

| Bill Payments | $125,633 | $175,686 | $225,656 |

| Subtotal Spent on Operations | $166,913 | $243,686 | $306,776 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $5,230 | $5,230 | $5,230 |

| Purchase Other Current Assets | $2,000 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $174,143 | $248,916 | $312,006 |

| Net Cash Flow | $27,458 | $47,233 | $72,879 |

| Cash Balance | $37,458 | $84,691 | $157,570 |

7.6 Projected Balance Sheet

The following table presents the Balance Sheet for Gymnastics Jump-Start. Our cash, retained earnings, and net worth will increase steadily as we establish a stable, returning customer base.

Pro Forma Balance Sheet

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $37,458 | $84,691 | $157,570 |

| Accounts Receivable | $10,002 | $14,197 | $18,391 |

| Other Current Assets | $2,000 | $2,000 | $2,000 |

| Total Current Assets | $49,460 | $100,888 | $177,962 |

| Long-term Assets | |||

| Long-term Assets | $40,000 | $40,000 | $40,000 |

| Accumulated Depreciation | $4,000 | $8,000 | $12,000 |

| Total Long-term Assets | $36,000 | $32,000 | $28,000 |

| Total Assets | $85,460 | $132,888 | $205,962 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $12,420 | $14,621 | $18,899 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $12,420 | $14,621 | $18,899 |

| Long-term Liabilities | $31,370 | $26,140 | $20,910 |

| Total Liabilities | $43,791 | $40,761 | $39,809 |

| Paid-in Capital | $50,000 | $50,000 | $50,000 |

| Retained Earnings | ($36,600) | ($8,330) | $42,127 |

| Earnings | $28,270 | $50,457 | $74,026 |

| Total Capital | $41,670 | $92,127 | $166,153 |

| Total Liabilities and Capital | $85,460 | $132,888 | $205,962 |

| Net Worth | $41,670 | $92,127 | $166,153 |

7.7 Business Ratios

The following table outlines some of the more important ratios from the Gymnastic instruction industry. The final column, Industry Profile, details specific ratios based on the industry as it is classified by the Standard Industry Classification (SIC) code, 7999.1109.

Ratio Analysis

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 41.94% | 29.54% | 4.94% |

| Percent of Total Assets | ||||

| Accounts Receivable | 11.70% | 10.68% | 8.93% | 5.13% |

| Other Current Assets | 2.34% | 1.51% | 0.97% | 36.35% |

| Total Current Assets | 57.88% | 75.92% | 86.41% | 43.63% |

| Long-term Assets | 42.12% | 24.08% | 13.59% | 56.37% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 12.53% | 13.21% | 13.48% | 7.74% |

| Long-term Liabilities | 36.88% | 25.81% | 17.65% | 46.45% |

| Total Liabilities | 49.41% | 39.03% | 31.13% | 54.19% |

| Net Worth | 50.59% | 60.97% | 68.87% | 45.81% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 67.78% | 67.84% | 64.64% | 100.00% |

| Selling, General & Administrative Expenses | 54.42% | 51.04% | 45.62% | 76.74% |

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 2.84% |

| Profit Before Interest and Taxes | 20.68% | 24.96% | 27.78% | 2.11% |

| Main Ratios | ||||

| Current | 3.98 | 6.90 | 9.42 | 1.05 |

| Quick | 3.98 | 6.90 | 9.42 | 0.69 |

| Total Debt to Total Assets | 51.24% | 30.67% | 19.33% | 62.49% |

| Pre-tax Return on Net Worth | 96.92% | 78.24% | 63.65% | 2.98% |

| Pre-tax Return on Assets | 47.26% | 54.24% | 51.35% | 7.95% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 13.36% | 16.80% | 19.03% | n.a |

| Return on Equity | 67.84% | 54.77% | 44.55% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 5.29 | 5.29 | 5.29 | n.a |

| Collection Days | 57 | 59 | 61 | n.a |

| Accounts Payable Turnover | 11.12 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 28 | 27 | n.a |

| Total Asset Turnover | 2.48 | 2.26 | 1.89 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 1.05 | 0.44 | 0.24 | n.a |

| Current Liab. to Liab. | 0.28 | 0.36 | 0.47Receptionist: 0% | $1,440 for each month

Wanda Bounce: 0% | $1,000 for each month Bea Flip: 0% | $1,000 for each month Total People: 8 for each month Total Payroll: $3,440 for each month Sales: $14,910, $15,357, $15,818, $16,293, $16,781, $17,285, $17,803, $18,337, $18,888, $19,454, $20,038, $20,639 Direct Cost of Sales: $4,567, $4,704, $4,845, $4,990, $5,140, $5,294, $5,453, $5,616, $5,785, $5,958, $6,137, $6,321 Other Costs of Sales: $280 for each month Total Cost of Sales: $4,847, $4,984, $5,125, $5,270, $5,420, $5,574, $5,733, $5,896, $6,065, $6,238, $6,417, $6,601 Gross Margin: $10,063, $10,374, $10,693, $11,023, $11,362, $11,711, $12,071, $12,441, $12,823, $13,216, $13,621, $14,038 Gross Margin %: 67.49%, 67.55%, 67.60%, 67.65%, 67.70%, 67.75%, 67.80%, 67.85%, 67.89%, 67.93%, 67.97%, 68.02% Expenses: Payroll: $3,440 for each month Marketing/Promotion: $2,000, $200, $200, $200, $700, $200, $200, $200, $200, $500, $200, $200 Depreciation: $333 for each month, $337 for Month 12 Rent: $2,000 for each month Utilities: $250, $250, $250, $250, $250, $250, $400, $400, $400, $400, $250, $250 Insurance: $1,666 for each month Payroll Taxes: 15%, $0 for each month Other: $150 for each month Total Operating Expenses: $9,839, $8,039, $8,039, $8,039, $8,539, $8,039, $8,189, $8,189, $8,189, $8,489, $8,039, $8,043 Profit Before Interest and Taxes: $224, $2,335, $2,654, $2,984, $2,823, $3,672, $3,882, $4,252, $4,634, $4,727, $5,582, $5,995 EBITDA: $557, $2,668, $2,987, $3,317, $3,156, $4,005, $4,215, $4,585, $4,967, $5,060, $5,915, $6,332 Interest Expense: $301, $298, $294, $290, $287, $283, $280, $276, $272, $269, $265, $261 Taxes Incurred: ($23), $611, $708, $808, $761, $1,017, $1,081, $1,193, $1,308, $1,337, $1,595, $1,720 Net Profit: ($54), $1,426, $1,652, $1,885, $1,775, $2,372, $2,521, $2,783, $3,053, $3,121, $3,722, $4,013 Net Profit/Sales: -0.36%, 9.28%, 10.44%, 11.57%, 10.58%, 13.72%, 14.16%, 15.18%, 16.16%, 16.04%, 18.57%, 19.45% Pro Forma Cash Flow |

| Pro Forma Cash Flow | ||||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |||

| Cash Received | ||||||||||||||

| Cash from Operations | ||||||||||||||

| Cash Sales | $11,183 | $11,518 | $11,864 | $12,219 | $12,586 | $12,964 | $13,352 | $13,753 | $14,166 | $14,591 | $15,028 | $15,479 | ||

| Cash from Receivables | $0 | $124 | $3,731 | $3,843 | $3,958 | $4,077 | $4,200 | $4,326 | $4,455 | $4,589 | $4,727 | $4,868 | ||

| Subtotal Cash from Operations | $11,183 | $11,642 | $15,595 | $16,063 | $16,544 | $17,041 | $17,552 | $18,079 | $18,621 | $19,180 | $19,755 | $20,348 | ||

| Additional Cash Received | ||||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Subtotal Cash Received | $11,183 | $11,642 | $15,595 | $16,063 | $16,544 | $17,041 | $17,552 | $18,079 | $18,621 | $19,180 | $19,755 | $20,348 | ||

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Expenditures from Operations | ||||||||||||||

| Cash Spending | $3,440 | $3,440 | $3,440 | $3,440 | $3,440 | $3,440 | $3,440 | $3,440 | $3,440 | $3,440 | $3,440 | $3,440 | ||

| Bill Payments | $373 | $11,156 | $10,166 | $10,401 | $10,654 | $11,230 | $11,152 | $11,518 | $11,790 | $12,078 | $12,560 | $12,553 | ||

| Subtotal Spent on Operations | $3,813 | $14,596 | $13,606 | $13,841 | $14,094 | $14,670 | $14,592 | $14,958 | $15,230 | $15,518 | $16,000 | $15,993 | ||

| Additional Cash Spent | ||||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Long-term Liabilities Principal Repayment | $436 | $436 | $436 | $436 | $436 | $436 | $436 | $436 | $436 | $436 | $436 | $437 | ||

| Purchase Other Current Assets | $0 | $0 | $2,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Subtotal Cash Spent | $4,249 | $15,032 | $16,042 | $14,277 | $14,530 | $15,106 | $15,028 | $15,394 | $15,666 | $15,954 | $16,436 | $16,430 | ||

| Net Cash Flow | $6,934 | ($3,390) | ($447) | $1,786 | $2,014 | $1,935 | $2,524 | $2,685 | $2,955 | $3,226 | $3,319 | $3,917 | ||

| Cash Balance | $16,934 | $13,544 | $13,097 | $14,883 | $16,897 | $18,832 | $21,356 | $24,041 | $26,996 | $30,221 | $33,541 | $37,458 | ||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!