Employment Agency Business Plan

All About People (AAP) started with a desire to contribute to the community, addressing a need that other agencies had not fulfilled in the southern Willamette Valley. AAP matches skilled workers with clients, saving businesses time and money. The agency values communication, which involves asking open-ended questions, listening, and understanding the local market to truly serve each client and employee. AAP is committed to providing quality service.

The long-term vision of AAP includes multiple offices throughout the southern Willamette Valley. The challenge lies not in the growth itself, but in ensuring that all AAP personnel treat each client and employee with equal care and communication.

Managing Growth

AAP is a sole proprietorship that will convert to an S Corporation. In Year 1, the company will add a part-time office staff person and an employment specialist. AAP will have a procedures manual for in-house staff to provide clear information. Regular training will be provided to employees within each division to enhance their understanding of daily work. For Year 2, a receptionist, another employment specialist, and a field representative are projected. In Year 3, AAP will explore the possibility of opening a branch office in Salem, Bend, or Medford/Ashland.

The Market

AAP is structured similarly to other placement agencies but focuses on serving clients with specific needs for skilled professionals rather than clerical or light industrial workers. While Portland, Oregon has similar businesses catering to specific groups, there are none in the Willamette Valley. AAP has five divisions specializing in:

- Computers

- Editors/Writers

- Event Planners

- Graphic Artists

- Interpreters/Translators

Services

AAP handles recruiting, including reference checks, skills evaluation, preliminary interviewing, and screening of employees for its clients. The agency functions as an extension of the client’s human resource department by fostering open communication between supervisor and employee and providing assistance with troubleshooting and problem-solving.

Financials

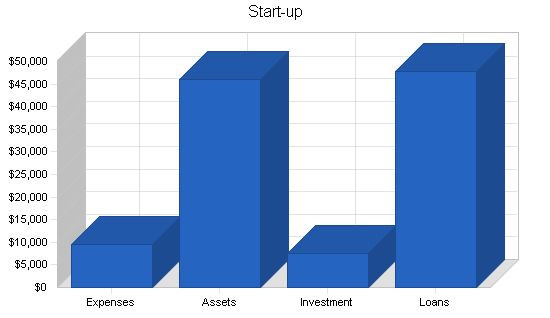

The start-up requirement for the company is $55,464, with $7,600 covered by the owner’s personal investment and the rest obtained through loans.

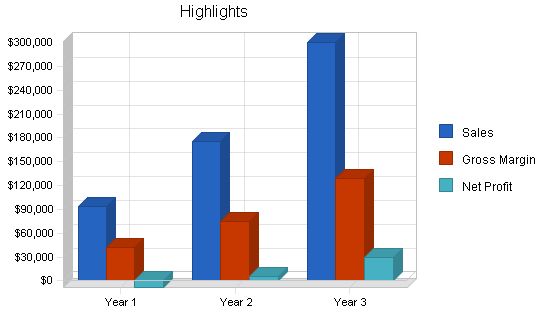

Business clients can expect a 50% markup on our services. For example, if an employee is paid $10 per hour, the client is charged $15 per hour. By Year 3, the company anticipates sales of approximately $300,000. The company does not incur direct costs of sales; payments to placed individuals are treated as regular payroll.

AAP is a specialized personnel agency focused on skilled professional workers and businesses in the Willamette Valley. Unlike other agencies, AAP provides highly qualified workers for both permanent and non-permanent positions. The company has five divisions, including Computers, Editors/Writers, Event Planners, Graphic Artists, and Interpreters/Translators. AAP does not offer clerical, light industrial, engineering, accounting, nursing, or medical technician services.

For each client, AAP conducts recruiting (with reference checks), skills evaluation, and screening. The company also performs regular evaluations to ensure open communication and assistance with troubleshooting or problem-solving. AAP’s research and connections have shown that there is a high demand for professional contingent workers in the Willamette Valley.

AAP is currently a sole proprietorship, but plans to convert to an S Corporation. The owner, Sarah Wayland, can be reached at AAP’s office. The projected start-up figures for AAP are provided in the chart and table below.

Start-up Expenses:

– Legal: $100

– Stationery etc.: $100

– Brochures: $164

– Insurance: $300

– Rent: $800

– Computers, printers, software: $8,000

– Total Start-up Expenses: $9,464

Start-up Assets:

– Cash Required: $46,000

– Other Current Assets: $0

– Long-term Assets: $0

– Total Assets: $46,000

Total Requirements: $55,464

Start-up Funding:

– Start-up Expenses to Fund: $9,464

– Start-up Assets to Fund: $46,000

– Total Funding Required: $55,464

Assets:

– Non-cash Assets from Start-up: $0

– Cash Requirements from Start-up: $46,000

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $46,000

– Total Assets: $46,000

Liabilities and Capital:

– Liabilities:

– Current Borrowing: $2,720

– Long-term Liabilities: $45,000

– Accounts Payable (Outstanding Bills): $144

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $47,864

– Capital:

– Planned Investment:

– Owner: $7,600

– Other: $0

– Additional Investment Requirement: $0

– Total Planned Investment: $7,600

– Loss at Start-up (Start-up Expenses): ($9,464)

– Total Capital: ($1,864)

Total Capital and Liabilities: $46,000

Total Funding: $55,464

Services:

The company can take advantage of this market opportunity because of the proprietor’s management and field expertise. Sarah Wayland worked in the temporary employment industry for three years with ADIA Personnel Services (now ADECCO). She built business relationships, hired employees, handled employee issues, worked with clients during the implementation of ADIA, and opened an additional office in Beaverton, Oregon.

For one year, the proprietor was a District Sales Manager at Columbia Distributing, with a 10% increase in $3.5 million in annual sales. She managed a staff of nine in sales and customer service and gained experience in hiring, reviewing, incentives, and personnel issues.

Most recently, she spent several years as Funds and Contracts Manager at the Oregon University System, managing four grants totaling $1.5 million annually and all personal service and interagency contracts.

The proprietor’s most notable success was bringing the second branch of Cellular West located in Portland, Oregon, from running in the red to breaking even within four months of its opening. This was accomplished by using motivational tools and providing the sales force with extensive training.

Products and Services Plan:

Changing labor market conditions threaten the concept of full-time permanent employment. AAP provides a complex blend of services to distinct populations. The company serves businesses by connecting them with the professional contingent work force. It also serves workers by connecting them with businesses, at no charge, and providing benefits not often provided by other employment agencies.

Market Analysis Summary:

All About People (AAP) is a local firm that costs less than a consultant or agency, provides for both project and long-term needs, and has an easy pay and billing rate system that covers employee payroll and worker’s compensation insurance.

Reasons why businesses may need AAP’s services include spikes in workload, expanding into an area where in-house expertise does not match, special events, pregnancy leave or sabbatical, increases in business after layoffs, and smaller businesses that do not have staff on-hand to complete extra projects.

According to economic forecasters, employment agencies and financial services are expected to have the largest industry growth over the next 25 years. The trend toward businesses cutting back on employees and their benefits due to high costs creates the demand for AAP’s services.

Consider the time, energy, and resources an employer may spend trying to employ a person for a 20-hour task.

In addition to the already lucrative temporary industry, several companies in the Portland Metro Area place professional contingent workers, but the southern Willamette Valley is not currently being served.

The company approaches businesses primarily through networking and cold calls. AAP is a member of the area Chamber of Commerce and actively participates in various activities. The proprietor is a member of the Women’s Business Network, the Professional Women’s Organization, and is connecting with the Society for Human Resource Management. Prior to start-up, AAP surveyed several area businesses about their use of contingent workers. The company will use its website and other marketing materials to describe the services provided and explain how simple it is to work with them.

AAP advertises in local papers and trade magazines when necessary, but most often uses the Oregon Employment Department, community college and university campuses, and networking groups they are members of to find the right employee. Prior to the start-up, the company started recruiting by administering twenty personnel surveys and advertising locally to create a staff of qualified contingent workers. This staff will be unaffected by AAP’s corporate restructuring.

Market Segmentation:

The market can be broken down into two segments: the business market segment and the employee market segment.

Business market targets include the University of Oregon, Lane Community College, nonprofit organizations, the publishing industry, the advertising industry, and other large businesses.

Employee market targets include editors/writers, graphic artists, computer specialists, event planners/fundraisers, and language translators/interpreters working in the business target markets listed above.

Service Business Analysis:

Types of workers employed by or signed up with AAP:

– Computer Application Specialists

– Computer Hardware Specialists

– Computer Programmers

– Network Administrators

– Web Specialists

Types of employers using AAP:

– High Tech: 14%

– Nonprofit: 39%

– Manufacturing: 18%

– Publisher: 11%

– Service: 18%

Database:

Each contact is entered into the database, either in the professionals file or the contacts file. The client and jobs files utilize the contact and client numbers to automatically fill in the information. This eliminates duplicate typing. The professionals file allows for easy searching based on skills and experience.

Competition and Buying Patterns:

The company follows a thorough process when a business expresses interest in contingent employees:

1. Consult with the client and create a follow-up plan.

2. Complete the contact, client, and job sheet in the database.

3. Print copies of the sheets and forward them to the employment specialist.

4. File the original sheets in the appropriate binders.

5. Review the database for potential matches.

6. Call potential candidates and discuss the job and pay.

7. Provide the client with information and/or resumes for review.

8. Schedule interviews or make a decision on appropriate candidates.

Sales Strategy:

When an employee seeks to work with the company, the following procedures are followed:

1. Complete the professional’s form in the database.

2. Screen the employee for experience levels during the form completion.

3. Set up an interview with the employment specialist if the professional is qualified.

4. Create a file for each employee and place all paperwork in the file.

5. Keep in touch with the professional quarterly, if possible.

6. Provide the professional with an employee policy manual, letterhead for invoicing, and required IRS forms before beginning work.

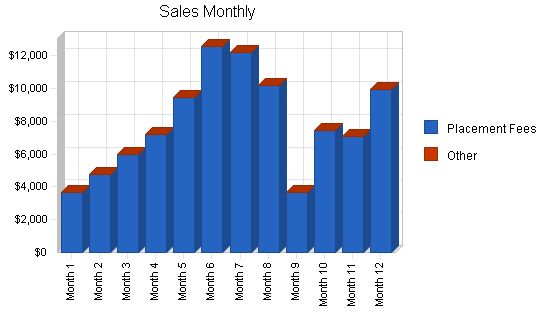

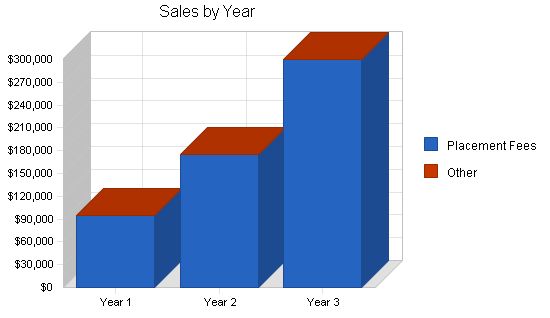

Sales forecast projections are presented in the chart and table below. Three years of annual projections are shown in the table. (First-year monthly forecast table is included in the appendix.)

Sales Forecast

Year 1 Year 2 Year 3

Sales

Placement Fees $94,248 $175,000 $300,000

Other $0 $0 $0

Total Sales $94,248 $175,000 $300,000

Direct Cost of Sales

Year 1 Year 2 Year 3

Placement Fees $0 $0 $0

Other $0 $0 $0

Subtotal Direct Cost of Sales $0 $0 $0

5.2.2 Target Market Segment Strategy

The pay rate data will be determined by changing market factors including business demand.

Our experience shows that the following is true in regards to pay and bill rates. A “good deal” for most temporary agencies is a 50% of pay rate markup. Thus, if the pay is $10, the bill is $15. However, we have traditionally used a flat markup that seemed appropriate. Pay and bill rates generally are outlined as follows:

Editors

Most editors require between $25 and $35 per hour, and our history has shown a $10 per hour markup is acceptable. One exception is in the technical arena, garnering between $45 and $55 per hour pay; again a $10 per hour markup is typical.

Writers

The only writing we have done is creative for [client name omitted], and we paid $15 with a $10 markup.

Event Planners

Event planners often will work for between $12.50 and $25 per hour, depending on the length of the job, requirements, and experience needed. We find a $5 per hour markup on the $12.50-$17.50 is reasonable, and a $10 per hour markup on anything over $17.50 per hour.

Fundraisers

Fundraisers can start at $10 per hour (nonprofit) and go up to $20 per hour. This usually depends on client and length of assignment. Bill rate markup for nonprofits is $5 per hour, others between $7.50 and $10 per hour.

Graphic Artists

Entry level beginning at $12.50 per hour, intermediate at $15 per hour, and a top of the line professional at $25 per hour. The exception may run about $50 per hour. Bill rates are between $7.50 per hour markup ($12.50-$15), and $10 markup.

Language Interpreters

This is a tricky arena. Pricing depends on the language (typical/atypical) and the length of the assignment. Interpreters have been known to work for as little as $15 per hour and for as much as $35 per hour. A $10 per hour markup is acceptable.

Language Translators

This division is difficult as each language and situation varies slightly. Translators tend to work by page or by word. Technical translation can be as much as $.30 per word. Other translation can be $10 per hour (an hour a page). We are unsure of markup at this time, but would suggest 50% of pay rate.

Computer Specialists:

Application-Starting at $12.50 an hour based on Xerox experience. Markup $5 per hour.

Programmer-Starting at $20 an hour based on AlbertIQ experience. Markup $10 per hour at a minimum. Try for $15.

Web Designer-Entry level positions can start at $10 per hour with a markup of $5. Project work typically starts at $15 an hour, markup at least $10 per hour.

Administration-Pay rates range between $50 and $75 per hour, with a preferred markup of $25 per hour.

When determining the bill rate, additional expense factors to remember above the pay rate are 15% employer taxes, advertising, and staff time to fill the position.

5.3 Milestones

The company has an outstanding client list and an incredible number of qualified employees available. AAP has a good reputation for providing qualified people in a timely manner.

AAP just moved its offices and in 2000 will add employees. The company will soon have one front office person, one employment specialist, as well as the proprietor who will concentrate on sales and running the business. We own all necessary equipment and are in the process of acquiring more to make our jobs easier. Most notably, we are in the process of completing our customized data base.

Management Summary

In a variety of settings the proprietor of AAP has strong management experience. The proprietor has the skills to not only listen well, drawing out a person’s needs through open-ended questions, but also has the ability to recognize people’s strengths and weaknesses. She will draw upon this extensive successful experience in addition to the knowledge collected over a period of 18 years working professionally. Much of the “people” skills have been developed during the seven years spent in management roles. This experience, along with a varied background, supports AAP’s goals.

AAP’s objectives are threefold:

1. To provide high quality, experienced, professional workers to businesses that are currently relying on the instability of word-of-mouth contacts, and are spending much of their time and resources (and, therefore, money) locating such workers;

2. To provide these workers with a path by which to reach the employer without spending their own time, money, and energy finding the work; and

3. To use this opportunity to make the contingent work force a better place for both the employer and the employee.

The long-term goal of the company is to franchise and/or to become multi-location, and eventually sell this business.

Management is a style, a belief, and a strategy.

In managing our clients, AAP will communicate regularly with them, setting up a schedule that meets their needs. The company will set goals for retention of clientele and strive to reach those goals by building relationships, listening to the client’s needs, and meeting those needs with a smile on our faces. We will take responsibility for our errors and the outcome.

In managing our workers, AAP will communicate regularly with them, providing them with an employee manual to minimize their confusion, and offer them the best pay and benefits possible. AAP will set goals for retention of employees and strive to reach those goals by treating each employee with respect, provide protection when appropriate, and do everything within our power to assure a healthy working environment.

This is a relationship business. AAP will manage all clients and employees through relationship building.

During 1998-99 the proprietor provided all services. In 2000 the company will add a part-time office staffer and an employment specialist. In response to this growth, we will have a procedures manual for in-house staff assuring that the information is clear. In addition, we will provide employees with regular training within the divisions to assure they understand the details of the work they are doing daily. 2001 projections include a receptionist, another employment specialist, and a field representative. In 2002 AAP will examine the feasibility of opening a branch office in the Salem, Bend, or Medford/Ashland areas.

Personnel Plan

Year 1 Year 2 Year 3

Placed Employees Personnel

Placed Workers at 2/3 of Sales $51,836 $99,750 $171,000

Other $0 $0 $0

Subtotal $51,836 $99,750 $171,000

General and Administrative Personnel

Office Employees $10,929 $25,000 $30,000

Other $0 $0 $0

Subtotal $10,929 $25,000 $30,000

Total People $0 $0 $0

Total Payroll $62,765 $124,750 $201,000

6.1 Payroll

All About People runs its payroll twice a month. Each professional will be given a check schedule when they work with AAP. Each check covers the previous two weeks.

In order to process payroll; AAP must receive a professional’s signed invoice the Wednesday prior to payday. The invoice, must be on AAP letterhead and include: name, social security number, mailing address, dates of work completed, location worked (at home, at the client’s office), one or two sentences describing what tasks were completed, and how much time was spent each day. At the bottom there must be a place for the client to sign and date in acceptance of the work to date. The original will be submitted to AAP, the client will receive one copy, and the professional will keep a copy.

AAP is unable to provide payroll advances. If a check is lost in the mail, we must wait seven days from the date of mailing, and then if the check has not arrived we will stop the check at the bank and have one reissued.

6.2 Benefits

Because we value our employees, we have employee group health insurance available, and contribute a major portion of the monthly premium. According to the Insurance Pool Governing Board (IPGB) employees must work at least 17.5 hours per week. Employees who work intermittently or who have worked fewer than 90 calendar days are not eligible. IPGB also states that all carriers may decline to offer coverage to the business or to any employee.

Technically, All About People is employer of the professionals we place. This means that we are responsible for covering the worker’s compensation insurance, running payroll, and that we are the ones to whom each employee is responsible. We understand that this can be tricky when employee professionals are working with a client, so we want to describe the expectations of this relationship:

1. If the professional doesn’t understand the work or assignment that has been given by the client, then discuss the work with the client.

2. If there are issues at work, the employee should inform AAP and then speak with the client.

3. If these issues continue, the employee should talk with AAP immediately.

4. If the professional feels they are being harassed at work they should let AAP know immediately.

5. If the employee should be being asked to perform tasks other than the original assignment, the employee should talk with AAP before beginning any tasks other than the original assignment.

6. If the professional is being asked to work overtime (more than 40 hours per week), they should let us know immediately.

AAP does not guarantee either work or wages when you join us to become an AAP employee. We will, of course, strive to keep you as busy as possible. AAP is also not able to guarantee an hourly wage prior to the assignment beginning. If you work on a job, and complete the work successfully, you will be paid at the agreed rate.

This employment relationship differs from others because you, AAP, or the client may end your employment with or without notice and with or without reasons. However, if you accept a job with AAP, we do expect you to finish the assignment.

AAP’s target market is both businesses and professional workers. Phase one of the marketing plan will target the University of Oregon, the technology industry, and the top 500 businesses in Eugene through networking and cold calling. Phase two will target small businesses with less than five employees because smaller businesses may not have the in-house capability to locate, evaluate, and hire potential professional contingent workers through a small PR campaign.

7.1 Businesses

We began marketing the businesses through several personnel surveys. The University of Oregon Alumni Association, University of Oregon Foundation, and University of Oregon Human Resources Department, as well as Symantec’s Human Resources director were approached for information regarding their need for professional temporary and permanent workers. These initial interviewees have all (with the exception of U of O HR Dept) become clients within the first year of business. After these personnel surveys were complete, we adjusted our recruitment of professional workers to meet the demand.

Another tactic was joining multiple business groups. AAP became a member of the Eugene Chamber of Commerce and attends the weekly greeters meetings; the Women’s Business Network and attends the monthly meetings; the Professional Women’s Organization and attend the monthly meetings; as well as the City Club, keeping a pulse on what is happening in the community, attending as the proprietor sees fit.

The next approach is face-to-face cold calls. The tools for these calls are simple-a business card and a brochure. The information collected during the cold call is vital: how many employees does the business have; in what areas have they experienced a need for professional contingent employees; and who is the appropriate contact.

7.2 Professional Workers

Our beginning point in marketing to workers was approximately 30 personnel surveys to professional contingent workers, building the foundation of our database. AAP intends to recruit workers through advertising in the newspaper and appropriate trade magazines, trade shows, the University of Oregon career center, and by referral. We have found that each division within the company requires a different approach for recruitment. We try not to depend on newspaper advertising as we find the results are moderate. Results are far better with the employment department for some areas, with the U of O for others, and also through a series of developed contacts for the other divisions.

7.2.1 Trust

In order to build trust with both businesses and employees AAP will follow through as promised. We will treat each business, employee, and ourselves, with integrity. AAP will communicate clearly, asking businesses to specify the needs for follow-up service during the time that they employ our contingent worker. We will work with employees to assure that they have a clear understanding of what AAP offers and what we expect of them.

7.3 Supporting Research

“A fading model of employment in the United States envisions a business enterprise with full-time employees who can expect to keep their jobs and perhaps advance so long as they perform satisfactorily and the business continues. Changing labor market conditions threaten the concept of full-time permanent employment. As reported by the Conference Board in September 1995, contingent workers account for at least 10 percent of the workforce at 21 percent of the companies surveyed, or almost double the 12 percent of respondents with that number in 1990. Writing in the Monthly Labor Review in March 1989, Belous estimated that contingent workers constitutes 24 to 29 percent of the labor force in the United States. In August 1995, however, the U.S. Bureau of Labor Statistics (BLS) estimated the size of the contingent labor force at 2 to 5 percent of the total workforce. However, BLS did not count long-term part-time employees, who constitute 90 percent of part-time workers.”— Society for Human Resource Management, The Contingent Worker: A Human Resource Perspective, by W. Gilmore McKie & Laurence Lipset taken from Chapter 1, What Is a Contingent Worker?

AAP is a service company providing businesses with customized personnel solutions by connecting them with the professional contingent work force. Research suggests that 2000 is an opportune time to be in the Eugene market with this service. Even with all of the evidence that contingent work is the wave of the present, and of the future, the niche of placing contingent workers who are paid $12.50 to $40 per hour is untapped in the Eugene area. However, a few companies place high-end contingent workers in the Portland area.

There are many reasons why businesses are turning to contingent workers. The Economic Policy Institute’s article “Contingent Work” by Polly Callaghan and Heidi Harmann explains that:

“Growth in involuntary part-time employment is causing total part-time employment to grow faster than total employment. Another indication of the shift toward part-time workers: hours for part-time workers are growing faster than hours for full-time workers. Temporary employment has grown three times faster than overall employment and temporary workers are being used for more hours. Contingent employment is growing faster than overall employment. Part-timers are disproportionately women, younger, or older workers. There has been a shift away from manufacturing toward trade and services. These structural changes help explain the growth in part-time employment.”

Because of the changing nature of jobs themselves, AAP’s services are desirable to employers of all sizes. Unlike five or ten years ago, many positions are so diversified, or specialized, that it is not financially feasible for an employer to hire a person to fill one position, requiring several areas of expertise. This is not financially wise for the business because of the pay range required to recruit and hire such a talented person (especially in areas such as graphics, design, etc.). The cost of payroll, taxes, benefits, and other miscellaneous staff required to run employees add to the burden of a downsized staff. Contacting AAP and using a professional contingent worker for each portion of a position as needed will solve this dilemma. Currently most businesses locate needed “qualified” workers by word of mouth. With one phone call, e-mail, or connection with our Web page, AAP makes the task easy.

In addition, Oregon’s economy is expected to continue growing, and employment, total personal and per capita income, and population growth rates are expected to exceed the national average (according to the 1997-98 Oregon Blue Book). Although Oregon

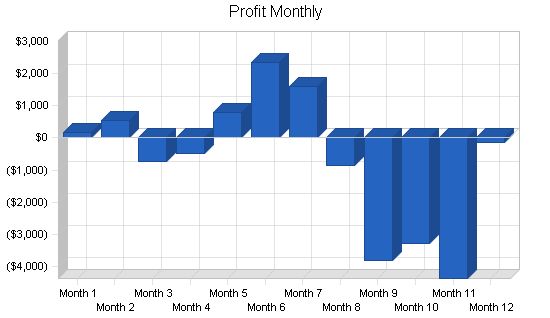

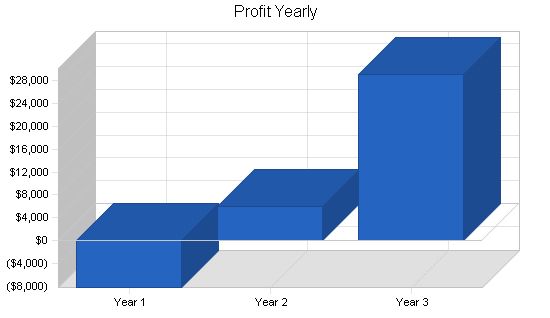

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $94,248 | $175,000 | $300,000 |

| Direct Cost of Sales | $0 | $0 | $0 |

| Placed Employees Payroll | $51,836 | $99,750 | $171,000 |

| Other | $0 | $0 | $0 |

| Total Cost of Sales | $51,836 | $99,750 | $171,000 |

| Gross Margin | $42,412 | $75,250 | $129,000 |

| Gross Margin % | 45.00% | 43.00% | 43.00% |

| Operating Expenses | |||

| Sales and Marketing Expenses | |||

| Sales and Marketing Payroll | $0 | $0 | $0 |

| Advertising/Promotion | $1,165 | $1,200 | $2,500 |

| Bank Service Charges | $1,019 | $1,000 | $1,500 |

| Contributions | $255 | $300 | $300 |

| Dues & Subscriptions | $887 | $250 | $500 |

| Total Sales and Marketing Expenses | $3,325 | $2,750 | $4,800 |

| Sales and Marketing % | 3.53% | 1.57% | 1.60% |

| General and Administrative Expenses | |||

| General and Administrative Payroll | $10,929 | $25,000 | $30,000 |

| Marketing/Promotion | $6,516 | $6,500 | $12,800 |

| Depreciation | $0 | $0 | $0 |

| Telephone & Pager | $4,168 | $4,800 | $5,000 |

| Recruitment | $1,573 | $1,575 | $2,000 |

| Referral Fees | $170 | $250 | $500 |

| Rent | $6,102 | $9,600 | $10,000 |

| Office Supplies | $2,114 | $2,000 | $3,000 |

| Postage | $1,062 | $1,250 | $1,500 |

| Printing | $3,362 | $4,000 | $5,000 |

| Professional Fees | $6,941 | $5,000 | $7,500 |

| Payroll Taxes | $0 | $0 | $0 |

| Maintenance and Repairs | $311 | $750 | $2,000 |

| Total General and Administrative Expenses | $43,248 | $60,725 | $79,300 |

| General and Administrative % | 45.89% | 34.70% | 26.43% |

| Other Expenses: | |||

| Other Payroll | $0 | $0 | $0 |

| Consultants | $0 | $0 | $0 |

| Misc. | $1,050 | $500 | $1,000 |

| Total Other Expenses | $1,050 | $500 | $1,000 |

| Other % | 1.11% | 0.29% | 0.33% |

| Total Operating Expenses | $47,623 | $63,975 | $85,100 |

| Profit Before Interest and Taxes | ($5,212) | $11,275 | $43,900 |

| EBITDA | ($5,212) | $11,275 | $43,900 |

| Interest Expense | $3,046 | $2,678 | $2,363 |

| Taxes Incurred | $0 | $2,579 | $12,461 |

| Net Profit | ($8,257) | $6,018 | $29,076 |

| Net Profit/Sales | -8.76% | 3.44% | 9.69% |

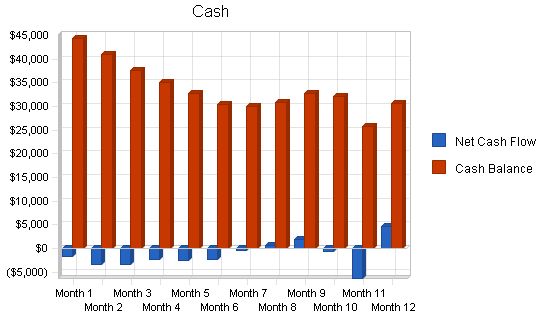

8.3 Projected Cash Flow

Our cash flow estimates are shown in the chart and table below. The owner expects to invest additional funds in the business over the next two years to support continued growth.

Pro Forma Cash Flow

| Year 1 | Year 2 | Year 3 |

| —— | —— | —— |

| Cash Received | | | |

| Cash from Operations | | | |

| Cash Sales | $23,562 | $43,750 | $75,000 |

| Cash from Receivables | $58,112 | $120,477 | $208,324 |

| Subtotal Cash from Operations | $81,674 | $164,227 | $283,324 |

| Additional Cash Received | | | |

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $10,000 | $20,000 | $0 |

| Subtotal Cash Received | $91,674 | $184,227 | $283,324 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | | | |

| Cash Spending | $62,765 | $124,750 | $201,000 |

| Bill Payments | $37,123 | $43,357 | $67,812 |

| Subtotal Spent on Operations | $99,888 | $168,107 | $268,812 |

| Additional Cash Spent | | | |

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $2,720 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $4,500 | $4,500 | $4,500 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $107,108 | $172,607 | $273,312 |

| Net Cash Flow | ($15,434) | $11,620 | $10,012 |

| Cash Balance | $30,566 | $42,186 | $52,199 |

8.4 Projected Balance Sheet

Three year annual balance sheets estimates appear below.

Pro Forma Balance Sheet

| Year 1 | Year 2 | Year 3 |

| —— | —— | —— |

| Assets | | | |

| Current Assets | | | |

| Cash | $30,566 | $42,186 | $52,199 |

| Accounts Receivable | $12,573 | $23,346 | $40,022 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $43,139 | $65,533 | $92,221 |

| Long-term Assets | | | |

| Long-term Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $43,139 | $65,533 | $92,221 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | | | |

| Accounts Payable | $2,761 | $3,635 | $5,747 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $2,761 | $3,635 | $5,747 |

| Long-term Liabilities | $40,500 | $36,000 | $31,500 |

| Total Liabilities | $43,261 | $39,635 | $37,247 |

| Paid-in Capital | $17,600 | $37,600 | $37,600 |

| Retained Earnings | ($9,464) | ($17,721) | ($11,703) |

| Earnings | ($8,257) | $6,018 | $29,076 |

| Total Capital | ($121) | $25,897 | $54,973 |

| Total Liabilities and Capital | $43,139 | $65,533 | $92,221 |

| Net Worth | ($121) | $25,897 | $54,973 |

8.5 Business Ratios

The table below presents important business ratios from the help supply services industry, as determined by the Standard Industry Classification (SIC) Index code 7363, Help Supply Services.

Ratio Analysis

| Year 1 | Year 2 | Year 3 | Industry Profile |

| —— | —— | —— | —————- |

| Sales Growth | 0.00% | 85.68% | 71.43% | 9.00% |

| Percent of Total Assets | | | | |

| Accounts Receivable | 29.15% | 35.63% | 43.40% | 28.80% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 44.00% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 76.30% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 23.70% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | | | | |

| Accounts Payable | 6.40% | 5.55% | 6.23% | 44.00% |

| Long-term Liabilities | 93.88% | 54.93% | 34.16% | 17.50% |

| Total Liabilities | 100.28% | 60.48% | 40.39% | 61.50% |

| Net Worth | -0.28% | 39.52% | 59.61% | 38.50% |

| Percent of Sales | | | | |

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 45.00% | 43.00% | 43.00% | 0.00% |

| Selling, General & Administrative Expenses | #NAME? | 39.56% | 33.31% | 82.20% |

| Advertising Expenses | 1.24% | 0.69% | 0.83% | 1.50% |

| Profit Before Interest and Taxes | -5.53% | 6.44% | 14.63% | 2.40% |

| Main Ratios | | | | |

| Current | 15.63 | 18.03 | 16.05 | 1.64 |

| Quick | 15.63 | 18.03 | 16.05 | 1.31 |

| Total Debt to Total Assets | 100.28% | 60.48% | 40.39% | 61.50% |

| Pre-tax Return on Net Worth | 6817.49% | 33.20% | 75.56% | 4.40% |

| Pre-tax Return on Assets | -19.14% | 13.12% | 45.04% | 11.50% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | -8.76% | 3.44% | 9.69% | n.a |

| Return on Equity | 0.00% | 23.24% | 52.89% | n.a |

| Activity Ratios | | | | |

| Accounts Receivable Turnover | 5.62 | 5.62 | 5.62 | n.a |

| Collection Days | 57 | 50 | 51 | n.a |

| Accounts Payable Turnover | 14.40 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 26 | 24 | n.a |

| Total Asset Turnover | 2.18 | 2.67 | 3.25 | n.a |

| Debt Ratios | | | | |

| Debt to Net Worth | 0.00 | 1.53 | 0.68 | n.a |

| Current Liab. to Liab. | 0.06 | 0.09 | 0.15 | n.a |

| Liquidity Ratios | | | | |

| Net Working Capital | $40,379 | $61,897 | $86,473 | n.a |

| Interest Coverage | -1.71 | 4.21 | 18.58 | n.a |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Assets to Sales | 0.46 | 0.37 | 0.31 | n.a |

| Current Debt/Total Assets | 6% | 6% | 6% | n.a |

| Acid Test | 11.07 | 11.60 | 9.08 | n.a |

| Sales/Net Worth | 0.00 | 6.76 | 5.46 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

Sales Forecast

| Year 1 | Year 2 | Year 3 |

| —— | —— | —— |

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 |

| $3,660 | $4,769 | $5,965 | $7,226 | $9,471 | $12,554 | $12,237 | $10,216 | $3,692 | $7,458 | $7,059 | $9,941 |

Direct Cost of Sales

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 |

| —— | —— | —— | —— | —— | —— | —— | —— | —— | ——- | ——- | ——- |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

Personnel Plan:

Placed Employees Personnel

Placed Workers at 2/3 of Sales

Other

Subtotal

Office Employees

Other

Subtotal

Total People

Total Payroll

General Assumptions:

Current Interest Rate

Long-term Interest Rate

Tax Rate

Other

Pro Forma Profit and Loss:

Sales

Direct Cost of Sales

Placed Employees Payroll

Other

Total Cost of Sales

Gross Margin

Gross Margin %

Operating Expenses

Sales and Marketing Expenses

Sales and Marketing Payroll

Advertising/Promotion

Bank Service Charges

Contributions

Dues & Subscriptions

Total Sales and Marketing Expenses

Sales and Marketing %

General and Administrative Expenses

General and Administrative Payroll

Marketing/Promotion

Depreciation

Telephone & Pager

Recruitment

Referral Fees

Rent

Office Supplies

Postage

Printing

Professional Fees

Payroll Taxes

Maintenance and Repairs

Total General and Administrative Expenses

General and Administrative %

Other Expenses:

Other Payroll

Consultants

Misc.

Total Other Expenses

Other %

Total Operating Expenses

Profit Before Interest and Taxes

EBITDA

Interest Expense

Taxes Incurred

Net Profit

Net Profit/Sales

Pro Forma Cash Flow

| Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash Sales | $915 | $1,192 | $1,491 | $1,807 | $2,368 | $3,139 | $3,059 | $2,554 | $923 | $1,865 | $1,765 | $2,485 | |

| Cash from Receivables | $0 | $92 | $2,773 | $3,607 | $4,505 | $5,476 | $7,180 | $9,408 | $9,127 | $7,499 | $2,863 | $5,584 | |

| Subtotal Cash from Operations | $915 | $1,284 | $4,264 | $5,413 | $6,873 | $8,614 | $10,240 | $11,962 | $10,050 | $9,363 | $4,628 | $8,069 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Other Liabilities (Interest-Free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $10,000 |

| Subtotal Cash Received | $915 | $1,284 | $4,264 | $5,413 | $6,873 | $8,614 | $10,240 | $11,962 | $10,050 | $9,363 | $4,628 | $18,069 | |

| Expenditures | |||||||||||||

| Expenditures from Operations | |||||||||||||

| Cash Spending | $2,013 | $2,836 | $3,631 | $4,324 | $5,559 | $7,371 | $7,430 | $7,119 | $3,781 | $5,852 | $5,632 | $7,217 | |

| Bill Payments | $193 | $1,465 | $1,449 | $3,089 | $3,388 | $3,125 | $2,863 | $3,222 | $3,954 | $3,752 | $4,923 | $5,699 | |

| Subtotal Spent on Operations | $2,206 | $4,301 | $5,080 | $7,413 | $8,947 | $10,496 | $10,293 | $10,341 | $7,735 | $9,604 | $10,555 | $12,916 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $2,220 | $0 | $0 | $0 | $0 | $500 | $0 | $0 | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $375 | $375 | $375 | $375 | $375 | $375 | $375 | $375 | $375 | $375 | $375 | $375 | $375 |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Spent | $2,581 | $4,676 | $7,675 | $7,788 | $9,322 | $10,871 | $10,668 | $11,216 | $8,110 | $9,979 | $10,930 | $13,291 | |

| Net Cash Flow | ($1,666) | ($3,392) | ($3,411) | ($2,375) | ($2,449) | ($2,257) | ($428) | $745 | $1,940 | ($616) | ($6,303) | $4,777 | |

| Cash Balance | $44,334 | $40,942 | $37,530 | $35,156 | $32,707 | $30,450 | $30,022 | $30,767 | $32,707 | $32,091 | $25,789 | $30,566 | |

Pro Forma Balance Sheet

| Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | |||||||||||||

| Starting Balances | |||||||||||||

| Current Assets | |||||||||||||

| Cash | $46,000 | $44,334 | $40,942 | $37,530 | $35,156 | $32,707 | $30,450 | $30,022 | $30,767 | $32,707 | $32,091 | $25,789 | $30,566 |

| Accounts Receivable | $0 | $2,745 | $6,230 | $7,931 | $9,744 | $12,342 | $16,282 | $18,279 | $16,534 | $10,176 | $8,270 | $10,701 | $12,573 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $46,000 | $47,079 | $47,172 | $45,462 | $44,900 | $45,049 | $46,732 | $48,301 | $47,301 | $42,883 | $40,361 | $36,490 | $43,139 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | |||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!