Contents

Maternity Clothing Business Plan

Malone’s Maternity, a start-up boutique retailer, offers a wide range of upscale maternity and child clothing and accessories. Founded by Sandy Malone, Malone’s Maternity aims to quickly gain market share by providing benchmarked customer service and an excellent selection of upper-end merchandise.

The Market

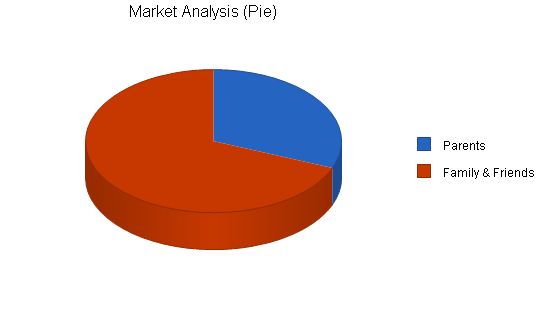

Malone’s Maternity targets two distinct market segments. The first segment consists of parents purchasing products for themselves or their spouses. This segment grows at an impressive 9% annually and includes 135,457 potential customers. The second segment comprises friends and other gift buyers, with an annual growth rate of 8% and 299,454 potential customers.

The Concept

Imagine walking into an upscale boutique, reminiscent of Fifth Avenue or Beverly Hills Drive. Exceptionally, this boutique is dedicated to expecting moms, infants, and kids. Filling a significant gap in the market, fashion-conscious women can now find chic clothing for themselves and fashionable clothes for their children, along with a wide range of gifts and accessories. While there is one other store in the Cleveland Metropolitan area with similar price points, it fails to provide the exclusive boutique experience. Malone’s Maternity distinguishes itself by catering to upscale clients.

Management

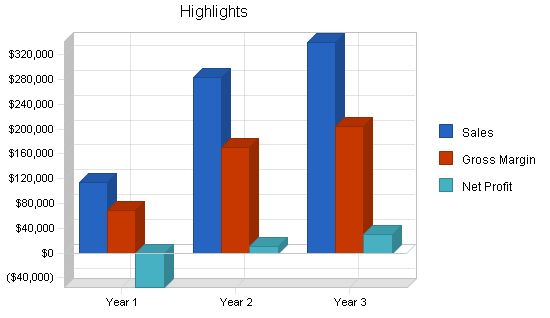

Sandy Malone, the founder, will lead Malone’s Maternity. Sandy has an undergraduate degree in Sociology and gained valuable industry experience as one of the main buyers for Saks Fifth Avenue. While working for the upscale retail chain, Sandy developed a wealth of knowledge and important skills. Later, as a mother of three, Sandy recognized the lack of high-end offerings for expectant mothers in the Cleveland area. Combining industry insight, experience, and skill sets, Sandy will guide Malone’s Maternity to become the premier boutique in the region. The company expects strong sales in years two and three, accompanied by moderate net profits.

1.1 Objectives

- Create a maternity clothes and accessory boutique.

- Gain market share by addressing the upper-end price point of maternity and infant clothing.

- Achieve profitability within two years.

1.2 Mission

Malone’s Maternity’s mission is to become the premier maternity boutique for upscale expectant mothers and their children, offering the newest fashions and exceptional customer service.

1.3 Keys to Success

- Offer the finest maternity clothing and accessories for mothers and children.

- Pamper customers.

- Develop a strict financial control regime for the business.

Company Summary

Malone’s Maternity, an Ohio registered corporation, was founded by Sandy Malone.

2.1 Company Ownership

Sandy Malone is the primary shareholder of Malone’s Maternity.

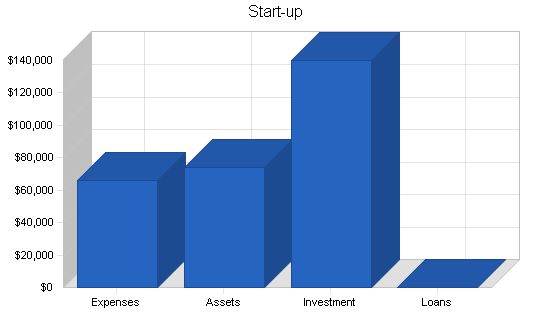

2.2 Start-up Summary

Malone’s Maternity will have the following start-up expenses:

- Point of purchase computer with back-end server.

- Additional office computer with Internet connection, laser printer, and required software (Business Plan Pro, Microsoft Office, QuickBooks Pro).

- Three-line phone system.

- Copier and fax machine.

- Two office desk setups.

- Various wall shelving.

- Build-out expenses, including shelving units, store fixtures, changing rooms, chairs, and couches.

Start-up Funding

Start-up Expenses to Fund: $65,950

Start-up Assets to Fund: $74,050

Total Funding Required: $140,000

Assets

Non-cash Assets from Start-up: $22,500

Cash Requirements from Start-up: $51,550

Additional Cash Raised: $0

Cash Balance on Starting Date: $51,550

Total Assets: $74,050

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $0

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $0

Capital

Planned Investment

Investor 1: $55,000

Investor 2: $45,000

Other: $40,000

Additional Investment Requirement: $0

Total Planned Investment: $140,000

Loss at Start-up (Start-up Expenses): ($65,950)

Total Capital: $74,050

Total Capital and Liabilities: $74,050

Total Funding: $140,000

Start-up

Requirements

Start-up Expenses

Legal: $2,500

Stationery etc.: $500

Brochures: $250

Consultants: $0

Insurance: $200

Rent: $2,500

Research and Development: $0

Build-out: $50,000

Inventory: $10,000

Total Start-up Expenses: $65,950

Start-up Assets

Cash Required: $51,550

Start-up Inventory: $0

Other Current Assets: $3,500

Long-term Assets: $19,000

Total Assets: $74,050

Total Requirements: $140,000

Products

Malone’s Maternity is a boutique that offers a wide range of fancy maternity clothes, accessories, and baby clothing. The concept is to offer high-end products for both the mother and child in one store. This level of convenience is unique to Malone’s Maternity. While there is one other store that offers upscale maternity clothing, no one else offers products for both mother and child in the same store. Some of Malone’s Maternity’s offerings include maternity clothes, baby clothes, new mother gift baskets, gift registries, fancy photo albums, new baby pamper kits, and assorted fancy containers for diapers and wet wipes.

Market Analysis Summary

Malone’s Maternity has identified two attractive market segments. The first segment includes expecting and just-delivered mothers, while the second segment consists of family, friends, coworkers, and others purchasing gifts. Malone’s Maternity operates within the large maternity industry and will compete within the upper echelon of this market.

4.1 Market Segmentation

Malone’s Maternity has identified two particularly attractive market segments.

Parents – This segment primarily includes expecting mothers and fathers.

Ages 24-34, median age 32.

Household income above $80,000.

Go out to eat 2.3 times a week.

89% have an undergraduate degree.

39% have a graduate degree.

Spend $350 a month on clothing for themselves.

Family & Friends – This segment is buying gifts for the new parents and child, looking for upscale options.

Ages 32-57.

Household income greater than $83,000.

Go out to eat 2.1 times a week.

83% have an undergraduate degree.

23% have a graduate degree.

Market Analysis:

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Parents | 4% | 135,457 | 140,875 | 146,510 | 152,370 | 158,465 | 4.00% |

| Family & Friends | 4% | 299,454 | 311,432 | 323,889 | 336,845 | 350,319 | 4.00% |

| Total | 4.00% | 434,911 | 452,307 | 470,399 | 489,215 | 508,784 | 4.00% |

4.2 Target Market Segment Strategy

Malone’s Maternity targets parents and family and friends, who have high disposable income and enjoy buying fashionable clothes and accessories, even during pregnancy. Expecting parents also like to reward themselves with nice gifts.

Family and friends are interested in buying nice and luxurious gifts for their expecting friends. They are looking for something that will stand out and be truly enjoyable for the new parents.

4.3 Industry Analysis

The retail maternity and child industry consists of specific retailers that focus either on maternity or children. Malone’s Maternity believes that there are opportunities to offer products for both mother and child in one store. This allows for one-stop shopping convenience.

Industry Trends

- In the new millennium, there is a shift towards younger moms, starting at age 20.

- 82% of 20-24 year olds consider motherhood the most important job compared to 72% of women aged 24-34.

- Molded cup nursing bras are the fastest-growing product, providing a fresh, young look and boosting mothers’ confidence.

- There is an increase in active wear due to the benefits of exercise during and after pregnancy and women becoming more athletic.

- The use of cotton for breathability and Lycra for body sculpting properties offer comfort, fit, and easy-care.

4.3.1 Competition and Buying Patterns

Malone’s Maternity faces competition from mail order/internet retailers and local retailers. Mail order/internet retailers offer a wide selection but do not allow for trying on clothing, which can be challenging for expecting mothers. Local retailers in the area cater to the mid-price point and do not offer products for children.

Strategy and Implementation Summary

Malone’s Maternity will leverage its competitive edge of offering products for both women and children to gain market share. They are the only store offering clothing and accessories for expectant and new mothers, as well as for infants and children. This provides unmatched convenience and leads to higher customer spending.

The marketing strategy includes focused advertising campaigns in the fashion section of Cleveland’s largest newspaper and strategic location in an upscale mall with high foot traffic.

The sales strategy focuses on providing excellent customer service to impress customers and encourage repeat business.

5.1 Competitive Edge

Malone’s Maternity’s competitive edge includes offering convenience by having items for both mother and child in one store and increasing ticket prices per customer by capturing sales from both groups.

5.2 Marketing Strategy

The marketing strategy includes advertising in various media, primarily in Cleveland’s largest newspaper, and location in an upscale mall with high foot traffic.

5.3 Sales Strategy

The sales strategy relies on providing excellent customer service, empowering employees to handle customer issues, and ensuring customer satisfaction and increased sales.

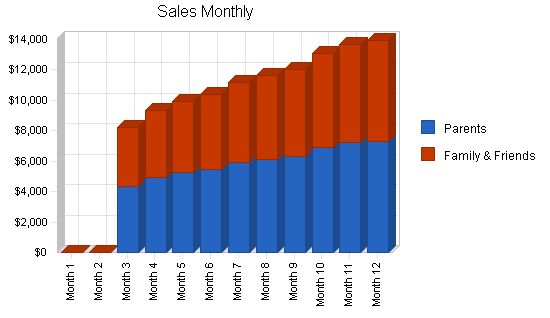

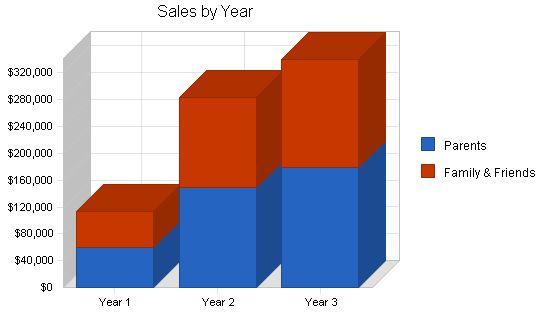

5.3.1 Sales Forecast

Malone’s Maternity has developed a conservative sales forecast, which will be monitored monthly to track progress. The goal is to ensure rising sales and sufficient staffing to serve customers on the sales floor.

Sales Forecast:

Year 1 Year 2 Year 3

Parents $59,671 $149,090 $178,998

Family & Friends $53,644 $134,032 $160,919

Total Sales $113,315 $283,122 $339,917

Direct Cost of Sales:

Year 1 Year 2 Year 3

Parents $23,868 $59,636 $71,599

Family & Friends $21,458 $53,613 $64,368

Subtotal Direct Cost of Sales $45,326 $113,249 $135,967

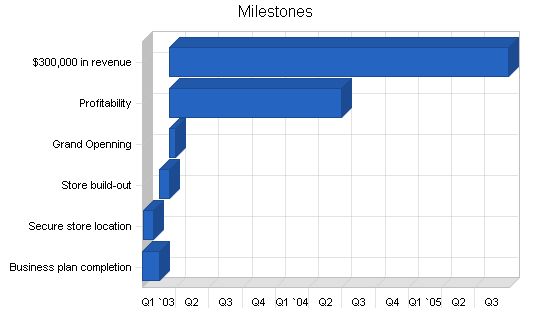

5.4 Milestones:

Malone’s Maternity has identified four quantifiable milestones. By setting ambitious but attainable goals, Malone’s Maternity provides a target for all staff members. The following table describes these milestones.

Milestones:

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business plan completion | 1/1/2003 | 2/15/2003 | $0 | Sandy | Business formation |

| Secure store location | 1/2/2003 | 1/30/2003 | $0 | Sandy | Business formation |

| Store build-out | 2/15/2003 | 3/15/2003 | $0 | Sandy | Accounting |

| Grand Opening | 3/16/2003 | 3/31/2003 | $0 | Sandy | Accounting |

| Profitability | 3/16/2003 | 6/30/2004 | $0 | Sandy | Accounting |

| $300,000 in revenue | 3/16/2003 | 9/30/2005 | $0 | All | Sales |

| Totals | $0 | ||||

Management Summary

Sandy Malone, an experienced leader, received her undergraduate degree in sociology from Case Western Reserve. She gained valuable experience working for the Saks Fifth Avenue Corporation, where she quickly advanced to become one of the main buyers responsible for procuring inventory valued at $55 million.

During her three years in this position, Sandy noticed the challenge of finding nice maternity clothes and the inconvenience of having to visit different stores for both herself and her child. This inspired her to consider starting her own business in the future. Sandy took management courses while raising her three children and, once her youngest turned two, she seriously considered opening her own thriving business.

6.1 Personnel Plan

Malone’s Maternity will require the following key personnel:

- Sandy – As the owner, Sandy will handle various responsibilities including purchasing, training and hiring, customer service, some accounting, and other duties as required.

- Sales staff – A team of sales staff will be employed to assist customers.

- Manager – By the second year, Malone’s Maternity plans to hire a part-time manager to support Sandy with operational responsibilities.

- Bookkeeper – This individual will be responsible for accounts payable and receivable functions.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Sandy | $24,000 | $20,000 | $24,000 |

| Sales staff | $14,000 | $16,800 | $16,800 |

| Sales staff | $12,600 | $16,800 | $16,800 |

| Sales staff | $9,800 | $16,800 | $16,800 |

| Bookkeeper | $8,000 | $9,600 | $9,600 |

| Manager | $0 | $14,000 | $14,000 |

| Total People | 5 | 6 | 6 |

| Total Payroll | $68,400 | $94,000 | $98,000 |

The following sections provide important financial information.

7.1 Important Assumptions

The table below outlines key financial assumptions.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

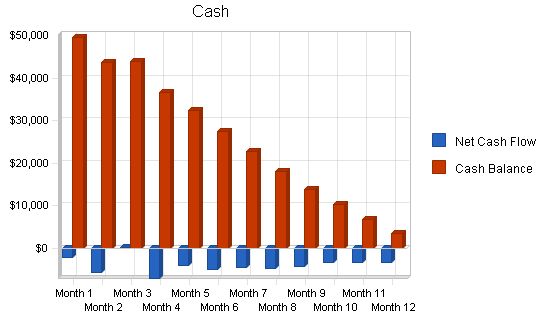

7.2 Projected Cash Flow

The following chart and table present the Projected Cash Flow.

Pro Forma Cash Flow:

Year 1 Year 2 Year 3

Cash Received:

Cash from Operations

Cash Sales: $113,315 $283,122 $339,917

Subtotal Cash from Operations: $113,315 $283,122 $339,917

Additional Cash Received:

Sales Tax, VAT, HST/GST Received: $0 $0 $0

New Current Borrowing: $0 $0 $0

New Other Liabilities (interest-free): $0 $0 $0

New Long-term Liabilities: $0 $0 $0

Sales of Other Current Assets: $0 $0 $0

Sales of Long-term Assets: $0 $0 $0

New Investment Received: $0 $0 $0

Subtotal Cash Received: $113,315 $283,122 $339,917

Expenditures:

Year 1 Year 2 Year 3

Expenditures from Operations:

Cash Spending: $68,400 $94,000 $98,000

Bill Payments: $93,011 $178,225 $208,176

Subtotal Spent on Operations: $161,411 $272,225 $306,176

Additional Cash Spent:

Sales Tax, VAT, HST/GST Paid Out: $0 $0 $0

Principal Repayment of Current Borrowing: $0 $0 $0

Other Liabilities Principal Repayment: $0 $0 $0

Long-term Liabilities Principal Repayment: $0 $0 $0

Purchase Other Current Assets: $0 $0 $0

Purchase Long-term Assets: $0 $0 $0

Dividends: $0 $0 $0

Subtotal Cash Spent: $161,411 $272,225 $306,176

Net Cash Flow: ($48,096) $10,897 $33,741

Cash Balance: $3,454 $14,350 $48,092

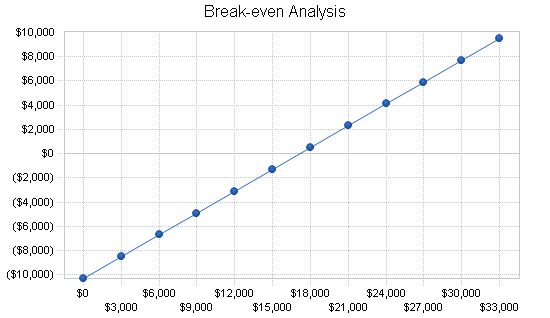

7.3 Break-even Analysis

The Break-even Analysis indicates the required monthly revenue to achieve the break-even point.

Break-even Analysis:

Monthly Revenue Break-even: $17,160

Assumptions:

– Average Percent Variable Cost: 40%

– Estimated Monthly Fixed Cost: $10,296

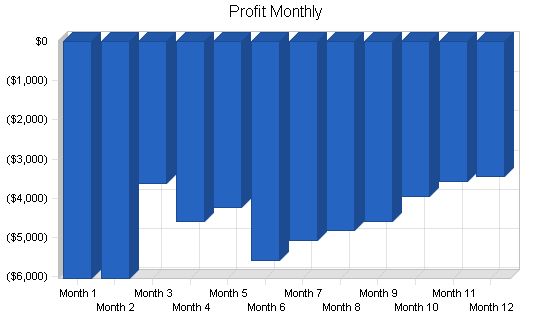

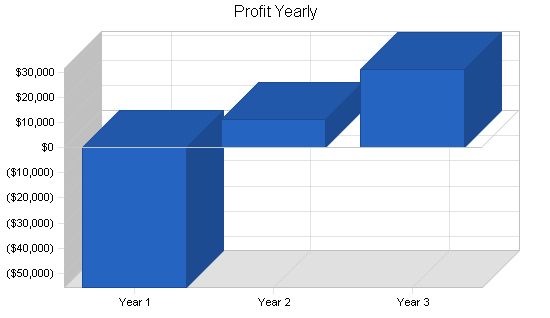

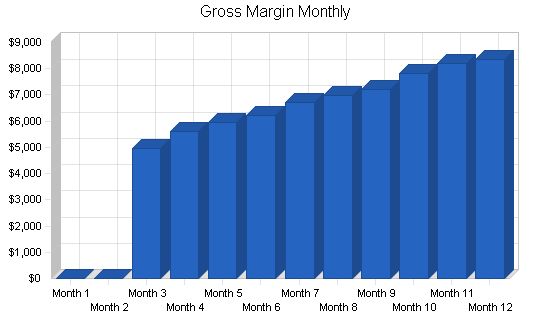

7.4 Projected Profit and Loss:

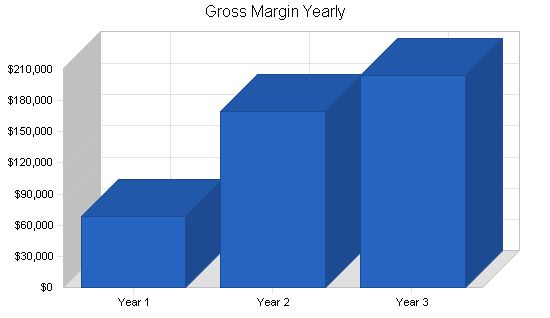

The table and charts below illustrate the projected Profit and Loss.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $113,315 | $283,122 | $339,917 |

| Direct Cost of Sales | $45,326 | $113,249 | $135,967 |

| Other Costs of Goods | $0 | $0 | $0 |

| Total Cost of Sales | $45,326 | $113,249 | $135,967 |

| Gross Margin | $67,989 | $169,873 | $203,950 |

| Gross Margin % | 60.00% | 60.00% | 60.00% |

| Expenses | |||

| Payroll | $68,400 | $94,000 | $98,000 |

| Sales and Marketing and Other Expenses | $4,200 | $4,400 | $4,600 |

| Depreciation | $3,792 | $3,792 | $3,792 |

| Rent | $30,000 | $30,900 | $31,827 |

| Utilities | $3,000 | $3,090 | $3,120 |

| Insurance | $2,400 | $2,400 | $2,400 |

| Payroll Taxes | $10,260 | $14,100 | $14,700 |

| Other | $1,500 | $1,500 | $1,500 |

| Total Operating Expenses | $123,552 | $154,182 | $159,939 |

| Profit Before Interest and Taxes | ($55,563) | $15,691 | $44,011 |

| EBITDA | ($51,771) | $19,483 | $47,803 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $0 | $4,707 | $13,203 |

| Net Profit | ($55,563) | $10,984 | $30,808 |

| Net Profit/Sales | -49.03% | 3.88% | 9.06% |

7.5 Projected Balance Sheet

The following table presents the Projected Balance Sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $3,454 | $14,350 | $48,092 |

| Inventory | $6,119 | $15,288 | $18,355 |

| Other Current Assets | $3,500 | $3,500 | $3,500 |

| Total Current Assets | $13,073 | $33,138 | $69,947 |

| Long-term Assets | |||

| Long-term Assets | $19,000 | $19,000 | $19,000 |

| Accumulated Depreciation | $3,792 | $7,584 | $11,376 |

| Total Long-term Assets | $15,208 | $11,416 | $7,624 |

| Total Assets | $28,281 | $44,554 | $77,571 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $9,793 | $15,083 | $17,292 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $9,793 | $15,083 | $17,292 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $9,793 | $15,083 | $17,292 |

| Paid-in Capital | $140,000 | $140,000 | $140,000 |

| Retained Earnings | ($65,950) | ($121,513) | ($110,529) |

| Earnings | ($55,563) | $10,984 | $30,808 |

| Total Capital | $18,487 | $29,471 | $60,279 |

| Total Liabilities and Capital | $28,281 | $44,554 | $77,571 |

| Net Worth | $18,487 | $29,471 | $60,279 |

7.6 Business Ratios

The following table indicates Business Ratios specific to Malone’s Maternity and to the industry. Their NAICS industry class is currently Woman’s clothing including, Maternity clothing 448120. Please note that the variance in gross margin between Malone’s Maternity and the industry as a whole can be explained by the fact that Malone’s Maternity is a high-end boutique that enjoys above industry margins.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 149.85% | 20.06% | -10.29% |

| Percent of Total Assets | ||||

| Inventory | 21.64% | 34.31% | 23.66% | 41.71% |

| Other Current Assets | 12.38% | 7.86% | 4.51% | 22.42% |

| Total Current Assets | 46.22% | 74.38% | 90.17% | 89.70% |

| Long-term Assets | 53.78% | 25.62% | 9.83% | 10.30% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | $9,793 | $15,083 | $17,292 | |

| Current Borrowing | $0 | $0 | $0 | |

| Other Current Liabilities | $0 | $0 | $0 | |

| Subtotal Current Liabilities | $9,793 | $15,083 | $17,292 | |

|

Month 1-12 Plan Month: 1-12 Current Interest Rate: 10.00% Long-term Interest Rate: 10.00% Tax Rate: 30.00% Other: 0 Pro Forma Profit and Loss: Month 1-12 Sales: $0, $0, $8,242, $9,322, $9,936, $10,355, $11,185, $11,607, $12,007, $13,061, $13,694, $13,906 Direct Cost of Sales: $0, $0, $3,297, $3,729, $3,974, $4,142, $4,474, $4,643, $4,803, $5,225, $5,477, $5,563 Other Costs of Goods: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 Total Cost of Sales: $0, $0, $3,297, $3,729, $3,974, $4,142, $4,474, $4,643, $4,803, $5,225, $5,477, $5,563 Gross Margin: $0, $0, $4,945, $5,593, $5,961, $6,213, $6,711, $6,964, $7,204, $7,837, $8,216, $8,344 Gross Margin %: 0.00%, 0.00%, 60.00%, 60.00%, 60.00%, 60.00%, 60.00%, 60.00%, 60.00%, 60.00%, 60.00%, 60.00% Expenses: Payroll: $2,000, $2,000, $4,200, $5,600, $5,600, $7,000, $7,000, $7,000, $7,000, $7,000, $7,000, $7,000 Sales and Marketing and Other Expenses: $350, $350, $350, $350, $350, $350, $350, $350, $350, $350, $350, $350 Depreciation: $316, $316, $316, $316, $316, $316, $316, $316, $316, $316, $316, $316 Rent: $2,500, $2,500, $2,500, $2,500, $2,500, $2,500, $2,500, $2,500, $2,500, $2,500, $2,500, $2,500 Utilities: $250, $250, $250, $250, $250, $250, $250, $250, $250, $250, $250, $250 Insurance: $200, $200, $200, $200, $200, $200, $200, $200, $200, $200, $200, $200 Payroll Taxes: 15%, $300, $300, $630, $840, $840, $1,050, $1,050, $1,050, $1,050, $1,050, $1,050, $1,050 Other: $125, $125, $125, $125, $125, $125, $125, $125, $125, $125, $125, $125 Total Operating Expenses: $6,041, $6,041, $8,571, $10,181, $10,181, $11,791, $11,791, $11,791, $11,791, $11,791, $11,791, $11,791 Profit Before Interest and Taxes: ($6,041), ($6,041), ($3,626), ($4,588), ($4,220), ($5,578), ($5,080), ($4,827), ($4,587), ($3,954), ($3,575), ($3,447) EBITDA: ($5,725), ($5,725), ($3,310), ($4,272), ($3,904), ($5,262), ($4,764), ($4,511), ($4,271), ($3,638), ($3,259), ($3,131) Interest Expense: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 Taxes Incurred: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 Net Profit: ($6,041), ($6,041), ($3,626), ($4,588), ($4,220), ($5,578), ($5,080), ($4,827), ($4,587), ($3,954), ($3,575), ($3,447) Net Profit/Sales: 0.00%, 0.00%, -44.00%, -49.21%, -42.47%, -53.86%, -45.42%, -41.59%, -38.20%, -30.27%, -26.11%, -24.79% Pro Forma Cash Flow: Month 1-12 Cash Received: Cash from Operations Cash Sales: $0, $0, $8,242, $9,322, $9,936, $10,355, $11,185, $11,607, $12,007, $13,061, $13,694, $13,906 Subtotal Cash from Operations: $0, $0, $8,242, $9,322, $9,936, $10,355, $11,185, $11,607, $12,007, $13,061, $13,694, $13,906 Additional Cash Received: Sales Tax, VAT, HST/GST Received: 0.00%, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 New Current Borrowing: $0, $0, $0, $0, $0, $0, Pro Forma Balance Sheet: |

||||

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $51,550 | $49,426 | $43,701 | $43,776 | $36,604 | $32,468 | $27,305 | $22,671 | $17,964 | $13,663 | $10,247 | $6,775 | $3,454 |

| Inventory | $0 | $0 | $0 | $3,626 | $4,102 | $4,372 | $4,556 | $4,921 | $5,107 | $5,283 | $5,747 | $6,025 | $6,119 |

| Other Current Assets | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 |

| Total Current Assets | $55,050 | $52,926 | $47,201 | $50,902 | $44,205 | $40,340 | $35,361 | $31,093 | $26,571 | $22,446 | $19,494 | $16,300 | $13,073 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 | $19,000 |

| Accumulated Depreciation | $0 | $316 | $632 | $948 | $1,264 | $1,580 | $1,896 | $2,212 | $2,528 | $2,844 | $3,160 | $3,476 | $3,792 |

| Total Long-term Assets | $19,000 | $18,684 | $18,368 | $18,052 | $17,736 | $17,420 | $17,104 | $16,788 | $16,472 | $16,156 | $15,840 | $15,524 | $15,208 |

| Total Assets | $74,050 | $71,610 | $65,569 | $68,954 | $61,941 | $57,760 | $52,465 | $47,881 | $43,043 | $38,602 | $35,334 | $31,824 | $28,281 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $3,601 | $3,601 | $10,612 | $8,187 | $8,225 | $8,508 | $9,004 | $8,993 | $9,139 | $9,824 | $9,890 | $9,793 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $3,601 | $3,601 | $10,612 | $8,187 | $8,225 | $8,508 | $9,004 | $8,993 | $9,139 | $9,824 | $9,890 | $9,793 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $0 | $3,601 | $3,601 | $10,612 | $8,187 | $8,225 | $8,508 | $9,004 | $8,993 | $9,139 | $9,824 | $9,890 | $9,793 |

| Paid-in Capital | $140,000 | $140,000 | $140,000 | $140,000 | $140,000 | $140,000 | $140,000 | $140,000 | $140,000 | $140,000 | $140,000 | $140,000 | $140,000 |

| Retained Earnings | ($65,950) | ($65,950) | ($65,950) | ($65,950) | ($65,950) | ($65,950) | ($65,950) | ($65,950) | ($65,950) | ($65,950) | ($65,950) | ($65,950) | ($65,950) |

| Earnings | $0 | ($6,041) | ($12,082) | ($15,708) | ($20,296) | ($24,515) | ($30,093) | ($35,173) | ($40,000) | ($44,587) | ($48,541) | ($52,116) | ($55,563) |

| Total Capital | $74,050 | $68,009 | $61,968 | $58,342 | $53,754 | $49,535 | $43,957 | $38,877 | $34,050 | $29,463 | $25,509 | $

Business Plan Outline

|

|

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!