The Magnolia Inn is a beautiful facility overlooking the Pacific Ocean in Half Moon Bay, California. We offer seven individually furnished rooms with unique antique themes. Our target market consists of professional couples in the greater San Francisco Bay area seeking relaxation and rejuvenation. We will also advertise to newly married couples looking for a special getaway. Visibility to potential guests on Highway 101 is crucial.

To attract customers, we will have an eye-catching sign and use the Yellow Pages and a dedicated webpage to market our Inn. Each room and the outside of the Inn will be showcased, along with nearby attractions, shuttle service, rates, and directions. We anticipate reaching full capacity within a year and aim for steady growth with over 90% capacity in Year 1 and 10% profit growth.

The Magnolia is owned and operated by Jim and Nancy Anderson, who reside at the Inn. They are hands-on owners and oversee all operations. A small staff, including a cook and maid, will work at the Inn. The cook will work 20 hours per week, and the maid will work 40 hours per week, assisting with reservations and the front desk. Nancy will oversee the inside operations, and Jim will handle maintenance and driving the shuttle van. They will both promote the Inn and oversee advertising efforts.

The Magnolia Inn aims to provide a serene setting for guests to enjoy the splendors of the California coast. Our goal is to treat each guest like family, allowing them to leave their troubles behind and experience luxury and rest. Our attentive staff is dedicated to providing exceptional service and attention to detail.

The primary keys to our success are:

– Providing a first-class facility with attention to detail.

– Making each guest feel like our top priority.

– Offering quality meals.

– Retaining guests to ensure repeat bookings and referrals.

Our objectives are to:

1. Achieve a customer satisfaction rate above 90%.

2. Generate an average monthly sales of $26,000.

3. Maintain an occupancy rate above 90% each month.

The Magnolia Inn is a beautiful facility located on a bluff overlooking the Pacific Ocean in Half Moon Bay, California. We offer seven individually furnished rooms with antiques and a large deck with an ocean-view hot tub. Our guests will enjoy a full breakfast each morning. Our target market includes professional couples from the San Francisco area and honeymooners.

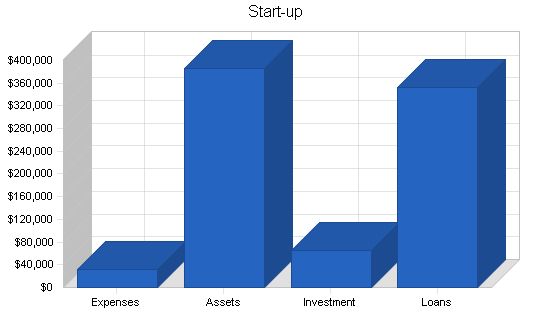

The Magnolia Inn is solely owned and operated by Jim and Nancy Anderson. They have refurbished a Victorian home to accommodate 14 guests in seven rooms. The start-up costs, totaling $38,000, are primarily financed by Jim and Nancy Anderson. Jim’s father, Joe Anderson, has contributed $15,000. The building improvements cost $30,000, and the Andersons purchased the property a year ago with the intention of renovating and opening the inn.

The Magnolia Inn is a four-star bed and breakfast on the central California coast, offering seven unique rooms and a complimentary breakfast. We cater to guests seeking both relaxation and adventure, providing van trips to local attractions upon request.

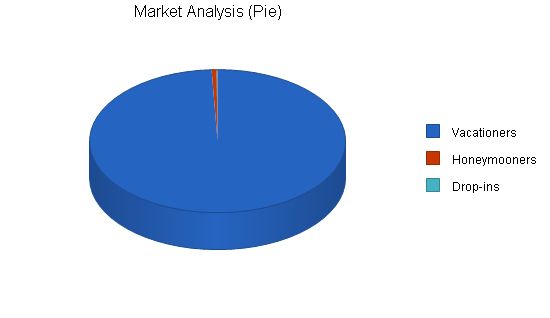

Our target market consists of individuals in the greater San Francisco Bay area who are seeking a getaway. This includes vacationers, honeymooners, and drop-in customers. We anticipate a yearly increase of 10% in our customer base.

Geographically, our primary market is the San Francisco Bay area, which has a population of over one million. Additionally, our services would appeal to customers within a 200-mile radius, encompassing a total target population of two million.

Demographically, our customers are male and female, married and single, with a combined annual income exceeding $75,000. They range in age from 25 to 65, with a median age of 40, and typically work in a professional setting.

Potential Customers Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Vacationers 10% 800,000 880,000 968,000 1,064,800 1,171,280 10.00%

Honeymooners 10% 5,000 5,500 6,050 6,655 7,321 10.00%

Drop-ins 10% 1,000 1,100 1,210 1,331 1,464 10.00%

Total 10.00% 806,000 886,600 975,260 1,072,786 1,180,065 10.00%

4.2 Target Market Segment Strategy

Our target market strategy focuses on becoming a destination for people looking to get away on the California coast. Our marketing strategy emphasizes superior performance in these areas:

– Quality facilities.

– Beautiful location.

– Customer service.

The target markets are separated into three segments: Vacationers, Honeymooners, and Drop-ins. The primary marketing opportunity is selling to these accessible target market segments that focus on vacation and recreational needs.

Vacationers

The most dominant segment is comprised of the San Francisco Bay and surrounding area. Half Moon Bay is approximately a 45-minute drive for Bay area residents. Half Moon Bay is attractive to those who need to get away but do not have the time to go far.

Honeymooners

Due to the beauty and location of our Inn, we will be an attractive choice for people looking for a honeymoon location.

Drop-ins

When rooms are available, we will welcome drop-in customers who are looking for a place to stay for the night. Our sign can be seen from Highway 101, and we expect to receive quite a few drop-ins.

4.3 Service Business Analysis

The Magnolia Inn is a seven-room facility that provides overnight lodging and breakfast in a luxurious setting on the California Coast. There are several other Inns and motels in the area. Most people who need lodging in the area make reservations in advance to assure room availability. Our main competitors are the Riptide Inn and the Bayshore Inn, two other Bed and Breakfast Inns.

4.3.1 Competition and Buying Patterns

Typically, consumers in this industry are not just looking for a room to sleep in, but a facility that provides a homestyle touch. Each Inn offers something unique to the guest, so customer service and quality facilities are important. Location is also a factor, and Inns with an ocean view have an advantage. The Magnolia will not compete on price, as the price of a room is on the high end of the scale. Guests at the Magnolia are paying for more than just a room; they are paying for an oasis away from their hectic world.

Strategy and Implementation Summary

The primary sales and marketing strategy for Magnolia includes these factors:

– To offer a bed and breakfast facility that appeals to busy professionals.

– To provide unmatched customer service to our guests.

– To concentrate our marketing in the greater San Francisco Bay area.

5.1 Competitive Edge

The Magnolia Inn sets itself apart from similar competition in the following ways:

– Location: Nestled on a bluff with a panoramic view of the Pacific Ocean, the Magnolia is the ideal place to enjoy mother nature.

– Our rooms: Each room is individually decorated with tasteful and comfortable antiques that create a luxurious atmosphere.

– Customer service: Customer service is our number one priority. The Magnolia will treat each guest like family.

5.2 Marketing Strategy

Our marketing strategy focuses on becoming a destination for vacationers and honeymooners who are looking for beautiful and unique lodgings. With the greater San Francisco Bay area as our main target market, we will use several different approaches to advertise our facility. We will use the Yellow Pages and develop a web page showcasing our Inn. On Highway 101, we will have an eye-catching sign to attract potential drop-ins. The Magnolia is confident that word-of-mouth from past customers will quickly build up our capacity.

5.3 Sales Strategy

Our prime location with a beautiful ocean view and quality facilities makes us an attractive choice for potential customers. Each room is individually decorated with antiques and quality furnishings to feel like home. A hot tub on the deck overlooking the ocean is available for our guests. A first-class breakfast is served every morning with various options to accommodate different tastes. Several fun and interesting destination spots are within 30 minutes of the Inn, and we provide shuttle service. The Magnolia guest will feel pampered and well-rested.

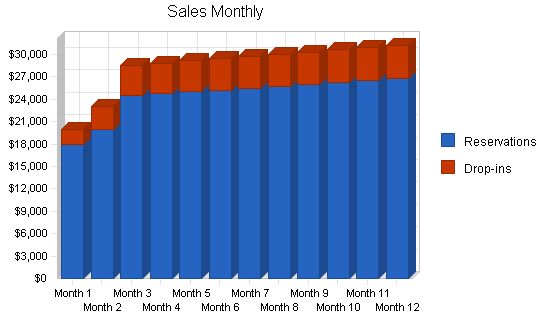

5.3.1 Sales Forecast

The sales forecast table is broken down into two revenue streams: Reservations and Drop-ins. The forecast is based on a 10% growth rate for direct sales. The Magnolia has seven rooms available at a rate of $175.00 per night. We expect the rate of occupied rooms to increase throughout the year. Despite economic unpredictability, these projections appear attainable and consider the increasing customer base. Growth rates for 2005 and 2006 are projected at 10% for both reservations and drop-ins.

Sales Forecast

Year 1 Year 2 Year 3

Sales

Reservations $294,140 $323,554 $355,909

Drop-ins $47,690 $52,459 $57,705

Total Sales $341,830 $376,013 $413,614

Direct Cost of Sales

Year 1 Year 2 Year 3

Reservations $14,707 $14,000 $16,000

Drop-ins $2,385 $7,000 $8,000

Subtotal Direct Cost of Sales $17,092 $21,000 $24,000

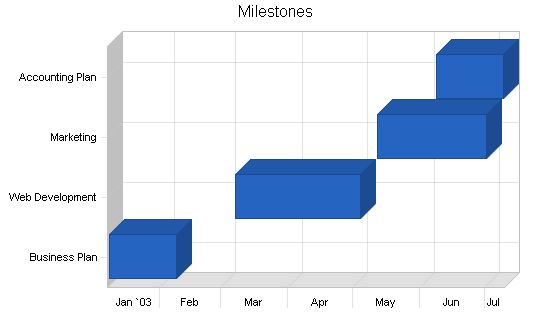

5.4 Milestones

The milestones table outlines key activities critical to our success. Owners Jim and Nancy Anderson will take care of these activities.

Milestones:

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business Plan | 1/8/2003 | 2/8/2003 | $500 | Jim | Management |

| Web Development | 3/7/2003 | 5/4/2003 | $1,000 | Nancy | Management |

| Marketing | 5/12/2003 | 7/1/2003 | $3,000 | Nancy | Management |

| Accounting Plan | 6/8/2003 | 7/9/2003 | $500 | Jim | Management |

| Totals | $5,000 | ||||

Web Plan Summary:

The Magnolia Inn website will focus on its unique features. Each room with its decor will be displayed along with pictures of the Inn, the gardens, and the grounds overlooking the Pacific Ocean. The breakfast menu will feature pictures of the food in the dining room. Room rates and maps will be provided for guests. Local attractions within 30 miles will also be highlighted. Online reservations will be available.

Website Marketing Strategy:

Our marketing strategy will target professional couples seeking a close and elegant vacation destination, with a focus on the Bay area. We will promote the Magnolia Inn website using detailed photos of the Inn and surrounding area, a price list for rooms, and a breakfast menu. We will also provide maps from various points in the Bay area that lead to the Inn.

Development Requirements:

Co-owner Nancy Anderson, who has a degree in computer science and extensive experience with websites, will develop the website. The development process will take several months and ongoing efforts will be made to add new information as necessary. Nancy will handle all aspects of the site, including the company logo, web page format, and site maintenance. The site will be hosted by AOL Web services.

Management Summary:

Jim and Nancy Anderson are the sole owners of the Magnolia Inn. A small staff consisting of a cook and maid will work at the Inn, with Jim and Nancy handling the rest of the tasks. Jim will be responsible for the maintenance of the grounds and the Inn, as well as driving the van for guests. Nancy will oversee day-to-day operations and handle reservations. Both Jim and Nancy will promote the Inn through various advertising methods. Nancy will also work with the cook to purchase food for the Inn.

Personnel Plan:

Jim and Nancy previously sold a small motel and have now established the Magnolia Inn. The personnel plan includes their schedules as well as that of the staff. The cook, Stacie, will work 20 hours per week and assist with shopping for supplies. Carol will work full-time preparing rooms, taking reservations, and overseeing the Inn in Jim and Nancy’s absence. Jim and Nancy will reside on-site. Jim’s dad will receive a monthly payment of $500 until his $15,000 investment is paid back. The total payroll, including Jim and Nancy’s salaries of $57,000, amounts to $111,000.

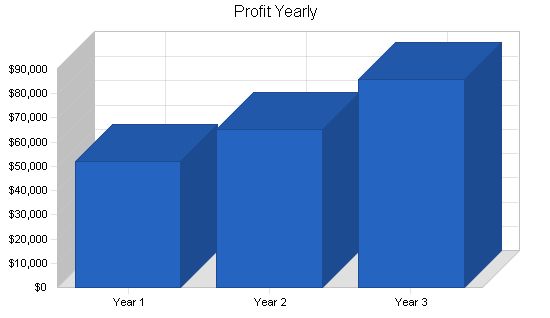

The Magnolia Inn expects steady business growth, with an average capacity rate of over 90% by 2004. We anticipate a conservative capacity rate of 50% at times. Profits are projected to grow at a rate of about 10%. Expenses will be well-managed, allowing the Inn to remain profitable even if the capacity rate drops as low as 50%.

Important Assumptions:

The potential for future success depends on the following critical assumptions:

– A healthy economy that supports moderate growth in our market.

– Keeping operating costs, particularly personnel and monthly expenses, as low as possible.

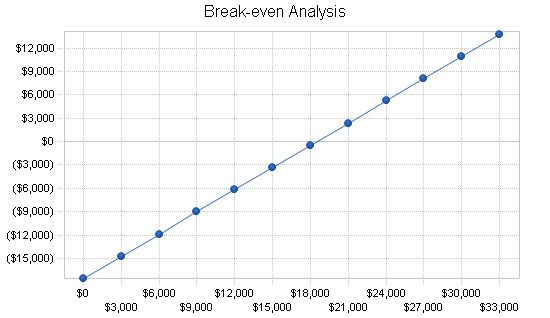

Break-even Analysis:

Our fixed costs at the onset will be $17,000 per month. We expect to reach the break-even point within the first few months of operation.

Break-even Analysis

Monthly Revenue Break-even: $18,487

Assumptions:

– Average Percent Variable Cost: 5%

– Estimated Monthly Fixed Cost: $17,563

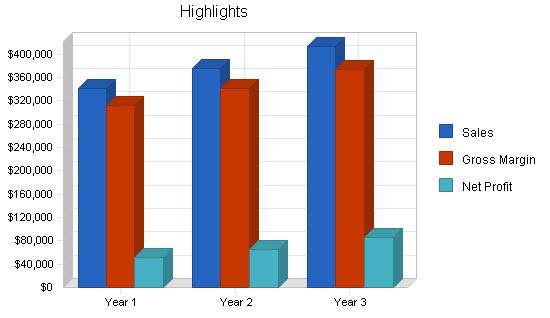

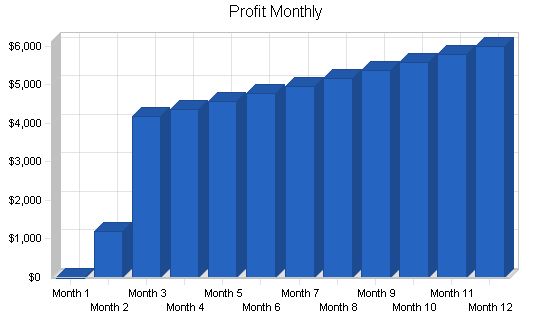

8.3 Projected Profit and Loss

The following represents the Projected Profit and Loss for the Magnolia Inn based on sales and expense projections for 2004 and beyond.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $341,830 | $376,013 | $413,614 |

| Direct Cost of Sales | $17,092 | $21,000 | $24,000 |

| Other Costs of Sales | $12,000 | $14,000 | $16,000 |

| Total Cost of Sales | $29,092 | $35,000 | $40,000 |

| Gross Margin | $312,739 | $341,013 | $373,614 |

| Gross Margin % | 91.49% | 90.69% | 90.33% |

| Expenses | |||

| Payroll | $105,000 | $117,000 | $119,000 |

| Sales and Marketing and Other Expenses | $12,000 | $14,000 | $16,000 |

| Depreciation | $0 | $0 | $0 |

| Rent | $48,000 | $48,000 | $48,000 |

| Utilities | $12,000 | $14,000 | $16,000 |

| Insurance | $6,000 | $7,000 | $8,000 |

| Payroll Taxes | $15,750 | $17,550 | $17,850 |

| Other | $12,000 | $3,000 | $0 |

| Total Operating Expenses | $210,750 | $220,550 | $224,850 |

| Profit Before Interest and Taxes | $101,989 | $120,463 | $148,764 |

| EBITDA | $101,989 | $120,463 | $148,764 |

| Interest Expense | $29,885 | $29,660 | $29,411 |

| Taxes Incurred | $20,188 | $25,425 | $33,618 |

| Net Profit | $51,916 | $65,378 | $85,736 |

| Net Profit/Sales | 15.19% | 17.39% | 20.73% |

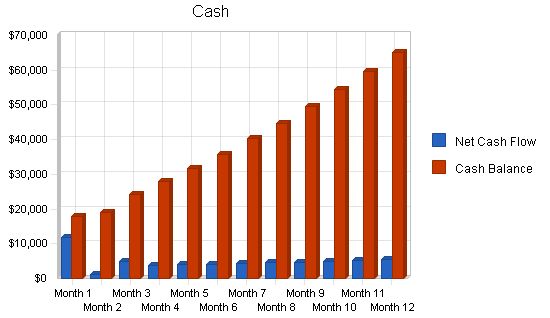

8.4 Projected Cash Flow

The projected Cash Flow is outlined below. These projections are based on our assumptions, with revenue generation being the most important factor. We expect a healthy cash flow and do not anticipate the need for additional capital investment in the business.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $341,830 | $376,013 | $413,614 |

| Subtotal Cash from Operations | $341,830 | $376,013 | $413,614 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $341,830 | $376,013 | $413,614 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $105,000 | $117,000 | $119,000 |

| Bill Payments | $169,225 | $193,409 | $207,626 |

| Subtotal Spent on Operations | $274,225 | $310,409 | $326,626 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $2,646 | $2,831 | $3,029 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $6,000 | $6,000 | $3,000 |

| Subtotal Cash Spent | $282,871 | $319,240 | $332,655 |

| Net Cash Flow | $58,959 | $56,773 | $80,959 |

| Cash Balance | $64,959 | $121,732 | $202,692 |

8.5 Projected Balance Sheet

The Balance Sheet in the following table shows sufficient growth and a very acceptable financial position. The monthly estimates are included and shown in the appendix.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $64,959 | $121,732 | $202,692 |

| Other Current Assets | $10,000 | $10,000 | $10,000 |

| Total Current Assets | $74,959 | $131,732 | $212,692 |

| Long-term Assets | |||

| Long-term Assets | $370,000 | $370,000 | $370,000 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $370,000 | $370,000 | $370,000 |

| Total Assets | $444,959 | $501,732 | $582,692 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $15,689 | $15,915 | $17,168 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $15,689 | $15,915 | $17,168 |

| Long-term Liabilities | $350,354 | $347,523 | $344,494 |

| Total Liabilities | $366,043 | $363,438 | $361,662 |

| Paid-in Capital | $65,000 | $65,000 | $65,000 |

| Retained Earnings | ($38,000) | $7,916 | $70,294 |

| Earnings | $51,916 | $65,378 | $85,736 |

| Total Capital | $78,916 | $138,294 | $221,030 |

| Total Liabilities and Capital | $444,959 | $501,732 | $582,692 |

| Net Worth | $78,916 | $138,294 | $221,030 |

8.6 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 7011.0401, Bed and Breakfast Inns are shown for comparison.

The following will enable us to keep on track. If we fail in any of these areas we will need to re-evaluate our business mode:

- Month-to-month annual comparisons indicate an increase of 10% or greater.

- Do not depend on credit line to meet cash requirements.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 10.00% | 10.00% | 7.24% |

| Percent of Total Assets | ||||

| Other Current Assets | 2.25% | 1.99% | 1.72% | 22.48% |

| Total Current Assets | 16.85% | 26.26% | 36.50% | 27.08% |

| Long-term Assets | 83.15% | 73.74% | 63.50% | 72.92% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 3.53% | 3.17% | 2.95% | 14.60% |

| Long-term Liabilities | 78.74% | 69.26% | 59.12% | 32.80% |

| Total Liabilities | 82.26% | 72.44% | 62.07% | 47.40% |

| Net Worth | 17.74% | 27.56% | 37.93% | 52.60% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 91.49% | 90.69% | 90.33% | 100.00% |

| Selling, General & Administrative Expenses | 76.30% | 73.30% | 69.55% | 67.52% |

|

Month 1 2 3 4 5 6 7 8 9 10 11 12 Plan Month 1 2 3 4 5 6 7 8 9 10 11 12 Current Interest Rate 9.50% 9.50% 9.50% 9.50% 9.50% 9.50% 9.50% 9.50% 9.50% 9.50% 9.50% 9.50% Long-term Interest Rate 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% Tax Rate 30.00% 28.00% 28.00% 28.00% 28.00% 28.00% 28.00% 28.00% 28.00% 28.00% 28.00% 28.00% Other 0 0 0 0 0 0 0 0 0 0 0 0 Pro Forma Profit and Loss: Month 1 2 3 4 5 6 7 8 9 10 11 12 Sales $20,000 $23,000 $28,563 $28,848 $29,137 $29,428 $29,723 $30,020 $30,320 $30,623 $30,929 $31,239 Direct Cost of Sales $1,000 $1,150 $1,428 $1,442 $1,457 $1,471 $1,486 $1,501 $1,516 $1,531 $1,546 $1,562 Other Costs of Sales $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 Total Cost of Sales $2,000 $2,150 $2,428 $2,442 $2,457 $2,471 $2,486 $2,501 $2,516 $2,531 $2,546 $2,562 Gross Margin $18,000 $20,850 $26,135 $26,406 $26,680 $26,957 $27,236 $27,519 $27,804 $28,092 $28,383 $28,677 Gross Margin % 90.00% 90.65% 91.50% 91.53% 91.57% 91.60% 91.64% 91.67% 91.70% 91.73% 91.77% 91.80% Expenses Payroll $7,000 $8,000 $9,000 $9,000 $9,000 $9,000 $9,000 $9,000 $9,000 $9,000 $9,000 $9,000 Sales and Marketing and Other Expenses $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 Depreciation $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Rent $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 Utilities $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 Insurance $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 Payroll Taxes 15% $1,050 $1,200 $1,350 $1,350 $1,350 $1,350 $1,350 $1,350 $1,350 $1,350 $1,350 $1,350 Other $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 Total Operating Expenses $15,550 $16,700 $17,850 $17,850 $17,850 $17,850 $17,850 $17,850 $17,850 $17,850 $17,850 $17,850 Profit Before Interest and Taxes $2,450 $4,150 $8,285 $8,556 $8,830 $9,107 $9,386 $9,669 $9,954 $10,242 $10,533 $10,827 EBITDA $2,450 $4,150 $8,285 $8,556 $8,830 $9,107 $9,386 $9,669 $9,954 $10,242 $10,533 $10,827 Interest Expense $2,499 $2,497 $2,496 $2,494 $2,493 $2,491 $2,490 $2,488 $2,487 $2,485 $2,483 $2,482 Taxes Incurred ($15) $463 $1,621 $1,697 $1,774 $1,852 $1,931 $2,011 $2,091 $2,172 $2,254 $2,337 Net Profit ($34) $1,190 $4,168 $4,364 $4,563 $4,763 $4,966 $5,170 $5,377 $5,585 $5,796 $6,008 Net Profit/Sales -0.17% 5.17% 14.59% 15.13% 15.66% 16.19% 16.71% 17.22% 17.73% 18.24% 18.74% 19.23% Pro Forma Cash Flow |

||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |||

| Cash Received | ||||||||||||||

| Cash from Operations | ||||||||||||||

| Cash Sales | $20,000 | $23,000 | $28,563 | $28,848 | $29,137 | $29,428 | $29,723 | $30,020 | $30,320 | $30,623 | $30,929 | $31,239 | ||

| Subtotal Cash from Operations | $20,000 | $23,000 | $28,563 | $28,848 | $29,137 | $29,428 | $29,723 | $30,020 | $30,320 | $30,623 | $30,929 | $31,239 | ||

| Additional Cash Received | ||||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Subtotal Cash Received | $20,000 | $23,000 | $28,563 | $28,848 | $29,137 | $29,428 | $29,723 | $30,020 | $30,320 | $30,623 | $30,929 | $31,239 | ||

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Expenditures from Operations | ||||||||||||||

| Cash Spending | $7,000 | $8,000 | $9,000 | $9,000 | $9,000 | $9,000 | $9,000 | $9,000 | $9,000 | $9,000 | $9,000 | $9,000 | $9,000 | |

| Bill Payments | $434 | $13,060 | $13,863 | $15,398 | $15,487 | $15,577 | $15,668 | $15,760 | $15,853 | $15,947 | $16,041 | $16,137 | ||

| Subtotal Spent on Operations | $7,434 | $21,060 | $22,863 | $24,398 | $24,487 | $24,577 | $24,668 | $24,760 | $24,853 | $24,947 | $25,041 | $25,137 | ||

| Additional Cash Spent | ||||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Long-term Liabilities Principal Repayment | $212 | $214 | $215 | $217 | $218 | $220 | $221 | $223 | $224 | $226 | $228 | $229 | ||

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | |

| Subtotal Cash Spent | $8,147 | $21,774 | $23,578 | $25,114 | $25,205 | $25,297 | $25,389 | $25,483 | $25,577 | $25,672 | $25,769 | $25,866 | ||

| Net Cash Flow | $11,853 | $1,226 | $4,985 | $3,734 | $3,932 | $4,132 | $4,333 | $4,537 | $4,743 | $4,951 | $5,161 | $5,373 | ||

| Cash Balance | $17,853 | $19,080 | $24,065 | $27,799 | $31,730 | $35,862 | $40,195 | $44,732 | $49,475 | $54,426 | $59,586 | $64,959 |

Pro Forma Balance Sheet

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |||

| Starting Balances | ||||||||||||||

| Current Assets | ||||||||||||||

| Cash | $6,000 | $17,853 | $19,080 | $24,065 | $27,799 | $31,730 | $35,862 | $40,195 | $44,732 | $49,475 | $54,426 | $59,586 | $64,959 | |

| Other Current Assets | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | |

| Total Current Assets | $16,000 | $27,853 | $29,080 | $34,065 | $37,799 | $41,730 | $45,862 | $50,195 | $54,732 | $59,475 | $64,426 | $69,586 | $74,959 | |

| Long-term Assets | ||||||||||||||

| Long |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!