Architecture Firm Business Plan

NW Architecture is an architectural firm specializing in residential, commercial, and industrial architecture in domestic and international markets. Based in the Bay Area near San Francisco, California, our firm offers technologically superior architectural services that provide greater value and enhanced design and construction.

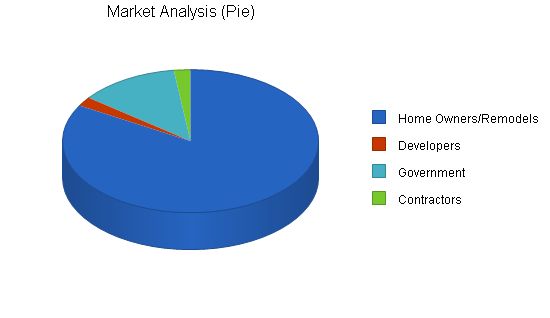

Our target clients fall into four categories: home owners, developers, government, and contractors. We differentiate ourselves through our knowledge of digital-based design resources and our commitment to superior customer service.

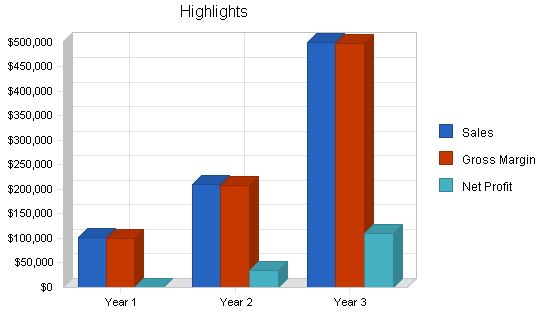

We anticipate first year sales of $102,000, with steady growth to reach $500,000 by the third year. Our goal is to achieve profitability within three years.

Challenges include securing a suitable location, establishing an initial client base, and positioning ourselves to compete in the global market.

This business plan outlines our objectives, focus, and implementation strategies for our start-up firm.

NW Architecture offers digital interactive media for clients and builders. This media provides a clear visual representation of the design and construction process, eliminating the need for clients to have architectural knowledge. Computer-rendered images and interactive videos are utilized to convey the end result effectively.

Additionally, this media is integrated into the construction documents. Builders are provided with an interactive video rendering that includes visual photographic quality images and construction specifications. This allows for a comprehensive understanding of the architectural presentation, accessible to anyone with computer skills.

To ensure success, NW Architecture focuses on technological superiority, a diverse staff of architects, and a wide network of global connections.

The objectives of NW Architecture include achieving sales of $500,000 by Year 3 and $700,000 by Year 4, expanding the market by 20% annually through the Internet, and establishing a niche in the market for three-dimensional construction documents and interactive digital presentations.

NW Architecture provides architectural design services through digital media, utilizing the latest technology to offer efficiency and value in design processes and construction methods.

The company is owned by Nathan Sawyer and operates as a California corporation based in the Bay Area.

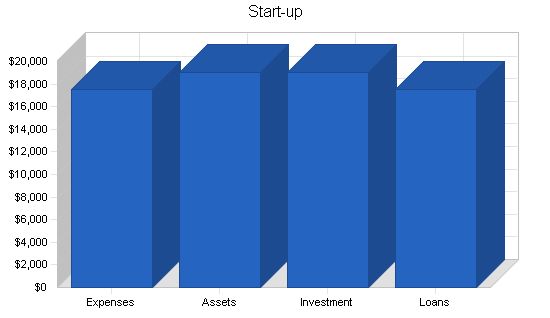

The start-up costs for NW Architecture total $36,540, which includes the necessary purchases of a blueprint machine, plotter, and drafting supplies. An additional $19,000 in cash is required to cover rent and wages for the first year until the business becomes profitable.

Start-up Requirements

Legal $1,000

Stationery etc. $3,000

Brochures $1,000

Consultants $2,000

Insurance $500

Rent $1,040

Expensed Equipment $9,000

Total Start-up Expenses $17,540

Start-up Assets

Cash Required $19,000

Start-up Inventory $0

Other Current Assets $0

Long-term Assets $0

Total Assets $19,000

Total Requirements $36,540

Start-up Funding

Start-up Expenses to Fund $17,540

Start-up Assets to Fund $19,000

Total Funding Required $36,540

Assets

Non-cash Assets from Start-up $0

Cash Requirements from Start-up $19,000

Additional Cash Raised $0

Cash Balance on Starting Date $19,000

Total Assets $19,000

Liabilities and Capital

Liabilities

Current Borrowing $17,540

Long-term Liabilities $0

Accounts Payable (Outstanding Bills) $0

Other Current Liabilities (interest-free) $0

Total Liabilities $17,540

Capital

Planned Investment

Investor 1 $19,000

Other $0

Additional Investment Requirement $0

Total Planned Investment $19,000

Loss at Start-up (Start-up Expenses) ($17,540)

Total Capital $1,460

Total Capital and Liabilities $19,000

Total Funding $36,540

Company Locations and Facilities

The interim office of NW Architecture will be located in Walnut Creek, California until dedicated office space is secured.

Services

NW Architecture will provide various levels of service to cater to corporations of all sizes, while making it affordable for middle and upper socioeconomic classes.

Service Description

To provide its innovative digital media service, NW Architecture will use high-speed computers running programs like AutoCad and Form-Z. The company will stay at the forefront of the market by continuously investigating upcoming software related to digital 3-D design. This strategic component will differentiate the firm and optimize productivity and efficiency.

Market Analysis Summary

NW Architecture will provide its services to homeowners looking to remodel, as well as developers, contractors, and government agencies in domestic and international markets. The company will determine its target market based on sales and trends observed in the initial months of operation.

Market Segmentation

Potential clients for NW Architecture’s market are broken down into four categories: homeowners, developers, government, and contractors. Homeowners comprise the largest group based on population, and the firm’s marketing and promotional efforts will prioritize this segment. Targeting the remaining three groups will depend on establishing meaningful relationships, and responding and qualifying for requests for proposals.

Market Analysis

Year 1 Year 2 Year 3 Year 4 Year 5

Potential Customers Growth CAGR

Home Owners/Remodels 15.00%

200,000 230,000 264,500 304,175 349,801

Developers 30.00%

5,000 6,500 8,450 10,985 14,281

Government 1.00%

30,000 30,300 30,603 30,909 31,218

Contractors 40.00%

5,000 7,000 9,800 13,720 19,208

Total 14.64%

240,000 273,800 313,353 359,789 414,508

4.2 Service Business Analysis

The architecture business across the country is primarily made up of small- to mid-sized firms specializing in a particular architectural type. However, there are also a few large firms that have almost dominated the design of large commercial and industrial facilities. NW Architecture’s main competitors will be the larger firms because they have more capital to keep up with technological changes.

Strategy and Implementation Summary

In the first year, NW Architecture will focus on the bay area in California. As the firm grows, sales will expand throughout California and globally.

5.1 Sales Strategy

Sales in this business is a result of exceptional client service, based on the firm’s image and referrals. Providing a positive experience will encourage clients to refer and return for future work.

To develop effective business strategies, perform a SWOT analysis of your company using our free guide and template. Learn how to perform a SWOT analysis.

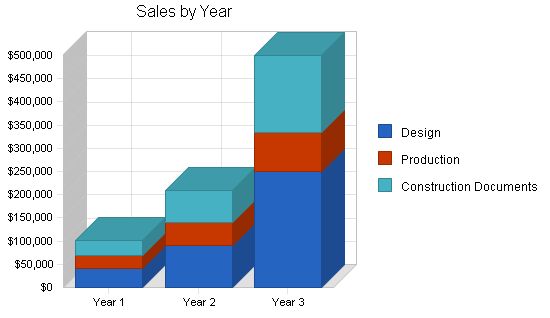

Sales are categorized into design, production, and construction. These categories comprise one architecture project. Totals for each project are based on a 10% cut from total construction costs. The table and chart below provide an overview of our forecast sales. Actual sales may vary based on project size and budget.

Sales Forecast:

[table]

[tr][td colspan="4" style="text-align: left"]Sales Forecast[/td][/tr]

[tr][td style="text-align: left"]Year 1[/td][td style="text-align: right"]Year 2[/td][td style="text-align: right"]Year 3[/td][/tr]

[tr][td style="text-align: left"]Sales[/td][td][/td][td][/td][td][/td][/tr]

[tr][td style="text-align: left"]Design[/td][td]$42,000[/td][td]$90,000[/td][td]$250,000[/td][/tr]

[tr][td style="text-align: left"]Production[/td][td]$26,000[/td][td]$50,000[/td][td]$85,000[/td][/tr]

[tr][td style="text-align: left"]Construction Documents[/td][td]$34,000[/td][td]$70,000[/td][td]$165,000[/td][/tr]

[tr][td style="text-align: left"]Total Sales[/td][td]$102,000[/td][td]$210,000[/td][td]$500,000[/td][/tr]

[tr][td][/td][td][/td][td][/td][td][/td][/tr]

[tr][td style="text-align: left"]Direct Cost of Sales[/td][td style="text-align: right"]Year 1[/td][td style="text-align: right"]Year 2[/td][td style="text-align: right"]Year 3[/td][/tr]

[tr][td style="text-align: left"]Design[/td][td]$500[/td][td]$500[/td][td]$1,000[/td][/tr]

[tr][td style="text-align: left"]Production[/td][td]$250[/td][td]$250[/td][td]$500[/td][/tr]

[tr][td style="text-align: left"]Construction Documents[/td][td]$500[/td][td]$500[/td][td]$1,000[/td][/tr]

[tr][td style="text-align: left"]Subtotal Direct Cost of Sales[/td][td]$1,250[/td][td]$1,250[/td][td]$2,500[/td][/tr]

[/table]

Competitive Edge:

The company will have a competitive edge over larger and smaller firms because it will be composed of a new generation of architects fluent in the digital world. Many firms today employ older architects who struggle with technology and can only design in 2-D.

Management Summary:

The company will start with one AutoCAD/Form-Z architect and the founder. In August of 2007, a clerical position will be added. By 2010, additional CAD/Form-Z architects will be hired to handle increased workloads.

Personnel Plan:

[table]

[tr][td colspan="4" style="text-align: left"]Personnel Plan[/td][/tr]

[tr][td][/td][td style="text-align: right"]Year 1[/td][td style="text-align: right"]Year 2[/td][td style="text-align: right"]Year 3[/td][/tr]

[tr][td style="text-align: left"]Nathan Sawyer[/td][td]$18,000[/td][td]$35,000[/td][td]$50,000[/td][/tr]

[tr][td style="text-align: left"]Clerical[/td][td]$12,000[/td][td]$25,200[/td][td]$26,000[/td][/tr]

[tr][td style="text-align: left"]CAD/Form-Z Designers[/td][td]$40,000[/td][td]$60,000[/td][td]$210,000[/td][/tr]

[tr][td style="text-align: left"]Total People[/td][td]4[/td][td]5[/td][td]7[/td][/tr]

[tr][td][/td][td][/td][td][/td][td][/td][/tr]

[tr][td style="text-align: left"]Total Payroll[/td][td]$70,000[/td][td]$120,200[/td][td]$286,000[/td][/tr]

[/table]

NW Architecture will invest in growth and technology as cash flow increases over the years. Additional funds will be allocated for consulting as needed.

Important Assumptions:

The assumptions in the following table are based on a stable economy. We will adjust these assumptions as changes occur in the turbulent Bay Area economy.

[table]

[tr][td colspan="4" style="text-align: left"]General Assumptions[/td][/tr]

[tr][td][/td][td style="text-align: right"]Year 1[/td][td style="text-align: right"]Year 2[/td][td style="text-align: right"]Year 3[/td][/tr]

[tr][td style="text-align: left"]Plan Month[/td][td style="text-align: right"]1[/td][td style="text-align: right"]2[/td][td style="text-align: right"]3[/td][/tr]

[tr][td style="text-align: left"]Current Interest Rate[/td][td]10.00%[/td][td]10.00%[/td][td]10.00%[/td][/tr]

[tr][td style="text-align: left"]Long-term Interest Rate[/td][td]10.00%[/td][td]10.00%[/td][td]10.00%[/td][/tr]

[tr][td style="text-align: left"]Tax Rate[/td][td]25.42%[/td][td]25.00%[/td][td]25.42%[/td][/tr]

[tr][td style="text-align: left"]Other[/td][td]0[/td][td]0[/td][td]0[/td][/tr]

[/table]

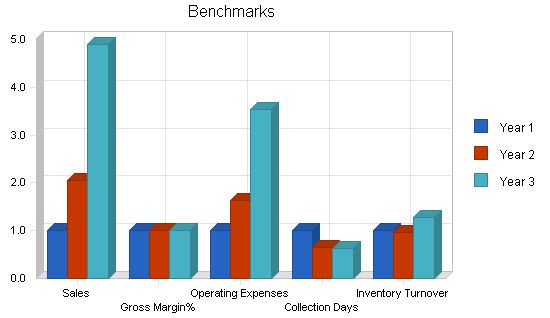

Key Financial Indicators:

The following chart shows the key financial indicators for the first three years.

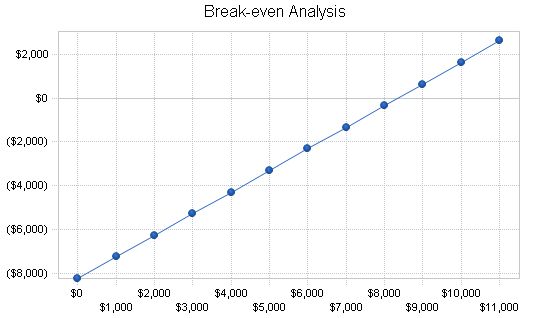

The chart and table summarize our break-even analysis.

Break-even Analysis

Monthly Revenue Break-even: $8,348

Assumptions:

Average Percent Variable Cost: 1%

Estimated Monthly Fixed Cost: $8,246

Projected Profit and Loss

Net profit is virtually nonexistent for the first two years of operation, with respectable increases after that time. Our projected profit and loss is shown on the following table, with sales starting at $102,000 for the first year and climbing to $500,000 the third year.

Pro Forma Profit and Loss

Year 1 Year 2 Year 3

Sales $102,000 $210,000 $500,000

Direct Cost of Sales $1,250 $1,250 $2,500

Other $0 $0 $0

Total Cost of Sales $1,250 $1,250 $2,500

Gross Margin $100,750 $208,750 $497,500

Gross Margin % 98.77% 99.40% 99.50%

Expenses

Payroll $70,000 $120,200 $286,000

Sales and Marketing and Other Expenses $8,200 $12,800 $34,500

Depreciation $0 $0 $0

Leased Equipment $1,440 $1,680 $1,920

Utilities $480 $620 $650

Insurance $1,800 $2,800 $3,500

Rent $17,030 $23,400 $23,400

Payroll Taxes $0 $0 $0

Other $0 $0 $0

Total Operating Expenses $98,950 $161,500 $349,970

Profit Before Interest and Taxes $1,800 $47,250 $147,530

EBITDA $1,800 $47,250 $147,530

Interest Expense $1,517 $1,097 $659

Taxes Incurred $374 $11,538 $37,330

Net Profit ($90) $34,615 $109,541

Net Profit/Sales -0.09% 16.48% 21.91%

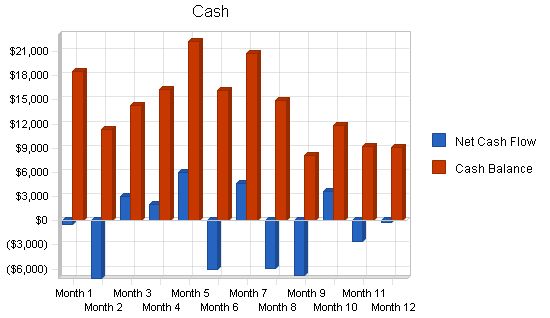

Projected Cash Flow

Cash flow is vital to the well being of this company because of the duration of payment. The following chart and table below show cash flow projections.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $0 | $0 | $0 |

| Cash from Receivables | $88,100 | $195,282 | $460,480 |

| Subtotal Cash from Operations | $88,100 | $195,282 | $460,480 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $6,000 | $0 | $0 |

| Subtotal Cash Received | $94,100 | $195,282 | $460,480 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $70,000 | $120,200 | $286,000 |

| Bill Payments | $29,684 | $53,805 | $101,097 |

| Subtotal Spent on Operations | $99,684 | $174,005 | $387,097 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $4,380 | $4,380 | $4,380 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $104,064 | $178,385 | $391,477 |

| Net Cash Flow | ($9,964) | $16,897 | $69,003 |

| Cash Balance | $9,036 | $25,932 | $94,936 |

7.6 Projected Balance Sheet

The following table shows our projected Balance Sheet and net worth over the next three years.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $9,036 | $25,932 | $94,936 |

| Accounts Receivable | $13,900 | $28,618 | $68,137 |

| Inventory | $750 | $750 | $1,500 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $23,686 | $55,300 | $164,573 |

| Long-term Assets | |||

| Long-term Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $23,686 | $55,300 | $164,573 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $3,156 | $4,536 | $8,647 |

| Current Borrowing | $13,160 | $8,780 | $4,400 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $16,316 | $13,316 | $13,047 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $16,316 | $13,316 | $13,047 |

| Paid-in Capital | $25,000 | $25,000 | $25,000 |

| Retained Earnings | ($17,540) | ($17,630) | $16,984 |

| Earnings | ($90) | $34,615 | $109,541 |

| Total Capital | $7,370 | $41,984 | $151,526 |

| Total Liabilities and Capital | $23,686 | $55,300 | $164,573 |

| Net Worth | $7,370 | $41,984 | $151,526 |

7.7 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 7383, Independent Artists (including Architects), are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 105.88% | 138.10% | 11.74% |

| Percent of Total Assets | ||||

| Accounts Receivable | 58.69% | 51.75% | 41.40% | 26.18% |

| Inventory | 3.17% | 1.36% | 0.91% | 3.42% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 50.14% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 79.74% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 20.26% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 68.89% | 24.08% | 7.93% | 35.02% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 21 |

| General Assumptions | ||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $8,000 | $5,000 | $12,000 | $2,000 | $14,000 | $5,000 | $7,000 | $16,000 | $9,000 | $10,000 | $3,000 | $11,000 | |

| Direct Cost of Sales | $100 | $50 | $200 | $50 | $200 | $100 | $50 | $150 | $100 | $50 | $100 | $100 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Total Cost of Sales | $100 | $50 | $200 | $50 | $200 | $100 | $50 | $150 | $100 | $50 | $100 | $100 | |

| Gross Margin | $7,900 | $4,950 | $11,800 | $1,950 | $13,800 | $4,900 | $6,950 | $15,850 | $8,900 | $9,950 | $2,900 | $10,900 | |

| Gross Margin % | 98.75% | 99.00% | 98.33% | 97.50% | 98.57% | 98.00% | 99.29% | 99.06% | 98.89% | 99.50% | 96.67% | 99.09% | |

| Expenses | |||||||||||||

| Payroll | $0 | $2,500 | $2,500 | $4,500 | $4,500 | $4,500 | $6,500 | $9,000 | $9,000 | $9,000 | $9,000 | $9,000 | |

| Sales and Marketing and Other Expenses | $350 | $350 | $1,350 | $350 | $350 | $1,350 | $350 | $350 | $1,350 | $350 | $350 | $1,350 | |

| Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Leased Equipment | $120 | $120 | $120 | $120 | $120 | $120 | $120 | $120 | $120 | $120 | $120 | $120 | |

| Utilities | $40 | $40 | $40 | $40 | $40 | $40 | $40 | $40 | $40 | $40 | $40 | $40 | |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!