The telecommunications revolution has arrived: Personal communications and unified messaging systems are at the forefront of this technological phenomenon. Dating from the 1984 deregulation of local and long distance telephone service, competition has accelerated and searched for every opportunity in the telecom products and services market for both consumers and businesses. Since then, mobile and cellular phones have become widely used, allowing communication anytime, anywhere in the world. Companies that have not anticipated or kept up with these changes are quickly left behind, as seen with Iridium. Financial muscle has been replaced by quality management, speed of execution, and depth of management as the final determinants in the marketplace. AT&T has realized this and brought in a technologically savvy CEO to drive necessary changes, while Iridium did not and paid the price.

TeleSpace is in a strong position to become the market leader in personal communications and unified messaging. With the rise of multiple phone and fax numbers, pagers, and email for businesses and consumers, they now demand simplicity and speed: One identifier for their complex lives that will reach them anywhere and deliver their communications. This is where MyLine comes in.

MyLine has been an operating system for over five years and has a small, loyal customer base. The technology is clean, elegant, and maintainable. However, MyLine has seen limited success due to poor engineering and marketing decisions. It was marketed like the pocket knife in early TV ads: heavy and burdened with unnecessary features. Consumers realized the product was flawed before even using it.

Internal market research has identified the consumer’s wants and needs, and MyLine fulfills them. There are five primary target markets, three of which will be discussed below. First, the businessmen and consumers who simply want to receive phone calls no matter where they are. MyLine ensures they can always be reached, whether in the office, car, plane, or on the golf course. Second, the Soccer/Sports Moms who are always on the move. Our toll-free number, 800 MyLine, allows them to stay reachable. Lastly, the military market, which requires mobile, reliable, and confidential communications. MyLine is well-prepared to cater to their needs.

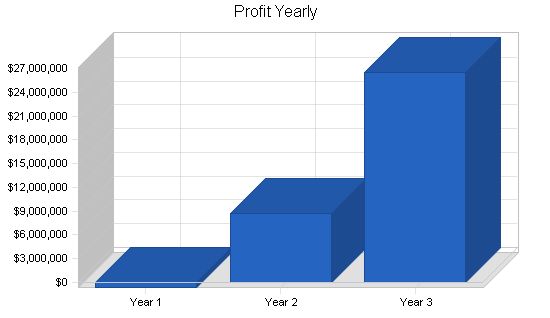

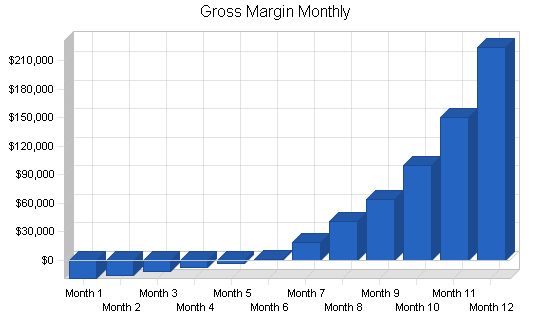

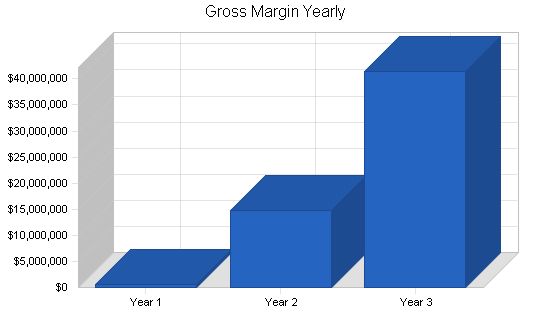

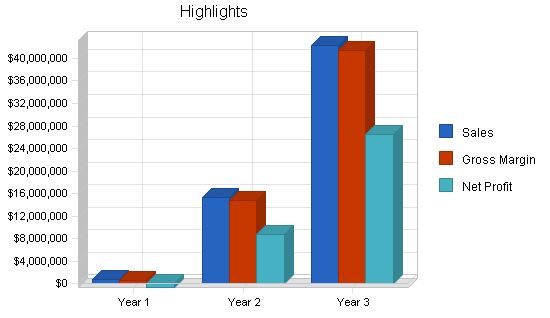

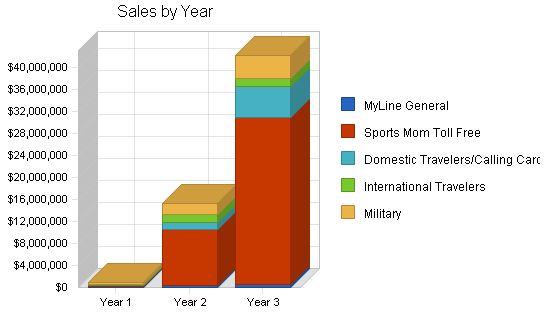

The overall telecommunications market exceeds $200 billion. The personal communications and unified messaging sub-industry, with its vast user base, is challenging to estimate at this stage. Management predicts sales of about $40 million in the third year, with monthly sales reaching $5 million by the end of that year. However, even with these projected sales, MyLine would only capture a one percent market share. To become the market leader, a five to ten percent market share within five years is the goal for Management.

1.1 Objectives

TeleSpace aims to become the market leader in personal communications and unified messaging products and services within five years. They also strive to be the lowest cost provider and have the best customer service by year-end Year 1.

1.2 Mission

MyLine is already the most technologically-superior personal communications system globally. TeleSpace plans to leverage MyLine’s brand and technical reputation to become the market leader in personal and business communications, as well as unified messaging systems within five years.

1.3 Keys to Success

TeleSpace’s success relies on three factors:

1. Marketing must generate sufficient sales volume to drive an aggressive pricing model while achieving planned profitability projections.

2. Strategic partners must be found to private label MyLine and promote it through their distribution channels.

3. Equity capital must be secured at a reasonable valuation.

TeleSpace, Inc. develops and markets programmable personal communications and unified messaging services for individuals and businesses. The company operates as a wholly-owned subsidiary of AmericomUSA, Inc., a public reporting company. TeleSpace management has proposed a leveraged buyout of the company from Americom, including the purchase of 81% of TeleSpace common stock and an option to acquire an additional 10% within two years. The management expects to finalize the negotiation by the end of October, Year 1, and pursue equity capital for the acquisition and ongoing operations.

2.1 Company Ownership

TeleSpace, Inc. is a wholly-owned subsidiary of AmericomUSA, Inc., where Mr. Robert Cezar, Chief Executive Officer of AmericomUSA, Inc., owns approximately 58% of the common stock.

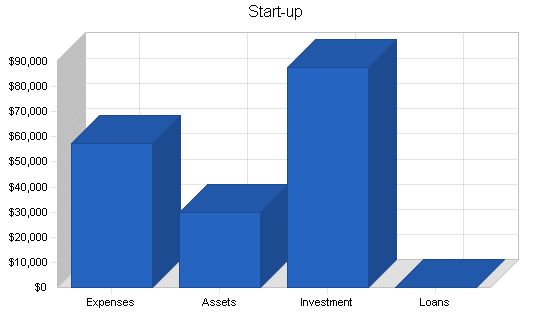

2.2 Start-up Summary

Start-up costs, excluding salaries, primarily consist of legal fees, marketing collateral, advertising, and consulting fees. These costs are financed by the parent company, AmericomUSA.

Start-up Funding

Start-up Expenses: $57,500

Start-up Assets: $30,000

Total Funding Required: $87,500

Assets

Non-cash Assets from Start-up: $30,000

Cash Requirements from Start-up: $0

Additional Cash Raised: $0

Cash Balance on Starting Date: $0

Total Assets: $30,000

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $0

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $0

Capital

Planned Investment

Americom USA: $87,500

Other: $0

Additional Investment Requirement: $0

Total Planned Investment: $87,500

Loss at Start-up (Start-up Expenses): ($57,500)

Total Capital: $30,000

Total Capital and Liabilities: $30,000

Total Funding: $87,500

Start-up

Requirements

Start-up Expenses

Legal: $5,000

Stationery etc.: $2,500

Brochures: $5,000

Consultants: $10,000

Advertising: $20,000

Expensed equipment: $5,000

Other: $10,000

Total Start-up Expenses: $57,500

Start-up Assets

Cash Required: $0

Start-up Inventory: $20,000

Other Current Assets: $10,000

Long-term Assets: $0

Total Assets: $30,000

Total Requirements: $87,500

2.3 Company Locations and Facilities

TeleSpace corporate offices are located in Arroyo Grande, CA. Existing space of 900 square feet is adequate for existing staff, but new facilities have to be leased when sales representatives are hired.

Products and Services

TeleSpace, Inc. develops and markets programmable personal communications and unified messaging services for individuals and businesses. The MyLine system can best be described as a personal communications platform, a remotely programmable "telocation" service which allows the user to access MyLine services from any telephone device or personal computer anywhere in the world.

3.1 Product and Service Description

The MyLine system can best be described as a personal communications platform, a remotely programmable "telocation" service which allows the user to access MyLine services from any telephone device or personal computer anywhere in the world. MyLine is a virtual telephone number which allows the user to control inbound telephone, fax, and data calls and receive them anywhere, but only on demand. MyLine is the only telephone number users will ever need. They receive every telephone call, fax, or email sent to their MyLine number in real time or stored for later use. Or they can screen and elect not to receive any particular communication, delete or divert for later handling. MyLine includes a proprietary security system to prevent unauthorized access and has real-time billing and accounting capabilities. The latter can generate comprehensive billing records by project and/or general ledger account.

3.2 Sales Literature

Initial radio and Internet ads and sales collateral will be developed by the company’s marketing, advertising, and public relations agency in Silicon Valley. This is a well-known firm specializing in high-tech clients.

3.3 Competitive Comparison

In 1992, AT&T launched their Easy Reach service which signified the need for a universal telocation virtual number and thus found immediate acceptance. MCI reacted by introducing its Personal 800 Follow Me Service. These services today require users to subscribe to their networks, lack a broad range of integrated services, and offer limited remote control capability.

There is one striking difference between MyLine and competing technologies: The competition has not integrated all means of communication. Some offer voice mail and follow me technology, others offer this, and other features, on a piece meal basis, not totally integrated. MyLine is the only totally integrated voice, fax, data, and email system on the market.

3.4 Fulfillment

The company now maintains its servers locally for supporting MyLine. As volume grows, management plans to co-locate at Above.Net’s facilities in San Jose, CA. A strategic marketing partner will also be sought, especially for the toll-free, 800 number.

3.5 Technology

The MyLine hardware platform is a state-of-the-art digital industry standard, and its design provides unique redundancy and flexibility. The MyLine system places the user on an electronic highway of digital call processing, operating on a Novell Local Area Network (LAN), integrating computer and telephone information into computer telephony technology. The LAN is connected to the Public Switch Network with the capability of using the ISDN/DSL features provided by the long distance carriers.

MyLine users have a personal communications exchange as a zero-blocking private global network providing voice, fax, and data transfer between themselves and any other MyLine or non-MyLine user. MyLine overlays and utilizes the Public Switched Telephone Network (PSTN) or the Public Switched Data Network, providing access to anyone with a MyLine number. The network routes all incoming and outgoing requests and data to a central hub for distribution to external routers, the Internet if needed, or delivers the request directly to local destinations.

The MyLine switching center provides the telephonic connection to the PSTN, which the network utilizes as its gateway. The MyLine system utilizes a Novell Netware Global Messaging Service which operates on Novell Netware file servers, providing a standardized platform and format for global message distribution to other Novell Netware servers, compatible applications and Internet addresses. Thus, access to the MyLine system is virtually unlimited. All communications within the network are encrypted, either with public/private key algorithms or with the proprietary MyLine rotational encryption algorithms.

3.6 Future Products and Services

MyLine features include:

– Call forwarding.

– Selective call screening.

– Automatic callback.

– Wake-up services.

– Conference calling.

– Call waiting.

– Call conferencing (integrating call waiting and conferencing).

– Voice messaging.

– Paging.

– Real-time billing/accounting.

– Information on demand.

– Number referral.

– Fax store and forward.

– Email.

Market Analysis Summary

Dun and Bradstreet estimates that 1999 sales of the U.S. telecommunications market will be over $150 billion, of which the personal communications and unified messaging market is three percent, or $4 billion. If the company can achieve a one percent market share within three years, its sales would be $40 million in a market growing eight percent per year. These estimates are conservative, given the accelerating growth rate of telecommunications and unified messaging in particular. There is ample space for the company, and many competitors, in this huge and fast-growing marketplace.

4.1 Market Segmentation

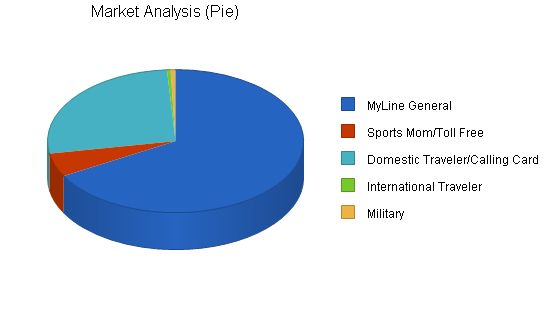

TeleSpace has targeted five primary market segments:

1. General consumer and business market.

2. Sports Mom toll-free.

3. Domestic Traveler/Calling Card.

4. International Traveler.

5. Military.

Market Analysis

Year 1 Year 2 Year 3 Year 4 Year 5

Potential Customers Growth CAGR

MyLine General 6% 150 159 169 179 190 6.09%

Sports Mom/Toll Free 9% 12 13 14 15 16 7.46%

Domestic Traveler/Calling Card 12% 60 67 75 84 94 11.88%

International Traveler 2% 1 1 1 1 1 0.00%

Military 0% 1 1 1 1 1 -8.07%

Total 7.71% 224 241 260 280 302 7.71%

4.2 Target Market Segment Strategy

The company will market its products to customer segments that require basic mobile telecommunication services in a single solution. Features will be tailored to each segment. The company will focus on determining the most attractive features for each segment and offering customized quality products at competitive prices.

4.2.1 Market Needs

All target segments seek reliable and easy-to-use communications. Feature preferences vary between segments. ‘Soccer moms’ in need of ‘always on’ accessibility desire a permanent 800 number. Business travelers desire a universal communications portal. TeleSpace will tailor its offerings to each segment.

4.3 Service Business Analysis

TeleSpace is part of the telecommunications industry, which includes national and international carriers, regional operating companies, competitive local exchange carriers, resellers, and unified messaging and personal communications service providers like TeleSpace.

4.3.1 Business Participants

The personal telecommunications and unified messaging system sub-industry is a new, technology-driven industry with high growth and many competitors. Industry sales should continue to accelerate as consumers learn the benefits of personal phone numbers. Industry leaders include AT&T, Excel Communications, Inc., Linx Communications, Inc., Nextel Communications, Inc., Sprint PCS, and Voice Mobility, Inc.

4.3.2 Competition and Buying Patterns

Price, accessibility, and ease of use are the primary buying factors. Brand loyalty is significant. MyLine has a technological lead and a superior management team. The primary competition includes Nextel, Linx Communications, and other well-branded companies. The marketplace is large enough to support all competitors.

4.3.3 Main Competitors

Competitors include Webley Systems, StarTouch International, Ltd., Nextel Communications, Inc., Linx Communications, Inc., and JFAX.COM. Each offers unique features and services.

Strategy and Implementation Summary

MyLine offers a wide range of features. Management will focus on key features that appeal to the target market and aggressively market them. Emphasis will be placed on speed in penetrating markets, implementing campaigns, and adjusting marketing as needed. Cost control and brand management are critical.

5.1 Competitive Edge

TeleSpace has a technological lead over major competitors with its seamless integration of voice, fax, and data communications. The management team has decades of experience in the telecommunications industry.

The strategy will focus on segmenting markets and tailoring the MyLine feature set to each market. The marketing message will be simple and focused on core features.

5.2.1 Promotion Strategy

A marketing firm will coordinate marketing, advertising, and promotion. Focus groups will determine the best feature set and pricing for MyLine.

5.2.2 Pricing Strategy

TeleSpace will have the lowest cost structure in the industry and premium pricing based on its rich feature set and quality service. Pricing will match significant competitors.

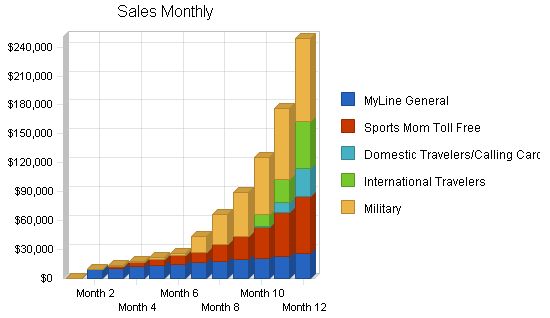

5.3 Sales Strategy

Sales strategies will vary depending on the target market. Sales forecasts predict high growth and competition in the industry.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| MyLine General | $183,000 | $420,000 | $635,000 |

| Sports Mom Toll Free | $210,000 | $10,100,000 | $30,300,000 |

| Domestic Travelers/Calling Cards | $42,550 | $1,300,000 | $5,600,000 |

| International Travelers | $84,000 | $1,400,000 | $1,500,000 |

| Military | $317,800 | $2,100,000 | $4,200,000 |

| Total Sales | $837,350 | $15,320,000 | $42,235,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| MyLine General | $0 | $0 | $0 |

| Sports Mom Toll Free | $0 | $0 | $0 |

| Domestic Travelers/Calling Cards | $0 | $0 | $0 |

| International Travelers | $0 | $0 | $0 |

| Military | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $0 | $0 | $0 |

Contents

5.3.2 Sales Programs

TeleSpace will utilize five primary sales programs:

- Direct Sales: This will be done by the CEO, Director of Marketing and Sales Channel Managers, all of whom have extensive contacts in the industry and have already been invited by several key prospects to present MyLine and other company services.

- Radio advertising: This will be the main entree to the consumer market, which the company will approach on a target market basis. Personal endorsements by celebrities will be emphasized.

- Print advertising: This will be used primarily for MyLine and placed in magazines and newspapers targeted to amateur sports and military officers and enlisted personnel, probably with endorsements by our contracted endorsers.

- Trade shows: Will be used to promote MyLine, mostly to businesses, CLECs, and small carriers.

- Web advertising: The company is now developing ads to be run on customer websites of its sister company, AdCast, Inc., which markets advertising delivery systems for the Internet.

5.4 Milestones

The following table lists important corporate milestones, with completion dates, budgets and responsible executive for each. This milestone schedule indicates our emphasis on planning for implementation.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Retain IBW Company | 11/1/1999 | 11/1/1999 | $10,000 | Matt | Sales |

| Set up focus group program | 12/1/1999 | 12/1/1999 | $10,000 | Matt | Marketing |

| Secure equity funding | 12/31/1999 | 12/31/1999 | $50,000 | Phil | Finance |

| Hire initial employees | 1/1/2000 | 1/1/2000 | $1,000 | Betty | Admin |

| Complete trade secrets/patent review | 1/1/2000 | 1/1/2000 | $5,000 | Trone | Corporate |

| Implement advertising program | 11/15/1999 | 11/15/1999 | $20,000 | Matt | Marketing |

| Retain Rob Dunaway | 9/1/1999 | 9/1/1999 | $5,000 | Phil | Corporate |

| Retain Alliance Ventures Group | 11/15/1999 | 11/15/1999 | $0 | Phil | Corporate |

| Secure/equip MyLine network | 9/15/1999 | 9/15/1999 | $1,000 | Russ | Operations |

| Finalize buyout agreement | 10/31/1999 | 10/31/1999 | $0 | Trone | Corporate |

| Close strategic investor | 12/15/1999 | 12/15/1999 | $0 | Phil | Corporate |

| Complete MyLine 2000 | 7/1/2000 | 7/1/2000 | $0 | Russ | Corporate |

| Other | 1/1/2000 | 1/1/2000 | $0 | ABC | Department |

| Totals | $102,000 | ||||

Management Summary

TeleSpace’s management philosophy is to outsource all non-critical corporate functions and focus on building a telecommunications marketing and sales internal team, accelerating MyLine sales penetration into target markets, and completing the MyLine 2000 upgrade.

The company currently has four executives and will hire a Sales Channel Manager in January, 2000.

6.1 Organizational Structure

TeleSpace is organized into three primary functional disciplines: Marketing and sales, operations and product development, and finance and administration. Each is managed by a senior executive who reports to the Chief Executive Officer.

TeleSpace, Inc. is a wholly-owned subsidiary of AmericomUSA, Inc., a public reporting company. Upon completion of the management buyout, the current board of directors will be replaced by Trone Miller, Chairman and CEO, Phil ErkenBrack, CFO, and an investor representative.

6.2 Management Team

Mr. Trone Miller is the founding Chairman and CEO of TeleSpace.

Mr. Phillip ErkenBrack, Jr. is the CFO, Director, and co-founder.

Mr. Russell Rish is the Vice President of Operations.

Mr. Matthew van Steenwyk is the Vice President of Marketing and Business Development.

6.3 Management Team Gaps

The company will hire a Sales Channel Manager in the near term, completing the management team for the first year.

6.4 Personnel Plan

The company currently has four executives and will hire a Sales Channel Manager shortly. Two sales representatives will be hired after the advertising program starts, completing the hiring for the first year.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Production Personnel | |||

| VP of Operations – Russ Fish | $78,400 | $100,000 | $130,000 |

| Sr. Systems Engineer – Dana Gilliam | $54,400 | $65,000 | $75,000 |

| Systems Engineer – David Gabler | $45,600 | $55,000 | $60,000 |

| Subtotal | $178,400 | $220,000 | $265,000 |

| Sales and Marketing Personnel | |||

| VP of Mkg. & Bus. Dev’t – M. van Steenwyk | $78,000 | $100,000 | $130,000 |

| Sales Channel Managers | $40,000 | $120,000 | $150,000 |

| Resource Analyst – Amber Higgins | $36,975 | $45,000 | $50,000 |

| Account Manager – Brenda Thomasi | $36,375 | $45,000 | $50,000 |

| Sales Representatives | $12,500 | $230,000 | $550,000 |

| Subtotal | $203,850 | $540,000 | $930,000 |

| General and Administrative Personnel | |||

| CEO – Trone Miller | $112,998 | $150,000 | $180,000 |

| CFO – Phil ErkenBrack | $103,002 | $130,000 | $150,000 |

| Controller | $0 | $60,000 | $70,000 |

| Billing Supervisor – Hector Padilla | $43,500 | $50,000 | $55,000 |

| Accountants | $26,000 | $150,000 | $300,000 |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Production Personnel | |||||||||||||

| VP of Operations – Russ Fish | $1,400 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | |

| Sr. Systems Engineer – Dana Gilliam | $4,200 | $4,200 | $4,600 | $4,600 | $4,600 | $4,600 | $4,600 | $4,600 | $4,600 | $4,600 | $4,600 | $4,600 | |

| Systems Engineer – David Gabler | $3,800 | $3,800 | $3,800 | $3,800 | $3,800 | $3,800 | $3,800 | $3,800 | $3,800 | $3,800 | $3,800 | $3,800 | |

| Subtotal | $9,400 | $15,000 | $15,400 | $15,400 | $15,400 | $15,400 | $15,400 | $15,400 | $15,400 | $15,400 | $15,400 | $15,400 | |

| Sales and Marketing Personnel | |||||||||||||

| VP of Mkg. & Bus.Dev’t – M. van Steenwyk | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | |

| Sales Channel Managers | $0 | $0 | $0 | $0 | $0 | $0 | $2,500 | $5,000 | $7,500 | $7,500 | $7,500 | $10,000 | |

| Resource Analyst – Amber Higgins | $2,600 | $3,125 | $3,125 | $3,125 | $3,125 | $3,125 | $3,125 | $3,125 | $3,125 | $3,125 | $3,125 | $3,125 | |

| Account Manager – Brenda Thomasi | $2,000 | $3,125 | $3,125 | $3,125 | $3,125 | $3,125 | $3,125 | $3,125 | $3,125 | $3,125 | $3,125 | $3,125 | |

| Sales Representatives | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $2,500 | $5,000 | $5,000 | |

| Subtotal | $10,600 | $12,250 | $12,250 | $12,250 | $12,250 | $12,250 | $15,750 | $18,250 | $20,750 | $23,250 | $25,750 | $28,250 | |

| General and Administrative Personnel | |||||||||||||

| CEO – Trone Miller | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $10,833 | $10,833 | $10,833 | $10,833 | $10,833 | $10,833 | |

| CFO – Phil ErkenBrack | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $9,167 | $9,167 | $9,167 | $9,167 | $9,167 | $9,167 | |

| Controller | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Billing Supervisor – Hector Padilla | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $4,000 | $4,000 | $4,000 | |

| Accountants | $0 | $0 | $0 | $0 | $0 | $0 | $2,000 | $4,000 | $4,000 | $4,000 | $6,000 | $6,000 | |

| Administration Manager – Betty Benedix | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,500 | $3,500 | |

| Asst. Manager | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $1,000 | $2,000 | $2,000 | $2,000 | $2,000 | |

| Receptionist | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $900 | $900 | $900 | $900 | $900 | |

| Human Resources Clerk | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal | $22,500 | $22,500 | $22,500 | $22,500 | $22,500 | $22,500 | $28,500 | $32,400 | $33,400 | $33,900 | $36,400 | $36,400 | |

| Other Personnel | Pro Forma Cash Flow | ||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $0 | $450 | $665 | $880 | $1,095 | $1,310 | $2,190 | $3,315 | $4,440 | $6,258 | $8,795 | $12,470 | |

| Cash from Receivables | $0 | $0 | $285 | $8,686 | $12,771 | $16,856 | $20,941 | $25,447 | $42,323 | $63,698 | $85,511 | $120,500 | |

| Subtotal Cash from Operations | $0 | $450 | $950 | $9,566 | $13,866 | $18,166 | $23,131 | $28,762 | $46,763 | $69,955 | $94,306 | $132,970 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Current Borrowing | $75,000 | $100,000 | $75,000 | $100,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $250,000 | $250,000 | $0 | $250,000 | $250,000 | $0 | $250,000 | $0 | |

| Subtotal Cash Received | $75,000 | $100,450 | $75,950 | $109,566 | $263,866 | $268,166 | $23,131 | $278,762 | $296,763 | $69,955 | $344,306 | $132,970 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $42,500 | $49,750 | $50,150 | $50,150 | $50,150 | $50,150 | $59,650 | $66,050 | $69,550 | $72,550 | $77,550 | $80,050 | |

| Bill Payments | $830 | $24,981 | $27,337 | $27,933 | $29,130 | $43,989 | $45,953 | $105,789 | $87,964 | $107,140 | $83,287 | $76,226 | |

| Subtotal Spent on Operations | $43,330 | $74,731 | $77,487 | $78,083 | $79,280 | $94,139 | $105,603 | $171,839 | $157,514 | $179,690 | $160,837 | $156,277 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $10,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | $15,000 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $45,000 | $45,000 | $45,000 | $45,000 | $45,000 | $45,000 | $45,000 | $45,000 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $ “> | |||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!