Contents

Custom Jewelry Business Plan

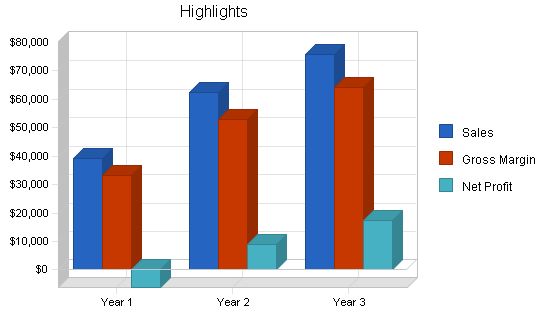

Contemporary Ti Design is a designer and manufacturer of unique titanium jewelry. They create various designs in the form of earrings, pins, and pendants. Every product is designed and manufactured by Steve Artificer. To achieve market penetration and growth, the company has set the following marketing/production goals for the next three years:

- Utilize Contemporary’s designs in at least 40 different galleries.

- Increase the number of designs offered by 8% annually.

The Company

Located in Hood River, OR, Contemporary Ti Design is a custom manufacturer of titanium jewelry. They offer a wide range of jewelry, including pendants, pins, and earrings. All items are handcrafted by Steve Artificer, who operates the business from his home. Steve sells his products directly through his website and selected galleries and art shows. By month eight, he plans to hire a sales representative to manage customer interactions.

The Market

The jewelry industry is highly competitive, with many artisans vying for distribution contracts and recognition. Some artisans focus on local distribution, while others have established national systems. Some designers create products for large companies to manufacture, while others personally design and produce their pieces. Contemporary Ti faces competition in the following forms:

- Artists who have their designs mass-produced and distributed nationally.

- Companies that handle all aspects in-house, including design, marketing, and wholesaling.

- Artists like Steve, who design and create their own pieces, and handle wholesale or retail themselves.

Contemporary Ti Design will target two customer groups: end consumers and galleries as distribution channels. Steve will interact with end consumers through his website and personal contact at exhibitions and shows. Galleries, such as museum shops and jewelry stores, will also be approached during these events.

Financial Considerations

Contemporary Ti Design will be funded solely through equity capital provided by Steve Artificer. The company expects to reach the break-even point within the first year. Conservative projections indicate an annual revenue of $75,000 by Year 3. The company anticipates maintaining a healthy cash account.

1.1 Objectives

The first three years of operation objectives:

- Create a jewelry manufacturing company to exceed customer’s expectations.

- Utilize Contemporary’s designs in at least 40 galleries.

- Increase the number of designs offered by 8% annually.

- Develop a profitable/sustainable home-based company.

1.2 Mission

Contemporary Ti Design’s mission is to create innovative titanium jewelry art. We exist to attract and retain customers. When we adhere to this maxim, everything else will fall in place. Our services will exceed customer expectations.

Company Summary

Contemporary Ti Design, located in Hood River, OR, is a custom titanium jewelry manufacturer. Contemporary Ti Design offers a wide range of jewelry, including pendants and pins. All pieces are made by Steve Artificer, who sells them directly through his website, as well as selected galleries and art shows.

The business will operate from Steve’s home.

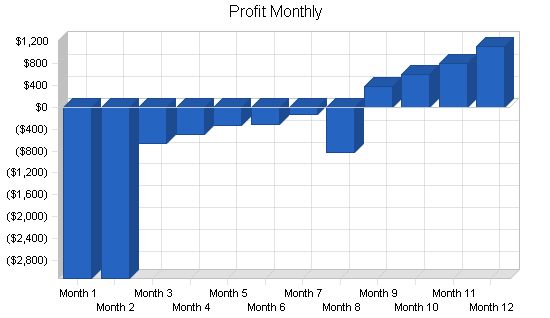

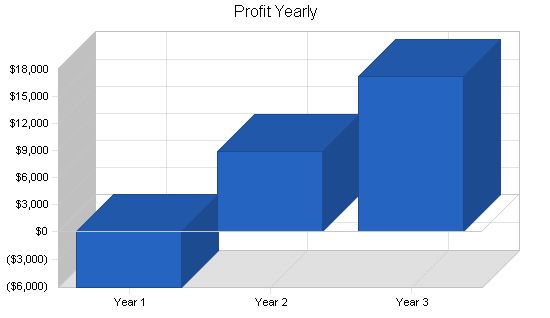

If the company follows its plan, profitability will be achieved in month nine, with a projected profit of $17,000 by year three.

2.1 Company Ownership

Contemporary Ti Design is a sole proprietorship owned by Steve Artificer. The advantage of incorporation, which generally eliminates personal liability, is of little concern.

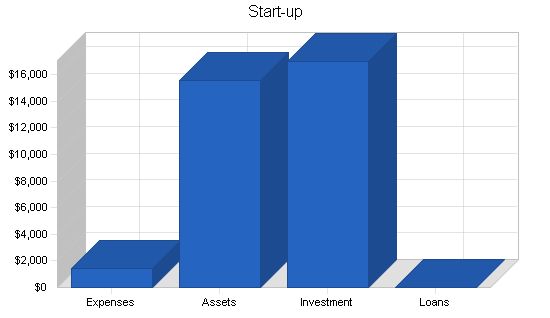

2.2 Start-up Summary

Contemporary Ti Design’s start-up costs will include the following equipment for the home-based business:

- Legal fees.

- Website creation fees.

- Home office furniture (desk, file cabinet, chairs).

- Computer (including printer, CD-RW).

- DSL hookup.

- Copier and fax machine.

- Extra land phone line.

- Cutting tools.

- Raw materials (titanium sheet and wire).

- Anodizing equipment.

Start-up Requirements:

– Legal: $500

– Stationery etc.: $150

– Website Development: $500

– DSL Set-up: $100

– Titanium Sheet: $200

– Other: $0

– Total Start-up Expenses: $1,450

Start-up Assets:

– Cash Required: $12,750

– Start-up Inventory: $0

– Other Current Assets: $0

– Long-term Assets: $2,800

– Total Assets: $15,550

Total Requirements: $17,000

Start-up Funding:

– Start-up Expenses to Fund: $1,450

– Start-up Assets to Fund: $15,550

– Total Funding Required: $17,000

Assets:

– Non-cash Assets from Start-up: $2,800

– Cash Requirements from Start-up: $12,750

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $12,750

– Total Assets: $15,550

Liabilities and Capital:

– Liabilities: $0

– Capital:

– Planned Investment:

– Steve: $17,000

– Investor 2: $0

– Other: $0

– Additional Investment Requirement: $0

– Total Planned Investment: $17,000

– Loss at Start-up (Start-up Expenses): ($1,450)

– Total Capital: $15,550

– Total Capital and Liabilities: $15,550

– Total Funding: $17,000

Products:

Contemporary Ti Design manufactures titanium jewelry, including pendants and pins. All products are made of titanium and designed by Steve. Titanium was chosen for its unique characteristics as it is stronger than steel yet similar in weight to aluminum, as well as being inert and hypoallergenic.

Most of the jewelry is left unfinished, showcasing the natural grey color of titanium. Some pieces are anodized to add a range of colors. Anodizing is achieved through immersing the titanium in electrically charged water or connecting it to a power source, resulting in the formation of a colorful oxide film on the surface.

Contemporary Ti Design’s pieces are made from titanium sheets, which are cut using a saw blade. The interior is cut by piercing a small hole and inserting a saw blade. The pieces are then held together with rivets by drilling small holes and inserting a wire. Rivets not only serve a functional purpose but also enhance the overall aesthetic of the piece.

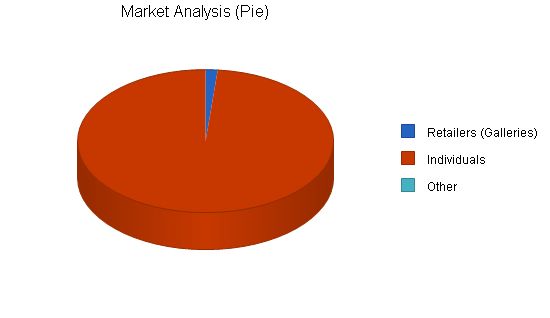

Market Analysis Summary:

Contemporary Ti Design targets two customer groups: galleries and individuals. Galleries purchase jewelry wholesale in quantity to resell to the public, including private galleries, artisan jewelry shops, and museum stores. These buyers are attracted to Contemporary’s work due to its upscale and modern appeal, favoring progressive and industrial design.

Individual buyers are familiar with Contemporary Ti Design through various channels, such as the website, art showings, word of mouth, etc. They order directly from the company through the website, phone, fax, or mail. Margins for individual sales are higher since there is no distribution layer involved. Individuals who appreciate this type of art tend to be progressive city dwellers, drawn to the intricate and organic shapes of Contemporary Ti Design pieces.

Market Analysis

Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Potential Customers Growth

Retailers (Galleries) 7% 2,525 2,702 2,891 3,093 3,310 7.00%

Individuals 9% 165,475 180,368 196,601 214,295 233,582 9.00%

Other 0% 0 0 0 0 0 0.00%

Total 8.97% 168,000 183,070 199,492 217,388 236,892 8.97%

4.2 Target Market Segment Strategy

Contemporary Ti Design targets galleries and individuals as their primary customers for jewelry purchases. Galleries usually purchase art pieces from multiple artists. They come into contact with Contemporary through exhibitions or when contacted by Steve (or a sales representative). If there is interest, the gallery will place an order and may establish a long-term relationship to reorder and broaden their product offering.

Contemporary also targets individuals through exhibitions and referrals. Individuals can make purchases on the website or find nearby galleries that carry Contemporary’s pieces.

The jewelry industry, including the broader art industry, is diverse and extensive. There are countless artisans producing various pieces of work. Artists from every state manufacture products, selling to department stores, galleries, websites, and through personal sales.

4.3.1 Competition and Buying Patterns

The jewelry industry is composed of countless individuals who work and distribute locally or have national distribution systems. Some artists design for larger companies, while others design and make their pieces. The competition can be categorized into artists who work with larger companies, companies with in-house designers, and artists like Steve who handle the entire process themselves.

Consumers’ buying patterns typically involve gift purchases or impulse purchases. Gifts are bought when someone sees an art piece and decides to purchase it. Impulse purchases occur when someone is shopping and falls in love with an item, buying it on the spot. Additionally, some individuals may come across a piece of jewelry while looking for an accessory to match an outfit.

Strategy and Implementation Summary

Contemporary Ti Design, owned by Steve Artificer, is known for its unique and creative designs, giving them a competitive edge. Using this edge, Steve initially sells his art through shows, exhibitions, and strategic relationships with retail outlets. By the end of year one, he plans to hire a sales representative to handle exhibitions and retailers.

5.1 Competitive Edge

Contemporary Ti Design’s competitive edge lies in the creative, unusual designs of their jewelry. While others may replicate this strategy, creative designs require skill. Steve’s expertise and skill make his pieces stand out from most jewelry.

5.2 Sales Strategy

Contemporary Ti Design aims to have their products available in a wide range of galleries. They achieve this through attending shows and exhibitions where both end consumers and gallery buyers attend. Another method is traveling to different galleries and personally showing them the pieces. Additionally, consumers can view and purchase the entire collection on the website.

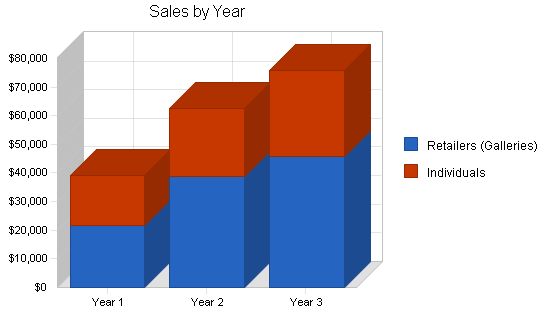

5.2.1 Sales Forecast

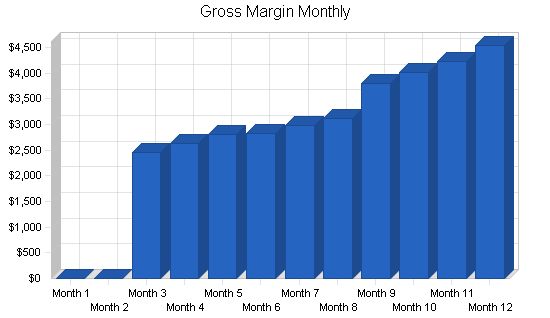

The first month focuses on setting up the workspace and building inventory. The second month involves visiting galleries to establish distribution channels. Sales activity begins in the third month, increasing incrementally over time. Steve will spend about one week per month traveling to galleries and exhibits until month eight when a sales representative will be hired. Month eight will mark a larger increase in sales.

Sales Forecast:

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Retailers (Galleries) | $21,593 | $38,874 | $45,785 |

| Individuals | $17,708 | $23,545 | $29,874 |

| Total Sales | $39,301 | $62,419 | $75,659 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Retailers (Galleries) | $3,239 | $5,831 | $6,868 |

| Individuals | $2,656 | $3,532 | $4,481 |

| Subtotal Direct Cost of Sales | $5,895 | $9,363 | $11,349 |

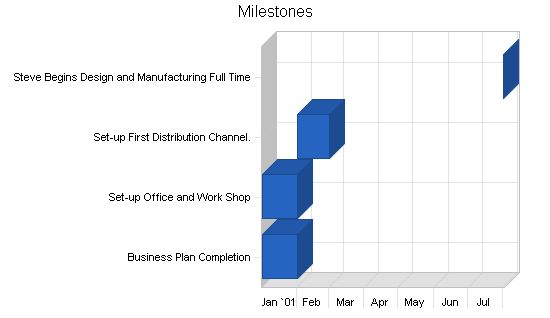

5.3 Milestones

Contemporary Ti Design will have several milestones early on:

- Business plan completion. This will be done as a roadmap for the organization. While we do not need a business plan to raise capital, it will be an indispensable tool for the ongoing performance and improvement of the company.

- Set up office and workshop.

- Set up the first distribution channel.

- Steve begins design and manufacturing full time.

Milestones:

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business Plan Completion | 1/1/2001 | 2/1/2001 | $0 | ABC | Marketing |

| Set-up Office and Work Shop | 1/1/2001 | 2/1/2001 | $1,450 | ABC | Department |

| Set-up First Distribution Channel. | 2/1/2001 | 3/1/2001 | $600 | ABC | Department |

| Steve Begins Design and Manufacturing Full Time | 8/1/2001 | 8/1/2001 | $0 | ABC | Department |

| Totals | $2,050 | ||||

Management Summary

Contemporary Ti Design is owned and operated by Steve Artificer, who has a passion for art and design. He pursued an undergraduate degree in graphic design from the Cleveland Institute of Art, where he gained experience in various design work. To further his skills, Steve pursued a Masters in product design from Iowa State University, where he discovered his interest in titanium. Steve decided to start his own jewelry design and manufacturing studio, specializing in titanium, and relocated to Hood River, OR.

6.1 Personnel Plan

For the first eight months, Steve will handle multiple roles as the designer, manufacturer, and salesperson for the jewelry. He plans to hire an independent sales representative to take over the sales and marketing responsibilities.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Steve | $24,000 | $24,000 | $24,000 |

| Independent Sales Representative | $3,500 | $8,400 | $8,400 |

| Total People | 2 | 2 | 2 |

| Total Payroll | $27,500 | $32,400 | $32,400 |

Financial Plan

Here are the important financial sections.

7.1 Important Assumptions

These are the key financial assumptions for Contemporary Ti Design.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 25.42% | 25.00% | 25.42% |

| Other | 0 | 0 | 0 |

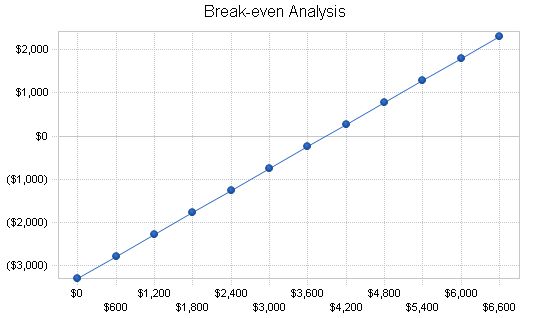

7.2 Break-even Analysis

Here is the Break-even Analysis for Contemporary Ti Design.

Break-even Analysis

Monthly Revenue Break-even: $3,879

Assumptions:

– Average Percent Variable Cost: 15%

– Estimated Monthly Fixed Cost: $3,297

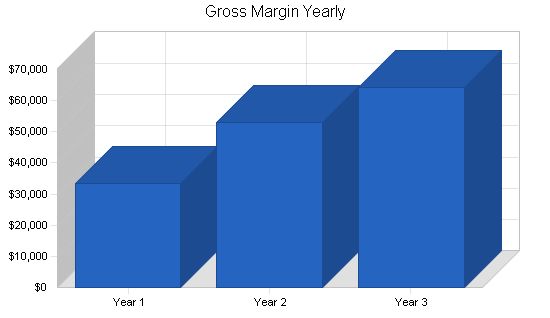

Projected Profit and Loss:

The table below shows the projected profit and loss.

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $39,301 | $62,419 | $75,659 |

| Direct Cost of Sales | $5,895 | $9,363 | $11,349 |

| Other | $0 | $0 | $0 |

| Total Cost of Sales | $5,895 | $9,363 | $11,349 |

| Gross Margin | $33,406 | $53,056 | $64,310 |

| Gross Margin % | 85.00% | 85.00% | 85.00% |

| Expenses | |||

| Payroll | $27,500 | $32,400 | $32,400 |

| Sales and Marketing and Other Expenses | $5,200 | $1,200 | $1,200 |

| Depreciation | $936 | $936 | $928 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $600 | $600 | $600 |

| Insurance | $1,200 | $1,200 | $1,200 |

| Rent | $0 | $0 | $0 |

| Payroll Taxes | $4,125 | $4,860 | $4,860 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $39,561 | $41,196 | $41,188 |

| Profit Before Interest and Taxes | ($6,155) | $11,860 | $23,122 |

| EBITDA | ($5,219) | $12,796 | $24,050 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $0 | $2,965 | $5,877 |

| Net Profit | ($6,155) | $8,895 | $17,245 |

| Net Profit/Sales | -15.66% | 14.25% | 22.79% |

Projected Cash Flow:

7.4 Projected Cash Flow

The chart and table below show projected cash flow.

Pro Forma Cash Flow:

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $13,755 | $21,847 | $26,481 |

| Cash from Receivables | $18,949 | $36,692 | $46,956 |

| Subtotal Cash from Operations | $32,705 | $58,539 | $73,437 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $2,000 | $0 | $0 |

| Subtotal Cash Received | $34,705 | $58,539 | $73,437 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $27,500 | $32,400 | $32,400 |

| Bill Payments | $16,525 | $20,725 | $25,078 |

| Subtotal Spent on Operations | $44,025 | $53,125 | $57,478 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $44,025 | $53,125 | $57,478 |

| Net Cash Flow | ($9,321) | $5,414 | $15,959 |

| Cash Balance | $3,429 | $8,843 | $24,802 |

7.5 Projected Balance Sheet

The following table indicates the projected balance sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $3,429 | $8,843 | $24,802 |

| Accounts Receivable | $6,596 | $10,477 | $12,699 |

| Inventory | $1,105 | $1,755 | $2,127 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $11,131 | $21,075 | $39,628 |

| Long-term Assets | |||

| Long-term Assets | $2,800 | $2,800 | $2,800 |

| Accumulated Depreciation | $936 | $1,872 | $2,800 |

| Total Long-term Assets | $1,864 | $928 | $0 |

| Total Assets | $12,995 | $22,003 | $39,628 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $1,600 | $1,713 | $2,092 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $1,600 | $1,713 | $2,092 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $1,600 | $1,713 | $2,092 |

| Paid-in Capital | $19,000 | $19,000 | $19,000 |

| Retained Earnings | ($1,450) | ($7,605) | $1,290 |

| Earnings | ($6,155) | $8,895 | $17,245 |

| Total Capital | $11,395 | $20,290 | $37,535 |

| Total Liabilities and Capital | $12,995 | $22,003 | $39,628 |

| Net Worth | $11,395 | $20,290 | $37,535 |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Retailers (Galleries) | 0% | $0 | $0 | $1,547 | $1,

Pro Forma Profit and Loss Sales: – Month 1: $0 – Month 2: $0 – Month 3: $2,892 – Month 4: $3,099 – Month 5: $3,292 – Month 6: $3,317 – Month 7: $3,519 – Month 8: $3,662 – Month 9: $4,474 – Month 10: $4,732 – Month 11: $4,968 – Month 12: $5,346 Direct Cost of Sales: – Month 1: $0 – Month 2: $0 – Month 3: $434 – Month 4: $465 – Month 5: $494 – Month 6: $498 – Month 7: $528 – Month 8: $549 – Month 9: $671 – Month 10: $710 – Month 11: $745 – Month 12: $802 Other: – Month 1: $0 – Month 2: $0 – Month 3: $0 – Month 4: $0 – Month 5: $0 – Month 6: $0 – Month 7: $0 – Month 8: $0 – Month 9: $0 – Month 10: $0 – Month 11: $0 – Month 12: $0 Total Cost of Sales: – Month 1: $0 – Month 2: $0 – Month 3: $434 – Month 4: $465 – Month 5: $494 – Month 6: $498 – Month 7: $528 – Month 8: $549 – Month 9: $671 – Month 10: $710 – Month 11: $745 – Month 12: $802 Gross Margin: – Month 1: $0 – Month 2: $0 – Month 3: $2,458 – Month 4: $2,634 – Month 5: $2,798 – Month 6: $2,819 – Month 7: $2,991 – Month 8: $3,113 – Month 9: $3,803 – Month 10: $4,022 – Month 11: $4,223 – Month 12: $4,544 Gross Margin %: – Month 1: 0.00% – Month 2: 0.00% – Month 3: 85.00% – Month 4: 85.00% – Month 5: 85.00% – Month 6: 85.00% – Month 7: 85.00% – Month 8: 85.00% – Month 9: 85.00% – Month 10: 85.00% – Month 11: 85.00% – Month 12: 85.00% Expenses: – Payroll: – Month 1: $2,000 – Month 2: $2,000 – Month 3: $2,000 – Month 4: $2,000 – Month 5: $2,000 – Month 6: $2,000 – Month 7: $2,000 – Month 8: $2,700 – Month 9: $2,700 – Month 10: $2,700 – Month 11: $2,700 – Month 12: $2,700 – Sales and Marketing and Other Expenses: – Month 1: $600 – Month 2: $600 – Month 3: $600 – Month 4: $600 – Month 5: $600 – Month 6: $600 – Month 7: $600 – Month 8: $600 – Month 9: $100 – Month 10: $100 – Month 11: $100 – Month 12: $100 – Depreciation: – Month 1: $78 – Month 2: $78 – Month 3: $78 – Month 4: $78 – Month 5: $78 – Month 6: $78 – Month 7: $78 – Month 8: $78 – Month 9: $78 – Month 10: $78 – Month 11: $78 – Month 12: $78 – Leased Equipment: – Month 1: $0 – Month 2: $0 – Month 3: $0 – Month 4: $0 – Month 5: $0 – Month 6: $0 – Month 7: $0 – Month 8: $0 – Month 9: $0 – Month 10: $0 – Month 11: $0 – Month 12: $0 – Utilities: – Month 1: $50 – Month 2: $50 – Month 3: $50 – Month 4: $50 – Month 5: $50 – Month 6: $50 – Month 7: $50 – Month 8: $50 – Month 9: $50 – Month 10: $50 – Month 11: $50 – Month 12: $50 – Insurance: – Month 1: $100 – Month 2: $100 – Month 3: $100 – Month 4: $100 – Month 5: $100 – Month 6: $100 – Month 7: $100 – Month 8: $100 – Month 9: $100 – Month 10: $100 – Month 11: $100 – Month 12: $100 – Rent: – Month 1: $0 – Month 2: $0 – Month 3: $0 – Month 4: $0 – Month 5: $0 – Month 6: $0 – Month 7: $0 – Month 8: $0 – Month 9: $0 – Month 10: $0 – Month 11: $0 – Month 12: $0 – Payroll Taxes: – Month 1: 15%, $300 – Month 2: 15%, $300 – Month 3: 15%, $300 – Month 4: 15%, $300 – Month 5: 15%, $300 – Month 6: 15%, $300 – Month 7: 15%, $300 – Month 8: 15%, $405 – Month 9: 15%, $405 – Month 10: 15%, $405 – Month 11: 15%, $405 – Month 12: 15%, $405 – Other: – Month 1: $0 – Month 2: $0 – Month 3: $0 – Month 4: $0 – Month 5: $0 – Month 6: $0 – Month 7: $0 – Month 8: $0 – Month 9: $0 – Month 10: $0 – Month 11: $0 – Month 12: $0 Total Operating Expenses: – Month 1: $3,128 – Month 2: $3,128 – Month 3: $3,128 – Month 4: $3,128 – Month 5: $3,128 – Month 6: $3,128 – Month 7: $3,128 – Month 8: $3,933 – Month 9: $3,433 – Month 10: $3,433 – Month 11: $3,433 – Month 12: $3,433 Profit Before Interest and Taxes: – Month 1: ($3,128) – Month 2: ($3,128) – Month 3: ($670) – Month 4: ($494) – Month 5: ($330) – Month 6: ($309) – Month 7: ($137) – Month 8: ($820) – Month 9: $370 – Month 10: $589 – Month 11: $790 – Month 12: $1,111 EBITDA: – Month 1: ($3,050) – Month 2: ($3,050) – Month 3: ($592) – Month 4: ($416) – Month 5: ($252) – Month 6: ($231) – Month 7: ($59) – Month 8: ($742) – Month 9: $448 – Month 10: $667 – Month 11: $868 – Month 12: $1,189 Interest Expense: – Month 1: $0 – Month 2: $0 – Month 3: $0 – Month 4: $0 – Month 5: $0 – Month 6: $0 – Month 7: $0 – Month 8: $0 – Month 9: $0 – Month 10: $0 – Month 11: $0 – Month 12: $0 Taxes Incurred: – Month 1: $0 – Month 2: $0 – Month 3: $0 – Month 4: $0 – Month 5: $0 – Month 6: $0 – Month 7: $0 – Month 8: $0 – Month 9: $0 – Month 10: $0 – Month 11: $0 – Month 12: $0 Net Profit: – Month 1: ($3,128) – Month 2: ($3,128) – Month 3: ($670) – Month 4: ($494) – Month 5: ($330) – Month 6: ($309) – Month 7: ($137) – Month 8: ($820) – Month 9: $370 – Month 10: $589 – Month 11: $790 – Month 12: $1,111 Net Profit/Sales: – Month 1: 0.00% – Month 2: 0.00% – Month 3: -23.16% – Month 4: -15.94% – Month 5: -10.02% – Month 6: -9.30% – Month 7: -3.89% – Month 8: -22.40% – Month 9: 8.27% – Month 10: 12.45% – Month 11: 15.90% – Month 12: 20.78% Pro Forma Cash Flow Cash Received: – Cash from Operations: – Month 1: $0 – Month 2: $0 – Month 3: $1,012 – Month 4: $1,085 – Month 5: $1,152 – Month 6: $1,161 – Month 7: $1,232 – Month 8: $1,282 – Month 9: $1,566 – Month 10: $1,656 – Month 11: $1,739 – Month 12: $1,871 – Cash from Receivables: – Month 1: $0 – Month 2: $0 – Month 3: $0 – Month 4: $63 – Month 5: $1,884 – Month 6: $2,019 – Month 7: $2,140 – Month 8: $2,160 – Month 9: $2,290 – Month 10: $2,398 – Month 11: $2,914 – Month 12: $3,081 Subtotal Cash from Operations: – Month 1: $0 – Month 2: $0 – Month 3: $1,012 – Month 4: $1,147 – Month 5: $3,036 – Month 6: $3,179 – Month 7: $3,372 – Month 8: $3,442 – Month 9: $3,856 – Month 10: $4,054 – Month 11: $4,652 – Month 12: $4,952 Additional Cash Received: – Sales Tax, VAT, HST/GST Received: – 0.00%, $0 – Month 2: $0 – Month 3: $0 – Month 4: $0 – Month 5: $0 – Month 6: $0 – Month 7: $0 – Month 8: $0 – Month 9: $0 – Month 10: $0 – Month 11: $0 – Month 12: $0 – New Current Borrowing: – Month 1: $0 – Month 2: $0 – Month 3: $0 – Month 4: $0 – Month 5: $0 – Month 6: $0 – Month 7: $0 – Month 8: $0 – Month 9: $0 – Month 10: $0 – Month 11: $0 – Month 12: $0 – New Other Liabilities (interest-free): – Month 1: $0 – Month 2: $0 – Month 3: $0 – Month 4: $0 – Month 5: $0 – Month 6: $0 – Month 7: $0 – Month 8: $0 – Month 9: $0 – Month 10: $0 – Month 11: $0 – Month 12: $0 – New Long-term Liabilities: – Month 1: $0 – Month 2: $0 – Month 3: $0 – Month 4: $0 – Month 5: $0 – Month 6: $0 – Month 7: $0 – Month 8: $0 – Month 9: $0 – Month 10: $0 – Month 11: $0 – Month 12: $0 – Sales of Other Current Assets: – Month 1: $0 – Month 2: $0 – Month 3: $0 – Month 4: $0 – Month 5: $0 – Month 6: $0 – Month 7: $0 – Month 8: $0 – Month 9: $0 – Month 10: $0 – Month 11: $0 – Month 12: $0 – Sales of Long-term Assets: Pro Forma Balance Sheet |

||||||||

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $12,750 | $10,715 | $7,665 | $5,594 | $2,691 | $1,711 | $1,807 | $1,162 | $818 | $1,836 | $1,535 | $1,866 | $3,429 |

| Accounts Receivable | $0 | $0 | $0 | $1,880 | $3,831 | $4,087 | $4,225 | $4,372 | $4,591 | $5,209 | $5,887 | $6,202 | $6,596 |

| Inventory | $0 | $0 | $0 | $566 | $1,101 | $608 | $1,110 | $582 | $1,033 | $1,362 | $1,652 | $907 | $1,105 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $12,750 | $10,715 | $7,665 | $8,040 | $7,624 | $6,406 | $7,142 | $6,116 | $6,442 | $8,407 | $9,074 | $8,975 | $11,131 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 | $2,800 |

| Accumulated Depreciation | $0 | $78 | $156 | $234 | $312 | $390 | $468 | $546 | $624 | $702 | $780 | $858 | $936 |

| Total Long-term Assets | $2,800 | $2,722 | $2,644 | $2,566 | $2,488 | $2,410 | $2,332 | $2,254 | $2,176 | $2,098 | $2,020 | $1,942 | $1,864 |

| Total Assets | $15,550 | $13,437 | $10,309 | $10,606 | $10,112 | $8,816 | $9,474 | $8,370 | $8,618 | $10,505 | $11,094 | $10,917 | $12,995 |

| Liabilities and Capital | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $1,015 | $1,015 | $1,982 | $1,982 | $1,015 | $1,982 | $1,015 | $2,083 | $1,600 | $1,600 | $633 | $1,600 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $1,015 | $1,015 | $1,982 | $1,982 | $1,015 | $1,982 | $1,015 | $2,083 | $1,600 | $1,600 | $633 | $1,600 |

| Long-term Liabilities | |||||||||||||

| Total Liabilities | $0 | $1,015 | $1,015 | $1,982 | $1,982 | $1,015 | $1,982 | $1,015 | $2,083 | $1,600 | $1,600 | $633 | $1,600 |

| Paid-in Capital | $17,000 | $17,000 | $17,000 | $17,000 | $17,000 | $17,000 | $17,000 | $17,000 | $17,000 | $19,000 | $19,000 | $19,000 | $19,000 |

| Retained Earnings | ($1,450) | ($1,450) | ($1,450) | ($1,450) | ($1,450) | ($1,450) | ($1,450) | ($1,450) | ($1,450) | ($1,450) | ($1,450) | ($1,450) | ($1,450) |

| Earnings | $0 | ($3,128) | ($6,256) | ($6,926) | ($7,420) | ($7,749) | ($8,058) | ($8,195) | ($9,015) | ($8,645) | ($8,056) | ($7,266) | ($6,155) |

| Total Capital | $15,550 | $12,422 | $9,294 | $8,624 | $8,130 | $7,801 | $7,492 | $7,355 | $6,535 | $8,905 | $9,494 | $10,284 | $11,395 |

| Total Liabilities and Capital | $15,550 | $13,437 | $10,309 | $10,606 | $10,112 | $8,816 | $9,474 | $8,370 | $8,618 | $10,505 | $11,094 | $10,917 | $12,995 |

| Net Worth | $15,550 | $12,422 | $9,294 | $8,624 | $8,130 | $7,801 | $7,492 | ||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!