Direct Mail and Shipping Business Plan

The Shipping Centre is a full-service shipping, fax transmittal, and private Mail Box company. It is an Oregon corporation, privately held and led by Steve Freighter. The current package shipping center business faces intense competition, with others offering what they claim to be simple shipping services.

The Shipping Centre aims to gain market share by leveraging its competitive advantages: customer service and convenience. Given the increasing commoditization of the industry, providing superior customer service is crucial for differentiation. The Shipping Centre also stands out by offering extended business hours, catering to the needs of full-time working customers, who are the typical clients for the company.

Through the use of innovative software that streamlines workflow, The Shipping Centre is able to offer slightly lower service charges on shipping packages and achieve better margins compared to its competitors. These efficiency improvements, coupled with the company’s competitive advantages, position The Shipping Centre to successfully grow its market share.

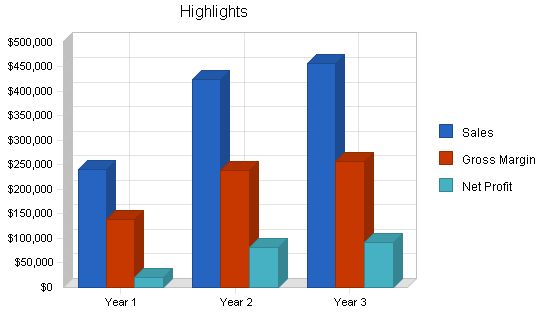

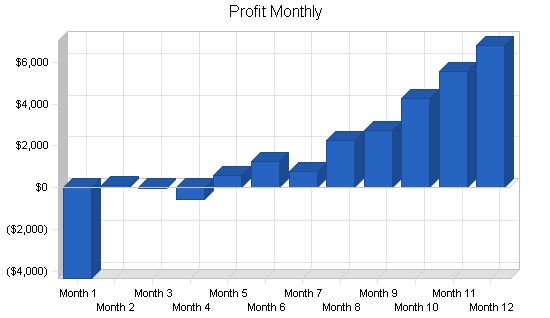

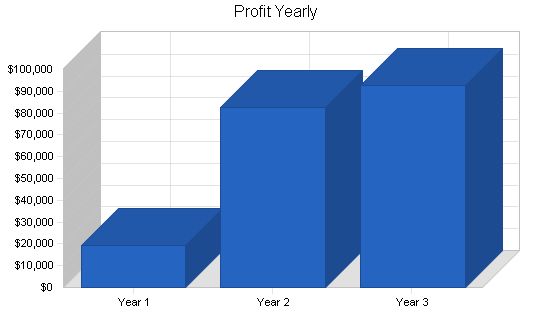

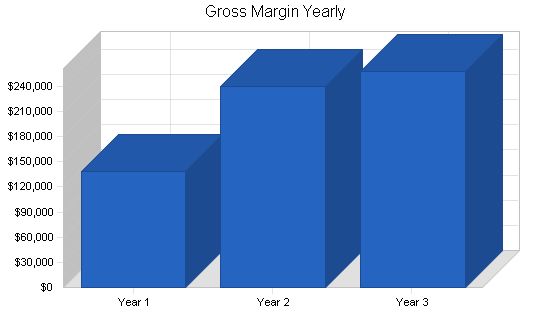

Profitability is projected to be reached by month 12, with a modest profit expected in year three.

Contents

1.1 Objectives

The objectives for the first three years include:

- To create a service-based company that exceeds customers’ expectations.

- To increase transactions by 20% annually through superior performance.

- To develop a sustainable service-based company, surviving off its own cash flow.

1.2 Mission

The Shipping Centre’s mission is to provide customers with all their shipping needs. We exist to attract and maintain customers. When we adhere to this maxim, everything else will fall into place. Our services will exceed customer expectations.

Company Summary

The Shipping Centre, located in Salem, OR, will be a full service shipping agency. Services will include USPS and UPS shipping, packaging, international shipments, and private Mail Boxes.

2.1 Company Ownership

The Shipping Centre is an Oregon Corporation founded and owned by Steve Freighter.

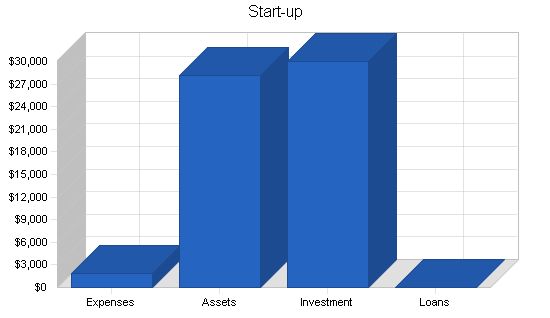

2.2 Start-up Summary

The Shipping Centre start-up costs include:

- Legal fees–for the formation of the corporation and general business issues.

- Office equipment–includes tables, desks, file cabinets, tape dispensers, rulers, scissors, etc.

- Two computer systems with DSL and CD-RW.

- Special software for work flow efficiencies.

- Advertising in the local newspaper.

- Signs for the front of the store.

- Scale.

- Mail Box set-up.

The items that will be considered long-term assets for depreciation purposes are:

- Office equipment.

- Computers.

- Software.

- Signs.

- Scale.

- Mail Box set-up.

Start-up

Requirements

– Legal: $1,000

– Stationery etc.: $300

– Advertisements: $500

– Expensed Equipment: $0

– Other: $0

– Total Start-up Expenses: $1,800

Start-up Assets

– Cash Required: $14,000

– Other Current Assets: $0

– Long-term Assets: $14,200

– Total Assets: $28,200

Total Requirements: $30,000

Start-up Funding

– Start-up Expenses to Fund: $1,800

– Start-up Assets to Fund: $28,200

– Total Funding Required: $30,000

Assets

– Non-cash Assets from Start-up: $14,200

– Cash Requirements from Start-up: $14,000

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $14,000

– Total Assets: $28,200

Liabilities and Capital

– Liabilities

– Current Borrowing: $0

– Long-term Liabilities: $0

– Accounts Payable (Outstanding Bills): $0

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $0

– Capital

– Planned Investment

– Investor 1: $30,000

– Other: $0

– Additional Investment Requirement: $0

– Total Planned Investment: $30,000

– Loss at Start-up (Start-up Expenses): ($1,800)

– Total Capital: $28,200

– Total Capital and Liabilities: $28,200

– Total Funding: $30,000

Services

The Shipping Centre will provide full service shipping services. Our main services will be:

– UPS and USPS shipping, including international shipping.

– Packaging of items, including weird shapes and fragile items.

– Private Mail Boxes.

– Fax service.

Market Analysis Summary

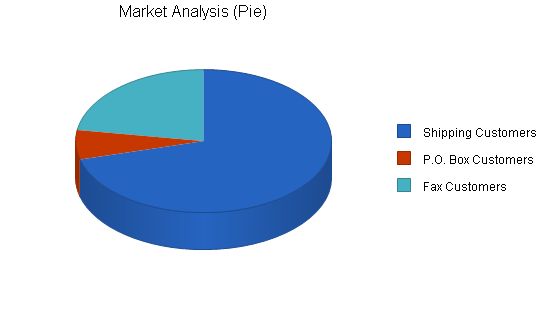

The Shipping Centre has three main customer groups: shipping customers, Mail Box customers, and fax customers.

Market Segmentation

The Shipping Centre’s customers can be broken down into three main groups:

– Shipping customers: These customers can be further broken down into customers who have packages ready for shipment, and those that require a packaging service. The typical customer that needs a package shipped is someone who does not have access to ship packages at work and the Post Office is not convenient, or they need to ship via UPS. The other subgroup requires items to be packaged for them. The items are typically unusually sized, or may be quite fragile and they want an expert to package it to absolve them from liability.

– Mail Box customers: These customers are in need of a private Mail Box for various reasons, including convenience of location, cost, hours of operation, legality issues, etc.

– Fax customers: These customers are in need of a fax transmittal service, either to send or receive a fax and do not otherwise have access to a fax machine.

Market Analysis:

Year 1 – Year 5

Potential Customers Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Shipping Customers 9% 27,000 29,430 32,079 34,966 38,113 9.00%

P.O. Box Customers 3% 2,547 2,623 2,702 2,783 2,866 2.99%

Fax Customers 6% 8,574 9,088 9,633 10,211 10,824 6.00%

Total 7.97% 38,121 41,141 44,414 47,960 51,803 7.97%

4.2 Target Market Segment Strategy

The Shipping Centre targets customers representing a growing portion of the population.

Shipping customers: This segment has grown due to the Internet. They return products to The Shipping Centre for convenience. This segment also includes eBay sellers and mail-order customers. Additionally, people sending packages prefer fast and convenient options. Some customers also require packaging services.

Mail Box customers: This segment is not increasing significantly, but there is still demand for this service.

Fax customers: Demand for fax services remains steady, despite the popularity of email.

4.3 Service Business Analysis

Several companies offer similar services to The Shipping Centre in high traffic areas. People choose based on convenience as there is little difference perceived between competitors.

Strategy and Implementation Summary

The Shipping Centre will be located in a high traffic strip mall to attract sufficient business. The company will advertise in local newspapers and flyers to raise awareness and generate interest. Good pricing, superior customer service, and extended business hours will drive sales and differentiate The Shipping Centre from competitors.

5.1 Competitive Edge

Customer Service: The Shipping Centre will provide exemplary customer service to differentiate from competitors. Customers will leave with an overwhelming feeling of superior treatment.

Convenience: The Shipping Centre will offer extended business hours to cater to working individuals’ needs for quick and easy solutions.

5.2 Sales Strategy

The Shipping Centre’s sales strategy focuses on work flow efficiencies and superior customer service.

Work flow efficiencies: Special software will streamline the shipping process, reducing transaction time and improving accuracy.

Superior customer service: Building long-term relationships with customers will result in repeat business, especially for frequent shippers.

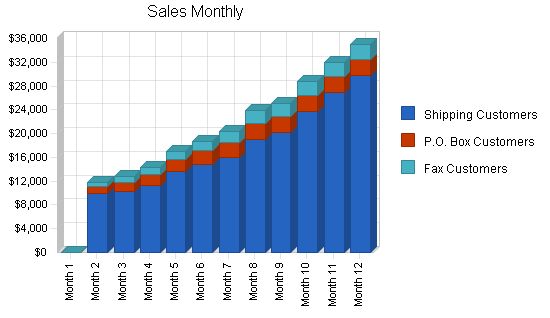

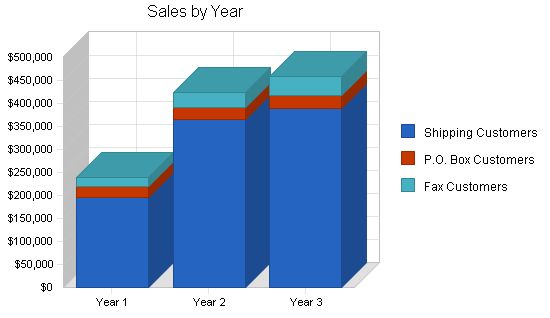

5.2.1 Sales Forecast

The first month will be spent setting up the business, with no sales activity. By the second month, customers will start trickling in, and a steady stream of customers is expected in months four and five.

For shipping and fax services, The Shipping Centre expects a steady increase in business. Mail Boxes will see a steady increase until reaching full utilization, followed by a sales activity plateau.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Shipping Customers | $195,425 | $365,412 | $389,850 |

| P.O. Box Customers | $24,432 | $26,000 | $26,987 |

| Fax Customers | $19,997 | $33,058 | $41,254 |

| Total Sales | $239,854 | $424,470 | $458,091 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Shipping Customers | $87,941 | $164,435 | $175,433 |

| P.O. Box Customers | $2,443 | $2,600 | $2,699 |

| Fax Customers | $10,998 | $18,182 | $22,690 |

| Subtotal Direct Cost of Sales | $101,383 | $185,217 | $200,821 |

5.3 Milestones

The Shipping Centre will have several milestones early on:

- Business plan completion.

- Completion of the storefront/back office.

- Completion of software.

- Steady growth in revenues, yearly.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business Plan Completion | 1/1/2001 | 1/1/2001 | $0 | Steve | Marketing |

| Completion of Storefront/Backoffice | 1/1/2001 | 2/1/2001 | $0 | Steve | Department |

| Completion of Software | 1/1/2001 | 2/15/2001 | $10,000 | Steve | Department |

| Totals | $10,000 | ||||

Management Summary

The Shipping Centre is founded and owned by Steve Freighter. It is an Oregon Corporation established to eliminate personal liability issues. Steve holds a degree in political science from Oregon State University and gained valuable insight into the shipping business while working part-time as a driver for UPS. He also took a business consulting course at OSU, where he studied Mailboxes Etc. and learned about the industry.

Steve’s conclusion from his consulting project was that the services provided by similar companies were too commoditized and the market was highly competitive. He suggested implementing meaningful differentiation, but the company did not take his advice due to ties with the corporate parent and cost constraints. However, Steve gained valuable industry knowledge from this experience.

With his practical and analytical knowledge, Steve is well-equipped to lead The Shipping Centre to profitability.

6.1 Personnel Plan

The Shipping Centre’s staff will initially consist of Steve working full-time. By month two, a part-time employee will be brought on board, who will transition to full-time by month three. A second full-time employee will be hired by the fourth month, and a third part-time employee will be added by month seven.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Steve | $30,000 | $30,000 | $30,000 |

| Employee 1 | $15,120 | $19,200 | $20,500 |

| Employee 2 | $12,960 | $19,200 | $20,500 |

| Employee 3 | $8,640 | $9,000 | $9,700 |

| Total People | 4 | 4 | 4 |

| Total Payroll | $66,720 | $77,400 | $80,700 |

Financial Plan

The following sections outline important financial information.

7.1 Important Assumptions

The following table highlights important assumptions.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 25.42% | 25.00% | 25.42% |

| Other | 0 | 0 | 0 |

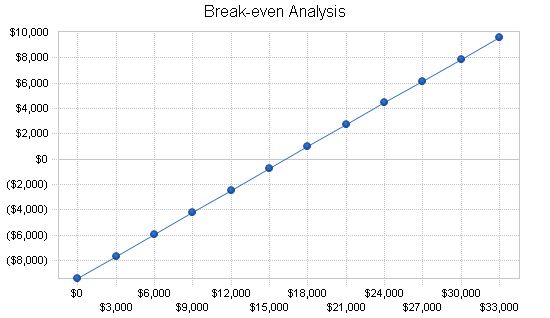

7.2 Break-even Analysis

The Break-even Analysis indicates the monthly sales required for The Shipping Centre to break even.

Break-even Analysis

Monthly Revenue Break-even: $16,314

Assumptions:

– Average Percent Variable Cost: 42%

– Estimated Monthly Fixed Cost: $9,418

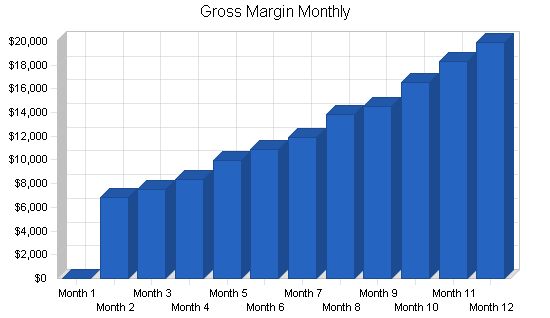

7.3 Projected Profit and Loss

The table below shows projected profit and loss.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Sales | $239,854 | $424,470 | $458,091 |

| Direct Cost of Sales | $101,383 | $185,217 | $200,821 |

| Total Cost of Sales | $101,383 | $185,217 | $200,821 |

| Gross Margin | $138,471 | $239,253 | $257,270 |

| Gross Margin % | 57.73% | 56.37% | 56.16% |

| Expenses | |||

| Payroll | $66,720 | $77,400 | $80,700 |

| Sales and Marketing and Other Expenses | $3,900 | $3,900 | $3,900 |

| Depreciation | $350 | $4,200 | $4,200 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $1,500 | $1,500 | $1,500 |

| DSL | $540 | $540 | $540 |

| Rent | $30,000 | $30,000 | $30,000 |

| Payroll Taxes | $10,008 | $11,610 | $12,105 |

| Total Operating Expenses | $113,018 | $129,150 | $132,945 |

| Profit Before Interest and Taxes | $25,453 | $110,103 | $124,325 |

| EBITDA | $25,803 | $114,303 | $128,525 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $6,052 | $27,526 | $31,599 |

| Net Profit | $19,401 | $82,577 | $92,726 |

| Net Profit/Sales | 8.09% | 19.45% | 20.24% |

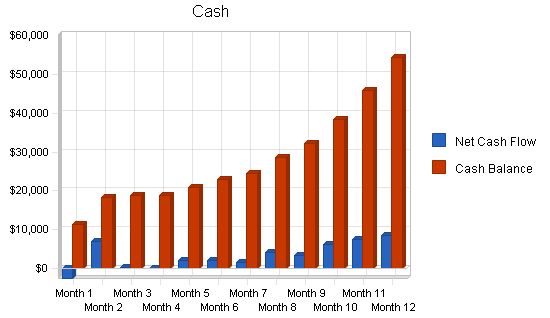

7.4 Projected Cash Flow

The following chart and table illustrate projected cash flow.

Pro Forma Cash Flow

7.5 Projected Balance Sheet

Pro Forma Balance Sheet

7.6 Business Ratios

Ratio Analysis

General Assumptions:

Month 1

Month 2

Month 3

Month 4

Month 5

Month 6

Month 7

Month 8

Month 9

Month 10

Month 11

Month 12

Plan Month

1

2

3

4

5

6

7

8

9

10

11

12

Current Interest Rate

10.00%

10.00%

10.00%

10.00%

10.00%

10.00%

10.00%

10.00%

10.00%

10.00%

10.00%

10.00%

10.00%

Long-term Interest Rate

10.00%

10.00%

10.00%

10.00%

10.00%

10.00%

10.00%

10.00%

10.00%

10.00%

10.00%

10.00%

10.00%

Tax Rate

30.00%

25.00%

25.00%

25.00%

25.00%

25.00%

25.00%

25.00%

25.00%

25.00%

25.00%

25.00%

25.00%

Other

0

0

0

0

0

0

0

0

0

0

0

0

0

Pro Forma Profit and Loss:

Month 1

Month 2

Month 3

Month 4

Month 5

Month 6

Month 7

Month 8

Month 9

Month 10

Month 11

Month 12

Sales

$0

$11,856

$12,856

$14,354

$17,033

$18,636

$20,433

$23,855

$25,115

$28,712

$32,000

$35,004

Direct Cost of Sales

$0

$4,995

$5,370

$5,959

$7,105

$7,766

$8,535

$10,026

$10,603

$12,212

$13,726

$15,086

Other

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

Total Cost of Sales

$0

$4,995

$5,370

$5,959

$7,105

$7,766

$8,535

$10,026

$10,603

$12,212

$13,726

$15,086

Gross Margin

$0

$6,861

$7,486

$8,395

$9,928

$10,870

$11,899

$13,829

$14,512

$16,500

$18,274

$19,918

Gross Margin %

0.00%

57.87%

58.23%

58.48%

58.28%

58.33%

58.23%

57.97%

57.78%

57.47%

57.11%

56.90%

Expenses

Payroll

$2,500

$3,220

$3,940

$5,380

$5,380

$5,380

$6,820

$6,820

$6,820

$6,820

$6,820

$6,820

Sales and Marketing and Other Expenses

$325

$325

$325

$325

$325

$325

$325

$325

$325

$325

$325

$325

Depreciation

$350

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

Leased Equipment

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

Utilities

$125

$125

$125

$125

$125

$125

$125

$125

$125

$125

$125

$125

DSL

$45

$45

$45

$45

$45

$45

$45

$45

$45

$45

$45

$45

Rent

$2,500

$2,500

$2,500

$2,500

$2,500

$2,500

$2,500

$2,500

$2,500

$2,500

$2,500

$2,500

Payroll Taxes

15%

$375

$483

$591

$807

$807

$807

$1,023

$1,023

$1,023

$1,023

$1,023

$1,023

Other

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

Total Operating Expenses

$6,220

$6,698

$7,526

$9,182

$9,182

$9,182

$10,838

$10,838

$10,838

$10,838

$10,838

$10,838

Profit Before Interest and Taxes

($6,220)

$163

($40)

($787)

$746

$1,688

$1,061

$2,991

$3,674

$5,662

$7,436

$9,080

EBITDA

($5,870)

$163

($40)

($787)

$746

$1,688

$1,061

$2,991

$3,674

$5,662

$7,436

$9,080

Interest Expense

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

Taxes Incurred

($1,866)

$41

($10)

($197)

$186

$422

$265

$748

$919

$1,416

$1,859

$2,270

Net Profit

($4,354)

$122

($30)

($590)

$559

$1,266

$795

$2,243

$2,756

$4,247

$5,577

$6,810

Net Profit/Sales

0.00%

1.03%

-0.24%

-4.11%

3.28%

6.79%

3.89%

9.40%

10.97%

14.79%

17.43%

19.46%

Pro Forma Cash Flow:

Month 1

Month 2

Month 3

Month 4

Month 5

Month 6

Month 7

Month 8

Month 9

Month 10

Month 11

Month 12

Cash Received

$0

$11,856

$12,856

$14,354

$17,033

$18,636

$20,433

$23,855

$25,115

$28,712

$32,000

$35,004

Subtotal Cash from Operations

$0

$11,856

$12,856

$14,354

$17,033

$18,636

$20,433

$23,855

$25,115

$28,712

$32,000

$35,004

Additional Cash Received

Sales Tax, VAT, HST/GST Received

0.00%

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

New Current Borrowing

$0

$0

$0

$0

$0

$0

$0

Pro Forma Balance Sheet

Business Plan Outline

- Executive Summary

- Company Summary

- Services

- Market Analysis Summary

- Strategy and Implementation Summary

- Management Summary

- Financial Plan

- Appendix

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!