Contents

Parenting Center Business Plan

A Mother’s Place is a new company targeted to open in downtown Santa Cruz. We will provide a family-friendly environment with high quality customer service to meet the daily emotional, physical and social well-being needs of mothers, young children, and other family members.

The principal, Emili Willet, a proud mother of a nine-month-old son, wants to fulfill her passion for helping and supporting other mothers in the community. Emili holds a Master’s degree in Child Development from Harvard Graduate School and has fifteen years of progressive management experience working with children and families. Most recently, she served as Chief of Operations of a childcare management company in the Silicon Valley, and as a Finance Account Manager for the largest corporate childcare center in California, Cisco Systems. The Cisco center was a start-up project serving over 500 children and employing 125 teachers and administrators. Emili aims to run a business that provides a service to families, with a fun atmosphere, innovative and top of the line products, a supportive environment, and high quality customer service. She believes that Santa Cruz lacks this service, providing her an excellent opportunity to utilize her skills, expertise, and experience in child development and finance management while continuing to exercise her passion for working with young children and families.

A Mother’s Place will offer a full range of services, including parenting and childbirth classes, children’s play programs, “Mommy & Me” classes, fitness and prenatal yoga, and coordinated birthday parties. Additionally, we will have a retail store with high-end products for babies and young children. All services and products will be provided by skilled and experienced employees with parenting and child development knowledge. A Mother’s Place is the only company in Santa Cruz county that provides all of these services in one location, with easy access from a freeway, convenient parking, and high quality customer service.

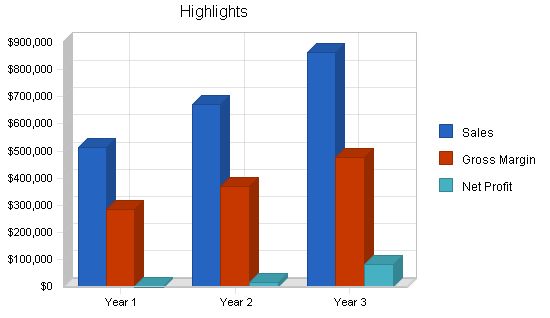

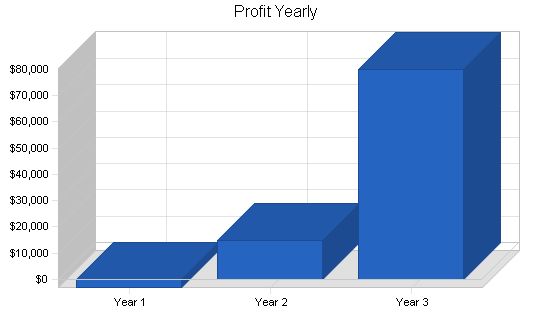

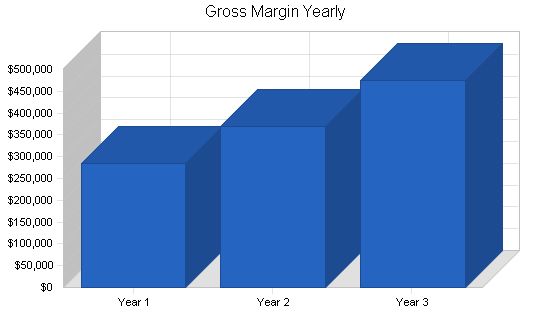

Sales projections for A Mother’s Place estimate starting at $513,000 in the first year, increasing to $863,000 by the end of the third year. Our net profit will increase over the next three years.

1.1 Objectives

A Mother’s Place aims to demonstrate the benefits of quality juvenile products for new mothers and families.

1.2 Goals

In order to achieve its objectives, A Mother’s Place has the following goals:

- Generate total revenue of $510,000 in the first year of operation.

- Generate total revenue of $665,000 in the second year of operation.

- Generate total revenue of $860,000 in the third year of operation.

1.3 Keys to Success

The keys to success for our business are:

- Superior Customer Service: Each employee will have experience and knowledge of our products and parenting.

- Environment: We will provide a clean, upscale, odor-free environment for professional and trusting service.

- Feeding support: We will provide a nursing room for mothers to breastfeed or bottle-feed their child while shopping.

- Convenience: We will offer a wide range of services in one location.

- Location: We will provide easily accessible location and parking for customer convenience.

- Reputation: The principal’s expertise, credibility, integrity, and knowledge from 15+ years of working with young children, her Master’s degree in Child Development, and her experience as a mother will establish our high reputation.

1.4 Mission

For the community: A Mother’s Place will provide a family-friendly atmosphere in which customers will gain expertise, resources, and support through a wide range of services.

For the employees: The company will provide the staff with the satisfaction of delivering quality services to young children and families.

For the business: A Mother’s Place will provide an economically viable business for the principal.

Company Summary

A Mother’s Place is a new company that will provide high-level customer service and a family-friendly environment in various categories:

- Juvenile Products (diapers, strollers, car seats, toys, and books)

- Baby registering service

- Yoga Pregnancy and Childbirthing classes

- StrollerFit Franchise (Exercise with baby program)

- “Mommy & Me” and parenting support programs

- Birthday parties for children coordinated by a child development specialist

- Infant/Child Car Seat Installation provided by AAA CPS Certified Employees

- All employees can provide expertise and knowledge on each baby product

- Full-service nursing room

What sets A Mother’s Place apart from the competition is our commitment to providing these services in one convenient location with expertise in child development, experience with each product, and high-quality customer service.

2.1 Company Location

A Mother’s Place will be located in downtown Santa Cruz at 504 Front Street. This location offers free on-site parking with new outside lighting and additional free public parking across the street. The Pacific Garden Mall, BabyGap, Cottontales, and Borders Books are nearby stores frequented by families. The location provides 4,000 square feet of space, including retail space, a tumbling and gym room, a nursing room, inventory storage, and restroom facilities. It is currently being renovated and is scheduled to be completed by June 30, 2004. A Mother’s Place will open in September.

2.2 Start-up Summary

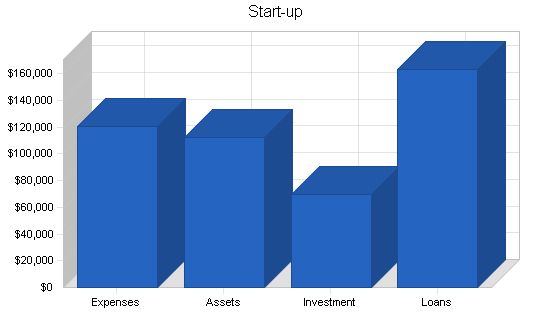

To achieve our objectives, Emili Willet will invest $70,000 cash into A Mother’s Place. In addition, the company is seeking $163,000 in loan financing, which will be repaid from the business’s cash flow. The loan will be secured by the assets of the company and backed by the character, experience, and personal guarantees of the owner.

The Start-up table below shows our expenses and assets, including necessary current assets such as shelving, gym room equipment, and nursing room furniture.

A Mother’s Place, an upscale baby products and parenting resources store, will provide various services and products to pregnant women, new moms, and families with young children under age five. Services include baby/gift registering, infant playgroup, young walkers playgroup, older walkers playgroup, Jr. Jumpers, Jumper Time, and Art Time. Products offered will include juvenile equipment such as car seats, strollers, swings, joggers, exersaucers, and high chairs. The target market for A Mother’s Place is families with young children in Santa Cruz County, where there has been a steady increase in the population of such families and a rising median income. A Mother’s Place aims to capture this growing interest in juvenile products and the increasing purchasing power of parents. To gain a competitive edge, A Mother’s Place will provide a small and family-friendly atmosphere and high-quality customer service that is lacking in Toys ‘R Us and K-Mart, the only two other places carrying juvenile products in a 10-mile radius from Santa Cruz city. Marketing strategies will include distributing brochures with promotional offers, posting flyers, and getting articles printed in local publications. Employee incentives and a clear sales strategy will further contribute to the success of the company. The sales forecast predicts retail sales as the strongest revenue during the first quarter, with classes and birthday parties contributing to increased revenue later on.

2.3 Company Ownership

A Mother’s Place will be owned by Emili Willet, M.Ed., and operate as a privately held S corporation.

Products and Services

A Mother’s Place will offer upscale baby products, parenting resources, children’s play programs, and fitness classes. Services include baby/gift registering, infant, young walkers, and older walkers playgroups, Jr. Jumpers, Jumper Time, and Art Time. Products offered will include juvenile equipment such as car seats, strollers, swings, joggers, exersaucers, and high chairs.

Market Analysis Summary

A Mother’s Place will focus on families with young children under age five in Santa Cruz County. The county has experienced an increase in the population of such families and rising median incomes. This growing interest in juvenile products and an increase in sales in the industry indicate a favorable market for A Mother’s Place.

Strategy and Implementation Summary

A Mother’s Place will implement consistent marketing and sales strategies prior to opening. The advantages it has over competitors include a small and family-friendly atmosphere, a wider selection of high-quality products, and superior customer service. Marketing efforts will include distributing brochures, posting flyers, and getting articles printed in local publications. The company will also have a strong online presence. Employee incentives, clear job expectations, and a well-defined sales strategy will contribute to the success of A Mother’s Place.

5.1 Competitive Edge

A Mother’s Place has the advantage of providing a wider selection of juvenile products in a small and family-friendly atmosphere compared to its competitors, Toys ‘R Us and K-Mart.

5.2 Marketing Strategy

A Mother’s Place will market through brochures with promotional offers, flyers posted at various locations, and articles in local publications, all promoting the website and its products and services.

5.3 Employee Incentive Program

A Mother’s Place will provide clear job descriptions and orientations to employees, aligning their performance expectations with the company’s mission and goals.

5.4 Sales Strategy

The sales strategy of A Mother’s Place will focus on convenience, competitive prices for certain products, and a "Review & Save Program" to encourage repeat customers. The company will also provide a comfortable nursing room and display products in an inviting manner to increase sales.

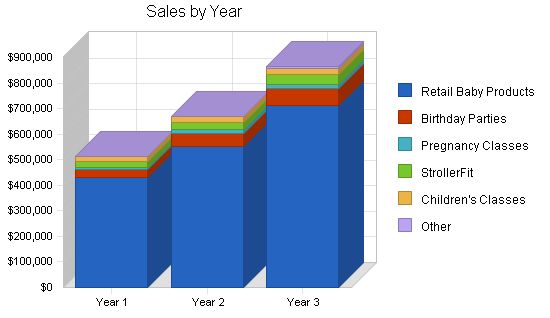

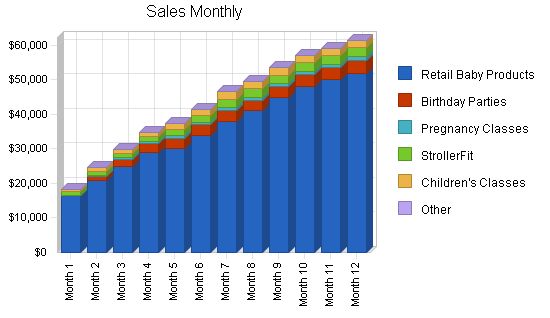

5.5 Sales Forecast

The sales forecast predicts retail sales as the strongest revenue during the first quarter, with classes and birthday parties contributing to increased revenue later on.

Sales Forecast

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Retail Baby Products | $429,400 | $552,000 | $713,495 |

| Birthday Parties | $31,060 | $52,000 | $65,000 |

| Pregnancy Classes | $9,120 | $12,480 | $16,640 |

| StrollerFit | $23,940 | $30,000 | $37,500 |

| Children’s Classes | $19,855 | $22,238 | $24,906 |

| Other | $0 | $1,000 | $6,000 |

| Total Sales | $513,375 | $669,718 | $863,541 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Retail Products | $214,500 | $276,000 | $356,748 |

| Birthday Parties | $11,250 | $23,000 | $29,250 |

| Classes | $2,100 | $2,352 | $2,634 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $227,850 | $301,352 | $388,632 |

5.6 Stepping Stones

The JPMA Trade Show is one of the largest trade shows in the baby products industry and takes place annually in May. The principal will attend to gather information on current and new product lines for 2005, meet company representatives, and establish strong relationships crucial to A Mother’s Place’s success.

The next step includes completing the business plan, holding the grand opening, and starting to generate profit in January 2005.

Milestones:

JPMA Trade Show – 1/1/2004 to 5/4/2004, $1,300 budget, Emili (Manager), N/A (Department)

Business Plan completed – 1/1/2004 to 5/16/2004, $90 budget, Emili (Manager), N/A (Department)

Application submitted to bank – 5/23/2004, $0 budget, Emili (Manager), Marketing (Department)

Secure building – 5/23/2004 to 6/15/2004, $15,000 budget, Emili (Manager), Web (Department)

Inventory Ordering – 6/15/2004 to 7/12/2004, $65,000 budget, Emili (Manager), Web (Department)

Website completed with Grand Opening & class schedules – 6/15/2004 to 8/1/2004, $2,000 budget, Emili (Manager), Department (Department)

Marketing of A Mother’s Place – 6/15/2004 to 8/1/2004, $650 budget, Emili (Manager), Department (Department)

Renovations of building completed – 6/15/2004 to 8/15/2004, $75,000 budget, Emili (Manager), Department (Department)

Set Up StrollerFit Franchise – 6/15/2004 to 8/16/2004, $2,500 budget, Emili (Manager), Web (Department)

Shelving and building set up – 8/1/2004 to 9/1/2004, $59,860 budget, EW & Mgr. (Manager), Department (Department)

Company doors opens – 9/1/2004 to 9/4/2004, $0 budget, Emili (Manager), Department (Department)

Grand Opening – 9/4/2004 to 9/10/2004, $1,000 budget, Emili (Manager), Department (Department)

Monthly sales over 30K – 9/4/2004 to 12/30/2004, $0 budget, EW & Mgr. (Manager), Department (Department)

Profitablity – 9/4/2004 to 2/1/2005, $0 budget, Emili (Manager), Department (Department)

Totals – $222,400 budget

Web Plan Summary:

A Mother’s Place will provide an informational website for mothers, families, and the community. The website, developed by Erik Gundersen at EDesigns, will serve as a resource and include the following resources:

– Class Schedules & Registration Form: Current schedule, detailed class descriptions, and registration form for each class, including Yoga Prenatal, StrollerFit, Children’s Play, Winter Play Groups, Childbirthing, and “Mommy & Me” classes.

– Birthday Party Packages: Detailed information on party packages, themes, party bags, and options.

– Car Seat Installation Program: Information on the car seat installation program.

– Baby Shower/Gift Registering: Access to baby shower/gift registering.

– General Information: Directions to A Mother’s Place, company hours, and an email link for customer inquiries.

Management Summary:

Emili has a Master’s Degree in Education & Child Development from Harvard. With 15 years of experience in administration in the child development field, she previously worked as Chief of Operations for a childcare management company and as Director of Finance/Account Manager for a Cisco Systems childcare center. Emili has also been a child development instructor at San Jose State University.

7.1 Personnel Plan:

A Mother’s Place will hire candidates with young children for part-time hours. The personnel plan will be implemented fully when total sales exceed $53,000 monthly and includes the following positions:

– Emili, Principal: Responsible for day-to-day operations, accounting/administrative tasks, and customer service.

– Full-time manager: Oversees all areas and provides high-quality customer service communications.

– Part-time manager: Covers weekend hours and has additional job-specific responsibilities.

– Part-time StrollerFit instructor: Teaches StrollerFit fitness classes.

The financial plan provides important information on the financial aspects of A Mother’s Place.

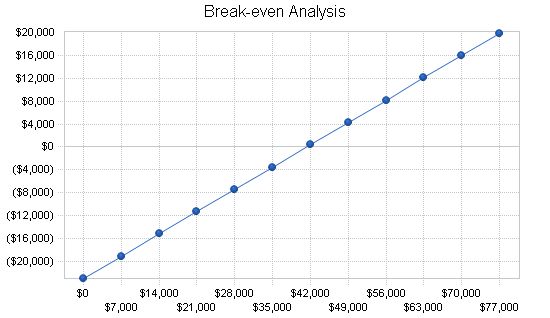

8.1 Break-even Analysis:

The break-even analysis table and chart show the break-even point for the business.

General Assumptions:

| Year | |||

| 1 | 2 | 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 8.00% | 8.00% | 8.00% |

| Long-term Interest Rate | 8.50% | 8.50% | 8.50% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

| Break-even Analysis | |

| Monthly Revenue Break-even | $41,323 |

| Assumptions: | |

| Average Percent Variable Cost | 44% |

| Estimated Monthly Fixed Cost | $22,983 |

8.2 Important Assumptions

Retail sales assumptions:

- Start-up growth:

- Slow steady growth from September – December.

- Marketing strategies will be implemented prior to grand opening to build customer base for this period.

- Growth will slow down slightly post holiday season in January.

- Steady growth will begin to pick up from February – August with the implementation of new class sessions and more marketing tools.

- StrollerFit® will begin in September.

- Children’s classes and birthday parties will begin in October.

- Holiday children’s parties will begin during the holiday season (Nov – Dec).

Classes sales assumptions:

- StrollerFit®:

- StrollerFit® will begin in September at two locations (Westlake Elementary, and at Lighthouse, WestCliff Drive) and continue through December.

- During the holidays, there will be no projection of increased enrollment.

- Enrollment for exercise programs tends to increase in January, and one more class will be added at A Mother’s Place.

- As the weather warms up again in March, increased enrollment is projected to begin and stay steady throughout the summer months.

- One class revenue is based on $7.50 fee per person, 8 participants per class, and 3 sessions per week which equals $780/month. StrollerFit® requires a 15% royalty fee of all sales which brings A Mother’s Place a total sales of $662/month.

- There is no direct cost of sales involved for StrollerFit®.

- Each children’s class is a 10-week session (Sept – mid Nov).

- One session will begin in September, restart every 10 weeks continuously.

- Another session will begin in October, restart every 10 weeks continuously.

- A total of 3 sessions will be offered starting in January.

- A total of 4 sessions will be offered starting in March.

- Each children’s class revenue is based on $9.00 per class, 11 participants, one class per week which is a total of $467/month.

- In addition, a Winter Playgroup will be offered each month from November – March. Each month will bring in an additional $200/month. This is based on $10 per month per child, 10 children each Playgroup session which equals $100/month. Each month will have 2 groups.

- Cost of all children’s classes combined is projected at $50/per class per month to maintain play and activity equipment.

- One childbirthing/pregnancy class will begin a 6-week session in October and restart continuously every 6 weeks. A second session will begin in November, and restart continuously every 6 weeks.

Birthday Parties assumptions:

- Several packages will be offered for Birthday parties, ranging from $500 – $800 per party.

- No birthday parties will be offered during the month of September.

- Two birthday parties will be offered during the month of October, and three parties in November.

- Holiday parties will be offered during the month of December, and a total of 5 parties is projected.

- A total of 6 parties per month will be held from January – May. During summer months, a maximum of 7 per month will be offered.

Payroll assumptions:

- In addition to the principal owner, a full-time manager (40hr/wk) and part-time manager (16hr/wk) will begin employment in September to cover a 7 day work week schedule. Due to the owner’s deafness, a manager must be on-staff at all times to provide customer service on the telephone.

- A part-time retail employee will be hired in March, when total gross sales reach $45,000, to work during busiest hours.

- A full-time employee will not be hired until total gross sales exceed $50,000, projected to occur in May.

- All instructors for StrollerFit® are part-time and work one hour per class at $20/hr.

- All instructors and party coordinators are part-time and work per class/party at $12.75/hr. The party coordinator will be employed an additional hour per party for set-up/clean-up and planning. The additional hours in October are for training.

Expenses assumptions:

- Loan repayment is estimated at $163,000 total borrowing, at 8.5% with a 6-year term, equaling payments of $2897 per month (principal repayment listed in the Cash Flow, and interest expenses in the Profit and Loss, below).

- POS System, insurance, payroll processing fees, website, StrollerFit manual, shelving, tumbling equipment, and all other equipment are based on actual bids from vendors.

- Janitorial services will not be hired during the first year of operation. The retail employee will assume the janitorial responsibilities to minimize cost.

- Rent is estimated at $5,000 per month for a 3,550 square foot space at $1.40 NNN.

- The space is estimated to provide 1600 sq ft for retail, 1150 sq ft for class/gym room, 400 sq ft for inventory storage, and 400 sq ft for office, nursing room, and bathroom.

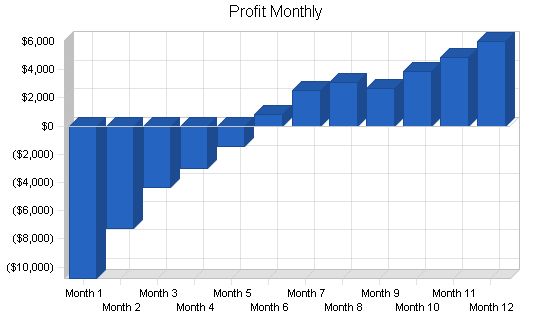

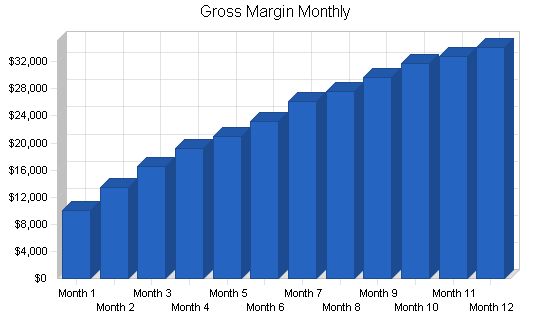

8.3 Projected Profit and Loss

The following table and chart show the profit and loss projections for the first three years of operation.

Pro Forma Profit and Loss

| Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $513,375 | $669,718 | $863,541 |

| Direct Cost of Sales | $227,850 | $301,352 | $388,632 |

| Other Costs of Goods | $2 | $0 | $0 |

| Total Cost of Sales | $227,852 | $301,352 | $388,632 |

| Gross Margin | $285,523 | $368,366 | $474,909 |

| Gross Margin % | 55.62% | 55.00% | 55.00% |

| Expenses | |||

| Payroll | $123,038 | $172,916 | $185,891 |

| Sales and Marketing and Other Expenses | $2,700 | $3,000 | $3,100 |

| Depreciation | $0 | $0 | $0 |

| Rent | $60,000 | $60,000 | $60,000 |

| Phone & DSL | $900 | $900 | $900 |

| Utilities | $4,800 | $4,800 | $4,800 |

| Insurance | $2,100 | $2,400 | $2,600 |

| Payroll Taxes | $24,608 | $34,583 | $37,178 |

| Payroll Processing fees | $1,280 | $1,290 | $1,300 |

| Loan payment | $33,600 | $33,600 | $33,600 |

| Bookkeeper | $1,000 | $1,000 | $1,500 |

| Office Supplies | $1,200 | $1,200 | $1,500 |

| Janitorial Service | $0 | $1,000 | $1,200 |

| Janitorial Supplies & Paper Products | $4,200 | $5,000 | $5,200 |

| Interest Expense | $13,020 | $11,097 | $9,005 |

| Other | $3,350 | $3,600 | $4,000 |

| Total Operating Expenses | $275,796 | $336,386 | $351,774 |

| Profit Before Interest and Taxes | $9,727 | $31,979 | $123,135 |

| EBITDA | $9,727 | $31,979 | $123,135 |

| Interest Expense | $12,853 | $10,999 | $8,898 |

| Taxes Incurred | $0 | $6,294 | $34,271 |

| Net Profit | ($3,126) | $14,686 | $79,966 |

| Net Profit/Sales | -0.61% | 2.19% | 9.26% |

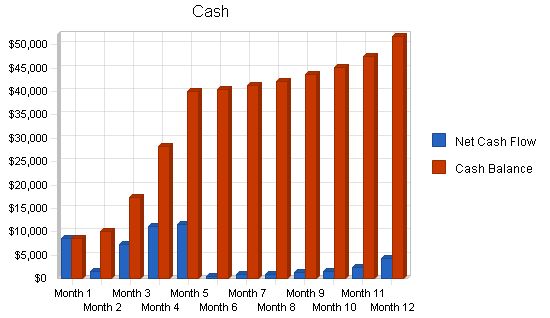

8.4 Projected Cash Flow

The table and chart below show the projected cash flow for the first three years of operation. Note that A Mother’s Place will receive cash for all purchases and services, and that all classes and birthday parties will be paid in advance upon registration.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $513,375 | $669,718 | $863,541 |

| Subtotal Cash from Operations | $513,375 | $669,718 | $863,541 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $513,375 | $669,718 | $863,541 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $123,038 | $172,916 | $185,891 |

| Bill Payments | $316,884 | $493,097 | $599,570 |

| Subtotal Spent on Operations | $439,922 | $666,013 | $785,461 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $21,756 | $23,677 | $25,770 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $461,678 | $689,690 | $811,231 |

| Net Cash Flow | $51,697 | ($19,972) | $52,310 |

| Cash Balance | $51,697 | $31,725 | $84,035 |

Projected Balance Sheet

The following table indicates the Projected Balance for the first three years of operation.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $51,697 | $31,725 | $84,035 |

| Inventory | $30,113 | $39,826 | $51,361 |

| Other Current Assets | $47,360 | $47,360 | $47,360 |

| Total Current Assets | $129,170 | $118,911 | $182,756 |

| Long-term Assets | |||

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $129,170 | $118,911 | $182,756 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $41,692 | $40,424 | $50,073 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $41,692 | $40,424 | $50,073 |

| Long-term Liabilities | $141,244 | $117,567 | $91,797 |

| Total Liabilities | $182,936 | $157,991 | $141,870 |

| Paid-in Capital | $70,000 | $70,000 | $70,000 |

| Retained Earnings | ($120,640) | ($123,766) | ($109,080) |

| Earnings | ($3,126) | $14,686 | $79,966 |

| Total Capital | ($53,766) | ($39,080) | $40,886 |

| Total Liabilities and Capital | $129,170 | $118,911 | $182,756 |

| Net Worth | ($53,766) | ($39,080) | $40,886 |

A Mother’s Place does not fit neatly into any one existing industry. We are a fitness and educational center, offering children’s entertainment (birthday parties, playgroups), and social space for mothers. We also have a retail component in our gift store. It is difficult to compare our projected overall business ratios to any one industry standard because our revenue stream and costs are mixed.

The following table lists our business ratios and includes a comparison with standard ratios from the “Children’s Goods” industry (SIC Code 5137.05). These industry ratios reflect only the retail side of our operations.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 30.45% | 28.94% | 3.65% |

| Percent of Total Assets | ||||

| Inventory | 23.31% | 33.49% | 28.10% | 34.08% |

| Other Current Assets | 36.66% | 39.83% | 25.91% | 27.86% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 89.32% |

| Long-term Assets | ||||

| Total Long-term Assets | 0.00% | 0.00% | 0.00% | 10.68% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 | |

| Current Liabilities | ||||

| Accounts Payable | 41.692 | 40.424 | 50.073 | |

| Current Borrowing | 0.00% | $0.00% | $0.00% | |

| Other Current Liabilities | $0 | $0 | $0 | |

| Subtotal Current Liabilities | 41.692 | 40.424 | 50.073 | |

| Long-term Liabilities | $141,244 | $117,567 | $91,797 | |

| Total Liabilities | $182,936 | $157,991 | $141,870 | |

| Paid-in Capital | $70,000 | $70,000 | $70,000 | |

| Retained Earnings | ($

Personnel Plan: Emili, Principal: 0% – $3,200 – $4,000 – $4,500 – $5,000 Manager: 0% – $2,600 PT Manager: 0% – $1,004 StrollerFit Fitness Certified Instructor: 0% – $520 – $780 – $1,040 PT Class Instructor/Party Coordinator: 0% – $0 – $350 – $484 – $550 – $600 – $724 – $780 – $820 PT Retail Specialist: 0% – $0 – $866 – $1,300 FT Retail Specialist: 0% – $0 – $1,730 Other: 0% Total People: 4 – 5 – 6 – 7 Total Payroll: $7,324 – $7,674 – $8,608 – $8,934 – $10,110 – $10,610 – $12,774 – $13,398 – $13,454 – $13,494 Pro Forma Profit and Loss: Sales: $18,150 – $24,535 – $29,835 – $34,695 – $37,430 – $41,470 – $46,500 – $49,500 – $53,500 – $57,100 – $59,160 – $61,500 Direct Cost of Sales: $8,050 – $11,050 – $13,325 – $15,550 – $16,500 – $18,275 – $20,325 – $21,825 – $23,825 – $25,375 – $26,375 – $27,375 Other Costs of Goods: $0 – $2 Total Cost of Sales: $8,050 – $11,050 – $13,325 – $15,550 – $16,500 – $18,277 – $20,325 – $21,825 – $23,825 – $25,375 – $26,375 – $27,375 Gross Margin: $10,100 – $13,485 – $16,510 – $19,145 – $20,930 – $23,193 – $26,175 – $27,675 – $29,675 – $31,725 – $32,785 – $34,125 Gross Margin %: 55.65% – 54.96% – 55.34% – 55.18% – 55.92% – 55.93% – 56.29% – 55.91% – 55.47% – 55.56% – 55.42% – 55.49% Expenses: Payroll: $7,324 – $7,674 – $8,608 – $8,934 – $8,984 – $10,110 – $10,610 – $12,774 – $13,398 – $13,454 – $13,494 Sales and Marketing and Other Expenses: $250 Depreciation: $0 Rent: $5,000 Phone & DSL: $75 Utilities: $400 Insurance: $175 Payroll Taxes: 20% – $1,465 – $1,535 – $1,722 – $1,787 – $2,022 – $2,122 – $2,555 – $2,680 – $2,691 – $2,699 Payroll Processing fees: $100 Loan payment: $2,800 Bookkeeper: $400 – $200 Office Supplies: $100 Janitorial Service: $0 Janitorial Supplies & Paper Products: $350 Interest Expense: 15% – $1,085 Other: $250 – $100 – $200 – $300 – $400 Total Operating Expenses: $19,774 – $19,644 – $19,744 – $21,065 – $21,256 – $21,266 – $22,617 – $23,567 – $25,984 – $26,833 – $26,900 – $27,148 Profit Before Interest and Taxes: ($9,674) – ($6,159) – ($3,234) – ($1,920) – ($326) – $1,927 – $3,558 – $4,108 – $3,691 – $4,892 – $5,885 – $6,977 EBITDA: ($9,674) – ($6,159) – ($3,234) – ($1,920) – ($326) – $1,927 – $3,558 – $4,108 – $3,691 – $4,892 – $5,885 – $6,977 Interest Expenses: $1,142 – $1,129 – $1,116 – $1,103 – $1,090 – $1,078 – $1,065 – $1,052 – $1,039 – $1,026 – $1,013 – $1,000 Taxes Incurred: $0 Net Profit: ($10,816) – ($7,288) – ($4,350) – ($3,023) – ($1,416) – $850 – $2,493 – $3,056 – $2,652 – $3,866 – $4,872 – $5,977 Net Profit/Sales: -59.59% – -29.70% – -14.58% – -8.71% – -3.78% – 2.05% – 5.36% – 6.17% – 4.96% – 6.77% – 8.24% – 9.72% Pro Forma Cash Flow |

|||

| Pro Forma Cash Flow | ||||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |||

| Cash Received | ||||||||||||||

| Cash from Operations | ||||||||||||||

| Cash Sales | $18,150 | $24,535 | $29,835 | $34,695 | $37,430 | $41,470 | $46,500 | $49,500 | $53,500 | $57,100 | $59,160 | $61,500 | ||

| Subtotal Cash from Operations | $18,150 | $24,535 | $29,835 | $34,695 | $37,430 | $41,470 | $46,500 | $49,500 | $53,500 | $57,100 | $59,160 | $61,500 | ||

| Additional Cash Received | ||||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Subtotal Cash Received | $18,150 | $24,535 | $29,835 | $34,695 | $37,430 | $41,470 | $46,500 | $49,500 | $53,500 | $57,100 | $59,160 | $61,500 | ||

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Expenditures from Operations | ||||||||||||||

| Cash Spending | $7,324 | $7,674 | $7,674 | $8,608 | $8,934 | $8,984 | $10,110 | $10,610 | $12,774 | $13,398 | $13,454 | $13,494 | ||

| Bill Payments | $453 | $13,575 | $13,102 | $13,232 | $15,076 | $30,156 | $33,674 | $36,196 | $37,577 | $40,316 | $41,554 | $41,974 | ||

| Subtotal Spent on Operations | $7,777 | $21,249 | $20,776 | $21,840 | $24,010 | $39,140 | $43,784 | $46,806 | $50,351 | $53,714 | $55,008 | $55,468 | ||

| Additional Cash Spent |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!