S Corporation Business Facts and Options

Many entrepreneurs have two goals when choosing a business structure: protecting personal assets from business claims and having business profits taxed on individual tax returns. Recently, S corporations have become less popular as limited liability companies (LLCs) have taken their place. Still, S corporations are appropriate for some businesses. If you’re interested, read on.

What is an S corporation?

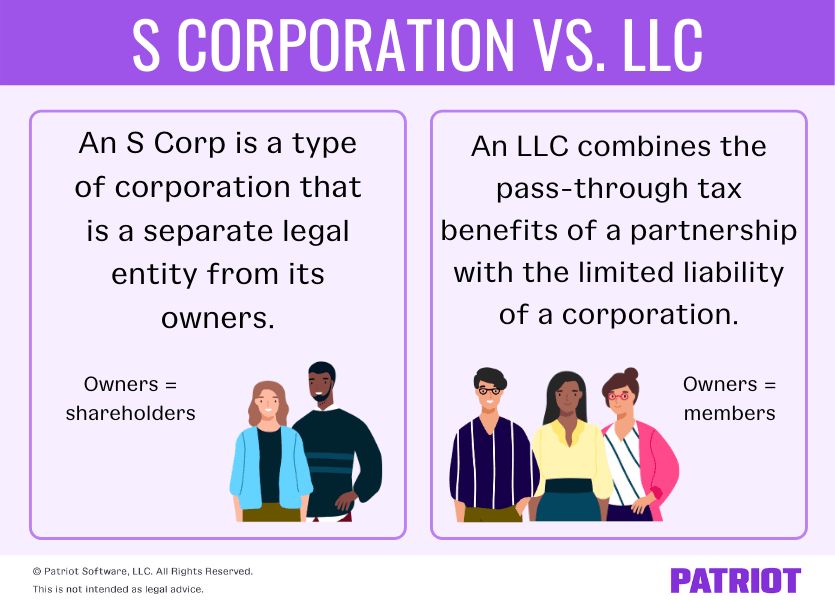

An S corporation is a regular corporation that provides limited liability for shareholders and allows income taxes to be paid on the same basis as a sole proprietor or partner.

In a regular corporation, the company itself is taxed on business profits. Owners pay individual income tax on money they draw from the corporation as salary, bonuses, or dividends. In an S corporation, however, business profits “pass through” to owners, who report them on personal tax returns, similar to sole proprietorships, partnerships, and LLCs. The S corporation itself does not pay income tax, although a co-owned S corporation must file an informational tax return to disclose each shareholder’s portion of the corporate income.

Most states tax S corporations in the same way as the federal government: by not imposing a corporate tax and instead taxing business profits on shareholders’ personal returns. However, a few states tax S corporations like regular corporations. Check with your state treasury department for information about how S corporations are taxed in your state.

Should you elect S corporation status?

If your corporation meets certain criteria, such as having only U.S. citizen or resident shareholders, you can choose to operate as an S corporation. Operating as an S corporation rather than a regular corporation may be wise for several reasons:

– An S corporation allows you to pass business losses through to your personal income tax return, offsetting income from other sources.

– When selling your S corporation, your taxable gain on the sale can be lower than if you operated as a regular corporation.

However, S corporations come with strict requirements:

– Each S corporation shareholder must be a U.S. citizen or resident.

– S corporation profits and losses can only be allocated based on each shareholder’s interest in the business.

– An S corporation shareholder cannot deduct corporate losses that exceed their stock basis.

– S corporations cannot deduct fringe benefits provided to employee-shareholders who own more than 2% of the corporation.

Fortunately, electing S corporation status isn’t permanent. If you later find that there are tax advantages to being a regular corporation, you can change your status.

How to elect S corporation status

To be treated as an S corporation, all shareholders must sign and file IRS Form 2553. Shareholders pay income tax on their share of the corporation’s income, regardless of whether they receive the money. If the corporation incurs a loss, shareholders can claim their share.

S corporation alternatives

Creating an LLC allows you to achieve both limited liability and pass-through taxation. LLCs offer greater flexibility in allocating profits and losses and aren’t subject to the same restrictions as S corporations. Therefore, forming an LLC is often a better choice.

Consult an expert

Choosing an ownership structure for your business can be complex. To determine whether an S corporation, C corporation, or LLC is best for your company, consult a tax lawyer or experienced accountant who is knowledgeable about the tax advantages and disadvantages of different ownership structures.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!