Car Wash Self-service Business Plan

Auto Paradise is a start-up company seeking $934,100 to establish a two-bay automatic and four-bay self-serve car wash in San Angelo, Texas. We aim to provide exceptional car care services to the local community and become the premier car wash service in the area. Bobby and Vicki Lewallen have pledged $45,000 and are seeking investors to raise an additional $150,000, representing 20% of the company stock. This funding will help secure a Small Business Administration (SBA) loan of $740,400.

We will offer high-quality laser car wash, self-serve car wash, and vacuum/shampoo services at Auto Paradise. In addition, we will provide ATM services and sell reverse osmosis (RO) water on site.

Our management team at Auto Paradise is strong. Mr. Lewallen, a former officer in the United States Army, will serve as the President and CEO of Auto Paradise Texas Corporation (C). His extensive leadership and organizational experience will contribute to the success of our company.

Research shows that the mild winter climate in San Angelo will support steady year-round sales for Auto Paradise. Our location on Avenue N and our marketing campaign will attract local residents, the Angelo State University community, and customers from Goodfellow Air Force Base. We will be conveniently located near the intersection of two major roads. Our main competitors are outdated "tunnel" or friction car washes, lube & washes, and convenience stores. We will differentiate ourselves by offering the advanced Laserwash 4000 "touchless, spot-free" system. Washing Equipment of Texas (WET) in San Angelo will supply all equipment and offer maintenance support.

After securing financing, Auto Paradise plans to open approximately 90 days later. Mr. Lewallen offers several investment opportunities:

1. Company stock: Mr. Lewallen offers 20% of company stock to investors, with each 1% share priced at $7,500. This capital will help establish the first Auto Paradise location. Investors will receive $2,500 per 1% share annually for the first three years.

2. Secured investment: Mr. Lewallen offers a guaranteed 10% annual return for a three-year investment, securing these investments with personal assets/investments.

To support our initial operations, Mr. Lewallen will secure an SBA loan of $740,400 from Compass Bank in San Antonio. The loan includes a 10% ($69,000) construction contingency that will convert to operating capital if construction costs align with estimates. It also covers nine months of interim interest, deferring the long-term mortgage payment.

Mr. Lewallen’s personal investment and his ability to sustain business losses for the first 6-12 months will enable Auto Paradise to expand to a second location within the first two years of operation.

Objectives:

1. Achieve average monthly sales of $28,000.

2. Establish a second site 12 months after the first Auto Paradise opens.

3. Provide initial investors a 33% ($2,500/share) distribution annually for the first three years to recover their initial investment.

Mission:

Auto Paradise is committed to providing customers with the ultimate car care experience. We prioritize customer satisfaction and value while offering an excellent reward for our owners and employees.

Auto Paradise, located near the intersection of two major roads in San Angelo, will offer car care services to the local community. It will have two automatic car wash bays, four self-serve bays, vacuum and car wash vending services, and a reverse osmosis drinking water service. The location is strategically positioned on the busy streets of Avenue N and Bryant Avenue. The facility includes an office in the middle of the bays, four high powered vacuum islands, a vending area, and an ATM/RO water area.

Auto Paradise will be a Texas C corporation owned primarily by Mr. and Mrs. Lewallen, with other investors making up the remaining 20%. The projected start-up expenses, including construction, equipment, land, landscaping, and related expenses, total $934,100. The financing options include investing in company stock or secured investment with a guaranteed 10% return for three years.

The SBA loan will ensure the success of Auto Paradise during the early months of operation. It includes a construction contingency of 10% and nine months of interim interest. The lot near the intersection of Bryant Ave. and Avenue N has been secured pending a favorable phase I environmental inspection.

The construction bid, which will be obtained after securing initial investors, is the next step. The estimated construction costs of $390,000 cover two automatic and four self-serve bays, parking lot, signage, landscaping, and architect fees. A construction contingency of 10% will cover any unexpected expenses. Washing Equipment of Texas (WET) will provide the equipment, maintenance, and repair services.

Overall, Auto Paradise aims to provide exceptional car care services and establish itself as the premier car wash service in San Angelo, Texas.

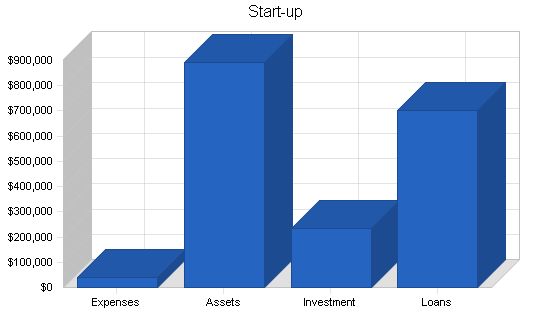

Start-up Funding

Start-up Expenses to Fund: $40,500

Start-up Assets to Fund: $893,500

Total Funding Required: $934,000

Assets

Non-cash Assets from Start-up: $799,000

Cash Requirements from Start-up: $94,500

Additional Cash Raised: $0

Cash Balance on Starting Date: $94,500

Total Assets: $893,500

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $700,000

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $700,000

Capital

Planned Investment

Bobby Lewallen: $45,000

Additional Investors (20% Ownership): $150,000

10% Construction Contingency: $39,000

Additional Investment Requirement: $0

Total Planned Investment: $234,000

Loss at Start-up (Start-up Expenses): ($40,500)

Total Capital: $193,500

Total Capital and Liabilities: $893,500

Total Funding: $934,000

Start-up

Requirements

Start-up Expenses

Project Closing Costs: $25,000

Summit Funding Fee: $10,500

Misc (Legal/CPA/Misc): $5,000

Total Start-up Expenses: $40,500

Start-up Assets

Cash Required: $94,500

Other Current Assets: $0

Long-term Assets: $799,000

Total Assets: $893,500

Total Requirements: $934,000

Services

Auto Paradise realizes the car wash industry is a service industry. Auto Paradise will establish itself as the premier car wash facility in San Angelo by providing quality service for a competitive price and focusing staff on customer service. We will offer the following services to the San Angelo community:

– Laser "touch-free and spot-free" car wash (4 different washes: $5, $6, $7, $8)

– Four "self-serve" bays ($1.25 for 4 min cycle)

– Vacuum and car wash vending services ($.75 for 4 min cycle)

– Reverse osmosis drinking water ($.25/gal)

– First Convenience Bank Goldkey ATM services.

Market Analysis Summary

Auto Paradise will focus on Angelo State University students, local residents, and Goodfellow Air Force Base drive-by traffic for repeat customers. The volume of drive-by traffic (approx. 14,000 – 17,000 cars/day) will provide a high volume of opportunity customers. Our most important group of potential customers are those who live and work in the immediate area, including college students, faculty, and local residents who want a quick, quality car wash at a competitive price. We will also pursue relationships with local car dealerships to develop additional business opportunities.

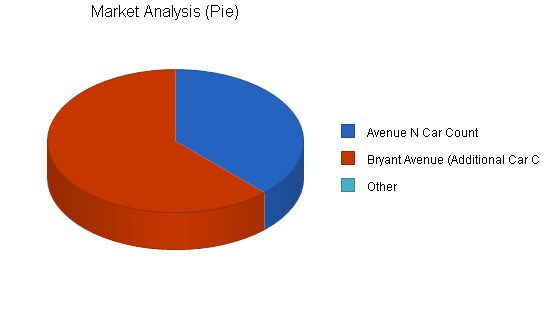

4.1 Market Segmentation

1. College Students/Faculty, Local Residents, and Goodfellow Air Force Base traffic.

2. Drive-by Opportunities: According to 1998 Department of Transportation data:

– Avenue N car count: 14,000 cars per day.

– Bryant Avenue car count: 37,000 cars per day (23,000 additional cars).

Market Analysis

year 1 year 2 year 3 year 4 year 5

Potential Customers Growth CAGR

Avenue N Car Count 3% 14,000 14,420 14,853 15,299 15,758 3.00%

Bryant Avenue (Additional Car Count) 3% 23,000 23,690 24,401 25,133 25,887 3.00%

Other 0% 0 0 0 0 0 0.00%

Total 3.00% 37,000 38,110 39,254 40,432 41,645 3.00%

4.2 Competition and Buying Patterns

Extensive research indicates that the mild winter climate in San Angelo will support steady year-round sales. Auto Paradise’s location and marketing campaign will attract residential, Angelo State University, and Goodfellow Air Force Base customers.

Direct competition is limited to outdated "tunnel" or friction car washes, lube and wash, and convenience stores.

Auto Paradise will boast the Laserwash 4000 "touchless, spot-free" system. Laserwash is widely recognized as the leader in automatic car wash systems. It will also have attendants on duty Monday – Saturday to provide additional customer service and car preparation. Washing Equipment of Texas (WET) of San Angelo will provide all car wash supplies, equipment, and maintenance support. The Laserwash system is a fast, convenient, high-quality car wash system that does not damage your car, while offering a great value to its customers. Auto Paradise will increase its customer base by also offering four self-serve bays for those "do-it-yourself" customers.

Strategy and Implementation Summary

The following topics describe our competitive edge, marketing strategy, and sales strategy.

5.1 Marketing Strategy

Marketing in our car wash business relies on the name recognition of the Laserwash system as an industry leader and the "curbside" appeal of the site for first-time customers. Quality service will bring customers back. We will also use a local radio station and the advertising of satisfied customers to grow our customer base. We will offer a competitive price for all budgets. Our base wash will be $5, and our deluxe wash will be $8.

To develop good business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis.

5.2 Competitive Edge

We start with a critical competitive edge: there is no competitor in San Angelo that offers a 2-bay, 24-hour, automatic, and self-serve combination car wash. Our competitors consist of "event washes." We define "event washes" as self-serve, lube+wash, gas+wash, and friction washes. Currently, San Angelo customers must plan significant time and/or effort to get a quality car wash. Our positioning in these areas is very hard to match if we maintain our focus on customer service, speed, quality, and reliability.

5.3 Sales Strategy

Sales in our business are client service. It is repeat business. We will ensure the following elements are the building blocks of our marketing/sales strategy:

– 24-hour service availability

– Quality service at good value (attendants on duty: 10 – 6, Mon – Sat, focused on customer satisfaction)

– Reliability in all seasons/weather.

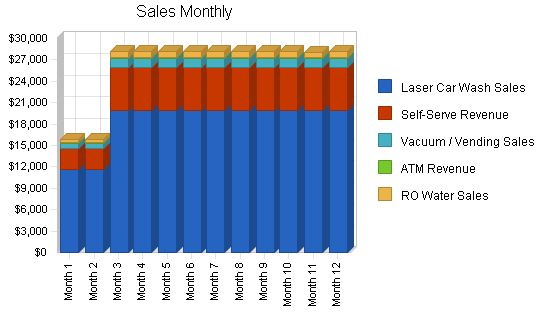

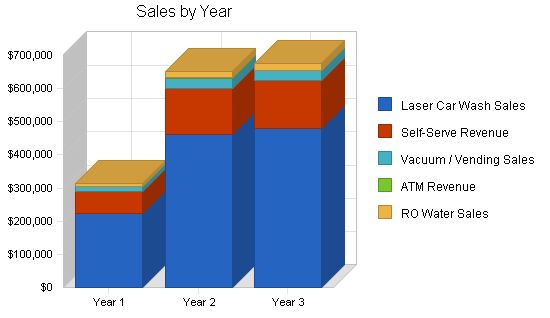

5.3.1 Sales Forecast

The following table and chart give a forecast of sales. We expect to average over $26,000 in overall sales by the third month of operation. Being an all-cash business, we also expect to at least break even during the first two months of operation.

Because of the all-weather capabilities of the Laserwash 4000 system and the mild winters in West Texas, we expect to have relatively consistent sales throughout the year. Variable expenses have been averaged to account for fluctuation in price from season to season.

Plan years 2004 and 2005 have the income and expenses for two sites with the same assumptions for the second site during its first year of operation.

Projected Gross Revenue:

1. Both Automatic Bays are projected to average 61 cars/day the first two months and 105 cars/day after the business is well established. Wash prices will vary, currently $5.00 to $8.00, depending on the options the customer selects. Projected automatic wash revenue assumes an average of $6.25 per wash.

2. Self Serve Bay income is projected at $1,500 per month. This assumes 40 cycles per bay each day. A cycle is $1.25 for 4 minutes. The average self-serve customer spends $4.50 per wash.

3. Vacuum and Vending revenue is projected to be 5% of the aggregate automatic and self-serve revenue. This projection is based on a vacuum price of $0.75 for 4 minutes.

4. Reverse Osmosis Water revenue is projected to be $750 per month. Drinking water in San Angelo is a significant market. Reverse osmosis water will be offered at $0.25 per gallon.

5. ATM revenue is projected to be $100 per month. First Convenience Bank will fully maintain the ATM.

Note: All numbers assume a second site is opened at the beginning of the second year.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Laser Car Wash | $222,802 | $462,334 | $479,064 |

| Self-Serve Revenue | $66,000 | $138,000 | $144,000 |

| Vacuum / Vending Sales | $14,440 | $29,600 | $30,672 |

| ATM Revenue | $1,096 | $2,224 | $2,304 |

| RO Water Sales | $8,500 | $19,224 | $19,920 |

| Total Sales | $312,838 | $651,382 | $675,960 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Laser Car Wash Sales | $50,130 | $104,025 | $107,789 |

| Self-Serve Revenue | $7,333 | $15,332 | $15,998 |

| Vacuum / Vending Sales | $2,834 | $5,950 | $6,231 |

| ATM Revenue | $0 | $0 | $0 |

| RO Water Sales | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $60,297 | $125,307 | $130,018 |

Contents

Management Summary

Auto Paradise has a strong management team. Mr. Lewallen, the President and Chief Executive Officer of the Auto Paradise Texas Corporation (C), brings extensive leadership, management, and organization experience. He served in the United States Army for 10 years, with one year as a Brigade logistics officer and two years as a company commander, gaining valuable expertise in planning, coordinating, and executing complex deployments and missions.

6.1 Personnel Plan

The table below summarizes our personnel expenditures for the first three years, with compensation increasing from less than $50,000 in the first year to about $140K in the third. Mr. Lewallen will be the CEO and manage the Avenue N location. Two attendants will staff the wash Monday – Saturday, providing customer service, vehicle prep at the automatic washes, and maintaining the car wash site. For a detailed monthly personnel plan for the first year, refer to the appendix.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| 2 Attendants, 1st site | $24,000 | $24,000 | $24,000 |

| Manager, 1st site (Owner) | $18,000 | $36,000 | $36,000 |

| 2 Attendants, 2nd site | $0 | $24,000 | $24,000 |

| Manager, 2nd site (Owner) | $0 | $18,000 | $36,000 |

| Total People | 3 | 5 | 5 |

| Total Payroll | $42,000 | $102,000 | $120,000 |

Financial Plan

Our business is an "all cash" business that will pay for all variable and fixed expenses monthly. Thus, we will rapidly build cash flow to finance future growth. During the first nine months (six months of operation), two key issues will assist Auto Paradise in rapidly building capital:

- Nine months (three months construction, six months of operation) of deferred long-term loan repayment ($7,081 savings/month)

- CEO/manager will not receive a salary for at least six months ($3,000 savings/month).

7.1 Important Assumptions

The financial plan depends on important assumptions, most of which are shown in the following table as annual assumptions. From the beginning, we recognize that variable expenses are critical. Water, sewer, and electricity costs are our largest expenses, with water being the major concern in West Texas. We have planned for this possibility by installing all the required storage, electrical, and plumbing for a total water reclamation system.

Two of the more important assumptions are:

- Our long-term financing includes nine months of interim interest for repayment.

- We assume a sound economy, without a major recession despite our modest pricing.

- We assume that there are no unforeseen changes in local regulations that will interrupt our service.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 7.50% | 7.50% | 7.50% |

| Long-term Interest Rate | 8.00% | 8.00% | 8.00% |

| Tax Rate | 20.83% | 20.00% | 20.83% |

| Other | 0 | 0 | 0 |

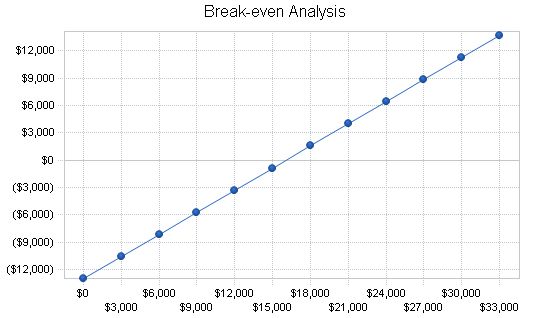

7.2 Break-even Analysis

The break-even analysis table below shows the following revenue sources:

1. Laser Car Wash Sales

2. Vacuum/vending sales

3. ATM revenue

4. Reverse Osmosis water revenue.

Break-even Analysis:

Monthly Revenue Break-even: $16,059

Assumptions:

Average Percent Variable Cost: 19%

Estimated Monthly Fixed Cost: $12,964

7.3 Projected Profit and Loss

Projected Revenue. Refer to the "Sales Forecast" for a detailed breakdown.

Projected Operating Expenses.

1. Direct Cost of Automatic Sales.

– Chemicals: 8.6% of gross revenue (includes soap, wax, and salt).

– Utilities: 13.9% of gross revenue (includes water, electricity, gas, and sewer).

2. Direct Cost of Self-Serve Sales. Total cost averages 11.1% of self-serve revenue.

3. Direct Cost of Vacuum/Vending Sales. Average 1% of aggregate automatic and self-serve revenue.

4. Variable/Fixed Expenses.

– Labor: Estimated at $2,000/month, with an additional 15% burden to cover payroll taxes and workman’s compensation insurance. Based on two part-time employees, 70 total hours/week at $6.50/hour.

– Repair and Maintenance: Includes $750/month for monthly service provided by WET and $100/month to clean each wash bay pit.

– Real Estate Taxes: Estimated at 3% of land and construction costs ($500,000).

– General Liability Insurance: Estimated at $1800/year.

Depreciation:

– Equipment: $295,000 ÷ 6 years ÷ 12 months = $4,097/month.

– Construction: $390,000 ÷ 15 years ÷ 12 months = $2,167/month.

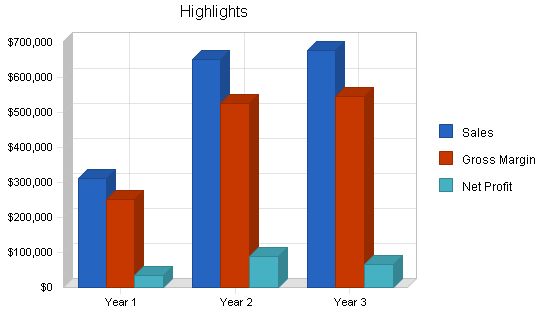

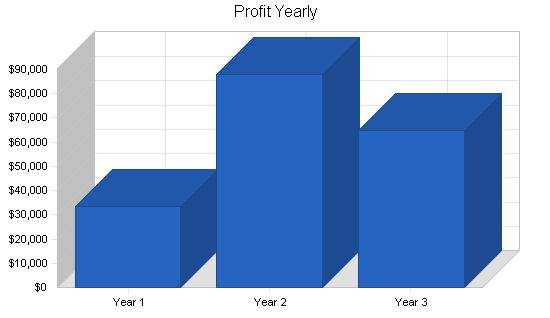

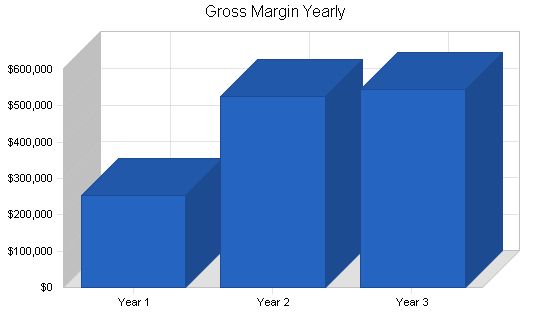

Pro Forma Profit and Loss

Sales: $312,838 (Year 1), $651,382 (Year 2), $675,960 (Year 3)

Direct Cost of Sales: $60,297 (Year 1), $125,307 (Year 2), $130,018 (Year 3)

Other Production Expenses: $0 (Year 1), $0 (Year 2), $0 (Year 3)

Total Cost of Sales: $60,297 (Year 1), $125,307 (Year 2), $130,018 (Year 3)

Gross Margin: $252,541 (Year 1), $526,075 (Year 2), $545,942 (Year 3)

Gross Margin %: 80.73% (Year 1), 80.76% (Year 2), 80.77% (Year 3)

Expenses

Payroll: $42,000 (Year 1), $102,000 (Year 2), $120,000 (Year 3)

Sales and Marketing and Other Expenses: $17,400 (Year 1), $34,800 (Year 2), $34,800 (Year 3)

Depreciation: $75,168 (Year 1), $150,336 (Year 2), $150,336 (Year 3)

Accounting / Legal: $1,200 (Year 1), $2,400 (Year 2), $2,400 (Year 3)

Dumpster / Telephone / Pager: $1,500 (Year 1), $3,000 (Year 2), $3,000 (Year 3)

Insurance: $1,800 (Year 1), $3,600 (Year 2), $3,600 (Year 3)

Repairs / Maintenance: $10,200 (Year 1), $20,400 (Year 2), $20,400 (Year 3)

Payroll Taxes: $6,300 (Year 1), $15,300 (Year 2), $18,000 (Year 3)

Other: $0 (Year 1), $0 (Year 2), $0 (Year 3)

Total Operating Expenses: $155,568 (Year 1), $331,836 (Year 2), $352,536 (Year 3)

Profit Before Interest and Taxes: $96,973 (Year 1), $194,239 (Year 2), $193,406 (Year 3)

EBITDA: $172,141 (Year 1), $344,575 (Year 2), $343,742 (Year 3)

Interest Expense: $55,603 (Year 1), $84,490 (Year 2), $111,401 (Year 3)

Taxes Incurred: $7,963 (Year 1), $21,950 (Year 2), $17,084 (Year 3)

Net Profit: $33,407 (Year 1), $87,800 (Year 2), $64,920 (Year 3)

Net Profit/Sales: 10.68% (Year 1), 13.48% (Year 2), 9.60% (Year 3)

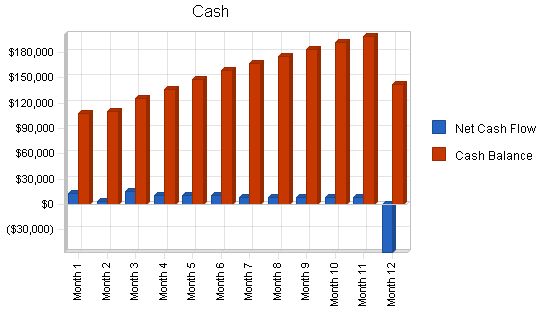

7.4 Projected Cash Flow

The following table outlines our estimated cash flow.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Sales | $312,838 | $651,382 | $675,960 |

| Subtotal Cash from Operations | $312,838 | $651,382 | $675,960 |

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $771,390 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $312,838 | $1,422,772 | $675,960 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Cash Spending | $42,000 | $102,000 | $120,000 |

| Bill Payments | $148,606 | $299,321 | $338,283 |

| Subtotal Spent on Operations | $190,606 | $401,321 | $458,283 |

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $9,168 | $40,808 | $57,792 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $857,100 | $0 |

| Dividends | $65,000 | $65,000 | $65,000 |

| Subtotal Cash Spent | $264,774 | $1,364,229 | $581,075 |

| Net Cash Flow | $48,064 | $58,543 | $94,885 |

| Cash Balance | $142,564 | $201,107 | $295,992 |

Projected Balance Sheet

The following table indicates our estimated balance sheet totals.

| Pro Forma Balance Sheet | |||

| Current Assets | $142,564 | $201,107 | $295,992 |

| Long-term Assets | $723,832 | $1,430,596 | $1,280,260 |

| Total Assets | $866,396 | $1,631,703 | $1,576,252 |

| Current Liabilities | $13,656 | $25,582 | $28,003 |

| Long-term Liabilities | $690,832 | $1,421,414 | $1,363,622 |

| Total Liabilities | $704,488 | $1,446,996 | $1,391,625 |

| Paid-in Capital | $234,000 | $234,000 | $234,000 |

| Retained Earnings | ($105,500) | ($137,093) | ($114,293) |

| Earnings | $33,407 | $87,800 | $64,920 |

| Total Capital | $161,907 | $184,707 | $184,627 |

| Total Liabilities and Capital | $866,396 | $1,631,703 | $1,576,252 |

| Net Worth | $161,907 | $184,707 | $184,627 |

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 7542, Car washes, are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 108.22% | 3.77% | 3.00% |

| Percent of Total Assets | ||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 26.40% |

| Total Current Assets | 16.45% | 12.32% | 18.78% | 44.60% |

| Long-term Assets | 83.55% | 87.68% | 81.22% | 55.40% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | Year 1 | Year 2 | Year 3 | n.a |

| Accounts Payable | $13,656 | $25,582 | $28,003 | |

| Current Borrowing | $0 | $0 | $0 | |

| Other Current Liabilities | $0 | $0 | $0 | |

| Subtotal Current Liabilities | $13,656 | $25,582 | $28,003 | |

| Long-term Liabilities | $690,832 | $1,421,414 | $1,363,622 | |

| Total Liabilities | $704,488 | $1,446,996 | $1,391,625 | |

| Net Worth | $161,907 | $184,707 | $184,627 | |

| Total Liabilities and Capital | $866,396 | $1,631,703 | $1,576,252 | |

| Net Profit Margin | 10.68% | 13.48% | 9.60% | n.a |

| Return on Equity | 20.63% | 47.53% | 35.16% | n.a |

| Accounts Payable Turnover | 11.88 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 23 | 29 | n.a |

| Total Asset Turnover | 0.36 | 0.40 | 0.43 | n.a |

| Debt to Net Worth | 4.35 | 7.83 | 7.54 | n.a |

| Current Liab. to Liab. | 0.02 | 0.02 | 0.02 | n.a |

| Net Working Capital | $128,907 | |||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Cash Sales | $15,876 | $15,876 | $28,109 | $28,109 | $28,109 | $28,109 | $28,109 | $28,109 | $28,109 | $28,105 | $28,109 | |

| Subtotal Cash from Operations | $15,876 | $15,876 | $28,109 | $28,109 | $28,109 | $28,109 | $28,109 | $28,109 | $28,109 | $28,109 | $28,105 | $28,109 |

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Net Cash Flow | $12,785 | $3,311 | $15,103 | $10,941 | $10,945 | $10,951 | $8,003 | $8,197 | $8,201 | $8,206 | $8,206 | ($56,786) |

Pro Forma Balance Sheet

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash | $107,285 | $110,596 | $125,699 | $136,640 | $147,586 | $158,536 | $166,539 | $174,737 | $182,938 | $191,144 | $199,349 | $142,564 | |

| Total Current Assets | $94,500 | $107,285 | $110,596 | $125,699 | $136,640 | $147,586 | $158,536 | $166,539 | $174,737 | $182,938 | $191,144 | $199,349 | $142,564 |

| Total Long-term Assets | $799,000 | $792,736 | $786,472 | $780,208 | $773,944 | $767,680 | $761,416 | $755,152 | $748,888 | $742,624 | $736,360 | $730,096 | $723,832 |

| Total Assets | $893,500 | $900,021 | $897,068 | $905,907 | $910,584 | $915,266 | $919,952 | $921,691 | $923,625 | $925,562 | $927,504 | $929,445 | $866,396 |

| Accounts Payable | $0 | $9,465 | $9,762 | $13,924 | $13,920 | $13,916 | $13,871 | $13,676 | $13,672 | $13,668 | $13,664 | $13,660 | $13,656 |

| Total Current Liabilities | $0 | $9,465 | $9,762 | $13,924 | $13,920 | $13,916 | $13,871 | $13,676 | $13,672 | $13,668 | $13,664 | $13,660 | $13,656 |

| Total Long-term Liabilities | $700,000 | $699,236 | $698,472 | $697,708 | $696,944 | $696,180 | $695,416 | $694,652 | $693,888 | $693,124 | $692,360 | $691,596 | $690,832 |

| Total Liabilities | $700,000 | $708,701 | $708,234 | $711,632 | $710,864 | $710,096 | $709,287 | $708,328 | $707,560 | $706,792 | $706,024 | $705,256 | $704,488 |

| Total Capital | $193,500 | $191,321 | $188,834 | $194,275 | $199,720 | $205,170 | $210,666 | $213,363 | $216,064 | $218,770 | $221,479 | $224,190 | $161,907 |

| Total Liabilities and Capital | $893,500 | $900,021 | $897,068 | $905,907 | $910,584 | $915,266 | $919,952 | $921,691 | $923,625 | $925,562 | $927,504 | $929,445 | $866,396 |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!