Contents

How to Apply for an EIN: Federal Tax ID Number

A federal tax ID number, also called an EIN or FEIN, is a 9 digit number assigned to a business by the IRS.

The U.S. Internal Revenue Service uses these numbers to:

- Identify businesses located in the United States and its territories

- Recognize a business for tax documentation purposes

- Identify the employer of employees filing taxes

Essentially, any business with employees needs to obtain one, but depending on the type of tax return you file, you may need one even if you have no employees. You can find out if you need to obtain an EIN on the IRS website or using the checklist posted in May 2019.

If you can answer “yes” to any of the IRS’s questions, you need to apply for an employer identification number:

- Do you have employees?

- Do you operate a business as a corporation or a partnership?

- Do you file an employment, excise, alcohol, tobacco, or firearms tax return?

- Do you withhold taxes on income paid to a non-resident alien (other than wages)?

- Do you have a Keogh plan?

- Are you involved with trusts, except certain grantor-owned revocable trusts, IRAs, or exempt organization business income tax returns?

- Are you involved with estates?

- Are you involved with real estate or mortgage investment conduits?

- Are you involved with nonprofit organizations?

- Are you involved with farmers’ cooperatives?

- Are you involved with plan administrators?

How to apply for a federal tax ID (FEIN) number:

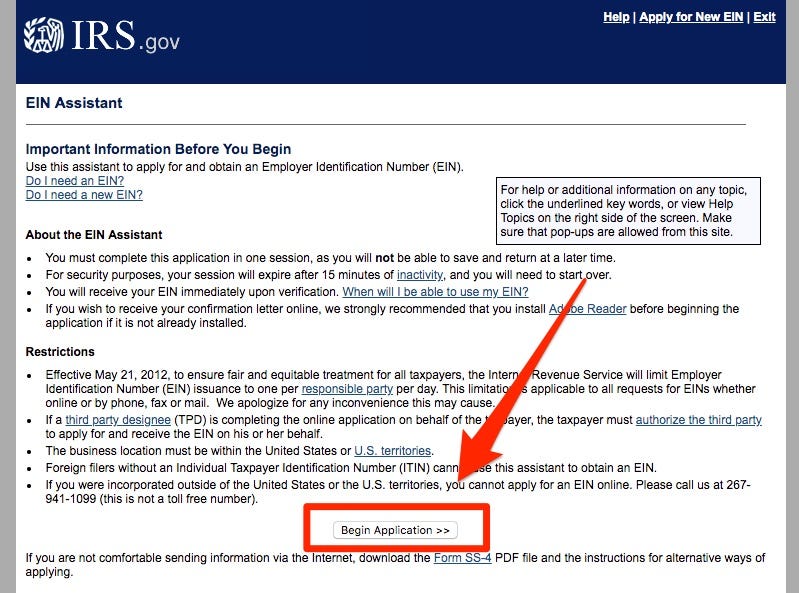

Applying is a simple process, usually done online. If you prefer to apply via fax, mail, or telephone, that is also possible.

Remember that applying for a tax ID number is free. If you’ve been asked to pay to apply, you’re on the wrong site!

During the application process, you will provide basic information about your business structure or organization, personal information, addresses, and other business-related details.

If you are not applying yourself, you will need to select a designated "responsible party" for the application. If you are the small business owner, it will most likely be yourself, but it could also be a business partner. The responsible party will need a valid taxpayer identification number (such as a social security number) to apply.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!