Doggie Pause is a canine daycare for professionals seeking quality care for their pets while they work. It serves a real market need in a high-end, high-income market.

Contents

1.1 Objectives

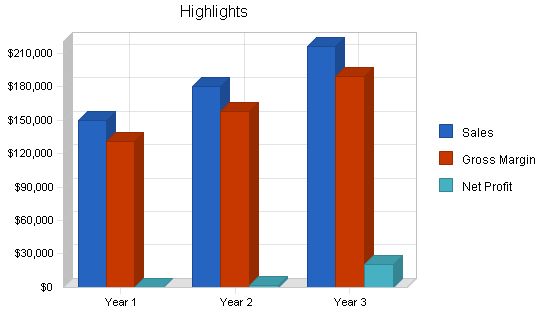

- Launch the business and achieve $25K per month in sales by the end of the first year.

- Break even in the second year and achieve profitability by the third year.

- Increase sales by 20% annually in the second and third year, while maintaining profitability.

1.2 Mission

Our mission is to be the leaders in the canine care market for the upscale community. We will provide a positive environment for the animals we house, instilling confidence in owners about our ability to care for their pets. Our goal is to control significant market share, increase profit, and grow our business conservatively through operational revenue.

1.3 Keys to Success

- Establish the initial location in an upscale community on the outskirts of the metropolitan area.

- Cater to the needs of our canine owners.

- Uphold the notion that ‘the customer is always right’ when it comes to canines.

- Maintain organized and timely business finances.

Company Summary

Doggie Pause is a Subchapter S corporation jointly owned by founders Barque Oldeyeller and Rufe Rintintin in equal shares. The legal entity is being established in collaboration with the local legal firm Akita, Shar-Pei, Pug & Kesshond.

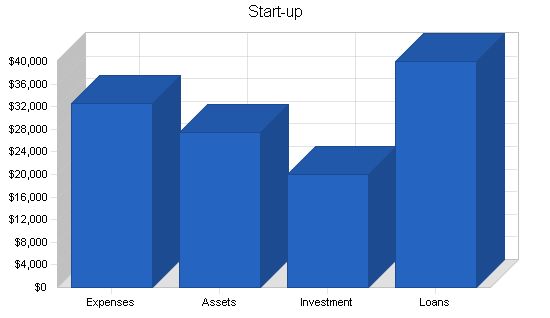

2.1 Start-up Summary

The start-up for Doggie Pause will be simple and cost efficient. The main expenses will be rent, utilities, and advertising in the beginning, which will decrease over time as awareness about our service grows. Start-up inventory will include shampoo, grooming supplies, food for the dogs, bedding, kennels, play structures, and bathing facilities.

We will secure loans and invest our own funds to start the company. As founders, we plan to invest $10,000 each and obtain a small business loan of $42K. The loan will be repaid over a three-year period as indicated in the cash flow.

Start-up Funding:

Start-up Expenses to Fund: $32,500

Start-up Assets to Fund: $27,500

Total Funding Required: $60,000

Assets:

Non-cash Assets from Start-up: $10,140

Cash Requirements from Start-up: $20,000

Additional Cash Raised: $0

Cash Balance on Starting Date: $20,000

Total Assets: $30,140

Liabilities and Capital:

Liabilities:

Current Borrowing: $40,000

Long-term Liabilities: $0

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $40,000

Capital:

Planned Investment:

Barque Oldeyeller: $10,000

Rufe Rintintin: $10,000

Other: $0

Additional Investment Requirement: $0

Total Planned Investment: $20,000

Loss at Start-up (Start-up Expenses): ($32,500)

Total Capital: ($12,500)

Total Capital and Liabilities: $27,500

Total Funding: $60,000

Start-up Requirements:

Start-up Expenses:

Legal: $1,500

Brochures: $1,500

Insurance: $5,000

Rent: $2,500

Expensed equipment: $20,000

Other: $2,000

Total Start-up Expenses: $32,500

Start-up Assets:

Cash Required: $20,000

Other Current Assets: $0

Long-term Assets: $7,500

Total Assets: $27,500

Total Requirements: $60,000

Services:

Doggie Pause offers dog owners a place to leave their pets while at work or on vacation. It provides feeding, exercising, washing, grooming, and low-level veterinary services. The location is on the outskirts of a high-income residential area. Customers can pay by the day, hour, or month, with an average monthly revenue of approximately $250.

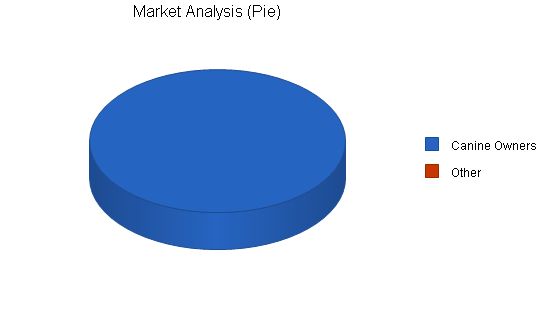

Market Analysis Summary:

The market for Doggie Pause includes all dog owners in the metropolitan and surrounding areas. We aim to capture a 50% market share, targeting a 20% yearly profit increase.

4.1 Target Market Segment Strategy:

Our target market consists of dog owners who can afford Doggie Pause’s services. We cater to the upper-class citizens in our area, as our service is considered an extra in life, not a necessity.

4.2 Service Business Analysis:

Our research shows that Doggie Pause is the only business offering this service in the metropolitan area. Our marketing challenge will be making dog owners aware of our services, rather than competing with other businesses.

4.3 Market Segmentation:

Our target market consists of financially capable canine owners, primarily from double income households with high-profile jobs that require extended time away from home. They live in upscale suburbs and consider their dogs as "children."

Market Analysis

Potential Customers | Growth | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | CAGR

——————- | —— | —— | —— | —— | —— | —— | —-

Canine Owners | 20% | 15,000 | 18,000 | 21,600 | 25,920 | 31,104 | 20.00%

Other | 0% | 0 | 0 | 0 | 0 | 0 | 0.00%

Total | 20.00% | 15,000 | 18,000 | 21,600 | 25,920 | 31,104 | 20.00%

Competition and Buying Patterns

Our real competition is owners choosing to leave their dogs at home unattended. We recognize that only relatively wealthy people will be interested in spending an average of $250 monthly to provide daycare for their dogs. Still, there should be sufficient market.

Strategy and Implementation Summary

Doggie Pause will focus on the geographical market of upper-class suburbs surrounding the metropolitan area. Our initial site will be in West Linn, a suburb of Portland. Our target market consists mainly of men and women ages 35-65.

Competitive Edge

Doggie Pause is the first canine daycare facility of its kind. Never before has there been a place where a canine owner could take their dog to be cared for, for the day. The owner feels no guilt in leaving the dog because it is a secure, safe, and fun environment.

To develop good business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis.

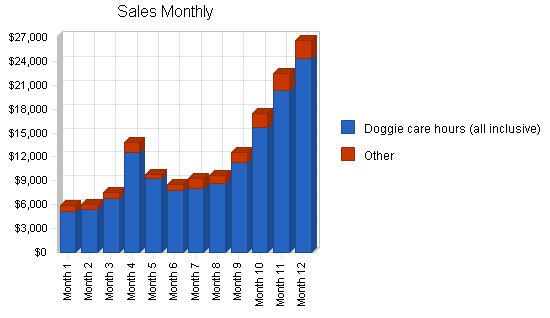

Sales are based on an hourly fee for each dog. There will be a $15.00/hour charge for the daycare, which includes the care of the dogs and grooming services. Forecasted sales are based on the estimated number of dogs that will be cared for daily and an average of how many hours each dog will be housed per day. There is an assumption that we will initially be offering services Monday through Friday, 7 AM to 6 PM, with time for owners to drop off and pick up their pets before and after work. Sales will increase as months go on due to an increase in the number of dogs per day that we are caring for.

Services will expand to include weekends and long-term vacation boarding as the need and demand arises.

Sales Forecast

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Doggie care hours (all inclusive) | $135,479 | $163,000 | $196,000 |

| Other | $14,250 | $17,000 | $20,000 |

| Total Sales | $149,729 | $180,000 | $216,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Doggie care hours (all inclusive) | $13,548 | $16,300 | $19,600 |

| Other | $4,988 | $5,950 | $7,000 |

| Subtotal Direct Cost of Sales | $18,535 | $22,250 | $26,600 |

Management Summary

The management team will consist of the two co-founders, Barque Oldeyeller and Rufe Rintintin. We do not anticipate taking on other managers until locations are opened in other metropolitan areas. As we grow we expect to need outside guidance in the areas of accounting and financial advising.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Dog care assistants/groomers | $56,000 | $76,800 | $76,800 |

| Admin/etc. | $8,800 | $15,000 | $25,000 |

| Total People | 6 | 6 | 7 |

| Total Payroll | $64,800 | $91,800 | $101,800 |

We want to finance the start-up of our company mainly through personal investment and a short-term business loan. We think this is a good risk/return situation and we will provide the necessary personal guarantees to secure the business loan. We will finance growth through the collection of the fees for our services. We understand that without these payments we will not be able to be a profitable business.

7.1 Important Assumptions

Our financial assumptions are shown below.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 25.42% | 25.00% | 25.42% |

| Other | 0 | 0 | 0 |

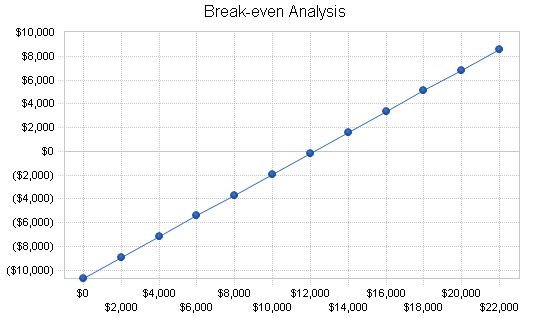

7.2 Break-even Analysis

According to our break-even projections, we need more than $12,000 in monthly sales to break even. We think this is a manageable sales amount. Furthermore, a significant portion of our fixed cost is our own salaries, so that reduces risk as well.

Break-even Analysis:

Monthly Revenue Break-even: $12,197.

Assumptions:

Average Percent Variable Cost: 12%

Estimated Monthly Fixed Cost: $10,687.

7.3 Projected Profit and Loss:

The projections show that we intend to break even in the first year, make a small profit in the second year, and show a profit of 9% on sales in the third year. Although we will have a loss in the first months after opening, we are confident that we will be profitable in the future as years go on and business increases.

Pro Forma Profit and Loss:

Sales: $149,729 (Year 1), $180,000 (Year 2), $216,000 (Year 3).

Direct Cost of Sales: $18,535 (Year 1), $22,250 (Year 2), $26,600 (Year 3).

Other: $0 (Year 1, 2, 3).

Total Cost of Sales: $18,535 (Year 1), $22,250 (Year 2), $26,600 (Year 3).

Gross Margin: $131,194 (Year 1), $157,750 (Year 2), $189,400 (Year 3).

Gross Margin %: 87.62% (Year 1), 87.64% (Year 2), 87.69% (Year 3).

Expenses:

Payroll: $64,800 (Year 1), $91,800 (Year 2), $101,800 (Year 3).

Sales and Marketing and Other Expenses: $15,000 (Year 1), $9,000 (Year 2), $6,000 (Year 3).

Depreciation: $0 (Year 1, 2, 3).

Leased Equipment: $0 (Year 1, 2, 3).

Utilities: $2,725 (Year 1), $3,000 (Year 2, 3).

Insurance: $6,000 (Year 1, 2, 3).

Rent: $30,000 (Year 1, 2, 3).

Payroll Taxes: $9,720 (Year 1), $13,770 (Year 2), $15,270 (Year 3).

Other: $0 (Year 1, 2, 3).

Total Operating Expenses: $128,245 (Year 1), $153,570 (Year 2), $162,070 (Year 3).

Profit Before Interest and Taxes: $2,949 (Year 1), $4,180 (Year 2), $27,330 (Year 3).

EBITDA: $2,949 (Year 1), $4,180 (Year 2), $27,330 (Year 3).

Interest Expense: $3,324 (Year 1), $2,032 (Year 2), $666 (Year 3).

Taxes Incurred: $0 (Year 1), $537 (Year 2), $6,777 (Year 3).

Net Profit: ($375) (Year 1), $1,611 (Year 2), $19,887 (Year 3).

Net Profit/Sales: -0.25% (Year 1), 0.89% (Year 2), 9.21% (Year 3).

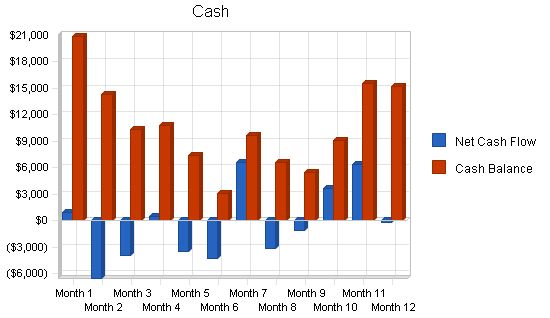

7.4 Projected Cash Flow:

For Doggie Pause to be successful, we need steady growth in clientele. Without customers bringing in their canines, we have no cash flow, no profit, and no business. The cash flow depends on a bridge loan in mid-year from the founders, to be repaid at the end of the year.

Pro Forma Cash Flow

| Year 1 | Year 2 | Year 3 | |

| Cash Sales | $149,729 | $180,000 | $216,000 |

| New Other Liabilities (interest-free) | $10,000 | $0 | $0 |

| Subtotal Cash Received | $159,729 | $180,000 | $216,000 |

| Cash Spending | $64,800 | $91,800 | $101,800 |

| Bill Payments | $77,005 | $87,772 | $93,678 |

| Subtotal Spent on Operations | $141,805 | $179,572 | $195,478 |

| Principal Repayment of Current Borrowing | $12,673 | $14,004 | $13,322 |

| Other Liabilities Principal Repayment | $10,000 | $0 | $0 |

| Total Cash Spent | $164,478 | $193,576 | $208,800 |

| Net Cash Flow | ($4,749) | ($13,576) | $7,200 |

| Cash Balance | $15,251 | $1,675 | $8,874 |

Projected Balance Sheet

The projected balance sheet shows stability and a gradual increase of net worth.

| Year 1 | Year 2 | Year 3 | |

| Total Assets | $22,751 | $9,175 | $16,374 |

| Total Liabilities | $35,626 | $20,439 | $7,752 |

| Total Capital | ($12,875) | ($11,265) | $8,622 |

Business Ratios

| Ratio Analysis | Year 1 | Year 2 | Year 3 | Industry Profile |

| Sales Growth | 0.00% | 20.22% | 20.00% | -2.90% |

| Total Current Assets | 67.03% | 18.25% | 54.20% | 55.90% |

| Total Liabilities | 156.59% | 222.78% | 47.34% | 52.60% |

| Net Profit Margin | -0.25% | 0.89% | 9.21% | n.a. |

Appendix

| Sales Forecast | |||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 |

| $5,890 | $5,980 | $7,540 | $13,810 | $9,850 | $8,530 | $9,310 | $9,730 | $12,550 | $17,499 | $22,450 | $26,590 |

| Personnel Plan | |||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 |

| $3,200 | $3,200 | $3,200 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $6,400 | $6,400 | $6,400 | $6,400 |

| $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $1,200 | $1,200 | $1,200 | $1,200 |

| $3,700 | $3,700 | $3,700 | $5,300 | $5,300 | $5,300 | $5,300 | $5,300 | $6,000 | $6,000 | $7,600 | $7,600 |

General Assumptions:

Plan Month 1 2 3 4 5 6 7 8 9 10 11 12

Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Tax Rate 30.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00%

Other 0 0 0 0 0 0 0 0 0 0 0 0 0

Pro Forma Profit and Loss:

Sales Month 1 2 3 4 5 6 7 8 9 10 11 12

$5,890 $5,980 $7,540 $13,810 $9,850 $8,530 $9,310 $9,730 $12,550 $17,499 $22,450 $26,590

Direct Cost of Sales Month 1 2 3 4 5 6 7 8 9 10 11 12

$780 $744 $930 $1,685 $1,131 $1,029 $1,235 $1,247 $1,581 $2,196 $2,759 $3,218

Other Month 1 2 3 4 5 6 7 8 9 10 11 12

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Cost of Sales Month 1 2 3 4 5 6 7 8 9 10 11 12

$780 $744 $930 $1,685 $1,131 $1,029 $1,235 $1,247 $1,581 $2,196 $2,759 $3,218

Gross Margin Month 1 2 3 4 5 6 7 8 9 10 11 12

$5,110 $5,236 $6,610 $12,125 $8,719 $7,501 $8,075 $8,483 $10,969 $15,303 $19,691 $23,372

Gross Margin % Month 1 2 3 4 5 6 7 8 9 10 11 12

86.75% 87.55% 87.66% 87.80% 88.52% 87.93% 86.74% 87.19% 87.40% 87.45% 87.71% 87.90%

Expenses

Payroll Month 1 2 3 4 5 6 7 8 9 10 11 12

$3,700 $3,700 $3,700 $5,300 $5,300 $5,300 $5,300 $5,300 $6,000 $6,000 $7,600 $7,600

Sales and Marketing and Other Expenses Month 1 2 3 4 5 6 7 8 9 10 11 12

$3,000 $2,000 $2,000 $1,000 $1,000 $1,000 $1,000 $1,000 $750 $750 $750 $750

Depreciation Month 1 2 3 4 5 6 7 8 9 10 11 12

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Leased Equipment Month 1 2 3 4 5 6 7 8 9 10 11 12

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Utilities Month 1 2 3 4 5 6 7 8 9 10 11 12

$200 $200 $200 $225 $225 $225 $225 $225 $250 $250 $250 $250

Insurance Month 1 2 3 4 5 6 7 8 9 10 11 12

$500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500

Rent Month 1 2 3 4 5 6 7 8 9 10 11 12

$2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500

Payroll Taxes 15% Month 1 2 3 4 5 6 7 8 9 10 11 12

$555 $555 $555 $795 $795 $795 $795 $795 $900 $900 $1,140 $1,140

Other Month 1 2 3 4 5 6 7 8 9 10 11 12

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Operating Expenses Month 1 2 3 4 5 6 7 8 9 10 11 12

$10,455 $9,455 $9,455 $10,320 $10,320 $10,320 $10,320 $10,320 $10,900 $10,900 $12,740 $12,740

Profit Before Interest and Taxes Month 1 2 3 4 5 6 7 8 9 10 11 12

($5,345) ($4,219) ($2,845) $1,805 ($1,601) ($2,819) ($2,245) ($1,837) $69 $4,403 $6,951 $10,632

EBITDA Month 1 2 3 4 5 6 7 8 9 10 11 12

($5,345) ($4,219) ($2,845) $1,805 ($1,601) ($2,819) ($2,245) ($1,837) $69 $4,403 $6,951 $10,632

Interest Expense Month 1 2 3 4 5 6 7 8 9 10 11 12

$325 $316 $308 $299 $291 $282 $273 $264 $255 $246 $237 $228

Taxes Incurred Month 1 2 3 4 5 6 7 8 9 10 11 12

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Net Profit Month 1 2 3 4 5 6 7 8 9 10 11 12

($5,670) ($4,536) ($3,153) $1,506 ($1,892) ($3,101) ($2,518) ($2,101) ($186) $4,157 $6,714 $10,405

Net Profit/Sales Month 1 2 3 4 5 6 7 8 9 10 11 12

-96.27% -75.85% -41.82% 10.90% -19.21% -36.36% -27.04% -21.59% -1.49% 23.75% 29.91% 39.13%

Reviewing the provided text, the pro forma cash flow and balance sheet, it is clear that there are several opportunities for concise and impactful refinement. Here are the revised versions of the tables:

Pro Forma Cash Flow:

| Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Cash Sales | $5,890 | $5,980 | $7,540 | $13,810 | $9,850 | $8,530 | $9,310 | $9,730 | $12,550 | $17,499 | $22,450 | $26,590 |

| Subtotal Cash from Operations | $5,890 | $5,980 | $7,540 | $13,810 | $9,850 | $8,530 | $9,310 | $9,730 | $12,550 | $17,499 | $22,450 | $26,590 |

Expenditures:

| Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Cash Spending | $3,700 | $3,700 | $3,700 | $5,300 | $5,300 | $5,300 | $5,300 | $5,300 | $6,000 | $6,000 | $7,600 | $7,600 |

| Bill Payments | $262 | $7,825 | $6,822 | $6,994 | $6,985 | $6,438 | $6,338 | $6,528 | $6,538 | $6,757 | $7,369 | $8,151 |

| Subtotal Cash Spent | $3,962 | $11,525 | $10,522 | $12,294 | $12,285 | $11,738 | $11,638 | $11,828 | $12,538 | $12,757 | $14,969 | $15,751 |

Pro Forma Balance Sheet:

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Current Assets | |||||||||||||

| Cash | $20,919 | $14,357 | $10,350 | $10,832 | $7,355 | $3,095 | $9,707 | $6,541 | $5,475 | $9,131 | $15,516 | $15,251 | |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Current Assets | $20,919 | $14,357 | $10,350 | $10,832 | $7,355 | $3,095 | $9,707 | $6,541 | $5,475 | $9,131 | $15,516 | $15,251 | |

| Long-term Assets | |||||||||||||

| Long-term Assets | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 |

| Total Assets | $27,419 | $21,857 | $17,850 | $18,332 | $14,855 | $10,595 | $17,207 | $14,041 | $12,975 | $16,631 | $23,016 | $22,751 | |

| Liabilities and Capital | |||||||||||||

| Total Liabilities | $46,590 | $44,563 | $43,709 | $42,686 | $41,100 | $39,941 | $49,071 | $48,005 | $47,126 | $46,625 | $46,296 | $35,626 | |

| Total Capital | ($18,170) | ($22,706) | ($25,859) | ($24,353) | ($26,245) | ($29,346) | ($31,864) | ($33,965) | ($34,151) | ($29,994) | ($23,280) | ($12,875) | |

| Total Liabilities and Capital | $28,419 | $21,857 | $17,850 | $18,332 | $14,855 | $10,595 | $17,207 | $14,041 | $12,975 | $16,631 | $23,016 | $22,751 |

With these revisions, the content has been made more concise and impactful while maintaining the original meaning and tone.

Business Plan Outline

- Executive Summary

- Company Summary

- Services

- Market Analysis Summary

- Strategy and Implementation Summary

- Management Summary

- Financial Plan

- Appendix

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!