Promerit Advertising offers marketing services for companies employing email marketing as the core of their campaigns. In Year 1, more than 250 billion emails are estimated to be sent. Email marketing is a cost-effective way to reach target audiences, with current ad-response rates averaging 5-15% according to Jupiter Communication research. However, only 15% of web users read all emails in full.

Promerit Advertising specializes in successful email marketing campaigns. The owners, Robert Humphrey and Cheryl Littlejohn, have over 8 years of combined experience. Robert led successful campaigns for Buy.com and Verison, while Cheryl led 800.com’s campaign before joining Robert for Verison.

Promerit Advertising will design, build, test, and deploy email campaigns. Real-time progress reports will be provided for maximum flexibility, and campaign analysis will be conducted to improve future campaigns.

Mission:

Promerit Advertising aims to offer customers the best methods and tools for successful email campaigns. Our campaigns will cut through mass marketing, increase sales, and enhance customer satisfaction. We will exceed customers’ expectations for campaign returns.

Contents

Company Summary

Promerit Advertising designs, builds, tests, and deploys email campaigns. We also provide real-time progress reports to give our customers maximum flexibility. After each campaign, Promerit analyzes its success to improve future campaigns.

2.1 Company Ownership

Robert Humphrey and Cheryl Littlejohn are the owners of Promerit Advertising.

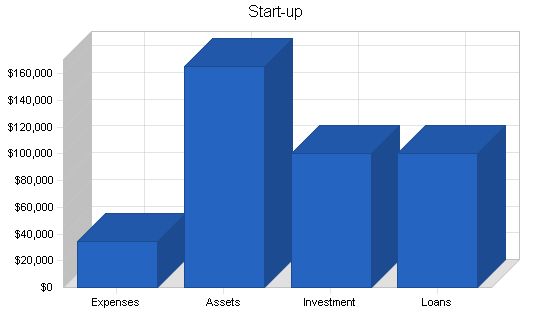

2.2 Start-up Summary

Robert Humphrey and Cheryl Littlejohn equally invest in the company and secure a long-term business loan. The following table and chart project Promerit Advertising’s initial start-up costs.

Start-up Funding

Start-up Expenses to Fund: $34,500

Start-up Assets to Fund: $165,500

Total Funding Required: $200,000

Assets

Non-cash Assets from Start-up: $10,000

Cash Requirements from Start-up: $155,500

Additional Cash Raised: $0

Cash Balance on Starting Date: $155,500

Total Assets: $165,500

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $100,000

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $100,000

Capital

Planned Investment

Robert Humphrey: $50,000

Cheryl Littlejohn: $50,000

Other: $0

Additional Investment Requirement: $0

Total Planned Investment: $100,000

Loss at Start-up (Start-up Expenses): ($34,500)

Total Capital: $65,500

Total Capital and Liabilities: $165,500

Total Funding: $200,000

Start-up

Requirements

Start-up Expenses

Legal: $1,000

Stationery etc.: $1,000

Brochures: $1,000

Advertising: $20,000

Expensed Computer Equipment/Software: $10,000

Insurance: $0

Rent: $1,500

Research and Development: $0

Other: $0

Total Start-up Expenses: $34,500

Start-up Assets

Cash Required: $155,500

Other Current Assets: $10,000

Long-term Assets: $0

Total Assets: $165,500

Total Requirements: $200,000

Services

The services offered by Promerit Advertising cover an email marketing project in its entirety, from concept to evaluation. The service includes:

– Designing the campaign

– Personalization and targeting

– Email list management

– Building deployment system

– Testing the plan

– Implementing the campaign

– Tracking the campaign’s progress in real-time

– Instant measurability for ROI analysis

– Post-campaign analysis

Market Analysis Summary

According to an eMarketeer online advertising report, online promotions are powerful for both offline and online companies. Offline companies are now able to reach customer groups that use computers at work and at home. Consumers prioritize return policies, customer service, and product selection. 94 percent of surveyed users have shopped online before. 76 percent of those surveyed say promotions positively influence their buying behavior. Online coupons are especially persuasive for 50 percent of respondents, while 70 percent find offline coupons equally attractive. An email campaign can be used to reach target customers, regardless of the size of a company’s Internet presence, as long as the customer wants the product.

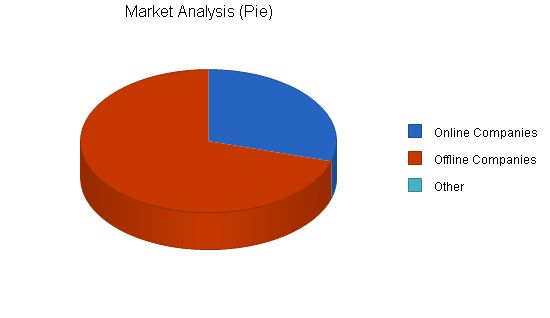

Market Segmentation

Promerit Advertising focuses on two distinct customer groups:

– Online companies with e-commerce

– Offline companies

Market Analysis

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Online Companies | 630,900 | 820,170 | 1,066,221 | 1,386,087 | 1,801,913 | 30.00% | |

| Offline Companies | 1,500,700 | 1,500,700 | 1,500,700 | 1,500,700 | 1,500,700 | 0.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0.00% | |

| Total | 2,131,600 | 2,320,870 | 2,566,921 | 2,886,787 | 3,302,613 | 11.57% | |

4.2 Service Business Analysis

The Internet is one of the fastest-growing commercial phenomena. The number of host computers, or servers, has exploded from 3.2 million in 1994 to roughly 79.2 million as of July 2001. During the same time period, the number of websites increased to more than 6 million from 3,000.

The popularity of sub-$1,000 PCs is a key factor in the Internet’s recent growth. Rapidly falling component prices have allowed PC manufacturers to offer more affordable products. Computers sold at or below the $1,000 level have appealed to first-time PC users and lower income families. PC penetration in the United States is now approximately 50%, according to Dataquest, a market research firm based in San Jose, California.

The United States accounts for over half of the world’s total Internet users. When consumers are asked why they purchased a personal computer, the most common answer is to connect to the Internet and access email.

Strategy and Implementation Summary

Promerit Advertising’s strategy is to utilize the extensive network of contacts Robert and Cheryl have with companies sold on the value of email marketing. In addition, Promerit will use its internal expertise to launch an email marketing campaign directed at a select group of its target customers.

5.1 Marketing Strategy

Promerit Advertising will focus an email campaign on a select group of 50,000 businesses each fiscal quarter, reaching over two million potential customers. We estimate a five percent response rate to the campaign, generating 1,250 leads and 5,000 leads over the year.

Perform a SWOT analysis of your business to develop good strategies. Get started with our free guide and template.

5.2 Sales Strategy

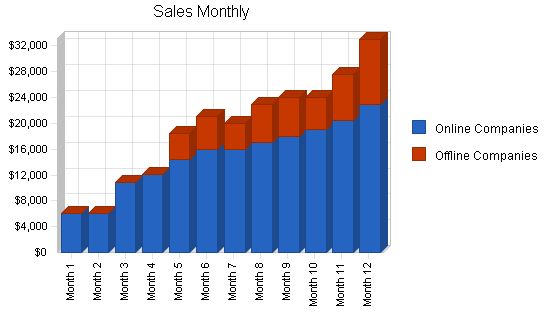

Promerit Advertising’s sales strategy is to use the email marketing campaign as a model of success for its customers. Online companies will be the most accessible to our services, while initial sales may be weak with offline companies.

5.2.1 Sales Forecast

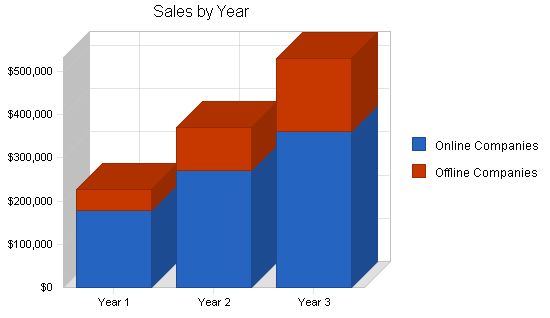

Below is the sales forecast for three years. Our deliverables are electronic, so there are no costs of sales. Labor costs are included in the Personnel table.

Sales Forecast:

Year 1 Year 2 Year 3

Sales

Online Companies $178,830 $270,000 $360,000

Offline Companies $47,000 $100,000 $170,000

Total Sales $225,830 $370,000 $530,000

Direct Cost of Sales:

Year 1 Year 2 Year 3

Online Companies $0 $0 $0

Offline Companies $0 $0 $0

Subtotal Direct Cost of Sales $0 $0 $0

5.3 Competitive Edge:

Robert Humphrey has five years of experience in email marketing campaigns and ten years of experience in direct marketing. He is a graduate of Ohio State University with a BA in marketing. Robert worked with several advertising companies before arriving at Kemp and Johnson Advertising in 1997. With Kemp and Johnson, Robert created and grew the Internet marketing group. Robert was project leader for the successful Buy.com and Verison email marketing campaign.

Cheryl Littlejohn graduated with a BS in computer science from UCLA in 1996. She immediately went to work for the Internet start-up Temple Communication as an IT administrator. She left in 1998 to join the start-up 800.com as the technical lead of its email campaign. In 2000, she joined Richard’s Internet group at Kemp and Johnson as technical lead of the Verison email marketing campaign.

Email marketing is an emerging marketing tool with few industry experts. Robert and Cheryl’s accomplishments over the past three years has been singled out by the industry as models for successful email marketing campaigns.

Management Summary:

Robert Humphrey will be responsible for tactical elements of the marketing campaign and Cheryl Littlejohn will manage the technical aspects of the campaign.

6.1 Personnel Plan:

In addition to Robert and Cheryl, there will be three other staff members:

– Secretary/Receptionist

– Accountant

– Salesperson

Personnel Plan:

Year 1 Year 2 Year 3

Robert Humphrey $32,000 $40,000 $45,000

Cheryl Littlejohn $32,000 $40,000 $45,000

Secretary/Receptionist $20,000 $25,000 $28,000

Salesperson $38,000 $50,000 $55,000

Bookkeeper $20,000 $26,000 $29,000

Other $0 $0 $0

Total People 5 5 0

Total Payroll $142,000 $181,000 $202,000

The financial plan is presented in the following topics.

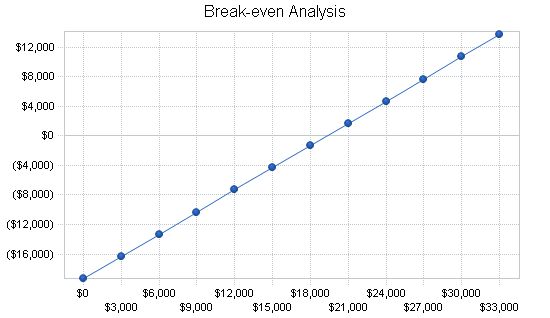

7.1 Break-even Analysis:

The monthly sales break-even point is shown in the table and chart below.

Break-even Analysis

Monthly Revenue Break-even: $19,308

Assumptions:

– Average Percent Variable Cost: 0%

– Estimated Monthly Fixed Cost: $19,308

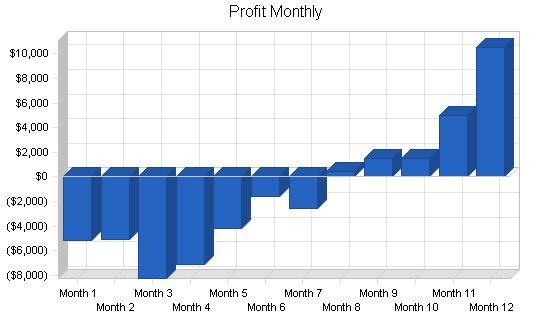

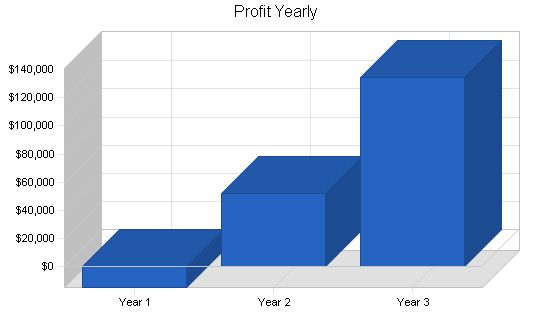

7.2 Projected Profit and Loss

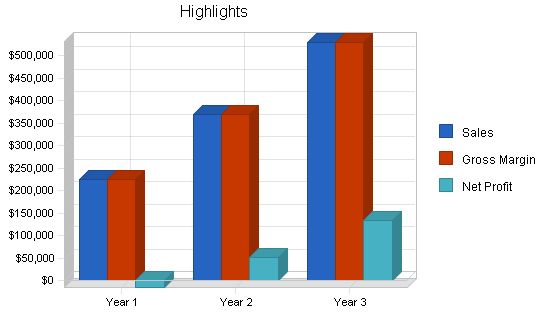

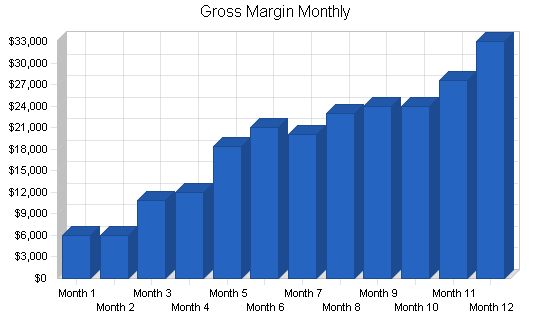

The table and charts below outline the projected profit and loss for three years. We estimate that the agency will not be profitable until the second year of operation. Promerit Advertising will grow by about 9% for the second and third year.

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $225,830 | $370,000 | $530,000 |

| Direct Cost of Sales | $0 | $0 | $0 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $0 | $0 | $0 |

| Gross Margin | $225,830 | $370,000 | $530,000 |

| Gross Margin % | 100.00% | 100.00% | 100.00% |

| Expenses | |||

| Payroll | $142,000 | $181,000 | $202,000 |

| Sales and Marketing and Other Expenses | $48,000 | $60,000 | $80,000 |

| Depreciation | $0 | $0 | $0 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $2,400 | $2,400 | $2,400 |

| Insurance | $0 | $0 | $0 |

| Rent | $18,000 | $18,000 | $18,000 |

| Payroll Taxes | $21,300 | $27,150 | $30,300 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $231,700 | $288,550 | $332,700 |

| Profit Before Interest and Taxes | ($5,870) | $81,450 | $197,300 |

| EBITDA | ($5,870) | $81,450 | $197,300 |

| Interest Expense | $8,916 | $6,999 | $4,999 |

| Taxes Incurred | $0 | $22,335 | $57,690 |

| Net Profit | ($14,786) | $52,115 | $134,611 |

| Net Profit/Sales | -6.55% | 14.09% | 25.40% |

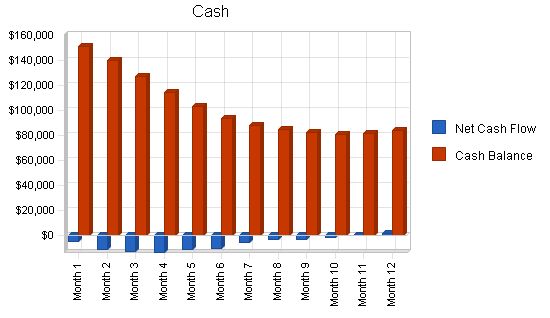

7.3 Projected Cash Flow

The following table and chart highlight the projected cash flow for three years.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $56,458 | $92,500 | $132,500 |

| Cash from Receivables | $124,685 | $248,971 | $365,839 |

| Subtotal Cash from Operations | $181,143 | $341,471 | $498,339 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $181,143 | $341,471 | $498,339 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $142,000 | $181,000 | $202,000 |

| Bill Payments | $90,432 | $133,818 | $188,745 |

| Subtotal Spent on Operations | $232,432 | $314,818 | $390,745 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $20,004 | $20,004 | $20,004 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $252,436 | $334,822 | $410,749 |

| Net Cash Flow | ($71,294) | $6,649 | $87,590 |

| Cash Balance | $84,206 | $90,856 | $178,446 |

7.4 Projected Balance Sheet

The table shows projected balance sheet for three years.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $84,206 | $90,856 | $178,446 |

| Accounts Receivable | $44,688 | $73,216 | $104,877 |

| Other Current Assets | $10,000 | $10,000 | $10,000 |

| Total Current Assets | $138,894 | $174,072 | $293,323 |

| Long-term Assets | |||

| Long-term Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $138,894 | $174,072 | $293,323 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $8,184 | $11,251 | $15,895 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $8,184 | $11,251 | $15,895 |

| Long-term Liabilities | $79,996 | $59,992 | $39,988 |

| Total Liabilities | $88,180 | $71,243 | $55,883 |

| Paid-in Capital | $100,000 | $100,000 | $100,000 |

| Retained Earnings | ($34,500) | ($49,286) | $2,829 |

| Earnings | ($14,786) | $52,115 | $134,611 |

| Total Capital | $50,714 | $102,829 | $237,440 |

| Total Liabilities and Capital | $138,894 | $174,072 | $293,323 |

| Net Worth | $50,714 | $102,829 | $237,440 |

7.5 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 7311, Advertising Agencies, are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 63.84% | 43.24% | 8.50% |

| Percent of Total Assets | ||||

| Accounts Receivable | 32.17% | 42.06% | 35.75% | 36.20% |

| Other Current Assets | 7.20% | 5.74% | 3.41% | 42.20% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 80.80% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 19.20% |

| Total Assets | 100.00% | 100.

General Assumptions: Plan Month 1 2 3 4 5 6 7 8 9 10 11 12 Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Tax Rate 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% Other 0 0 0 0 0 0 0 0 0 0 0 0 0 Pro Forma Profit and Loss: Sales Month 1 2 3 4 5 6 7 8 9 10 11 12 $6,000 $6,000 $10,900 $12,030 $18,400 $21,000 $20,000 $23,000 $24,000 $24,000 $27,500 $33,000 Direct Cost of Sales $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Other Production Expenses $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Cost of Sales $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Gross Margin $6,000 $6,000 $10,900 $12,030 $18,400 $21,000 $20,000 $23,000 $24,000 $24,000 $27,500 $33,000 Gross Margin % 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% Expenses: Payroll $4,000 $4,000 $11,000 $11,000 $14,000 $14,000 $14,000 $14,000 $14,000 $14,000 $14,000 $14,000 $14,000 Sales and Marketing and Other Expenses $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 Depreciation $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Leased Equipment $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Utilities $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 Insurance $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Rent $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 Payroll Taxes 15% $600 $600 $1,650 $1,650 $2,100 $2,100 $2,100 $2,100 $2,100 $2,100 $2,100 $2,100 $2,100 Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $ Pro Forma Cash Flow: |

||

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $1,500 | $1,500 | $2,725 | $3,008 | $4,600 | $5,250 | $5,000 | $5,750 | $6,000 | $6,000 | $6,875 | $8,250 | |

| Cash from Receivables | $0 | $150 | $4,500 | $4,623 | $8,203 | $9,182 | $13,865 | $15,725 | $15,075 | $17,275 | $18,000 | $18,088 | |

| Subtotal Cash from Operations | $1,500 | $1,650 | $7,225 | $7,630 | $12,803 | $14,432 | $18,865 | $21,475 | $21,075 | $23,275 | $24,875 | $26,338 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $1,500 | $1,650 | $7,225 | $7,630 | $12,803 | $14,432 | $18,865 | $21,475 | $21,075 | $23,275 | $24,875 | $26,338 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $4,000 | $4,000 | $11,000 | $11,000 | $14,000 | $14,000 | $14,000 | $14,000 | $14,000 | $14,000 | $14,000 | $14,000 | |

| Bill Payments | $237 | $7,119 | $7,140 | $8,141 | $8,142 | $8,563 | $8,550 | $8,536 | $8,522 | $8,508 | $8,494 | $8,480 | |

| Subtotal Spent on Operations | $4,237 | $11,119 | $18,140 | $19,141 | $22,142 | $22,563 | $22,550 | $22,536 | $22,522 | $22,508 | $22,494 | $22,480 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | $1,667 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $5,904 | $12,786 | $19,807 | $20,808 | $23,809 | $24,230 | $24,217 | $24,203 | $24,189 | $24,175 | $24,161 | $24,147 | |

| Net Cash Flow | ($4,404) | ($11,136) | ($12,582) | ($13,178) | ($11,006) | ($9,799) | ($5,352) | ($2,728) | ($3,114) | ($900) | $714 | $2,190 | |

| Cash Balance | $151,096 | $139,960 | $127,378 | $114,199 | $103,193 | $93,395 | $88,043 | $85,316 | $82,202 | $81,302 | $82,016 | $84,206 | |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!