Crest Systems is a new Value Added Reseller (VAR) focused on marketing specialty inventory software products to over 1,200 VARs selling in distinct vertical markets. In addition to the software, Crest will sell the inventory data collection hardware required. Traditionally, VARs selling in these markets focus solely on the industry’s unique product line or service, leaving a gap in their inventory control offerings.

The success of the product depends on being able to offer customers an inventory management solution costing less than $5,000. Crest Systems has signed a strategic alliance agreement with Promerit Engineering to sell their software products through these VARs. The first product, Promerit Inventory Basic, will be released in May. Crest Systems anticipates sales of 20,000 units in 36 months, priced at $850 each.

Each VAR will receive $400 from the sale, while Crest Systems will earn $250 per unit. Crest Systems will also sell hardware from Symbol and PSC for portable data collection, priced between $2,000 and $3,200 per unit. Crest Systems will earn between $600 and $900 per unit. The total package of software and hardware will be under $5,000.

While the company primarily targets vertical markets, there is also interest from warehouse management VARs for a low-end data collection solution. Crest Systems plans to engage 1,000-plus warehouse management VARs to sell Promerit Inventory Basic.

Additionally, Crest Systems will develop specialty software modules that can be integrated with Promerit Inventory Basic software. These modules will be sold for $800 to $1,000. The company aims to establish strong business relationships with its VARs to expand its range of software and hardware products.

Richard Torres, owner of Crest System, has over twelve years of experience in sales to vertical markets. He was Cycon Systems’ top salesperson last year, generating over $3 million in sales.

1.1 Objectives

The objectives of Crest Systems are to sell 8,000 units in the first year, establish strong relationships with critical VARs, increase the software module business by 15% annually, and improve product quality and customer satisfaction through effective communication with Promerit Systems.

1.2 Keys to Success

The keys to success in Crest Systems are offering inexpensive inventory control solutions that cost less than $5,000, providing reliable and timely response to VARs’ inquiries, and maintaining a reliable administration for accurate billing, order follow-up, expense monitoring, and account receivable collection.

Crest Systems is a Value Added Reseller (VAR) focused on selling low-end inventory software and hardware products. The company markets Promerit Engineering software products to over 1,200 VARs in vertical markets, as well as warehouse systems VARs seeking a low-end inventory software product.

2.1 Company Ownership

Richard Torres is the owner of Crest Systems, which is set up as a C Corporation. This form of incorporation allows room for growth and effective capital acquisition in five to seven years.

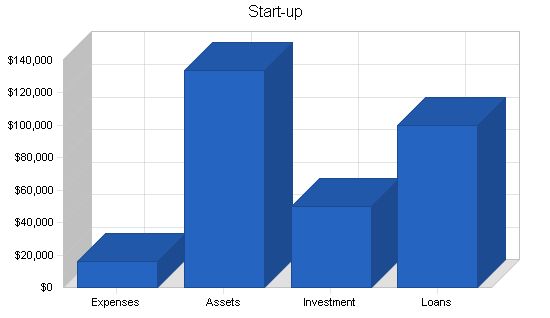

2.2 Start-up Summary

The start-up cost of Crest Systems primarily involves establishing an account receivable system and communication system for salespeople. Richard Torres will invest $50,000 and secure a $100,000 loan.

Start-up Requirements:

– Legal: $1,000

– Stationery etc.: $300

– Brochures: $2,000

– Office Equipment: $6,000

– Insurance: $3,000

– Rent: $2,000

– Phone System: $2,000

– Total Start-up Expenses: $16,300

Start-up Assets:

– Cash Required: $133,700

– Other Current Assets: $0

– Long-term Assets: $0

– Total Assets: $133,700

Total Requirements: $150,000

Start-up Funding:

– Start-up Expenses to Fund: $16,300

– Start-up Assets to Fund: $133,700

– Total Funding Required: $150,000

Assets:

– Non-cash Assets from Start-up: $0

– Cash Requirements from Start-up: $133,700

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $133,700

– Total Assets: $133,700

Liabilities and Capital:

– Liabilities:

– Current Borrowing: $0

– Long-term Liabilities: $100,000

– Accounts Payable (Outstanding Bills): $0

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $100,000

– Capital:

– Planned Investment:

– Investor 1: $50,000

– Other: $0

– Additional Investment Requirement: $0

– Total Planned Investment: $50,000

– Loss at Start-up (Start-up Expenses): ($16,300)

– Total Capital: $33,700

Total Capital and Liabilities: $133,700

Total Funding: $150,000

Products:

Crest Systems’ products are:

– Promerit Inventory Basic

– Software modules that integrate Promerit Inventory Basic

– Data Collection Hardware

We have an experienced sales team that markets our products to VARs serving vertical markets.

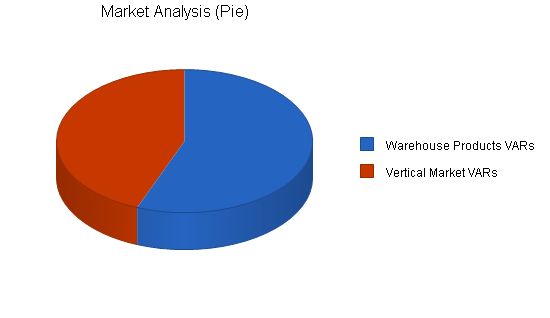

Market Analysis Summary:

There are many small businesses dissatisfied with available inventory control products. Most of these businesses are not a priority for software companies, as they can only spend $5,000 on a solution. To address this opportunity, Crest Systems plans to sell to VARs serving vertical markets and VARs selling warehouse products and services. We will sell hardware directly to customers when the software is purchased by the VARs’ customers, building relationships with businesses with growing inventories.

4.1 Market Segmentation:

Crest Systems will focus on two customer groups:

– Warehouse Products and Services VARs: These VARs offer warehouse management hardware and software. They retain $500 on each product sold.

– Vertical Market VARs: These VARs typically don’t sell inventory management products, but they have thousands of customers. They would also retain $500 on each product sold.

Market Analysis:

Potential Customers Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Warehouse Products VARs 15% 1,400 1,610 1,852 2,130 2,450 15.02%

Vertical Market VARs 15% 1,100 1,265 1,455 1,673 1,924 15.00%

Total 15.01% 2,500 2,875 3,307 3,803 4,374 15.01%

Strategy and Implementation Summary:

Crest Systems will aggressively market Promerit Inventory Basic to VARs. We believe the payoff to the VARs on each sale will make the product attractive. We will train their salespeople to be successful in demonstrating the products to customers, especially with vertical market VARs who don’t typically offer software products.

Competitive Edge:

Richard Torres is the competitive edge of Crest Systems. He has worked for Cycon Systems for ten years, serving as the company’s manager of sales to vertical market VARs. In the past five years, Richard was responsible for over $15 million worth of sales to vertical market VARs. His strength is his customer relation skills, and he has been successful in expanding the number of vertical market VARs who bought Cycon System products.

Another competitive edge for Crest Systems is the ability to create specialized software modules for customers that customize the software. The company believes that one-fourth of all software customers will request a customized module to be added to the software after purchase.

To develop effective business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis.

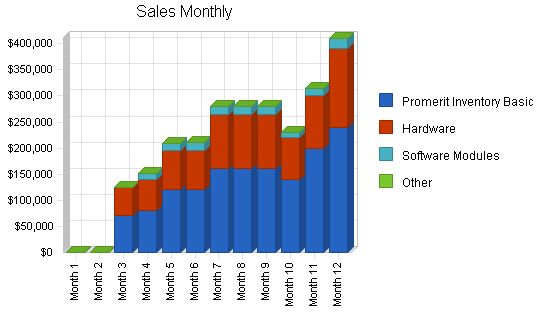

Sales Strategy:

Crest Systems’ sales strategy is to train VARs and put resources in place to facilitate sales within the first 60 days of operation. We anticipate sales will begin during our third month of operation.

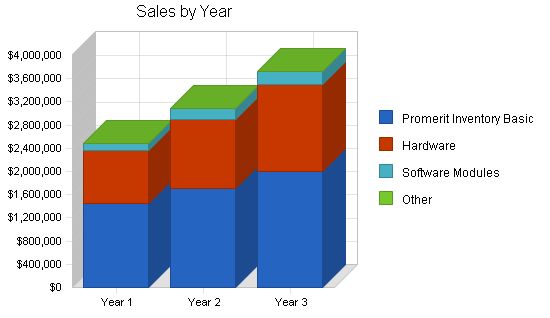

The following is the sales forecast for the next three years.

Sales Forecast:

Year 1 Year 2 Year 3

Sales

Promerit Inventory Basic $1,450,000 $1,700,000 $2,000,000

Hardware $909,000 $1,200,000 $1,500,000

Software Modules $129,000 $180,000 $220,000

Other $0 $0 $0

Total Sales $2,488,000 $3,080,000 $3,720,000

Direct Cost of Sales:

Year 1 Year 2 Year 3

Promerit Inventory Basic $1,087,000 $1,200,000 $1,400,000

Hardware $580,000 $770,000 $930,000

Software Modules $0 $0 $0

Other $0 $0 $0

Subtotal Direct Cost of Sales $1,667,000 $1,970,000 $2,330,000

Management Summary

Richard Torres will manage the day to day operations of Crest Systems.

6.1 Personnel Plan

The personnel plan for Crest Systems is as follows:

– Manager

– Accounts Manager

– Sales Staff (3)

– Software Engineer (1)

Crest Systems anticipates hiring another software engineer in September of this year.

Personnel Plan:

Year 1 Year 2 Year 3

Manager $60,000 $70,000 $80,000

Accounting Manager $42,000 $44,000 $46,000

Sales Staff $180,000 $200,000 $230,000

Software Engineers $85,000 $100,000 $104,000

Other $0 $0 $0

Total People 0 0 0

Total Payroll $367,000 $414,000 $460,000

The following is the financial plan for Crest Systems.

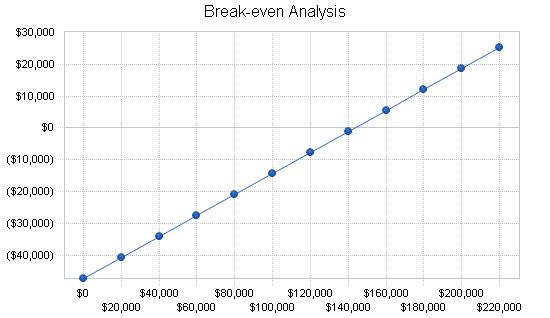

7.1 Break-even Analysis

The monthly break-even point is shown below.

Break-even Analysis

Monthly Revenue Break-even: $143,373

Assumptions:

– Average Percent Variable Cost: 67%

– Estimated Monthly Fixed Cost: $47,311

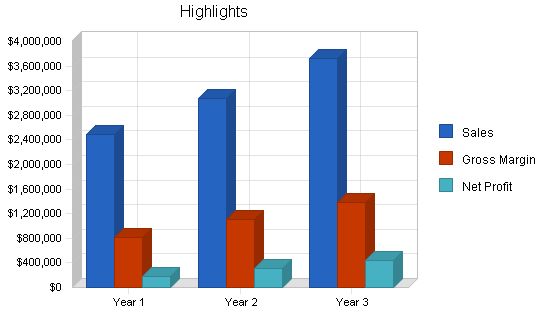

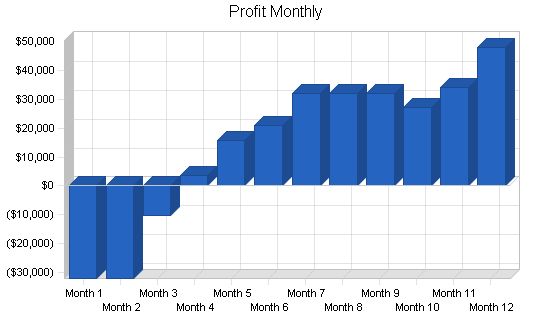

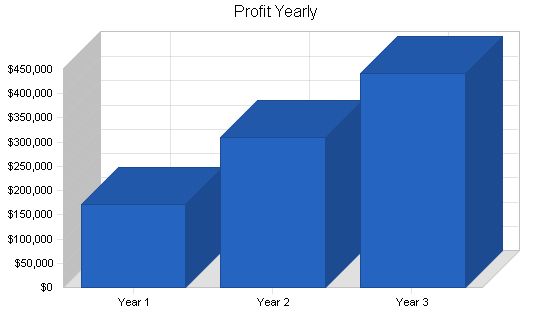

7.2 Projected Profit and Loss

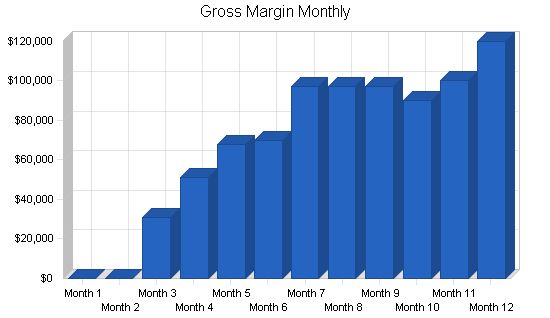

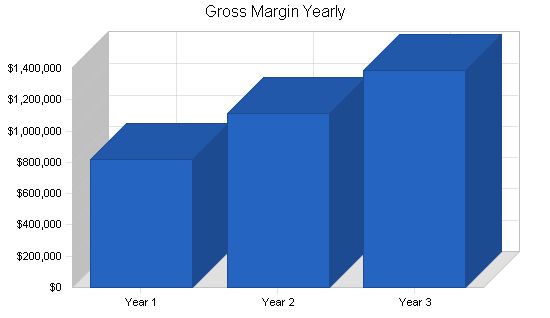

The table and charts below show projected profit and loss for the next three years.

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $2,488,000 | $3,080,000 | $3,720,000 |

| Direct Cost of Sales | $1,667,000 | $1,970,000 | $2,330,000 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $1,667,000 | $1,970,000 | $2,330,000 |

| Gross Margin | $821,000 | $1,110,000 | $1,390,000 |

| Gross Margin % | 33.00% | 36.04% | 37.37% |

| Expenses | |||

| Payroll | $367,000 | $414,000 | $460,000 |

| Sales and Marketing and Other Expenses | $120,000 | $160,000 | $200,000 |

| Depreciation | $0 | $0 | $0 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $1,680 | $1,680 | $1,680 |

| Insurance | $0 | $0 | $0 |

| Rent | $24,000 | $24,000 | $24,000 |

| Payroll Taxes | $55,050 | $62,100 | $69,000 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $567,730 | $661,780 | $754,680 |

| Profit Before Interest and Taxes | $253,270 | $448,220 | $635,320 |

| EBITDA | $253,270 | $448,220 | $635,320 |

| Interest Expense | $8,903 | $6,962 | $4,936 |

| Taxes Incurred | $73,310 | $132,378 | $189,115 |

| Net Profit | $171,057 | $308,881 | $441,269 |

| Net Profit/Sales | 6.88% | 10.03% | 11.86% |

Projected Cash Flow:

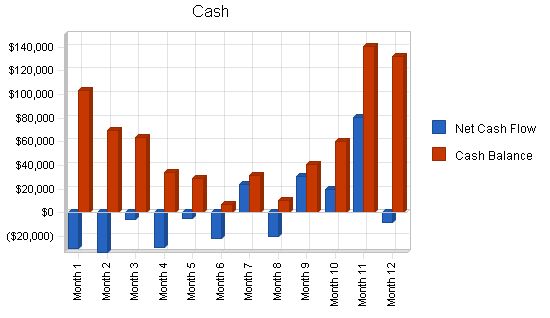

7.3 Projected Cash Flow

The following table and chart highlight the projected cash flow for three years.

Pro Forma Cash Flow

[table]

[tr]

[td colspan="4"]Pro Forma Cash Flow[/td]

[/tr]

[tr]

[td]Year 1[/td]

[td]Year 2[/td]

[td]Year 3[/td]

[/tr]

[tr]

[td]Cash Received[/td]

[/tr]

[tr]

[td]Cash Sales[/td]

[td]$622,000[/td]

[td]$770,000[/td]

[td]$930,000[/td]

[/tr]

[tr]

[td]Cash from Receivables[/td]

[td]$1,330,125[/td]

[td]$2,182,493[/td]

[td]$2,652,154[/td]

[/tr]

[tr]

[td]Subtotal Cash from Operations[/td]

[td]$1,952,125[/td]

[td]$2,952,493[/td]

[td]$3,582,154[/td]

[/tr]

[tr]

[td]Additional Cash Received[/td]

[/tr]

[tr]

[td]Sales Tax, VAT, HST/GST Received[/td]

[td]$0[/td]

[td]$0[/td]

[td]$0[/td]

[/tr]

[tr]

[td]New Current Borrowing[/td]

[td]$0[/td]

[td]$0[/td]

[td]$0[/td]

[/tr]

[tr]

[td]New Other Liabilities (interest-free)[/td]

[td]$0[/td]

[td]$0[/td]

[td]$0[/td]

[/tr]

[tr]

[td]New Long-term Liabilities[/td]

[td]$0[/td]

[td]$0[/td]

[td]$0[/td]

[/tr]

[tr]

[td]Sales of Other Current Assets[/td]

[td]$0[/td]

[td]$0[/td]

[td]$0[/td]

[/tr]

[tr]

[td]Sales of Long-term Assets[/td]

[td]$0[/td]

[td>$0

[tr]

[/tr]

[tr]

[td]Expenditures[/td]

[td]Year 1[/td]

[td]Year 2[/td]

[td]Year 3[/td]

[/tr]

[tr]

[td]Expenditures from Operations[/td]

[/tr]

[tr]

[td]Cash Spending[/td]

[td>$367,000[/td]

[td>$414,000[/td]

[td>$460,000[/td]

[tr]

[/tr]

[tr]

[td]Additional Cash Spent[/td]

[/tr]

[tr]

[td>Sales Tax, VAT, HST/GST Paid Out

[tr]

[/tr]

[tr>

[td>Net Cash Flow

[/tr]

[/table]

7.4 Projected Balance Sheet

The following table highlights the projected balance sheet for three years.

[table]

[tr]

[td colspan="4"]Pro Forma Balance Sheet[/td]

[/tr]

[tr]

[td]Year 1[/td]

[td>Year 2[/td]

[td]Year 3[/td]

[/tr]

[tr>

[/tr]

[tr>

[td]Current Assets[/td]

[/tr>

[td>Cash

[tr]

[td>Long-term Assets

[/tr]

[tr]

[td>Liabilities and Capital[/td]

[/tr]

[td>Current Liabilities[/td]

[/tr>

[tr]

[td>Long-term Liabilities[/td]

[/tr]

[tr>

[/tr]

[tr>

[/tr]

[/table]

7.5 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 5045, Computers, peripherals and software, are shown for comparison.

[table]

[tr]

[td colspan="5"]Ratio Analysis[/td]

[/tr]

[tr]

[td]Year 1[/td>

[td>Year 2[/td]

[td]Year 3[/td]

[td>Industry Profile[/td>

[/tr]

[tr]

[td]Sales Growth[/td>

[td>0.00%[/td>

[td>23.79%[/td>

[td>20.78%[/td>

[td>5.80%[/td>

[/tr]

[tr]

[td]Percent of Total Assets[/td>

[/tr]

[tr]

[td>Accounts Receivable[/td>

[td>80.22%[/td>

[td>79.65%[/td>

[td>62.02%[/td>

[td>29.30%[/td>

[/tr]

[tr]

[td>Other Current Assets[/td>

[td>0.00%[/td>

[td>0.00%[/td>

[td>0.00%[/td>

[td>21.50%[/td>

[/tr]

[tr>

[td>Total Current Assets[/td>

[td>Long-term Assets[/td>

[/tr]

[tr]

[td>Long-term Assets[/td>

[td>0.00%[/td>

[td>0.00%[/td>

[td>0.00%[/td>

[td>13.20%[/td>

[/tr]

[td>Total Assets[/td]

[tr]

[td>Current Liabilities[/td>

[/tr]

[td>Accounts Payable[/td>

[td>Net Worth[/td]

[/tr]

[tr]

[td>Percent of Sales[/td]

[/tr]

[td>Sales

[td>Gross Margin[/td>

[td>Selling, General & Administrative Expenses[/td>

[td>Advertising Expenses[/td>

[td>Profit Before Interest and Taxes[/td>

[/tr]

[tr]

[td>Main Ratios[/td>

[/tr]

[td>Current[/td>

[td>Total Debt to Total Assets[/td]

[tr]

[td>Additional Ratios[/td>

[td>Year 1[/td>

[td>Year 2[/td>

[td>Year 3[/td>

[td>n.a[/td>

[/tr]

[td>Net Profit Margin[/td>

[/tr]

[tr]

[td>Activity Ratios[/td>

[/tr]

[/tr]

[tr]

[/tr]

[/tr]

[/tr

Personnel Plan

Manager: 0%, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000

Accounting Manager: 0%, $3,500, $3,500, $3,500, $3,500, $3,500, $3,500, $3,500, $3,500, $3,500, $3,500, $3,500, $3,500

Sales Staff: 0%, $15,000, $15,000, $15,000, $15,000, $15,000, $15,000, $15,000, $15,000, $15,000, $15,000, $15,000, $15,000

Software Engineers: 0%, $5,000, $5,000, $5,000, $5,000, $5,000, $0, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000

Other: 0%, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Total People: 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0

Total Payroll: $28,500, $28,500, $28,500, $28,500, $28,500, $23,500, $33,500, $33,500, $33,500, $33,500, $33,500, $33,500

General Assumptions

Plan Month: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12

Current Interest Rate: 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%

Long-term Interest Rate: 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%

Tax Rate: 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00%, 30.00%

Other: 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0

Pro Forma Profit and Loss

Sales: $0, $0, $124,000, $151,000, $208,000, $210,000, $280,000, $280,000, $280,000, $230,000, $315,000, $410,000

Direct Cost of Sales: $0, $0, $93,000, $100,000, $140,000, $140,000, $183,000, $183,000, $183,000, $140,000, $215,000, $290,000

Other Production Expenses: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Total Cost of Sales: $0, $0, $93,000, $100,000, $140,000, $140,000, $183,000, $183,000, $183,000, $140,000, $215,000, $290,000

Gross Margin: $0, $0, $31,000, $51,000, $68,000, $70,000, $97,000, $97,000, $97,000, $90,000, $100,000, $120,000

Gross Margin %: 0.00%, 0.00%, 25.00%, 33.77%, 32.69%, 33.33%, 34.64%, 34.64%, 34.64%, 39.13%, 31.75%, 29.27%

Expenses

Payroll: $28,500, $28,500, $28,500, $28,500, $28,500, $23,500, $33,500, $33,500, $33,500, $33,500, $33,500, $33,500

Sales and Marketing and Other Expenses: $10,000, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000, $10,000

Depreciation: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Leased Equipment: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Utilities: $140, $140, $140, $140, $140, $140, $140, $140, $140, $140, $140, $140

Insurance: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Rent: $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000

Payroll Taxes: 15%, $4,275, $4,275, $4,275, $4,275, $4,275, $3,525, $5,025, $5,025, $5,025, $5,025, $5,025, $5,025

Other: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Total Operating Expenses: $44,915, $44,915, $44,915, $44,915, $44,915, $39,165, $50,665, $50,665, $50,665, $50,665, $50,665, $50,665

Profit Before Interest and Taxes: ($44,915), ($44,915), ($13,915), $6,085, $23,085, $30,835, $46,335, $46,335, $46,335, $39,335, $49,335, $69,335

EBITDA: ($44,915), ($44,915), ($13,915), $6,085, $23,085, $30,835, $46,335, $46,335, $46,335, $39,335, $49,335, $69,335

Interest Expense: $819, $805, $791, $777, $763, $749, $735, $721, $707, $693, $679, $665

Taxes Incurred: ($13,720), ($13,716), ($4,412), $1,592, $6,697, $9,026, $13,680, $13,684, $13,688, $11,593, $14,597, $20,601

Net Profit: ($32,014), ($32,004), ($10,294), $3,716, $15,625, $21,060, $31,920, $31,930, $31,940, $27,050, $34,059, $48,069

Net Profit/Sales: 0.00%, 0.00%, -8.30%, 2.46%, 7.51%, 10.03%, 11.40%, 11.40%, 11.41%, 11.76%, 10.81%, 11.72%

Pro Forma Cash Flow

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

_________________________________________________

Cash Received

Cash Sales $0 $0 $31,000 $37,750 $52,000 $52,500 $70,000 $70,000 $70,000 $57,500 $78,750 $102,500

Cash from Receivables $0 $0 $0 $3,100 $93,675 $114,675 $156,050 $159,250 $210,000 $210,000 $208,750 $174,625

Subtotal Cash from Operations $0 $0 $31,000 $40,850 $145,675 $167,175 $226,050 $229,250 $280,000 $267,500 $287,500 $277,125

Additional Cash Received

Sales Tax, VAT, HST/GST Received 0.00% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

New Current Borrowing $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

New Long-term Liabilities $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Sales of Other Current Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Sales of Long-term Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

New Investment Received $0 $0 $0 $66,000 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Subtotal Cash Received $0 $0 $31,000 $106,850 $145,675 $167,175 $226,050 $229,250 $280,000 $267,500 $287,500 $277,125

Expenditures

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

_________________________________________________

Expenditures from Operations

Cash Spending $28,500 $28,500 $28,500 $28,500 $28,500 $23,500 $33,500 $33,500 $33,500 $33,500 $33,500 $33,500

Bill Payments $117 $3,514 $6,914 $106,227 $120,287 $163,927 $167,078 $214,580 $214,570 $213,057 $172,050 $250,140

Subtotal Spent on Operations $28,617 $32,014 $35,414 $134,727 $148,787 $187,427 $200,578 $248,080 $248,070 $246,557 $205,550 $283,640

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Principal Repayment of Current Borrowing $0 $0 $0 $0 $0 $0 $0 $0 $0 $

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!