ReHabiliments, a Limited Liability Corporation, is a clothing and apparel business based in Sandybar Harbour. The company sells trendy clothing and apparel to an international market of all ages and backgrounds. ReHabiliments markets its product line as "ReHab Your Wardrobe – ReHab Your World" and supports programs that help less fortunate individuals and combat exploitation.

The founder of ReHabiliments, L. Owerd Emlynes, came up with the idea while managing a musical performance group. He started by selling tee shirts and sweat shirts with the group’s name, logo, and slogan. After quickly selling out of the initial stock, Emlynes expanded the clothing line to revolve around the concept of "harmony."

The foundation of ReHabiliments is built upon the principle of harmony – harmony in thought, purpose, and humility. By purchasing ReHabiliments, consumers actively choose to become part of a community dedicated to the greater good of humanity.

Emlynes has successfully sold over $6,000 worth of ReHabiliments’ products through various venues and online sales. The company now seeks funding to expand its operations, establish a storefront, and further develop its business infrastructure, products, and marketing efforts.

The mission of ReHabiliments is to sell trendy clothing and apparel to a global market while supporting programs that benefit the less fortunate. The company prioritizes customer satisfaction, as well as the success of its employees, community, and investors. It also upholds its social responsibility by contributing to environmental protection and serving as a responsible corporate citizen.

To ensure the achievement of corporate objectives, ReHabiliments’ management has established concrete goals and measures progress toward them. The company plans to secure start-up funding and subsequent funding through a mix of investment and debt strategies.

ReHabiliments recognizes that the keys to success lie in focus and competence. The company aims to become a leader in the branded urban apparel industry.

Overall, ReHabiliments is a clothing and apparel business that prioritizes harmony, customer satisfaction, and social responsibility. The company seeks funding to expand its operations and become an industry leader in the urban apparel industry.

ReHabiliments is a start-up clothing and apparel business based in Sandybar Harbour. It was established as a Limited Liability Corporation in 1994 by Mr. Emlynes, who managed a music performance group at the time. To promote the group and increase revenue, Mr. Emlynes created a clothing line with the group’s name, logo, and slogan, "There is Strength in Harmony." T-shirts and sweatshirts featuring the line were sold to the public, and two local clothing stores agreed to carry the line. The initial stock sold out within a week. After Mr. Emlynes resigned as the group’s manager, he developed the idea of expanding the clothing line around the concept of "harmony." The clothing line, known as ReHabiliments, and the company were then solely owned by Mr. Emlynes.

The philosophy behind ReHabiliments is centered on harmony of thought, purpose, and humility. It believes that unity in thought supports individuals in their purpose and overlooks their weaknesses. By purchasing ReHabiliments, consumers become part of a community dedicated to the greater good of humanity. This principle is of great significance to Mr. Emlynes, who advocates for the rights of exploited children. In efforts to combat exploitation, the company donates a portion of its proceeds to programs such as "Feed the Children" and UNICEF. They also contribute to causes supporting child education and the eradication of life-threatening diseases. ReHabiliments is committed to sourcing its inventory from manufacturers that adhere to ethical production practices and do not employ child or forced labor.

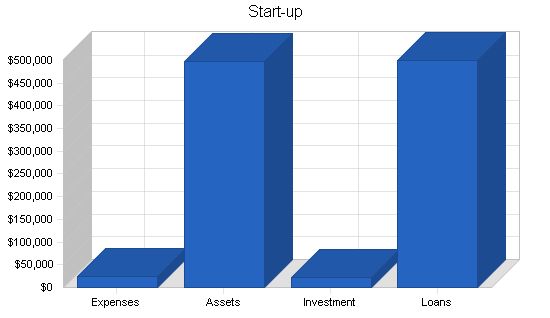

ReHabiliments is privately owned by Mr. L. Owerd Emlynes and was incorporated as a Limited Liability Corporation. The company’s start-up expenses have been financed largely by direct owner investment, and additional funding is being sought through investment and debt strategies. Mr. Emlynes is working with the Social Security Administration to secure funding through the Plan for Achieving Self-Support (PASS) Program.

Start-up expenses for ReHabiliments include legal fees, business planning, consulting, advertising, research and development, office equipment, and manufacturing and distribution costs. The founder has received $10,000 in grant money and an additional $7,000 from other investors. The total capital and liabilities after start-up costs amount to $580.

Assets to be purchased during start-up include inventory worth $50,000, miscellaneous apparel accessories worth $900, and embroidery supplies and assorted threads worth $2,000. The current assets amount to $24,950 and include a used 1999 Chevrolet Step Van, garment racks, computer systems, telephone/FAX machines, display mannequins, and office furniture. The long-term assets amount to $34,485 and include a digital embroidery station, industrial sewing machines, a steam press, and cash registers.

ReHabiliments is a start-up business specializing in classy, versatile apparel. Our product line includes casual and active wear, headgear, leather coats, and baseball jackets, with sizes ranging from toddler to 5XL. We currently source our garments from three factories, carefully ensuring that they do not employ child labor. As the demand for our products grows, we plan to establish our own U.S.-based manufacturing operation. We also utilize technology such as computer aided design (CAD) and quick response capability to meet customer demand and stay competitive in the industry. In the future, we aim to expand our product offerings and continue to innovate.

ReHabiliments’ objectives include expanding into an apparel line for college graduates and professionals, as well as licensed and branded cologne and perfume, bedding, underwear, small leather goods, jewelry, and eyewear. Starting in Fall 2004, ReHabiliments will offer clothing marketed as apparel for "Tomorrow’s Professionals."

The economic slowdown and events of September 11, 2001, negatively impacted consumer confidence and led to declining sales in the apparel industry. The men’s wear industry was more affected than the women’s wear industry. Despite this, the apparel market remains positive due to its size and strength. Manufacturers entering the market must invest in promotions, market tests, and trade show participation to increase visibility and chances of success.

ReHabiliments aims to target men, women, and children in the Tri-State Area who want competitively priced, branded clothing. Customers vary in age and background, ranging from one year to 59 years old. Women dominate sportswear spending, accounting for 80% of all spending. They control 96% of spending on their own clothes, 93% on children’s clothes, and 60% on men’s sports apparel.

In 1999, women’s apparel sales grew by 3.7% and represented 52% of all apparel sales, while men’s apparel sales grew by 4.1% and accounted for 31% of total sales. Women’s apparel sales tend to be consistent, while men’s apparel sales are growing. Individuals under 20 years old account for 43% of sports apparel sales, while those aged 45 and older make up 25% of the market. Girl’s apparel sales rose by 0.5% and boy’s apparel sales increased by 3.8%.

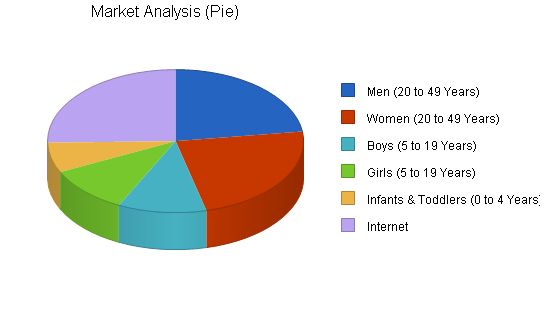

The table and chart below depict potential customers in the Tri-State Area by gender, age groups, and potential Internet sales.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Men (20-49 Years) | 1% | 202,693 | 204,719 | 206,765 | 208,831 | 210,918 | 1.00% |

| Women (20-49 Years) | 1% | 207,075 | 209,151 | 211,247 | 213,364 | 215,503 | 1.00% |

| Boys (5-19 Years) | 1% | 98,462 | 99,440 | 100,428 | 101,425 | 102,432 | 0.99% |

| Girls (5-19 Years) | 1% | 93,859 | 94,790 | 95,730 | 96,679 | 97,638 | 0.99% |

| Infants & Toddlers (0-4 Years) | 1% | 60,577 | 61,180 | 61,789 | 62,404 | 63,025 | 1.00% |

| Internet | 13% | 225,000 | 254,250 | 287,303 | 324,652 | 366,857 | 13.00% |

| Total | 4.45% | 887,666 | 923,530 | 963,262 | 1,007,355 | 1,056,373 | 4.45% |

4.2 Target Market Segment Strategy

According to the Yale School of Management, larger apparel manufacturers report revenue growth of between 2% and 9%. Mass manufacturing and rapid fashion copying means that consumers can afford innovative looks at high street prices without the couture price tag. Age is no barrier to following a fashion trend, as consumers actively seek new fashion-forward items.

Current opportunities in the apparel industry include:

– Adult Apparel (Men/Women, Ages 20-49 Years)

– Sportswear (Men/Women, Ages 20-49; Boys/Girls, Ages 5-19)

– Junior Clothing (Boys/Girls, Ages 5-19)

– Children’s Wear (Infants/Toddlers, Ages 0-4 Years)

Adult Apparel

The production of adult apparel, particularly women’s clothing, is the largest sector of the industry. Traditionally, the women’s apparel business operates on a five-season basis. Men’s clothing sales are in a state of upheaval. The market for men’s clothing has grown faster than any other category, with the acceptance of casual fashion being the main factor.

Sportswear

The sportswear industry is marked by growth among female consumers, who now see themselves as more athletic and wear these collections as street clothes. The junior market segment is also important, as sportswear is often tied to fashion. Technical characteristics and fabrications are important factors in the consumer’s buying decision.

Junior Clothing

The junior clothing industry has seen strong growth in demand, but heavy competition in the market makes retailers conscious of fluctuations in demand. Popularity and brand visibility are important in buying decisions made by this market segment.

Children’s Wear

The children’s wear industry has grown considerably in recent years, but remains a small market segment. Children’s collections must please children while also reflecting current trends in the adult market. Price remains a decisive factor in making purchases, given that children outgrow their clothes quickly.

4.2.1 Market Trends

The Marketplace & Consumer Shopping

Apparel remains the number one choice for shopping, beating groceries. Women aged 45-64 spend more on clothing per capita than any other group. Comfort is an important element in purchasing clothing. Stretch fabrics have become extremely popular.

Apparel Selection, Fashion, Personal Appearance, and Image

Consumers prioritize comfort over appearance when choosing clothing. Textile care and maintenance is an important consideration for consumers.

Apparel Production/Sewing

The ready-to-wear apparel industry is suffering from cheaper imports and heavy discounting. Global expansion is critical for long-term success in the industry.

4.2.2 Market Growth

Adult Apparel

The apparel market has been suffering from a deflationary trend in prices, along with the casual trend in clothing. Online/Internet sales have shown double-digit growth. Sales of women’s apparel outpaced total market growth, driven by strong sales in both the large size and petite markets.

Sportswear

Casual sportswear has been narrowing its appeal, but sales among women and men over the age of 35 have increased. Women’s casual sportswear showed slight contraction, while men’s sportswear had less dramatic growth. The most significant gains were made with consumers over 35 years of age.

Junior’s Clothing

Teen and tween apparel purchases fell in 2001-2002. Price is an important factor for teen clothing purchases.

Children’s Wear

The children’s apparel market has experienced continuous growth, particularly in infant and toddler clothing. Leading brand manufacturers rely on alliances with mass merchandise and department stores. Specialty clothing stores gained significant market share.

4.2.3 Market Needs

Men (Ages 20-49 Years)

Men desire branded products and comfortable, easy-care apparel.

Women (Ages 20-49 Years)

Women seek comfortable, easy-care apparel and clothing that fits their varying body shapes and sizes. There is a void in the market for women’s sportswear.

Children (Boys/Girls, Ages 5-19 Years)

Children’s apparel needs to be fashionable and reflect older styles. There is a demand for attractive and diverse ethnic designs and colors.

Infants/Toddlers (Boys/Girls, Ages 0-4 Years)

Children’s clothing companies have identified ethnic markets as their most important audience. Designs and colors tailored to appeal to African Americans and Hispanics are in high demand.

The apparel industry is a mature, slow-growing industry with intense competition. The market is highly fragmented, particularly in the Tri-State Area. The fashion industry looks to New York City as the main gathering point for buyers and designers. The Tri-State Area follows fashion in longer cycles and can serve as a springboard for manufacturers entering the market.

Overall, the U.S. apparel industry is large, mature, and fragmented. Apparel sold in the United States is produced domestically and abroad. According to estimates from the American Apparel Manufacturers Association (AAMA), the dollar value of domestic apparel production in 1997 was $39 billion, which was less than the $46 billion value of goods imported into the United States. Additionally, $15 billion of goods were produced in both the United States and another country.

In 1998, Americans purchased approximately $215 billion of apparel and footwear. NPD Group, Inc. reports that approximately $177 billion was spent on clothing in 1998, with the remaining $38 billion used to purchase more than 1.1 billion pairs of shoes. With a population of 270 million, this accounts for roughly $800 spent per capita on apparel and footwear.

Distribution Patterns: New York has a unique trade structure that enhances business opportunities. In addition to market weeks, showroom representatives offer opportunities for placing orders throughout the year. This creates visibility for designers entering the market. Traditional distribution channels are followed, with products bought from distributors or manufacturers. A sales representative is recommended to facilitate entry into the market. Direct distribution can require an extensive investment with no assurance of positive results.

Competition and Buying Patterns: Competition in the industry turns on prices. Leading textile manufacturers have been forced to lower their prices due to rising prices, foreign competition, and shaky economic conditions. The retail apparel industry competes with all other sectors in the retail industry. Many companies have combined and operate in various divisions to increase profitability. The largest retailers in the apparel industry in 1999 were Wal-Mart, Sears, Roebuck and company, K-Mart company, Target Corporation, and J.C. Penny. The top retailers in the Apparel Stores category included The Gap, The Limited, TJX, Intimate Brands, and Spiegel/Eddie Bauer. Consumer attitudes are driving the restructuring in the retail apparel industry. Consumers have become more cautious in their buying habits and are reducing their spending on apparel. They demand quality goods at low prices, forcing retailers to sell merchandise at “sale” prices throughout the year.

Main Competitors: The apparel industry is competitive and dynamic. Companies are restructuring to create leaner organizations and adopt new technologies. ReHabiliments’ competition comes from various sources including Tommy Hilfiger, Inc.; The Gap, Inc.; Abercrombie & Fitch; the Jones Apparel Group, Inc.; Polo Ralph Lauren Corp.; Liz Claiborne, Inc.; and Nautica Enterprises, Inc. The closest competitor in terms of popularity, growth, and product line is the FUBU Corporation.

Each competitor has a unique brand and distribution strategy. Tommy Hilfiger Corporation offers a broad array of related apparel, accessories, footwear, fragrance, and home furnishings. The Gap, Inc. operates stores that emphasize style, quality, and value. Abercrombie & Fitch Co. sells casual apparel and accessories. Jones Apparel Group, Inc. designs and markets branded apparel, footwear, and accessories. Polo Ralph Lauren Corporation designs, markets, and distributes apparel, accessories, fragrances, and home furnishings. Liz Claiborne, Inc. designs and markets branded apparel, accessories, and fragrance products. Nautica Enterprises, Inc. designs and markets sportswear, outerwear, and sleepwear for men, as well as jeans and childrenswear.

ReHabiliments faces financial risks and contingencies, including style piracy and market risk. To mitigate style piracy, the company will copyright protect its designs. Market risk will be managed through analysis and forecasting.

Economic Stability Risk: Changes in the economy will require the company to adjust its operations for financial and economic fluctuations. ReHabiliments will pursue strategies like horizontal integration and economies of scale to reduce economic risk. To ensure continued profits during economic instability, the company will control its operating environment by reducing uncertainty, minimizing competition, and increasing market share.

Operational Risk: ReHabiliments, like all large companies, is exposed to operational risks like fraud, unauthorized transactions, and errors in computer systems. To mitigate these risks, ReHabiliments will maintain controls that keep operational risk at a minimum, such as limiting authority and conducting business activities in appropriate functional departments/branches.

Supply Chain/Merchandising Risk: Due to recent events like terrorist attacks and political instability, supply chain risks have increased. To mitigate these risks, management will construct and optimize future scenarios. These scenarios will help refine decision-making and support long-term supply chain forecasts.

Early Stage Business: As a start-up, ReHabiliments will leverage the experience of external advisors to mitigate risks associated with inexperience and support management decisions.

Brand Identity: Maintaining and strengthening ReHabiliments’ brand is crucial in attracting and retaining customers. To mitigate brand risk, the company will ensure that its brand is clear, specific, and unique to its product and service offerings. ReHabiliments will build brand strength through leadership, stability, market presence, and protection.

Intellectual Property: ReHabiliments’ intellectual property rights are critical to its success. The company will rely on trademark and copyright laws, trade secret protection, and contractual agreements to protect its intellectual property.

4.3.5 Industry Participants

The Apparel Industry is made up of small firms, with an average of 38 employees. Majority of establishments employ fewer than 20 workers. The average size varies across product sectors, with men’s wear establishments being larger than women’s wear establishments. Firms with fewer than 20 employees account for less than 10% of the industry’s workforce, while 37% of the workforce is employed in establishments with 250 or more employees.

The U.S. apparel market can be divided into national brands and other apparel. National brands account for 30% of wholesale apparel sales, while the second tier comprises small brands and private-label goods.

Apparel is sold through various retail outlets, including discount stores, specialty stores, department stores, major chains, and direct mail/catalogs.

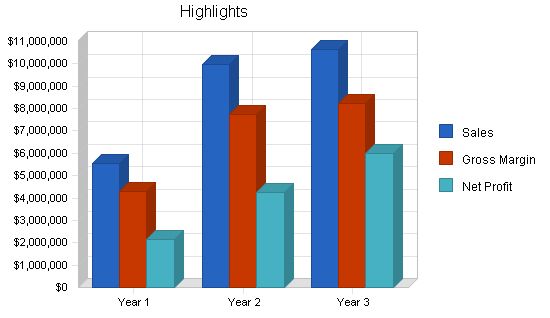

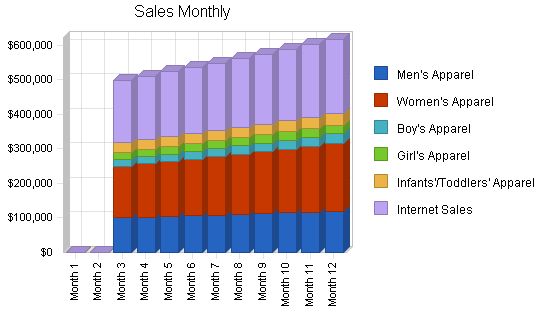

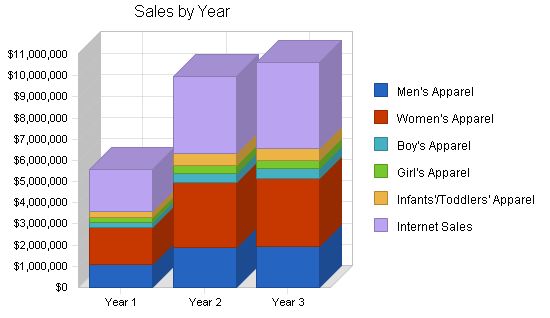

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Men’s Apparel | $1,094,972 | $1,880,106 | $1,957,191 |

| Women’s Apparel | $1,719,582 | $3,067,151 | $3,180,636 |

| Boy’s Apparel | $240,122 | $446,537 | $463,505 |

| Girl’s Apparel | $229,944 | $383,065 | $386,896 |

| Infants’/Toddlers’ Apparel | $306,592 | $538,061 | $572,497 |

| Internet Sales | $1,970,950 | $3,641,013 | $4,077,934 |

| Total Sales | $5,562,162 | $9,955,933 | $10,638,658 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| All Product Lines | $1,112,432 | $1,991,187 | $2,127,732 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $1,112,432 | $1,991,187 | $2,127,732 |

5.4 Strategic Alliances

ReHabiliments has strategic alliances with Music Records and the Entertainment Group. These alliances are critical to the company’s marketing strategy, as they provide exposure for the company’s apparel line and associate ReHabiliments’ products with celebrities. Celebrities are valuable strategic allies, as they receive free apparel for their participation in interviews, concerts, and music videos.

Current and potential product line representation and advertising contracts include:

- Wal-Mart

- Infinity Broadcasting

- WMCA 570 & 970 DJ

- Crystal Blue Media

- BulkWorks.com

- K’s Corporation, Japan

- Shop America Network, Inc.

In addition, ReHabiliments has a promotional collaboration with one of the hottest disc jockeys in America, “Degas VanGO.” He travels throughout the world entertaining listeners on New York Radio 107.5 WBLC, FM. Degas VanGO has his own radio show and is well known. He is well connected in the music industry, which is one of ReHabiliments’ primary target market areas, and has used his connections to forge a relationship between ReHabiliments and Virgin Records America, Inc.

Through our affiliation with Degas VanGO, Virgin Records has allowed ReHabiliments to use their famous logo on promotional items, such as leather jackets, hats, and T-shirts. This affiliation sends a powerful message to investors and customers alike.

ReHabiliments has the earning potential to become the fastest growing, most universally accepted clothing line since FUBU. The partnership with Degas VanGO is the golden key to countless hundreds of thousands of dollars in sales, as well as a direct promotional channel.

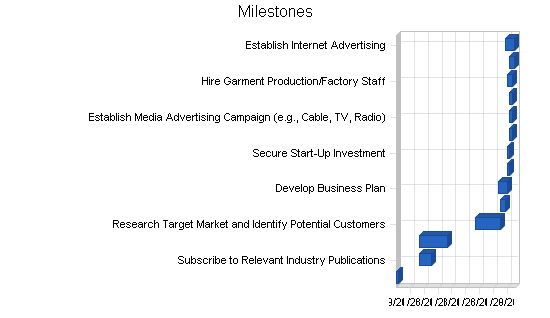

5.5 Milestones

The following table lists important program milestones, with projected start and finish dates, the names of individuals in charge of completing each milestone, and budgets for each milestone. The milestone schedule indicates the company’s emphasis on planning and implementation of the business.

What the table doesn’t show is the commitment behind each milestone. ReHabiliments’ business plan includes provisions for plan-versus-actual analysis, and the company will hold monthly follow-up meetings with key management to discuss any variances and to plan a course of action to resolve those variances.

Milestones:

Develop Corporate Logo 3/1/2000 3/31/2000 $335 M. Culvert Marketing

Subscribe to Relevant Industry Publications 1/1/2001 6/1/2001 $1,000 M. Culvert Marketing

Research and Join Industry Associations 1/1/2001 12/31/2001 $2,000 M. Culvert Marketing

Research Target Market and Identify Potential Customers 1/1/2003 12/1/2003 $0 M. Culvert R&D

Develop Corporate Website 12/1/2003 2/1/2004 $5,000 M. Culvert Marketing

Develop Business Plan 11/5/2003 2/28/2004 $850 M. Culvert R&D

Hire Support Staff 3/1/2004 3/31/2004 $78,650 M. Culvert Personnel

Secure Start-Up Investment 3/1/2004 3/31/2004 $0 M. Culvert Finance

Establish Print Advertising Campaign (e.g., Newspaper, Industry Publications) 3/31/2004 4/30/2004 $35,000 M. Culvert Advertising

Establish Media Advertising Campaign (e.g., Cable, TV, Radio) 3/31/2004 4/30/2004 $7,000 M. Culvert Advertising

Establish Bookkeeping and Finance System 3/31/2004 4/30/2004 $1,000 M. Culvert Finance

Hire Garment Production/Factory Staff 3/1/2004 5/1/2004 $196,282 M. Culvert Personnel

Hire Corporate Officers 4/1/2004 6/1/2004 $136,946 M. Culvert Personnel

Establish Internet Advertising 2/1/2004 6/1/2004 $0 M. Culvert Advertising

Totals $464,063

Web Plan Summary:

Clearly defining goals and plans for ReHabiliments’ website are critical to the company’s success. Implementing a web presence as part of the company’s marketing plan is crucial for visibility and promotion to a variety of customers. The website will provide current and potential customers, public relations, and media entities with efficient means to communicate with ReHabiliments and obtain relevant information about the Company and its products. Through the website, ReHabiliments will manage customers, track market opportunities, and quickly respond to shifts in demand and customer needs.

Website Marketing Strategy:

ReHabiliments must actively promote its website to stand out among its competitors. The company will use a combination of offline and online methods, including business cards, printed materials, local newspapers, presentations, conferences/events/seminars, radio/television/press/cinema, web journals, Usenet groups, reciprocal links, e-mail signatures, search engines, web directories, specific domain name, portal sites, banner advertising, e-mail marketing, online competitions, and affiliate partnerships.

ReHabiliments will ensure that its website provides useful and informative information, promoting other sections of the site through strategically placed relevant links. The company will invest in maximizing its online presence to effectively promote its products.

Development Requirements:

ReHabiliments has chosen to contract out its web development services to meet specific e-commerce needs. The final website will include a web hosting account, registered domain name, secure SSL certificate, shopping cart system, merchant account, terminal software, and payment gateway account. The estimated cost for the e-commerce website is between $5,000 and $8,000.

Management Summary:

ReHabiliments’ management philosophy is based on responsibility, mutual respect, and profitability. The company’s present and future growth depend on exceptional people, social responsibility, commitment to customer service, excellence, and core values.

Management Team:

Mr. L. Owerd Emlynes – Chief Executive Officer (CEO), will be responsible for all aspects of the company, including operations, marketing, strategy, financing, and public relations. Ms. Ravel d’Eddge – Vice President of Business Development/Strategic Alliances will identify new market opportunities and establish strategic partnerships. Other management positions have not yet been filled.

Management Team Gaps:

ReHabiliments currently lacks experienced professional management in the retail apparel industry. The company will require a strong finance manager and plans to add more experienced individuals to the team as it matures. Unfilled positions include Chief Financial Officer, Vice President of Product Management, Vice President of Marketing, and Vice President of Sales.

Personnel Plan:

The company’s personnel expenditures for the first three years include salaries for the President/CEO, Chief Financial Officer, Vice Presidents, Executive Assistant, Senior Fashion Designer, Design Assistant, Seamstress, Assistant Seamstress, Pattern Cutter, Warehouse Manager, Heavy Truck Driver/Warehouse Assistant, and Packer/Shipping & Receiving Clerk. Total payroll for each year ranges from $638,317 to $766,217.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!