BizComm, Inc. specializes in customer communication products, specifically generic cards for business-to-business and business-to-client communication. Our goal with this business plan is to address our current cash-flow problem and increase profits from break-even to $54,650 by the end of the first year. To achieve this, we plan on modifying our website, repackaging popular products for retail chains, and targeting specific markets.

Let’s start with some background on the company. Bizcomm’s mission is to provide specialized customer communication products that are not available at traditional commercial printers or are too costly to obtain. Unfortunately, due to a lack of initial working capital, the company has struggled to achieve profitable response rates through mail order. We plan to fix this by reconfiguring our market and sales approach.

Bizcomm is a limited liability corporation owned by Mr. Pullman, who comes from an office supply background. Over time, the company has shifted towards commercial printing and ad specialties. Currently located in Bronxville, New York, we plan to move our operations to Jefferson in September to optimize space utilization. With less than ten employees, the growth of Bizcomm will be dependent on the successful implementation of this business plan.

Now, let’s discuss our products. Our core offerings include client communication cards, such as personalized cards for auto dealers to send to potential customers. These cards can feature the dealer’s logo and a custom message. Traditional commercial printers cannot compete with this level of customization. Additionally, we offer Slida-Cards, Cirlo-Cards, Presentation and custom pocket folders, as well as promotional products like keychains and pens.

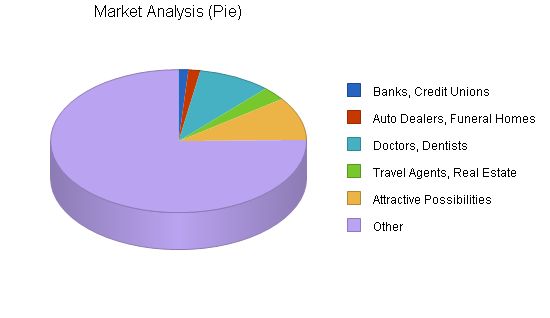

Turning to the market, there is a significant demand in the United States for customer communication products, and capturing market share is both feasible and profitable. We will focus on key industries such as banks, insurance companies, funeral homes, doctors/dentists, travel agents, and auto dealers. Utilizing specialty catalogues tailored to these industries will help us gain a larger market share.

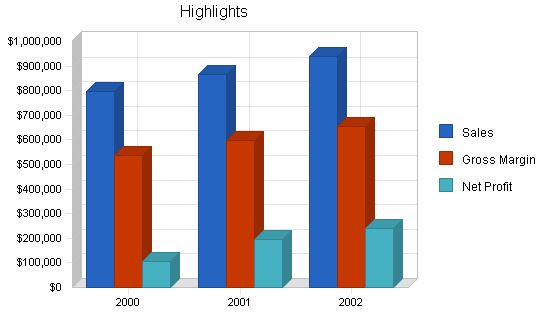

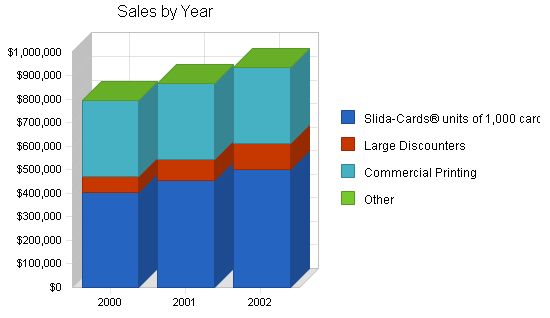

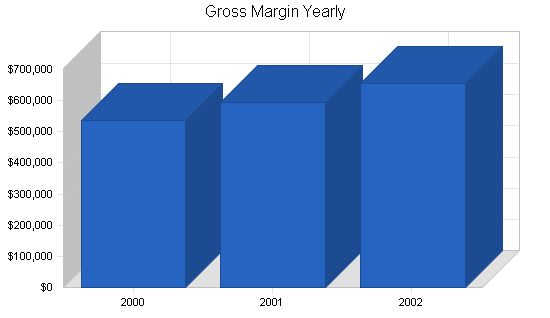

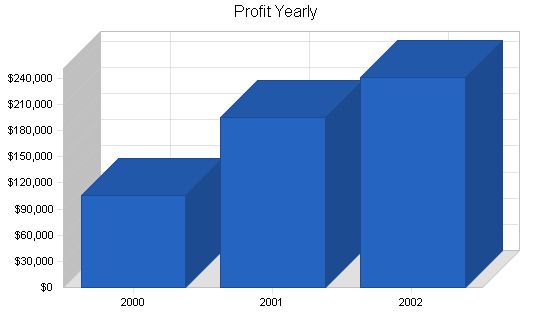

In terms of financial success, by refocusing on key industries and optimizing our website, we expect steady profit growth. Our projected revenues will increase by almost 19% over the next three years, from ~$800,000 to ~$950,000. We anticipate significant increases in net profits due to reduced marketing costs and improved efficiency. To support our marketing changes and maintain sufficient cash, we plan to secure a $47,000 short-term loan. This improved cash flow will enable us to leverage our assets and pursue new opportunities without any anticipated sales difficulties.

In conclusion, Bizcomm’s mission is to provide specialized customer communication products through mail order. Our goals include solving our working capital shortage, modifying our website, repackaging popular products for retail chains, and implementing targeted marketing strategies. By executing these objectives effectively, we are confident in achieving our financial targets and growing our market share.

Company Summary

Bizcomm has lost touch with the know-how needed to consistently achieve profitable response rates through mail order due to ownership changes. Inadequate initial working capital has forced the owner to resort to commercial printing activity. These setbacks are the cause for this business plan, which will be remedied according to Bizcomm’s reconfigured market and sales approach.

2.1 Company History

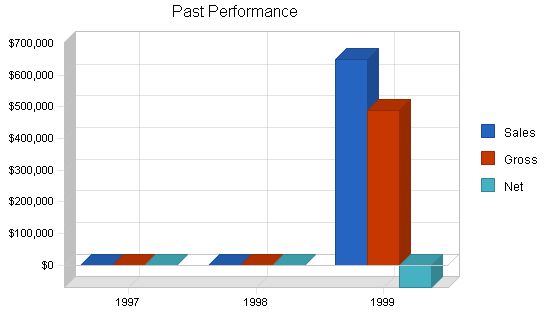

Bizcomm was sold in October of 1998, so comparable financial results will not be available until 1999. However, past financial information indicates room for improvement:

- The income tax returns for 1996 show gross sales of $722,635 and an operating loss of $76,470.

- The returns for 1997 show sales of $476,194 and operating profits of $38,223.

- During that period, the gross profit margin increased from 42% to 64%, and expenses decreased by $70,000.

Improvements on the 1997 tax return might have included window dressing to achieve a better sales price.

Bizcomm has lost continuity in respect to the knowledge and experience gained over the years in direct mail. The company cannot continue to engage in expensive mass mailings with any reasonable expectation of quick success. This business plan will propose other means to expand the company and give it breathing room to engage in direct mail in a less-hurried, more professionally researched way.

The table varies somewhat from the auditor’s figures of December 31, 1999. For one thing, the current portion of long-term debt was removed from current liabilities to avoid assuming that all debt classified as “current” would be repaid in the current year. The total long-term debt is $271,874.

| Loan | Percent of Interest | Amount Owed |

| Revolving Credit | 11% | $24,852 |

| Mortgage at | 10.5% | $141,147 |

| Time Note | 11.25% | $20,500 |

| Debt to Former Owner | 8% | $12,500 |

| EDIC Debt | 6% | $72,875 |

| Total Amount Owed | $271,874 |

Depreciation and amortization have been lumped together. Capital assets include intangibles of $56,406.

Notes payable to stockholder of $26,912 represent money owed to the owner, Mr. Pullman, and do not accrue interest. To more accurately reflect the equity nature of these funds, and for ease of projecting interest charges, this $26,912 has been placed into the capital stock category.

Past Performance:

Yearly Sales:

– 1997: $0

– 1998: $0

– 1999: $650,546

Gross Margin:

– 1997: $0

– 1998: $0

– 1999: $489,564

Gross Margin %:

– 1997: 0.00%

– 1998: 0.00%

– 1999: 75.25%

Operating Expenses:

– 1997: $0

– 1998: $0

– 1999: $533,537

Collection Period (days):

– 1997: 0

– 1998: 0

– 1999: 18

Inventory Turnover:

– 1997: 0.00

– 1998: 0.00

– 1999: 2.50

Yearly Current Assets:

– 1997: $0

– 1998: $0

– 1999: $176,338

Yearly Long-term Assets:

– 1997: $0

– 1998: $0

– 1999: $183,952

Yearly Total Assets:

– 1997: $0

– 1998: $0

– 1999: $360,290

Yearly Current Liabilities:

– 1997: $0

– 1998: $0

– 1999: $91,955

Yearly Long-term Liabilities:

– 1997: $0

– 1998: $0

– 1999: $271,874

Yearly Total Liabilities:

– 1997: $0

– 1998: $0

– 1999: $363,829

Yearly Paid-in Capital:

– 1997: $0

– 1998: $0

– 1999: $46,912

Yearly Retained Earnings:

– 1997: $0

– 1998: $0

– 1999: $20,631

Yearly Earnings:

– 1997: $0

– 1998: $0

– 1999: ($71,082)

Yearly Total Capital:

– 1997: $0

– 1998: $0

– 1999: ($3,539)

Yearly Total Capital and Liabilities:

– 1997: $0

– 1998: $0

– 1999: $360,290

Other Inputs:

– Payment Days:

– 1997: 0

– 1998: 0

– 1999: 30

– Sales on Credit:

– 1997: $0

– 1998: $0

– 1999: $585,491

– Receivables Turnover:

– 1997: 0.00

– 1998: 0.00

– 1999: 9.97

2.2 Company Locations and Facilities:

Bizcomm’s facilities are currently located in Bronxville, New York. Plans are in place to move the entire operation to Jefferson in September 2000, at the end of the present lease. This move is expected to reduce monthly rent by $1,500.

2.3 Company Ownership:

Bizcomm is a limited liability corporation fully owned by Mr. Pullman. The corporation was originally named Eric Rutherford Inc. and operated under the name Bizcomm, Inc. The corporate name was later changed to Bizcomm, Inc. Mr. Pullman’s office supply background has led to changes in Bizcomm’s modus operandi, with an increasing focus on commercial printing work and ad specialties.

Products and Services:

Bizcomm’s core product is client communication cards. These cards can be personalized with a business logo and a custom message. Bizcomm also offers presentation and custom pocket folders, custom stationery, envelopes, memo pads, customized shipping labels, and ad specialty and promotional products.

Competitive Comparison:

For a competitive comparison of Bizcomm’s core product, the Slida-Card®, the following options are considered:

1. Retail Outlets: Staples offers generic cards without slits or personalized options for $3.29 per box of 20 cards. Bizcomm sells personalized cards with slits and a wider choice of messages for $199 per thousand. Special options are also available.

2. Mail-order Competitor: Rockford offers a similar product to Bizcomm’s Slida-Card® for $202 per thousand.

3. Do-it-yourself Desk Top Publishing Programs: This method is less competitive due to limitations with printer capabilities and higher costs.

4. Other Competitors: Some specialized industry catalogs offer cards similar to Bizcomm’s Executive cards for $490 per thousand, and lighter personalized cards without slits for $139 per thousand.

Fulfillment:

Bizcomm sources ink, paper stock, and envelopes from various paper suppliers. The company has a close relationship with Etheridge Ferry Papers. Ad specialty and promotional items are drop-shipped by a large number of manufacturers.

Technology:

Technological advancements in customer communication include specialized services for companies to outsource customer communications and email ads to reach direct mail targets. Bizcomm is adapting to these trends.

Future Products and Services:

Bizcomm is planning to develop a catalog specifically designed to cater to the needs of a targeted industry. This market segmentation approach aims to secure a stable market share against competition from specialty catalogs.

Market Analysis Summary:

The overall market for customer communication products is vast. Bizcomm has identified over seven million businesses that have a potential need for its products. The company targets industries such as animal hospitals, beauty salons, caterers, alternative medicine, employment agencies, retailers (furniture and jewelry), health clubs, interior decorators, and marinas as attractive possibilities for new territory and market segmentation.

4.2 Target Market Segment Strategy

The largest category is the “Other” category consisting of over five million businesses with sales of $1 million or less. These businesses are likely to patronize large retailers because of their pricing systems. The customer communication products currently on the shelves of these retailers are limited.

The specialized market sectors such as banks, insurance companies, and auto dealers have received marketing attention from Bizcomm. Some of these sectors have been the targets of market segmentation from comprehensive catalogs positioning themselves as the “super store” for that industry.

The 700,000 businesses categorized as “Attractive Possibilities” have not received as much direct mail attention. These businesses are likely to be owner-run–a business in which the owner is likely to receive the mail.

4.2.1 Market Needs

Needs have changed significantly in recent years. With the era of computer service, it is even more important now for a client to receive a man-made token of appreciation. One can never underestimate the value of a Thank You note. People want to feel like their patronage is important; they want to know that there are people behind the automated customer service engines. Bizcomm provides businesses with a means to show their appreciation to their customers. Receiving a Thank You note or a reminder in the mail is real, tangible, and cannot be deleted. Bizcomm creates heartfelt, elegant, and to-the-point notes, offering a sincere way to extend customer service to the human level.

4.2.2 Market Trends

Traditionally, Bizcomm has sent mailers to various industry sectors. Those receiving the mail decide they need the product, fill out the form, and call in an order. Market trends have moved in the following direction:

- With the increase in “junk” mail, it has become difficult to get noticed in the mail.

- Mail costs have increased.

- Competition from market segmentation has increased. Companies are now segmenting the market by concentrating on one specialized industry, putting less-specialized direct mail companies at a disadvantage.

- Overall competition has increased.

- Growth in the use of the Internet for customer communications products. Bizcomm must create an efficient website to cater to potential customers resorting to the Internet for their needs.

4.2.3 Market Growth

The market for customer base development products is expected to grow due to increased competition for purchasing dollars. Despite technological advancements, the effect of a customer receiving a Thank You note in the mail is still an elegant way to say their patronage is appreciated. Customer loyalty is built this way, and no suitable alternatives are in sight.

4.3 Service Business Analysis

In industries where the product purchased is similar to products offered by the competition, businesses use economic tools to win and maintain customers. Where a business cannot offer a price savings or other recognized advantage, customer communication products have proven useful. Below is a list of situations in which a doctor or dentist might use a customer communication product:

- Patient Acquisition: Attracting new residents to the practice.

- Welcome Patients: Making a good first-visit impression.

- Promotional gifts: Keep patients coming back.

- Recall Card: Sending a recall card after six months.

- Reminder Notices: To avoid missed appointments.

- Thanks for Referral: A simple gesture that goes a long way.

- Reactivate: Inform customers that they are missed if they stop coming.

Customer communication products are traditionally offered via direct mail. Bizcomm has been offering these products to a broad spectrum of businesses for years. The products have been relatively generic with a simple message like “Thank You” that can be used by many businesses. Bizcomm’s ability to print its own cards gives it an advantage over the competition. The retail launch of Bizcomm’s products can generate leads and increase brand exposure.

4.3.1 Main Competitors

Bizcomm’s main competitor is Rockford as their products are virtually identical. Bizcomm has an advantage over them with the ability to do its own printing, promising and delivering quick shipments of accurate orders. Bizcomm must renew its effort to regain its old clientele from Rockford.

Strategy and Implementation Summary

Bizcomm’s primary focus in its marketing strategy must be to increase sales and profitability in its core card business quickly. This can be achieved by gaining entry into large business supply retailers and building a useful sales-generating website.

5.1 Competitive Edge

Bizcomm has several advantages over the competition:

- Bizcomm does its own printing.

- Bizcomm has an Internet site and an online store.

- Bizcomm has unused printing capacity, providing room for growth.

- Bizcomm owns two trademarks: Slida-Card® and Cirlo-Card®.

5.2 Marketing Strategy

The first strategic move for Bizcomm is to improve its website, signing a contract for $5,000 to complete it by April. A shopping cart capability must be included for online secured credit card transactions. Bizcomm will also take steps to enter the retail market with popular Slida-Card® products.

Bizcomm will consider new distribution channels and target specialized markets by developing specialized business communication solutions and printing needs.

5.2.1 Distribution Strategy

In addition to distributing products in the retail market, Bizcomm will consider distributing brochures to ad specialty dealers and researching publications catering to specialized markets.

5.2.2 Marketing Programs

The specific marketing programs outlined in the plan are:

- Improving the website and online store.

- Marketing Slida-Card® products in the retail market.

- Implementing a direct mail marketing program.

5.2.3 Pricing Strategy

Pricing strategy will be determined by management, taking into account input from telemarketers.

5.3 Sales Strategy

Bizcomm’s telemarketing department is currently operating satisfactorily. Once the market programs are installed, closing sales deals over the phone will become more efficient, with an increase in online orders.

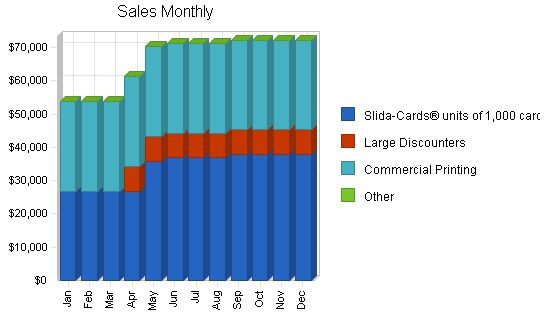

5.3.1 Sales Forecast

Projected sales include core business mail-orders, sales to large discounters, and commercial printing. Monthly sales for each category are estimated based on historical sales figures and market trends.

[table]

[tr]

[td colspan="4"]Sales Forecast[/td]

[/tr]

[tr]

[td]Year[/td]

[td]Unit Sales[/td]

[td]Unit Prices[/td]

[td]Sales[/td]

[/tr]

[tr]

[td]2000[/td]

[td]2,857[/td]

[td]$199.00[/td]

[td]$404,965[/td]

[/tr]

[tr]

[td]2001[/td]

[td]3,372[/td]

[td]$199.00[/td]

[td]$453,720[/td]

[/tr]

[tr]

[td]2002[/td]

[td]3,887[/td]

[td]$199.00[/td]

[td]$502,475[/td]

[/tr]

[/table]

Milestones:

[table]

[tr]

[td colspan="6"]Milestones[/td]

[/tr]

[tr]

[td]Milestone[/td]

[td]Start Date[/td]

[td]End Date[/td]

[td]Budget[/td]

[td]Manager[/td]

[td]Department[/td]

[/tr]

[tr]

[td]Web Site Design[/td]

[td]2/28/2000[/td]

[td]2/28/2000[/td]

[td]$5,000[/td]

[td]Cathy[/td]

[td]Design[/td]

[/tr]

[tr]

[td]Retail Launch[/td]

[td]3/31/2000[/td]

[td]3/31/2000[/td]

[td]$5,000[/td]

[td]Outside cons[/td]

[td]Marketing[/td]

[/tr]

[tr]

[td]Market Sector Research[/td]

[td]10/30/2000[/td]

[td]10/30/2000[/td]

[td]$15,000[/td]

[td]ABC[/td]

[td]Marketing[/td]

[/tr]

[tr]

[td]Other[/td]

[td]1/1/1998[/td]

[td]1/1/1998[/td]

[td]$0[/td]

[td]ABC[/td]

[td]Department[/td]

[/tr]

[tr]

[td]Totals[/td]

[td][/td]

[td][/td]

[td]$25,000[/td]

[td][/td]

[td][/td]

[/tr]

[/table]

Management Summary:

The new management of Bizcomm lacks direct mail experience. Building the necessary expertise for consistent mass mailing and accurate result prediction is crucial before implementing the recommended direct mail marketing program scheduled for October 30, 2000.

Personnel Plan:

[table]

[tr]

[td colspan="4"]Personnel Plan[/td]

[/tr]

[tr]

[td]Year[/td]

[td]Production Personnel[/td]

[td]Sales and Marketing Personnel[/td]

[td]General and Administrative Personnel[/td]

[/tr]

[tr]

[td]2000[/td]

[td]$49,920[/td]

[td]$31,524[/td]

[td]$122,028[/td]

[/tr]

[tr]

[td]2001[/td]

[td]$49,920[/td]

[td]$31,524[/td]

[td]$122,028[/td]

[/tr]

[tr]

[td]2002[/td]

[td]$49,920[/td]

[td]$31,524[/td]

[td]$122,028[/td]

[/tr]

[/table]

Total People: 7

Total Payroll:

2000: $203,472

2001: $203,472

2002: $203,472

The financial plan for Bizcomm includes:

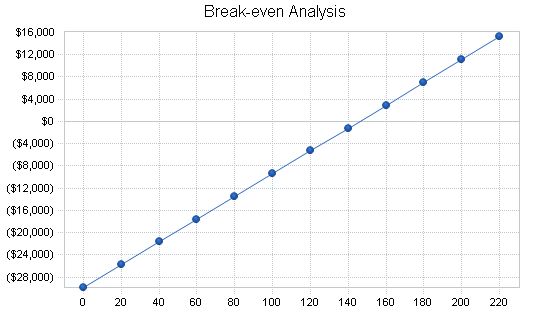

Break-even Analysis:

The following table and chart illustrate our Break-even Analysis.

| Break-even Analysis | |

| Monthly Units Break-even | 146 |

| Monthly Revenue Break-even | $40,601 |

| Assumptions: | |

| Average Per-Unit Revenue | $278.54 |

| Average Per-Unit Variable Cost | $73.71 |

| Estimated Monthly Fixed Cost | $29,857 |

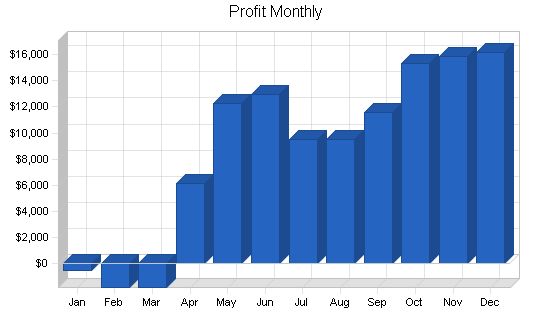

7.2 Projected Profit and Loss

The Profit and Loss expenses:

- Rent: Rent in Bronxville is split between the factory area and the office area. For the factory, the lease amount is $1,688.80 plus an operations and maintenance fee of $475. For the office area, the lease amount is $1,520.51 plus an operations and maintenance fee of $259. Total comes to $3,943.31. The present lease is up at the end of August, 2000. Beginning September 1, 2000 a move is planned to Jefferson to a smaller facility costing no more than $2,500 per month.

- Depreciation: Depreciation of printing equipment is straight-line over 7 years. Depreciation of computers is over five years. Total provision for depreciation comes to $37,250 annually, or $3,104 monthly. In addition, intangibles (Goodwill, Non-Compete, and some organization charges) are being amortized at an annual rate of $4,348 or $362 monthly. Added together these non-cash charges come to $3,466 monthly.

- Contract Labor: One contract laborer works at $11/hour (30 hrs weekly) = $1430 per month, and another contract worker is putting in 25 hours weekly @ $15/hr = $1,625 monthly. Combined, contract labor equals $3,055.

- Telemarketing Commissions: Only one telemarketer receives commissions of 10% on sales which she generates (12% if she convinces the customer to pay cash). These commissions have traditionally been running about $500 every two weeks ($1,000 per month).

- Utilities: A security alarm system costing $25/month. Electricity averages $366/month. Poland Springs water $20/month. Total comes to $411 per month.

- Telephone: There is one cell phone costing about $120 per month. The company’s normal phone bill comes to approximately $850 per month. Total $970 monthly.

- Medical and Dental: Single Blue Cross Blue Shield is $219, family plan runs $619. Company pays 60% for 4 singles, 100% for 1 single and 100% for 2 family plans. Total monthly is $1,982.60 for medical. Dental runs $23 for a single and $68 for the family plan. Company will pay 50% for 1 family plan and 4 singles and 100% for one family and one single. Total for dental comes to $171.

- Insurance: Manager’s life insurance is $140 per quarter. Workers’ Compensation and liability comes to $200 monthly. Auto insurance comes to $250 monthly for the two vehicles. Total monthly is $496.66.

- Leased Vehicles: The company leases two vehicles–one from Ford Credit @ $531.33 and one from Key Bank @ $453.70. Total monthly comes to $985.03.

- Payroll Services: The company uses the services of PAYMEX. Cost is approximately $168 monthly.

- Internet Services: The company pays $22.50 monthly to ShoreNet for Internet connection, $100/monthly to Yahoo! Store, and $75 monthly for Web hosting. Total monthly Internet services come to $197.50.

- Postage: Normal postage (does not include special promotional mailings) will cost approximately $950 per month.

| Pro Forma Profit and Loss | |||

| 2000 | 2001 | 2002 | |

| Sales | $795,790 | $866,820 | $937,850 |

| Direct Cost of Sales | $210,593 | $221,040 | $231,488 |

| Production Payroll | $49,920 | $49,920 | $49,920 |

| Industrial rags | $264 | $264 | $264 |

| Total Cost of Sales | $260,777 | $271,224 | $281,672 |

| Gross Margin | $535,014 | $595,596 | $656,179 |

| Gross Margin % | 67.23% | 68.71% | 69.97% |

| Operating Expenses | |||

| Sales and Marketing Expenses | |||

| Sales and Marketing Payroll | $31,524 | $31,524 | $31,524 |

| Travel | $0 | $0 | $0 |

| Miscellaneous | $0 | $0 | $0 |

| Advertising/Promotion | $25,000 | $0 | $0 |

| Telemarketing commissions | $12,000 | $12,000 | $12,000 |

| Internet Services: | $2,370 | $2,370 | $2,370 |

| Total Sales and Marketing Expenses | $70,894 | $45,894 | $45,894 |

| Sales and Marketing % | 8.91% | 5.29% | 4.89% |

| General and Administrative Expenses | |||

| General and Administrative Payroll | $122,028 | $122,028 | $122,028 |

| Sales and Marketing and Other Expenses | $0 | $0 | $0 |

| Depreciation | $41,592 | $41,592 | $41,592 |

| Leased Vehicles: | $11,820 | $11,820 | $11,820 |

| Utilities | $4,932 | $4,932 | $4,932 |

| Insurance | $5,964 | $5,964 | $5,964 |

| Medical and Dental: | $25,848 | $25,848 | $25,848 |

| Telephone | $11,640 | $12,000 | $12,000 |

| Retirement Acct (P. Vitale): | $3,600 | $3,600 | $3,600 |

| Payroll Services: | $2,016 | $2,016 | $2,016 |

| Postage | $11,400 | $11,400 | $11,400 |

| Rent | $41,544 | $30,000 | $30,000 |

| Payroll Taxes | $0 | $0 | $0 |

| Other General and Administrative Expenses | $0 | $0 | $0 |

| Total General and Administrative Expenses | $282,384 | $271,200 | $271,200 |

| General and Administrative % | 35.48% | 31.29% | 28.92% |

| Other Expenses: | |||

| Other Payroll | $0 | $0 | $0 |

| Consultants | $0 | $0 | $0 |

| Contract/Consultants | $5,000 | $0 | $0 |

| Total Other Expenses | $5,000 | $0 | $0 |

| Other % | 0.63% | 0.00% | 0.00% |

| Total Operating Expenses | $358,278 | $317,094 | $317,094 |

| Profit Before Interest and Taxes | $176,736 | $278,502 | $339,085 |

| EBITDA | $218,328 | $320,094 | $380,677 |

| Interest Expense | $36,688 | $19,185 | $15,885 |

| Taxes Incurred | $34,978 | $64,829 | $82,146 |

| Net Profit | $105,070 | $194,487 | $241,053 |

| Net Profit/Sales | 13.20% | 22.44% | 25.70% |

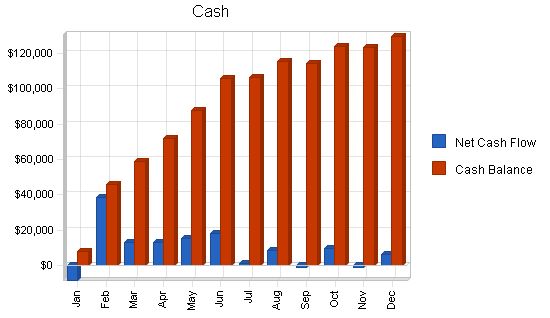

7.3 Projected Cash Flow

The Cash Flow table and chart are as follows:

Long-term Debt Repayments: Three loans at Beverly National Bank are considered as long-term:

- Note 200: A revolving line of credit with outstandings of $24,852.12 as of year-end 1999. The rate is 11%. Repayment is not included in cash flow projections 2000-2002.

- Note 201: A mortgage loan secured by all assets of the company and the owner’s personal home in Jefferson. The loan amount was $153,000 with outstandings of $141,147.40 as of year-end 1999. The interest rate is fixed at 10.5%. This loan is being repaid monthly in payments of principle and interest of $2,064.51. The final maturity is September 29, 2001. Principle repayments on this mortgage total $10,362 in 2000, $10,446 in 2001, and $10,530 in 2002.

- Time Note: The original amount was $35,250 with outstandings of $20,500 due January 7, 2000. The interest rate is 11.25%. Repayment is not included in the cash flow projections 2000-2002.

In addition to the bank debt, there is $12,500 in principle outstanding on an original $30,000 loan to the seller of Bizcomm, Inc. This is being repaid at the rate of $1,250 monthly and carries an interest rate of 8%.

Repayments due monthly to EDIC are also included in reduction in long-term liabilities. The original loan was $75,000 to be repaid at the rate of $2,083 in principle monthly plus 6% interest. Present outstandings in the EDIC loan include accumulated interest due to back-due payments. The final maturity is September, 2002. The EDIC principle repayments each month added to the repayments to the previous owner of the company amount to $3,333 for the first ten months of 2000, after which the debt to the previous owner is fully repaid. Thereafter, $2,083 principle repayment monthly on the EDIC loan will continue through September of 2002.

Short-term Debt: It is expected that Bizcomm will secure a loan from 80% of outstanding accounts receivable in February. This $46,752 shows up as Short-term Debt which is repaid as soon as possible due to its high cost. Due to the high interest rate built in to these funds, they have been reduced as soon as cash flow permits. They are totally repaid by the end of year 2000.

Pro Forma Cash Flow

Cash Received

Operations

– Cash Sales: $0

– Cash from Receivables: $712,449 (2000), $854,140 (2001), $925,170 (2002)

– Subtotal Cash from Operations: $712,449 (2000), $854,140 (2001), $925,170 (2002)

Additional Cash Received

– Sales Tax, VAT, HST/GST Received: $0

– New Current Borrowing: $46,752 (2000), $0 (2001), $0 (2002)

– New Other Liabilities (interest-free): $0

– New Long-term Liabilities: $0

– Sales of Other Current Assets: $0

– Sales of Long-term Assets: $0

– New Investment Received: $76,000 (2000), $0 (2001), $0 (2002)

– Subtotal Cash Received: $835,201 (2000), $854,140 (2001), $925,170 (2002)

Expenditures

Expenditures from Operations

– Cash Spending: $203,472 (2000), $203,472 (2001), $203,472 (2002)

– Bill Payments: $423,946 (2000), $427,570 (2001), $450,728 (2002)

– Subtotal Spent on Operations: $627,418 (2000), $631,042 (2001), $654,200 (2002)

Additional Cash Spent

– Sales Tax, VAT, HST/GST Paid Out: $0

– Principal Repayment of Current Borrowing: $46,752 (2000), $0 (2001), $0 (2002)

– Other Liabilities Principal Repayment: $0

– Long-term Liabilities Principal Repayment: $47,858 (2000), $35,442 (2001), $35,526 (2002)

– Purchase Other Current Assets: $0

– Purchase Long-term Assets: $0

– Dividends: $0

– Subtotal Cash Spent: $722,028 (2000), $666,484 (2001), $689,726 (2002)

Net Cash Flow: $113,172 (2000), $187,656 (2001), $235,444 (2002)

Cash Balance: $129,359 (2000), $317,015 (2001), $552,460 (2002)

Sales Growth: 22.33% (2000), 8.93% (2001), 8.19% (2002) (Industry Profile: 9.85%)

Percent of Total Assets

– Accounts Receivable: 32.58% (2000), 25.97% (2001), 20.84% (2002) (Industry Profile: 26.60%)

– Inventory: 4.65% (2000), 3.57% (2001), 2.77% (2002) (Industry Profile: 8.47%)

– Other Current Assets: 0.46% (2000), 0.34% (2001), 0.25% (2002) (Industry Profile: 28.27%)

– Total Current Assets: 67.35% (2000), 83.09% (2001), 92.63% (2002) (Industry Profile: 63.34%)

– Long-term Assets: 32.65% (2000), 16.91% (2001), 7.37% (2002) (Industry Profile: 36.66%)

– Total Assets: 100.00% (2000), 100.00% (2001), 100.00% (2002) (Industry Profile: 100.00%)

Current Liabilities: 7.91% (2000), 5.91% (2001), 4.63% (2002) (Industry Profile: 25.65%)

Long-term Liabilities: 51.37% (2000), 31.65% (2001), 19.05% (2002) (Industry Profile: 21.72%)

Total Liabilities: 59.29% (2000), 37.56% (2001), 23.68% (2002) (Industry Profile: 47.37%)

Net Worth: 40.71% (2000), 62.44% (2001), 76.32% (2002) (Industry Profile: 52.63%)

Percent of Sales

– Sales: 100.00% (2000), 100.00% (2001), 100.00% (2002) (Industry Profile: 100.00%)

– Gross Margin: 67.23% (2000), 68.71% (2001), 69.97% (2002) (Industry Profile: 37.54%)

– Selling, General & Administrative Expenses: 56.91% (2000), 48.91% (2001), 46.56% (2002) (Industry Profile: 11.38%)

– Advertising Expenses: 0.00% (2000), 0.00% (2001), 0.00% (2002) (Industry Profile: 0.82%)

– Profit Before Interest and Taxes: 22.21% (2000), 32.13% (2001), 36.16% (2002) (Industry Profile: 2.23%)

Main Ratios

– Current: 8.51 (2000), 14.06 (2001), 20.00 (2002) (Industry Profile: 2.03)

– Quick: 7.93 (2000), 13.46 (2001), 19.40 (2002) (Industry Profile: 1.56)

– Total Debt to Total Assets: 59.29% (2000), 37.56% (2001), 23.68% (2002) (Industry Profile: 55.90%)

– Pre-tax Return on Net Worth: 78.89% (2000), 69.71% (2001), 52.72% (2002) (Industry Profile: 4.93%)

– Pre-tax Return on Assets: 32.12% (2000), 43.52% (2001), 40.23% (2002) (Industry Profile: 11.17%)

Additional Ratios

– Net Profit Margin: 13.20% (2000), 22.44% (2001), 25.70% (2002) (Industry Profile: n.a)

– Return on Equity: 59.18% (2000), 52.28% (2001), 39.32% (2002) (Industry Profile: n.a)

Activity Ratios

– Accounts Receivable Turnover: 5.60 (2000), 5.60 (2001), 5.60 (2002) (Industry Profile: n.a)

– Collection Days: 58 (2000), 62 (2001), 63 (2002) (Industry Profile: n.a)

– Inventory Turnover: 6.27 (2000), 10.65 (2001), 10.63 (2002) (Industry Profile: n.a)

– Accounts Payable Turnover: 10.62 (2000), 12.17 (2001), 12.17 (2002) (Industry Profile: n.a)

– Payment Days: 34 (2000), 30 (2001), 29 (2002) (Industry Profile: n.a)

– Total Asset Turnover: 1.83 (2000), 1.45 (2001), 1.17 (2002) (Industry Profile: n.a)

Debt Ratios

– Debt to Net Worth: 1.46 (2000), 0.60 (2001), 0.31 (2002) (Industry Profile: n.a)

– Current Liab. to Liab.: 0.13 (2000), 0.16 (2001), 0.20 (2002) (Industry Profile: n.a)

Liquidity Ratios

– Net Working Capital: $259,187 (2000), $459,824 (2001), $706,943 (2002) (Industry Profile: n.a)

– Interest Coverage: 4.82 (2000), 14.52 (2001), 21.35 (2002) (Industry Profile: n.a)

Additional Ratios

– Assets to Sales: 0.55 (2000), 0.69 (2001), 0.86 (2002) (Industry Profile: n.a)

– Current Debt/Total Assets: 8% (2000), 6% (2001), 5% (2002) (Industry Profile: n.a)

– Acid Test: 3.81 (2000), 9.06 (2001), 14.90 (2002) (Industry Profile: n.a)

– Sales/Net Worth: 4.48 (2000), 2.33 (2001), 1.53 (2002) (Industry Profile: n.a)

– Dividend Payout: 0.00 (2000), 0.00 (2001), 0.00 (2002) (Industry Profile: n.a)

Appendix

Sales Forecast

Unit Sales

– Slida-Cards™ units of 1,000 cards: 135 (Jan), 135 (Feb), 135 (Mar), 135 (Apr), 180 (May), 185 (Jun), 185 (Jul), 185 (Aug), 190 (Sep), 190 (Oct), 190 (Nov), 190 (Dec)

– Large Discounters: 0 (Jan), 0 (Feb), 0 (Mar), 90 (Apr), 90 (May), 90 (Jun), 90 (Jul), 90 (Aug), 90 (Sep), 90 (Oct), 90 (Nov), 90 (Dec)

– Commercial Printing: 1 (Jan), 1 (Feb), 1 (Mar), 1 (Apr), 1 (May), 1 (Jun), 1 (Jul), 1 (Aug), 1 (Sep), 1 (Oct), 1 (Nov), 1 (Dec)

– Other: 0 (Jan), 0 (Feb), 0 (Mar), 0 (Apr), 0 (May), 0 (Jun), 0 (Jul), 0 (Aug), 0 (Sep), 0 (Oct), 0 (Nov), 0 (Dec)

– Total Unit Sales: 136 (Jan), 136 (Feb), 136 (Mar), 226 (Apr), 271 (May), 276 (Jun), 276 (Jul), 276 (Aug), 281 (Sep), 281 (Oct), 281 (Nov), 281 (Dec)

Unit Prices

– Slida-Cards™ units of 1,000 cards: $199.00 (Jan), $199.00 (Feb), $199.00 (Mar), $199.00 (Apr), $199.00 (May), $199.00 (Jun), $199.00 (Jul), $199.00 (Aug), $199.00 (Sep), $199.00 (Oct), $199.00 (Nov), $199.00 (Dec)

– Large Discounters: $0.00 (Jan), $0.00 (Feb), $0.00 (Mar), $82.50 (Apr), $82.50 (May), $82.50 (Jun), $82.50 (Jul), $82.50 (Aug), $82.50 (Sep), $82.50 (Oct), $82.50 (Nov), $82.50 (Dec)

– Commercial Printing: $27,000.00 (Jan), $27,000.00 (Feb), $27,000.00 (Mar), $27,000.00 (Apr), $27,000.00 (May), $27,000.00 (Jun), $27,000.00 (Jul), $27,000.00 (Aug), $27,000.00 (Sep), $27,000.00 (Oct), $27,000.00 (Nov), $27,000.00 (Dec)

– Other: $0.00 (Jan), $0.00 (Feb), $0.00 (Mar), $0.00 (Apr), $0.00 (May), $0.00 (Jun), $0.00 (Jul), $0.00 (Aug), $0.00 (Sep), $0.00 (Oct), $0.00 (Nov), $0.00 (Dec)

Sales

– Slida-Cards™ units of 1,000 cards: $26,865 (Jan), $26,865 (Feb), $26,865 (Mar), $26,865 (Apr), $35,820 (May), $36,815 (Jun), $36,815 (Jul), $36,815 (Aug), $37,810 (Sep), $37,810 (Oct), $37,810 (Nov), $37,810 (Dec)

– Large Discounters: $0 (Jan), $0 (Feb), $0 (Mar), $7,425 (Apr), $7,425 (May), $7,425 (Jun), $7,425 (Jul), $7,425 (Aug), $7,425 (Sep), $7,425 (Oct), $7,425 (Nov), $7,425 (Dec)

– Commercial Printing: $27,000 (Jan), $27,000 (Feb), $27,000 (Mar), $27,000 (Apr), $27,000 (May), $27,000 (Jun), $27,000 (Jul), $27,000 (Aug), $27,000 (Sep), $27,000 (Oct), $27,000 (Nov), $27,000 (Dec)

– Other: $0 (Jan), $0 (Feb), $0 (Mar), $0 (Apr), $0 (May), $0 (Jun), $0 (Jul), $0 (Aug), $0 (Sep), $0 (Oct), $0 (Nov), $0 (Dec)

– Total Sales: $53,865 (Jan), $53,865 (Feb), $53,865 (Mar), $61,290 (Apr), $70,245 (May), $71,240 (Jun), $71,240 (Jul), $71,240 (Aug), $72,235 (Sep), $72,235 (Oct), $72,235 (Nov), $72,235 (Dec)

Direct Unit Costs

– Slida-Cards™ units of 1,000 cards: $19.50 (Jan), $19.50 (Feb), $19.50 (Mar), $19.50 (Apr), $19.50 (May), $19.50 (Jun), $19.50 (Jul), $19.50 (Aug), $19.50 (Sep), $19.50 (Oct), $19.50 (Nov), $19.50 (Dec)

– Large Discounters: $0.00 (Jan), $0.00 (Feb), $0.00 (Mar), $21.00 (Apr), $21.00 (May), $21.00 (Jun), $21.00 (Jul), $21.00 (Aug), $21.00 (Sep), $21.00 (Oct), $21.00 (Nov), $21.00 (Dec)

– Commercial Printing: $12,825.00 (Jan), $12,825.00 (Feb), $12,825.00 (Mar), $12,825.00 (Apr), $12,825.00 (May), $12,825.00 (Jun), $12,825.00 (Jul), $12,825.00 (Aug), $12,825.00 (Sep), $12,825.00 (Oct), $12,825.00 (Nov), $12,825.00 (Dec)

– Other:

Personnel Plan:

Production Personnel:

– Production Manager – Frank: $4,160 per month

– Assistant: $0 per month

– Other: $0 per month

– Subtotal: $4,160 per month

Sales and Marketing Personnel:

– Telemarketer – Sadie: $569 per month

– Telemarketer – Jennie: $693 per month

– Telemarketer – Jack: $1,365 per month

– Other: $0 per month

– Subtotal: $2,627 per month

General and Administrative Personnel:

– General Manager – Francis Pullman: $5,416 per month

– Art Designer – Vie: $2,500 per month

– Secretary – Jonathon: $2,253 per month

– Other: $0 per month

– Subtotal: $10,169 per month

Other Personnel:

– Name or title: $0 per month

– Other: $0 per month

– Subtotal: $0 per month

Total People: 7

Total Payroll: $16,956

General Assumptions:

Plan Month: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12

Current Interest Rate: 45.00%

Long-term Interest Rate: 9.30%

Tax Rate: 30.00% (Jan), 25.00% (Feb-Dec)

Other: 0

Pro Forma Profit and Loss:

Sales:

Jan – $53,865

Feb – $53,865

Mar – $53,865

Apr – $61,290

May – $70,245

Jun – $71,240

Jul – $71,240

Aug – $71,240

Sep – $72,235

Oct – $72,235

Nov – $72,235

Dec – $72,235

Direct Cost of Sales:

Jan – $15,458

Feb – $15,458

Mar – $15,458

Apr – $17,348

May – $18,225

Jun – $18,323

Jul – $18,323

Aug – $18,323

Sep – $18,420

Oct – $18,420

Nov – $18,420

Dec – $18,420

Production Payroll:

Jan – $4,160

Feb – $4,160

Mar – $4,160

Apr – $4,160

May – $4,160

Jun – $4,160

Jul – $4,160

Aug – $4,160

Sep – $4,160

Oct – $4,160

Nov – $4,160

Dec – $4,160

Industrial rags:

Jan – $22

Feb – $22

Mar – $22

Apr – $22

May – $22

Jun – $22

Jul – $22

Aug – $22

Sep – $22

Oct – $22

Nov – $22

Dec – $22

Total Cost of Sales:

Jan – $19,640

Feb – $19,640

Mar – $19,640

Apr – $21,530

May – $22,407

Jun – $22,505

Jul – $22,505

Aug – $22,505

Sep – $22,602

Oct – $22,602

Nov – $22,602

Dec – $22,602

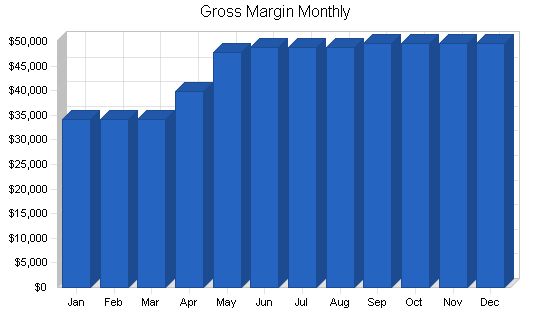

Gross Margin:

Jan – $34,226

Feb – $34,226

Mar – $34,226

Apr – $39,761

May – $47,838

Jun – $48,736

Jul – $48,736

Aug – $48,736

Sep – $49,633

Oct – $49,633

Nov – $49,633

Dec – $49,633

Gross Margin %:

Jan – 63.54%

Feb – 63.54%

Mar – 63.54%

Apr – 64.87%

May – 68.10%

Jun – 68.41%

Jul – 68.41%

Aug – 68.41%

Sep – 68.71%

Oct – 68.71%

Nov – 68.71%

Dec – 68.71%

Operating Expenses:

Sales and Marketing Expenses:

Jan – $2,627

Feb – $2,627

Mar – $2,627

Apr – $2,627

May – $2,627

Jun – $2,627

Jul – $2,627

Aug – $2,627

Sep – $2,627

Oct – $2,627

Nov – $2,627

Dec – $2,627

Travel:

Jan – $0

Feb – $0

Mar – $0

Apr – $0

May – $0

Jun – $0

Jul – $0

Aug – $0

Sep – $0

Oct – $0

Nov – $0

Dec – $0

Miscellaneous:

Jan – $0

Feb – $0

Mar – $0

Apr – $0

May – $0

Jun – $0

Jul – $0

Aug – $0

Sep – $0

Oct – $0

Nov – $0

Dec – $0

Advertising/Promotion:

Jan – $0

Feb – $5,000

Mar – $5,000

Apr – $0

May – $0

Jun – $0

Jul – $5,000

Aug – $5,000

Sep – $5,000

Oct – $0

Nov – $0

Dec – $0

Telemarketing commissions:

Jan – $1,000

Feb – $1,000

Mar – $1,000

Apr – $1,000

May – $1,000

Jun – $1,000

Jul – $1,000

Aug – $1,000

Sep – $1,000

Oct – $1,000

Nov – $1,000

Dec – $1,000

Internet Services:

Jan – $198

Feb – $198

Mar – $198

Apr – $198

May – $198

Jun – $198

Jul – $198

Aug – $198

Sep – $198

Oct – $198

Nov – $198

Dec – $198

Total Sales and Marketing Expenses:

Jan – $3,825

Feb – $8,825

Mar – $8,825

Apr – $3,825

May – $3,825

Jun – $3,825

Jul – $8,825

Aug – $8,825

Sep – $8,825

Oct – $3,825

Nov – $3,825

Dec – $3,825

Sales and Marketing %:

Jan – 7.10%

Feb – 16.38%

Mar – 16.38%

Apr – 6.24%

May – 5.44%

Jun – 5.37%

Jul – 12.39%

Aug – 12.39%

Sep – 12.22%

Oct – 5.29%

Nov – 5.29%

Dec – 5.29%

General and Administrative Expenses:

General and Administrative Payroll:

Jan – $10,169

Feb – $10,169

Mar – $10,169

Apr – $10,169

May – $10,169

Jun – $10,169

Jul – $10,169

Aug – $10,169

Sep – $10,169

Oct – $10,169

Nov – $10,169

Dec – $10,169

Sales and Marketing and Other Expenses:

Jan – $0

Feb – $0

Mar – $0

Apr – $0

May – $0

Jun – $0

Jul – $0

Aug – $0

Sep – $0

Oct – $0

Nov – $0

Dec – $0

Depreciation:

Jan – $3,466

Feb – $3,466

Mar – $3,466

Apr – $3,466

May – $3,466

Jun – $3,466

Jul – $3,466

Aug – $3,466

Sep – $3,466

Oct – $3,466

Nov – $3,466

Dec – $3,466

Leased Vehicles:

Jan – $985

Feb – $985

Mar – $985

Apr – $985

May – $985

Jun – $985

Jul – $985

Aug – $985

Sep – $985

Oct – $985

Nov – $985

Dec – $985

Utilities:

Jan – $411

Feb – $411

Mar – $411

Apr – $411

May – $411

Jun – $411

Jul – $411

Aug – $411

Sep – $411

Oct – $411

Nov – $411

Dec – $411

Insurance:

Jan – $497

Feb – $497

Mar – $497

Apr – $497

May – $497

Jun – $497

Jul – $497

Aug – $497

Sep – $497

Oct – $497

Nov – $497

Dec – $497

Medical and Dental:

Jan – $2,154

Feb – $2,154

Mar – $2,154

Apr – $2,154

May – $2,154

Jun – $2,154

Jul – $2,154

Aug – $2,154

Sep – $2,154

Oct – $2,154

Nov – $2,154

Dec – $2,154

Telephone:

Jan – $970

Feb – $970

Mar – $970

Apr – $970

May – $970

Jun – $970

Jul – $970

Aug – $970

Sep – $970

Oct – $970

Nov – $970

Dec – $970

Retirement Acct (P. Vitale):

Jan – $300

Feb – $300

Mar – $300

Apr – $300

May – $300

Jun – $300

Jul – $300

Aug – $300

Sep – $300

Oct – $300

Nov – $300

Dec – $300

Payroll Services:

Jan – $168

Feb – $168

Mar – $168

Apr – $168

May – $168

Jun – $168

Jul – $168

Aug – $168

Sep – $168

Oct – $168

Nov – $168

Dec – $168

Postage:

Jan – $950

Feb – $950

Mar – $950

Apr – $950

May – $950

Jun – $950

Jul – $950

Aug – $950

Sep – $950

Oct – $950

Nov – $950

Dec – $950

Rent:

Jan – $3,943

Feb – $3,943

Mar – $3,943

Apr – $3,943

May – $3,943

Jun – $3,943

Jul – $3,943

Aug – $3,943

Sep – $2,500

Oct – $2,500

Nov – $2,500

Dec – $2,500

Payroll Taxes:

Jan – 15%

Feb – $0

Mar – $0

Apr – $0

May – $0

Jun – $0

Jul – $0

Aug – $0

Sep – $0

Oct – $0

Nov – $0

Dec – $0

Other General and Administrative Expenses:

Jan – $0

Feb – $0

Mar – $0

Apr – $0

May – $0

Jun – $0

Jul – $0

Aug – $0

Sep – $0

Oct – $0

Nov – $0

Dec – $0

Total General and Administrative Expenses:

Jan – $24,013

Feb – $24,013

Mar – $24,013

Apr – $24,013

May – $24,013

Jun – $24,013

Jul – $24,013

Aug – $24,013

Sep – $22,570

Oct – $22,570

Nov – $22,570

Dec – $22,570

General and Administrative %:

Jan – 44.58%

Feb – 44.58%

Mar – 44.58%

Apr – 39.18%

May – 34.18%

Jun – 33.71%

Jul – 33.71%

Aug – 33.71%

Sep – 31.25%

Oct – 31.25%

Nov – 31.25%

Dec – 31.25%

Other Expenses:

Other Payroll:

Jan – $0

Feb – $0

Mar – $0

Apr – $0

May – $0

Jun – $0

Jul – $0

Aug – $0

Sep – $0

Oct – $0

Nov – $0

Dec – $0

Consultants:

Jan – $0

Feb – $0

Mar – $0

Apr – $0

May – $0

Jun – $0

Jul – $0

Aug – $0

Sep – $0

Oct – $0

Nov – $0

Dec – $0

Contract/Consultants:

Jan – $5,000

Feb – $0

Mar – $0

Apr – $0

May – $0

Jun – $0

Jul – $0

Aug – $0

Sep – $0

Oct – $0

Nov – $0

Dec – $0

Total Other Expenses:

Jan – $5,000

Feb – $0

Mar – $0

Apr – $0

May – $0

Jun – $0

Jul – $0

Aug – $0

Sep – $0

Oct – $0

Nov – $0

Dec – $0

Other %:

Jan – 9.28%

Feb – 0.00%

Mar – 0.00%

Apr – 0.00%

May – 0.00%

Jun – 0.00%

Jul – 0.00%

Aug – 0.00%

Sep – 0.00%

Oct – 0.00%

Nov – 0.00%

Dec – 0.00%

Total Operating Expenses:

Jan – $32,838

Feb – $32,838

Mar – $32,838

Apr – $27,838

May – $27,838

Jun – $27,838

Jul – $32,838

Aug – $32,838

Sep – $31,395

Oct – $26,395

Nov – $26,395

Dec – $26,395

Profit Before Interest and Taxes:

Jan – $1,388

Feb – $1,388

Mar – $1,388

Apr – $11,923

May – $20,001

Jun – $20,898

Jul – $15,898

Aug – $15,898

Sep – $18,239

Oct – $23,239

Nov – $23,239

Dec – $23,239

EBITDA:

Jan – $4,854

Feb – $4,854

Mar – $4,854

Apr – $15,389

May – $23,467

Jun – $24,364

Jul – $19,364

Aug – $19,364

Sep – $21,705

Oct – $26,705

Nov – $26,705

Dec – $26,705

Interest Expense:

Jan – $2,075

Feb – $3,796

Mar – $3,763

Apr – $3,731

May – $3,699

Jun – $3,666

Jul – $3,259

Aug – $3,226

Sep – $2,818

Oct – $2,786

Nov – $2,134

Dec – $1,736

Taxes Incurred:

Jan – ($206)

Feb – ($602)

Mar – ($594)

Apr – $2,048

May – $4,075

Jun – $4,308

Jul – $3,160

Aug – $3,168

Sep – $3,855

Oct – $5,113

Nov – $5,276

Dec – $5,376

Net Profit:

Jan – ($481)

Feb – ($1,806)

Mar – ($1,782)

Apr – $6,144

May – $12,226

Jun – $12,924

Jul – $9,480

Aug – $9,504

Sep – $11,565

Oct – $15,340

Nov – $15,828

Dec – $16,127

Net Profit/Sales:

Jan – (-0.89%)

Feb – (-3.35%)

Mar – (-3.31%)

Apr – 10.02%

May – 17.41%

Jun – 18.14%

Jul – 13.31%

Aug – 13.34%

Sep – 16.01%

Oct – 21.24%

Nov – 21.91%

Dec – 22.33%

Pro Forma Cash Flow

Cash Received

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Cash from Operations

Cash Sales $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Cash from Receivables $29,361 $31,156 $53,865 $53,865 $54,113 $61,589 $70,278 $71,240 $71,240 $71,273 $72,235 $72,235

Subtotal Cash from Operations $29,361 $31,156 $53,865 $53,865 $54,113 $61,589 $70,278 $71,240 $71,240 $71,273 $72,235 $72,235

Additional Cash Received

Sales Tax, VAT, HST/GST Received 0.00% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

New Current Borrowing $0 $46,752 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

New Long-term Liabilities $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Sales of Other Current Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Sales of Long-term Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

New Investment Received $76,000 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Subtotal Cash Received $105,361 $77,908 $53,865 $53,865 $54,113 $61,589 $70,278 $71,240 $71,240 $71,273 $72,235 $72,235

Expenditures

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Expenditures from Operations

Cash Spending $16,956 $16,956 $16,956 $16,956 $16,956 $16,956 $16,956 $16,956 $16,956 $16,956 $16,956 $16,956 $16,956

Bill Payments $92,571 $18,510 $19,790 $19,687 $17,528 $22,470 $38,113 $41,338 $41,282 $40,226 $36,457 $35,975

Subtotal Spent on Operations $109,527 $35,466 $36,746 $36,643 $34,484 $39,426 $55,069 $58,294 $58,238 $57,182 $53,413 $52,931

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0 $0 $0 $0 $0 $0 $0

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!