Diamond Retailer Business Plan

Purchasing an engagement ring can be a hassle, especially for those with little knowledge about diamonds. Studies show that 1.7 million engagement rings are bought annually in the United States, accounting for 74% of brides from 2.3 million weddings. The average expenditure on a diamond engagement ring is approximately $2,000.

The Internet has revolutionized connectivity and interactivity, allowing potential buyers to learn more about the characteristics of diamonds before visiting jewelers. This solves the problem of not knowing enough about the merchandise. People can now gather information before purchasing diamonds from their local jewelers.

However, online retailers do not simply want people to learn and gather information; they want those actions to convert into sales. Selling diamonds online is different from selling books online because customers want to see the actual product before buying. They might have concerns about the diamond’s brilliance not matching the one they saw online.

High-end dot-com retailers are faced with the challenge of incorporating a "high-touch" experience. While low-end jewelry retailers focus on selling a greater quantity of items, we aim to find the right approach to bring high-end loose diamonds to consumers.

Rocks by Request (RBR), founded by third-generation jeweler Rock Stone three years ago in the Bay Area, provides the answer to this challenge. After operating for three years, RBR plans to expand outside of California. RBR’s concept is simple: leveraging local jewelers as its "front-end" to address credibility and high-touch issues in online diamond sales.

RBR differentiates itself in the aftermath of the dot-com bust. While maintaining connectivity, interactivity, and speed, RBR combines technology and tradition to humanize e-commerce in the diamond retail industry.

This strategic plan focuses on optimizing connectivity, interactivity, and speed to develop recommendations for RBR’s new business strategy.

1.1 Objectives:

– Develop additional recommendations and changes to RBR’s current strategy to expand its market share in the loose diamond e-tail industry.

– Advise RBR on industry insights, market trends, and the competitive landscape of the diamond business, while providing a psychographic study of the current and potential engagement market.

1.2 Mission:

Our mission is to increase our current 2% market share in online diamond retail. Considering the number of diamonds sold in the United States annually, our current market share is relatively low. To achieve growth, RBR must expand its network of jewelers, form stronger alliances with media and Internet vendors, and invest in R&D to deliver cutting-edge e-commerce technology.

1.3 Keys to Success:

Key factors that will help RBR expand its operations include:

– Expanding its network of family jewelers nationwide and globally.

– Establishing additional warehouses to meet demand.

– Improving logistic/supply chain for fast delivery and returns.

– Enhancing the website’s appearance with upgraded graphics and state-of-the-art navigation.

– Forming alliances with media and Internet partners to promote the idea of purchasing loose diamonds online.

– Expanding product categories to include gold settings for pendants, rings, and earrings, as well as gold trinkets/accessories targeted at a younger audience.

**Company Summary**

Rocks by Request (RBR) is distinct from other e-business diamond retailers. They are not brokers like most others, who rely on diamond wholesalers for their inventory. Instead, RBR purchases its diamonds outright, allowing them more control over the merchandise and the ability to ship directly to local jewelers. Many of RBR’s competitors have consignment agreements with stone cutters for distribution.

RBR employs a combination of online and traditional methods for its business model. The goal is to create a "high touch" experience, which is essential in the diamond business. RBR also takes a unique approach by utilizing local stores in California as their customer-facing front-end. These stores are often owned by RBR and serve as both brick-and-mortar locations and online platforms.

This business model appeals to local jewelers who recognize the importance of e-commerce but may be unsure of how to incorporate it into their own businesses. By partnering with RBR, they can expand their customer base and generate more revenue, while RBR gains customers in different areas.

**Company History**

Rocks by Request was established three years ago in response to the re-invention of the dot com era. The founder, Rock Stone, transformed his family business into a futuristic enterprise by combining traditional brick-and-mortar concepts with connectivity. Initial funding came from Mr. Stone’s savings and his father’s company, which included a significant number of loose diamonds. After experiencing promising growth in its three years of operation, Mr. Stone is confident in RBR’s future success and plans to finance its further expansion. He recognizes the importance of marketing to capture people’s interest and aims to expand distribution by partnering with local jewelers.

Unlike other online diamond sellers, RBR has a unique approach to establishing its identity. They do not operate a virtual store like Blue Nile or Diamonds.com. Instead, RBR presents themselves as a traditional wholesaler, leveraging the advantages of the new economy through the use of the internet to sell diamonds directly to end consumers.

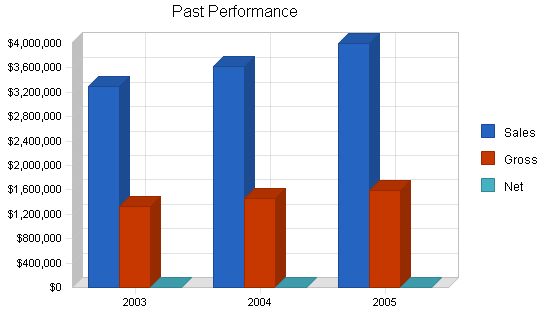

| Past Performance | |||

| 2003 | 2004 | 2005 | |

| Sales | $3,300,000 | $3,630,000 | $3,993,000 |

| Gross Margin | $1,320,000 | $1,452,000 | $1,597,200 |

| Gross Margin % | 40.00% | 40.00% | 40.00% |

| Operating Expenses | $900,000 | $900,000 | $900,000 |

| Inventory Turnover | 0.00 | 0.00 | 7.99 |

| Balance Sheet | |||

| 2003 | 2004 | 2005 | |

| Current Assets | |||

| Cash | $3,080,000 | $2,752,000 | $2,287,000 |

| Inventory | $0 | $0 | $600,000 |

| Other Current Assets | $600,000 | $200,000 | $30,000 |

| Total Current Assets | $3,680,000 | $2,952,000 | $2,917,000 |

| Long-term Assets | |||

| Long-term Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $3,680,000 | $2,952,000 | $2,917,000 |

| Current Liabilities | |||

| Accounts Payable | $260,000 | $200,000 | $120,000 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities (interest free) | $0 | $0 | $0 |

| Total Current Liabilities | $260,000 | $200,000 | $120,000 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $260,000 | $200,000 | $120,000 |

| Paid-in Capital | $3,000,000 | $2,200,000 | $1,500,000 |

| Retained Earnings | $420,000 | $552,000 | $1,297,000 |

| Earnings | $0 | $0 | $0 |

| Total Capital | $3,420,000 | $2,752,000 | $2,797,000 |

| Total Capital and Liabilities | $3,680,000 | $2,952,000 | $2,917,000 |

| Other Inputs | |||

| Payment Days | 30 | 30 | 30 |

Contents

2.2 Company Ownership

The company is privately held. The Managing Director of RBR is a third-generation diamond trader who has established long-term relationships with local jewelry stores and end customers, some of whom are long-time family clients. In the next growth phase, RBR is open to selling portions of the company’s ownership to investors.

2.3 Company Locations and Facilities

The company currently operates two offices. RBR is headquartered in a building occupied by jewelry suppliers, from loose diamond wholesalers to precious/semi-precious stone suppliers to jewelry retail stores. RBR is known for offering certified loose-diamond jewelry at a good price.

RBR also operates a warehouse equipped with state-of-the-art technology for quick processing in delivering and returning loose diamonds to and from partner jewelers. The warehouse staff includes four controllers responsible for finance and accounting, one programmer (who also maintains IT), one buyer who selects inventory from diamond cutters, and one sales person.

Products

RBR’s main product is loose diamonds, including various shapes from emerald-cut to round-cut with brilliant color and V VS 1 clarity. All of RBR’s diamonds are GIA certified with laser inscription inside. RBR previously focused on diamond wholesaling but now offers a variety of options and designs. Customers can expect excellent quality diamonds and extraordinary design settings.

3.1 Product Description

RBR carries various diamond shapes in its inventory:

- Round, price ranging from $360 to $970,000 depending on the 4Cs

- Princess, price ranging from $370 to $200,000 depending on the 4Cs

- Emerald, price ranging from $270 to $550,000 depending on the 4Cs

- Asscher, price ranging from $500 to $300,000 depending on the 4Cs

- Marquis, price ranging from $615 to $500,000 depending on the 4Cs

- Oval, price ranging from $460 to $240,000 depending on the 4Cs

- Radiant, price ranging from $470 to $512,000 depending on the 4Cs

- Pear, price ranging from $460 to $1,150,000 depending on the 4Cs

- Heart, price ranging from $570 to $280,000 depending on the 4Cs

- Cushion, price ranging from $895 to $480,000 depending on the 4Cs

In addition to loose diamonds, RBR carries signature items made exclusively for RBR, including the world’s finest round-cut diamonds and emerald-cut diamonds.

3.2 Sales Literature

In addition to the interactive website, RBR publishes an annual diamond catalog distributed to local jewelers. The catalog includes the diamond report and information about the 4Cs of the merchandise. The catalog also provides the names and addresses of RBR’s network jewelers.

Customers can request a catalog through the website free of charge.

3.3 Sourcing

RBR has long-term relationships with diamond cutters such as Levy Diamond Cutters Inc. (Israel) and Schumacher Diamond Cutters Inc. (Antwerp, Belgium). These relationships date back to the owner’s father, who has purchased loose diamonds directly from these sources since 1970.

3.4 Future Products

RBR recognizes the importance of variety and options in the diamond market. As the company expands, it plans to introduce new product categories to increase sales volume, including popular trinkets and setting sales in addition to loose diamonds.

3.5 Technology

RBR utilizes a hybrid approach of brick-and-mortar and Internet connectivity. The company leverages local jewelry stores to provide a "high touch" diamond shopping experience. Customers can select diamonds online and schedule an appointment with a jeweler to see and examine the diamond. Merchandise is shipped to the jeweler within 24 hours, and sales are made on the spot. RBR is continuously adding local jewelers to its selection to expand its strategic infrastructure.

Market Analysis Summary

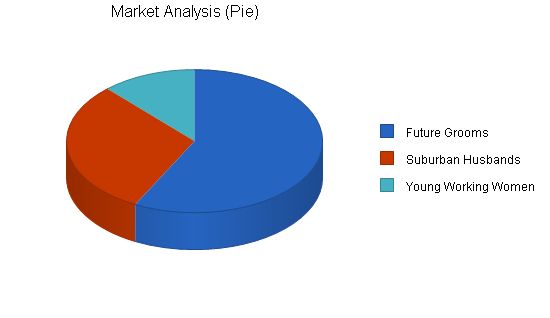

The market is divided into three segments: "Future Grooms," "Suburban Husbands," and "Young Working Women." RBR prioritizes marketing to men, as the surprise factor is crucial in the engagement ring market. RBR also targets suburban husbands looking for anniversary rings and young working women who value the ability to see and examine the diamonds before purchasing.

4.1 Market Segmentation

The "Future Grooms" segment consists of young men aged 28-45 with high incomes, living in metro areas. They are in their prime careers and often dating their college sweethearts, ready to start a family. They tend to be computer literate and engaged in high-profile sports.

The "Suburban Husbands" segment includes slightly older men aged 32-55 with higher incomes, living in the suburbs. They are celebrating their wedding anniversaries and are willing to spend more than $5,000 on an anniversary ring.

The "Young Working Women" segment represents women who are computer literate and value the ability to see the diamonds before purchasing. They are frequent visitors of women’s community websites and make up a significant portion of the e-tailing market.

– The table shows the growth of potential customers from 2006 to 2010.

– RBR has been focusing on the "Future Grooms" market since 2002 because engagement rings are the largest segment in diamond purchasing in the U.S.

– In Western culture, a diamond ring signifies marriage proposal.

– RBR offers loose diamonds, allowing customers to choose their own settings.

– The female target market segment has shown significant growth in the last three years, leading to RBR’s expansion plan by adding innovative setting design.

– Market Needs:

– Recognition and exclusivity: Customers want unique and custom-made engagement rings.

– Security/absence of fear: Trust is important in purchasing diamonds from RBR.

– Love: A diamond engagement ring represents exclusive love.

– Value:

– RBR sells high-quality diamonds at wholesale prices and maintains a high-end retail image.

– Customers can select diamonds online and inspect them physically when RBR ships the diamonds to local jewelers.

– Market Growth:

– Generation X is beginning to make up the largest working class and has enough disposable income.

– Total diamond sales in the U.S. reach $5.5 billion, with approximately $400 million in diamond sales annually.

– The diamond market is divided into premium end, middle end, and low end.

– Online diamond retail has different categories paralleling brick-and-mortar stores.

– RBR deals in the upper echelon of high-quality diamonds.

– RBR’s initial target is the top 35% of the diamond market.

– Blue Nile currently holds 25% of the total online diamond sales market.

– Distribution Patterns:

– Products move from diamond mines to diamond cutters, then to retailers or wholesalers, and finally to smaller retailers.

– Major jewelry stores can sell cheaper diamonds than mom-and-pop shops due to larger purchasing quantities.

– Consignment sales allow mom-and-pop shops to compete with large jewelry chains.

– Competition and Buying Patterns:

– RBR has strong competition in both online and traditional diamond retail.

– Big names like Tiffany & Co., Zales Jewelers, and Cartier dominate the high-end diamond market in the U.S.

– Online sales are increasing due to improved safety and good value.

– Main Competitors:

– Diamonds.com: Offers a wide range of products and convenience in online shopping.

– Blue Nile: Largest online diamond seller with a diverse product range and features for customization.

– Diamond.com: Offers tracking of orders and ships internationally.

– Best Gem: Limited display of diamonds, offers repairs and financing.

– Mondera: Portrays itself as traditional with wide product selection and celebrity features.

– Strategy and Implementation Summary:

– Restructuring the company by delegating responsibilities and improving management culture.

– Revamping the RBR brand to appeal to Generation X and increase value in serving customers.

– Strategy Pyramid:

– Recruiting non-family members to strategic positions to increase accountability.

– Investing in the competency of employees through seminars.

– Emphasizing the marketing campaign "One Diamond, One Love."

– Competitive Edge:

– Utilizing the Internet to connect customers with store inventory and local jewelers for a high-touch experience.

By working with local jewelers, RBR eliminates the need to purchase diamonds before inspection, unlike competitors. With RBR, diamonds (limit 2 per customer) are shipped to jewelers for free, even if the customer doesn’t make a purchase. It’s a risk-free guarantee.

The concept of e-marketing is similar to traditional marketing. It involves planning and executing the distribution of ideas, goods, and services to satisfy company objectives. Marketing involves fully utilizing all of the company’s resources to encourage customers to buy products.

RBR has three marketing strategies for e-commerce marketing: posting, positioning, and traditional marketing. These strategies include advertising and a combination of all methods.

The most challenging aspect of marketing for RBR is combining electronic and traditional publication. RBR uses push and pull methods to attract customers. The pull approach involves educating customers about diamonds through the website. The push approach involves advertising, direct mail, in-store promotions, and strategic alliances with other firms to support RBR’s competitive advantages.

Major advertising campaigns are efficient for reaching potential buyers, but they can be costly and reach random targets. To target specific customers, RBR uses SRI data to determine which media to use. Sales promotions can stimulate demand but may cheapen the brand image. Publicity is a low-cost option with more credible messages, but there are barriers such as uncooperative media and heavy competition.

RBR can benchmark other companies like Mondera.com by endorsing their products in celebrity events. Catalogs are also an effective way to create an exclusive brand image.

RBR offers a unique combination of high-tech and high-touch shopping for discriminating diamond purchasers who prefer to shop online. Unlike other online retailers, RBR allows customers to inspect chosen stones in person before buying.

RBR implements standard pricing based on the Rappaport. The pricing of settings depends on design complexity and includes 18k yellow gold or 14k white gold. RBR also plans to outsource the manufacture of accessories made of 14k white gold decorated with small-carat diamonds.

RBR’s sales strategy involves working with local jewelers and offering them a 10% commission fee. Local jewelers act as the "front-end" for customers, providing credibility and a personal touch. This strategy has been successful for RBR for the past three years.

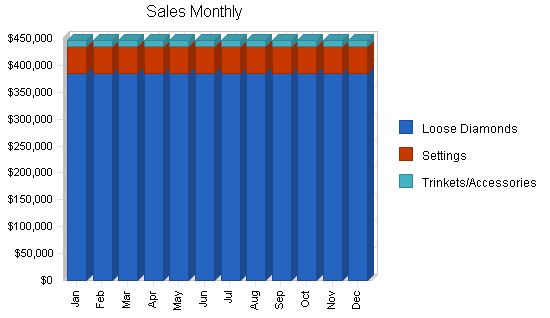

The sales forecast for RBR is conservative due to competition. RBR expects a boost in revenue with the addition of settings and accessories. To attract local jewelers, RBR plans to decrease its margin from 40% to 30%. Bargaining takes place when the merchandise is at the local jewelers’ hand. RBR sets the average 30% margin for all loose diamond sales but the numbers can range from 25% to 50% in the diamond retail industry.

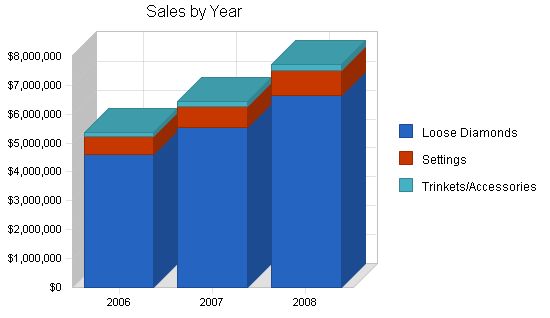

Sales Forecast:

2006 2007 2008

Loose Diamonds $4,620,000 $5,544,000 $6,652,800

Settings $600,000 $720,000 $864,000

Trinkets/Accessories $140,000 $168,000 $200,100

Total Sales $5,360,000 $6,432,000 $7,716,900

Direct Cost of Sales:

2006 2007 2008

Loose Diamonds $3,234,000 $3,880,800 $4,656,400

Settings $420,000 $504,000 $604,000

Trinkets/Accessories $98,000 $118,000 $140,000

Subtotal Direct Cost of Sales $3,752,000 $4,502,800 $5,400,400

5.5 Strategic Alliances

Strategic alliances have a significant impact on creating brand image. They can be more powerful than advertising campaigns alone. I propose alliances with Visa, American Express, and MasterCard to boost our image and customers’ spending power. We will also join Shop@AOL, placing our diamonds in AOL’s selection of engagement diamonds. This will greatly impact our image as we will be in the same place as AOL’s endorsed online diamond retailers, like Blue Nile and Diamonds.com.

Yahoo! and Amazon are entering the high-end retailing market. RBR should become one of their endorsed merchants to enhance brand awareness.

5.6 Milestones

The milestones program details RBR’s implementation schedule for expanding its product portfolio and distribution strategy. Mr. Stone will lead the project, finding potential upscale jewelry stores in the area and controlling the budget in strategic areas.

Milestones

Milestone Start Date End Date Budget Manager Department

Website Redesign 11/20/2005 2/12/2006 $500 Jay Pegg IT

Annual Marketing Program 11/16/2005 1/2/2006 $48,000 Buzz Wird Marketing

Finding Potential Jeweler Partner 10/28/2005 6/6/2009 $1,200 Rock Stone Business Dvpmnt

Establish Alliance With Internet Vendors 12/15/2005 2/10/2006 $1,200 Rock Stone Business Dvpmnt

Establish Relationship With Outsourcing Workshops 12/2/2005 2/12/2006 $1,200 Rock Stone Business Dvpmnt

Revamp Logo Design 11/20/2005 6/6/2009 $800 Rock Stone Business Dvpmnt

Establish Relationship With Banks For Co Branding 11/22/2005 1/17/2006 $1,200 Buck Pound Business Dvpmnt

Upgrade Existing Warehouse 12/2/2005 3/20/2006 $12,000 Chip N. Storage Operation

Update List of New Local Jeweler Partners 1/5/2006 1/9/2006 $0 Jay Pegg IT

Totals $66,100

Web Plan Summary

The new RBR website will have several new features that will add to the company’s competitive advantage in online diamond retailing. Some of these features, such as “Design Your Own Ring” and “Live Online Sales Assistance,” have already been implemented by other players in the marketplace.

New features of RBR website will include:

– “Design Your Own Ring,” utilizing Macromedia Flash that will enable customers to view their ring setting with their own selection of diamond shape.

– “Live Online Sales Assistance,” that will be available from 8AM to 8PM Pacific Standard Time.

– Paypal friendly.

– “3-D Interactive,” utilizing Macromedia Flash, so that customers can view 360 degrees of the selected ring.

6.1 Website Marketing Strategy

Optimizing our Search Results

This process refers to optimizing RBR’s website by including the frequent use of keywords from customers going to search engines looking for diamonds, such as “diamonds,” “diamond,” and “wholesale diamonds” into its Web pages. Optimization is currently handled by an organization called WebMama.com. IT personnel at WebMama.com puts the use of words in a fashion where search engines pick them up. This all being done in text rather than in pdf format as the spiders and callers only work in text environment. Another way to position the website is by optimizing the meta-text, which means the back-end of the website, where it tells the search engine about the presence of RBR’s website.

The concept of web optimization is quite simple, knowing that search engines’ spiders would not go as far as two levels in delivering the websites to Internet users. Note that flash pages are not friendly to the spiders, so it is advisable not to put flashy pages on the first two levels. There are doors to get in every website from the search engines, which in the case of RBR, it uses four doors. In order to optimize RBR’s doors with the search engines portals, we use strategy that is derived from the common customers’ habit if they were looking for diamonds online. For instance, customers will use the four C’s to educate themselves about the diamonds they are going to buy, and RBR provides the four C’s information in the first level of its website to get customers learning about the four C’s from RBR.

Currently the Web positioning strategy is more than adequate to put RBR among other competitors. Although it is in Yahoo’s 19th rank when customers type keyword “diamonds,” it still visible for them to view the website.

Now, with the optimized keywords and meta-texts in position, RBR needs to do one final step, posting the site for search engines.

Current posting on Yahoo! indicates sponsorship under the word “wholesale diamonds” and “engagement diamonds,” but not under single keywords”diamonds” or “diamond,” which is not posing a problem as long as the optimization process keeps up with the fast pace in the changing trend of the Internet.

Although Yahoo! and Google are the most used search engines in the world today, my recommendation in this part is to post RBR’s website under Shop@AOL, for the reason that AOL is the biggest online community where its users listen for virtual “word of mouth” with other chatters or members. As Blue Nile and Diamond.com are already in sponsorship with AOL, along with Macy’s and Ice.com that are now expanding to the upper echelon of loose diamond retail, RBR should establish a connection with AOL to increase its competitiveness in the industry.

6.2 Development Requirements

In developing this high-tech website, RBR will utilize mainly Macromedia Flash software, as well as open source software to achieve cost efficiency in this area. RBR’s IT Manager will be responsible in the development of both front-end and back-end of the website. RBR’s in-house programmer will be responsible to create the program that will enable these new features, while for data entry, image cropping, and simple programming, RBR will use temp workers to help minimize the budget. Temp workers will also be contracted on an as-needed basis in the maintenance and update of the website.

Management Summary

Rock Stone, CEO of RBR, will be responsible for developing business strategy, identifying business opportunities, and achieving projected revenue and expense targets.

Our CFO will be responsible for supervising the finance and accounting department.

Our Marketing and Brand Manager will be responsible for developing brand advertising and marketing programs.

7.1 Organizational Structure

The new organization restructuring will focus on the relationship between the owner and the other managers, not necessarily limiting the involvement of the owner. The purpose of this new organizational model is to increase the accountability of each subdivision to gain maximum performance.

– Mr. Stone will act as a CEO/Strategic Business Officer. The role of Vice President and CFO will be combined.

– Jay Pegg will be responsible for the IT development of the company, both front-end design and back-end database management.

– The Marketing Department, headed by Buzz Wird, will include Branding Development.

– Warehouse and Logistic Operation will be headed by Mr. Chip N. Storage.

7.2 Personnel Plan

Mr. Stone will now receive an annual salary instead of taking the whole profit as it was in the past. The purpose of giving salary to owner is to accumulate extra cash for the further development of the company.

Personnel Plan

2006 2007 2008

CEO/Owner $108,000 $108,000 $108,000

CFO $78,000 $78,000 $78,000

Marketing/Brand Manager $54,000 $54,000 $54,000

Marketing Personnel $24,000 $24,000 $24,000

IT Manager $54,000 $54,000 $54,000

Programmer $38,400 $38,400 $38,400

Web Designer $26,400 $26,400 $26,400

General Administrative Assistant $24,000 $24,000 $24,000

Shipping Personnel 1 $22,000 $22,000 $22,000

Security Guard 1 $24,000 $24,000 $24,000

Security Guard 2 $24,000 $24,000 $24,000

Security Guard 3 $24,000 $24,000 $24,000

Security Guard 4 $24,000 $24,000 $24,000

Shipping Personnel 2 $22,000 $22,000 $22,000

Total People 15 15 15

Total Payroll $546,799 $546,800 $546,800

Our financial plan is based on our overall strategy of new market development. We will cut our margins from 40% to 30% to increase our appeal to a wider audience. With lower prices, we must rely on online marketing efforts and local jewelers to maintain and enhance the prestige of our brand.

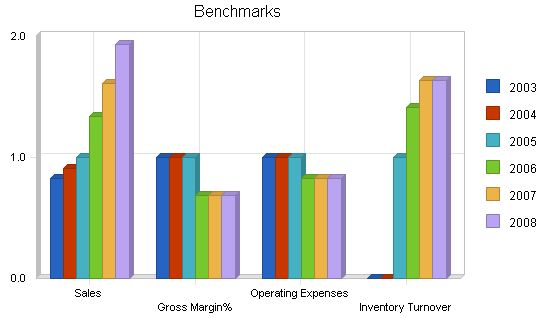

8.1 Important Assumptions

Our assumption is based on the historical 20% annual sales growth since 2002. This is a rather conservative sales projection. As we expand our categories and revamp the technology, in addition to building a stronger image brand, we expect a higher growth percentage during three years of operation.

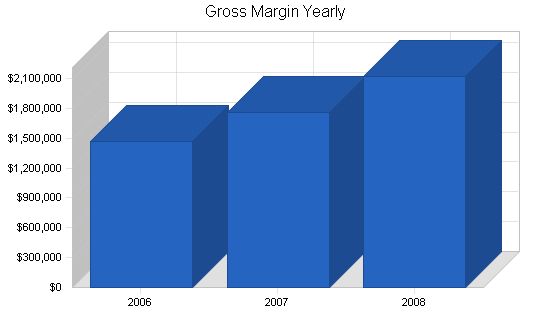

8.2 Key Financial Indicators

We will decrease our gross margin from 40% in previous years to 30% of all loose diamond sales, to boost sales volume. As mentioned in a previous chapter, we purchased a large amount of loose diamonds directly from our network of diamond cutters with 30 days collection days. Based on our estimated operating expense monthly, we expect to generate more sales to cover our fixed expenses.

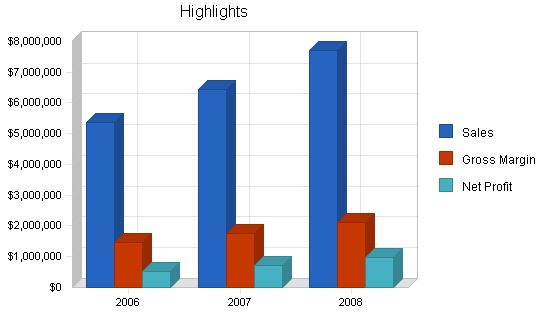

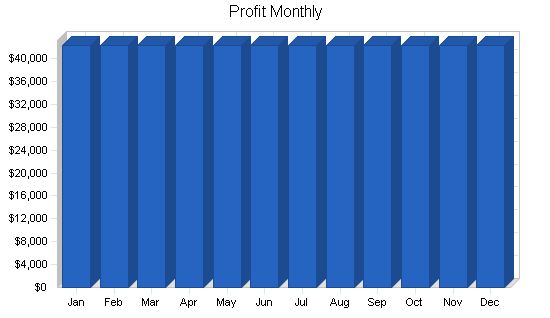

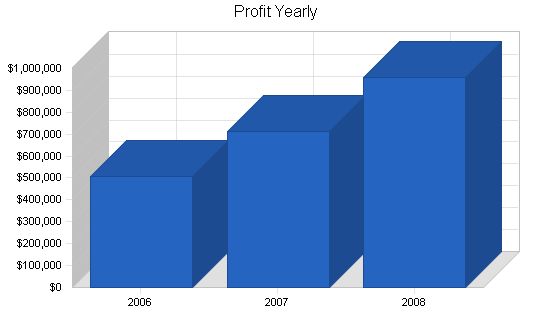

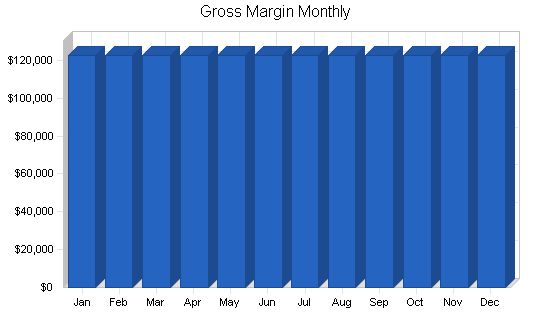

Projected Profit and Loss for 2006 and 2007 is shown in the table and charts below.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| 2006 | 2007 | 2008 | |

| Sales | $5,360,000 | $6,432,000 | $7,716,900 |

| Direct Cost of Sales | $3,752,000 | $4,502,800 | $5,400,400 |

| Other Costs of Sales | $138,600 | $166,400 | $199,600 |

| Total Cost of Sales | $3,890,600 | $4,669,200 | $5,600,000 |

| Gross Margin | $1,469,400 | $1,762,800 | $2,116,900 |

| Gross Margin % | 27.41% | 27.41% | 27.43% |

| Expenses | |||

| Payroll | $546,799 | $546,800 | $546,800 |

| Marketing/Promotion | $48,000 | $48,000 | $48,000 |

| Depreciation | $0 | $0 | $0 |

| Rent @ Brannan Street | $36,000 | $36,000 | $36,000 |

| Utilities @ Brannan Street | $4,200 | $4,200 | $4,200 |

| Warehouse Utilities | $7,200 | $7,200 | $7,200 |

| Payroll Taxes | $0 | $0 | $0 |

| Warehouse Rent | $72,000 | $72,000 | $72,000 |

| Web Hosting | $480 | $480 | $480 |

| Database Maintenance | $100 | $100 | $100 |

| Shipping | $30,000 | $30,000 | $30,000 |

| Total Operating Expenses | $744,779 | $744,780 | $744,780 |

| Profit Before Interest and Taxes | $724,621 | $1,018,020 | $1,372,120 |

| EBITDA | $724,621 | $1,018,020 | $1,372,120 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $217,386 | $305,406 | $411,636 |

| Net Profit | $507,234 | $712,614 | $960,484 |

| Net Profit/Sales | 9.46% | 11.08% | 12.45% |

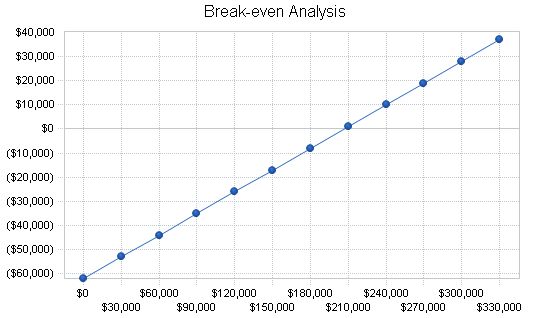

8.4 Break-even Analysis

The table and chart below show the monthly break-even point in diamond sales based on fixed costs and variable costs. We have already exceeded the break-even point, despite the lower margins.

Break-even Analysis:

Monthly Revenue Break-even: $206,883

Assumptions:

– Average Percent Variable Cost: 70%

– Estimated Monthly Fixed Cost: $62,065

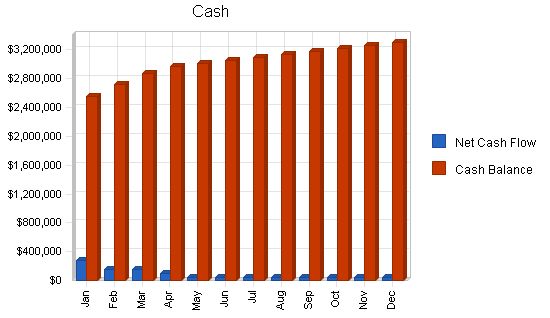

8.5 Projected Cash Flow:

Our projected cash flow is outlined in the chart and table below.

Pro Forma Cash Flow

2006 2007 2008

Cash Received

Cash from Operations

Cash Sales $5,360,000 $6,432,000 $7,716,900

Subtotal Cash from Operations $5,360,000 $6,432,000 $7,716,900

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $0 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $0 $0 $0

Subtotal Cash Received $5,360,000 $6,432,000 $7,716,900

Expenditures

Expenditures from Operations

Cash Spending $546,799 $546,800 $546,800

Bill Payments $3,791,764 $5,151,736 $6,198,175

Subtotal Spent on Operations $4,338,563 $5,698,536 $6,744,975

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $0 $0 $0

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $0 $0 $0

Purchase Other Current Assets $0 $0 $0

Purchase Long-term Assets $0 $0 $0

Dividends $0 $0 $0

Subtotal Cash Spent $4,338,563 $5,698,536 $6,744,975

Net Cash Flow $1,021,437 $733,464 $971,925

Cash Balance $3,308,437 $4,041,902 $5,013,827

Projected Balance Sheet

Assets

2006 2007 2008

Current Assets

Cash $3,308,437 $4,041,902 $5,013,827

Inventory $312,667 $375,233 $450,033

Other Current Assets $30,000 $30,000 $30,000

Total Current Assets $3,651,104 $4,447,135 $5,493,860

Long-term Assets

Long-term Assets $0 $0 $0

Accumulated Depreciation $0 $0 $0

Total Long-term Assets $0 $0 $0

Total Assets $3,651,104 $4,447,135 $5,493,860

Liabilities and Capital

2006 2007 2008

Current Liabilities

Accounts Payable $346,869 $430,287 $516,527

Current Borrowing $0 $0 $0

Other Current Liabilities $0 $0 $0

Subtotal Current Liabilities $346,869 $430,287 $516,527

Long-term Liabilities $0 $0 $0

Total Liabilities $346,869 $430,287 $516,527

Paid-in Capital $1,500,000 $1,500,000 $1,500,000

Retained Earnings $1,297,000 $1,804,234 $2,516,848

Earnings $507,234 $712,614 $960,484

Total Capital $3,304,234 $4,016,848 $4,977,332

Total Liabilities and Capital $3,651,104 $4,447,135 $5,493,860

Sales Growth 2006 2007 2008 Industry Profile

34.23% 20.00% 19.98% 6.95%

Percent of Total Assets

Inventory 8.56% 8.44% 8.19% 35.78%

Other Current Assets 0.82% 0.67% 0.55% 21.61%

Total Current Assets 100.00% 100.00% 100.00% 89.85%

Long-term Assets 0.00% 0.00% 0.00% 10.15%

Total Assets 100.00% 100.00% 100.00% 100.00%

Current Liabilities

Accounts Payable 9.50% 9.68% 9.40% 29.22%

Long-term Liabilities 0.00% 0.00% 0.00% 8.75%

Total Liabilities 9.50% 9.68% 9.40% 37.97%

Net Worth 90.50% 90.32% 90.60% 62.03%

Percent of Sales

Sales 100.00% 100.00% 100.00% 100.00%

Gross Margin 27.41% 27.41% 27.43% 19.18%

Selling, General & Administrative Expenses 17.95% 16.33% 14.99% 8.17%

Advertising Expenses 0.00% 0.00% 0.00% 0.93%

Profit Before Interest and Taxes 13.52% 15.83% 17.78% 2.22%

Main Ratios

Current 10.53 10.34 10.64 2.80

Quick 9.62 9.46 9.76 1.48

Total Debt to Total Assets 9.50% 9.68% 9.40% 45.68%

Pre-tax Return on Net Worth 21.93% 25.34% 27.57% 5.98%

Pre-tax Return on Assets 19.85% 22.89% 24.98% 11.00%

Additional Ratios 2006 2007 2008

Net Profit Margin 9.46% 11.08% 12.45% n.a

Return on Equity 15.35% 17.74% 19.30% n.a

Activity Ratios

Inventory Turnover 11.29 13.09 13.09 n.a

Accounts Payable Turnover 11.59 12.17 12.17 n.a

Payment Days 28 27 27 n.a

Total Asset Turnover 1.47 1.45 1.40 n.a

Debt Ratios

Debt to Net Worth 0.10 0.11 0.10 n.a

Current Liab. to Liab. 1.00 1.00 1.00 n.a

Liquidity Ratios

Net Working Capital $3,304,234 $4,016,848 $4,977,332 n.a

Interest Coverage 0.00 0.00 0.00 n.a

Additional Ratios

Assets to Sales 0.68 0.69 0.71 n.a

Current Debt/Total Assets 10% 10% 9% n.a

Acid Test 9.62 9.46 9.76 n.a

Sales/Net Worth 1.62 1.60 1.55 n.a

Dividend Payout 0.00 0.00 0.00 n.a

Appendix

Sales Forecast

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Sales

Loose Diamonds $385,000 $385,000 $385,000 $385,000 $385,000 $385,000 $385,000 $385,000 $385,000 $385,000 $385,000 $385,000

Settings $50,000 $50,000 $50,000 $50,000 $50,000 $50,000 $50,000 $50,000 $50,000 $50,000 $50,000 $50,000

Trinkets/Accessories $11,667 $11,667 $11,667 $11,667 $11,667 $11,667 $11,667 $11,667 $11,667 $11,667 $11,667 $11,667

Total Sales $446,667 $446,667 $446,667 $446,667 $446,667 $446,667 $446,667 $446,667 $446,667 $446,667 $446,667 $446,667

Direct Cost of Sales

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Loose Diamonds $269,500 $269,500 $269,500 $269,500 $269,500 $269,500 $269,500 $269,500 $269,500 $269,500 $269,500 $269,500

Settings $35,000 $35,000 $35,000 $35,000 $35,000 $35,000 $35,000 $35,000 $35,000 $35,000 $35,000 $35,000

Trinkets/Accessories $8,167 $8,167 $8,167 $8,167 $8,167 $8,167 $8,167 $8,167 $8,167 $8,167 $8,167 $8,167

Subtotal Direct Cost of Sales $312,667 $312,667 $312,667 $312,667 $312,667 $312,667 $312,667 $312,667 $312,667 $312,667 $312,667 $312,667

| Personnel Plan | |||||||||||||

| CEO/Owner | 0% | $9,000 | $9,000 | $9,000 | $9,000 | $9,000 | $9,000 | $9,000 | $9,000 | $9,000 | $9,000 | $9,000 | $9,000 |

| CFO | 0% | $6,500 | $6,500 | $6,500 | $6,500 | $6,500 | $6,500 | $6,500 | $6,500 | $6,500 | $6,500 | $6,500 | $6,500 |

| Marketing/Brand Manager | 0% | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 |

| Marketing Personnel | 0% | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 |

| IT Manager | 0% | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 |

| Programmer | 0% | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 |

| Web Designer | 0% | $2,200 | $2,200 | $2,200 | $2,200 | $2,200 | $2,200 | $2,200 | $2,200 | $2,200 | $2,200 | $2,200 | $2,200 |

| General Administrative Assistant | 0% | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 |

| Shipping Personnel 1 | 0% | $1,833 | $1,833 | $1,833 | $1,833 | $1,833 | $1,833 | $1,833 | $1,833 | $1,833 | $1,833 | $1,833 | $1,833 |

| Security Guard 1 | 0% | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 |

| Security Guard 2 | 0% | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 |

| Security Guard 3 | 0% | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 |

| Security Guard 4 | 0% | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 |

| Shipping Personnel 2 | 0% | $1,833 | $1,833 | $1,833 | $1,833 | $1,833 | $1,833 | $1,833 | $1,833 | $1,833 | $1,833 | $1,833 | $1,833 |

| Total People | 15 | 15 | 15 | 15 | 15 | 15 | 15 | 15 | 15 | 15 | 15 | 15 | |

| Total Payroll | $45,566 | $45,567 | $45,567 | $45,567 | $45,567 | $45,567 | $45,567 | $45,567 | $45,567 | $45,567 | $45,567 | $45,567 | |

| Pro Forma Profit and Loss | |||||||||||||

| Sales | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | |

| Direct Cost of Sales | $312,667 | $312,667 | $312,667 | $312,667 | $312,667 | $312,667 | $312,667 | $312,667 | $312,667 | $312,667 | $312,667 | $312,667 | |

| Other Costs of Sales | $11,550 | $11,550 | $11,550 | $11,550 | $11,550 | $11,550 | $11,550 | $11,550 | $11,550 | $11,550 | $11,550 | $11,550 | |

| Total Cost of Sales | $324,217 | $324,217 | $324,217 | $324,217 | $324,217 | $324,217 | $324,217 | $324,217 | $324,217 | $324,217 | $324,217 | $324,217 | |

| Gross Margin | $122,450 | $122,450 | $122,450 | $122,450 | $122,450 | $122,450 | $122,450 | $122,450 | $122,450 | $122,450 | $122,450 | $122,450 | |

| Gross Margin % | 27.41% | 27.41% | 27.41% | 27.41% | 27.41% | 27.41% | 27.41% | 27.41% | 27.41% | 27.41% | 27.41% | 27.41% | |

| Expenses | |||||||||||||

| Payroll | $45,566 | $45,567 | $45,567 | $45,567 | $45,567 | $45,567 | $45,567 | $45,567 | $45,567 | $45,567 | $45,567 | $45,567 | |

| Marketing/Promotion | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | |

| Depreciation | $0 | $0 | |||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | |

| Subtotal Cash from Operations | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | $446,667 | |

| Expenditures | |||||||||||||

| Expenditures from Operations | |||||||||||||

| Cash Spending | $45,566 | $45,567 | $45,567 | $45,567 | $45,567 | $45,567 | $45,567 | $45,567 | $45,567 | $45,567 | $45,567 | $45,567 | |

| Bill Payments | $128,205 | $246,164 | $247,853 | $298,897 | $358,831 | $358,831 | $358,831 | $358,831 | $358,831 | $358,831 | $358,831 | $358,831 | |

| Subtotal Spent on Operations | $173,771 | $291,731 | $293,419 | $344,464 | $404,397 | $404,397 | $404,397 | $404,397 | $404,397 | $404,397 | $404,397 | $404,397 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $173,771 | $291,731 | $293,419 | $344,464 | $404,397 | $404,397 | $404,397 | $404,397 | $404,397 | $404,397 | $404,397 | $404,397 | |

| Net Cash Flow | $272,896 | $154,936 | $153,247 | $102,203 | $42,270 | $42,270 | $42,270 | $42,270 | $42,270 | $42,270 | $42,270 | $42,270 | |

| Cash Balance | $2,559,896 | $2,714,832 | $2,868,079 | $2,970,281 | $3,012,551 | $3,054,820 | $3,097,090 | $3,139,359 | $3,181,629 | $3,223,898 | $3,266,168 | $3,308,437 | $3,350,707 |

Pro Forma Balance Sheet

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $2,287,000 | $2,559,896 | $2,714,832 | $2,868,079 | $2,970,281 | $3,012,551 | $3,054,820 | $3,097,090 | $3,139,359 | $3,181,629 | $3,223,898 | $3,266,168 | $3,308,437 |

| Inventory | $600,000 | $487,333 | $374,666 | $312,667 | $312,667 | $312,667 | $312,667 | $312,667 | $312,667 | $312,667 | $312,667 | $312,667 | $312,667 |

| Other Current Assets | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 |

| Total Current Assets | $2,917,000 | $3,077,229 | $3,119,498 | $3,210,745 | $3,312,948 | $3,355,217 | $3,397,487 | $3,439,756 | $3,482,026 | $3,524,295 | $3,566,565 | $3,608,834 | $3,651,104 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Assets | $2,917,000 | $3,077,229 | $3,119,498 | $3,210,745 | $3,312,948 | $3,355,217 | $3,397,487 | $3,439,756 | $3,482,026 | $3,524,295 | $3,566,565 | $3,608,834 | $3,651,104 |

| Liabilities and Capital |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!