Coffee Export Business Plan

Silvera & Sons prepares green Arabica coffee beans from Brazil for export to American specialty roasters and sells to wholesalers in Brazil. We plan to increase production from 72,000/60kg bags per year to 120-160,000/60kg per year. Our coffee stands out in terms of quality standards, being in the top five percent of all Arabica beans on the market. Customers seek our product as it differentiates them from specialty roasters. Demand for our coffee has exceeded supply, leading us to reject larger orders.

We predict thirty percent growth in the first year, exceeding ($BRL) expectations. By year three, the plant will be at maximum capacity, resulting in excellent profits ($BRL). Importers have shown interest in the additional beans.

Our keys to success are:

1. Building relationships with importers, brokers, and wholesalers.

2. Reaching maximum production within three years.

3. Improving profit margin with advanced technology.

4. Effectively communicating our position as provider of highest quality Arabica beans.

Overall, our goal is to meet the growing demand for specialty coffee in the American market while maintaining exceptional quality and profitability.

Contents

- 1 Company Summary

- 2 Strategy and Implementation Summary

- 2.1 5.1 Competitive Edge

- 2.2 5.2 Strategy Pyramid

- 2.3 5.3 Marketing Strategy

- 2.4 5.3.1 Promotion Strategy

- 2.5 5.3.2 Distribution Strategy

- 2.6 5.3.3 Marketing Programs

- 2.7 5.3.4 Positioning Statement

- 2.8 5.3.5 Pricing Strategy

- 2.9 5.4 Sales Strategy

- 2.10 5.4.1 Sales Forecast

- 2.11 5.4.2 Sales Programs

- 2.12 5.5 Strategic Alliances

- 2.13 5.6 Milestones

- 2.14 7.4 Projected Profit and Loss

- 3 Appendix

- 4 Business Plan Outline

1.1 Objectives

Silvera & Sons aims to:

- Increase production and sales from 78,000/60kg bags per year to approximately 100,000/60kg bags per year in the first year at the proposed facility, reaching a maximum capacity of 120,000/60kg bags per year by year three.

- Substantially increase sales in the first full year.

- Establish strategic relationships with 10-15 American importers in Los Angeles, San Francisco, & Seattle.

- Increase gross margins over the next three years.

1.2 Mission

Silvera & Sons Ltda seeks to serve coffee importers and enthusiasts by exceeding minimum quality standards and providing the highest quality product at the lowest price possible. We value our relationships with current and future customers and aim to demonstrate our appreciation through outstanding product quality, personal service, and efficient delivery. Our commitment to customers and Brazil will be reflected in honest and responsible business practices.

1.3 Keys to Success

The keys to success for Silvera & Sons are:

- Establishing and maintaining working relationships and contractual agreements with American importers and Brazilian coffee brokers and wholesalers.

- Achieving maximum production within three years of operation at the new facility.

- Increasing profit margins by utilizing improved technology.

- Effectively communicating our position as a differentiated provider of the highest quality Arabica beans to current and potential customers.

Company Summary

Silvera & Sons buys and prepares raw coffee in parchment (pergamino), or post-harvest coffee. The final product, green Arabica coffee beans, is packaged in 60kg sacks and sold in the U.S. and Brazilian markets. Our primary customers are American importers and Brazilian wholesalers who supply high-quality beans to the specialty roasting market.

2.1 Company Ownership

Silvera & Sons Ltda. is a private, family-owned preparer and exporter of Brazilian-grown, green Arabica coffee beans. It is owned and operated by Marco Silvera Sr. and his sons, Marco Silvera Jr. and Antonio Silvera.

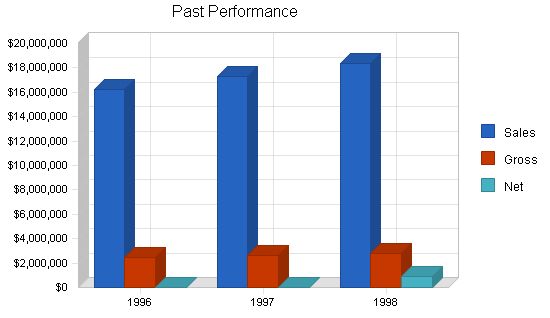

2.2 Company History

Silvera & Sons is in its sixth year of operation. The current plant has been operational for 15 years, with Marco Silvera Sr., the current owner, serving as the manager for 12 of those years. Since acquiring the plant, Silvera & Sons has maintained maximum production and sales. It is currently operating at full capacity.

Past Performance:

Sales

1996: $16,262,532

1997: $17,304,066

1998: $18,345,600

Gross Margin

1996: $2,439,380

1997: $2,630,218

1998: $2,814,215

Gross Margin %

1996: 15.00%

1997: 15.20%

1998: 15.34%

Operating Expenses

1996: $12,196,899

1997: $12,631,968

1998: $13,346,424

Inventory Turnover

1996-1998: 12.00

Balance Sheet:

Current Assets

Cash

1996-1997: $0

1998: $994,260

Inventory

1996-1997: $0

1998: $355,200

Other Current Assets

1996-1997: $0

1998: $243,936

Total Current Assets

1996-1997: $0

1998: $1,593,396

Long-term Assets

Long-term Assets

1996-1997: $0

1998: $521,650

Accumulated Depreciation

1996-1997: $0

1998: $100,000

Total Long-term Assets

1996-1997: $0

1998: $421,650

Total Assets

1996-1997: $0

1998: $2,015,046

Current Liabilities

Accounts Payable

1996-1997: $0

1998: $8,435

Current Borrowing

1996-1997: $0

1998: $58,000

Other Current Liabilities (interest free)

1996-1997: $0

1998: $0

Total Current Liabilities

1996-1997: $0

1998: $66,435

Long-term Liabilities

1996-1997: $0

1998: $402,000

Total Liabilities

1996-1997: $0

1998: $468,435

Paid-in Capital

1996-1997: $0

1998: $525,000

Retained Earnings

1996-1997: $0

1998: $85,985

Earnings

1996-1997: $0

1998: $935,626

Total Capital

1996-1997: $0

1998: $1,546,611

Total Capital and Liabilities

1996-1997: $0

1998: $2,015,046

Other Inputs

Payment Days

1996-1997: $0

1998: $60

Company Locations and Facilities:

The Silvera & Son’s main warehouse and office is located in Ouro Fino. The warehouse has the capacity to prepare 6,000 60kg bags of exportable coffee beans. The proposed new warehouse and preparation facility site, also in Ouro Fino, will be 3,500m2 with 30 selecting machines. It will have the capacity to prepare 40,000 bags for exportation and 80,000 bags for storage. The proposed facility will also handle shipping.

Products:

Silvera & Sons deals exclusively in green coffee, grown in the southern states of Brazil. The coffee is 100% Arabica. Beans in parchment are purchased directly from growers and de-husked and packaged into 60kg sacks in the Silvera & Sons’ plant. The final product is suitable for sale and exportation.

Competitive Comparison:

To differentiate our coffee from competitors, all beans are guaranteed fresh and shipped within seven days of preparation. Additionally, all beans are sorted at 95% screen 18 and above, compared to the industry standard of 90% screen 17 and above. The larger beans shipped by Silvera & Sons are guaranteed to be fresh. Furthermore, all farms that Silvera & Sons purchases coffee from adhere to environmentally sound farming practices and avoid the use of pesticides and chemicals in crop production.

There are approximately ten competitors offering a similar product. Research indicates that with increased capacity, Silvera & Sons would become one of the top four providers in terms of quantity. Silvera & Sons has the advantage of established distribution channels and reputation. Further improvements to marketing efforts will help differentiate the company in the market.

Sales Literature:

Silvera & Sons currently works with two importers in the United States for all shipments. Brazilian wholesalers handle internal sales. Sales have been conducted through personal selling, but additional sales literature will include a website, direct mail to specialty roasters and importers, and print advertising in trade publications like "Coffee Times."

Sourcing:

Both the existing and proposed facilities are located in Ouro Fino, in the state of Minas Gerais. Minas Gerais is the largest coffee producing state in Brazil and produces high-quality beans. With additional financing, Silvera & Sons will be able to buy larger volumes of coffee at lower prices. Currently, the company purchases from six private growers or grower cooperatives, securing contracts six months in advance of harvest.

Technology:

Improvements in technology will include the use of partially automated selecting machines, increasing production capacity with a lower machine-to-operator ratio. Additional storage capabilities will decrease shipping charges and reduce the need for permanent shipping employees by 35%. High-technology information systems upgrades will improve inventory control, shipment tracking, and communication with import clients.

Future Products:

Silvera & Sons offers the Arabica bean, which is considered the best in the world. The company adheres to higher quality standards than approximately 95% of the market. All beans are of the Bourbon Santos variety, which is highly sought after by specialty roasters. Silvera & Sons aims to provide exceptional coffee and has gained recognition from American and Brazilian specialty roasters for its ability to provide the desired beans.

Market Analysis Summary:

Coffee is the second largest commodity market, next to oil. Brazil has been the largest producer of coffee in the world for two centuries. Imports of Arabica coffee in the United States have increased 94% in the past five years, and coffee consumption within Brazil has seen similar increases. Demand for green coffee is high, and market prices and crop yield estimates are at an all-time high.

The increase in the number of independent specialty roasters in the United States and Brazil indicates a growing demand for coffee. Silvera & Sons targets the specialty roaster market, which seeks the highest quality coffee beans. Specialty roasters are willing to pay more for Arabica beans and value specific characteristics such as the bean’s origin, farming methods, and size. The specialty roasting market in the U.S. alone is estimated to be a $1 billion market.

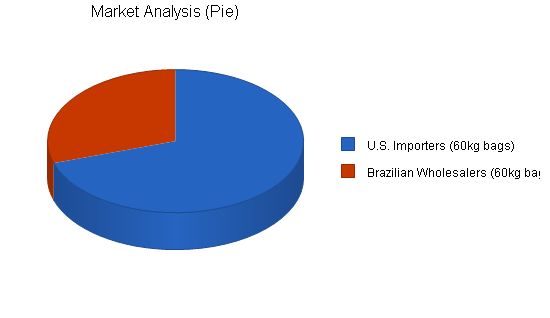

Market Segmentation:

The potential customer groups for Silvera & Sons include American importers of green Arabica beans, Brazilian green coffee wholesalers, and Brazilian specialty roasters. Silvera & Sons maintains relationships with Brazilian wholesalers as a safety valve for its export business. The company plans to aggressively target Brazilian specialty roasters as it reaches maximum capacity, aiming to reduce transactions with wholesalers and capture their value-added costs as profit.

Market Analysis

| 1999 | 2000 | 2001 | 2002 | 2003 | |||||||||||||||||||||||||

| Potential Customers | Growth | CAGR | CAGR | CAGR | CAGR | ||||||||||||||||||||||||

| U.S. Importers (60kg bags) | 26% | 70,140 | 88,376 | 111,354 | 140,306 | 176,786 | 26.00% | 26.00% | 26.00% | 26.00% | |||||||||||||||||||

| Brazilian Wholesalers (60kg bags) | 26% | 30,060 | 37,876 | 47,724 | 60,132 | 75,766 | 26.00% | 26.00% | 26.00% | 26.00% | |||||||||||||||||||

| Total | 26.00% | 100,200 | 126,252 | 159,078 | 200,438 | 252,552 | 26.00% | 26.00% | 26.00% | 26.00% | |||||||||||||||||||

4.2 Industry Analysis

Coffee has experienced significant growth in the American market over the past five years. Imports have nearly doubled, and the market price has increased. The number of specialty roasters has also multiplied. Brazilian coffee producers and exporters have been making efforts to improve agricultural techniques, processing methods, and distribution in order to meet the growing market demand. However, demand for Brazilian coffee currently exceeds supply.

4.2.1 Competition and Buying Patterns

Our customers base their purchasing decision on trust in our process and bean selection. The Silvera & Sons label signifies the highest quality standards and our customers are willing to pay a premium for our product. We have established strong relationships with our customers, which sets us apart from competitors. Our success in the marketplace has fostered this trust.

4.2.2 Main Competitors

Brazil has approximately 150 exporters of green Arabica beans, with 45 members in the Brazilian Coffee Exporters Association (ABECAFE) representing 50% of all green coffee exports. The largest competitors are likely among the ABECAFE members.

4.2.3 Industry Participants

Silvera & Sons exclusively deals in the exportation and sale of green Arabica beans. There are approximately 150 Brazilian businesses in this market, with around 30 companies accounting for 80% of green Arabica exports. Additionally, many of these companies also prepare, export, and sell other coffee products in the Brazilian market.

- Green Robusta (Conillon) beans: Represents less than 10% of all coffee produced in Brazil.

- Soluble coffee products: Account for approximately 12% of the total market.

- Roasted & Ground coffee: Represents approximately 85% of all roasted and ground coffee and 27% of the total coffee market.

- Primary competitors include: Golden Brazil, Bramazonia, Comexim, and Nicchio Cafe.

4.2.4 Distribution Patterns

All coffee produced for exportation by Silvera & Sons and 85% of all coffee produced for exportation in Brazil is shipped from Porto de Santos. Distribution costs for internal sales are absorbed by the customer, while distribution costs for exports are absorbed by us. Increasing the volume of exports makes us eligible for reduced fees and ensures maximum capacity for trucks and rail cars.

Strategy and Implementation Summary

Silvera & Sons aims to expand production capabilities to meet larger orders from importers, establish contracts with West Coast importers, and increase sales in the Brazilian market. The strategy is to first maximize quantity sold within existing channels and then establish additional accounts through targeted marketing efforts.

5.1 Competitive Edge

Silvera & Sons has a competitive edge from established relationships with American importers, Brazilian coffee growers, green coffee brokers, and wholesalers. Requests for larger shipments affirm the demand for our product. Our superior product is attributed to larger bean size and sourcing from growers who minimize the use of chemicals and pesticides. Prompt preparation and shipment ensure fresher beans compared to competitors.

5.2 Strategy Pyramid

Our main strategy is to effectively communicate the unique aspects of our coffee to larger segments of the American and Brazilian markets. We sell a superior product in a commodity market, so it’s crucial to convey its unique qualities for a niche market.

Unique aspects include superior selection and preparation of beans, quality assurance, and efficient distribution. These factors have been core to our business. Tactics to communicate these strengths include personal selling, targeted print advertising, and improved communication capabilities via information system improvements and a sophisticated website.

5.3 Marketing Strategy

Silvera & Sons will utilize targeted print media advertising and direct selling to importers in the United States who provide green coffee to specialty roasters. We capitalize on existing relationships with importers who can recommend our coffee. Our goal is to communicate our position as a provider of the highest quality Arabica beans to existing and potential customers.

5.3.1 Promotion Strategy

Relationships play a vital role in the export business. Personal selling remains our most important means of promotion. We have established and maintained relationships through personal contact. Print advertisements in specialty publications and direct mail will supplement personal selling efforts. Our promotion budget includes expenses for personal selling, print advertising, and maintaining a website.

5.3.2 Distribution Strategy

Distribution poses challenges in Brazil due to an outdated and inefficient system. Distribution costs for internal sales are absorbed by the customer, while we cover distribution costs for exports. Increasing export volume qualifies us for reduced fees and maximizes transportation capacity.

5.3.3 Marketing Programs

Our key marketing program is an increase in personal selling combined with targeted direct mail and print advertising. Marco Silvera Jr. will oversee this program. Additionally, we plan to develop a sophisticated website to enhance our web presence and improve communication and customer data collection.

5.3.4 Positioning Statement

For American importers of Brazilian coffee who use our coffee to supply specialty roasters, Silvera & Sons coffee beans are the highest quality and largest beans available. Our beans exceed minimum quality standards and are shipped within one week of preparation, ensuring the largest and freshest beans on the market. Our products are ideally suited for the specialty roasting market.

5.3.5 Pricing Strategy

Silvera & Sons has slightly higher prices (4-9% higher) compared to the market average due to our adherence to higher quality standards. Importers have been willing to pay this premium. The import market largely determines the price of imported coffee in the United States.

5.4 Sales Strategy

Silvera & Sons’ strategy focuses on meeting increased demand from existing importers and increasing sales within the Brazilian market. Maximizing sales in existing channels enables us to secure additional import accounts on the East and West coasts of the United States. Once maximum sales within existing channels are reached, we can shift our focus to securing additional import accounts.

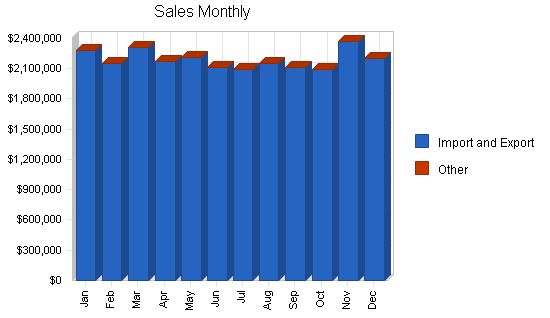

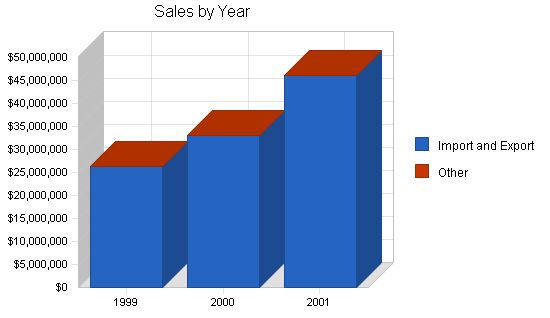

5.4.1 Sales Forecast

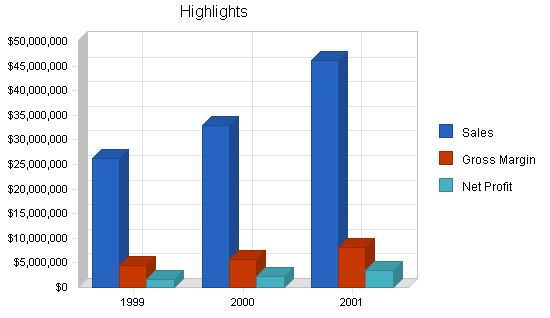

Our sales forecast indicates healthy growth in 1999 and a smaller increase in 2000. By 2001, we expect to reach maximum production capacity, representing significant growth over the previous year.

Sales Forecast:

| Sales Forecast | |||

| 1999 | 2000 | 2001 | |

| Unit Sales | |||

| Import and Export | 100,200 | 120,000 | 160,000 |

| Other | 0 | 0 | 0 |

| Total Unit Sales | 100,200 | 120,000 | 160,000 |

| Unit Prices | 1999 | 2000 | 2001 |

| Import and Export | $262.08 | $275.18 | $288.29 |

| Other | $0.00 | $0.00 | $0.00 |

| Sales | |||

| Import and Export | $26,260,416 | $33,021,600 | $46,126,400 |

| Other | $0 | $0 | $0 |

| Total Sales | $26,260,416 | $33,021,600 | $46,126,400 |

| Direct Unit Costs | 1999 | 2000 | 2001 |

| Import and Export | $212.00 | $222.60 | $233.20 |

| Other | $0.00 | $0.00 | $0.00 |

| Direct Cost of Sales | |||

| Import and Export | $21,242,400 | $26,712,000 | $37,312,000 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $21,242,400 | $26,712,000 | $37,312,000 |

5.4.2 Sales Programs

Personal selling: We need to confirm in writing orders for larger quantities of our product from American importers and Brazilian wholesalers. Additionally, we need to establish sales agreements with at least six, possibly ten, additional American importers. Marco Silvera Jr. is responsible and the due date is May 30, with a budget of ($BRL) 24,000.

5.5 Strategic Alliances

Our most valued alliances are with American importers. They have the ability and willingness to purchase larger quantities of our products and recommend us to other importers. We also have alliances with trucking contractors and the Porto de Santos Cafe Commission.

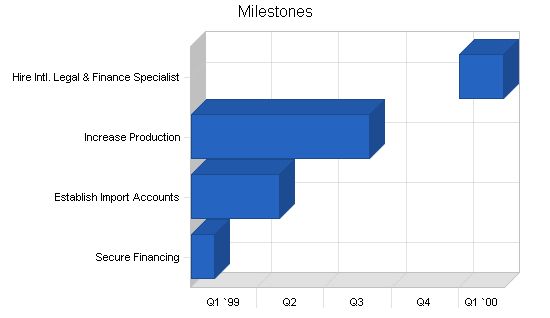

5.6 Milestones

The accompanying table shows specific milestones, with assigned responsibilities, dates, and budgets. The milestones represented in this plan are the most important ones we have determined.

Milestones:

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Secure Financing | 1/1/1999 | 2/1/1999 | $12,000 | M. Silvera Sr. | Finance |

| Establish Import Accounts | 1/1/1999 | 5/1/1999 | $18,000 | M. Silvera Jr. | Sales & Marketing |

| Increase Production | 1/1/1999 | 9/1/1999 | $18,000 | A Silvera | Production & Shipping |

| Hire Intl. Legal & Finance Specialist | 1/1/2000 | 3/1/2000 | $35,000 | TBA | Administration |

| Totals | $83,000 |

Management Summary:

Silvera & Sons management consists of four full-time employees. Additional assistance is acquired on a part-time basis and/or through the use of consultants, specifically in legal matters. Detailed descriptions are found in the following section.

6.1 Management Team:

Marco Silvera Sr: CEO/President in charge of finance and administration. Marco Silvera Sr., 57 has worked in the coffee export business for 30 years. Before starting Silvera & Sons he was the Chief Financial Officer and general manager of the Cafe Fino coffee company. He began working for Cafe Fino after finishing an accounting degree at the University of Southern California. The current Silvera & Sons plant was formerly owned by Cafe Fino and was sold to Mr. Silvera who decided to "retire" and wanted to run a small business. Cafe Fino had purchased larger facilities and no longer needed the plant.

Marco Silvera Jr: Vice president in charge of product sourcing, sales, and marketing. Marco Silvera Jr., 32 completed his MBA at Syracuse University and worked for several years on the Brazilian stock and commodities market as a broker. He later took a position as an International Sales and Marketing Representative for a major agricultural brokerage and supply firm in Sao Paulo. He is expected to succeed his father as CEO of Silvera & Sons Ltda.

Antonio Silvera: Vice president in charge of production and shipping. Antonio Silvera, 29 worked as a civil engineer for two years for the Brazilian government after completing an engineering degree at the University of Brazil, Sao Paulo. He is responsible for supervising all plant employees.

Additional Management:

Ralph Henzo, CFO:

Gracie, Renoldo, & Fertado Attorneys at Law, Sao Paulo.

6.2 Management Team Gaps:

We currently lack a full-time professional who can deal with the changing legal and financial aspects of international business. We have relied on legal consultants but are now analyzing the possibility of adding an additional position to deal exclusively with international issues. In addition, as we continue to grow and hire more personnel, we may hire a controller.

6.3 Personnel Plan:

The personnel plan requires an increase in plant employees from 11 to 17-20 within the next three years. Additional employees will be added to increase administrative and accounting support. One additional employee will be added to the sales and marketing division. We will retain all current employees as they will not have to relocate.

Personnel Plan:

| Personnel Plan | |||

| 1999 | 2000 | 2001 | |

| Production Personnel | |||

| Antonio Silvera, VP Production | $38,400 | $41,088 | $43,964 |

| Plant Employees | $219,996 | $228,796 | $237,948 |

| Other | $42,000 | $47,000 | $50,000 |

| Subtotal | $300,396 | $316,884 | $331,912 |

| Sales and Marketing Personnel | |||

| Marco Silvera Jr, VP Sales/Mktg. | $45,000 | $48,150 | $51,521 |

| Other | $180,492 | $80,000 | $85,000 |

| Subtotal | $225,492 | $128,150 | $136,521 |

| General and Administrative Personnel | |||

| Marco Slivera Sr, CEO | $50,400 | $53,928 | $57,703 |

| Ralph Henzo, CFO | $42,000 | $44,940 | $44,940 |

| Admin/Acctg. Staff | $9,000 | $9,360 | $44,734 |

| Other | $18,000 | $22,000 | $26,000 |

| Subtotal | $119,400 | $130,228 | $173,377 |

| Other Personnel | |||

| Name or Title or Group | $0 | $0 | $0 |

| Name or Title or Group | $0 | $0 | $0 |

| Name or Title or Group | $0 | $0 | $0 |

| Subtotal | $0 | $0 | $0 |

| Total People | 15 | 16 | 17 |

| Total Payroll | $645,288 | $575,262 | $641,810 |

We want to finance growth through a combination of long-term debt and cash flow. Purchase of the larger facility and equipment will require approximately eighty percent debt financing. Additional technology will be primarily financed with cash flow. Inventory turnover must remain at or above four or we run the risk of backing up orders and jeopardizing our freshness guarantees. We have had no problems with accounts receivable and we expect to maintain our collection days at 30 with thirty percent of sales on credit.

In addition, we must achieve gross margins of thirty-five percent and hold operating costs no more than sixty-five percent of sales.

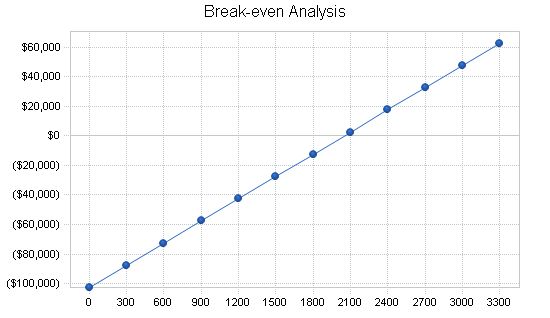

7.1 Break-even Analysis:

The break-even analysis shows that Silvera & Sons has sufficient sales strength to remain viable. Our per month break-even point projections are detailed in the following table and chart.

Break-even Analysis:

Monthly Units Break-even: 2,049

Monthly Revenue Break-even: $537,078

Assumptions:

Average Per-Unit Revenue: $262.08

Average Per-Unit Variable Cost: $212.00

Estimated Monthly Fixed Cost: $102,629

7.2 Important Assumptions:

Important assumptions for this plan are found in the following table. These assumptions largely determine the financial plan and require additional financing.

General Assumptions:

Plan Month: 1 2 3

Current Interest Rate: 14.00% 14.00% 14.00%

Long-term Interest Rate: 9.00% 9.00% 9.00%

Tax Rate: 47.00% 47.00% 47.00%

Other: 0 0 0

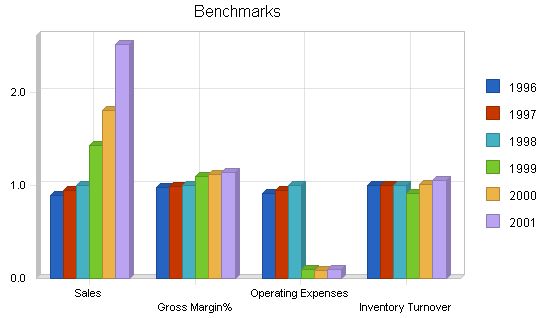

7.3 Key Financial Indicators:

The most important factor to Silvera & Sons’ anticipated growth is the procurement of necessary financing. The size of the orders currently requested by importers is larger than our present plant capacity allows.

The following chart shows changes in key financial indicators: sales, gross margin, operating expenses, collection days, and inventory turnover. Sales growth exceeds thirty percent in the first year, twenty percent in the second, and returns to thirty percent in year three before stabilizing. We expect to increase gross margin, but projections indicate a decline in the first two years after purchasing the new facility due to it not being run at maximum capacity. The projections for collection days and inventory turnover suggest a decline in these indicators.

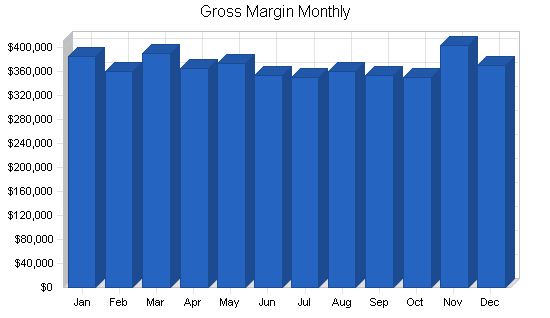

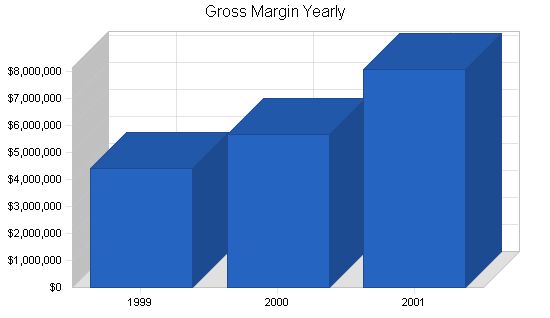

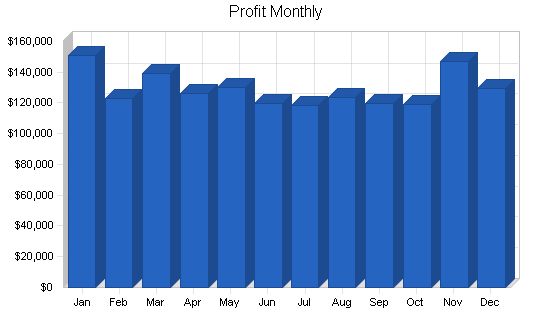

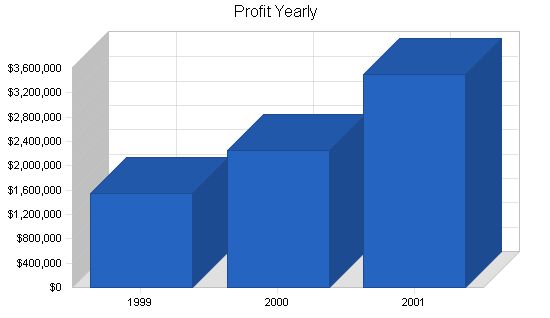

7.4 Projected Profit and Loss

In the first year of production at our new facility, we anticipate achieving impressive ($BRL) sales. We also project sales growth in the second and third years. Our net earnings will surpass the industry average ($BRL).

Pro Forma Profit and Loss

1999 2000 2001

Sales $26,260,416 $33,021,600 $46,126,400

Direct Cost of Sales $21,242,400 $26,712,000 $37,312,000

Production Payroll $300,396 $316,884 $331,912

Other Costs of Sales $300,000 $345,000 $410,000

Total Cost of Sales $21,842,796 $27,373,884 $38,053,912

Gross Margin $4,417,620 $5,647,716 $8,072,488

Gross Margin % 16.82% 17.10% 17.50%

Operating Expenses

Sales and Marketing Expenses

Sales and Marketing Payroll $225,492 $128,150 $136,521

Advertising/Promotion $144,000 $165,000 $165,000

Travel $21,000 $22,500 $24,000

Other Sales and Marketing Expenses $24,000 $26,500 $28,500

Total Sales and Marketing Expenses $414,492 $342,150 $354,021

Sales and Marketing % 1.58% 1.04% 0.77%

General and Administrative Expenses

General and Administrative Payroll $119,400 $130,228 $173,377

Marketing/Promotion $0 $0 $0

Depreciation $216,000 $216,000 $216,000

Leased Equipment $50,400 $50,400 $50,400

Utilities $36,000 $36,000 $36,000

Insurance $72,000 $75,000 $78,000

Rent $305,250 $300,000 $300,000

Payroll Taxes $0 $0 $0

Other General and Administrative Expenses $0 $0 $0

Total General and Administrative Expenses $799,050 $807,628 $853,777

General and Administrative % 3.04% 2.45% 1.85%

Other Expenses:

Other Payroll $0 $0 $0

Consultants $18,000 $24,000 $30,000

Other Expenses $0 $0 $0

Total Other Expenses $18,000 $24,000 $30,000

Other % 0.07% 0.07% 0.07%

Total Operating Expenses $1,231,542 $1,173,778 $1,237,798

Profit Before Interest and Taxes $3,186,078 $4,473,938 $6,834,690

EBITDA $3,402,078 $4,689,938 $7,050,690

Interest Expense $269,166 $238,449 $225,191

Taxes Incurred $1,370,949 $1,990,680 $3,106,465

Net Profit $1,545,964 $2,244,809 $3,503,035

Net Profit/Sales 5.89% 6.80% 7.59%

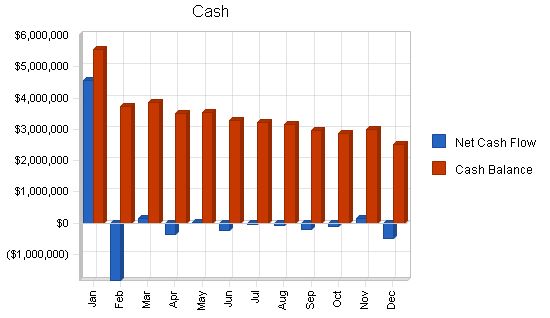

7.5 Projected Cash Flow

Silvera & Sons expects to manage cash flow over the next three years with the assistance of a loan supported by the Central Bank of Brazil. This financing assistance is required to provide the working capital for the construction of the new production facility, additional personnel, distribution costs, and other related expenses.

Appendix

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Pro Forma Cash Flow | 1999 | 2000 | 2001 |

| Cash Sales | $26,260,416 | $33,021,600 | $46,126,400 |

| Subtotal Cash from Operations | $26,260,416 | $33,021,600 | $46,126,400 |

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $2,700,000 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $650,000 | $650,000 |

| Subtotal Cash Received | $28,960,416 | $33,671,600 | $46,776,400 |

| Cash Spending | $645,288 | $575,262 | $641,810 |

| Bill Payments | $23,678,478 | $29,770,693 | $41,735,934 |

| Subtotal Spent on Operations | $24,323,766 | $30,345,955 | $42,377,744 |

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $57,996 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $305,250 | $294,636 | $0 |

| Purchase Other Current Assets | $60,000 | $75,000 | $85,000 |

| Purchase Long-term Assets | $2,700,000 | $0 | $0 |

| Subtotal Cash Spent | $27,447,012 | $30,715,591 | $42,462,744 |

| Net Cash Flow | $1,513,404 | $2,956,009 | $4,313,656 |

| Cash Balance | $2,507,664 | $5,463,673 | $9,777,329 |

Projected Balance Sheet

7.6 Projected Balance Sheet

As shown in the balance sheet in the table below, our net will grow quickly by the end of 1999 and continue steadily through the end of the plan period.

| Pro Forma Balance Sheet | |||

| Assets | 1999 | 2000 | 2001 |

| Cash | $2,507,664 | $5,463,673 | $9,777,329 |

| Inventory | $1,958,880 | $2,463,262 | $3,440,747 |

| Other Current Assets | $303,936 | $378,936 | $463,936 |

| Total Current Assets | $4,770,480 | $8,305,872 | $13,682,013 |

| Long-term Assets | $3,221,650 | $3,221,650 | $3,221,650 |

| Accumulated Depreciation | $316,000 | $532,000 | $748,000 |

| Total Long-term Assets | $2,905,650 | $2,689,650 | $2,473,650 |

| Total Assets | $7,676,130 | $10,995,522 | $16,155,663 |

| Liabilities and Capital | 1999 | 2000 | 2001 |

| Current Liabilities | |||

| Accounts Payable | $1,786,801 | $2,506,020 | $3,513,127 |

| Current Borrowing | $4 | $4 | $4 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $1,786,805 | $2,506,024 | $3,513,131 |

| Long-term Liabilities | $2,796,750 | $2,502,114 | $2,502,114 |

| Total Liabilities | $4,583,555 | $5,008,138 | $6,015,245 |

| Paid-in Capital | $525,000 | $1,175,000 | $1,825,000 |

| Retained Earnings | $1,021,611 | $2,567,575 | $4,812,383 |

| Earnings | $1,545,964 | $2,244,809 | $3,503,035 |

| Total Capital | $3,092,575 | $5,987,383 | $10,140,418 |

| Total Liabilities and Capital | $7,676,130 | $10,995,522 | $16,155,663 |

| Net Worth | $3,092,575 | $5,987,383 | $10,140,418 |

7.7 Business Ratios

The standard business ratios are included in the table below. The ratios show an aggressive growth plan to reach maximum production within three years. Return on investment increases each year as we bring the new facility to maximum capacity and production. Return on sales and assets remain strong, and the cost of goods decreases based on efficiency projections. Projections are based on the 1997/98 selling price. The industry profile is based on the NAICS code 311920, Coffee and Tea Manufacturing.

| Ratio Analysis | |||||||||||||

| Ratio | 1999 | 2000 | 2001 | Industry Profile | |||||||||

| Sales Growth | 43.14% | 25.75% | 39.69% | 5.50% | |||||||||

| Percent of Total Assets | |||||||||||||

| Inventory | 25.52% | 22.40% | 21.30% | 12.43% | |||||||||

| Other Current Assets | 3.96% | 3.45% | 2.87% | 27.50% | |||||||||

| Total Current Assets | 62.15% | 75.54% | 84.69% | 60.13% | |||||||||

| Long-term Assets | 37.85% | 24.46% | 15.31% | 39.87% | |||||||||

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% | |||||||||

| Current Liabilities | 23.28% | 22.79% | 21.75% | 8.46% | |||||||||

| Sales Forecast | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Unit Sales | |||||||||||||

| Import and Export | 0% | 8,700 | 8,200 | 8,800 | 8,300 | 8,450 | 8,050 | 8,000 | 8,200 | 8,050 | 8,000 | 9,050 | 8,400 |

| Other | 0% | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Total Unit Sales | 8,700 | 8,200 | 8,800 | 8,300 | 8,450 | 8,050 | 8,000 | 8,200 | 8,050 | 8,000 | 9,050 | 8,400 | |

| Unit Prices | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Import and Export | $262.08 | $262.08 | $262.08 | $262.08 | $262.08 | $262.08 | $262.08 | $262.08 | $262.08 | $262.08 | $262.08 | $262.08 | |

| Other | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | |

| Sales | |||||||||||||

| Import and Export | $2,280,096 | $2,149,056 | $2,306,304 | $2,175,264 | $2,214,576 | $2,109,744 | $2,096,640 | $2,149,056 | $2,109,744 | $2,096,640 | $2,371,824 | $2,201,472 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Sales | $2,280,096 | $2,149,056 | $2,306,304 | $2,175,264 | $2,214,576 | $2,109,744 | $2,096,640 | $2,149,056 | $2,109,744 | $2,096,640 | $2,371,824 | $2,201,472 | |

| Direct Unit Costs | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Import and Export | 0.00% | $212.00 | $212.00 | $212.00 | $212.00 | $212.00 | $212.00 | $212.00 | $212.00 | $212.00 | $212.00 | $212.00 | $212.00 |

| Other | 0.00% | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Direct Cost of Sales | |||||||||||||

| Import and Export | $1,844,400 | $1,738,400 | $1,865,600 | $1,759,600 | $1,791,400 | $1,706,600 | $1,696,000 | $1,738,400 | $1,706,600 | $1,696,000 | $1,918,600 | $1,780,800 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Direct Cost of Sales | $1,844,400 | $1,738,400 | $1,865,600 | $1,759,600 | $1,791,400 | $1,706,600 | $1,696,000 | $1,738,400 | $1,706,600 | $1,696,000 | $1,918,600 | $1,780,800 | |

Personnel Plan

| Personnel Plan | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Production Personnel | |||||||||||||

| Antonio Silvera, VP Production | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | $3,200 | |

| Plant Employees | $18,333 | $18,333 | $18,333 | $18,333 | $18,333 | $18,333 | $18,333 | $18,333 | $18,333 | $18,333 | $18,333 | $18,333 | |

| Other | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | $3,500 | |

| Subtotal | $25,033 | $25,033 | |||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Cash Received | ||||||||||||

| Cash from Operations | ||||||||||||

| Cash Sales | $2,280,096 | $2,149,056 | $2,306,304 | $2,175,264 | $2,214,576 | $2,109,744 | $2,096,640 | $2,149,056 | $2,109,744 | $2,096,640 | $2,371,824 | $2,201,472 |

| Subtotal Cash from Operations | $2,280,096 | $2,149,056 | $2,306,304 | $2,175,264 | $2,214,576 | $2,109,744 | $2,096,640 | $2,149,056 | $2,109,744 | $2,096,640 | $2,371,824 | $2,201,472 |

| Additional Cash Received | ||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Long-term Liabilities | $2,700,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Received | $4,980,096 | $2,149,056 | $2,306,304 | $2,175,264 | $2,214,576 | $2,109,744 | $2,096,640 | $2,149,056 | $2,109,744 | $2,096,640 | $2,371,824 | $2,201,472 |

| Expenditures | ||||||||||||

| Expenditures from Operations | ||||||||||||

| Cash Spending | $53,774 | $53,774 | $53,774 | $53,774 | $53,774 | $53,774 | $53,774 | $53,774 | $53,774 | $53,774 | $53,774 | $53,774 |

| Bill Payments | $132,806 | $3,668,016 | $1,850,946 | $2,222,911 | $1,867,189 | $2,040,313 | $1,827,442 | $1,898,330 | $1,996,185 | $1,883,378 | $1,911,190 | $2,379,772 |

| Subtotal Spent on Operations | $186,580 | $3,721,790 | $1,904,720 | $2,276,685 | $1,920,963 | $2,094,087 | $1,881,216 | $1,952,104 | $2,049,959 | $1,937,152 | $1,964,964 | $2,433,546 |

| Additional Cash Spent | ||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $4,833 | $4,833 | $4,833 | $4,833 | $4,833 | $4,833 | $4,833 | $4,833 | $4,833 | $4,833 | $4,833 | $4,833 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $27,750 | $27,750 | $27,750 | $27,750 | $27,750 | $27,750 | $27,750 | $27,750 | $27,750 | $27,750 | $27,750 |

| Purchase Other Current Assets | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 |

| Purchase Long-term Assets | $225,000 | $225,000 | $225,000 | $225,000 | $225,000 | $225,000 | $225,000 | $225,000 | $225,000 | $225,000 | $225,000 | $225,000 |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Spent | $421,413 | $3,984,373 | $2,167,303 | $2,539,268 | $2,183,546 | $2,356,670 | $2,143,799 | $2,214,687 | $2,312,542 | $2,199,735 | $2,227,547 | $2,696,129 |

| Net Cash Flow | $4,558,683 | ($1,835,317) | $139,001 | ($364,004) | $31,030 | ($246,926) | ($47,159) | ($65,631) | ($202,798) | ($103,095) | $144,277 | ($494,657) |

| Cash Balance | $5,552,943 | $3,717,626 | $3,856,626 | $3,492,622 | $3,523,653 | $3,276,727 | $3,229,568 | $3,163,937 | $2,961,139 | $2,858,044 | $3,002,321 | $2,507,664 |

Pro Forma Balance Sheet

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

| Assets |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!