If you’ve built a budget and forecast for your business, you’re already ahead of most businesses. In fact, just by taking this step, you’ve improved your chances of success by up to 40%.

But, you can’t just rest – you need to put that budget and forecast to work. You can use your financial forecast to actively manage your business and improve your chances of success and growth.

A key benefit of using your forecast as a management tool is that you’ll significantly improve how you manage your cash flow. This will give you clarity about the health of your business, highlight growth opportunities, and help you avoid pitfalls.

Why is cash flow management important?

Businesses operate on cash. This is obvious and unnecessary for anyone who’s in business, but it’s important to remember. By cash, I don’t mean physical coins and bills, but money in your bank account that you are able to spend. You need cash to pay your bills, purchase inventory, meet payroll, and keep your business running. And this is true for nonprofit organizations as well.

Having a cash flow management system is a critical part of building a successful business. Most businesses need to wait for customers to pay while needing to purchase more inventory, pay payroll, or fulfill other obligations. Cash doesn’t always show up in your bank account the moment you make a sale and, for most businesses, you need to spend money on your product or preparing your services before you make that sale.

Cash flow management example

For example, think of a company that sells high-end stainless steel water bottles. The company needs to pay for the materials to make their bottles, invest in manufacturing, and pay for shipping to deliver the bottles to retail stores around the country.

Even though the company has spent money on all of this, the retail stores probably won’t pay the company for the water bottles they ordered for a while — probably several months. Meanwhile, if sales in the retail stores go well, they may order even more water bottles from the company, perhaps doing this before they have paid for the first shipment.

The company now needs even more cash to make more water bottles and ship them out. Eventually, the company will get paid, but it may take months before cash actually comes in the door, long after manufacturing and shipping have been paid for.

This may sound extreme, but ask anyone who’s ever distributed a product to retail stores and they will tell you this is more the rule, rather than the exception.

A cash flow management system that shows you historical payment and spending patterns and predicts future cash spending and cash deposits can help ease the pain. With a system, your business will be better prepared to handle the ups and downs of cash flow and keep enough money in the bank to operate healthily.

How to manage cash flow

There are three parts of a successful cash flow management system that you need to know to build a healthy business.

1. Know your cash position

Start managing cash by knowing your immediate cash position. You need to know how much money you have in the bank to pay your bills and other immediate expenses.

2. Understand your cash flow statement

Your cash flow statement shows you how cash is moving in and out of your business and if your business is generally accumulating cash over time or rapidly using up cash reserves. This historical look back at your cash flow helps you identify trends and better understand how your business is performing.

3. Develop your cash flow forecast

Lastly, you need a cash flow forecast that predicts your future cash flow and shows you how much money you’ll have in the bank in the coming months. A cash flow forecast helps you figure out if there will be points in the future where you may run low on cash and need a loan or line of credit. Your forecast also helps you figure out when it might be the right time to expand, buy a new piece of equipment, or hire more employees.

How to create a dynamic, more accurate cash flow forecast

The key to a better cash flow management system is bringing together the three key ingredients of cash flow management.

Your accounting system should generate your historical cash flow statement for you. You’ll use this to see how your business has performed, based on your actual results. These are the financial facts of your business, based on your actual sales, expenses, loans, purchases, etc.

You’ll also want to create a cash flow forecast to predict what your future cash position will look like each month for at least the next 12 months. You can create a cash flow forecast using spreadsheets, but you’ll save time and potential headaches by using a forecasting tool like LivePlan. Tools like LivePlan can also connect to your accounting software to give you direct access to your cash flow statement so you have all your information in one place.

However, the day you create your cash flow forecast is the same day that it goes out of date. Let’s look into why this happens.

Why your cash flow forecast goes out of date

As your business operates, you make sales and have expenses. These sales and expenses are never exactly what you predicted when you created an initial forecast. Predicting the future is nearly impossible, so it’s perfectly understandable that your forecast and actual results are different.

This all means that the actual cash you have in the bank at the end of the month is going to be a different number from what you forecasted. Unfortunately, your forecast bases the next month’s predictions on that now-inaccurate number that you predicted, as well as several other numbers that are now also inaccurate.

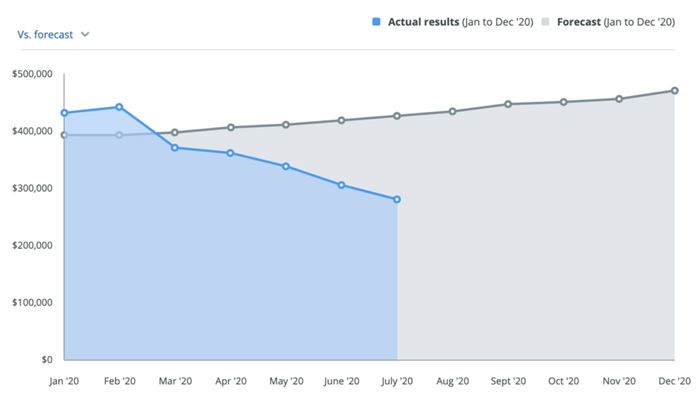

Over time, as your forecast and reality diverge, your forecast becomes less and less accurate. If your sales each month are less than expected, for example, you’ll be working off an incredibly optimistic forecast that could lead to cash flow problems.

Fortunately, you can combat this by updating your forecasts every month. By doing this, you’ll replace last month’s predicted numbers with the actual results, updating your sales forecast, expense budget, Accounts Receivable, and Accounts Payable. If you received money from a loan or investors or paid out any other cash to purchase assets or pay down debt, you’ll want to update those numbers as well.

For example, if it’s the beginning of June, you’ll want to go into your forecast and replace all of the numbers that you predicted for May with your actual results. Assuming that you’ve created a forecast with linked formulas or are using forecasting software, your cash flow forecast will automatically update to provide a more accurate prediction of the future.

If you update your forecast at the beginning of every month, it will only take you a few minutes, and you’ll immediately have a smarter, more accurate prediction of the future.

Based on your past results, you should also update your predictions for sales and expenses. If sales are consistently exceeding your expectations, revise your forecast up. If expenses are higher than predicted and look like they will stay that way, make changes to your budget.

Adjusting your forecast monthly is part of good management and should be a normal part of your monthly financial review.

Some people think that once you create a forecast for the upcoming year, you should never change it. However, adjusting your predictions based on what’s happening in your business and market is crucial for running a better business. Don’t continue spending according to an outdated budget if conditions have changed. Instead, adjust your budget and communicate those changes to your team.

An easy solution is to have it both ways. Save your original forecast and create a new forecast scenario that’s a copy of the original. Edit and update the copy and keep your original predictions as a historical record. This way, you can look back at your original predictions and see how right or wrong you were and also create a dynamic forecast that helps you run your business better.

With a monthly updated cash flow forecast, you’ll have a more accurate prediction of your future cash position, cash burn rate, and runway. Identifying trends will help you improve your cash flow and avoid cash flow problems in the future.

Creating a cash flow management system may seem complex, but it doesn’t take much time and brings immeasurable value to your business. Imagine having solid predictions of your future cash position to make smart decisions about your business today. That’s the magic of dynamic, live cash flow forecasting.

Revising your forecast monthly doesn’t just give you more accurate predictions of cash flow. It also provides smarter predictions of future sales and more accurate budgets to guide your spending.

Knowing this information helps you set more effective goals for your team. Increasing your sales forecast motivates your team and impacts predicted profitability. With updated profit projections, revise your expense budget to reflect the direction your sales are going. If sales are increasing, consider investing more in marketing or additional hiring. If things aren’t going as well, tighten your budget to prevent overspending.

Big companies revise their forecasts all the time, called "guidance". This strategy isn’t just for big companies though. You can revise your forecasts in under an hour every month and create a smart forecast to grow your business with confidence.

Using a tool like LivePlan is recommended. Spend more time focusing on running your business and let the tool handle the formulas and calculations.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!