Reading and Analyzing an Income Statement

Ever feel left out when people talk about P&L’s? How about when they mention income statements, profit and loss reports, or statement of activities? The good news is that they all refer to the same thing, so you have less to learn than you think. An income statement is based on simple concepts that you already understand.

A company produces a set of financial statements at least annually, which includes the statement of cash flows, the balance sheet (or statement of financial position), and the income statement.

Most people tend to look at and pretend to understand the balance sheet and the income statement. The main difference between them is that the balance sheet is a snapshot, while the income statement is a movie. In other words, the balance sheet shows your assets and liabilities at a specific moment in time (usually December 31). On the other hand, the income statement shows what happens over a period (usually a year): what comes in, what goes out, and what’s left over.

Here is an example of a basic income statement for one month:

Revenue (or Gross Income):

Expenses:

Net Income: $0.50

See how it works? The top section lists money coming in, the middle section lists money going out, and the bottom line is the difference between the two. All you need for this statement is basic subtraction.

Now, open the annual report of any Fortune 500 company and find the income statement. It will have the same basic concept and structure as the example above, but with more lines.

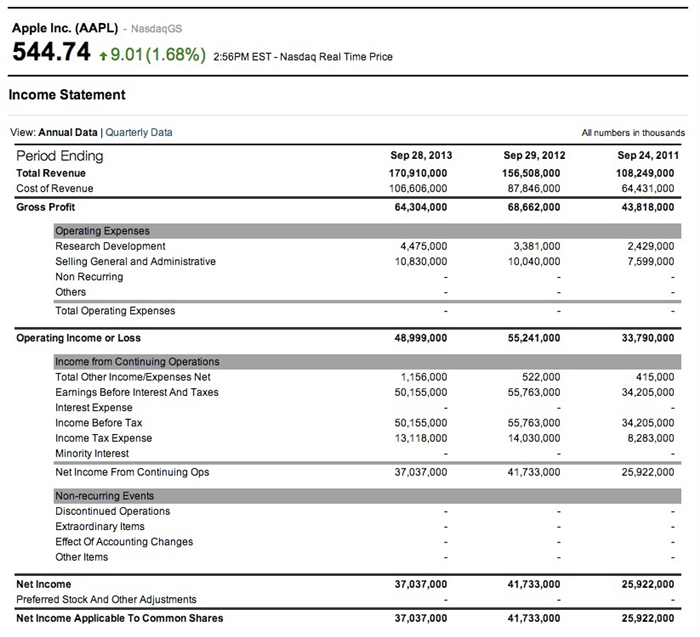

Companies often make variations to their structure as they grow larger. One common variation is the inclusion of a section at the top of the income statement that starts with total revenue. From there, "cost of revenue" is subtracted to show the "gross profit." This line represents the total expenses directly related to generating revenue, such as the cost of inventory. Following that, normal operating expenses, such as administration and research and development, are subtracted to arrive at another sub-total known as "operating income" or EBITDA (Earnings before Interest, Taxes, Depreciation, and Amortization). Interest and taxes are further subtracted from operating income before reaching the final net income line.

However, despite the complexity, it’s just a rearrangement of income and expenses into sub-categories. The fundamental principles remain the same, regardless of the level of complexity. The income statement always includes income, expenses, and the differences between the two. Additionally, income is always listed before expenses in any group, but companies may have more sub-grouping before reaching the bottom line.

Regardless of the twists and turns, the bottom line is crucial. It is referred to as "Net Income," "the bottom line," or "contribution to savings." A negative bottom line is often called a "deficit" or "loss." Though different in terminology, the math and meaning remain the same.

When reviewing an income statement, start by checking all the math. Errors can occur even in printed, published statements. Finding errors not only demonstrates your expertise but can also reveal significant changes in results. Checking the math also enhances your understanding of how the numbers fit together.

Next, find the bottom line, which should be easy as it is located at the bottom of the statement. A positive number indicates that the company earned more than it spent, while a negative number indicates that expenses exceeded revenue. Understanding why expenses exceeded revenue and knowing the plan for improvement is essential. Occasional net losses are common, especially for new companies or those in cyclical industries. However, if net losses become a trend or if the company lacks sufficient cash to cover expenses in challenging times, it could signify a problem.

Examining the sources of income is also important. Do they align with the business? For instance, if the business sells cotton candy, income from county fair sales makes sense. However, if one income line comes from "gifts from friends," it’s unlikely to be sustainable. In the case of a museum, analyzing income sources and determining their sustainability is crucial. If a significant percentage of income comes from a rare event like a blockbuster exhibit, questions should be asked about the revenue model’s sustainability.

Analyzing expense categories is equally important. Are they logical? Most businesses have categories such as salaries, insurance, rent, supplies, and interest. Any missing categories should be investigated. For example, if a business has many employees but doesn’t have a rent or mortgage interest expense, clarification is needed.

Next, focus on the amounts and identify the biggest expenses. In service businesses, salaries are typically a significant expense, while manufacturing businesses often have substantial spending on materials and supplies. If the salary line is high but the company only has a few employees, or if interest expense is significant despite the company being profitable, further investigation is required.

Comparing year-over-year numbers is also valuable. Income statements often include a separate column for the prior year’s figures, allowing for percentage changes to be calculated. Significant changes should be questioned and analyzed. For example, a 50% decrease in sales income or a 20% decrease in insurance raises concerns that require investigation.

Lastly, consider the logical relationships between numbers. At most companies, employee benefits contribute significantly to costs. If the salary line doubles but the benefits number only increases by 10%, it may indicate that new employees don’t qualify for benefits or that the company dropped a benefit plan.

Answering these questions will help you gain a comprehensive understanding of income statements and ensure confidence in your analysis. In the end, remember that revenue minus expenses equals the bottom line, and everything else is just details.

Ready to get started? Download our free Profit and Loss Template today.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!