Martini Astrology and Tarot is a specialized business in Eugene, OR, providing astrology and tarot reading services. Initially operating from the owner’s home, Sarah Esppe, the founder, will also offer out-call services by appointment. Sarah plans to open a dedicated office between Years One and Three.

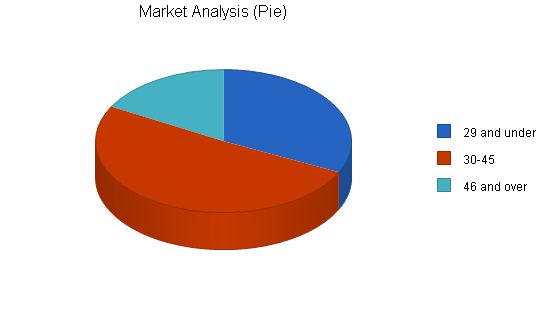

Martini will be located in Eugene, OR, a liberal community in the Willamette river valley. The business will target three customer segments: under 29 year olds, 30-45year olds, and over 46 year olds. The first segment is growing at a rate of 15% annually, with 95,000 potential customers. The second group has a growth rate of 10%, with 150,000 potential customers. The last group, with a slow annual growth rate of 5%, consists of 50,000 people.

Martini’s readings will cater to consulting and entertainment purposes. Sarah aims to establish long-term relationships with clients, offering weekly or bi-weekly sessions. She will achieve this by providing relevant, accurate, and quality readings at reasonable rates.

Sarah Esppe, the sole proprietor of Martini, has been providing readings for four years. She received formal training at the prestigious Iowa Center for Astrology, completing an 8-month program and earning certification. Sarah furthered her studies at Tarot University in New Orleans for four months, achieving the highest level of certification, the Master Tarot Reader degree. With this training, Sarah will provide top-notch astrology and tarot consultations.

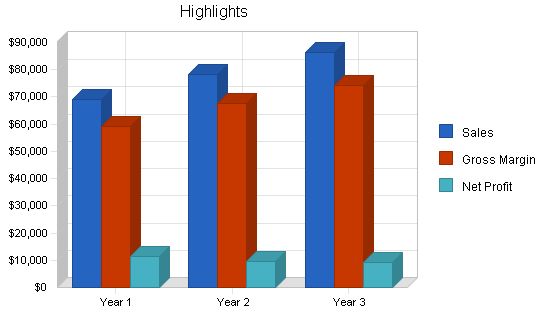

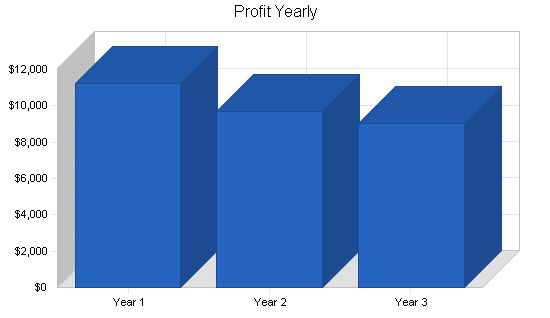

Martini is an exciting start-up, with projected sales of $68,000 in Year One and a rise to $86,000 by Year Three. Sarah expects to achieve profitability in Year One.

1.1 Objectives

The business objectives are:

- Reach break-even and positive cash flow.

- Earn enough profit to maintain an external location and purchase a stand at the Saturday Market and local festivals.

- Establish a reputation as an accurate and entertaining tarot and astrological reader.

1.2 Mission

Martini Astrology and Tarot will offer high-quality, personal astrology and tarot readings for entertainment purposes. I will provide personalized, accurate readings tailored to clients’ needs at varying prices to ensure accessibility and affordability. To gain respect and trust, Martini must be known for accuracy and quality.

1.3 Keys to Success

- Satisfy clients with accurate and quality readings at a reasonable price.

- Develop word-of-mouth and advertising revenue to maintain a client base.

- Purchase a booth at the Saturday Market for regular tarot and astrology readings.

Company Summary

Martini Astrology and Tarot is a new company that provides high-level readings to clients in the Eugene area. It initially focuses on astrology and tarot readings and plans to expand by purchasing a booth at the Saturday Market and other local fairs and festivals.

2.1 Company Ownership

Martini Astrology and Tarot will be a sole proprietorship based in Eugene, Oregon.

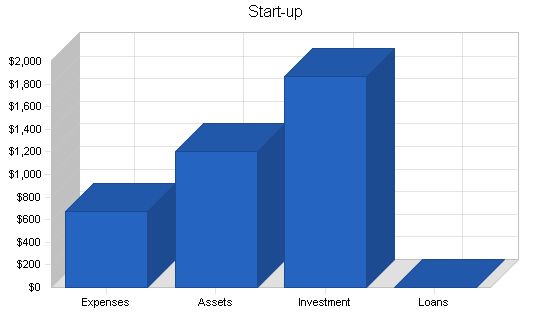

2.2 Start-up Summary

The company’s assets include a computer, software, and books. Start-up costs are reduced as most items are already owned. Funding will be provided by the owner.

Start-up Requirements:

– Legal: $300

– Stationery etc.: $120

– Brochures: $150

– Research and development: $50

– Astrology Program and Tarot Cards: $50

– Total Start-up Expenses: $670

Start-up Assets:

– Cash Required: $200

– Other Current Assets: $1,000

– Long-term Assets: $0

– Total Assets: $1,200

Total Requirements: $1,870

Start-up Funding:

– Start-up Expenses to Fund: $670

– Start-up Assets to Fund: $1,200

– Total Funding Required: $1,870

Assets:

– Non-cash Assets from Start-up: $1,000

– Cash Requirements from Start-up: $200

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $200

– Total Assets: $1,200

Liabilities and Capital:

– Liabilities:

– Current Borrowing: $0

– Long-term Liabilities: $0

– Accounts Payable (Outstanding Bills): $0

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $0

– Capital:

– Planned Investment:

– Investor 1: $1,870

– Investor 2: $0

– Other: $0

– Additional Investment Requirement: $0

– Total Planned Investment: $1,870

– Loss at Start-up (Start-up Expenses): ($670)

– Total Capital: $1,200

Total Capital and Liabilities: $1,200

Total Funding: $1,870

Company Locations and Facilities:

Initially, Martini Astrology and Tarot will be run from my home, with out-call services as my main business. However, this business plan calls for establishing a location outside the home. I am currently negotiating for booth space at the 5th Street Market complex, which has good traffic, easy parking, and people with the right aura.

Services:

Martini Astrology and Tarot offers the expertise of a quality astrology and tarot reader to its clients.

Service Description:

As of June 2001, Martini has two basic services available for clients:

– Astrology Readings

– Tarot Readings

Sales Literature:

The business will begin with simple business cards listing my services. Eventually, with a larger client base, brochures will be made that include prices and what type of tarot and astrology readings are available.

Fulfillment:

Key fulfillment will be delivered by the sole proprietor of Martini Astrology and Tarot. The core value is professional expertise, provided by a combination of experience, empathy, and education.

Market Analysis Summary:

Martini will focus on customers between the ages of 15 and 60 wanting to have their astrological charts interpreted or who are interested in tarot readings. The largest growth market will be those under the age of 29, but the market with the most repeat customers will be between the ages of 30 to 45.

Market Segmentation:

The market analysis numbers are based on the general population of Eugene and were taken by the Census Board.

Market Analysis

| Market Analysis | ||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| 95,000 | 109,250 | 125,638 | 144,484 | 166,157 |

| 150,000 | 165,000 | 181,500 | 199,650 | 219,615 |

| 50,000 | 52,500 | 55,125 | 57,881 | 60,775 |

| 295,000 | 326,750 | 362,263 | 402,015 | 446,547 |

4.2 Market Needs

My target clients are those interested in their future. They will use my readings for consulting and entertainment. Ideally, they will seek a long-term alliance, looking for reliable readings and empathic support.

4.3 Target Market Segment Strategy

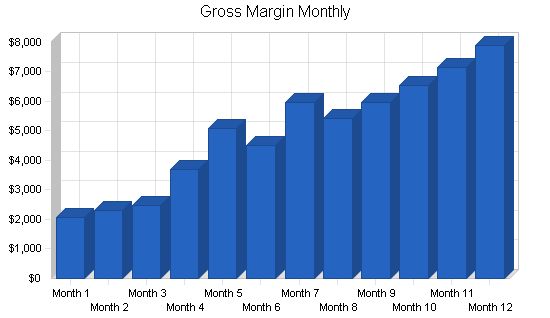

Higher sales forecast for October and December due to holidays like Halloween/Samhain and Christmas/Winter Solstice. Concrete sales forecast of units is difficult due to business being conducted in coffee shops, fairs, and parties, but should remain steady.

4.4 Service Business Analysis

The astrology and tarot business consists of thousands of smaller companies and individuals. Most are online at this time, so face-to-face service is harder to find and not easily accessible. Clients stumble upon these businesses by mistake or luck and purchase depending on their needs at that time.

4.4.1 Main Competitors

My main competition will be others in the Eugene/Springfield area providing the same services, and internet-based services.

4.4.2 Competition and Buying Patterns

The key element in purchase decisions at the client level is trust in the reputation and reliability of Martini Astrology and Tarot.

Pricing is surprisingly variable. When consulting at this level, it is easier to price too low than too high. Clients and potential clients expect to pay substantial fees for the best quality professional advice.

4.4.3 Business Participants

The astrology and tarot reading industry is made up of many small participants, with a few world-renowned readers.

4.4.4 Distributing a Service

Consulting is sold and purchased mainly through word-of-mouth, with relationships and previous experience being the most important factor.

Strategy and Implementation Summary

Martini Astrology and Tarot will primarily focus on Eugene and surrounding cities. The target customer is someone who wants a tarot or astrology reading and would like to continue consulting my services in the future.

5.1 Marketing Strategy

The target market will mainly be people under 40 who want a tarot or astrology reading for entertainment. Initially, I will target people in the downtown area who want a quick tarot reading for $10 to $20. After their first reading, I will inform them of my astrology services.

To develop good business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis

5.1.1 Positioning Statement

For clients who want an astrology or tarot reading, Martini offers specialized expertise. Readings will be face-to-face and reasonably priced, unlike online companies.

5.1.2 Pricing Strategy

My prices will be competitive, ranging from $10 for a quick 10-minute reading to $25 and higher for an astrology chart printout and summary.

5.1.3 Promotion Strategy

Martini must generate and manage speaking opportunities at fairs, festivals, parties, and other events. The company will depend on retail traffic at its location and word of mouth until a client base is formed, then begin advertising with fliers, brochures, and classified advertisements in smaller publications.

5.2 Sales Strategy

Sales in our business is client service. It is a repeat business. One doesn’t sell an astrology and tarot company, one develops a reputation that gains the trust and respect of clients.

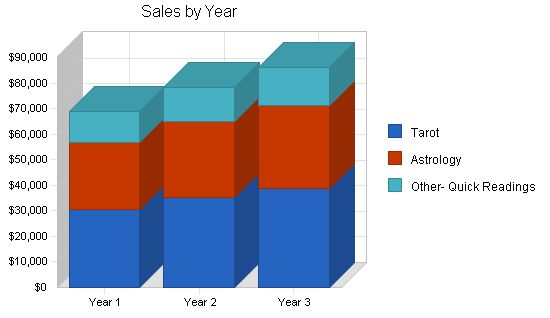

5.2.1 Sales Forecast

The Sales Forecast table and chart give a rundown on forecasted sales. I expect holidays such as Halloween, Christmas, and New Year’s Eve to be my biggest sales events, which will include being hired for parties and festivals. The first-year sales forecast includes the general ramp-up expected as the business gets going.

Sales Forecast

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Unit Sales | |||

| Tarot | 2,134 | 2,347 | 2,582 |

| Astrology | 1,077 | 1,185 | 1,303 |

| Other- Quick Readings | 1,235 | 1,359 | 1,494 |

| Total Unit Sales | 4,446 | 4,891 | 5,380 |

| Unit Prices | Year 1 | Year 2 | Year 3 |

| Tarot | $14.25 | $15.00 | $15.00 |

| Astrology | $24.26 | $25.00 | $25.00 |

| Other- Quick Readings | $10.00 | $10.00 | $10.00 |

| Sales | |||

| Tarot | $30,420 | $35,211 | $38,732 |

| Astrology | $26,130 | $29,618 | $32,579 |

| Other- Quick Readings | $12,350 | $13,585 | $14,944 |

| Total Sales | $68,900 | $78,414 | $86,255 |

| Direct Unit Costs | Year 1 | Year 2 | Year 3 |

| Tarot | $2.00 | $2.00 | $2.00 |

| Astrology | $4.00 | $4.00 | $4.00 |

| Other- Quick Readings | $0.95 | $1.00 | $1.00 |

| Direct Cost of Sales | |||

| Tarot | $4,268 | $4,695 | $5,164 |

| Astrology | $4,308 | $4,739 | $5,213 |

| Other- Quick Readings | $1,174 | $1,359 | $1,494 |

| Subtotal Direct Cost of Sales | $9,750 | $10,792 | $11,871 |

Management Summary

As a sole proprietor, I will handle the management of the team myself, so there won’t be any issues. I will only hire part-time administrative and support help for $500 per month when the business gets going.

Personnel Plan

The payroll consists of myself and one other person for support and administrative help. The amounts are calculated based on expected profits for each month. Profits after payroll will be reinvested in the business for advertising, travel, and other miscellaneous expenses.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Principal | $34,000 | $40,000 | $45,000 |

| Other | $1,500 | $5,000 | $6,500 |

| Total People | 2 | 2 | 2 |

| Total Payroll | $35,500 | $45,000 | $51,500 |

Martini Astrology and Tarot will experience financial growth through cash flow. While this means slower growth, it ensures stability.

Important Assumptions

The financial plan depends on specific assumptions, most of which are shown in the following table. Quality readings and customer satisfaction will be crucial in generating word of mouth and repeat customers.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 25.00% | 25.00% | 25.00% |

| Other | 0 | 0 | 0 |

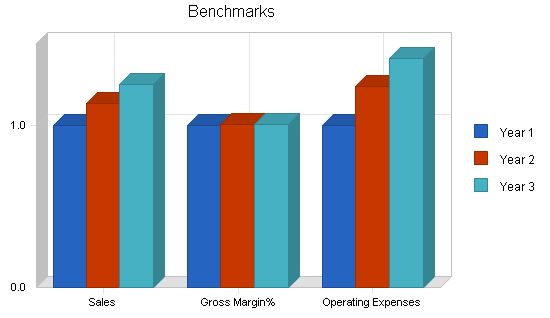

Key Financial Indicators

The following chart shows the key financial indicators for the first three years. Significant sales growth is expected, especially during holiday seasons.

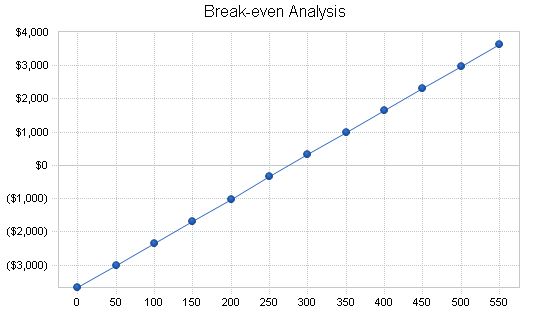

The Break-even Analysis is summarized in the table and chart below. Achieving the break-even point in the first month will not be difficult due to the relatively low monthly fixed costs. It’s important to note that the majority of the fixed cost is my own compensation.

Break-even Analysis

Monthly Units Break-even: 276

Monthly Revenue Break-even: $4,281

Assumptions:

– Average Per-Unit Revenue: $15.50

– Average Per-Unit Variable Cost: $2.19

– Estimated Monthly Fixed Cost: $3,675

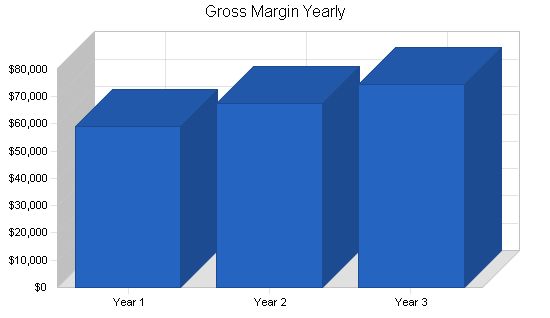

Projected Profit and Loss

Advertising expenses vary based on upcoming holidays, while travel expenses remain constant as most travel will be within Eugene. Other expenses encompass books, seminars, costumes, and more. Utilities, rent, and consultants are excluded as work will primarily be conducted outside of home. Additional costs to consider later on may include renting a stand at the Saturday Market, licensing, and a small office space.

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $68,900 | $78,414 | $86,255 |

| Direct Cost of Sales | $9,750 | $10,792 | $11,871 |

| Other | $60 | $65 | $70 |

| Total Cost of Sales | $9,810 | $10,857 | $11,941 |

| Gross Margin | $59,090 | $67,556 | $74,314 |

| Gross Margin % | 85.76% | 86.15% | 86.16% |

| Expenses | |||

| Payroll | $35,500 | $45,000 | $51,500 |

| Sales and Marketing and Other Expenses | $3,200 | $3,875 | $4,550 |

| Depreciation | $0 | $0 | $0 |

| Rent | $5,400 | $5,800 | $6,200 |

| Payroll Taxes | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $44,100 | $54,675 | $62,250 |

| Profit Before Interest and Taxes | $14,990 | $12,881 | $12,064 |

| EBITDA | $14,990 | $12,881 | $12,064 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $3,748 | $3,220 | $3,016 |

| Net Profit | $11,243 | $9,661 | $9,048 |

| Net Profit/Sales | 16.32% | 12.32% | 10.49% |

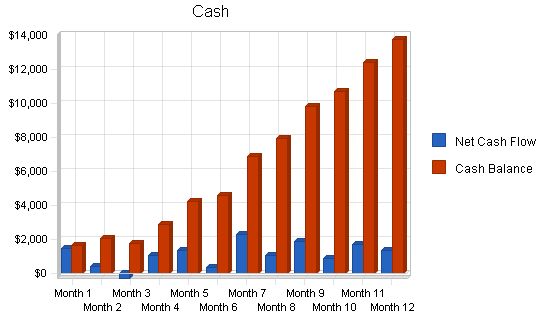

Projected Cash Flow:

7.5 Projected Cash Flow

The annual cash flow figures are included below. Detailed monthly numbers can be found in the appendix. Cash flow depends on the time spent providing services to customers, so projections may vary.

Pro Forma Cash Flow

Cash Received

– Cash from Operations:

– Cash Sales: $68,900 (Year 1), $78,414 (Year 2), $86,255 (Year 3)

– Additional Cash Received:

– Sales Tax, VAT, HST/GST Received: $0 (Year 1), $0 (Year 2), $0 (Year 3)

– New Current Borrowing: $0 (Year 1), $0 (Year 2), $0 (Year 3)

– New Other Liabilities (interest-free): $0 (Year 1), $0 (Year 2), $0 (Year 3)

– New Long-term Liabilities: $0 (Year 1), $0 (Year 2), $0 (Year 3)

– Sales of Other Current Assets: $0 (Year 1), $0 (Year 2), $0 (Year 3)

– Sales of Long-term Assets: $0 (Year 1), $0 (Year 2), $0 (Year 3)

– New Investment Received: $0 (Year 1), $0 (Year 2), $0 (Year 3)

– Subtotal Cash Received: $68,900 (Year 1), $78,414 (Year 2), $86,255 (Year 3)

Expenditures

– Expenditures from Operations:

– Cash Spending: $35,500 (Year 1), $45,000 (Year 2), $51,500 (Year 3)

– Bill Payments: $19,845 (Year 1), $24,113 (Year 2), $25,547 (Year 3)

– Additional Cash Spent:

– Sales Tax, VAT, HST/GST Paid Out: $0 (Year 1), $0 (Year 2), $0 (Year 3)

– Principal Repayment of Current Borrowing: $0 (Year 1), $0 (Year 2), $0 (Year 3)

– Other Liabilities Principal Repayment: $0 (Year 1), $0 (Year 2), $0 (Year 3)

– Long-term Liabilities Principal Repayment: $0 (Year 1), $0 (Year 2), $0 (Year 3)

– Purchase Other Current Assets: $0 (Year 1), $0 (Year 2), $0 (Year 3)

– Purchase Long-term Assets: $0 (Year 1), $0 (Year 2), $0 (Year 3)

– Dividends: $0 (Year 1), $0 (Year 2), $0 (Year 3)

– Subtotal Cash Spent: $55,345 (Year 1), $69,113 (Year 2), $77,047 (Year 3)

Net Cash Flow: $13,555 (Year 1), $9,301 (Year 2), $9,208 (Year 3)

Cash Balance: $13,755 (Year 1), $23,056 (Year 2), $32,264 (Year 3)

7.6 Projected Balance Sheet

The Balance Sheet below shows managed and sufficient growth of net worth, and a healthy financial position. Monthly estimates can be found in the appendices.

Pro Forma Balance Sheet

Assets

– Current Assets:

– Cash: $13,755 (Year 1), $23,056 (Year 2), $32,264 (Year 3)

– Other Current Assets: $1,000 (Year 1), $1,000 (Year 2), $1,000 (Year 3)

– Total Current Assets: $14,755 (Year 1), $24,056 (Year 2), $33,264 (Year 3)

– Long-term Assets:

– Total Long-term Assets: $0 (Year 1), $0 (Year 2), $0 (Year 3)

– Total Assets: $14,755 (Year 1), $24,056 (Year 2), $33,264 (Year 3)

Liabilities and Capital

– Current Liabilities:

– Accounts Payable: $2,313 (Year 1), $1,952 (Year 2), $2,113 (Year 3)

– Current Borrowing: $0 (Year 1), $0 (Year 2), $0 (Year 3)

– Other Current Liabilities: $0 (Year 1), $0 (Year 2), $0 (Year 3)

– Total Current Liabilities: $2,313 (Year 1), $1,952 (Year 2), $2,113 (Year 3)

– Long-term Liabilities: $0 (Year 1), $0 (Year 2), $0 (Year 3)

– Total Liabilities: $2,313 (Year 1), $1,952 (Year 2), $2,113 (Year 3)

Paid-in Capital: $1,870 (Year 1), $1,870 (Year 2), $1,870 (Year 3)

Retained Earnings: ($670) (Year 1), $10,573 (Year 2), $20,234 (Year 3)

Earnings: $11,243 (Year 1), $9,661 (Year 2), $9,048 (Year 3)

Total Capital: $12,443 (Year 1), $22,104 (Year 2), $31,151 (Year 3)

Total Liabilities and Capital: $14,755 (Year 1), $24,056 (Year 2), $33,264 (Year 3)

Net Worth: $12,442 (Year 1), $22,104 (Year 2), $31,151 (Year 3)

7.7 Business Ratios

The table below contains ratios from the entertainment industry, based on the Standard Industry Classification (SIC) Index #7299, Personal Services.

Ratio Analysis

– Sales Growth: 0.00% (Year 1), 13.81% (Year 2), 10.00% (Year 3), Industry Profile: 8.15%

– Percent of Total Assets:

– Other Current Assets: 6.78% (Year 1), 4.16% (Year 2), 3.01% (Year 3), Industry Profile: 35.03%

– Total Current Assets: 100.00% (Year 1), 100.00% (Year 2), 100.00% (Year 3), Industry Profile: 55.79%

– Long-term Assets:

– Total Long-term Assets: 0.00% (Year 1), 0.00% (Year 2), 0.00% (Year 3), Industry Profile: 44.21%

– Total Assets: 100.00% (Year 1), 100.00% (Year 2), 100.00% (Year 3), Industry Profile: 100.00%

– Current Liabilities:

– Accounts Payable: 15.67% (Year 1), 8.12% (Year 2), 6.35% (Year 3), Industry Profile: 25.11%

– Long-term Liabilities: 0.00% (Year 1), 0.00% (Year 2), 0.00% (Year 3), Industry Profile: 22.00%

– Total Liabilities: 15.67% (Year 1), 8.12% (Year 2), 6.35% (Year 3), Industry Profile: 47.11%

– Net Worth: 84.33% (Year 1), 91.88% (Year 2), 93.65% (Year 3), Industry Profile: 52.89%

– Percent of Sales: 100.00% (Year 1), 100.00% (Year 2), 100.00% (Year 3), Industry Profile: 100.00%

– Gross Margin: 85.76% (Year 1), 86.15% (Year 2), 86.16% (Year 3), Industry Profile: 100.00%

– Selling, General & Administrative Expenses: 75.24% (Year 1), 80.29% (Year 2), 82.38% (Year 3), Industry Profile: 77.99%

– Advertising Expenses: 3.48% (Year 1), 3.83% (Year 2), 4.06% (Year 3), Industry Profile: 1.85%

– Profit Before Interest and Taxes: 21.76% (Year 1), 16.43% (Year 2), 13.99% (Year 3), Industry Profile: 3.35%

– Main Ratios:

– Current: 6.38 (Year 1), 12.32 (Year 2), 15.74 (Year 3), Industry Profile: 1.73

– Quick: 6.38 (Year 1), 12.32 (Year 2), 15.74 (Year 3), Industry Profile: 1.30

– Total Debt to Total Assets: 15.67% (Year 1), 8.12% (Year 2), 6.35% (Year 3), Industry Profile: 6.16%

– Pre-tax Return on Net Worth: 120.47% (Year 1), 58.28% (Year 2), 38.73% (Year 3), Industry Profile: 59.92%

– Pre-tax Return on Assets: 101.59% (Year 1), 53.55% (Year 2), 36.27% (Year 3), Industry Profile: 15.38%

– Additional Ratios:

– Net Profit Margin: 16.32% (Year 1), 12.32% (Year 2), 10.49% (Year 3), Industry Profile: n.a

– Return on Equity: 90.36% (Year 1), 43.71% (Year 2), 29.04% (Year 3), Industry Profile: n.a

– Activity Ratios:

– Accounts Payable Turnover: 9.58 (Year 1), 12.17 (Year 2), 12.17 (Year 3), Industry Profile: n.a

– Payment Days: 27 (Year 1), 33 (Year 2), 29 (Year 3), Industry Profile: n.a

– Total Asset Turnover: 4.67 (Year 1), 3.26 (Year 2), 2.59 (Year 3), Industry Profile: n.a

– Debt Ratios:

– Debt to Net Worth: 0.19 (Year 1), 0.09 (Year 2), 0.07 (Year 3), Industry Profile: n.a

– Current Liab. to Liab.: 1.00 (Year 1), 1.00 (Year 2), 1.00 (Year 3), Industry Profile: n.a

– Liquidity Ratios:

– Net Working Capital: $12,442 (Year 1), $22,104 (Year 2), $31,151 (Year 3), Industry Profile: n.a

– Interest Coverage: 0.00 (Year 1), 0.00 (Year 2), 0.00 (Year 3), Industry Profile: n.a

– Additional Ratios:

– Assets to Sales: 0.21 (Year 1), 0.31 (Year 2), 0.39 (Year 3), Industry Profile: n.a

– Current Debt/Total Assets: 16% (Year 1), 8% (Year 2), 6% (Year 3), Industry Profile: n.a

– Acid Test: 6.38 (Year 1), 12.32 (Year 2), 15.74 (Year 3), Industry Profile: n.a

– Sales/Net Worth: 5.54 (Year 1), 3.55 (Year 2), 2.77 (Year 3), Industry Profile: n.a

– Dividend Payout: 0.00 (Year 1), 0.00 (Year 2), 0.00 (Year 3), Industry Profile: n.a

Appendix

Sales Forecast

Unit Sales

Tarot: 0%, 96, 106, 116, 128, 180, 156, 210, 188, 206, 226, 248, 274

Astrology: 0%, 48, 53, 58, 64, 95, 78, 110, 94, 103, 113, 124, 137

Other- Quick Readings: 0%, 58, 64, 70, 77, 84, 94, 102, 113, 124, 136, 149, 164

Total Unit Sales: 202, 223, 244, 269, 359, 328, 422, 395, 433, 475, 521, 575

Unit Prices

Tarot: $10.00, $10.00, $10.00, $15.00, $15.00, $15.00, $15.00, $15.00, $15.00, $15.00, $15.00, $15.00, $15.00

Astrology: $20.00, $20.00, $20.00, $25.00, $25.00, $25.00, $25.00, $25.00, $25.00, $25.00, $25.00, $25.00, $25.00

Other- Quick Readings: $10.00, $10.00, $10.00, $10.00, $10.00, $10.00, $10.00, $10.00, $10.00, $10.00, $10.00, $10.00, $10.00

Sales

Tarot: $960, $1,060, $1,160, $1,920, $2,700, $2,340, $3,150, $2,820, $3,090, $3,390, $3,720, $4,110

Astrology: $960, $1,060, $1,160, $1,600, $2,375, $1,950, $2,750, $2,350, $2,575, $2,825, $3,100, $3,425

Other- Quick Readings: $580, $640, $700, $770, $840, $940, $1,020, $1,130, $1,240, $1,360, $1,490, $1,640

Total Sales: $2,500, $2,760, $3,020, $4,290, $5,915, $5,230, $6,920, $6,300, $6,905, $7,575, $8,310, $9,175

Personnel Plan

Principal: 0%, $1,000, $1,000, $2,000, $2,000, $3,000, $3,000, $3,000, $3,000, $3,000, $4,000, $4,000, $5,000

Other: 0%, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $500, $500, $500

Total People: 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 2, 2, 2

Total Payroll: $1,000, $1,000, $2,000, $2,000, $3,000, $3,000, $3,000, $3,000, $3,000, $4,500, $4,500, $5,500

General Assumptions

Plan Month: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12

Current Interest Rate: 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%

Long-term Interest Rate: 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%

Tax Rate: 25.00%, 25.00%, 25.00%, 25.00%, 25.00%, 25.00%, 25.00%, 25.00%, 25.00%, 25.00%, 25.00%, 25.00%, 25.00%

Other: 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0

Pro Forma Profit and Loss

Sales: $2,500, $2,760, $3,020, $4,290, $5,915, $5,230, $6,920, $6,300, $6,905, $7,575, $8,310, $9,175

Direct Cost of Sales: $413, $456, $534, $589, $824, $718, $962, $865, $948, $1,040, $1,141, $1,260

Other: $5, $5, $5, $5, $5, $5, $5, $5, $5, $5, $5, $5

Total Cost of Sales: $418, $461, $539, $594, $829, $723, $967, $870, $953, $1,045, $1,146, $1,265

Gross Margin: $2,082, $2,299, $2,481, $3,696, $5,086, $4,507, $5,953, $5,430, $5,952, $6,530, $7,164, $7,910

Gross Margin %: 83.28%, 83.30%, 82.15%, 86.15%, 85.98%, 86.18%, 86.03%, 86.19%, 86.20%, 86.20%, 86.21%, 86.21%

Expenses

Payroll: $1,000, $1,000, $2,000, $2,000, $3,000, $3,000, $3,000, $3,000, $3,000, $4,500, $4,500, $5,500

Sales and Marketing and Other Expenses: $450, $250, $250, $250, $250, $250, $250, $250, $250, $250, $250, $250, $250

Depreciation: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Rent: $450, $450, $450, $450, $450, $450, $450, $450, $450, $450, $450, $450, $450

Payroll Taxes: 15%, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Other: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Total Operating Expenses: $1,900, $1,700, $2,700, $2,700, $3,700, $3,700, $3,700, $3,700, $3,700, $5,200, $5,200, $6,200

Profit Before Interest and Taxes: $182, $599, ($219), $996, $1,386, $807, $2,253, $1,730, $2,252, $1,330, $1,964, $1,710

EBITDA: $182, $599, ($219), $996, $1,386, $807, $2,253, $1,730, $2,252, $1,330, $1,964, $1,710

Interest Expense: $0, $0, $0, $0, $0, $0

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $2,500 | $2,760 | $3,020 | $4,290 | $5,915 | $5,230 | $6,920 | $6,300 | $6,905 | $7,575 | $8,310 | $9,175 | |

| Subtotal Cash from Operations | $2,500 | $2,760 | $3,020 | $4,290 | $5,915 | $5,230 | $6,920 | $6,300 | $6,905 | $7,575 | $8,310 | $9,175 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $2,500 | $2,760 | $3,020 | $4,290 | $5,915 | $5,230 | $6,920 | $6,300 | $6,905 | $7,575 | $8,310 | $9,175 | |

| Expenditures | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Expenditures from Operations | |||||||||||||

| Cash Spending | $1,000 | $1,000 | $2,000 | $2,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $4,500 | $4,500 | $5,500 | |

| Bill Payments | $45 | $1,362 | $1,307 | $1,196 | $1,554 | $1,867 | $1,645 | $2,223 | $2,010 | $2,211 | $2,086 | $2,339 | |

| Subtotal Spent on Operations | $1,045 | $2,362 | $3,307 | $3,196 | $4,554 | $4,867 | $4,645 | $5,223 | $5,010 | $6,711 | $6,586 | $7,839 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $1,045 | $2,362 | $3,307 | $3,196 | $4,554 | $4,867 | $4,645 | $5,223 | $5,010 | $6,711 | $6,586 | $7,839 | |

| Net Cash Flow | $1,455 | $398 | ($287) | $1,094 | $1,361 | $363 | $2,275 | $1,077 | $1,895 | $864 | $1,724 | $1,336 | |

| Cash Balance | $1,655 | $2,053 | $1,766 | $2,860 | $4,221 | $4,584 | $6,859 | $7,936 | $9,832 | $10,695 | $12,419 | $13,755 | |

Pro Forma Balance Sheet

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | |||||||||||||

| Current Assets | |||||||||||||

| Cash | $200 | $1,655 | $2,053 | $1,766 | $2,860 | $4,221 | $4,584 | $6,859 | $7,936 | $9,832 | $10,695 | $12,419 | $13,755 |

| Other Current Assets | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 |

| Total Current Assets | $1,200 | $2,655 | $3,053 | $2,766 | $3,860 | $5,221 | $5,584 | $7,859 | $8,936 | $10,832 | $11,695 | $13,419 | $14,755 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $

Business Plan Outline

|

||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!