Ethnic Food Import Business Plan

Aztec Food Imports (Aztec) will offer food imports from Mexico to meet increased demand by the city’s growing Hispanic/Latino community in the greater Richmond area. Over the last five years, this community has grown by 70% and represents half of the Richmond Metro population (250,000). Aztec has successfully supplied imported Mexican food products to the area’s two PriceRight supermarkets. With this foundation, Aztec will build a successful business serving the area’s markets.

1.1 Objectives

– Establish Aztec Food Imports as the top importer of Mexican food products in Richmond.

– Increase the number of Mexican food products in local markets by 20% over the next two years.

– Build solid relationships with local store purchasing agents serving Richmond’s Hispanic/Latino population.

1.2 Mission

Aztec’s mission is to supply Mexican food imports to Richmond stores, currently underserved by importers located over 150 miles away. Raymond Garcia, co-owner, will utilize his importing background, experience in the food retail market, and contacts in Mexico to bring in products that customers demand.

1.3 Keys to Success

The keys to success for Aztec’s business are:

– Offering high-quality products not available everywhere, essential for maintaining niche market sectors.

– Reliable and timely deliveries, requiring long-range planning and consideration of Mexican business practices.

– A reliable administration that serves customers, prepares accurate billing, follows up on orders and documentation, and closely monitors expenses and accounts receivable.

Aztec Food Imports will import Mexican food products to the Richmond Metro area markets.

2.1 Company Ownership

Aztec’s ownership is shared equally between Raymond Garcia and Jose Arroyo. Raymond has eight years of importing experience and is responsible for daily management, sales, and store deliveries. Jose Arroyo has 10 years of experience in managing imports from Mexico and shipping to the U.S. market. He is responsible for quality control and shipping.

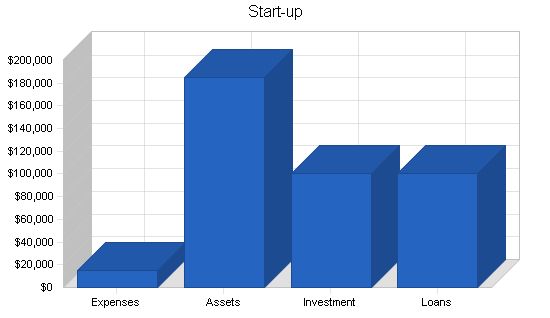

2.2 Start-up Summary

The start-up cost of Aztec Food Imports primarily consists of inventory. Raymond Garcia and Jose Arroyo will each invest $50,000, and they will also secure a $100,000 SBA loan.

Start-up Funding

Start-up Expenses to Fund: $15,300

Start-up Assets to Fund: $184,700

Total Funding Required: $200,000

Assets

Non-cash Assets from Start-up: $80,000

Cash Requirements from Start-up: $104,700

Additional Cash Raised: $0

Cash Balance on Starting Date: $104,700

Total Assets: $184,700

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $100,000

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $100,000

Capital

Planned Investment

Raymond Garcia: $50,000

Jose Arroya: $50,000

Other: $0

Additional Investment Requirement: $0

Total Planned Investment: $100,000

Loss at Start-up (Start-up Expenses): ($15,300)

Total Capital: $84,700

Total Capital and Liabilities: $184,700

Total Funding: $200,000

Start-up Requirements

Start-up Expenses

Legal: $5,000

Stationery etc.: $800

Brochures: $2,000

Consultants: $0

Insurance: $0

Rent: $3,000

Expensed Equipment: $4,000

Utilities: $500

Other: $0

Total Start-up Expenses: $15,300

Start-up Assets

Cash Required: $104,700

Start-up Inventory: $60,000

Other Current Assets: $0

Long-term Assets: $20,000

Total Assets: $184,700

Total Requirements: $200,000

Company Locations and Facilities

Aztec Food Imports will have warehouse space located in the Fillmore industrial district.

Products

Aztec’s product line consists of over 200 items:

– Beverages.

– Canned foods.

– Chile peppers.

– Desserts.

– Packaged foods.

– Salsas.

– Snacks.

– Spices and herbs.

Aztec also carries popular brands:

– Ducal.

– Herdez.

– Juanita’s.

– La Costeña.

– La Joya.

– La Lechonera.

– La Sierra.

– Pico Pica.

Market Analysis Summary

The Hispanic/Latino population in the Richmond Metro area has grown by 10% over the past five years. The current population stands at over 100,000 and is projected to reach over 160,000 in the next five years. A majority of these inner-city residents live in family groups of six or more members. The average household income for the area is $32,000.

There are four major supermarkets and over 50 smaller food stores that serve the metro communities. Last year, the four major supermarkets grossed over $150,000,000 in sales. Additional supermarkets are planned to be built in the Richmond Metro area in 2003 and 2004. Two of the current supermarkets in the Richmond Metro area are part of the local PriceRight chain. PriceRight is planning a new store in the area in 2004.

Though exact sales figures for the small markets in the area are unknown, traditionally, the community residents have been supportive of the smaller stores if their prices are competitive. Last year, Wilson Foods Imports grossed $1.5 million in sales with smaller markets in the Richmond Metro area.

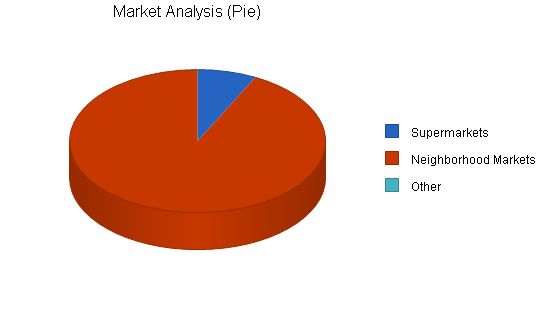

Market Segmentation

Aztec Food Imports will serve all retail food outlets in the Richmond Metro area, including neighborhood markets and supermarkets.

Market Analysis

Year 1 Year 2 Year 3 Year 4 Year 5

Potential Customers Growth CAGR

Supermarkets 20% 4 5 6 7 8 18.92%

Neighborhood Markets 20% 50 60 72 86 103 19.80%

Other 0% 0 0 0 0 0 0.00%

Total 19.74% 54 65 78 93 111 19.74%

4.2 Target Market Segment Strategy

Aztec Food Imports will have two distinct marketing approaches:

– For Neighborhood Markets: Raymond will promote a small group of popular Mexican food products that are likely to move fast in smaller stores. These products will be priced attractively for small store owners. Once successful, Raymond will expand the product group.

– For Supermarkets: Raymond will promote the complete line of products that Aztec can provide. Aztec prices will reflect a stronger import connection in Mexico, resulting in lower prices and more product.

4.3 Main Competitors

Currently, Acme Food Importers in Wilsonville supplies Richmond area food stores with imported Mexican food products. Wilsonville is 150 miles north of Richmond. Only in the past two years has the demand for these products grown sufficiently to impact Acme’s ability to meet demand. Besides the distance, Acme is plagued with weak import connections in Mexico, contributing to the high wholesale price of their imported products.

Strategy and Implementation Summary

Aztec Food Imports aims to become the leading provider of wholesale imported Mexican food products in the Richmond Metro area.

5.1 Competitive Edge

Raymond Garcia and Jose Arroyo are the competitive edge of Aztec Food Imports. Raymond has worked for both Acme Food Imports and Wilson Food Imports over the past eight years. In his last position with Wilson, Raymond imported Mexican food products to numerous markets in the southwest, generating annual sales exceeding $2 million. His strength lies in customer relations and expanding the range of imported Mexican food purchased by markets in his sales region.

Jose has been a shipping agent for M. Zegarra Exporting in Mexico City for the past ten years. The company exported $20 million worth of products to the U.S last year. Jose’s responsibilities included eliminating shipping obstacles and ensuring timely product delivery to the U.S.

To develop effective business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis.

5.2 Sales Strategy

Aztec Food Imports will have two distinct sales approaches:

– For Neighborhood Markets: Raymond will promote a small group of popular Mexican food products that are likely to move fast in smaller stores. These items will be packaged as a group at an attractive price. Raymond will make frequent visits to these stores to build a strong working relationship that will lead to more purchases.

– For Supermarkets: Raymond will promote the complete line of products that Aztec can provide. Aztec prices will reflect a stronger import connection in Mexico, resulting in lower prices and more product. Raymond will also promote new seasonal products and provide assistance in marketing the products to the Hispanic/Latino community.

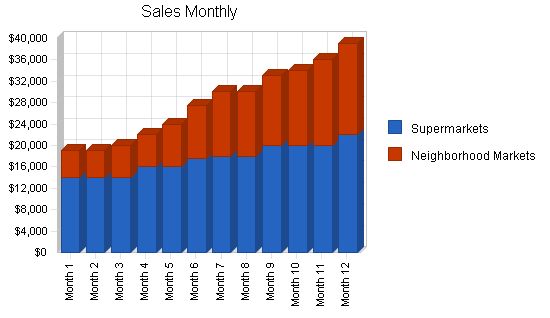

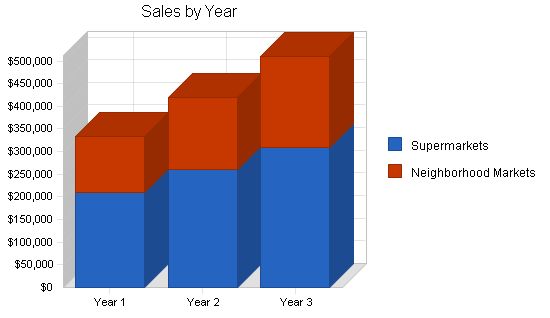

5.2.1 Sales Forecast

The following is the sales forecast for three years.

Sales Forecast:

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Supermarkets | $209,500 | $260,000 | $310,000 |

| Neighborhood Markets | $124,000 | $160,000 | $200,000 |

| Total Sales | $333,500 | $420,000 | $510,000 |

Management Summary:

The two owners will co-manage the business. Raymond Garcia handles daily management, sales, and store deliveries, while Jose Arroyo oversees quality control and shipping of goods from Mexico to the U.S.

Personnel Plan:

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Raymond Garcia | $36,000 | $45,000 | $50,000 |

| Jose Arroyo | $36,000 | $45,000 | $50,000 |

| Delivery Persons | $48,000 | $54,000 | $60,000 |

| Office Manager | $31,200 | $34,000 | $38,000 |

| Other | $0 | $0 | $0 |

| Total People | 5 | 5 | 5 |

| Total Payroll | $151,200 | $178,000 | $198,000 |

The following sections provide conservative estimates of Aztec Food Imports’ financial performance.

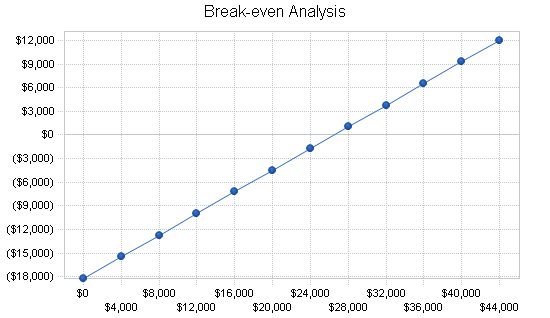

Break-even Analysis:

The monthly break-even point is $26,514.

Break-even Analysis

Monthly Revenue Break-even: $26,514

Assumptions:

– Average Percent Variable Cost: 31%

– Estimated Monthly Fixed Cost: $18,230

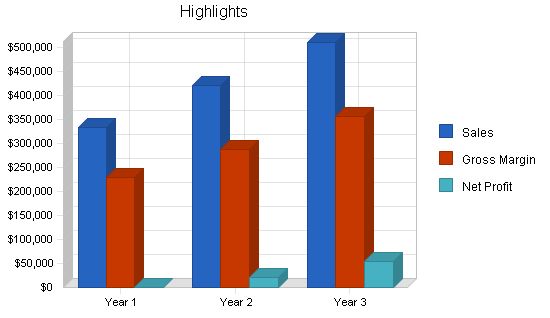

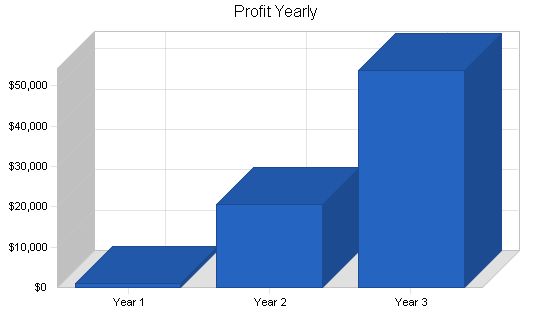

7.2 Projected Profit and Loss

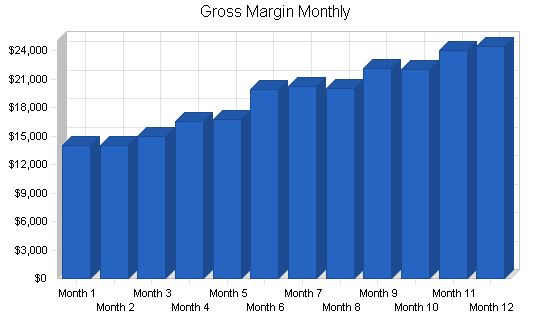

The table and charts below illustrate the next three years.

The table provided illustrates the pro forma profit and loss for three years. Here are the figures:

Year 1:

– Sales: $333,500

– Direct Cost of Sales: $104,200

– Other Production Expenses: $0

– Total Cost of Sales: $104,200

– Gross Margin: $229,300

– Gross Margin %: 68.76%

– Expenses:

– Payroll: $151,200

– Sales and Marketing and Other Expenses: $0

– Depreciation: $2,880

– Leased Equipment: $0

– Utilities: $6,000

– Insurance: $0

– Rent: $36,000

– Payroll Taxes: $22,680

– Other: $0

– Total Operating Expenses: $218,760

– Profit Before Interest and Taxes: $10,540

– EBITDA: $13,420

– Interest Expense: $9,233

– Taxes Incurred: $392

– Net Profit: $915

– Net Profit/Sales: 0.27%

Year 2:

– Sales: $420,000

– Direct Cost of Sales: $133,000

– Other Production Expenses: $0

– Total Cost of Sales: $133,000

– Gross Margin: $287,000

– Gross Margin %: 68.33%

– Expenses:

– Payroll: $178,000

– Sales and Marketing and Other Expenses: $0

– Depreciation: $2,880

– Leased Equipment: $0

– Utilities: $6,000

– Insurance: $0

– Rent: $36,000

– Payroll Taxes: $26,700

– Other: $0

– Total Operating Expenses: $249,580

– Profit Before Interest and Taxes: $37,420

– EBITDA: $40,300

– Interest Expense: $7,876

– Taxes Incurred: $8,863

– Net Profit: $20,681

– Net Profit/Sales: 4.92%

Year 3:

– Sales: $510,000

– Direct Cost of Sales: $154,000

– Other Production Expenses: $0

– Total Cost of Sales: $154,000

– Gross Margin: $356,000

– Gross Margin %: 69.80%

– Expenses:

– Payroll: $198,000

– Sales and Marketing and Other Expenses: $0

– Depreciation: $2,880

– Leased Equipment: $0

– Utilities: $6,000

– Insurance: $0

– Rent: $36,000

– Payroll Taxes: $29,700

– Other: $0

– Total Operating Expenses: $272,580

– Profit Before Interest and Taxes: $83,420

– EBITDA: $86,300

– Interest Expense: $6,460

– Taxes Incurred: $23,088

– Net Profit: $53,872

– Net Profit/Sales: 10.56%

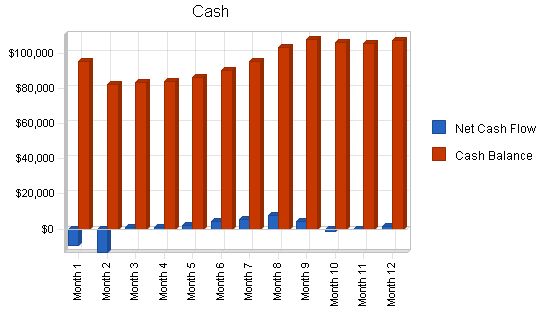

Moving on, the following table and chart present the projected cash flow for three years.

Pro Forma Cash Flow Table:

Year 1 Year 2 Year 3

Cash Received

Cash from Operations

Cash Sales $83,375 $105,000 $127,500

Cash from Receivables $194,775 $300,644 $367,563

Subtotal Cash from Operations $278,150 $405,644 $495,063

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $0 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $0 $0 $0

Subtotal Cash Received $278,150 $405,644 $495,063

Expenditures

Year 1 Year 2 Year 3

Expenditures from Operations

Cash Spending $151,200 $178,000 $198,000

Bill Payments $110,267 $228,719 $255,535

Subtotal Spent on Operations $261,467 $406,719 $453,535

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $0 $0 $0

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $14,160 $14,160 $14,160

Purchase Other Current Assets $0 $0 $0

Purchase Long-term Assets $0 $0 $0

Dividends $0 $0 $0

Subtotal Cash Spent $275,627 $420,879 $467,695

Net Cash Flow $2,523 ($15,235) $27,368

Cash Balance $107,223 $91,987 $119,355

Projected Balance Sheet:

Pro Forma Balance Sheet

Year 1 Year 2 Year 3

Assets

Current Assets

Cash $107,223 $91,987 $119,355

Accounts Receivable $55,350 $69,706 $84,643

Inventory $15,950 $20,358 $23,573

Other Current Assets $0 $0 $0

Total Current Assets $178,523 $182,052 $227,571

Long-term Assets

Long-term Assets $20,000 $20,000 $20,000

Accumulated Depreciation $2,880 $5,760 $8,640

Total Long-term Assets $17,120 $14,240 $11,360

Total Assets $195,643 $196,292 $238,931

Liabilities and Capital

Year 1 Year 2 Year 3

Current Liabilities

Accounts Payable $24,188 $18,316 $21,243

Current Borrowing $0 $0 $0

Other Current Liabilities $0 $0 $0

Subtotal Current Liabilities $24,188 $18,316 $21,243

Long-term Liabilities

$85,840 $71,680 $57,520

Total Liabilities $110,028 $89,996 $78,763

Paid-in Capital $100,000 $100,000 $100,000

Retained Earnings ($15,300) ($14,385) $6,296

Earnings $915 $20,681 $53,872

Total Capital $85,615 $106,296 $160,168

Total Liabilities and Capital $195,643 $196,292 $238,931

Net Worth $85,615 $106,296 $160,168

Year 1 Year 2 Year 3 Industry Profile

Sales Growth 0.00% 25.94% 21.43% 4.60%

Percent of Total Assets

Accounts Receivable 28.29% 35.51% 35.43% 33.30%

Inventory 8.15% 10.37% 9.87% 26.00%

Other Current Assets 0.00% 0.00% 0.00% 20.90%

Total Current Assets 91.25% 92.75% 95.25% 80.20%

Long-term Assets 8.75% 7.25% 4.75% 19.80%

Total Assets 100.00% 100.00% 100.00% 100.00%

Current Liabilities

Accounts Payable 12.36% 9.33% 8.89% 45.20%

Long-term Liabilities 43.88% 36.52% 24.07% 10.00%

Total Liabilities 56.24% 45.85% 32.96% 55.20%

Net Worth 43.76% 54.15% 67.04% 44.80%

Percent of Sales

Gross Margin 68.76% 68.33% 69.80% 44.10%

Selling, General & Administrative Expenses 68.48% 63.41% 59.24% 26.70%

Advertising Expenses 0.00% 0.00% 0.00% 0.70%

Profit Before Interest and Taxes 3.16% 8.91% 16.36% 0.80%

Main Ratios

Current 7.38 9.94 10.71 1.69

Quick 6.72 8.83 9.60 1.01

Total Debt to Total Assets 56.24% 45.85% 32.96% 55.20%

Pre-tax Return on Net Worth 1.53% 27.79% 48.05% 3.60%

Pre-tax Return on Assets 0.67% 15.05% 32.21% 8.00%

Additional Ratios

Net Profit Margin 0.27% 4.92% 10.56% n.a

Return on Equity 1.07% 19.46% 33.63% n.a

Activity Ratios

Accounts Receivable Turnover 4.52 4.52 4.52 n.a

Collection Days 56 72 74 n.a

Inventory Turnover 3.83 7.33 7.01 n.a

Accounts Payable Turnover 5.56 12.17 12.17 n.a

Payment Days 27 35 28 n.a

Total Asset Turnover 1.70 2.14 2.13 n.a

Debt Ratios

Debt to Net Worth 1.29 0.85 0.49 n.a

Current Liab. to Liab. 0.22 0.20 0.27 n.a

Liquidity Ratios

Net Working Capital $154,335 $163,736 $206,328 n.a

Interest Coverage 1.14 4.75 12.91 n.a

Additional Ratios

Assets to Sales 0.59 0.47 0.47 n.a

Current Debt/Total Assets 12% 9% 9% n.a

Acid Test 4.43 5.02 5.62 n.a

Sales/Net Worth 3.90 3.95 3.18 n.a

Dividend Payout 0.00 0.00 0.00 n.a

Appendix:

Sales Forecast Table:

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Sales $19,000 $19,000 $20,000 $22,000 $24,000 $27,500 $30,000 $30,000 $33,000 $34,000 $36,000 $39,000

Direct Cost of Sales Table:

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Supermarkets $4,000 $4,000 $4,000 $4,400 $6,000 $6,300 $8,000 $8,200 $9,000 $10,000 $10,000 $12,000

Neighborhood Markets $1,000 $1,000 $1,000 $1,080 $1,200 $1,280 $1,700 $1,740 $1,800 $2,000 $2,000 $2,500

Subtotal Direct Cost of Sales $5,000 $5,000 $5,000 $5,480 $7,200 $7,580 $9,700 $9,940 $10,800 $12,000 $12,000 $14,500

| Raymond Garcia | 0% | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 |

| Jose Arroyo | 0% | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 |

| Delivery Persons | 0% | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 |

| Office Manager | 0% | $2,600 | $2,600 | $2,600 | $2,600 | $2,600 | $2,600 | $2,600 | $2,600 | $2,600 | $2,600 | $2,600 | $2,600 |

| Other | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total People | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 |

| Total Payroll | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 |

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Sales | $19,000 | $19,000 | $20,000 | $22,000 | $24,000 | $27,500 | $30,000 | $30,000 | $33,000 | $34,000 | $36,000 | $39,000 | |

| Direct Cost of Sales | $5,000 | $5,000 | $5,000 | $5,480 | $7,200 | $7,580 | $9,700 | $9,940 | $10,800 | $12,000 | $12,000 | $14,500 | |

| Other Production Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $5,000 | $5,000 | $5,000 | $5,480 | $7,200 | $7,580 | $9,700 | $9,940 | $10,800 | $12,000 | $12,000 | $14,500 | |

| Gross Margin | $14,000 | $14,000 | $15,000 | $16,520 | $16,800 | $19,920 | $20,300 | $20,060 | $22,200 | $22,000 | $24,000 | $24,500 | |

| Gross Margin % | 73.68% | 73.68% | 75.00% | 75.09% | 70.00% | 72.44% | 67.67% | 66.87% | 67.27% | 64.71% | 66.67% | 62.82% | |

| Expenses | |||||||||||||

| Payroll | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | |

| Sales and Marketing and Other Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Depreciation | $240 | $240 | $240 | $240 | $240 | $240 | $240 | $240 | $240 | $240 | $240 | $240 | |

| Leased Equipment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Utilities | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | |

| Insurance | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Rent | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | |

| Payroll Taxes | 15% | $1,890 | $1,890 | $1,890 | $1,890 | $1,890 | $1,890 | $1,890 | $1,890 | $1,890 | $1,890 | $1,890 | $1,890 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $18,230 | $18,230 | $18,230 | $18,230 | $18,230 | $18,230 | $18,230 | $18,230 | $18,230 | $18,230 | $18,230 | $18,230 | |

| Profit Before Interest and Taxes | ($4,230) | ($4,230) | ($3,230) | ($1,710) | ($1,430) | $1,690 | $2,070 | $1,830 | $3,970 | $3,770 | $5,770 | $6,270 | |

| EBITDA | ($3,990) | ($3,990) | ($2,990) | ($1,470) | ($1,190) | $1,930 | $2,310 | $2,070 | $4,210 | $4,010 | $6,010 | $6,510 | |

| Interest Expense | $824 | $814 | $804 | $794 | $784 | $774 | $765 | $755 | $745 | $735 | $725 | $715 | |

| T

Pro Forma Cash Flow |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $4,750 | $4,750 | $5,000 | $5,500 | $6,000 | $6,875 | $7,500 | $7,500 | $8,250 | $8,500 | $9,000 | $9,750 | |

| Cash from Receivables | $0 | $475 | $14,250 | $14,275 | $15,050 | $16,550 | $18,088 | $20,688 | $22,500 | $22,575 | $24,775 | $25,550 | |

| Subtotal Cash from Operations | $4,750 | $5,225 | $19,250 | $19,775 | $21,050 | $23,425 | $25,588 | $28,188 | $30,750 | $31,075 | $33,775 | $35,300 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $4,750 | $5,225 | $19,250 | $19,775 | $21,050 | $23,425 | $25,588 | $28,188 | $30,750 | $31,075 | $33,775 | $35,300 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | $12,600 | |

| Bill Payments | $157 | $4,697 | $4,700 | $4,999 | $5,435 | $5,541 | $6,443 | $6,738 | $12,520 | $18,899 | $20,331 | $19,808 | |

| Subtotal Spent on Operations | $12,757 | $17,297 | $17,300 | $17,599 | $18,035 | $18,141 | $19,043 | $19,338 | $25,120 | $31,499 | $32,931 | $32,408 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $1,180 | $1,180 | $1,180 | $1,180 | $1,180 | $1,180 | $1,180 | $1,180 | $1,180 | $1,180 | $1,180 | $1,180 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $13,937 | $18,477 | $18,480 | $18,779 | $19,215 | $19,321 | $20,223 | $20,518 | $26,300 | $32,679 | $34,111 | $33,588 | |

| Net Cash Flow | ($9,187) | ($13,252) | $770 | $996 | $1,835 | $4,104 | $5,365 | $7,670 | $4,450 | ($1,604) | ($336) | $1,712 | |

| Cash Balance | $95,513 | $82,261 | $83,031 | $84,027 | $85,862 | $89,966 | $95,331 | $103,000 | $107,451 | $105,847 | $105,511 | $107,223 | |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!