Automobile Restoration Business Plan

Phaethon’s Chariot is a start-up auto restoration shop specializing in the restoration of old American cars, as well as the designing and building of hot rods and street rods. Our main focus is body work and rust repair. We have recently rented a new state-of-the-art restoration shop located at 510 W. 200th Terrace Circle Boulevard, Centerton, Ohmstate. Our dedication is to provide the highest quality workmanship and stay up to date with the latest tools and techniques in the industry.

We are located in Centerton, Ohmstate and our company and employees are committed to getting each job done right the first time, aiming to retain each car owner as a lifelong customer of our shop.

The company is a state chartered corporation in Ohmstate owned by Isoroku Tarnmaclahan. The owner has 20 years of experience working for other shops in the Highland Valley area and is dedicated to excellence. With our new space, we are able to take on more work. The office area encompasses 500 square feet, while the shop area, where the day-to-day work on the cars is performed, covers 5,000 sq.ft.

The seven communities surrounding Phaethon’s Chariot Restorations have an estimated population of 918,279. This suggests that the total restoration market in this area exceeds $2.0 million annually. Our goal is to gain a significant share of this local market.

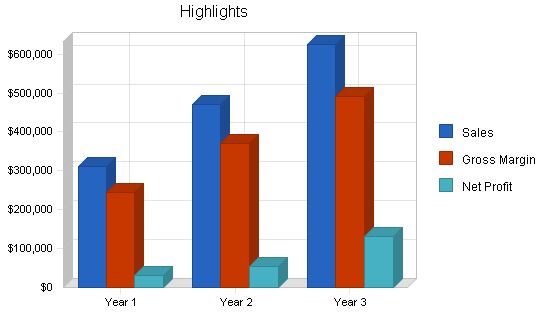

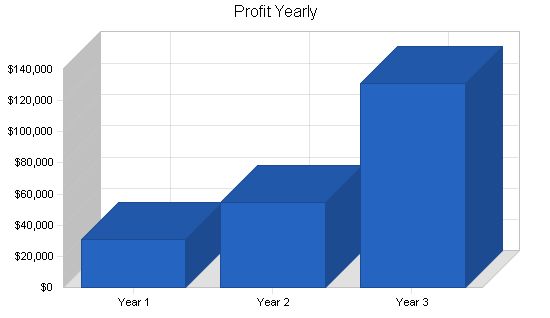

The marketing research and tailored strategy described in this business plan will result in modest after-tax profits in year 1, which will quadruple within three years. By year 3, we anticipate achieving a substantial market share of the local restoration market.

Within the next twelve months, our objective is to promote our business in the Highland Valley and surrounding areas. Our target market consists of 30- to 65-year old owners of old American cars. After year three, we plan to expand our business to the Carahge City, Mythtate area, where competition is limited.

1.1 Objectives:

– Penetrate the automotive restoration market in the Highland Valley and surrounding areas, targeting men and women aged 30 to 65 who own old American cars. Expand to the Carahge City, Mythtate area in year two.

– Increase profitability by encouraging price-sensitive jobs to go elsewhere, allowing for more high-end custom work.

– Improve administrative processes to reduce owner’s involvement in simple tasks, freeing up more time for sales and marketing.

1.2 Mission:

– Our mission at Phaethon’s Chariot is to perform the highest quality work at the best price.

– We achieve this by using the best parts and supplies available in the market today.

– We only employ knowledgeable people and have a metal fabricator for custom parts.

– All restoration technicians go through a rigorous application process.

1.3 Keys to Success:

– Maintain an untarnished reputation.

– Provide quality care.

– Offer competitive pricing.

– Provide flexible hours.

Phaethon’s Chariot is an auto restoration shop in Centerton, Ohmstate. We specialize in restoring 1970 and earlier American cars and building custom hot rods. Our work mainly involves body work and rust repair. The market for auto restoration in our target communities is approximately $2.7 million, with the share of this market dependent on disposable income.

Phaethon’s Chariot Restorations focuses on serving the high-end customer share of the auto restoration market. We cannot compete with large mass production shops or "insurance job" body repair shops. Our commitment is to provide high-quality workmanship, meet delivery dates, and execute custom work according to the customer’s concept.

2.1 Company Ownership:

Phaethon’s Chariot Restorations is a corporation registered in Ohmstate, owned by Isoroku Tarnmaclahan.

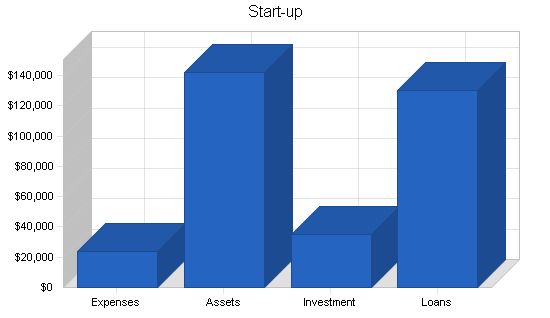

2.2 Start-up Summary:

The company founder, Mr. Isoroku Tarnmaclahan, will manage day-to-day operations and work collaboratively with all employees. Start-up costs include legal fees, advertising, one month’s rent and utilities, and related expenses. Additional funding is needed for heavy equipment and cash on hand. Total start-up requirements are detailed in the table below.

Some long-term assets that will be acquired include:

– Air Compressor System

– Air Filtration System

– Air Powered Tools

– Car Lift/Hoist

– Computerized Engine Diagnostic Equipment

– Fixtures

– Hand Tools

– Jigs and Work Stands

– Auto Hand Tools

– Spray Painting Equipment

Inventory will consist of restoration materials and custom parts will be purchased on a just-in-time basis.

Phaethon’s Chariot Restorations specializes in selling classic car restoration services at a rate of $45 per hour. We offer complete frame off restoration work for all makes of American classic cars and muscle cars. Our services include mechanical repairs, body and paint restoration, electrical repair, custom engine building, custom paint, and metal fabrication. We focus on pre-1970 American cars and trucks, with an average frame off restoration taking approximately 600 hours of labor, resulting in an average labor charge of $27,000. Additional charges apply for any necessary parts. We are capable of performing various types of work on pre-1970 American cars, including mechanical service, body and paint work.

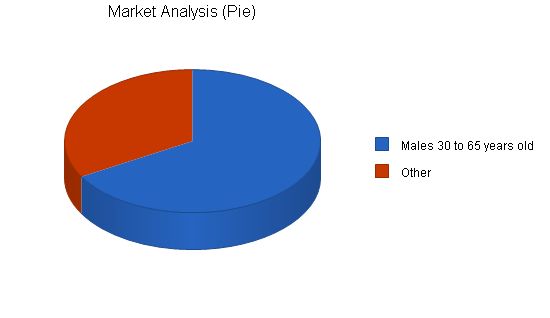

Our target market consists mainly of males aged 30 to 65 with an income of $100,000 or more. Some customers in lower income ranges may be interested in specific services, like interior restoration or paint work and parts sales. These customers are looking for quality restoration or custom services, timely completion of their cars’ work, competitive rates, attention to detail, and ideas and close customer services. Phaethon’s Chariot can meet all these demands as the owner has substantial experience in this field and upholds high standards for the shop’s work. The owner and foreman ensure that all employees meet these standards. Our reputation is based not only on quality work but also on the attention and care we provide to our customers and their cars.

Potential customers for Phaethon’s Chariot are not limited to a specific geographical location. They are located throughout the United States and choose us based on our reputation and referrals. We expect that eventually, 50% of our customers will come from out of state.

The auto restoration market has seen significant growth in recent years and is expected to continue increasing until it levels off at double or triple the current market. Phaethon’s Chariot has received a referral from Car Barn Renewals, a reputable company with a waiting list of three years. This referral will increase our potential customer base and contribute to our word-of-mouth reputation.

In terms of competition, there are two other companies in the Centerton area that offer similar services. One has been in business for 40 years and has an excellent reputation within the restoration community, with a waiting list of three years. The other shop has been in business for 15 years but has a poor reputation and seldom has repeat business.

Phaethon’s Chariot’s labor rates are $45 per hour, which is lower than the $65 per hour charged by the other shops. We believe this competitive rate will not have a negative impact on our bottom line.

To market our services, Phaethon’s Chariot has implemented a modest program that includes flyers, discounts, newspaper and magazine ads, press releases, car shows, local radio stations, and a website. We consider our website to be one of our most effective marketing strategies, as it is linked to various classic car restoration-oriented websites and portals. The website features news about our business, FAQs, and pictures of cars we have restored and the restoration process.

Our market segmentation is based on the buyer’s income bracket and standard of living. The segments include material outlets, simple jobs, custom paint, restoration, and custom body work. The average age of our customers is between 30 and 65, with an average income of $60,000 per year. Most full restoration customers have incomes over $100,000. Our customers are predominantly male, with a college education, and reside in Centerton county and surrounding areas. The increasing coverage of our industry on television shows like "American Muscle Car" and "Dream Car Garage" has contributed to the growth of the auto restoration industry, which is now a billion dollar a year industry in the United States.

Year 1 Year 2 Year 3 Year 4 Year 5

Potential Customers Growth CAGR

Males 30 to 65 years old 70% 20 34 58 99 168 70.24%

Other 30% 10 10 10 13 17 14.19%

Total 57.58% 30 44 68 112 185 57.58%

4.2 Target Market Segment Strategy

Our target market strategy includes using local radio and television stations and advertising in publications such as Hot Rod and Super Chevy magazines. These publications are distributed to people interested in old American cars and muscle cars. We use emotions to persuade people to restore their old cars with our various advertising methods, such as flyers, discounts, newspapers, press releases, magazine articles, and our website. Phaethon’s Chariot will use every means possible to convey our message to the public.

Our market strategy is to flood magazines and airwaves with our shop’s advertisements during morning and afternoon drive times. This is when more people listen to the radio, increasing the likelihood of gaining customers. The magazines reach hundreds of thousands of people every month, so converting even a small percentage to sales will lead to success. We also join the chamber of commerce to network our business, use flyers at car shows, and distribute business cards.

4.3 Service Business Analysis

To develop a suitable market strategy for Phaethon’s Chariot, we contacted other local industry players in the greater Centerton area. We called Classy Chassis and discovered that their labor rate is $65 per hour and it would take about 600 hours of labor plus parts to restore a car, resulting in a cost of $39,000. We also spoke with Khamm Zhaapht from Car Barn Renewals and found out that he has a three-year waiting list for his services.

4.3.1 Competition and Buying Patterns

Competition in this business is based on customer loyalty and positive word of mouth. Building trust and delivering above customer expectations is crucial. At Phaethon’s Chariot, we set ourselves apart with our high standards for professionalism, cleanliness, and efficiency. Our prices are reasonable, and we use only the highest quality parts and supplies. In addition, our shop environment is professional and comfortable for customers.

Strategy and Implementation Summary

Image is key to making inroads into the higher echelons of auto restoration. Phaethon’s Chariot’s strategy is to lift its image through advertising in prestigious trade publications, networking with the Chamber of Commerce, and marketing to a select group of people in the target market area.

5.1 Competitive Edge

Our competitive edge comes from our commitment to hard work and customer satisfaction. We only produce top-quality work that is show-ready when it leaves the shop. This generates positive word of mouth and brings in work from past and present customers.

To develop an attractive image to the trade, we advertise in Hemmings Motor News and in the regional telephone directory Yellow Pages. We also join the Chamber of Commerce and invest in the development of a top-quality logo and photography. Participating in local car shows is another image-building tactic. In addition to these activities, we directly market to target clients who attend car shows and use color literature and portfolio presentations to showcase our work. Networking with other professionals in the restoration world is also important.

5.3 Sales Strategy

Our sales strategy involves generating sales through our website, the Chamber of Commerce, and effective marketing tactics. We transfer administrative tasks away from the owner, allowing them to focus on meeting with clients, networking, and marketing the shop. We prioritize customer service and communication, responding promptly to important inquiries. We adopt a "salesman’s" approach when approaching prospects and keep detailed notes on each client.

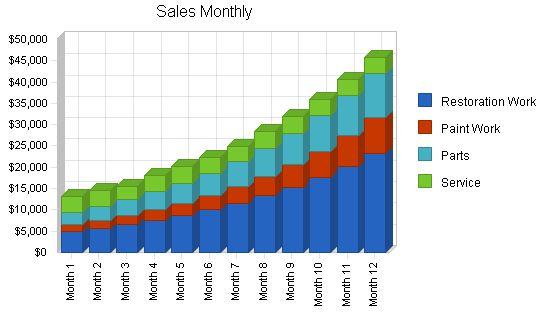

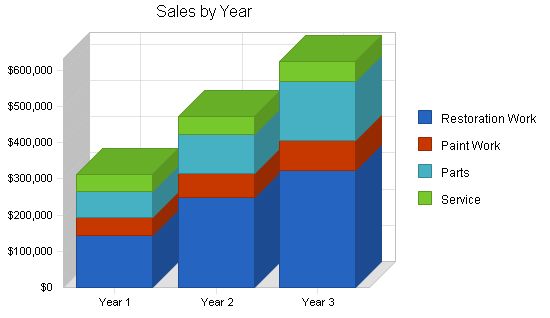

5.3.1 Sales Forecast

Our sales forecast is divided into major categories of restoration work, paint work, and service. We estimate a 10% market share in the local restoration market by FY 2006 and aim to complete one full restoration project each month. As our market share grows, we plan to raise our shop rates while remaining competitively priced.

Sales Forecast:

Restoration Work:

Year 1: $145,008

Year 2: $250,000

Year 3: $324,000

Paint Work:

Year 1: $49,236

Year 2: $64,007

Year 3: $83,209

Parts:

Year 1: $72,399

Year 2: $108,599

Year 3: $162,899

Service:

Year 1: $44,400

Year 2: $48,800

Year 3: $53,600

Total Sales:

Year 1: $311,044

Year 2: $471,406

Year 3: $623,707

Direct Cost of Sales:

Restoration Work:

Year 1: $26,717

Year 2: $50,000

Year 3: $64,800

Paint Work:

Year 1: $9,063

Year 2: $12,801

Year 3: $16,642

Parts:

Year 1: $13,000

Year 2: $19,548

Year 3: $29,322

Service:

Year 1: $17,760

Year 2: $19,520

Year 3: $21,440

Subtotal Direct Cost of Sales:

Year 1: $66,540

Year 2: $101,869

Year 3: $132,203

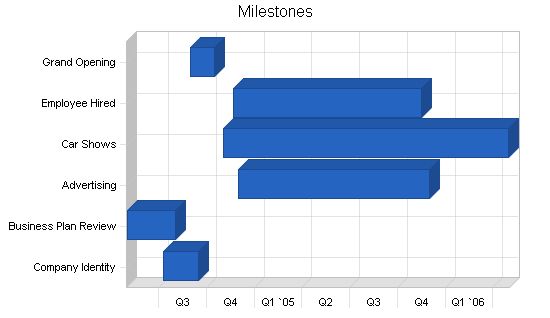

5.4 Milestones:

The milestone table serves as a detailed flow-chart for setting up the restoration shop and ensuring a smooth execution of tasks leading up to the Grand Opening. Each manager is assigned specific duties based on their expertise. The milestone table also marks the beginning of the 2005 marketing plan.

Milestones:

– Milestone: Start Date / End Date / Budget / Manager / Department

– Company Identity: 7/10/2004 / 9/15/2004 / $7,500 / Isoroku / Marketing

– Business Plan Review: 5/1/2004 / 8/1/2004 / $0 / Isoroku / Finance

– Advertising: 12/1/2004 / 12/1/2005 / $42,000 / Isoroku / Marketing

– Car Shows: 11/1/2004 / 5/1/2006 / $4,800 / Isoroku / Marketing

– Employee Hired: 11/20/2004 / 11/16/2005 / $20,800 / Jane / HR

– Grand Opening: 8/30/2004 / 10/15/2004 / $1,000 / Jane / Marketing

– Total Budget: $76,100

Web Plan Summary:

Our website offers current information on our services, showcases recent restorations, upcoming car shows, and special events. It will be promoted on all major search engines and linked to City Search.com® and other classic car restoration-oriented websites and portals. We also promote it through blog directories, online malls, and news outlets. The owner developed the website himself, providing news about our business, reasons to restore old cars, and warranty information. The home page summarizes our shop, while the overview page contains our mission statement. The services page describes what we offer, and the news page provides information on upcoming events and car shows we sponsor.

Management Summary:

Phaethon’s Chariot Restorations currently has two employees who work 40 hours per week. Our goal is to use no sub-contractors and hire new employees as work demand increases. By March 2005, we expect to hire two additional technicians. By June 2005, we will hire a new painter/body man, increasing to a full 40-hour week by September. By the end of 2006, we will have five full-time technicians. A sixth technician may be added in FY 2007 or 2008, depending on demand volume.

Personnel Plan:

– Owner: $21,000 (Year 1) / $40,000 (Year 2) / $45,000 (Year 3)

– Foreman: $17,400 (Year 1) / $22,400 (Year 2) / $30,000 (Year 3)

– Sheet Metal & Body Technicians: $12,831 (Year 1) / $45,000 (Year 2) / $50,000 (Year 3)

– Automotive Mechanics: $15,162 (Year 1) / $52,000 (Year 2) / $58,000 (Year 3)

– Painting Technician: $6,750 (Year 1) / $24,000 (Year 2) / $27,000 (Year 3)

– Admin Asst.: $9,000 (Year 1) / $20,800 (Year 2) / $22,800 (Year 3)

– Total People: 6 (Year 1) / 8 (Year 2) / 8 (Year 3)

– Total Payroll: $82,143 (Year 1) / $204,200 (Year 2) / $232,800 (Year 3)

Phaethon’s Chariot Restorations does not require substantial inventory outlays, and sales are primarily cash/credit card based, avoiding cash-flow deficits. Start-up costs will be financed by the owner’s personal investment and a 7-year loan.

Start-up Funding:

– Start-up Expenses to Fund: $23,500

– Start-up Assets to Fund: $142,000

– Total Funding Required: $165,500

– Assets: $132,000 (Non-cash Assets from Start-up) / $10,000 (Cash Requirements from Start-up) / $0 (Additional Cash Raised) / $10,000 (Cash Balance on Starting Date) / $142,000 (Total Assets)

– Liabilities: $0 (Current Borrowing) / $119,000 (Long-term Liabilities) / $6,000 (Accounts Payable) / $5,500 (Other Current Liabilities) / $130,500 (Total Liabilities)

– Capital: $35,000 (Planned Investment: Owner) / $0 (Investor) / $0 (Additional Investment Requirement) / $35,000 (Total Planned Investment) / ($23,500) (Loss at Start-up) / $11,500 (Total Capital)

– Total Capital and Liabilities: $142,000

– Total Funding: $165,500

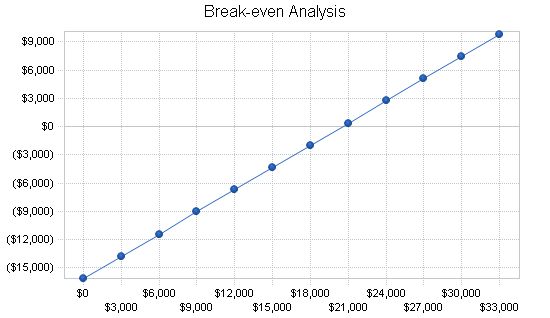

Break-even Analysis:

The Break-even Analysis is based on average first-year figures for total sales, average cost of sales, and monthly operating expenses. Monthly sales need to reach the amounts shown in the table and chart below to break even.

Break-even Analysis

Monthly Revenue Break-even: $20,506

Assumptions:

– Average Percent Variable Cost: 21%

– Estimated Monthly Fixed Cost: $16,120

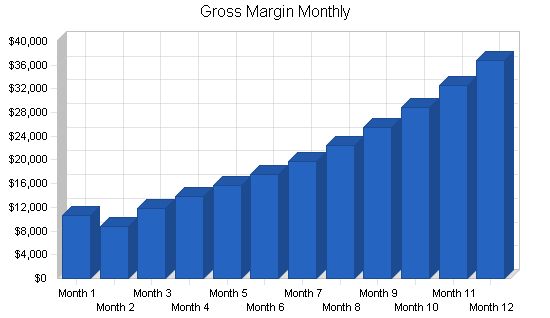

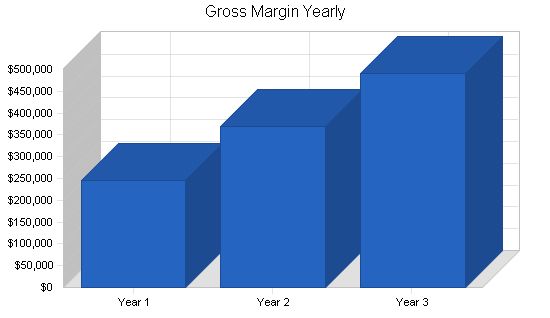

8.3 Projected Profit and Loss

The Profit and Loss table shows the company’s expected steady growth in profitability over the next three years of operations.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $311,044 | $471,406 | $623,707 |

| Direct Cost of Sales | $66,540 | $101,869 | $132,203 |

| Other Costs of Sales | $0 | $0 | $0 |

| Total Cost of Sales | $66,540 | $101,869 | $132,203 |

| Gross Margin | $244,504 | $369,537 | $491,504 |

| Gross Margin % | 78.61% | 78.39% | 78.80% |

| Expenses | |||

| Payroll | $82,143 | $204,200 | $232,800 |

| Marketing/Promotion | $22,500 | $22,500 | $22,500 |

| Depreciation | $19,992 | $20,000 | $20,000 |

| Rent | $21,600 | $15,200 | $24,000 |

| Utilities | $15,200 | $24,000 | $0 |

| Insurance | $24,000 | $0 | $0 |

| Payroll Taxes | $0 | $0 | $0 |

| Fixtures | $8,000 | $0 | $0 |

| Total Operating Expenses | $193,435 | $285,900 | $299,300 |

| Profit Before Interest and Taxes | $51,069 | $83,637 | $192,204 |

| EBITDA | $71,061 | $103,637 | $212,204 |

| Interest Expense | $6,672 | $5,852 | $4,720 |

| Taxes Incurred | $13,319 | $23,335 | $56,245 |

| Net Profit | $31,078 | $54,449 | $131,239 |

| Net Profit/Sales | 9.99% | 11.55% | 21.04% |

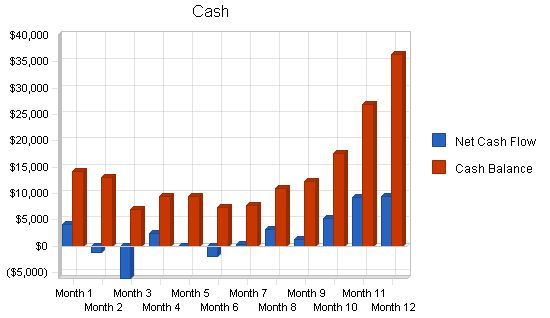

8.4 Projected Cash Flow

Phaethon’s Chariot Restorations benefits from a low cost of goods sold and high gross margin, as it is the company’s policy for clients to provide the parts for the restoration. Clients have the option to purchase the parts themselves or have us make the purchase on their behalf. This custom approach eliminates inventory costs and accounts payable.

With a strong cash flow, the company plans to utilize this asset to expand its markets and production capacity in the future.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Sales | $311,044 | $471,406 | $623,707 |

| Subtotal Cash from Operations | $311,044 | $471,406 | $623,707 |

| Sales Tax, VAT, HST/GST Received | $20,716 | $31,396 | $41,539 |

| New Current Borrowing | $5,000 | $7,500 | $5,000 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $336,759 | $510,301 | $670,246 |

| Expenditures from Operations | |||

| Cash Spending | $82,143 | $204,200 | $232,800 |

| Bill Payments | $176,173 | $209,073 | $244,046 |

| Subtotal Spent on Operations | $258,316 | $413,273 | $476,846 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $20,716 | $31,396 | $41,539 |

| Principal Repayment of Current Borrowing | $3,500 | $6,000 | $7,500 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $16,476 | $17,492 | $18,570 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $2,400 | $4,000 | $4,000 |

| Dividends | $9,000 | $0 | $0 |

| Subtotal Cash Spent | $310,408 | $472,160 | $548,455 |

| Net Cash Flow | $26,352 | $38,141 | $121,792 |

| Cash Balance | $36,352 | $74,493 | $196,284 |

8.5 Projected Balance Sheet

The following table presents the Balance Sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Current Assets | |||

| Cash | $36,352 | $74,493 | $196,284 |

| Inventory | $17,818 | $27,279 | $35,402 |

| Other Current Assets | $30,000 | $30,000 | $30,000 |

| Total Current Assets | $84,170 | $131,772 | $261,686 |

| Long-term Assets | |||

| Long-term Assets | $102,400 | $106,400 | $110,400 |

| Accumulated Depreciation | $19,992 | $39,992 | $59,992 |

| Total Long-term Assets | $82,408 | $66,408 | $50,408 |

| Total Assets | $166,578 | $198,180 | $312,094 |

| Current Liabilities | |||

| Accounts Payable | $23,476 | $16,621 | $20,366 |

| Current Borrowing | $1,500 | $3,000 | $500 |

| Other Current Liabilities | $5,500 | $5,500 | $5,500 |

| Subtotal Current Liabilities | $30,476 | $25,121 | $26,366 |

| Long-term Liabilities | $102,524 | $85,032 | $66,462 |

| Total Liabilities | $133,000 | $110,153 | $92,828 |

| Paid-in Capital | $35,000 | $35,000 | $35,000 |

| Retained Earnings | ($32,500) | ($1,422) | $53,027 |

| Earnings | $31,078 | $54,449 | $131,239 |

| Total Capital | $33,578 | $88,027 | $219,266 |

| Total Liabilities and Capital | $166,578 | $198,180 | $312,094 |

| Net Worth | $33,578 | $88,027 | $219,266 |

8.6 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Industry Standards, Antique and Classic Automobile Restoration services, SIC code 7532 are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 51.56% | 32.31% | 1.55% |

| Percent of Total Assets | ||||

| Inventory | 10.70% | 13.76% | 11.34% | 9.44% |

| Other Current Assets | 18.01% | 15.14% | 9.61% | 29.30% |

| Total Current Assets | 50.53% | 66.49% | 83.85% | 52.30% |

| Long-term Assets | 49.47% | 33.51% | 16.15% | 47.70% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 23.476 | 16.621 | 20.366 | 20.70% |

| Current Borrowing | 1.500 | 3.000 | 0.500 | 20.70% |

| Other Current Liabilities | 5.500 | 0.23 | 0.28 | 20.70% |

| Total Liabilities | 133000 | 110,153 | 92.83 | 49.64% |

| Net Worth | 20.16% | 44.42% | 70.26% | 50.36% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 78.61% | 78.39% | 78.80% | 100.00% |

| Selling, General & Administrative Expenses | 68

Personnel Plan: |

|||

| Owner | 0% | $1,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 |

| Foreman | 0% | $0 | $1,000 | $1,000 | $1,000 | $1,500 | $1,500 | $1,700 | $1,700 | $2,000 | $2,000 | $2,000 | $2,000 |

| Sheet Metal & Body Technician(s) | 0% | $0 | $0 | $0 | $0 | $0 | $1,833 | $1,833 | $1,833 | $1,833 | $1,833 | $1,833 | $1,833 |

| Automotive Mechanic(s) | 0% | $0 | $0 | $0 | $0 | $0 | $2,166 | $2,166 | $2,166 | $2,166 | $2,166 | $2,166 | $2,166 |

| Painting Technician | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $1,500 | $1,500 | $1,750 | $2,000 |

| Admin Asst. | 0% | $0 | $0 | $0 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 |

| Total People | 1 | 2 | 2 | 3 | 3 | 5 | 5 | 5 | 6 | 6 | 6 | 6 | |

| Total Payroll | $1,000 | $2,000 | $2,000 | $4,000 | $4,500 | $8,499 | $8,699 | $8,699 | $10,499 | $10,499 | $10,749 | $10,999 |

Pro Forma Profit and Loss:

| Sales | $13,100 | $14,465 | $15,429 | $18,122 | $20,176 | $22,232 | $24,935 | $28,334 | $31,890 | $35,971 | $40,656 | $45,734 | ||

| Direct Cost of Sales | $2,428 | $5,609 | $3,585 | $4,202 | $4,506 | $4,748 | $5,178 | $5,810 | $6,418 | $7,142 | $8,004 | $8,909 | ||

| Other Costs of Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Total Cost of Sales | $2,428 | $5,609 | $3,585 | $4,202 | $4,506 | $4,748 | $5,178 | $5,810 | $6,418 | $7,142 | $8,004 | $8,909 | ||

| Gross Margin | $10,673 | $8,856 | $11,844 | $13,920 | $15,670 | $17,484 | $19,756 | $22,524 | $25,472 | $28,829 | $32,652 | $36,824 | ||

| Gross Margin % | 81.47% | 61.22% | 76.76% | 76.81% | 77.67% | 78.64% | 79.23% | 79.49% | 79.87% | 80.14% | 80.31% | 80.52% | ||

| Expenses | ||||||||||||||

| Payroll | $1,000 | $2,000 | $2,000 | $4,000 | $4,500 | $8,499 | $8,699 | $8,699 | $10,499 | $10,499 | $10,749 | $10,999 | ||

| Marketing/Promotion | $0 | $1,000 | $1,000 | $1,500 | $1,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | ||

| Depreciation | $1,666 | $1,666 | $1,666 | $1,666 | $1,666 | $1,666 | $1,666 | $1,666 | $1,666 | $1,666 | $1,666 | $1,666 | ||

| Rent | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | ||

| Utilities | $2,000 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | ||

| Insurance | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | ||

| Payroll Taxes | 15% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Fixtures | $1,000 | $1,000 | $1,200 | $300 | $300 | $300 | $300 | $300 | $300 | $1,000 | $1,000 | $1,000 | ||

| Total Operating Expenses | $9,466 | $10,666 | $10,866 | $12,466 | $12,966 | $17,965 | $18,165 | $18,165 | $19,965 | $20,665 | $20,915 | $21,165 | ||

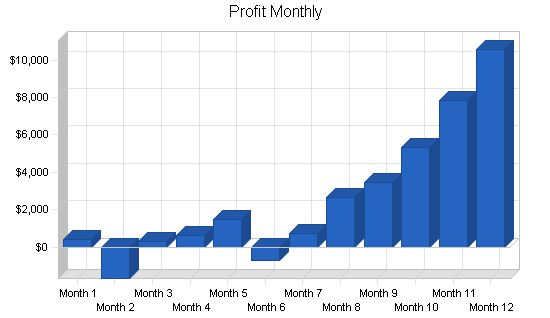

| Profit Before Interest and Taxes | $1,207 | ($1,810) | $978 | $1,454 | $2,704 | ($481) | $1,591 | $4,359 | $5,507 | $8,164 | $11,737 | $15,659 | ||

| EBITDA | $2,873 | ($144) | $2,644 | $3,120 | $4,370 | $1,185 | $3,257 | $6,025 | $7,173 | $9,830 | $13,403 | $17,325 | ||

| Interest Expense | $588 | $590 | $587 | $572 | $561 | $554 | $548 | $549 | $534 | $527 | $536 | $525 | ||

| Taxes Incurred | $185 | ($720) | $117 | $264 | $643 | ($311) | $313 | $1,143 | $1,492 | $2,291 | $3,360 | $4,540 | ||

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $13,100 | $14,465 | $15,429 | $18,122 | $20,176 | $22,232 | $24,935 | $28,334 | $31,890 | $35,971 | $40,656 | $45,734 | |

| Subtotal Cash from Operations | $13,100 | $14,465 | $15,429 | $18,122 | $20,176 | $22,232 | $24,935 | $28,334 | $31,890 | $35,971 | $40,656 | $45,734 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 6.66% | $872 | $963 | $1,028 | $1,207 | $1,344 | $1,481 | $1,661 | $1,887 | $2,124 | $2,396 | $2,708 | $3,046 |

| New Current Borrowing | $0 | $1,000 | $1,000 | $0 | $0 | $0 | $0 | $1,000 | $0 | $0 | $2,000 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $13,972 | $16,428 | $17,457 | $19,328 | $21,520 | $23,713 | $26,595 | $31,221 | $34,014 | $38,367 | $45,363 | $48,779 | |

| Expenditures | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Expenditures from Operations | |||||||||||||

| Cash Spending | $1,000 | $2,000 | $2,000 | $4,000 | $4,500 | $8,499 | $8,699 | $8,699 | $10,499 | $10,499 | $10,749 | $10,999 | |

| Bill Payments | $6,429 | $13,056 | $18,478 | $8,061 | $12,625 | $13,125 | $13,323 | $14,762 | $16,595 | $17,542 | $19,982 | $22,195 | |

| Subtotal Spent on Operations | $7,429 | $15,056 | $20,478 | $12,061 | $17,125 | $21,624 | $22,022 | $23,461 | $27,094 | $28,041 | $30,731 | $33,194 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $872 | $963 | $1,028 | $1,207 | $1,344 | $1,481 | $1,661 | $1,887 | $2,124 | $2,396 | $2,708 | $3,046 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $500 | $1,000 | $500 | $0 | $0 | $0 | $1,000 | $0 | $0 | $500 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $1,336 | $1,342 | $1,349 | $1,356 | $1,363 | $1,370 | $1,376 | $1,383 | $1,390 | $1,397 | $1,404 | $1,410 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | |

| Dividends | $0 | $0 | $0 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | |

| Subtotal Cash Spent | $9,837 | $17,561 | $23,555 | $16,824 | $21,532 | $25,674 | $26,259 | $27,931 | $32,808 | $33,034 | $36,042 | $39,350 | |

| Net Cash Flow | $4,135 | ($1,133) | ($6,098) | $2,504 | ($12) | ($1,961) | $336 | $3,290 | $1,206 | $5,333 | $9,321 | $9,429 | |

| Cash Balance | $14,135 | $13,003 | $6,904 | $9,409 | $9,397 | $7,435 | $7,772 | $11,062 | $12,268 | $17,601 | $26,922 | $36,352 | |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!