Real Estate Website Business Plan

Our market presence, due to luck and arrogance, positions us to revolutionize the real estate industry. The growth of e-commerce and the Internet doesn’t affect our business plan. The Internet is merely a tool we use to provide services to agents while complying with state and federal laws. We offer agents 100% commission, a privilege typically reserved for the most successful realtors, for a monthly fee of $200 plus $100 per listing or sale. Our projections show that we can achieve this while generating substantial profits. By joining our company, agents save thousands of dollars, while consumers also benefit financially. Agents affiliated with Amerihall are known as Amerihall Realest®, indicating their expertise and professionalism in the industry.

The program partners excel in business automation and understanding the needs of real estate agents. With the Web’s potential for change, we have created a website catering to the real estate industry, including agents, clients, suppliers, and educational services. Our vision includes providing exclusive continuing education classes to agents through our website, allowing them to fulfill state requirements conveniently from home for a fee. We aim to automate the entire process, including state license renewal.

We are the future of real estate, and we believe that by collaborating with the following organizations, we can revolutionize the industry.

1.1 Strategic Alliances

AT&T will meet our Web needs and automate servers for our agents to receive calls through our virtual floor plan. Clients can enter an agent’s extension when calling our toll-free number, which will then be forwarded to the agent’s home office. If a client doesn’t have an extension, the call will be forwarded to the closest Amerihall agent. AT&T has anticipated our growth, automating their systems to handle the demand. They will also provide wide-band Internet access through cable modems. A script page is being developed for our agents to easily sign up and receive discounted installation for fast Internet access. Our company’s growth relies on clients and agents adapting to technology, making AT&T the best choice to implement these future products.

Bank of America provides merchant services for our billing needs and has developed a system for our agents to deposit escrow checks into our corporate account instantly. They also certify our escrow accounts monthly, ensuring the highest quality control in the industry. Bank of America’s software developers are working on additional features to allow agents and clients to track the transaction progress.

Sterling Capital Mortgage offers our agents the ability to go online and run credit history checks on clients for free. A prequalification letter is generated immediately for submitting offers. This system is exclusive to Amerihall.

Lowen Signs, the largest real estate sign manufacturer, has developed a dedicated page for our agents to order personalized Amerihall signs, shipped directly to them.

1.2 Service Description

Our product is available on the Internet, providing agents with the power to handle all real estate activities. Agents can access regional multiple listing services, post listings, and report sales. Our goal is to offer all the services of a traditional office without the need for agents to physically visit.

Agents can order paper supplies from our vendor area, selecting style, quantity, and personal information. The order will be fulfilled and shipped directly to their home office. Similar systems are in place for house signs, insurance, inspection agencies, real estate lawyers, and mortgage companies. Agents can also bill services, including monthly fees, to credit cards.

We provide a blanket Errors & Omissions insurance policy, paying the insurance carrier annually and billing agents quarterly. Agents also receive a nationally advertised toll-free number, which can be used for marketing purposes. Calls are forwarded to agents’ home offices using extensions. If no Amerihall agent is available, the call is referred to a non-participating agent with a 20% referral fee.

We have a live online help desk during business hours and an email help desk available 24/7. Agents can download all necessary forms from the website. We also plan to implement a live chat for agents to communicate with each other and our staff.

1.3 Description of Company

Amerihall is the combination of several real estate companies, focusing on creative marketing through technology. We aim to provide individual agents with the ability to work from home using their own equipment. Amerihall agents pay a flat fee and receive 100% of their commissions.

1.4 Mission

Our mission is to change the real estate industry by reducing the expense of a traditional office and replacing it with a virtual office through the Internet. By saving agents thousands of dollars, they can offer lower commissions to consumers and ultimately save the consumer money on property sales.

1.5 Financing Requirements

The owner has invested $125,000 into the company, with the remaining funds coming from new memberships and service sales. Outside funding will be sought for national expansion, using direct marketing campaigns targeted towards state licensing agencies.

We have the knowledge and foresight to help the industry evolve. We provide all the tools of a traditional office at a fraction of the cost. Vendors in the industry can directly market their products and services to Amerihall agents. Clients can list properties without the expense of a full-service real estate company.

2.1 Organizational Structure

Each regional office has a managing broker, clerical secretary, and regional sales administrator. At the national level, we have a managing director, director of Realest® Relations, clerical secretaries, online help representatives, national convention administrators, and a convention/sales coordinator.

2.2 Guarantees and Warranties

Our service agreement includes all state requirements and provides technical support. Hardware warranties are provided by the computer manufacturer. Errors and Omissions Insurance is mandatory, with escrow accounts certified monthly by a Bank of America subsidiary. Agents must be members of the National Association of Realtors and adhere to their rules.

2.3 Start-up Summary

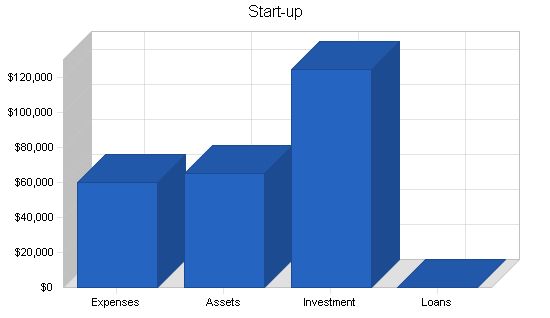

Our start-up is fully financed by David Hall. Revenues will fuel the company’s growth, with the potential for outside funding to accelerate national expansion.

Start-up Requirements:

– Legal: $15,000

– Stationery etc.: $1,200

– Brochures: $6,000

– Consultants: $2,000

– Insurance: $850

– Rent: $0

– Research and Development: $20,000

– Expensed Equipment: $12,000

– Other: $3,000

– Total Start-up Expenses: $60,050

Start-up Assets:

– Cash Required: $65,000

– Other Current Assets: $0

– Long-term Assets: $0

– Total Assets: $65,000

Total Requirements: $125,050

Start-up Funding:

– Start-up Expenses to Fund: $60,050

– Start-up Assets to Fund: $65,000

– Total Funding Required: $125,050

Assets:

– Non-cash Assets from Start-up: $0

– Cash Requirements from Start-up: $65,000

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $65,000

– Total Assets: $65,000

Liabilities and Capital:

– Liabilities: $0

– Current Borrowing: $0

– Long-term Liabilities: $0

– Accounts Payable (Outstanding Bills): $0

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $0

Capital:

– Planned Investment:

– David Hall: $125,050

– Investor 2: $0

– Other: $0

– Additional Investment Requirement: $0

– Total Planned Investment: $125,050

– Loss at Start-up (Start-up Expenses): ($60,050)

– Total Capital: $65,000

Total Capital and Liabilities: $65,000

Total Funding: $125,050

2.4 Technology:

We will allocate a significant portion of our profits to develop and upgrade computer equipment in order to better serve our agents and stay ahead of technology trends. Capital requirements for the project will only slightly increase over the first three years, as our business plan template can be easily replicated across states. Our expenses will primarily focus on long-term maintenance and upgrades, not exceeding 2% of gross revenues.

Market Analysis Summary:

This innovative plan is revolutionizing the future of real estate. No existing franchised or corporate-owned real estate company can compete with the fees and subsequent profits established by our industry plan.

Even if real estate sales become automated to the point of eliminating the need for real estate agents, our company will maintain a strong presence in the FSBO (For Sale By Owner) market. We are committed to embracing inevitable change and possess the foresight to adapt to a profitable future in the industry.

3.1 Market Segmentation:

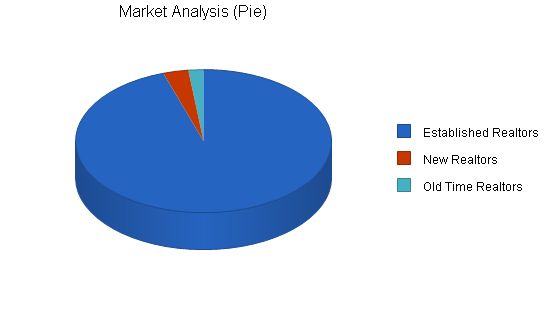

– Established Realtors: The majority of our market consists of tech-savvy, forward-thinking realtors who constantly seek new ways to increase their profit margin. They have already embraced a 100% commission program, established a home office, and have a strong online presence. These agents view our company as the future of real estate.

– New Real Estate Agents: We anticipate that the segment of new agents will be smaller than our Established Realtors segment. Inexperienced agents will benefit from the hands-on training provided in traditional real estate offices, but as technology advances and our website matures, they too will find value in Amerihall.

– Old Timers: This segment, characterized by resistance to change, is predicted to experience the slowest growth. They may be less willing to embrace new technology compared to the Established Realtors.

Market Analysis

Potential Customers Growth CAGR

Established Realtors 43% 15,000 21,450 30,674 43,864 62,726 43.00%

New Realtors 5% 500 525 551 579 608 5.01%

Old Time Realtors 3% 300 309 318 328 338 3.03%

Total 41.68% 15,800 22,284 31,543 44,771 63,672 41.68%

Target Market Segment Strategy

Originally our target will be experienced, computer-literate agents in Illinois. We will expand nationally after two years. Our research shows that initially, our clients will be aged 30 to 45, with annual sales between $1.5 and $5 million. The clientele should be in northwest suburbs, expanding to western suburbs, metropolitan Chicago, and rural Illinois. We will re-evaluate the growth market to determine the future plan.

Market Needs

With our focus on e-commerce, our business can provide specialized real estate software to all real estate agents, including competitors.

Phase 2 of our plan will focus on clients looking to sell real estate on their own (FSBO – For Sale By Owner). This market is growing rapidly, and research shows a decline in top-producing real estate agents. We aim to provide full-service real estate sales at a fraction of the cost of traditional real estate offices.

Currently, traditional real estate offices charge approximately 6% commission on the total sale. This figure can reach as high as 10% for commercial properties. A home selling for $200,000 will cost $12,000 in commissions alone, not to mention legal fees and closing costs. It is evident why clients are looking for alternatives. In Illinois alone, there are 49,000 licensed real estate agents with a 98.2% share of all sales. However, 82% of listings are sold by other agents. Our proposal for Phase 2 is to establish a revenue base from the growing FSBO market.

Our plan is to initiate a Web-based tool that allows the public to list their properties directly into the Multiple Listing Service (MLS). The advantage is that this can be accomplished by paying only 2.5% to 3.5%, compared to the industry standard of 6%. The public will also receive offers from other realtors, who will earn a commission upon closing.

If clients need a full-service realtor at any point, they can negotiate a deal with a local Amerihall Realest® agent.

Our agents benefit from added income when services are rendered. We hope that agents will accept our proposed strategy to tap into a new market instead of considering it a threat to their livelihood.

Clients benefit by saving thousands of dollars when taking responsibility for showing their homes themselves, a task that is increasingly performed by consumers in the industry.

Our share of the profit is 1% commission on the sale, and no overhead on our part. This establishes a future market in this ever-changing environment. This phase of the plan will not be initiated until the Web volume is appropriate.

Market Growth

Our initial plan includes mailing 27,000 Amerihall brochures to all active realtors within the Multiple Listing Services of Northern Illinois (MLSNI). We expect a response of at least 1,800 agents, who will receive a start-up package. We project gaining 1,000 new agents with the bulk of agents joining when their contracts expire with their existing offices. Within the first year, we anticipate having 1,500 agents.

Service Business Analysis

Our plan is simple: we will have no competition due to the structure of established national real estate companies. Franchise-based companies like Re/Max, Century 21, and Coldwell Banker cannot compete, while independently owned offices have too much overhead to compete with us.

Competitive Edge

We project that all agents working for Amerihall will increase their profit margin by 70%. By volume, our advertising and sales will stand out above other real estate companies. Our agents will offer their services for 25% of the normal rates and still make a significant profit.

Our agents will change the industry standard by underbidding the competition to the point where traditional real estate companies cannot compete due to high operating costs.

Main Competitors

Our main competitors are Re/Max and Century 21. We expect resistance from these industry leaders. They may attempt a legal assault on our company or focus on our credibility. However, we can defend these situations with a professional image and the technology our agents bring to the table.

Competition and Buying Patterns

Our knowledge of realtors’ needs and the uniqueness of our company give us an exceptional lead over any competitor. We are concerned about copycat companies and are using copyrights and patent laws to secure our position.

Strategy and Implementation Summary

During the first phase of our plan, we will focus on the region of Illinois covered by the MLSNI. This service is used by all realtors in the northwest region of the state. Amerihall decided to use this region as its test market to prove the validity of our corporate plans and test all the features associated with the different phases of the operation.

Sales Strategy

Our sales strategy is to automate the process so agents can apply for membership on the website and print the required forms for application to our company, the state, and the appropriate MLS.

Our services are automated and based on volume. Agents must join our company or succumb to the industry change. Our business plan’s patent pending status will hopefully prevent copycat companies and allow us to establish a strong foothold in the industry.

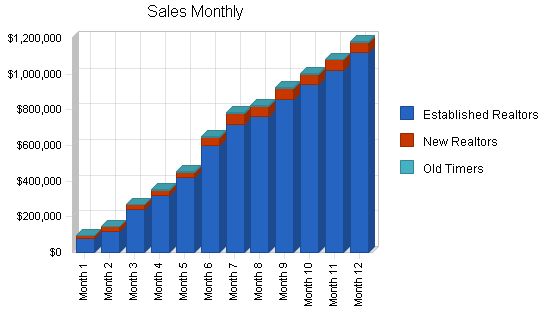

We expect strong sales growth for each product in the first few months. August through September may have slow sales due to the process of transferring agents from one office to another. Our services will attract more realtors steadily over the first several years, and we will be tested by the volume of agents entering the office, particularly in the first year.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Unit Sales | |||

| Established Realtors | 18,000 | 54,000 | 180,000 |

| New Realtors | 1,790 | 5,370 | 17,900 |

| Old Timers | 176 | 528 | 1,760 |

| Total Unit Sales | 19,966 | 59,898 | 199,660 |

| Unit Prices | Year 1 | Year 2 | Year 3 |

| Established Realtors | $400.00 | $400.00 | $400.00 |

| New Realtors | $300.00 | $300.00 | $300.00 |

| Old Timers | $250.00 | $250.00 | $250.00 |

| Sales | |||

| Established Realtors | $7,200,000 | $21,600,000 | $72,000,000 |

| New Realtors | $537,000 | $1,611,000 | $5,370,000 |

| Old Timers | $44,000 | $132,000 | $440,000 |

| Total Sales | $7,781,000 | $23,343,000 | $77,810,000 |

| Direct Unit Costs | Year 1 | Year 2 | Year 3 |

| Established Realtors | $65.00 | $65.00 | $65.00 |

| New Realtors | $60.00 | $60.00 | $60.00 |

| Old Timers | $60.00 | $60.00 | $60.00 |

| Direct Cost of Sales | |||

| Established Realtors | $1,170,000 | $3,510,000 | $11,700,000 |

| New Realtors | $107,400 | $322,200 | $1,074,000 |

| Old Timers | $10,560 | $31,680 | $105,600 |

| Subtotal Direct Cost of Sales | $1,287,960 | $3,863,880 | $12,879,600 |

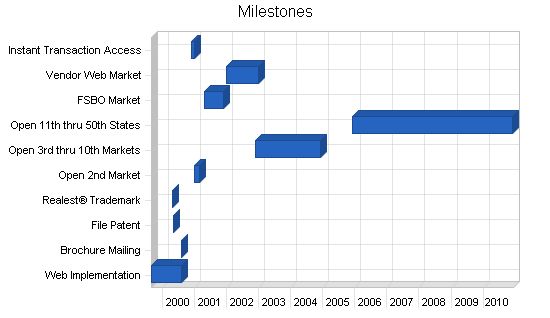

4.2 Milestones

The following table is self-explanatory, but the dates are not fixed. Our plan will vary based on capital. Everything listed in the table could be accomplished within a 12-month period, aligning with Internet growth technology.

The table doesn’t show the commitment behind it. Our business plan includes provisions for an analysis of planned vs actual performance, and we will hold monthly follow-up meetings to discuss variances and make course corrections.

Milestones:

– Web Implementation: 9/1/1999 – 8/1/2000, $20,000 Budget, Catherine, CG-2 Department

– Brochure Mailing: 8/10/2000 – 8/10/2000, $6,000 Budget, Ellisa, Corporate Department

– File Patent: 5/10/2000 – 5/10/2000, $2,000 Budget, Mertes, Legal Department

– Realest® Trademark: 5/1/2000 – 5/1/2000, $2,000 Budget, Mertes, Legal Department

– Open 2nd Market: 1/1/2001 – 3/1/2001, $5,000 Budget, David Hall, Corporate Department

– Open 3rd thru 10th Markets: 12/1/2002 – 12/1/2004, $65,000 Budget, David Hall, Corporate Department

– Open 11th thru 50th States: 12/1/2005 – 12/1/2010, $1,256,000 Budget, David Hall, Corporate Department

– FSBO Market: 5/1/2001 – 12/1/2001, $25,000 Budget, Catherine, CG-2 Department

– Vendor Web Market: 1/1/2002 – 1/1/2003, $40,000 Budget, Catherine, CG-2 Department

– Instant Transaction Access: 12/1/2000 – 1/1/2001, $100,000 Budget, Catherine, CG-2 Department

– Totals: $1,521,000 Budget

Management Summary:

The management in this plan is a strong point. Our Internet-based service allows for automation to be our key asset. This virtual office is the most automated office environment in the industry. Our planning is based on servicing all clients using an Internet-based system with low overhead. This process, though expensive initially, will lead to incredible profit over the years.

We keep each state-represented office to three full-time personnel, and the corporate office to 13 employees, allowing us to man the entire country with 163-170 personnel. Traditional offices have three personnel per office on average, servicing 30 agents.

In Illinois, there are over 42,000 agents with over 45,000 offices. The average office employs three full-time personnel and one part-time employee, totaling 13,500 full-time employees. A fully-staffed, National Amerihall corporate presence will need no more than 200 employees to service up to 525,000 agents, or one employee for every 2,625 agents. This compares to the national average of one employee for every 3.1 agents. This figure saves millions of dollars and makes us a formidable real estate company.

Personnel Plan:

From the outset, we keep staff to a minimum and prioritize automation. Our success depends on providing high-quality service at low cost. We use automated database applications and the Internet to achieve our goals.

The table summarizes our personnel expenditures for the first three years, with compensation increasing from less than $240,000 for the first year to over $2.1 million in the third. This plan balances fairness and expedience, aligning with our mission statement.

Management Team:

David Hall, Managing Director, founded Amerihall and previously founded Hall Properties Realty, Inc. He has expertise in the medical industry and office automation techniques.

Ellisa Hall, Director of Realest® Relations, manages office staff and bookkeeping. She has extensive experience in management positions and firsthand knowledge of major real estate companies.

We plan to hire two full-time realtors for office duties and client relations. Additionally, we aim to hire an Internet server administrator and marketing personnel for advertising.

We aim to finance growth mainly through cash flow, understanding that it may result in slower growth. Collection days are crucial, and our agents commit to a year lease with a 30-day cancellation policy. Payment is made monthly through direct withdrawal. Failure to make a payment locks agents out of the members area until the issue is resolved.

The owner plans to invest $125,000 from the liquidation of Hall Properties Realty, Inc.’s assets. The cash flow projections indicate a need for $65,000 of working capital in the early months of the first year. If unforeseen growth requires a new corporate site, additional financing may be necessary. We have identified three options for raising additional funds:

1. Sale of equity, raising between $200,000 and $300,000. Any shortfall can be funded through a line of credit or bank loan.

2. Seeking a medium-term loan of $200,000 and a line of credit of $60,000 from our bank. David Hall can provide security for part or all of this facility.

3. Seeking an additional $1 million or more for future growth to secure our national presence.

Important Assumptions:

The financial plan depends on several assumptions, including a strong economy without a major recession. We assume no unforeseen changes in technology that would make our products and services obsolete. Additionally, we assume no changes in laws that would interfere with the real estate market as it currently stands.

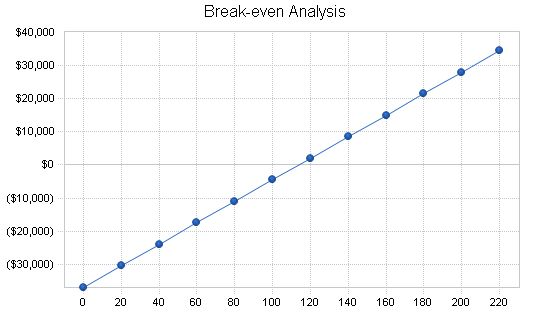

With fixed costs of $37,000 per month initially, we need to bill $45,000 to cover our costs.

Break-even Analysis:

Monthly Units Break-even: 114

Monthly Revenue Break-even: $44,342

Assumptions:

– Average Per-Unit Revenue: $389.71

– Average Per-Unit Variable Cost: $64.51

– Estimated Monthly Fixed Cost: $37,002

6.4 Projected Profit and Loss:

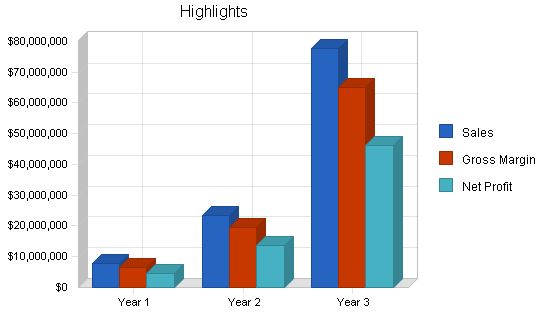

Our projected profit and loss is shown in the following chart and table. Sales will increase from $7.78 million in the first year to over $77 million in the third year, with significant profits even during the start-up phase of the business.

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $7,781,000 | $23,343,000 | $77,810,000 |

| Direct Cost of Sales | $1,287,960 | $3,863,880 | $12,879,600 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $1,287,960 | $3,863,880 | $12,879,600 |

| Gross Margin | $6,493,040 | $19,479,120 | $64,930,400 |

| Gross Margin % | 83.45% | 83.45% | 83.45% |

| Expenses | |||

| Payroll | $232,078 | $860,000 | $2,149,000 |

| Sales and Marketing and Other Expenses | $72,940 | $143,800 | $424,600 |

| Depreciation | $2,400 | $5,000 | $5,000 |

| Website | $55,000 | $100,000 | $100,000 |

| Utilities | $9,600 | $28,800 | $96,000 |

| Insurance | $1,200 | $2,400 | $7,200 |

| Rent | $36,000 | $50,300 | $51,200 |

| Payroll Taxes | $34,812 | $129,000 | $322,350 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $444,030 | $1,319,300 | $3,155,350 |

| Profit Before Interest and Taxes | $6,049,010 | $18,159,820 | $61,775,050 |

| EBITDA | $6,051,410 | $18,164,820 | $61,780,050 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $1,514,143 | $4,539,955 | $15,701,159 |

| Net Profit | $4,534,868 | $13,619,865 | $46,073,891 |

| Net Profit/Sales | 58.28% | 58.35% | 59.21% |

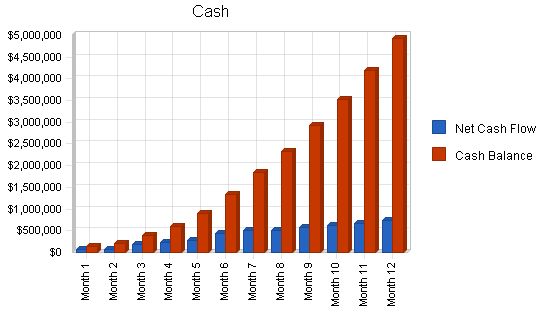

6.5 Projected Cash Flow:

The company’s projected cash flow analysis for FY2001-2003 is provided below.

Pro Forma Cash Flow

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $7,781,000 | $23,343,000 | $77,810,000 |

| Subtotal Cash from Operations | $7,781,000 | $23,343,000 | $77,810,000 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $7,781,000 | $23,343,000 | $77,810,000 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $232,078 | $860,000 | $2,149,000 |

| Bill Payments | $2,578,130 | $8,563,593 | $27,878,768 |

| Subtotal Spent on Operations | $2,810,208 | $9,423,593 | $30,027,768 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $100,000 | $120,000 | $130,000 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $2,910,208 | $9,543,593 | $30,157,768 |

| Net Cash Flow | $4,870,792 | $13,799,407 | $47,652,232 |

| Cash Balance | $4,935,792 | $18,735,199 | $66,387,430 |

6.6 Projected Balance Sheet

The following table shows managed but sufficient growth of net worth and a healthy financial position.

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $4,935,792 | $18,735,199 | $66,387,430 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $4,935,792 | $18,735,199 | $66,387,430 |

| Long-term Assets | |||

| Long-term Assets | $100,000 | $220,000 | $350,000 |

| Accumulated Depreciation | $2,400 | $7,400 | $12,400 |

| Total Long-term Assets | $97,600 | $212,600 | $337,600 |

| Total Assets | $5,033,392 | $18,947,799 | $66,725,030 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $433,524 | $728,066 | $2,431,406 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $433,524 | $728,066 | $2,431,406 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $433,524 | $728,066 | $2,431,406 |

| Paid-in Capital | $125,050 | $125,050 | $125,050 |

| Retained Earnings | ($60,050) | $4,474,818 | $18,094,683 |

| Earnings | $4,534,868 | $13,619,865 | $46,073,891 |

| Total Capital | $4,599,868 | $18,219,733 | $64,293,624 |

| Total Liabilities and Capital | $5,033,392 | $18,947,799 | $66,725,030 |

| Net Worth | $4,599,868 | $18,219,733 | $64,293,624 |

6.7 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 6531, Real Estate Agents and Managers, are shown for comparison.

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 200.00% | 233.33% | 3.60% |

| Percent of Total Assets | ||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 49.90% |

| Total Current Assets | 98.06% | 98.88% | 99.49% | 57.30% |

| Long-term Assets | 1.94% | 1.12% | 0.51% | 42.70% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 8.61% | 3.84% | 3.64% | 28.50% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 27.20% |

| Total Liabilities | 8.61% | 3.84% | 3.64% | 55.70% |

| Net Worth | 91.39% | 96.16% | 96.36% | 44.30% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 83.45% | 83.45% | 83.45% | 100.00% |

| Selling, General & Administrative Expenses |

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Unit Sales | |||||||||||||

| Established Realtors | 0% | 200 | 300 | 600 | 800 | 1,050 | 1,500 | 1,800 | 1,900 | 2,150 | 2,350 | 2,550 | 2,800 |

| New Realtors | 0% | 50 | 90 | 100 | 100 | 100 | 150 | 200 | 200 | 200 | 200 | 200 | 200 |

| Old Timers | 0% | 0 | 0 | 6 | 10 | 20 | 20 | 20 | 20 | 20 | 20 | 20 | 20 |

| Total Unit Sales | 250 | 390 | 706 | 910 | 1,170 | 1,670 | 2,020 | 2,120 | 2,370 | 2,570 | 2,770 | 3,020 | |

| Unit Prices | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Established Realtors | $400.00 | $400.00 | $400.00 | $400.00 | $400.00 | $400.00 | $400.00 | $400.00 | $400.00 | $400.00 | $400.00 | $400.00 | |

| New Realtors | $300.00 | $300.00 | $300.00 | $300.00 | $300.00 | $300.00 | $300.00 | $300.00 | $300.00 | $300.00 | $300.00 | $300.00 | |

| Old Timers | $250.00 | $250.00 | $250.00 | $250.00 | $250.00 | $250.00 | $250.00 | $250.00 | $250.00 | $250.00 | $250.00 | $250.00 | |

| Sales | |||||||||||||

| Established Realtors | $80,000 | $120,000 | $240,000 | $320,000 | $420,000 | $600,000 | $720,000 | $760,000 | $860,000 | $940,000 | $1,020,000 | $1,120,000 | |

| New Realtors | $15,000 | $27,000 | $30,000 | Plan Month Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Tax Rate 30.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% Other 0 0 0 0 0 0 0 0 0 0 0 0 0 Pro Forma Profit and Loss Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 Sales $95,000 $147,000 $271,500 $352,500 $455,000 $650,000 $785,000 $825,000 $925,000 $1,005,000 $1,085,000 $1,185,000 Direct Cost of Sales $16,000 $24,900 $45,360 $58,600 $75,450 $107,700 $130,200 $136,700 $152,950 $165,950 $178,950 $195,200 Other Production Expenses $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Cost of Sales $16,000 $24,900 $45,360 $58,600 $75,450 $107,700 $130,200 $136,700 $152,950 $165,950 $178,950 $195,200 Gross Margin $79,000 $122,100 $226,140 $293,900 $379,550 $542,300 $654,800 $688,300 $772,050 $839,050 $906,050 $989,800 Gross Margin % 83.16% 83.06% 83.29% 83.38% 83.42% 83.43% 83.41% 83.43% 83.46% 83.49% 83.51% 83.53% Expenses Payroll $16,242 $16,250 $16,250 $16,250 $17,917 $17,917 $17,917 $17,917 $17,917 $24,167 $26,667 $26,667 Sales and Marketing and Other Expenses $3,420 $6,320 $6,320 $6,320 $6,320 $6,320 $6,320 $6,320 $6,320 $6,320 $6,320 $6,320 Depreciation $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 Website $15,000 $15,000 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 Utilities $800 $800 $800 $800 $800 $800 $800 $800 $800 $800 $800 $800 Insurance $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 Rent $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 Payroll Taxes 15% $2,436 $2,438 $2,438 $2,438 $2,688 $2,688 $2,688 $2,688 $2,688 $3,625 $4,000 $4,000 Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Operating Expenses $41,198 $44,108 $31,608 $31,608 $33,525 $33,525 $33,525 $33,525 $33,525 $40,712 $43,587 $43,587 Profit Before Interest and Taxes $37,802 $77,993 $194,533 $262,293 $346,025 $508,775 $621,275 $654,775 $738,525 $798,338 $862,463 $946,213 EBITDA $38,002 $78,193 $194,733 $262,493 $346,225 $508,975 $621,475 $654,975 $738,725 $798,538 $862,663 $946,413 Interest Expense $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Taxes Incurred $11,341 $19,498 $48,633 $65,573 $86,506 $127,194 $155,319 $163,694 $184,631 $199,584 $215,616 $236,553 Net Profit $26,461 $58,494 $145,899 $196,719 $259,519 $381,582 $465,957 $491,082 $553,894 $598,753 $646,847 $709,660 Net Profit/Sales 27.85% 39.79% 53.74% 55.81% 57.04% 58.70% 59.36% 59.53% 59.88% 59.58% 59.62% 59.89% Pro Forma Cash Flow |

|||||||||

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $95,000 | $147,000 | $271,500 | $352,500 | $455,000 | $650,000 | $785,000 | $825,000 | $925,000 | $1,005,000 | $1,085,000 | $1,185,000 | |

| Subtotal Cash from Operations | |||||||||||||

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Current Borrowing | |||||||||||||

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Subtotal Cash Received | $95,000 | $147,000 | $271,500 | $352,500 | $455,000 | $650,000 | $785, “> | ||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!