Inspect A-bode is a residential home inspection service in Eugene, OR. It offers complete home inspections and additional services such as electromagnetic field testing, radon testing, and asbestos testing. These services are available to both home buyers and sellers, with real estate agents being the main source of sales through strategic relationships.

To achieve projected profitability, Inspect A-bode has two main goals: to be utilized/referenced by at least five of the top 15 real estate brokers in the area and to increase the number of clients by 20% annually.

Owned and operated by Mr. Chek Domisile, Inspect A-bode is a sole-proprietorship. Mr. Domisile has 12 years of industry experience, which will be used to develop a competitive advantage and maintain a high level of professionalism. Selle Domisile, Chek’s wife and a residential realtor, will act as a paid consultant and leverage her existing relationships for referrals. The company does not plan to hire additional employees and will outsource accounting and bookkeeping.

Inspect A-bode provides a wide range of inspection services. These include foundation analysis, plumbing inspection, electrical inspection, interior inspection, as well as optional services like electromagnetic field testing, radon testing, and asbestos testing. The cost of the full service varies from $200 to $400 based on the size of the home and any special attention needed for areas like swimming pools.

The home inspection industry in Eugene consists of around 20 different companies, most of which are small outfits offering similar services at similar prices. Inspect A-bode targets two main customer groups: real estate agents and individual buyers/sellers. The company’s strategic relationships with agents include economic incentives for referrals. Individual buyers and sellers are targeted through focused advertisements in publications they typically read, as well as in the Yellow Pages.

Inspect A-bode’s objectives for the first three years of operation include: exceeding customer expectations, being utilized/referenced by at least five of the top 15 real estate brokers listed in the Eugene Chamber of Commerce book of lists, increasing the number of clients by 20% per year through superior performance, and developing a sustainable home business.

Inspect A-bode’s mission is to provide high-quality residential home inspections. Our services will exceed customer expectations.

Inspect A-bode, located in Eugene, OR, offers comprehensive residential home inspections. We also provide optional services such as electromagnetic field testing, radon testing, and asbestos testing.

We aim to develop strategic relationships with local realtors to ensure most inspections are referred by them. The remaining inspections will come from direct solicitation.

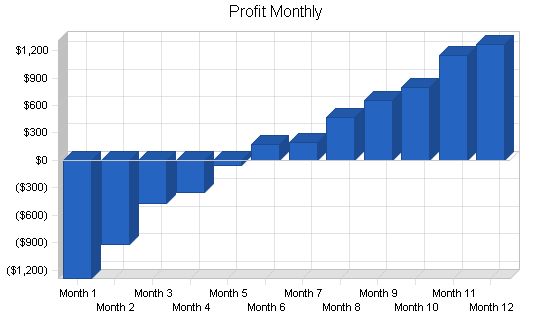

The business will operate from Chek Domisile’s home. Inspect A-bode is projected to reach profitability by month six and generate profits by year three.

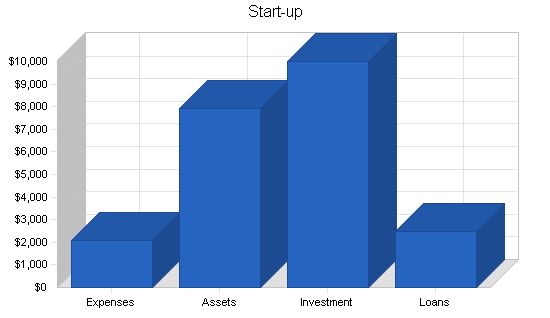

Start-up costs include a laptop computer, printer, internet connection, CD-RW, home inspection specific software, fax machine, copier, pager, cell phone, desk, chair, file cabinet, coveralls, flashlight, binoculars, ladder, combined receptacle and GFI tester, tic tracer, moisture meter, gas detector, inspection mirror, screwdriver, pliers, awe probe, smoke detector tester, pressure and temperature water gauges, electromagnetic field tester, and asbestos tester.

Note that all assets used for longer than one year will be depreciated using the straight-line method according to GAAP.

Inspect A-bode, founded and owned by Chek Domisile, is a sole proprietorship specializing in residential home inspections for buyers and sellers. The majority of service calls come from strategic partnerships with realtors. Inspect A-bode offers a comprehensive standard inspection that includes site assessment, foundation inspection, exterior evaluation, structural analysis, roofing examination, plumbing and electrical evaluation, heating and ventilation inspection, insulation assessment, interior assessment, built-in appliances inspection, pest and dry rot inspection, and carbon monoxide measurement. Optional services such as electromagnetic field testing, radon testing, and asbestos testing are also available. A written report accompanies the service, and Inspect A-bode recommends clients be present during the inspection. The cost ranges from $200 to $400, depending on the size and special features of the home.

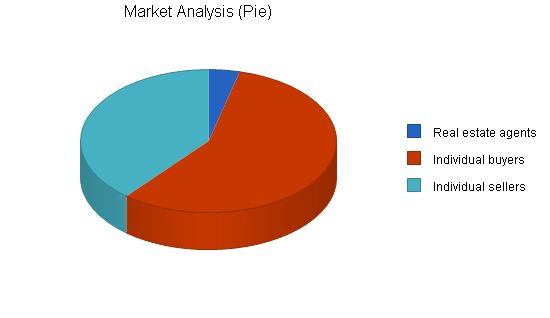

Inspect A-bode’s target market consists of real estate agents and individual buyers and sellers. The company aims to build strong relationships with realtors who will refer clients to Inspect A-bode. Individual buyers and sellers also benefit from inspections, and Inspect A-bode plans to attract them through focused advertisements.

Inspect A-bode aims to target three segments: real estate agents, individual buyers, and individual sellers.

Real Estate Agents: Inspect A-bode will establish strategic alliances with realtors through networking relationships. Selle, a realtor herself, will encourage her clients to use Inspect A-bode and will assist her colleagues in utilizing the service.

Individual Buyers: The target audience will be reached through advertising in publications commonly read by home buyers, as well as in the Yellow Pages. The focus will be on the importance of due diligence in checking the condition of a home before purchase.

Individual Sellers: An advertising campaign will educate sellers about the advantages of having an objective report detailing the condition of their house, making it easier to sell.

Service Business Analysis

In Eugene, the home inspection market consists of around 20 small companies offering similar services at comparable prices. The key differentiating factors are experience and professionalism.

Competition and Buying Patterns

The home inspection market has many competitors offering similar services and prices. However, customer preferences are influenced by the experience and professionalism of the service provider.

Home buyers typically rely on referrals or advertisements in local magazines and the Yellow Pages to find a home inspector. Realtors primarily recommend inspectors they know rather than relying on advertisements.

Strategy and Implementation Summary

Inspect A-bode will leverage its competitive edges, particularly its experience and professionalism. Satisfied customers will become unpaid advocates for the company. Additionally, Inspect A-bode will utilize a 10-year veteran from the real estate industry, Selle Domisile, as a paid consultant to develop a referral system among her colleagues.

Competitive Edge

Inspect A-bode’s competitive edge is based on the experience and professionalism of its team. Chek, with 12 years of experience as a general contractor, brings a discerning eye to inspections. His knowledge and experience result in accurate and informed inspections.

Sales Strategy

Inspect A-bode’s primary sales strategy involves establishing strategic relationships with local realtors through networking efforts. Selle will reach out to her colleagues and set up partnerships. Agents who refer clients to Inspect A-bode will receive a commission, incentivizing them to do so. Chek will communicate the company’s competitive advantages, experience and professionalism, when responding to prospect inquiries.

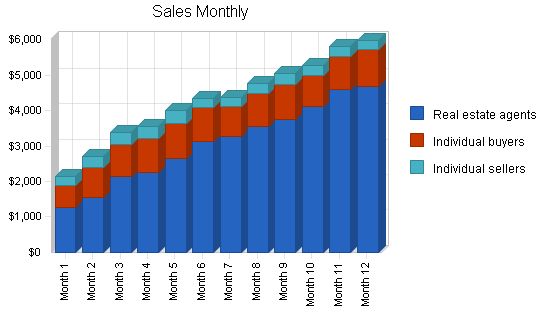

In the first month, there will be no sales activity as the office is set up and organized. Chek will familiarize himself with the software and develop a template for inspection reports. During this time, Selle will establish partnerships with realtors. Business will begin to grow in the second month and is expected to steadily increase. The need for an additional employee is projected for the second year, primarily for administrative tasks.

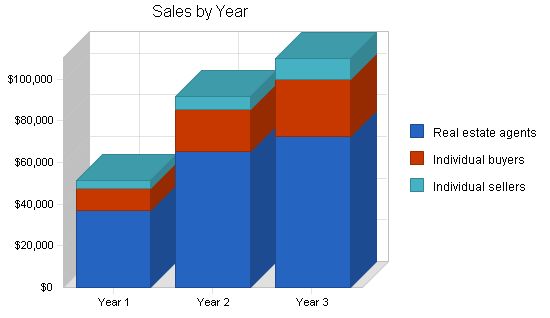

Sales Forecast

Year 1 Year 2 Year 3

Sales

Real estate agents $36,905 $65,478 $72,514

Individual buyers $10,854 $19,854 $27,458

Individual sellers $3,532 $6,547 $9,858

Total Sales $51,291 $91,879 $109,830

Direct Cost of Sales

Year 1 Year 2 Year 3

Real estate agents $1,845 $3,274 $3,626

Individual buyers $543 $993 $1,373

Individual sellers $177 $327 $493

Subtotal Direct Cost of Sales $2,565 $4,594 $5,492

5.3 Milestones

1. Business plan completion – essential for ongoing company performance and improvement.

2. Set up the office.

3. Set up realtor partnerships.

4. Hire a second employee.

Milestones

Milestone Start Date End Date Budget Manager Department

Business plan completion 1/1/2001 2/1/2001 $0 Chek Marketing

Set up office 1/1/2001 2/1/2001 $0 Chek Department

Set up realtor partnerships 1/1/2001 2/1/2001 $0 Selle Department

Revenues of $50,000 1/1/2001 1/1/2002 $0 Chek Department

Hiring a second employee 1/1/2001 1/1/2002 $0 Chek Department

Totals

Management Summary

Chek Domisile, the founder of Inspect A-bode, transitioned from the general contractor industry. After earning his Bachelors degree at the University of Oregon, Chek worked for a general contractor to gain experience and training. However, an injury forced him to change professions. Realizing he could work in a similar industry, Chek started Inspect A-bode.

Selle Domisile, Chek’s wife, will be a paid consultant leveraging her experience as a residential realtor. Selle will establish partnerships with local realtors and drive referrals to Inspect A-bode.

6.1 Personnel Plan

In year one, Chek will handle all tasks and inspections. By year two, an assistant will be hired for back office support. Selle will work as a paid consultant developing relationships with realtors.

Personnel Plan

Year 1 Year 2 Year 3

Chek $36,000 $42,000 $50,000

Office assistant $0 $12,000 $12,000

Total People 1 2 2

Total Payroll $36,000 $54,000 $62,000

Important Assumptions

General Assumptions

Year 1 Year 2 Year 3

Plan Month 1 2 3

Current Interest Rate 10.00% 10.00% 10.00%

Long-term Interest Rate 10.00% 10.00% 10.00%

Tax Rate 30.00% 30.00% 30.00%

Other 0 0 0

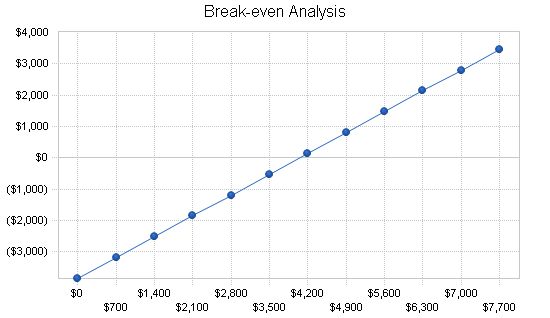

Break-even Analysis

The Break-even Analysis determines the monthly revenue needed.

Break-even Analysis:

Contents

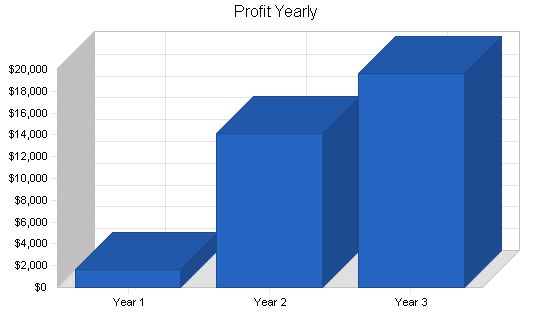

Projected Profit and Loss

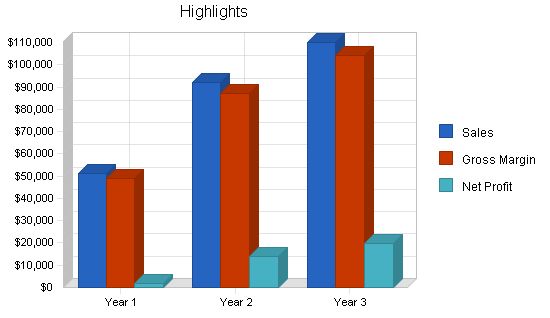

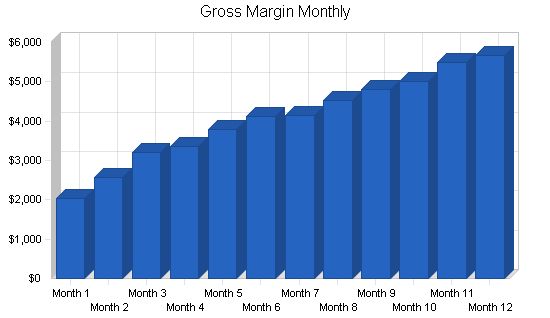

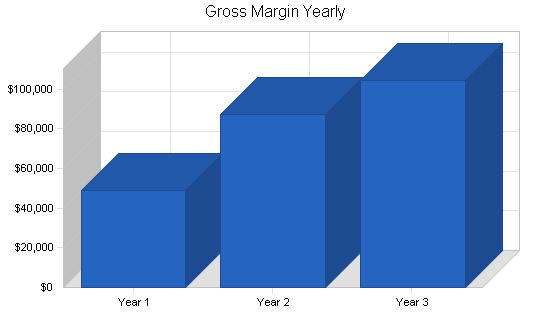

The following table indicates projected profit and loss.

Pro Forma Profit and Loss:

Year 1 Year 2 Year 3

Sales

$51,291 $91,879 $109,830

Direct Cost of Sales

$2,565 $4,594 $5,492

Other Production Expenses

$0 $0 $0

Total Cost of Sales

$2,565 $4,594 $5,492

Gross Margin

$48,726 $87,285 $104,339

Gross Margin %

95.00% 95.00% 95.00%

Expenses

Payroll

$36,000 $54,000 $62,000

Sales and Marketing and Other Expenses

$1,200 $1,200 $1,200

Depreciation

$864 $864 $864

Leased Equipment

$0 $0 $0

Utilities

$0 $0 $0

Insurance

$0 $0 $0

License fees and association dues

$2,700 $2,700 $2,700

Payroll Taxes

$5,400 $8,100 $9,300

Other

$0 $0 $0

Total Operating Expenses

$46,164 $66,864 $76,064

Profit Before Interest and Taxes

$2,562 $20,421 $28,275

EBITDA

$3,426 $21,285 $29,139

Interest Expense

$250 $250 $250

Taxes Incurred

$694 $6,051 $8,407

Net Profit

$1,619 $14,120 $19,617

Net Profit/Sales

3.16% 15.37% 17.86%

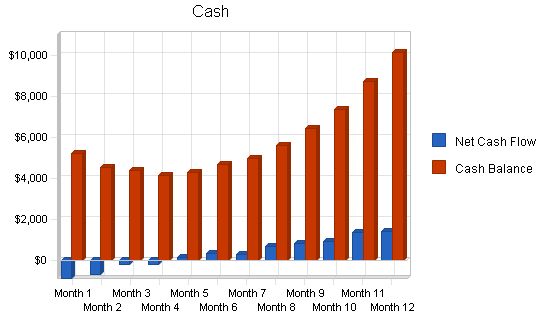

7.4 Projected Cash Flow:

The following chart and table indicate projected cash flow.

Pro Forma Cash Flow

| Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $51,291 | $91,879 | $109,830 |

| Subtotal Cash from Operations | $51,291 | $91,879 | $109,830 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $51,291 | $91,879 | $109,830 |

| Expenditures | |||

| Year 1 | Year 2 | Year 3 | |

| Expenditures from Operations | |||

| Cash Spending | $36,000 | $54,000 | $62,000 |

| Bill Payments | $11,225 | $22,596 | $26,983 |

| Subtotal Spent on Operations | $47,225 | $76,596 | $88,983 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $47,225 | $76,596 | $88,983 |

| Net Cash Flow | $4,066 | $15,283 | $20,847 |

| Cash Balance | $10,166 | $25,448 | $46,295 |

7.5 Projected Balance Sheet

The projected balance sheet is shown in the table below.

| Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $10,166 | $25,448 | $46,295 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $10,166 | $25,448 | $46,295 |

| Long-term Assets | |||

| Long-term Assets | $4,300 | $4,300 | $4,300 |

| Accumulated Depreciation | $864 | $1,728 | $2,592 |

| Total Long-term Assets | $3,436 | $2,572 | $1,708 |

| Total Assets | $13,602 | $28,020 | $48,003 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $1,583 | $1,882 | $2,248 |

| Current Borrowing | $2,500 | $2,500 | $2,500 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $4,083 | $4,382 | $4,748 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $4,083 | $4,382 | $4,748 |

| Paid-in Capital | $10,000 | $10,000 | $10,000 |

| Retained Earnings | ($2,100) | ($481) | $13,638 |

| Earnings | $1,619 | $14,120 | $19,617 |

| Total Capital | $9,519 | $23,638 | $43,256 |

| Total Liabilities and Capital | $13,602 | $28,020 | $48,003 |

| Net Worth | $9,519 | $23,638 | $43,256 |

7.6 Business Ratios

The following table shows the business ratios for the years of the plan, along with industry profile ratios for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 79.13% | 19.54% | 10.93% |

| Percent of Total Assets | ||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 48.08% |

| Total Current Assets | 74.74% | 90.82% | 96.44% | 77.44% |

| Long-term Assets | 25.26% | 9.18% | 3.56% | 22.56% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $6,100 | $5,217 | $4,554 | $4,378 | $4,156 | $4,321 | $4,676 | $4,962 | $5,626 | $6,438 | $7,386 | $8,767 | $10,166 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $6,100 | $5,217 | $4,554 | $4,378 | $4,156 | $4,321 | $4,676 | $4,962 | $5,626 | $6,438 | $7,386 | $8,767 | $10,166 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $4,300 | $4,300 | $4,300 | $4,300 | $4,300 | $4,300 | $4,300 | $4,300 | $4,300 | $4,300 | $4,300 | $4,300 | $4,300 |

| Accumulated Depreciation | $0 | $72 | $144 | $216 | $288 | $360 | $432 | $504 | $576 | $648 | $720 | $792 | $864 |

| Total Long-term Assets | $4,300 | $4,228 | $4,156 | $4,084 | $4,012 | $3,940 | $3,868 | $3,796 | $3,724 | $3,652 | $3,580 | $3,508 | $3,436 |

| Total Assets | $10,400 | $9,445 | $8,710 | $8,462 | $8,168 | $8,261 | $8,544 | $8,758 | $9,350 | $10,090 | $10,966 | $12,275 | $13,602 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $337 | $519 | $738 | $795 | $941 | $1,050 | $1,064 | $1,192 | $1,282 | $1,357 | $1,523 | $1,583 |

| Current Borrowing | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $2,500 | $2,837 | $3,019 | $3,238 | $3,295 | $3,441 | $3,550 | $3,564 | $3,692 | $3,782 | $3,857 | $4,023 | $4,083 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $2,500 | $2,837 | $3,019 | $3,238 | $3,295 | $3,441 | $3,550 | $3,564 | $3,692 | $3,782 | $3,857 | $4,023 | $4,083 |

| Paid-in Capital | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| Retained Earnings | ($2,100) | ($2,100) | ($2,100) | ($2,100) | ($2,100) | ($2,100) | ($2,100) | ($2,100) | ($2,100) | ($2,100) | ($2,100) | ($2,100) | ($2,100) |

| Earnings | $0 | ($1,292) | ($2,209) | ($2,677) | ($3,027) | ($3,080) | ($2,906) | ($2,706) | ($2,242) | ($1,592) | ($791) | $352 | $1,619 |

| Total Capital | $7,900 | $6,608 | $5,691 | $5,223 | $4,873 | $4,820 | $4,994 | $5,194 | $5,658 | $6,308 | $7,109 | $8,252 | $9,519 |

| Total Liabilities and Capital | $10,400 | $9,445 | $8,710 | $8,462 | $8,168 | $8,261 | $8,544 | $8,758 | $9,350 | $10,090 | $10,966 | $12,275 | $13,602 |

| Net Worth | $7,900 | $6,608 | $5,691 | $5,223 | $4,873 | $4,820 | $4,994 | $5,194 | $5,658 | $6,308 | $7,109 | $8,252 | $9,519 |

Business Plan Outline

- Executive Summary

- Company Summary

- Services

- Market Analysis Summary

- Strategy and Implementation Summary

- Management Summary

- Financial Plan

- Appendix

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!