Educational Website Business Plan

One Week At A Time is a website business in Lexington, Kentucky owned and operated by Frank Williams. The website aims to educate people on how to help the Earth and reduce their environmental impact by completing one task each week for 52 weeks. The tasks are simple and demonstrate how small changes can make a big difference. Revenue for this website will come from commissions on Earth-friendly product recommendations that align with our weekly tips. We will have affiliate relationships with retailers offering these products, earning commission on each sale.

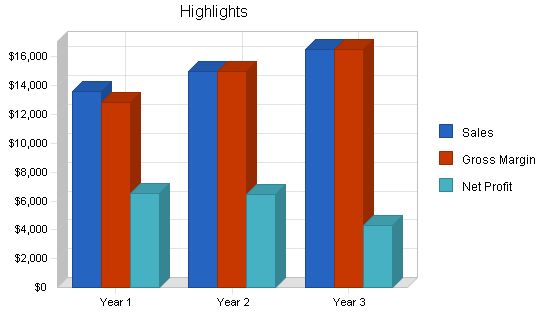

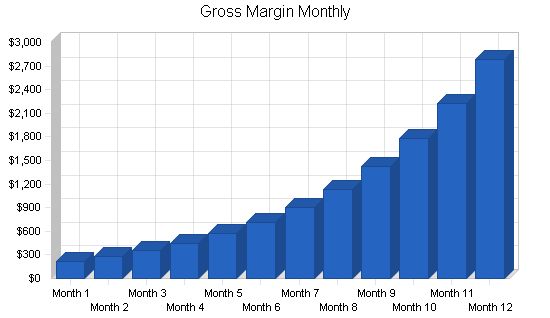

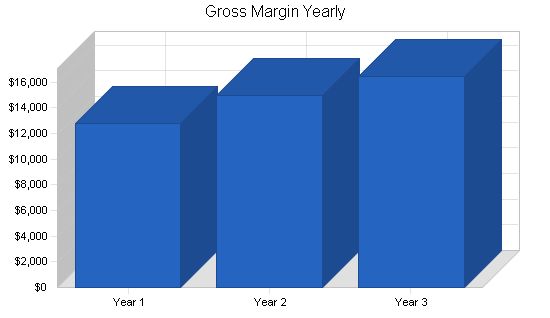

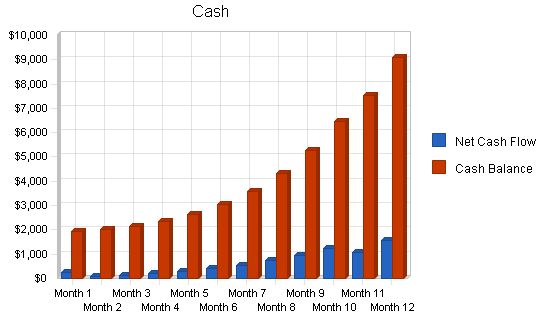

Our financial strategy is to stay profitable by keeping expenses extremely low. We plan to use profits to support environmental causes we believe in, rather than solely focusing on earning as much money as possible. Our priority is maintaining positive cash flow and balance. The accompanying chart highlights our financial plans.

To achieve our goals, we must:

- Create quality content in the form of engaging, empowering tips that inspire readers to share and help grow our user base.

- Execute our marketing plan effectively, maximizing online exposure without significant spending.

- Maintain low expenses, recognizing that generating high revenue in the short term is not our focus.

- Pre-sell our product recommendations to encourage users to purchase through our site and earn commissions.

One Week At A Time is an educational website teaching busy people to help the environment through simple weekly tasks over one year. Our goal is to increase environmental consciousness, promote Earth-friendly products, and contribute profits to environmental causes.

Objectives:

1. Teach people to help the environment and reduce personal impact through weekly tasks.

2. Gain 5,000 subscribers for our weekly environmental tips list within one year.

3. Attract 10,000 monthly visitors to our website.

4. Achieve profitability within six months.

5. Use all profits to support environmental organizations and causes.

Keys to Success:

– Quality Content: Provide well-written, friendly tips that motivate people to complete their weekly tasks.

One Week At A Time is a small sole proprietor website based in Lexington, Kentucky. It educates busy individuals on reducing their personal environmental impact with weekly tasks on the site or via free email subscriptions. Revenue is generated through commissions on Earth-friendly products recommended to subscribers.

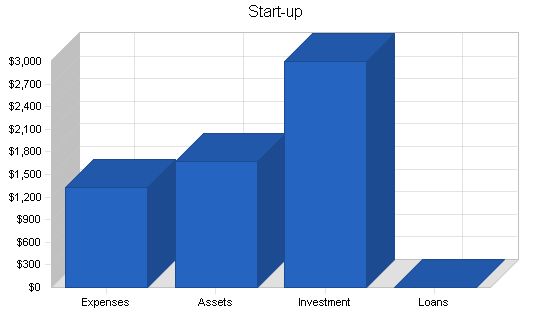

Start-up Summary:

One Week At A Time will start with a $3,000 investment from Frank Williams. Mr. Williams will handle initial website design and content creation, eliminating associated costs. Remaining expenses include $250 for legal fees, $1,000 for computer equipment, and $75 for domain registration.

The initial investment will cover these expenses and leave a cash balance of $1,675 to sustain the company until income is generated.

Start-up Funding

Start-up Expenses to Fund

$1,325

Start-up Assets to Fund

$1,675

Total Funding Required

$3,000

Assets

Non-cash Assets from Start-up

$0

Cash Requirements from Start-up

$1,675

Additional Cash Raised

$0

Cash Balance on Starting Date

$1,675

Total Assets

$1,675

Liabilities and Capital

Liabilities

Current Borrowing

$0

Long-term Liabilities

$0

Accounts Payable (Outstanding Bills)

$0

Other Current Liabilities (interest-free)

$0

Total Liabilities

$0

Capital

Planned Investment

Frank Williams

$3,000

Other

$0

Additional Investment Requirement

$0

Total Planned Investment

$3,000

Loss at Start-up (Start-up Expenses)

($1,325)

Total Capital

$1,675

Total Capital and Liabilities

$1,675

Total Funding

$3,000

Start-up

Requirements

Start-up Expenses

Legal

$250

Domain Name

$75

Computer Equipment

$1,000

Total Start-up Expenses

$1,325

Start-up Assets

Cash Required

$1,675

Other Current Assets

$0

Long-term Assets

$0

Total Assets

$1,675

Total Requirements

$3,000

2.2 Company Ownership

One Week At A Time is a sole-proprietorship, founded, owned, and operated by Frank Williams of Lexington, Kentucky.

Products

One Week At A Time does not actually produce any products or services. We recommend Earth-friendly products from various retailers who pay us a commission based on the amount of the sale. These are usually referred to as “affiliate relationships” and “affiliate commissions” in the Web world.

The advantage to this setup is that we don’t have any cost of goods, we don’t have to worry about production, inventory levels, fulfillment, or customer service. The negative aspect is that we obviously only receive a percentage of the sale instead of the full amount of the sale.

We will be recommending Earth-friendly products of the following types:

– Reusable Products: Reusable replacements for everyday products that are normally disposed of after one use such as rechargeable batteries, reusable lunch bags, etc.

– Recycled Paper Products: Printer paper, envelopes, stationary, etc.

– Kitchen Products: Cloth towels, cloth rags, etc.

– Organic Foods: Fruits, vegetables, snack foods, etc.

– Cloth Diapers

– Clothing: Made by Earth-Friendly companies such as Lands’ End, L.L. Bean, etc.

– Cleaning Products: Organic and chlorine/chemical free cleaning products like carpet cleaner, laundry detergent, dish soap, car wash soap, etc.

– Herbal Medicines

– Lighting: Energy Star approved lighting which uses less energy than standard bulbs and lighting products.

– Heating/Cooling Equipment: Hot Water Heater jackets, Energy Star air conditioners, heaters, etc.

– Books: About being Earth-friendly.

– Music: By Earth-Friendly artists or ones whose proceeds are donated to environmental organizations.

– Low Water Usage: Shower heads, hose nozzles, and other water-reducing gadgets.

– Energy Star Appliances: Kitchen appliances, TVs, monitors, etc.

– Solar Powered Appliances: Major and minor appliances, tools, and gadgets that run on solar power.

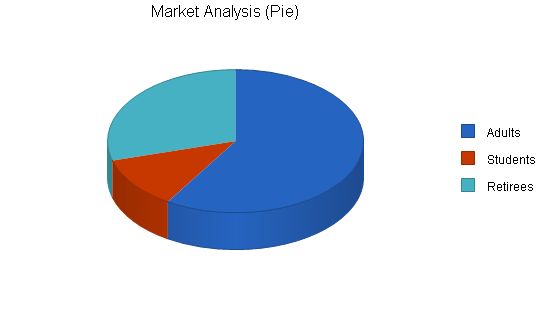

Market Analysis Summary

One Week At A Time targets all people in general, but the content will be slanted towards what we call “busy people.” These are people who most likely have busy lives such as being a full-time student, working, having a family, etc. These people often feel that they’re too busy to help the Earth, and often think it takes a ton of work to lessen their environmental impact. They tend to be in the 18-55 age range, moderate to high income level, and they live in all geographical locations. Obviously, our market must have access to the Internet to view our site.

Our secondary markets are students who range from 12-22 in age who can get started early on being Earth-friendly, and the retired community who may have more free time to help live an Earth-friendly life.

These markets encompass everyone, but we expect our primary market to account for a majority of our visitors and sales.

4.1 Market Segmentation

We segment our market by their “state in life.” By “state in life” we mean what age and point in life the people in the market are in. Usually, their “state of life” has a bearing on their interests, amount of free time, and income.

Our market is segmented as follows:

Students:

Students range from 12-22 years old. Geography is not important beyond the fact that our site will only be in English.

Market Analysis

Potential Customers:

– Adults: 10% growth from Year 1 to Year 5 (10M, 11M, 12.1M, 13.31M, 14.641M). CAGR: 10.00%.

– Students: 5% growth from Year 1 to Year 5 (2M, 2.1M, 2.205M, 2.315M, 2.431M). CAGR: 5.00%.

– Retirees: 10% growth from Year 1 to Year 5 (5M, 5.5M, 6.05M, 6.655M, 7.32M). CAGR: 10.00%.

– Total: 9.45% growth from Year 1 to Year 5 (17M, 18.6M, 20.355M, 22.28M, 24.392M). CAGR: 9.45%.

4.2 Target Market Segment Strategy

One Week At A Time’s main goal is to help people live in a more Earth-friendly manner. We target different market segments.

– Students: Targeting students is important because they need to become educated on how to live in an Earth-friendly manner. The children are the future.

One Week At A Time falls into two industries.

1. We are an environmental education website. Our competition mainly consists of environmental news sites and websites focusing on specific environmental topics. We cover many topics and provide weekly tasks to educate and engage our users.

2. We are an Earth-friendly product retailing website. While we don’t directly sell products, we compete with other websites offering similar or competing environmental products.

4.3.1 Competition and Buying Patterns

Our target audience includes people who are not experts in living an Earth-friendly life. We introduce them to ways they can help the environment and products they may not be aware of.

– Our approach differentiates us from other environmental education websites. We provide a fun writing style and weekly tasks that allow users to make a difference.

– We aim to simplify the product-finding process by providing one or two recommended choices and retailers to buy from.

Strategy and Implementation Summary

Our strategy is to:

– Market the site through search engine placement, links, pay-per-click advertising, and word of mouth.

– Build trust with users to encourage product sales.

– Keep expenses low for easy profitability.

5.1 Competitive Edge

Our competitive edge includes:

– Providing content in a fun format with weekly tasks that empower users to make a difference.

– Offering a unique approach that combines environmental education with product recommendations.

– Leveraging affiliate and online marketing experience for effective promotion.

Our key marketing strategy is search engine and directory placement. We utilize targeted keywords to improve visibility.

Additionally, we focus on link building, pay-per-click advertising, and word-of-mouth marketing to increase site traffic and engagement.

5.3 Sales Strategy

To drive sales, we emphasize trust and pre-selling:

– We build trust by demonstrating our knowledge, recommending high-quality products, and sharing personal experiences and testimonials.

– We simplify the product selection process by offering one or two recommended choices.

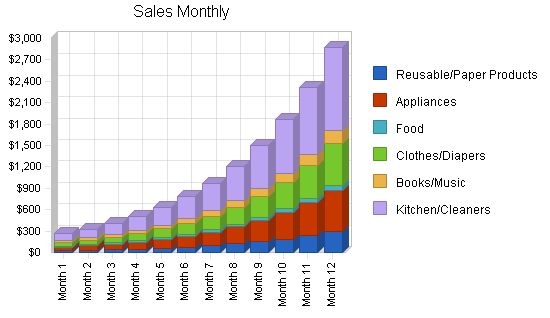

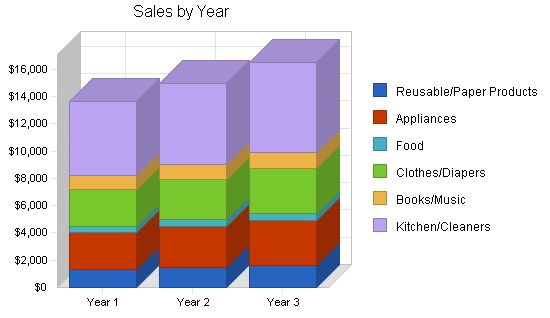

5.3.1 Sales Forecast

Our sales forecast is conservative due to the nature of affiliate sales.

– Costs of sales are under $100/month for pay-per-click advertising.

– Initial sales levels are based on a few sales of each product category in the first month.

– Growth rates range from 10-20% depending on category popularity and visitor acquisition.

Sales Forecast

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Reusable/Paper Products | $1,355 | $1,491 | $1,640 |

| Appliances | $2,710 | $2,981 | $3,280 |

| Food | $435 | $479 | $526 |

| Clothes/Diapers | $2,710 | $2,981 | $3,280 |

| Books/Music | $990 | $1,088 | $1,197 |

| Kitchen/Cleaners | $5,421 | $5,963 | $6,559 |

| Total Sales | $13,621 | $14,983 | $16,482 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Online Marketing | $796 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $796 | $0 | $0 |

5.4 Milestones

The Milestones table for One Week At A Time is simple, but so is this business. Our development consists of a few major milestones:

- Completing the Business Plan: An organized and good business plan is essential to success.

- Website Development: This includes site design, database and email system creation, affiliate relationship establishment, and writing content for the weekly tasks. Our website is our product.

- Search Engine Optimization and Submission: Crucial for generating traffic, we must appear in search engine results for our identified keyword terms.

- Link Building Campaign: Key to our marketing, we need hundreds of links from other environmental and educational sites to drive traffic to our site.

Milestones

– Business Plan: 10/1/2002 – 10/10/2002, $0, Frank Williams, Management

– Web Site: 10/10/2002 – 12/1/2002, $0, Frank Williams, Web

– Search Engine/Directory Submissions: 12/1/2002 – 12/10/2002, $500, Frank Williams, Marketing

– Link Campaign: 12/1/2002 – 1/1/2003, $0, Frank Williams, Web

– Totals: $500

Web Plan Summary

The One Week At A Time website is our company’s main focus as it’s the only part that interacts with the customer.

The website will have a simple design with minimal graphics and minimal text.

The website will provide a brief description and mission statement on the front page, along with links to environmental news and options for three tasks:

1. Sign up for our weekly email tasks subscription.

2. Browse our weekly tips immediately.

3. Read our full mission statement.

The back end of the website will have a basic design with a database for storing tips and subscriptions to the newsletter. This design ensures easy maintenance and minimizes time spent on technical issues.

Website Marketing Strategy

– Search Engine Placement:

The site copy will contain keywords and phrases used in search engines. Combined with good title tags and a simple design, we expect good placement for relevant search terms.

– Link Building:

We will implement a link building campaign to attract direct traffic and improve search engine placement. We will exchange links with other environmental and educational websites.

– Pay-Per-Click:

We will use Overture and Google Adwords for pay-per-click advertising, targeting keywords related to recommended products.

– Word of Mouth:

Our site’s compelling content should naturally motivate users to share our weekly tips. We will also provide options for easily sharing tips with others.

Development Requirements

Our website development consists of three phases:

1. Front End:

Developing the graphic look and layout for the site, which we estimate will take about one week.

2. Back End:

Coding the system for storing and distributing content. This includes creating databases for weekly tips and subscriber information.

3. Tip Writing:

Adding content for the 52 weeks, including tip backgrounds, specific actions, related product links, and additional resources.

Management Summary

One Week At A Time is owned and operated by Mr. Frank Williams. We have no plans to hire additional personnel at this time.

Personnel Plan

Frank Williams is the only planned employee. He will not receive a salary until September 2003, when revenues have grown to a level that makes it feasible. At that time, he will start with a $500/month salary.

One Week At A Time has minimal expenses, consisting of marketing, website hosting, and one salary starting in late 2003. The primary goal is not to generate large amounts of income, but to remain profitable and maintain positive cash flow.

Important Assumptions

The Financial Plan assumes:

– We can generate website traffic through our marketing methods.

– Affiliate programs for Earth-friendly products will remain available and fulfill orders correctly and on time.

– People will continue to be interested in helping the environment.

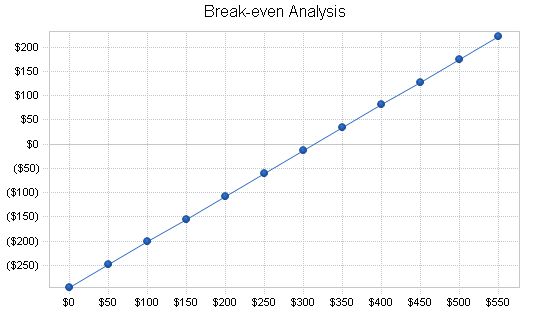

Break-even Analysis

Our Break-even Analysis is simple. We earn commissions on recommended products in our weekly tips. We estimate earning around $2 per sale, as most companies pay 5-15% in commission for products ranging from $5-$20. Our fixed costs include website hosting, bills, expenses, and search engine marketing.

Break-even Analysis

Monthly Revenue Break-even: $314

Assumptions:

– Average Percent Variable Cost: 6%

– Estimated Monthly Fixed Cost: $296

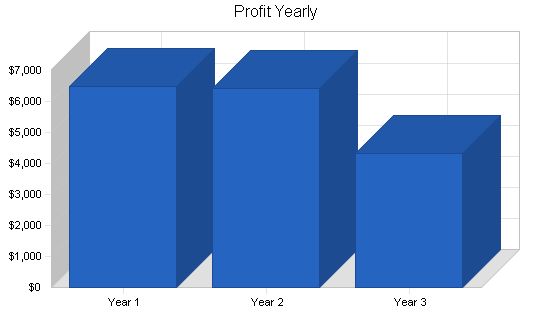

8.3 Projected Profit and Loss

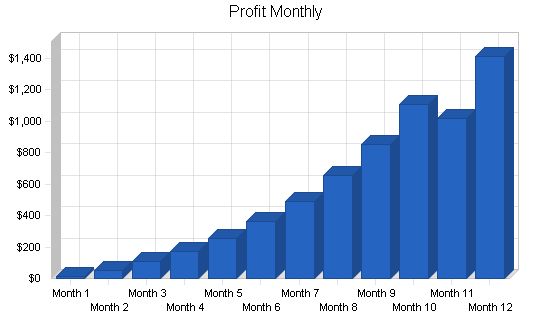

One Week At A Time anticipates significant net profit due to minimal expenses, absence of cost of goods, and a solitary employee. However, we do not anticipate generating substantial sales or earning a significant net income.

We project reaching net profit in 2003 and 2004, which will be allocated towards the environmental causes that we support.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $13,621 | $14,983 | $16,482 |

| Direct Cost of Sales | $796 | $0 | $0 |

| Other Costs of Goods | $0 | $0 | $0 |

| Total Cost of Sales | $796 | $0 | $0 |

| Gross Margin | $12,825 | $14,983 | $16,482 |

| Gross Margin % | 94.16% | 100.00% | 100.00% |

| Expenses | |||

| Payroll | $1,000 | $2,000 | $4,000 |

| Sales and Marketing and Other Expenses | $1,200 | $2,300 | $4,500 |

| Depreciation | $0 | $0 | $0 |

| Web Site Hosting | $1,200 | $1,200 | $1,200 |

| Payroll Taxes | $150 | $300 | $600 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $3,550 | $5,800 | $10,300 |

| Profit Before Interest and Taxes | $9,275 | $9,183 | $6,182 |

| EBITDA | $9,275 | $9,183 | $6,182 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $2,783 | $2,755 | $1,855 |

| Net Profit | $6,493 | $6,428 | $4,327 |

| Net Profit/Sales | 47.67% | 42.90% | 26.25% |

8.4 Business Ratios

The ratios in our table indicate that One Week At A Time is a simple and profitable business.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 10.00% | 10.00% | 0.00% |

| Percent of Total Assets | ||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 100.00% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 10.25% | 3.56% | 3.42% | 0.00% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Liabilities | 10.25% | 3.56% | 3.42% | 0.00% |

| Net Worth | 89.75% | 96.44% | 96.58% | 100.00% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 94.16% | 100.00% | 100.00% | 0.00% |

| Selling, General & Administrative Expenses | 46.49% | 57.10% | 73.75% | 0.00% |

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 0.00% |

| Profit Before Interest and Taxes | 68.10% | 61.29% | 37.51% | 0.00% |

| Main Ratios | ||||

| Current | 9.76 | 28.09 | 29.23 | 0.00 |

| Quick | 9.76 | 28.09 | 29.23 | 0.00 |

| Total Debt to Total Assets | 10.25% | 3.56% | 3.42% | 0.00% |

| Pre-tax Return on Net Worth | 113.56% | 62.92% | 32.67% | 0.00% |

| Pre-tax Return on Assets | 101.92% | 60.68% | 31.55% | 0.00% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 47.67% | 42.90% | 26.25% | n.a |

| Return on Equity | 79.49% | 44.04% | 22.87% | n.a |

| Activity Ratios | ||||

| Accounts Payable Turnover | 6.57 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 41 | 27 | n.a |

| Total Asset Turnover | 1.50 | 0.99 | 0.84 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.11 | 0.04 | 0.04 | n.a |

| Current Liab. to Liab. | 1.00 | 1.00 | 1.00 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $8,168 | $14,596 | $18,923 | n.a |

| Interest Coverage | 0.00 | 0.00 | 0.00 | n.a |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Assets to Sales | 0.67 | 1.01 | 1.19 | n.a |

| Current Debt/Total Assets | 10% | 4% | 3% | n.a |

| Acid Test | 9.76 | 28.09 | 29.23 | n.a |

| Sales/Net Worth | 1.67 | 1.03 | 0.87 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

8.5 Projected Cash Flow

Starting with our initial investment, One Week At A Time always plans to maintain a positive cash balance and cash flow. We anticipate that we will never spend more in expenses than we bring in from sales, thanks to our low overhead and initial investment. We do not foresee the need to borrow cash or sell off assets to contribute to our cash balance. The only fixed expense we have is website hosting, but we can trim our marketing expenses to ensure a positive cash flow and cash balance.

Pro Forma Cash Flow

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $13,621 | $14,983 | $16,482 |

| Subtotal Cash from Operations | $13,621 | $14,983 | $16,482 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $13,621 | $14,983 | $16,482 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $1,000 | $2,000 | $4,000 |

| Bill Payments | $5,196 | $6,949 | $8,023 |

| Subtotal Spent on Operations | $6,196 | $8,949 | $12,023 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $6,196 | $8,949 | $12,023 |

| Net Cash Flow | $7,425 | $6,034 | $4,459 |

| Cash Balance | $9,100 | $15,135 | $19,594 |

8.6 Projected Balance Sheet

Due to our low expenses and gradual growth in site traffic and sales, the company’s net worth will increase over time. We are not in a rush and have no intention of spending money unnecessarily to reach our goals.

Our liabilities are minimal, and our sales forecast is conservative, making it more likely for us to exceed our projections than to fall short.

Pro Forma Balance Sheet

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $9,100 | $15,135 | $19,594 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $9,100 | $15,135 | $19,594 |

| Long-term Assets | |||

| Long-term Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $9,100 | $15,135 | $19,594 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $933 | $539 | $670 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $933 | $539 | $670 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $933 | $539 | $670 |

| Paid-in Capital | $3,000 | $3,000 | $3,000 |

| Retained Earnings | ($1,325) | $5,168 | $11,596 |

| Earnings | $6,493 | $6,428 | $4,327 |

| Total Capital | $8,168 | $14,596 | $18,923 |

| Total Liabilities and Capital | $9,100 | $15,135 | $19,594 |

| Net Worth | $8,168 | $14,596 | $18,923 |

Appendix

Sales Forecast

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Sales | ||||||||||||

| Reusable/Paper Products | $25 | $31 | $39 | $49 | $61 | $76 | $95 | $119 | $149 | $186 | $233 | $291 |

| Appliances | $50 | $63 | $78 | $98 | $122 | $153 | $191 | $238 | $298 | $373 | $466 | $582 |

| Food | $15 | $17 | $20 | $23 | $26 | $30 | $35 | $40 | $46 | $53 | $61 | $70 |

| Clothes/Diapers | $50 | $63 | $78 | $98 | $122 | $153 | $191 | $238 | $298 | $373 | $466 | $582 |

| Books/Music | $25 | $30 | $36 | $43 | $52 | $62 | $75 | $90 | $107 | $129 | $155 | $186 |

| Kitchen/Cleaners | $100 | $125 | $156 | $195 | $244 | $305 | $381 | $477 | $596 | $745 | $931 | $1,164 |

| Total Sales | $265 | $329 | $407 | $505 | $627 | $779 | $968 | $1,202 | $1,494 | $1,858 | $2,311 | $2,875 |

Direct Cost of Sales

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 |

| Online Marketing | $53 | $55 | $58 | $61 | $64 | $67 | $70 | $74 | $78 | $81 | $86 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $53 | $55 | $58 | $61 | $64 | $67 | $70 | $74 | $78 | $81 | $86 |

Personnel Plan

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Frank Williams | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $500 | $500 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $1,675 | $1,932 | $2,005 | $2,136 | $2,340 | $2,634 | $3,040 | $3,588 | $4,310 | $5,252 | $6,466 | $7,524 | $9,100 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $1,675 | $1,932 | $2,005 | $2,136 | $2,340 | $2,634 | $3,040 | $3,588 | $4,310 | $5,252 | $6,466 | $7,524 | $9,100 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Assets | $1,675 | $1,932 | $2,005 | $2,136 | $2,340 | $2,634 | $3,040 | $3,588 | $4,310 | $5,252 | $6,466 | $7,524 | $9,100 |

| Liabilities and Capital | |||||||||||||

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $246 | $266 | $291 | $321 | $358 | $404 | $461 | $532 | $619 | $727 | $766 | $933 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $246 | $266 | $291 | $321 | $358 | $404 | $461 | $532 | $619 | $727 | $766 | $933 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $0 | $246 | $266 | $291 | $321 | $358 | $404 | $461 | $532 | $619 | $727 | $766 | $933 |

| Paid-in Capital | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 |

| Retained Earnings | ($1,325) | ($1,325) | ($1,325) | ($1,325) | ($1,325) | ($1,325) | ($1,325) | ($1,325) | ($1,325) | ($1,325) | ($1,325) | ($1,325) | ($1,325) |

| Earnings | $0 | $11 | $64 | $170 | $344 | $600 | $961 | $1,451 | $2,104 | $2,958 | $4,065 | $5,083 | $6,493 |

| Total Capital | $1,675 | $1,686 | $1,739 | $1,845 | $2,019 | $2,275 | $2,636 | $3,126 | $3,779 | $4,633 | $5,740 | $6,758 | $8,168 |

| Total Liabilities and Capital | $1,675 | $1,932 | $2,005 | $2,136 | $2,340 | $2,634 | $3,040 | $3,588 | $4,310 | $5,252 | $6,466 | $7,524 | $9,100 |

| Net Worth | $1,675 | $1,686 | $1,739 | $1,845 | $2,019 | $2,275 | $2,636 | $3,126 | $3,779 | $4,633 | $5,740 | $6,758 | $8,168 |

Business Plan Outline

- Executive Summary

- Company Summary

- Products

- Market Analysis Summary

- Strategy and Implementation Summary

- Web Plan Summary

- Management Summary

- Financial Plan

- Appendix

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!