Contents

Office Equipment Rental Business Plan

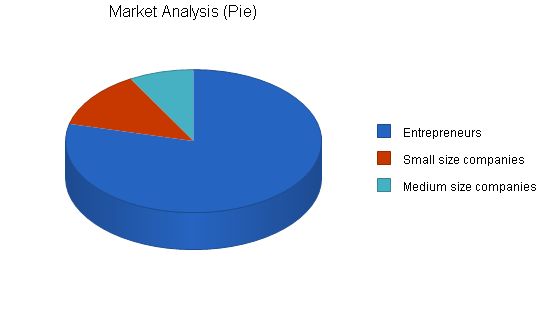

House of Projectors (HOP) is an Ohio based Limited Liability Corporation start-up business that rents Liquid Crystal Display (LCD) computer projectors. The company is led by John Laaklytte, a veteran of the computer rental industry. HOP targets three market segments. The first segment is entrepreneurs, who often need projectors for presentations to investors. This segment has 33,243 potential customers and a 9% growth rate. The second segment is small size companies with less than 15 employees, who require projectors but do not use them frequently. This segment has 5,423 potential customers and a 7% growth rate. The last group is medium size companies with 15-50 employees, who share similar projector rental motivations. This group has 3,433 potential customers and a 6% growth rate.

The Industry

The computer office equipment rental industry is a $745 million industry. House of Projectors differentiates itself by specializing solely in projector rentals, allowing them to provide a high level of service. Unlike comprehensive service providers, House of Projectors focuses solely on projectors, allowing them to excel in their niche. House of Projectors believes they can maintain their niche competitive edge through their concentration on projectors and their organization-wide commitment to customer support.

Management

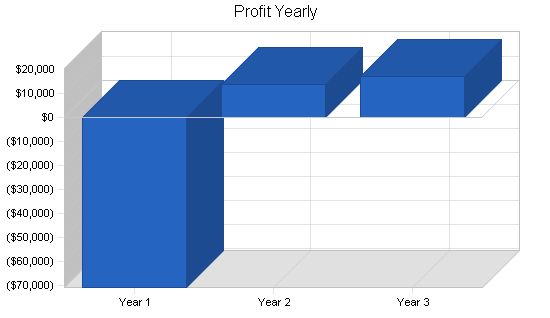

John Laaklytte, a Case Western Reserve University graduate with practical experience in the computer retail and rental industry, will lead House of Projectors. Leveraging his knowledge and experience, John aims to establish House of Projectors as a prominent player in the computer office hardware industry. By executing a well-thought-out business plan and proven business model, John expects to achieve profitability by the end of year two.

1.1 Objectives:

– Become the premier source for LCD computer projector rentals.

– Develop a significant base of long-term customers.

– Achieve profitability by the end of year two.

1.2 Keys to Success:

1. Design and employ strict financial controls to analyze all aspects of the business.

2. Treat every customer as the most important customer.

3. Constantly evaluate the market and customer needs, using interactive feedback to gain insight.

1.3 Mission:

– House of Projectors’ mission is to become the premier source of computer projectors for the Cleveland business community by offering fair prices and groundbreaking service.

– House of Projectors is an Ohio-based company that rents computer projectors.

2.1 Company Ownership:

– HOP was founded and is owned by John Laaklytte. The company is a Limited Liability Corporation to enjoy personal liability protection and avoid double taxation.

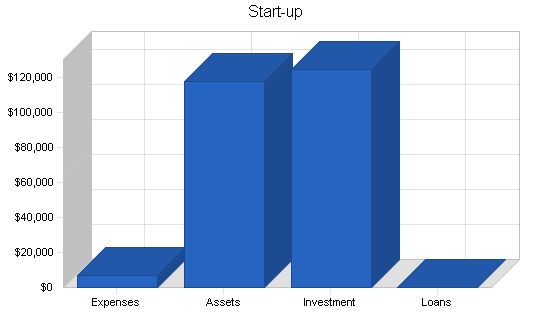

2.2 Start-up Summary:

– Equipment and services needed for start-up:

– Attorney fees for business formation, registration, and contract review.

– Business consultant to be used sparingly due to pricey hourly rates.

– Four computers with two laser printers. QuickBooks Pro and ACT! software for accounting, customer invoicing, database management, and reservation system.

– Four desks, chairs, and office/desk supplies.

– Fax, paper shredder, phone system with five terminals, and hardware-based voice mail.

– Lighting units and shelving units.

– Website development, brochures, and stationery.

– Rental stock: initially purchasing 25 projector units and two laptop computers, divided equally between three models.

Start-up Funding:

Start-up Expenses to Fund: $6,900

Start-up Assets to Fund: $118,100

Total Funding Required: $125,000

Assets:

Non-cash Assets from Start-up: $50,000

Cash Requirements from Start-up: $68,100

Additional Cash Raised: $0

Cash Balance on Starting Date: $68,100

Total Assets: $118,100

Liabilities and Capital:

Liabilities:

Current Borrowing: $0

Long-term Liabilities: $0

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $0

Capital:

Planned Investment:

Owner: $75,000

Investor 2: $50,000

Other: $0

Additional Investment Requirement: $0

Total Planned Investment: $125,000

Loss at Start-up (Start-up Expenses): ($6,900)

Total Capital: $118,100

Total Capital and Liabilities: $118,100

Total Funding: $125,000

Start-up:

Requirements:

Start-up Expenses:

Legal: $2,000

Stationery etc.: $200

Brochures: $200

Consultants: $3,000

Insurance: $0

Rent: $0

Research and Development: $0

Website Development: $1,500

Other: $0

Total Start-up Expenses: $6,900

Start-up Assets:

Cash Required: $68,100

Other Current Assets: $0

Long-term Assets: $50,000

Total Assets: $118,100

Total Requirements: $125,000

Services:

House of Projectors rents LCD projectors to a variety of customers. The projectors are computer-based and display the computer’s content on a wall or screen. LCD projectors are expensive, making it impractical for many companies to purchase them. Only companies that frequently use projectors find it cost-effective to buy their own equipment.

While two other local businesses rent projectors, HOP differentiates itself by providing exceptional support for the units. Configuring projectors to individual computers can be difficult and time-consuming. HOP has a comprehensive database for configuring projectors with many different laptop models. With their outstanding support, HOP can assist customers in configuring the unit to their laptop in just five minutes. This is unlike competitors who only provide cables and instructions, leaving customers to figure out configuration issues on their own. HOP goes beyond projector rentals and offers a comprehensive computer support service specifically for their projectors. If there are difficulties configuring a customer’s laptop, HOP provides a complimentary laptop to ensure a smooth rental experience.

HOP only rents top-of-the-line InFocus projectors. These projectors can be connected via a USB or FireWire port. Customers can choose from three different models based on their projection needs. The size and weight of the projector unit increase with its strength, as well as the cost to rent. To always offer customers the best machines, HOP sells used machines after a year or two and purchases new ones.

Through a partnership with InFocus, HOP can purchase projectors directly, bypassing wholesale distribution. This special deal was made possible through a personal relationship with a VP at InFocus. While InFocus generally sells to wholesalers, they are willing to sell to HOP because of the personal relationship, HOP’s commitment to buying a reasonable number of units, and HOP’s willingness to provide customer feedback, which is valuable to InFocus.

Market Analysis Summary:

HOP has identified two customer segments: entrepreneurs and small and medium-sized companies. Each group will be addressed individually. Unlike competitors in the office equipment rental marketplace, HOP focuses exclusively on projector rentals.

Market Segmentation:

HOP has identified three market segments: entrepreneurs, small-sized companies, and medium-sized companies.

Entrepreneurs:

This segment includes individuals seeking funding for their new business ideas. They use projectors for presentations to angel investors and venture capitalists. Projectors are also used for sales presentations. Entrepreneurs recognize the need for projectors to convey information effectively.

Small-sized companies:

For companies with fewer than 15 employees, projectors are used as a sales tool. While not used frequently, projectors are effective for presentations involving two or more people.

Medium-sized companies:

Similar to small-sized companies, medium-sized businesses (15-50 employees) use projectors for sales presentations as well as internal events such as board meetings, HR presentations, and training seminars. Purchasing a projector is cost-effective only if it is used frequently. Renting from HOP allows companies to save on upfront costs and maintenance expenses while always having access to top-of-the-line equipment.

Market Analysis

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Entrepreneurs | 9% | 33,243 | 36,235 | 39,496 | 43,051 | 46,926 | 9.00% |

| Small size companies | 7% | 5,453 | 5,835 | 6,243 | 6,680 | 7,148 | 7.00% |

| Medium size companies | 6% | 3,433 | 3,639 | 3,857 | 4,088 | 4,333 | 5.99% |

| Total | 8.51% | 42,129 | 45,709 | 49,596 | 53,819 | 58,407 | 8.51% |

4.2 Target Market Segment Strategy

HOP has targeted the previously named market segments for two reasons. The first reason is the need for the services. The targeted customer segments all use projectors. As computers and laptops have become more commonplace and indispensable in modern business transactions, projectors have become a useful communication tool. While the projectors are not yet ubiquitous, they are useful. Price, however, has kept purchase rates linked to cost efficiency relative to how often the projector is used.

Price is the second reason why the chosen target markets are attractive. The projectors are useful to the customers, but they don’t use the equipment often enough to justify the expense. Rentals, therefore, are an attractive alternative, providing a service that is highly valued and not likely to decrease significantly anytime soon.

4.3 Service Business Analysis

HOP operates within the larger industry of office equipment rentals, which includes copier machines, computers, and other office technological equipment. Companies in this industry offer rentals as a service. The rentals can be as short as a day or for a long term of weeks or months. The type of businesses that participate in this industry are both franchises such as IKON Office Systems and individual companies.

Most rental companies do not rent projectors. This can be explained by the high cost of the projectors and their technological support needs. This is not to say there is not a huge market in need of projector rentals; it reflects the needed dedication of technical expertise in support of the equipment investment. For this reason, not many companies rent projectors. For companies that offer a wide range of rentals, there is a higher return on investment if the equipment does not require too much time or energy in support or maintenance. This logic only applies to companies that have full-service rental facilities. For a company like HOP that only rents projectors, the cost of serving a customer is drastically reduced when there is only one type of hardware rented out.

4.3.1 Competition and Buying Patterns

House of Projectors faces three local competitors that rent projectors:

- IKON Office Systems: This franchised company offers a wide range of business equipment rentals. While IKON rents the units, they are not helpful in terms of hardware support, making it a struggle for customers with configuration issues specific to their type of computer.

- Reliant Office Rentals: This competitor offers a range of different equipment rentals. They offer a total of three projectors. Customers do not have a choice of the unit they rent, it is first-come/first-served.

- AA Office Equipment: This is a retail sales operation that also offers rentals. Their rental options are not comprehensive. The rental department appears to be run as a source of supplemental income to their retail sales. Support is quite limited. Because the rental business unit appears not to be an independent unit, but just supportive of the sales, it gets little attention.

Buying habits of customers are generally based on convenience. Customers are unable to significantly shop by price because the three competitors (excluding HOP) charge about the same rate. Customers make the rental choice based on availability and convenience.

Strategy and Implementation Summary

HOP’s strategy will involve a marketing and sales effort that seeks to develop awareness of their superior service and product offerings and to build a large foundation of long-term customers. This strategy recognizes that it is more costly to attract new customers than to maintain current ones. Additionally, happy customers as cheerleaders for the organization are an extremely effective, vocal, and cost-effective sales tool. Lastly, HOP will leverage their competitive edge of benchmarked service to quickly gain market penetration.

5.1 Competitive Edge

HOP’s competitive edge is their benchmarked service provided to all customers. The typical level of service that customers expect from competing rental companies is that the store will determine compatibility of the rental unit and the customer’s computer and then rent the unit. The rental agent will give a few bits of information regarding configuration issues, but the customer is typically left to their own labor to get it to work. This basic level of service is all that is typically offered because of the great and sometimes overwhelming amount of knowledge that is required for projector support. Companies that offer a wide range of rentals do not have the time to compile and offer the needed level of knowledge.

House of Projectors rents only projectors, so it is far easier for them to be projector experts. With this high level of knowledge, it is easy for HOP to offer a standard level of service that is super deluxe. If a customer had rented from a competitor and then from HOP, the huge difference in the level of service would be quite obvious. HOP asks the customer to bring in their specific laptop so that HOP experts can configure the projector for them. HOP finds it problematic and therefore unacceptable if the customer has to spend any of their own time wrestling with the unit. HOP therefore offers true plug and play capability, not plug and pray that the competition offers.

HOP offers 24-hour support for their rentals as well. Customers will find this quite useful, particularly customers who are traveling as they are able to get product support any time they need it, no matter where they may be.

To develop good business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis.

5.2 Marketing Strategy

House of Projectors’ marketing strategy will be an effort to gain visibility of HOP within the business community as the premier LCD computer projector rental facility. House of Projectors will undertake a marketing campaign that will, in part, use traditional media sources such as the Cleveland Business Journal, a well-read business and Cleveland-specific journal. In addition to advertising, HOP will launch a networking campaign based on guerrilla marketing principles to gain visibility for the company by establishing business and personal relationships with many people in the Cleveland business community.

One specific alliance that House of Projectors will build and emphasize is a relationship with the Cleveland Entrepreneurs Forum. This organization is run through the Cleveland Chamber of Commerce and supports budding entrepreneurs. House of Projectors will be able to offer value for this process because projector presentations are almost a standard element of a presentation to sophisticated angel or venture capital investors. By forming an alliance with this organization and supporting its main activities, House of Projectors will generate visibility of itself specifically to one of their key customer segments.

Additional networking will be accomplished by participating in various other business associations. This will be quite effective as many people have the empirical experience that much business is conducted among networking contacts.

5.3 Sales Strategy

The sales strategy will be a system of goals and processes that stress the delivery of the industry’s finest service to every customer. The entire sales system is based on the idea that House of Projectors must do its best to satisfy every customer so that after their first experience with House of Projectors, they have no desire to use a different service provider. By providing the finest service, the customer will have no reason to seek out a different company. Ideally, the customer will praise the outstanding service to their friends. It is this "friends referral" that can be effective because the praise for the service provider comes from a friend who has already established a trust relationship with the audience.

This strategy of providing the finest service as a means for developing a large and loyal customer base accepts implicitly that projectors are computer hardware and can be difficult and frustrating for many people to operate. By providing the best support, House of Projectors is able to remove the element of fear that many people have when they are forced to interact with technology.

There are two main elements in HOP’s delivery of customer support. The first is the task of making the customer’s interaction with the company and the technology as painless as possible. Each customer should feel like they were treated special and that all of their needs were looked after by HOP. The second element is crisis management. This involves a situation where the customer is unhappy or did not receive the best service. All employees will be trained to be able to survey a situation and correct any issues themselves. While some issues will have to be elevated to the manager level, the employees are trained to be able to effectively handle most things themselves.

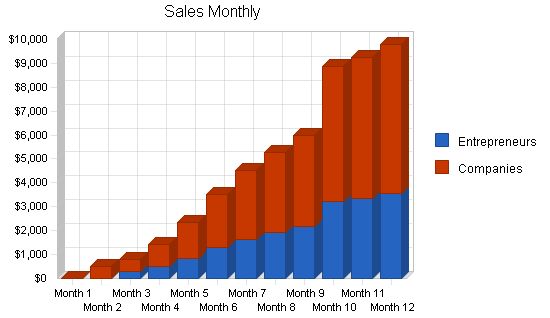

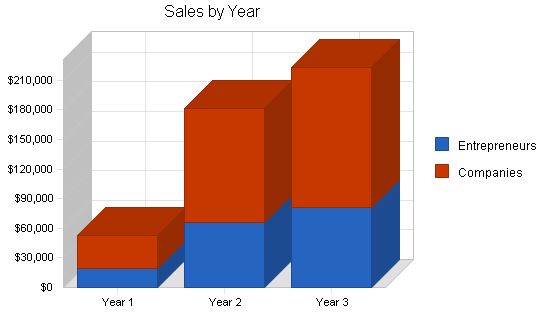

5.3.1 Sales Forecast

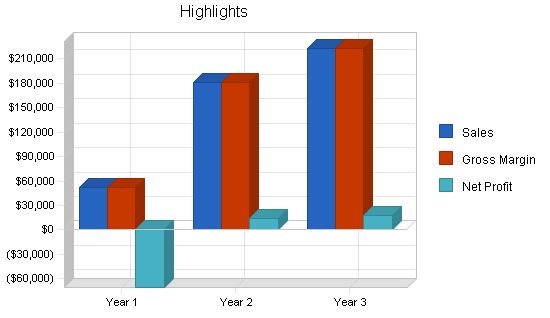

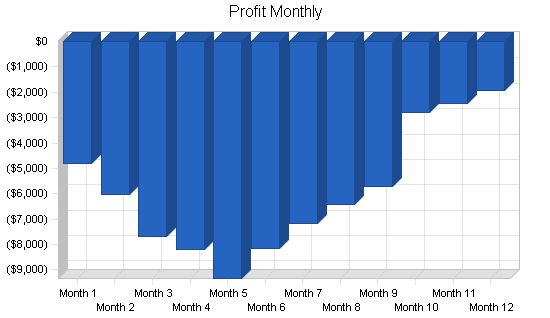

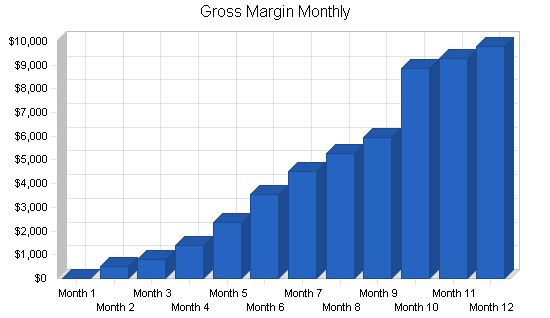

House of Projectors has taken a conservative approach to the sales forecast to make it more difficult to disappoint and easier to succeed. The following table and charts show that the first few months of business will be relatively slow, which is reasonable as the organization is in start-up mode and very little goodwill among customers and the community has been developed.

House of Projectors believes that sales for the first year will grow incrementally month to month. HOP will be encouraged if there is a steady increase in sales. With profitability forecasted to be reached during the second year, HOP does not have the unrealistic expectation of making a profit immediately or even within the first year. HOP recognizes that building a sustainable organization is a slow incremental process. HOP also recognizes that the sales forecast is just that, an educated guess of the sales patterns and level of the organization based on all available information.

Sales Forecast:

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Entrepreneurs | $18,796 | $65,778 | $80,943 |

| Companies | $33,475 | $115,400 | $142,005 |

| Total Sales | $52,271 | $181,178 | $222,948 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Entrepreneurs | $0 | $0 | $0 |

| Companies | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $0 | $0 | $0 |

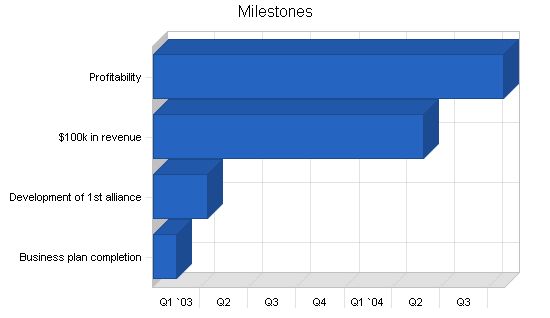

5.4 Milestones:

House of Projectors has developed ambitious yet achievable milestones for the entire organization. The following table lists the milestones, their expected completion timeline, and the responsible individuals.

Milestones

| Business plan completion | 1/1/2003 | 2/15/2003 | $0 | John | Business Dev |

| Development of 1st alliance | 1/1/2003 | 4/15/2003 | $0 | John | Marketing |

| $100k in revenue | 1/1/2003 | 5/30/2004 | $0 | John | Sales |

| Profitability | 1/1/2003 | 10/30/2004 | $0 | John | Operations |

| Totals | $0 |

Web Plan Summary

The website will be used as an informational tool for House of Projectors, providing information about the company and its services and equipment. The site will not have e-commerce functionality at this time. The functionality for customers to make reservations or place orders online will be reconsidered in the future.

6.1 Website Marketing Strategy

The website will be marketed through two specific activities. The first is including the URL of House of Projectors in all printed literature. The second activity is submitting the site to several search engines, including Google and Yahoo!, to help people who need a projector rental find HOP.

6.2 Development Requirements

The website will be developed by leveraging below market programming skills from graduate students at nearby universities.

Management Summary

John Laaklytte graduated from Case Western Reserve University with a Business Degree. While in school, John worked as an assistant manager at a CompUSA retail store. After two years with CompUSA, John became a computer lab manager at the University during his last year of school. This position allowed John to interact with student lab patrons and develop his customer service skills.

After graduation, John worked for a national company that rents laptop computers to businesses. He improved his business skills and advanced to the position of regional manager. However, John felt restless and wanted more autonomy in his work.

John recognized that starting his own business would give him the challenge and autonomy he desired. This led to the idea of House of Projectors, a projector rental company.

7.1 Personnel Plan

– John: Responsible for operations, marketing, sales, and other functions.

– Bookkeeper: Part-time position handling accounts payable and receivable.

– Sales: Two part-time account managers responsible for customer maintenance and support.

– Customer support: Four part-time individuals responsible for customer technology support.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| John | $24,000 | $30,000 | $34,000 |

| Bookkeeper | $6,800 | $7,200 | $9,000 |

| Sales | $16,900 | $24,000 | $28,000 |

| Customer support | $38,000 | $48,000 | $48,000 |

| Total People | 8 | 8 | 8 |

| Total Payroll | $85,700 | $109,200 | $119,000 |

This section provides important financial information.

8.1 Important Assumptions

The following table details important financial assumptions.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

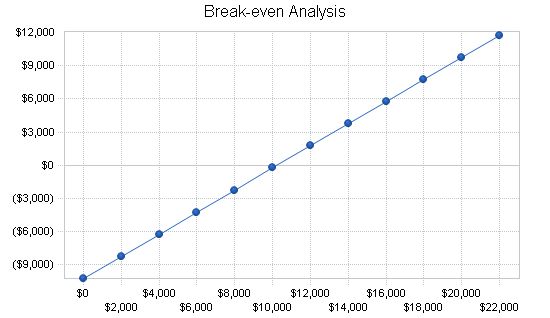

The Break-even Analysis determines the monthly revenue needed to reach the break-even point.

Break-even Analysis

Monthly Revenue Break-even: $10,246

Assumptions:

– Average Percent Variable Cost: 0%

– Estimated Monthly Fixed Cost: $10,246

8.3 Projected Profit and Loss

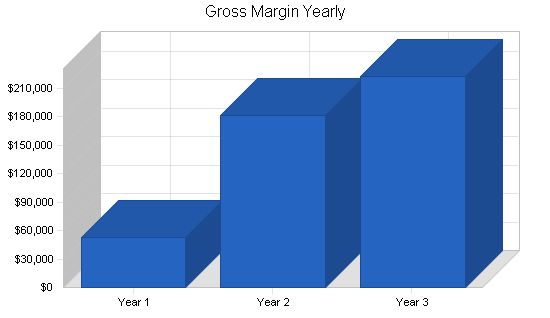

This table and charts project the Profit and Loss.

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $52,271 | $181,178 | $222,948 |

| Direct Cost of Sales | $0 | $0 | $0 |

| Other Costs of Sales | $0 | $0 | $0 |

| Total Cost of Sales | $0 | $0 | $0 |

| Gross Margin | $52,271 | $181,178 | $222,948 |

| Gross Margin % | 100.00% | 100.00% | 100.00% |

| Expenses | |||

| Payroll | $85,700 | $109,200 | $119,000 |

| Sales and Marketing and Other Expenses | $2,400 | $12,846 | $17,440 |

| Depreciation | $9,996 | $9,996 | $9,996 |

| Rent | $7,800 | $8,200 | $8,500 |

| Utilities | $2,400 | $3,000 | $3,500 |

| Insurance | $1,800 | $2,000 | $22,000 |

| Payroll Taxes | $12,855 | $16,380 | $17,850 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $122,951 | $161,622 | $198,286 |

| Profit Before Interest and Taxes | ($70,681) | $19,556 | $24,662 |

| EBITDA | ($60,684) | $29,552 | $34,658 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $0 | $5,867 | $7,399 |

| Net Profit | ($70,681) | $13,689 | $17,263 |

| Net Profit/Sales | -135.22% | 7.56% | 7.74% |

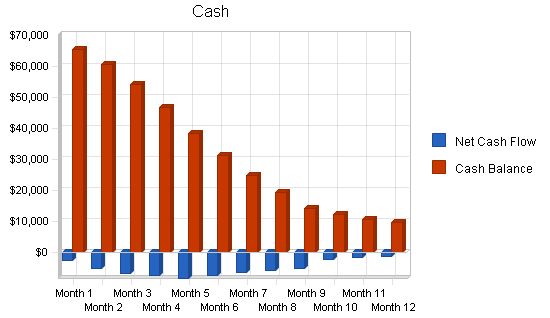

Projected Cash Flow:

8.4 Projected Cash Flow

The chart and table below present the Projected Cash Flow.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $52,271 | $181,178 | $222,948 |

| Subtotal Cash from Operations | $52,271 | $181,178 | $222,948 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $52,271 | $181,178 | $222,948 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $85,700 | $109,200 | $119,000 |

| Bill Payments | $24,877 | $46,702 | $74,355 |

| Subtotal Spent on Operations | $110,577 | $155,902 | $193,355 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $110,577 | $155,902 | $193,355 |

| Net Cash Flow | ($58,306) | $25,276 | $29,593 |

| Cash Balance | $9,794 | $35,070 | $64,663 |

8.5 Projected Balance Sheet

The following table displays the Projected Balance Sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $9,794 | $35,070 | $64,663 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $9,794 | $35,070 | $64,663 |

| Long-term Assets | |||

| Long-term Assets | $50,000 | $50,000 | $50,000 |

| Accumulated Depreciation | $9,996 | $19,992 | $29,988 |

| Total Long-term Assets | $40,004 | $30,008 | $20,012 |

| Total Assets | $49,797 | $65,078 | $84,675 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $2,378 | $3,969 | $6,303 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $2,378 | $3,969 | $6,303 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $2,378 | $3,969 | $6,303 |

| Paid-in Capital | $125,000 | $125,000 | $125,000 |

| Retained Earnings | ($6,900) | ($77,581) | ($63,891) |

| Earnings | ($70,681) | $13,689 | $17,263 |

| Total Capital | $47,419 | $61,109 | $78,372 |

| Total Liabilities and Capital | $49,797 | $65,078 | $84,675 |

| Net Worth | $47,419 | $61,109 | $78,372 |

8.6 Business Ratios

Business Ratios for HOP. SIC class/code: Office machine rental, except computers – 7359.0505

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 246.61% | 23.05% | 7.07% |

| Percent of Total Assets | ||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 44.65% |

| Total Current Assets | 19.67% | 53.89% | 76.37% | 76.22% |

| Long-term Assets | 80.33% | 46.11% | 23.63% | 23.78% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 4.78% | 6.10% | 7.44% | 33.47% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 16.23% |

| Total Liabilities | 4.78% | 6.10% | 7.44% | 49.70% |

| Net Worth | 95.22% | 93.90% | 92.56% | 50.30% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 100.00% | 100.00% | 100.00% | 100.00% |

| Selling, General & Administrative Expenses | 235.22% | 92.44% | 92.26% | 84.88% |

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 1.01% |

| Profit Before Interest and Taxes | -135.22% | 10.79% | 11.06% | 1.94% |

| Main Ratios | General Assumptions:

– The provided table includes a 12-month plan, with the interest rate, tax rate, and other costs remaining constant throughout. Pro Forma Profit and Loss: – The table shows the sales, direct cost of sales, total cost of sales, gross margin, and gross margin percentage for each month. – It also includes the expenses, such as payroll, sales and marketing expenses, depreciation, rent, utilities, insurance, payroll taxes, and other costs, for each month. – The table then displays the total operating expenses, profit before interest and taxes, and EBITDA for each month. – Lastly, it presents the net profit and net profit/sales percentage for each month. Pro Forma Cash Flow: – The table shows the cash received from operations, including cash sales and the subtotal cash from operations, for each month. – It also lists additional cash received, such as sales tax, VAT, and HST/GST received. – The table then displays the expenditures from operations, including cash spending and bill payments, as well as the subtotal spent on operations for each month. – Additionally, it includes additional cash spent, such as sales tax, VAT, HST/GST paid out, and principal repayment of current borrowing. – Lastly, it presents the net cash flow and cash balance for each month. Pro Forma Balance Sheet |

|||

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $68,100 | $65,648 | $60,681 | $54,072 | $46,840 | $38,596 | $31,261 | $24,922 | $19,345 | $14,451 | $12,470 | $10,873 | $9,794 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $68,100 | $65,648 | $60,681 | $54,072 | $46,840 | $38,596 | $31,261 | $24,922 | $19,345 | $14,451 | $12,470 | $10,873 | $9,794 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 |

| Accumulated Depreciation | $0 | $833 | $1,666 | $2,499 | $3,332 | $4,165 | $4,998 | $5,831 | $6,664 | $7,497 | $8,330 | $9,163 | $9,996 |

| Total Long-term Assets | $50,000 | $49,167 | $48,334 | $47,501 | $46,668 | $45,835 | $45,002 | $44,169 | $43,336 | $42,503 | $41,670 | $40,837 | $40,004 |

| Total Assets | $118,100 | $114,815 | $109,014 | $101,573 | $93,508 | $84,431 | $76,262 | $69,091 | $62,681 | $56,954 | $54,139 | $51,709 | $49,797 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $1,508 | $1,726 | $1,972 | $2,117 | $2,378 | $2,378 | $2,378 | $2,378 | $2,378 | $2,378 | $2,378 | $2,378 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $1,508 | $1,726 | $1,972 | $2,117 | $2,378 | $2,378 | $2,378 | $2,378 | $2,378 | $2,378 | $2,378 | $2,378 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $0 | $1,508 | $1,726 | $1,972 | $2,117 | $2,378 | $2,378 | $2,378 | $2,378 | $2,378 | $2,378 | $2,378 | $2,378 |

| Paid-in Capital | $125,000 | $125,000 | $125,000 | $125,000 | $125,000 | $125,000 | $125,000 | $125,000 | $125,000 | $125,000 | $125,000 | $125,000 | $125,000 |

| Retained Earnings | ($6,900) | ($6,900) | ($6,900) | ($6,900) | ($6,900) | ($6,900) | ($6,900) | ($6,900) | ($6,900) | ($6,900) | ($6,900) | ($6,

Business Plan Outline

|

|

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!