Contents

Law Firm Business Plan

Wy’East Law Firm (WLF) is a boutique technology law firm based in Portland, Oregon. It is led by Richard Bloom, a seasoned attorney formerly with (name omitted)’s e-group. WLF specializes in servicing technology firms, particularly in the areas of mergers and acquisitions and qualified stock option plans. The firm caters to both startups and established companies.

In addition to the technology practice, WLF provides public interest legal work at subsidized rates. This allows the firm to offer legal assistance to public interest organizations without imposing excessive overhead costs.

WLF, a limited liability company, was founded and is directed by Richard Bloom.

1.1 Objectives

The objectives for WLF for the first three years include:

– Create a law firm that exceeds customer expectations.

– Develop a client list with 20 companies, each earning over $3 million.

– Increase service to public interest organizations each year.

– Offer subsidized legal services annually.

1.2 Mission

The mission of Wy’East Law Firm is to provide technological and public interest legal guidance to the Portland community. We aim to attract and maintain customers while supporting the public interest community. When we adhere to this mission, everything else will fall into place.

WLF is a law firm specializing in technology companies and public interest organizations. Our public interest work is subsidized by local companies. We specialize in mergers and acquisitions, stock option plans, and other legal needs for technology companies. The technology work covers the overhead cost of our public interest work.

2.1 Company Ownership

WLF is owned solely by Richard Bloom as a limited liability company.

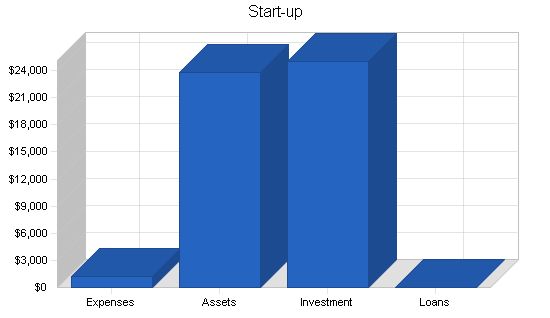

2.2 Start-up Summary

WLF’s start-up costs include equipment for the home office, website creation, and advertising.

– The home office equipment comprises 4 computers, a fax machine, copier, cellular phone, office supplies, an additional landline, DSL connection, and office furniture.

– Advertising will be done through a content-only website and the Yellow Pages.

Start-up Requirements

Start-up Expenses

– Legal: $0

– Stationery etc.: $100

– Website creation: $500

– DSL installation: $150

– Office equipment: $500

– Rent: $0

– Research and development: $0

– Expensed equipment: $0

– Other: $0

– Total Start-up Expenses: $1,250

Start-up Assets

– Cash Required: $18,750

– Other Current Assets: $0

– Long-term Assets: $5,000

– Total Assets: $23,750

Total Requirements: $25,000

Start-up Funding

Start-up Expenses to Fund: $1,250

Start-up Assets to Fund: $23,750

Total Funding Required: $25,000

Assets

– Non-cash Assets from Start-up: $5,000

– Cash Requirements from Start-up: $18,750

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $18,750

– Total Assets: $23,750

Liabilities and Capital

Liabilities

– Current Borrowing: $0

– Long-term Liabilities: $0

– Accounts Payable (Outstanding Bills): $0

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $0

Capital

– Planned Investment

– Investor 1: $25,000

– Investor 2: $0

– Other: $0

– Additional Investment Requirement: $0

– Total Planned Investment: $25,000

– Loss at Start-up (Start-up Expenses): ($1,250)

– Total Capital: $23,750

Total Capital and Liabilities: $23,750

Total Funding: $25,000

Services

WLF will provide law services to two groups of customers.

1. Technology law services: WLF will provide legal services to high technology clients, including start-up companies and established firms. While the firm excels in mergers, acquisitions, and qualified stock option plans, we also have experience in almost any legal field that a tech firm encounters. These clients, billed at market rate, will subsidize the public interest clients.

Market Analysis Summary

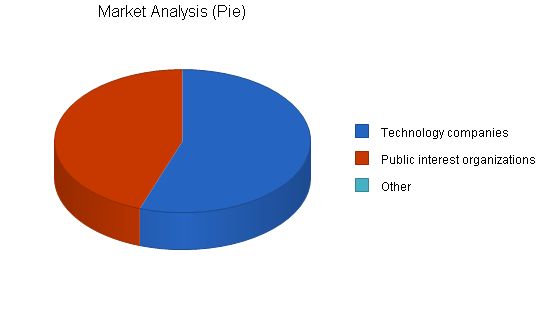

WLF’s customers can be divided into two groups, technology firms, and public interest organizations.

1. Technology firms: New clients are likely to be from small technology firms or start-up companies. Larger tech firms typically choose larger law firms that can offer a wide range of services. However, smaller companies with fewer legal needs can be serviced by a boutique firm like WLF. Start-ups may also be attracted to WLF because of our willingness to accept equity as partial payment for services rendered. Some clients were brought over from Richard’s old firm, including both small and larger companies.

2. Public interest organizations: These clients are diversified, ranging from environmental organizations to civil rights groups. While some receive pro bono legal services, there is a shortage of legal help for these organizations. Therefore, it is attractive for them to receive top legal help at a subsidized rate. The challenge for Richard will be selecting which organization to help.

Market Analysis:

Year 1 Year 2 Year 3 Year 4 Year 5

Potential Customers Growth CAGR

Technology companies 9% 345 376 410 447 487 9.00%

Public interest organizations 8% 278 300 324 350 378 7.98%

Other 0% 0 0 0 0 0 0.00%

Total 8.55% 623 676 734 797 865 8.55%

4.1 Target Market Segment Strategy

WLF will be targeting high technology companies for two reasons.

Although the economy has taken a recent plummet, particularly technology firms, technology is still a growing sector. This is evidenced by the fact that 17 out of the top 25 fastest growing companies are technology firms, according to The Business Journal of Portland.

WLF will be targeting public interest organizations for one simple reason: a desire to give back to the community. Public interest work is inherently altruistic. Generally, the person performing the work receives a good feeling for their contribution, but in today’s capitalistic society, someone who donates their time at far below market wages should be considered altruistic.

4.2 Service Business Analysis

The technology law practice is fairly competitive in Portland. Most larger, more prestigious firms have attorneys who specialize in technology. Some smaller firms also have attorneys who work for technology companies. Lastly, there are boutique firms, like WLF. As a service-based industry, the practice of law is driven by personal relationships and reputation. Potential clients choose attorneys based on reputation and who they know or are recommended to. Therefore, if an attorney provides better service to a client, the client is likely to form a long-lasting business relationship.

Clients typically switch attorneys only if they are unhappy with their current attorney. New companies find attorneys through networking: who they know or who their friends know.

WLF has the advantage that when Richard left (name omitted), he brought 15 clients, which, for now, are almost enough to survive.

Strategy and Implementation Summary

WLF will be courting new technology clients through networking and advertisements in the Yellow Pages, Business Journal of Portland, and other technology-specific regional journals. As stated earlier, WLF has enough business at day one. However, more technology clients mean the ability to perform more public interest work.

Richard will be attending the Portland Venture Group meetings as well as other informal gatherings of technology companies to network with different firms in the region. These networking activities, along with advertisements in appropriate media forms, will allow WLF to grow their list of clients.

5.1 Competitive Edge

WLF’s competitive advantage will be based on two factors: experience and specialization.

Experience. Richard brings to WLF three years of practicing technology law at a top Portland firm. Reputation carries a lot of weight, and Richard’s time at (name omitted) means a lot in the Portland legal community and is attractive to prospective clients. Additionally, the three years at (name omitted) provided Richard with big-name clients.

To develop good business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis.

5.2 Sales Strategy

WLF’s sales strategy will begin with months two through five, with the goal of serving existing clients. The absence of bringing in new clients during this time allows WLF and the existing clients to form a new relationship at WLF, different from their previous relationship at (name omitted).

Month six will signal WLF’s conscious effort to generate new clients. Using previous networking techniques, Richard, through personal communications, will convince prospective clients of the value of a boutique technology law firm, specifically the depth of knowledge and close attention that the client will get when dealing with a small firm.

Regarding public interest organizations, there will be less of a sales strategy, more of a choosing of the organizations that Richard wants to represent. There are many needy public interest organizations, and Richard will have to pick and choose those he wishes to help out.

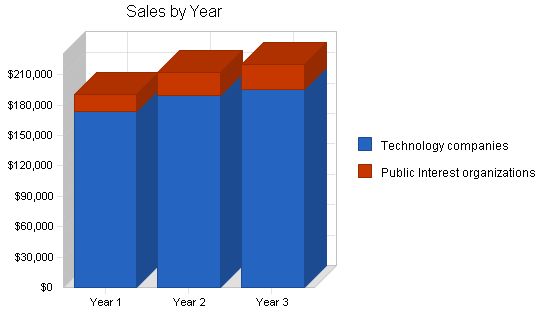

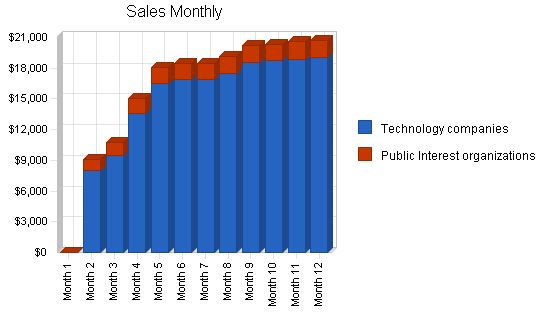

5.2.1 Sales Forecast

The first month will be spent setting up the home office, including an office, conference room, and computer equipment. During the first month, Richard will also be serving existing technology clients and some public interest clients. We project that if we spend 1/3 of our time on technology clients, this would sufficiently subsidize the public interest clients so we would only have to cover overhead expenses.

By month six, Richard will begin actively soliciting new clients. Between months one and five, he will continue networking but not be actively seeking customers. From month seven on, there will be a slight increase in clients taken on. There will be only a slight increase to create solid relationships with new and existing clients. Richard will be cognizant of the possibility of growing too fast and not being able to offer the same quality service to his clients.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Technology companies | $174,096 | $189,525 | $195,747 |

| Public Interest organizations | $16,839 | $22,578 | $24,547 |

| Total Sales | $190,935 | $212,103 | $220,294 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Technology companies | $0 | $0 | $0 |

| Public Interest organizations | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $0 | $0 | $0 |

5.3 Milestones

WLF will have several milestones early on:

- Business plan completion.

- Set up home office.

- First month of total technology subsidy.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business plan completion | 1/1/2001 | 1/1/2001 | $0 | Richard | Marketing |

| Set up office | 1/1/2001 | 1/1/2001 | $0 | Richard | Department |

| First month of total technology subsidy | 4/1/2001 | 4/1/2001 | $0 | WLF | Department |

| Totals | $0 | ||||

Management Summary

Wy’East Law Firm is an Oregon Corporation founded and run by Richard Bloom. Richard has a degree in Political Science from the University of Colorado, Boulder, and a J.D. from Lewis and Clark University. While at Lewis and Clark, Richard was the President of the school’s Public Interest Student Organization. It was through this organization that Richard became fond of public interest law. After graduation, Richard went to work for (name omitted) for three years in the e-group which concentrated on technology. While working in the e-group, Richard worked on technology issues with a number of well known start-up organizations and established companies.

One of the perks working at (name omitted) was his ability to do pro bono work which counted toward his required yearly billable hours requirement. Richard has spent a fair amount of time with 1000 Friends of Oregon and other public interest organizations. After three years however, Richard was feeling constrained and desired more autonomy. He decided to leave and start his own firm. Richard was able to bring a fair number of his clients from (name omitted) to his new firm, helping the transition from leaving an established practice to hanging out his own shingle and starting over.

6.1 Personnel Plan

The staff will consist of Richard working full time. In addition to Richard, a part-time secretary and part-time paralegal will join WLF by month two. Month four will bring WLF a law clerk, and a second law clerk by month eight.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Richard | $66,000 | $66,000 | $66,000 |

| Receptionist/ secretary | $11,550 | $12,500 | $13,500 |

| Paralegal | $22,000 | $23,000 | $24,000 |

| Law clerk | $8,100 | $11,000 | $12,000 |

| Law clerk | $4,500 | $11,000 | $12,000 |

| Total People | 5 | 5 | 5 |

| Total Payroll | $112,150 | $123,500 | $127,500 |

Financial Plan

The following sections will outline important financial information.

7.1 Important Assumptions

The following table details important assumptions.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 25.42% | 25.00% | 25.42% |

| Other | 0 | 0 | 0 |

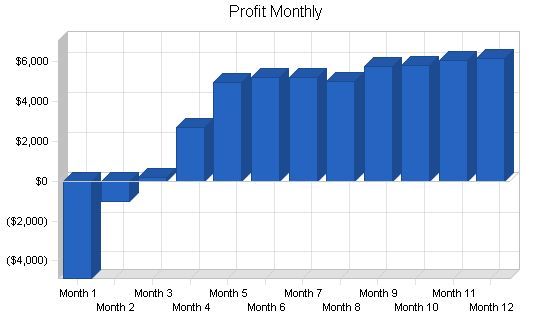

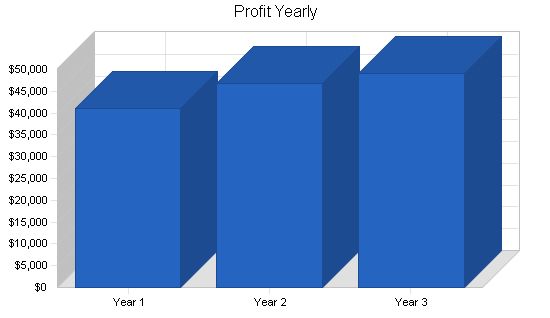

7.2 Projected Profit and Loss

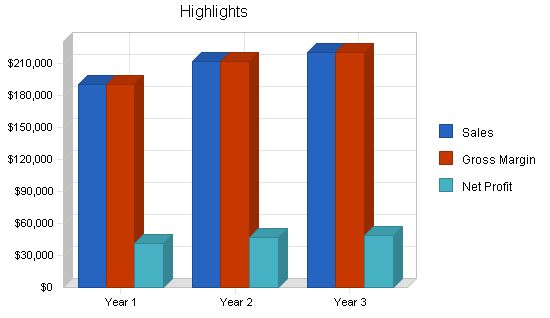

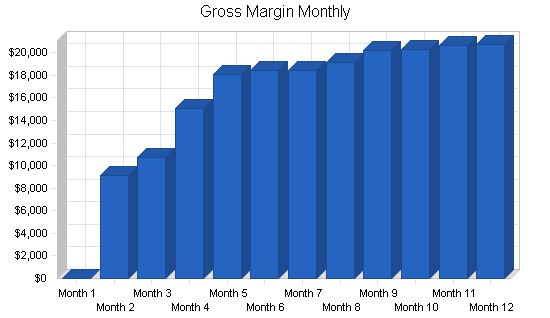

The following table and charts present the projected profit and loss.

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $190,935 | $212,103 | $220,294 |

| Direct Cost of Sales | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Total Cost of Sales | $0 | $0 | $0 |

| Gross Margin | $190,935 | $212,103 | $220,294 |

| Gross Margin % | 100.00% | 100.00% | 100.00% |

| Expenses | |||

| Payroll | $112,150 | $123,500 | $127,500 |

| Sales and Marketing and Other Expenses | $2,160 | $2,160 | $2,160 |

| Depreciation | $1,668 | $1,666 | $1,666 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $1,500 | $1,500 | $1,500 |

| Rent | $2,400 | $2,400 | $2,400 |

| Payroll Taxes | $16,823 | $18,525 | $19,125 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $136,701 | $149,751 | $154,351 |

| Profit Before Interest and Taxes | $54,235 | $62,352 | $65,943 |

| EBITDA | $55,903 | $64,018 | $67,609 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $13,210 | $15,588 | $16,761 |

| Net Profit | $41,024 | $46,764 | $49,182 |

| Net Profit/Sales | 21.49% | 22.05% | 22.33% |

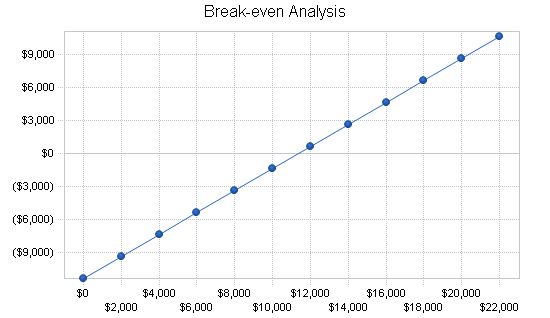

7.3 Break-even Analysis

The Break-even Analysis shows the hours and revenue needed per month for WLF to reach the break-even point.

Break-even Analysis

Monthly Revenue Break-even: $11,392

Assumptions:

– Average Percent Variable Cost: 0%

– Estimated Monthly Fixed Cost: $11,392

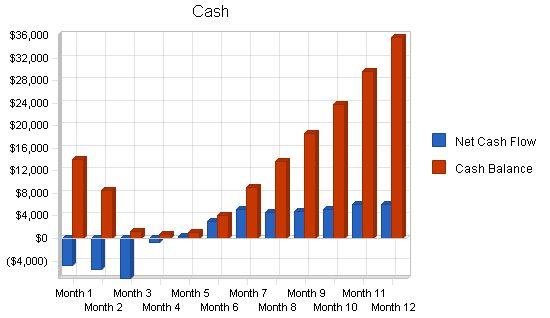

7.4 Projected Cash Flow

The chart and table below display anticipated cash flow.

Pro Forma Cash Flow

Year 1 Year 2 Year 3

Cash Received

Cash from Operations

Cash Sales $47,734 $53,026 $55,074

Cash from Receivables $112,707 $155,697 $163,912

Subtotal Cash from Operations $160,441 $208,722 $218,986

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $0 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $0 $0 $0

Subtotal Cash Received $160,441 $208,722 $218,986

Expenditures

Year 1 Year 2 Year 3

Expenditures from Operations

Cash Spending $112,150 $123,500 $127,500

Bill Payments $31,394 $41,570 $41,800

Subtotal Spent on Operations $143,544 $165,070 $169,300

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $0 $0 $0

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $0 $0 $0

Purchase Other Current Assets $0 $0 $0

Purchase Long-term Assets $0 $0 $0

Dividends $0 $0 $0

Subtotal Cash Spent $143,544 $165,070 $169,300

Net Cash Flow $16,898 $43,652 $49,686

Cash Balance $35,648 $79,300 $128,986

7.5 Projected Balance Sheet

The following table displays the projected balance sheet.

Pro Forma Balance Sheet

Year 1 Year 2 Year 3

Assets

Current Assets

Cash $35,648 $79,300 $128,986

Accounts Receivable $30,494 $33,874 $35,183

Other Current Assets $0 $0 $0

Total Current Assets $66,141 $113,174 $164,168

Long-term Assets

Long-term Assets $5,000 $5,000 $5,000

Accumulated Depreciation $1,668 $3,334 $5,000

Total Long-term Assets $3,332 $1,666 $0

Total Assets $69,473 $114,840 $164,168

Liabilities and Capital

Year 1 Year 2 Year 3

Current Liabilities

Accounts Payable $4,699 $3,302 $3,448

Current Borrowing $0 $0 $0

Other Current Liabilities $0 $0 $0

Subtotal Current Liabilities $4,699 $3,302 $3,448

Long-term Liabilities $0 $0 $0

Total Liabilities $4,699 $3,302 $3,448

Paid-in Capital $25,000 $25,000 $25,000

Retained Earnings ($1,250) $39,774 $86,538

Earnings $41,024 $46,764 $49,182

Total Capital $64,774 $111,538 $160,721

Total Liabilities and Capital $69,473 $114,840 $164,168

Net Worth $64,774 $111,538 $160,721

7.6 Business Ratios

Industry profile ratios based on the NAICS code 541110, Offices of Lawyers, are shown in the table below.

Ratio Analysis

Year 1 Year 2 Year 3 Industry Profile

Sales Growth 0.00% 11.09% 3.86% 8.50%

Percent of Total Assets

Accounts Receivable 43.89% 29.50% 21.43% 8.60%

Other Current Assets 0.00% 0.00% 0.00% 66.90%

Total Current Assets 95.20% 98.55% 100.00% 75.50%

Long-term Assets 4.80% 1.45% 0.00% 24.50%

Total Assets 100.00% 100.00% 100.00% 100.00%

Current Liabilities

Accounts Payable 6.76% 2.88% 2.10% 50.20%

Long-term Liabilities 0.00% 0.00% 0.00% 12.90%

Total Liabilities 6.76% 2.88% 2.10% 63.10%

Net Worth 93.24% 97.12% 97.90% 36.90%

Percent of Sales

Sales 100.00% 100.00% 100.00% 100.00%

Gross Margin 100.00% 100.00% 100.00% 0.00%

Selling, General & Administrative Expenses 78.70% 77.95% 77.55% 58.20%

Advertising Expenses 0.13% 0.11% 0.11% 0.50%

Profit Before Interest and Taxes 28.40% 29.40% 29.93% 3.40%

Main Ratios

Current 14.08 34.28 47.62 1.54

Quick 14.08 34.28 47.62 1.09

Total Debt to Total Assets 6.76% 2.88% 2.10% 63.10%

Pre-tax Return on Net Worth 83.73% 55.90% 41.03% 12.30%

Pre-tax Return on Assets 78.07% 54.29% 40.17% 33.40%

Additional Ratios

Net Profit Margin 21.49% 22.05% 22.33% n.a

Return on Equity 63.33% 41.93% 30.60% n.a

Activity Ratios

Accounts Receivable Turnover 4.70 4.70 4.70 n.a

Collection Days 57 74 76 n.a

Accounts Payable Turnover 7.68 12.17 12.17 n.a

Payment Days 34 36 29 n.a

Total Asset Turnover

General Assumptions

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Plan Month 1 2 3 4 5 6 7 8 9 10 11 12

Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Tax Rate 30.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00%

Other 0 0 0 0 0 0 0 0 0 0 0 0

Pro Forma Profit and Loss

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Sales $0 $9,105 $10,714 $15,087 $18,092 $18,461 $18,438 $19,179 $20,213 $20,300 $20,628 $20,718

Direct Cost of Sales $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Cost of Sales $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Gross Margin $0 $9,105 $10,714 $15,087 $18,092 $18,461 $18,438 $19,179 $20,213 $20,300 $20,628 $20,718

Gross Margin % 0.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

Expenses

Payroll $5,500 $8,550 $8,550 $9,450 $9,450 $9,450 $9,450 $10,350 $10,350 $10,350 $10,350 $10,350

Sales and Marketing and Other Expenses $180 $180 $180 $180 $180 $180 $180 $180 $180 $180 $180 $180

Depreciation $139 $139 $139 $139 $139 $139 $139 $139 $139 $139 $139 $139

Leased Equipment $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Utilities $125 $125 $125 $125 $125 $125 $125 $125 $125 $125 $125 $125

Rent $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200

Payroll Taxes 15% $825 $1,283 $1,283 $1,418 $1,418 $1,418 $1,418 $1,418 $1,553 $1,553 $1,553 $1,553

Other $0 $0 $0 $

Pro Forma Balance Sheet

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||||||||

| Assets | Starting Balances | ||||||||||||||||||

| Current Assets | |||||||||||||||||||

| Cash | $18,750 | $14,011 | $8,424 | $1,322 | $634 | $1,010 | $3,995 | $9,073 | $13,707 | $18,533 | $23,693 | $29,663 | $35,648 | ||||||

| Accounts Receivable | $0 | $0 | $6,829 | $14,637 | $19,083 | $24,507 | $26,962 | $27,213 | $27,752 | $29,065 | $29,879 | $30,188 | $30,494 | ||||||

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||||||

| Total Current Assets | $18,750 | $14,011 | $15,253 | $15,959 | $19,717 | $25,517 | $30,958 | $36,286 | $41,459 | $47,597 | $53,573 | $59,852 | $66,141 | ||||||

| Long-term Assets | |||||||||||||||||||

| Long-term Assets | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | ||||||

| Accumulated Depreciation | $0 | $139 | $278 | $417 | $556 | $695 | $834 | $973 | $1,112 | $1,251 | $1,390 | $1,529 | $1,668 | ||||||

| Total Long-term Assets | $5,000 | $4,861 | $4,722 | $4,583 | $4,444 | $4,305 | $4,166 | $4,027 | $3,888 | $3,749 | $3,610 | $3,471 | $3,332 | ||||||

| Total Assets | $23,750 | $18,872 | $19,975 | $20,542 | $24,161 | $29,822 | $35,124 | $40,313 | $45,347 | $51,346 | $57,183 | $63,323 | $69,473 | ||||||

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |||||||

| Current Liabilities | |||||||||||||||||||

| Accounts Payable | $0 | $0 | $2,132 | $2,521 | $3,458 | $4,184 | $4,273 | $4,268 | $4,327 | $4,577 | $4,598 | $4,677 | $4,699 | ||||||

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||||||

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||||||

| Subtotal Current Liabilities | $0 | $0 | $2,132 | $2,521 | $3,458 | $4,184 | $4,273 | $4,268 | $4,327 | $4,577 | $4,598 | $4,677 | $4,699 | ||||||

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||||||

| Total Liabilities | $0 | $0 | $2,132 | $2,521 | $3,458 | $4,184 | $4,273 | $4,268 | $4,327 | $4,577 | $4,598 | $4,677 | $4,699 | ||||||

| Paid-in Capital | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | ||||||

| Retained Earnings | ($1,250) | ($1,250) | ($1,250) | ($1,250) | ($1,250) | ($1,250) | ($1,250) | ($1,250) | ($1

Business Plan Outline

+ |

||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!