Web Solutions, Inc. (Web Solutions) is an ISP based in Phoenix, Arizona. The company offers the following services:

– Dialup and dedicated Internet access (up to 64 Kbps).

– High bandwidth Internet access (128 Kbps) including ISDN, DSL, and wireless.

Web Solutions aims to provide customers with a complete solution for their Internet and private network needs. Their customer base includes all consumers and small to medium-sized businesses, including start-ups.

The company benefits from strategic alliances, which allow them to offer competitive pricing on their services.

According to the International Data Corporation (IDC), the consumer ISP market is projected to expand from $10.7 billion in 1998 to $37 billion in 2003.

Competitive threats come from other ISPs in Phoenix, such as Jump.Net, Arizona.Net, EarthLink, and Mindspring. However, most competitors only offer solutions for Windows and Macintosh, leaving opportunities for Web Solutions to excel with the rise of alternative operating systems like Linux.

Web Solutions has a world-class management team with extensive industry knowledge, research experience, and unique administration skills. The team includes Jason Williams, Amy Williams, and Geena James.

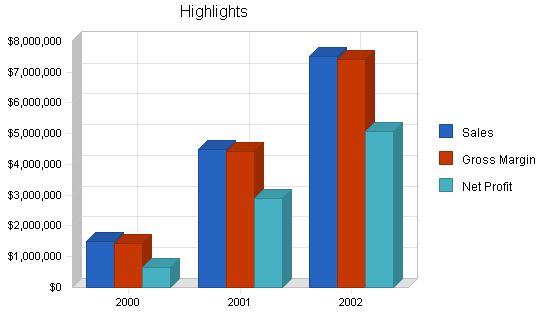

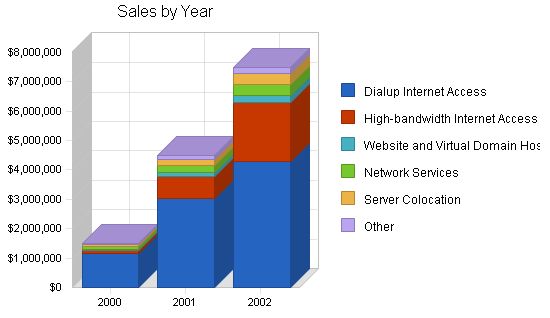

Projected revenues for 2000 through 2002 demonstrate substantial steady growth. The company seeks a major investment to fund four areas of growth:

1. Increase personnel for sales, service, and development.

2. Expand marketing efforts to ensure awareness of offerings and competitive pricing.

3. Extend operations to include the top 100 U.S. markets for dialup and dedicated Internet access through wholesale providers, partnerships, and other mechanisms.

4. Conduct research and development for new product offerings.

Web Solutions aims to provide customers with complete solutions for their Internet and private network needs. With a focus on quality work, the company seeks to enhance its industry image and become a respected provider of advanced network solutions. This will be accomplished by increasing service offerings, availability, and accessibility to customers, as well as creating innovative and cost-effective solutions.

Web Solutions, Inc. is a C-class corporation, incorporated in Arizona in July 1997. Its offices are currently located in Phoenix, and all operations, including administration and product development, are conducted in this leased office. As the company expands and its staff grows beyond four full-time employees, there are plans to move to a larger facility.

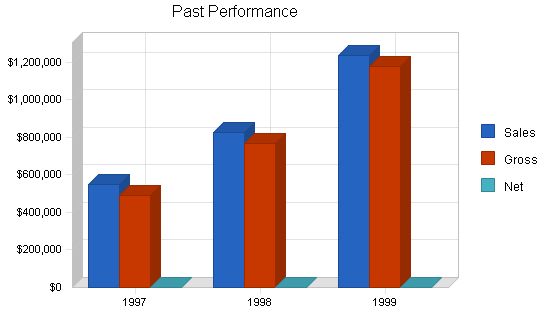

Past Performance:

Sales

1997

$550,000

$825,000

$1,237,500

Gross Margin

$490,000

$765,000

$1,177,500

Gross Margin %

89.09%

92.73%

95.15%

Operating Expenses

$160,100

$180,100

$200,100

Collection Period (days)

0

0

0

1997

1998

1999

Current Assets

Cash

$50,050

$75,075

$112,613

Accounts Receivable

$10,875

$15,400

$23,500

Other Current Assets

$15,400

$23,100

$34,650

Total Current Assets

$76,325

$113,575

$170,763

Long-term Assets

Long-term Assets

$147,400

$221,100

$331,650

Accumulated Depreciation

$0

$0

$0

Total Long-term Assets

$147,400

$221,100

$331,650

Total Assets

$223,725

$334,675

$502,413

Current Liabilities

Accounts Payable

$50,750

$65,125

$70,688

Current Borrowing

$40,150

$60,225

$90,337

Other Current Liabilities (interest free)

$0

$0

$0

Total Current Liabilities

$90,900

$125,350

$161,025

Long-term Liabilities

$287,100

$430,650

$645,975

Total Liabilities

$378,000

$556,000

$807,000

Paid-in Capital

$0

$0

$0

Retained Earnings

($154,275)

($221,325)

($304,587)

Earnings

$0

$0

$0

Total Capital

($154,275)

($221,325)

($304,587)

Total Capital and Liabilities

$223,725

$334,675

$502,413

Other Inputs

Payment Days

0

0

0

Sales on Credit

$0

$0

$0

Receivables Turnover

0.00

0.00

0.00

Services

Web Solutions currently delivers Internet service to dialup and ISDN customers, and will sell DSL services by February. The company hosts approximately 30 websites and has five co-located servers. Additionally, the company is evaluating e-commerce software, looking for the most flexible solution for its customers.

All services are competitively priced and targeted towards small businesses and SOHO customers. This market segment has been neglected due to the high fees charged by many ISPs for poor service and support.

By simplifying the creation, management, and support of our services, we enable customers to perform tasks themselves, making our pricing more competitive and our operation more reliable and profitable.

With our current hardware and facilities, we can:

– Handle an unlimited number of dialup users.

– Handle up to 46 dedicated channels.

– Handle up to 1,000 email users.

Service Description

Web Solutions is a full-service ISP, offering dialup and dedicated Internet access, Web and virtual domain hosting, server co-located, and network-related professional solutions. The company allows people and businesses to access and publish documents on the World Wide Web without the need for expensive resources.

The company provides many services for customers to get online, including connectivity and consulting. We select products based on their benefit to customers/company, cost/benefit ratio, and maintainability.

We strive to keep customers informed and resolve problems quickly. We offer telephone support during extended business hours and have an on-call pager for emergencies. We plan to implement a 24/7 network operations center and a toll-free technical support phone number in the future.

Fulfillment

All products are implementations of Open Source products. The groupware product is based on OpenDesk.com’s software, with added functionality developed by our team.

For the VVD product, we will design and manufacture custom equipment for customers to receive and convert data to video or voice.

We have a usage policy that allows us to refund a portion of the customers’ monthly access fee for extended network outages.

We provide technical advice to pre-sales customers and offer technical support for all purchases at no cost to our clientele.

Future Services

We plan to offer a free back-office service with email, file sharing, calendaring/scheduling, and other applications. This will provide collaboration tools for groups at little or no cost.

We are researching integrated voice, video, and data services over high-speed network connections to compete with traditional cable and telephone companies and provide new revenue streams. We plan to have a working prototype by October 1, 2000, and a limited launch by March 1, 2001.

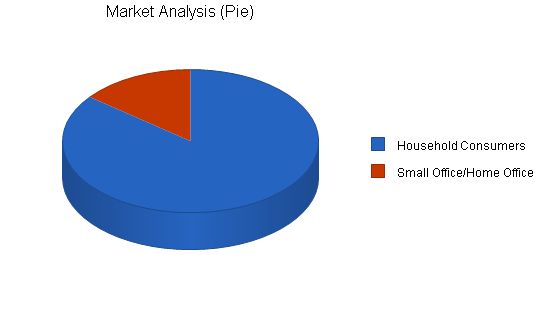

Market Analysis Summary

Our customer base includes all consumers and small to medium-sized businesses. We will focus on SOHO clients as they have special pricing and service needs and offer the greatest growth potential.

– End of document –

Market Analysis Table:

Market Analysis

Year 2000 2001 2002 2003 2004

Potential Customers Growth CAGR

Household Consumers 10% 101,041,000 111,044,059 122,037,421 134,119,126 147,396,919 9.90%

Small Office/Home Office 3% 16,963,070 17,404,110 17,856,617 18,320,889 18,797,232 2.60%

Total 8.94% 118,004,070 128,448,169 139,894,038 152,440,015 166,194,151 8.94%

Service Business Analysis:

4.2 Competition and Buying Patterns

Web Solutions believes its customers choose its products and services based on price, experience, reputation, service, and accessibility.

4.2.2 Main Competitors

Competitive threats come from other ISPs, including Jump.Net, Arizona.Net, AOL, EarthLink, Mindspring, and Prodigy Internet. Most competitors offer solutions for Windows and Mac, ignoring other operating systems. With the rise of Linux and alternative systems, there is potential for Web Solutions to surpass competitors.

Key competitors are:

Jump.Net

– Basic service: simple, inexpensive way to connect home or business to the Internet.

– Complete details: custom solution for unique requirements, offering connectivity and special services.

Arizona.Net

– ISP specializing in modem dial-up, ISDN, LAN access, and T1 to the Internet.

Earthlink

– Provides reliable, unlimited Internet access, Web hosting services, technical support, information, and innovative services.

Mindspring

– Delivers complete Business Internet Solutions tailored to small businesses.

4.2.3 Risks

The company acknowledges market and industry risks. These include regulations, monopolistic pricing, legal matters, and technology shifts. To mitigate these risks, the company diversifies, maintains low prices, complies with the law, and stays up to date with technological advancements.

4.2.4 Business Participants

Web Solutions competes in low-cost Internet access and website hosting. The industry is moving towards a fusion of VVD services over a single common media. Web Solutions aims to be a content provider and is specialized in functionalities, web hosting, dialup access, and content provision.

Strategy and Implementation Summary:

The Web Solutions strategy is to achieve name recognition and attract customers by aggressively pricing its services. In addition, the company plans to implement a low-cost strategy, establish agreements with local media companies for discounted advertising, and offer secondary income streams through free email services, business directories, and other services. The company’s small size allows it to respond quickly to opportunities and adapt to technological advancements.

Competitive Edge:

Web Solutions is the lowest-priced provider in Phoenix for most commercial services. Its size gives it a competitive advantage in terms of agility and hiring talented individuals. The company has learned from previous ISP mistakes and hires technically-savvy individuals.

Web Solutions’ marketing activities include advertising design and placement, public relations, industry conferences, competitive information analysis, creation and maintenance of corporate literature and websites, sales support material creation, and client testimonials collection and dissemination. The company utilizes direct marketing, computer reseller and repair facilities, and high-traffic areas for generating sales. Marketing initiatives focus on contact campaigns, print advertising, trade shows, industry organizations, telemarketing campaigns, and promotional giveaways.

The sales forecast is based on industry predictions mentioned in the Executive Summary.

Sales Forecast Table

Direct Cost of Sales Table

Strategic Alliances

Web Solutions currently has strategic relationships with:

– World Communications for Internet service.

– Phoenix DSL Networks for DSL resale.

– Phoenix Communications for high-speed wireless.

– Internet of Phoenix for dialup connectivity (they provide wholesale pricing in the Phoenix area).

Web Solutions benefits from these relationships by receiving competitive pricing on most services, allowing the company to offer competitive pricing to customers.

The company is pursuing an agreement with a local radio station to provide web hosting services, including extended email services and dial-up access under a co-branding agreement. Discussions are ongoing about a potential collaboration between Web Solutions and the radio station’s parent company, Jordan’s Media.

The company plans to develop community calendaring and groupware applications based on the Open Source project maintained at www.opendesk.com. This will provide a simple tool for organizations, businesses, and individuals to organize, plan, announce, and track projects and events.

In the future, the company plans to partner with backbone providers, wholesale carriers, and other organizations to:

– Reduce cost of goods and services.

– Increase the variety of goods and services offered to customers.

– Expand into new territories.

The company is establishing re-seller agreements with DSL and wireless high-bandwidth providers and other services to compete in these markets and gain broader consumer recognition.

Management Summary

The company’s management philosophy is based on responsibility and mutual respect. Web Solutions encourages productivity and respect for customers and employees. The company aims to create an environment where creativity can flourish, generating new ideas and products is rewarded, and communication and sharing of knowledge are encouraged.

Management Team

Web Solution’s management team is highly experienced and qualified. Key members include:

– Donald Williams – President

– Amy Williams – Secretary

– Geena James – Treasurer

Personnel Plan

Web Solutions’ annual Personnel Plan is shown below:

This section presents our financial projections:

Important Assumptions

1. Nature and Limitation of Projections: This financial projection is based on expected sales volume and represents the company’s assets, liabilities, capital, revenues, and expenses. The projections reflect management’s judgement and expected course of action.

2. Revenues: The company’s revenue is primarily from subscriptions. Revenue projections are based on industry averages and previous sales.

3. Expenses: The company’s expenses include salaries, sales commissions, and administrative costs. Other expenses are based on management’s estimates and industry averages.

General Assumptions Table

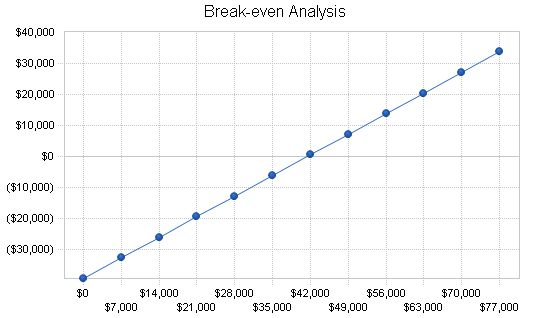

The following table and chart reflect the company’s break-even estimates based on fixed and variable cost estimates. Web Solutions has high gross margins and is adaptable to changing market conditions.

Break-even Analysis

Monthly Revenue Break-even: $41,368

Assumptions:

Average Percent Variable Cost: 5%

Estimated Monthly Fixed Cost: $39,228

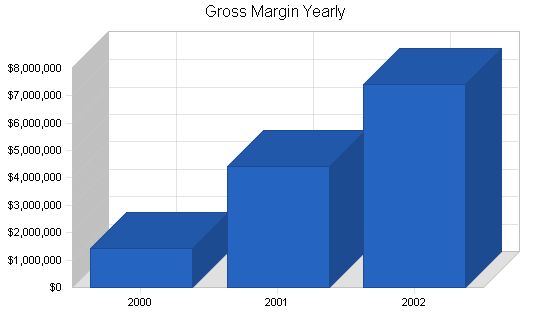

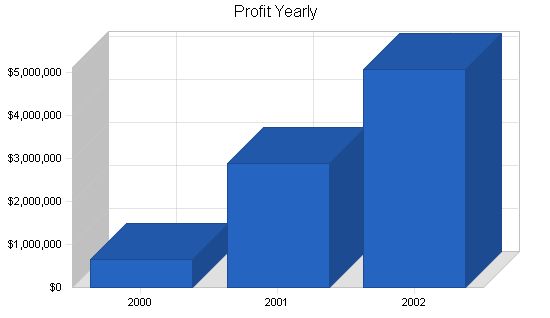

7.3 Projected Profit and Loss

Web Solutions is in the early stage of development, so initial projections have only been made for key revenue drivers. The table below shows Web Solution’s projected income statements for 2000-2002.

Pro Forma Profit and Loss

| 2000 | 2001 | 2002 | |

| Sales | $1,500,000 | $4,500,000 | $7,500,000 |

| Direct Cost of Sales | $77,596 | $84,296 | $88,796 |

| Other | $0 | $0 | $0 |

| Total Cost of Sales | $77,596 | $84,296 | $88,796 |

| Gross Margin | $1,422,404 | $4,415,704 | $7,411,204 |

| Gross Margin % | 94.83% | 98.13% | 98.82% |

| Expenses | |||

| Payroll | $307,800 | $342,400 | $392,400 |

| Sales and Marketing and Other Expenses | $41,468 | $41,468 | $41,468 |

| Depreciation | $0 | $0 | $0 |

| Legal Fees | $300 | $300 | $300 |

| Utilities | $3,600 | $3,600 | $3,600 |

| Insurance | $4,200 | $4,200 | $4,200 |

| Mortgage | $67,200 | $67,200 | $67,200 |

| Payroll Taxes | $46,170 | $51,360 | $58,860 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $470,738 | $510,528 | $568,028 |

| Profit Before Interest and Taxes | $951,666 | $3,905,176 | $6,843,176 |

| EBITDA | $951,666 | $3,905,176 | $6,843,176 |

| Interest Expense | $62,256 | $43,614 | $27,097 |

| Taxes Incurred | $226,397 | $965,390 | $1,732,420 |

| Net Profit | $663,013 | $2,896,171 | $5,083,659 |

| Net Profit/Sales | 44.20% | 64.36% | 67.78% |

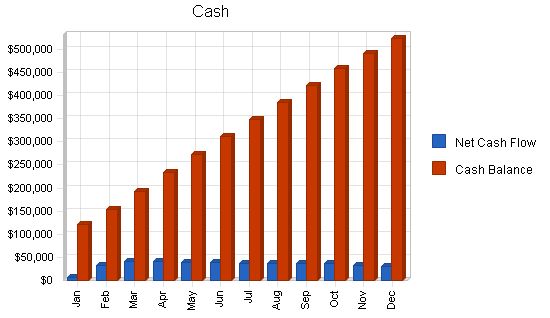

Projected Cash Flow

This chart and table display our cash flow and cash balance projections.

Pro Forma Cash Flow:

Cash Received:

– Cash from Operations:

– Cash Sales: $1,275,000 (2000), $3,825,000 (2001), $6,375,000 (2002)

– Cash from Receivables: $213,735 (2000), $605,470 (2001), $1,055,470 (2002)

– Subtotal Cash from Operations: $1,488,735 (2000), $4,430,470 (2001), $7,430,470 (2002)

– Additional Cash Received:

– Sales Tax, VAT, HST/GST Received: $0 (2000), $0 (2001), $0 (2002)

– New Current Borrowing: $0 (2000), $0 (2001), $0 (2002)

– New Other Liabilities (interest-free): $0 (2000), $0 (2001), $0 (2002)

– New Long-term Liabilities: $0 (2000), $0 (2001), $0 (2002)

– Sales of Other Current Assets: $0 (2000), $0 (2001), $0 (2002)

– Sales of Long-term Assets: $0 (2000), $0 (2001), $0 (2002)

– New Investment Received: $0 (2000), $0 (2001), $0 (2002)

– Subtotal Cash Received: $1,488,735 (2000), $4,430,470 (2001), $7,430,470 (2002)

Expenditures:

– Expenditures from Operations:

– Cash Spending: $307,800 (2000), $342,400 (2001), $392,400 (2002)

– Bill Payments: $560,320 (2000), $1,197,305 (2001), $1,961,269 (2002)

– Subtotal Spent on Operations: $868,120 (2000), $1,539,705 (2001), $2,353,669 (2002)

– Additional Cash Spent:

– Sales Tax, VAT, HST/GST Paid Out: $0 (2000), $0 (2001), $0 (2002)

– Principal Repayment of Current Borrowing: $60,000 (2000), $30,338 (2001), $0 (2002)

– Other Liabilities Principal Repayment: $0 (2000), $0 (2001), $0 (2002)

– Long-term Liabilities Principal Repayment: $150,000 (2000), $150,000 (2001), $150,000 (2002)

– Purchase Other Current Assets: $0 (2000), $0 (2001), $0 (2002)

– Purchase Long-term Assets: $0 (2000), $0 (2001), $0 (2002)

– Dividends: $0 (2000), $0 (2001), $0 (2002)

– Subtotal Cash Spent: $1,078,120 (2000), $1,720,043 (2001), $2,503,669 (2002)

– Net Cash Flow: $410,615 (2000), $2,710,427 (2001), $4,926,801 (2002)

– Cash Balance: $523,228 (2000), $3,233,655 (2001), $8,160,456 (2002)

Projected Balance Sheet:

Assets:

– Current Assets:

– Cash: $523,228 (2000), $3,233,655 (2001), $8,160,456 (2002)

– Accounts Receivable: $34,765 (2000), $104,295 (2001), $173,825 (2002)

– Other Current Assets: $34,650 (2000), $34,650 (2001), $34,650 (2002)

– Total Current Assets: $592,643 (2000), $3,372,600 (2001), $8,368,931 (2002)

– Long-term Assets:

– Long-term Assets: $331,650 (2000), $331,650 (2001), $331,650 (2002)

– Accumulated Depreciation: $0 (2000), $0 (2001), $0 (2002)

– Total Long-term Assets: $331,650 (2000), $331,650 (2001), $331,650 (2002)

– Total Assets: $924,293 (2000), $3,704,250 (2001), $8,700,581 (2002)

Liabilities and Capital:

– Current Liabilities:

– Accounts Payable: $39,555 (2000), $103,679 (2001), $166,351 (2002)

– Current Borrowing: $30,337 (2000), ($1) (2001), ($1) (2002)

– Other Current Liabilities: $0 (2000), $0 (2001), $0 (2002)

– Subtotal Current Liabilities: $69,892 (2000), $103,678 (2001), $166,350 (2002)

– Long-term Liabilities: $495,975 (2000), $345,975 (2001), $195,975 (2002)

– Total Liabilities: $565,867 (2000), $449,653 (2001), $362,325 (2002)

– Paid-in Capital: $0 (2000), $0 (2001), $0 (2002)

– Retained Earnings: ($304,587) (2000), $358,426 (2001), $3,254,597 (2002)

– Earnings: $663,013 (2000), $2,896,171 (2001), $5,083,659 (2002)

– Total Capital: $358,426 (2000), $3,254,597 (2001), $8,338,256 (2002)

– Total Liabilities and Capital: $924,293 (2000), $3,704,250 (2001), $8,700,581 (2002)

– Net Worth: $358,426 (2000), $3,254,597 (2001), $8,338,256 (2002)

Ratio Analysis:

– Sales Growth: 21.21% (2000), 200.00% (2001), 66.67% (2002), Industry Profile: 15.97%

– Percent of Total Assets:

– Accounts Receivable: 3.76% (2000), 2.82% (2001), 2.00% (2002), Industry Profile: 23.91%

– Other Current Assets: 3.75% (2000), 0.94% (2001), 0.40% (2002), Industry Profile: 56.89%

– Total Current Assets: 64.12% (2000), 91.05% (2001), 96.19% (2002), Industry Profile: 85.48%

– Long-term Assets: 35.88% (2000), 8.95% (2001), 3.81% (2002), Industry Profile: 14.52%

– Total Assets: 100.00% (2000), 100.00% (2001), 100.00% (2002), Industry Profile: 100.00%

– Current Liabilities:

– Accounts Payable: 7.56% (2000), 2.80% (2001), 1.91% (2002), Industry Profile: 28.28%

– Long-term Liabilities: 53.66% (2000), 9.34% (2001), 2.25% (2002), Industry Profile: 19.52%

– Total Liabilities: 61.22% (2000), 12.14% (2001), 4.16% (2002), Industry Profile: 47.80%

– Net Worth: 38.78% (2000), 87.86% (2001), 95.84% (2002), Industry Profile: 52.20%

– Percent of Sales:

– Sales: 100.00% (2000), 100.00% (2001), 100.00% (2002), Industry Profile: 100.00%

– Gross Margin: 94.83% (2000), 98.13% (2001), 98.82% (2002), Industry Profile: 100.00%

– Selling, General & Administrative Expenses: 50.52% (2000), 33.89% (2001), 30.75% (2002), Industry Profile: 74.12%

– Advertising Expenses: 1.67% (2000), 0.56% (2001), 0.33% (2002), Industry Profile: 1.33%

– Profit Before Interest and Taxes: 63.44% (2000), 86.78% (2001), 91.24% (2002), Industry Profile: 2.07%

– Main Ratios:

– Current: 8.48 (2000), 32.53 (2001), 50.31 (2002), Industry Profile: 2.18

– Quick: 8.48 (2000), 32.53 (2001), 50.31 (2002), Industry Profile: 1.67

– Total Debt to Total Assets: 61.22% (2000), 12.14% (2001), 4.16% (2002), Industry Profile: 59.04%

– Pre-tax Return on Net Worth: 248.14% (2000), 118.65% (2001), 81.74% (2002), Industry Profile: 3.94%

– Pre-tax Return on Assets: 96.23% (2000), 104.25% (2001), 78.34% (2002), Industry Profile: 9.61%

– Additional Ratios (2000, 2001, 2002):

– Net Profit Margin: 44.20%, 64.36%, 67.78%, Industry Profile: n.a

– Return on Equity: 184.98%, 88.99%, 60.97%, Industry Profile: n.a

– Activity Ratios:

– Accounts Receivable Turnover: 6.47 (2000), 6.47 (2001), 6.47 (2002), Industry Profile: n.a

– Collection Days: 59 (2000), 38 (2001), 45 (2002), Industry Profile: n.a

– Accounts Payable Turnover: 13.38 (2000), 12.17 (2001), 12.17 (2002), Industry Profile: n.a

– Payment Days: 31 (2000), 21 (2001), 24 (2002), Industry Profile: n.a

– Total Asset Turnover: 1.62 (2000), 1.21 (2001), 0.86 (2002), Industry Profile: n.a

– Debt Ratios:

– Debt to Net Worth: 1.58 (2000), 0.14 (2001), 0.04 (2002), Industry Profile: n.a

– Current Liabilities to Liabilities: 0.12 (2000), 0.23 (2001), 0.46 (2002), Industry Profile: n.a

– Liquidity Ratios:

– Net Working Capital: $522,751 (2000), $3,268,922 (2001), $8,202,581 (2002), Industry Profile: n.a

– Interest Coverage: 15.29 (2000), 89.54 (2001), 252.54 (2002), Industry Profile: n.a

– Additional Ratios (2000, 2001, 2002):

– Assets to Sales: 0.62, 0.82, 1.16, Industry Profile: n.a

– Current Debt/Total Assets: 8%, 3%, 2%, Industry Profile: n.a

– Acid Test: 7.98, 31.52, 49.26, Industry Profile: n.a

– Sales/Net Worth: 4.18, 1.38, 0.90, Industry Profile: n.a

– Dividend Payout: 0.00, 0.00, 0.00, Industry Profile: n.a

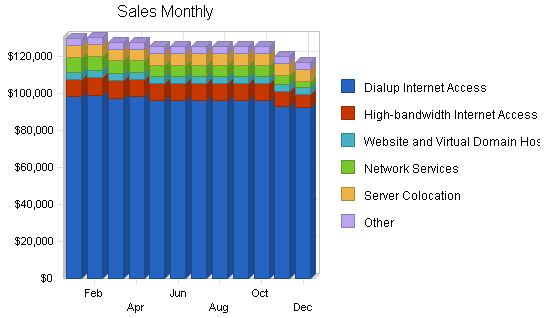

Sales Forecast:

Sales:

– Dialup Internet Access: $0 (Jan), $98,250 (Feb), $98,500 (Mar), $97,250 (Apr), $98,250 (May), $96,250 (Jun), $96,250 (Jul), $96,250 (Aug), $96,250 (Sep), $96,250 (Oct), $96,250 (Nov), $93,000 (Dec)

– High-bandwidth Internet Access: $0 (Jan), $9,250 (Feb), $9,750 (Mar), $9,500 (Apr), $9,250 (May), $8,750 (Jun), $8,750 (Jul), $8,750 (Aug), $8,750 (Sep), $8,750 (Oct), $8,750 (Nov), $7,750 (Dec)

– Website and Virtual Domain Hosting: $0 (Jan), $3,750 (Feb), $3,750 (Mar), $3,750 (Apr), $3,750 (May), $3,750 (Jun), $3,750 (Jul), $3,750 (Aug), $3,750 (Sep), $3,750 (Oct), $3,750 (Nov), $3,750 (Dec)

– Network Services: $0 (Jan), $8,000 (Feb), $8,000 (Mar), $7,000 (Apr), $6,250 (May), $6,250 (Jun), $6,250 (Jul), $6,250 (Aug), $6,250 (Sep), $6,250 (Oct), $6,250 (Nov), $5,000 (Dec)

– Server Colocation: $0 (Jan), $6,250 (Feb), $6,250 (Mar), $6,250 (Apr), $6,250 (May), $6,250 (Jun), $6,250 (Jul), $6,250 (Aug), $6,250 (Sep), $6,250 (Oct), $6,250 (Nov), $6,250 (Dec)

– Other: $0 (Jan), $3,750 (Feb), $3,750 (Mar), $3,750 (Apr), $3,750 (May), $3,750 (Jun), $3,750 (Jul), $3,750 (Aug), $3,750 (Sep), $3,750 (Oct), $3,750 (Nov), $3,750 (Dec)

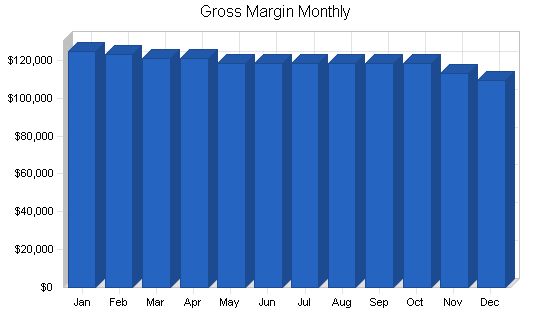

– Total Sales: $129,250 (Jan), $130,000 (Feb), $127,500 (Mar), $127,500 (Apr), $125,000 (May), $125,000 (Jun), $125,000 (Jul), $125,000 (Aug), $125,000 (Sep), $125,000 (Oct), $125,000 (Nov), $119,500 (Dec)

Direct Cost of Sales:

– Dialup Internet Access: $3,333 (Jan), $3,333 (Feb), $3,333 (Mar), $3,333 (Apr), $3,333 (May), $3,333 (Jun), $3,333 (Jul), $3,333 (Aug), $3,333 (Sep), $3,333 (Oct), $3,333 (Nov), $3,333

Personnel Plan:

Donald Williams: $2,500 per month (Jan-Dec)

Amy Williams: $2,500 per month (Jan-Dec)

Geena James: $3,000 per month (Jan-Dec)

Dialup Services Manager: $3,750 per month (Jan-Dec)

R & D Manager: $5,000 per month (Jan-Dec)

R & D Researcher: $5,000 per month (Jan-Dec)

Technical Support Personnel: $2,600 per month (Jan-Dec)

Technical Support Personnel: $0 per month (Jan-Jul, Sep-Dec)

Total People: 8

Total Payroll: $24,350 (Jan-Dec)

General Assumptions:

Plan Month: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12

Current Interest Rate: 10.00% (Jan-Dec)

Long-term Interest Rate: 10.00% (Jan-Dec)

Tax Rate: 30.00% (Jan), 25.00% (Feb-Dec)

Other: 0 (Jan-Dec)

Pro Forma Profit and Loss:

Sales: $129,250 (Jan), $130,000 (Feb), $127,500 (Mar), $125,000 (Apr-Dec)

Direct Cost of Sales: $4,633 (Jan-Dec)

Other: $0 (Jan-Dec)

Total Cost of Sales: $4,633 (Jan-Dec)

Gross Margin: $124,617 (Jan), $123,367 (Feb), $120,867 (Mar-Dec)

Gross Margin %: 96.42% (Jan), 94.90% (Feb-Dec)

Expenses:

Payroll: $24,350 (Jan-Dec)

Sales and Marketing and Other Expenses: $3,456 (Jan-Dec)

Depreciation: $0 (Jan-Dec)

Legal Fees: $25 (Jan-Dec)

Utilities: $300 (Jan-Dec)

Insurance: $350 (Jan-Dec)

Mortgage: $5,600 (Jan-Dec)

Payroll Taxes: 15%, $3,653 (Jan), $4,043 (Feb-Dec)

Other: $0 (Jan-Dec)

Total Operating Expenses: $37,733 (Jan-Dec)

Profit Before Interest and Taxes: $86,884 (Jan), $85,634 (Feb), $83,134 (Mar-Dec)

EBITDA: $86,884 (Jan), $85,634 (Feb), $83,134 (Mar-Dec)

Interest Expense: $5,990 (Jan), $5,844 (Feb-Dec)

Taxes Incurred: $24,268 (Jan), $19,947 (Feb-Dec)

Net Profit: $56,626 (Jan), $59,842 (Feb-Dec)

Net Profit/Sales: 43.81% (Jan), 46.03% (Feb-Dec)

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $109,863 | $110,500 | $108,375 | $108,375 | $106,250 | $106,250 | $106,250 | $106,250 | $106,250 | $106,250 | $101,575 | $98,813 | |

| Cash from Receivables | $11,750 | $12,396 | $19,391 | $19,488 | $19,125 | $19,113 | $18,750 | $18,750 | $18,750 | $18,750 | $18,750 | $18,723 | |

| Subtotal Cash from Operations | $121,613 | $122,896 | $127,766 | $127,863 | $125,375 | $125,363 | $125,000 | $125,000 | $125,000 | $125,000 | $120,325 | $117,535 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Subtotal Cash Received | $121,613 | $122,896 | $127,766 | $127,863 | $125,375 | $125,363 | $125,000 | $125,000 | $125,000 | $125,000 | $120,325 | $117,535 | |

| Expenditures | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $24,350 | $24,350 | $24,350 | $24,350 | $24,350 | $24,350 | $26,950 | $26,950 | $26,950 | $26,950 | $26,950 | $26,950 | |

| Bill Payments | $72,297 | $48,192 | $45,783 | $45,070 | $44,940 | $44,226 | $44,105 | $43,650 | $43,540 | $43,431 | $43,276 | $41,810 | |

| Subtotal Spent on Operations | $96,647 | $72,542 | $70,133 | $69,420 | $69,290 | $68,576 | $71,055 | $70,600 | $70,490 | $70,381 | $70,226 | $68,760 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $12,500 | $12,500 | $12,500 | $12,500 | $12,500 | $12,500 | $12,500 | $12,500 | $12,500 | $12,500 | $12,500 | $12,500 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | |||||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!