Concrete Fabricators is a company that provides concrete fabrication services, utilizing formwork, foundations, placement, and excavation. The company has worked on projects in Norman and Southwestern Oklahoma, and plans to bid on contracts for commercial concrete projects statewide.

The objective is to become the leading formwork-services provider for reinforced concrete in the state. This means having the best facilities, processes, and people. Concrete Fabricators will invest in competitive advantages for customers, such as structural plan review, equipment, and a full line of forming, reinforcing, and aftermarket products. A client evaluation form has been developed to gather feedback and improve the company.

The biggest concern in the industry is employee safety. Concrete Fabricators prioritizes safety and aims to be a “safe company.”

Concrete Fabricators participates in the concrete work industry, including contractors engaged in concrete work. Sales in this industry were approximately $21 million annually, with an average sales per establishment of $.7 million. Establishments primarily engaged in manufacturing portland cement concrete had sales of approximately $19 million, with an average sales per establishment of $6.5 million.

Concrete Fabricators aims to be the top contractor in the industry, offering superior cement and concrete masonry services. Established in January 1987, the company is a sole proprietorship based in Norman, Oklahoma, founded by Lloyd and Anne James.

Concrete Fabricators offers concrete fabrication services, including foundations, road construction, and excavation. They also create house slabs, driveways, and trailer path foundations. Jobs are obtained through bids from both businesses and individuals. The company serves customers in southwest Oklahoma and southeast Texas.

The system provided by Concrete Fabricators is adaptable to various construction requirements and offers high strength-to-weight ratio at cost-effective prices. Safety is a priority for the company, and they strive to eliminate hazards that could cause injury or illness. Concrete Fabricators operates in two market segments: commercial and residential.

In the commercial segment, they specialize in foundation construction and parking lot projects. Concrete is preferred for parking lots due to its durability, beauty, safety features, and load-carrying capacity.

In the residential segment, Concrete Fabricators offers basement walls, which provide extra room and storage, easy access to utilities, and a permanent finished look. They also specialize in driveways, which are durable, require minimal maintenance, and offer environmental benefits. Concrete driveways are also versatile and can be customized.

In terms of market analysis, the housing industry has been thriving in recent years, with record-breaking sales and construction activity. There is a significant market for single-family housing construction, residential construction (excluding single-family houses), heavy construction, bridge and tunnel construction, highway and street construction, and nonresidential construction.

Overall, Concrete Fabricators provides a range of concrete fabrication services for both commercial and residential projects. With their expertise and commitment to safety and quality, they are well-positioned to meet the demands of the thriving construction industry.

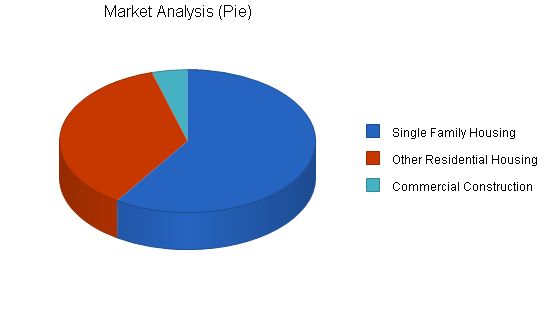

Market Analysis:

Potential Customers Growth 2000 2001 2002 2003 2004 CAGR

Single Family Housing 4% 1,094,541 1,132,850 1,172,500 1,213,528 1,256,012 3.50%

Other Residential Housing 3% 670,848 687,619 704,809 722,429 740,490 2.50%

Commercial Construction 2% 82,623 84,275 85,961 87,680 89,434 2.00%

Total 3.07% 1,848,012 1,904,744 1,963,270 2,023,637 2,085,936 3.07%

4.2 Target Market Segment Strategy

The Market Analysis table and chart show the estimated number of single-family homes, other residential units, and commercial buildings in Oklahoma. This information is derived from U.S. Census Bureau estimates and represents the total number of potential clients for Concrete Fabricators.

Market Size Statistics–Concrete work

Special trade contractors primarily engaged in concrete work, including portland cement and asphalt.

Estimated number of U.S. establishments: 30,214

Number of people employed in this industry: 230,338

Total annual sales in this industry: $21 million

Average employees per establishment: 8

Average sales per establishment: $.7 million

Establishments primarily engaged in manufacturing portland cement concrete, manufactured and delivered to a purchaser in a plastic and unhardened steel.

Estimated number of U.S. establishments: 5,798

Number of people employed in this industry: 89,662

Total annual sales in this industry: $19 million

Average employees per establishment: 17

Average sales per establishment: $7 million

4.4 Competition and Buying Patterns

Competition

Competitive threats come from other concrete fabrication companies in the area. Competitors include Jones Construction, James Boyd Construction, Jerry Manuel Construction, Quality Construction, and Charles Johnson, Inc.

Strategy and Implementation Summary

The company’s strategy is based on a continuous improvement process of setting objectives, measuring results, and providing feedback for growth and progress. This includes quarterly and annual reporting and crisis management plans.

The company plans to develop marketing alliances with industry leaders and pursue new sales to residential and commercial builders. The strategy is to capitalize on alliances by securing government contracts.

Concrete Fabricators is committed to ensuring that the products used on its customers’ job sites are safe and approved by OSHA. The company believes in managing potential loss in the work environment.

Concrete Fabricators has adopted a corporate strategy dedicated to improving the performance of activities on its customers’ projects. The company builds on core strengths, innovative equipment, design engineering expertise, project and site management, and safety excellence.

From the customers’ point of view, this strategy translates into benefits such as reduction of set-up time for trades, increased site safety, project cost reduction, quality construction practices, immediate resolution of punch lists, and review of structural plans.

Marketing Strategy and Plan. The overall marketing plan is based on segmentation of the market, distribution channels, and capturing market share over time.

Market Responsibilities. Concrete Fabricators has implemented an extensive promotional campaign to attract a quality workforce and customers who will choose the company for their construction projects. The company advertises in the yellow pages, newspapers, radio, and on billboards.

Promotion. In addition to standard advertising practices, Concrete Fabricators gains recognition through caps, T-shirts, signs, and word of mouth from satisfied customers.

Incentives. Concrete Fabricators plans to distribute promotional items such as coffee mugs, T-shirts, pens, and other advertising specialties with the company logo.

Brochures. Brochures portray Concrete Fabricators’ goals and products and demonstrate the latest technology in construction and building services.

Investment in Advertising and Promotion. Concrete Fabricators plans to allocate ten percent of revenues for its advertising campaign.

The company plans to become the leading provider of formwork and foundation services. To achieve this, Concrete Fabricators invests in structural drawing review, pre-job conferencing, efficient material delivery, and a variety of concrete forming and foundation materials.

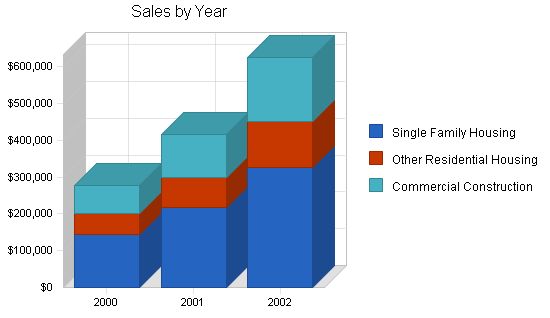

5.3 Sales Strategy

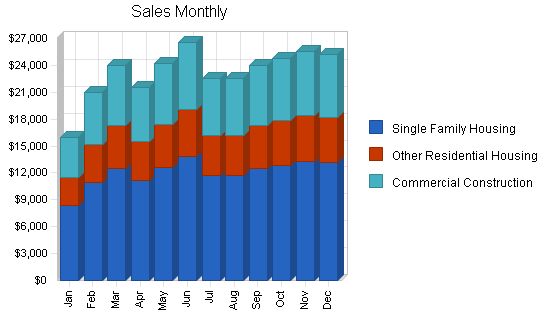

The following chart and table show the estimated sales forecast for this plan.

| Sales Forecast | |||

| 2000 | 2001 | 2002 | |

| Sales | |||

| Single Family Housing | $144,399 | $216,600 | $324,900 |

| Other Residential Housing | $55,538 | $83,308 | $124,961 |

| Commercial Construction | $77,755 | $116,631 | $174,946 |

| Total Sales | $277,692 | $416,539 | $624,807 |

| Direct Cost of Sales | 2000 | 2001 | 2002 |

| Single Family Housing | $5,200 | $10,400 | $20,800 |

| Other Residential Housing | $2,000 | $4,000 | $8,000 |

| Commercial Construction | $2,800 | $5,600 | $11,200 |

| Subtotal Direct Cost of Sales | $10,000 | $20,000 | $40,000 |

Contents

Management Summary

The company’s management philosophy is based on responsibility and mutual respect. Concrete Fabricators maintains an environment and structure that encourages productivity and respect for customers and fellow employees.

Concrete Fabricators’ employees and management are committed to:

- Providing a safe work environment to protect employees, customers, subcontractors, and the public.

- Supplying safe products for customers.

- Continuously improving the company’s safety program to reduce the risk of accidents and occupational illness in a changing work environment.

- Encouraging employees to participate in accident prevention programs and take personal responsibility for their own and their co-workers’ health and safety.

- Employing properly trained personnel, equipment, and procedures necessary for regulatory compliance and high safety standards in the industry.

- Monitoring workplaces, enforcing safe work practices, and communicating the company’s safety performance.

- Making safety a value-added service provided to customers.

6.1 Management Team

Concrete Fabricators’ management is highly experienced and qualified. The key management team includes Mr. Lloyd James, Mrs. Anne James, and Mr. Sam McDonald. Mr. James acts as general manager, construction consultant, and occasionally as a site manager. Mrs. James carries out office management duties, and Mr. McDonald acts as the primary on-site manager.

6.2 Personnel Plan

The following table shows the Personnel Plan, with salaries, raises, and additional employees.

| Personnel Plan | |||

| 2000 | 2001 | 2002 | |

| Lloyd James | $28,800 | $30,240 | $31,752 |

| Anne James | $18,000 | $18,900 | $19,845 |

| Sam McDonald | $26,400 | $27,720 | $29,106 |

| Cement Layer No. 1 | $22,104 | $23,209 | $24,370 |

| Cement Layer No. 2 | $22,104 | $23,209 | $24,370 |

| Cement Layer No. 3 | $22,104 | $23,209 | $24,370 |

| Part-time Cement Layer No. 4 | $0 | $5,688 | $12,000 |

| Part-time Cement Layer No. 5 | $0 | $0 | $5,688 |

| Total People | 6 | 7 | 8 |

| Total Payroll | $139,512 | $152,176 | $171,500 |

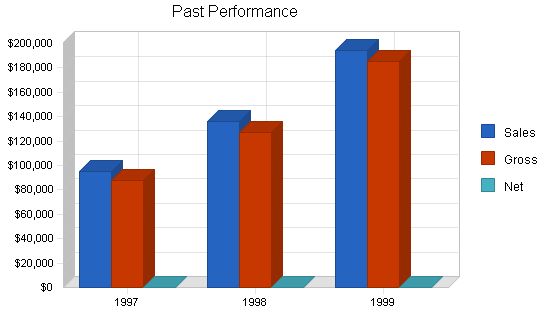

Financial Plan

Summary of three-year financial projections

Financial projections are based on sales volume at the levels described in the revenue section; they present, to the best of management’s knowledge and belief, the company’s expected assets, liabilities, capital, revenues, and expenses. Furthermore, the projections reflect management’s judgment of expected conditions and expected course of action, given hypothetical assumptions.

Financial notes and assumptions

- Revenues will be derived from sales of services for the installation of reinforced-concrete utilizing formwork, reinforcing steel, embedded items, concrete placement, and engineering. Concrete Fabricators plans to bid and receive contracts for commercial concrete projects at all levels throughout the state. Management also expects to achieve a small percentage of revenues resulting from consulting services arising out of training.

- Annual Growth The company expects annual growth to increase by 110% through increased sales efforts and new partnerships and alliances that will foster growth and extensions of our markets. These strategies are designed to build momentum and critical mass within the company and its sales.

- Cost of Goods Concrete Fabricators expects high markup on its services, resulting in relatively low cost of goods. Cost of goods includes equipment, products, bank charges due to credit card transactions (not passed along to the consumer), and labor.

- Operating Expenses Concrete Fabricators groups sales and marketing expenses, and general and administrative expense items under this category.

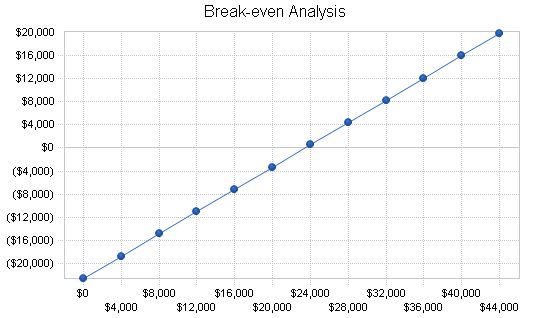

7.1 Break-even Analysis

The Break-even Analysis chart and table show that if costs stay at the current, stable level, we will be able to increase profits by the second year.

Break-even Analysis

Monthly Revenue Break-even: $23,465

Assumptions:

– Average Percent Variable Cost: 4%

– Estimated Monthly Fixed Cost: $22,620

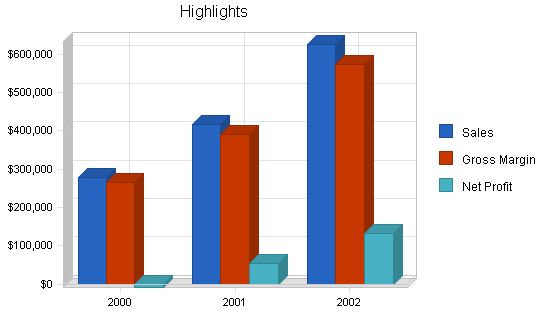

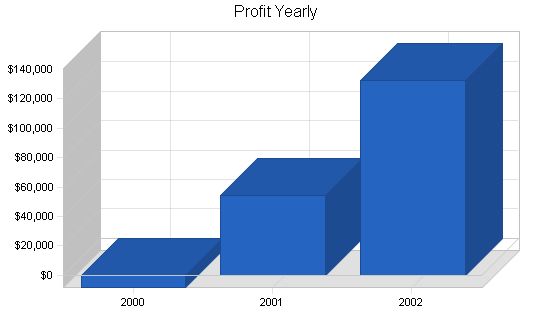

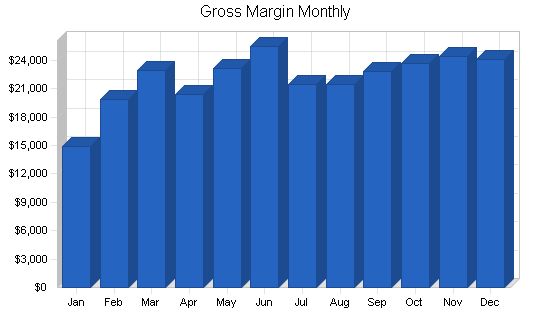

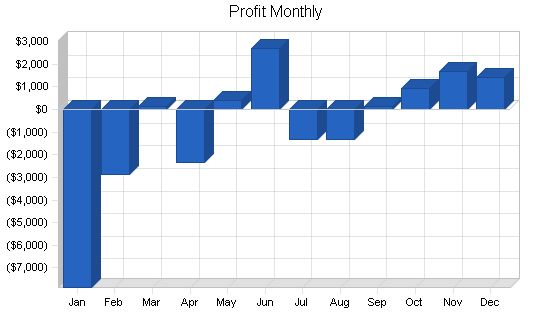

Projected Profit and Loss:

The table below shows our expected profit and loss for fiscal years 2000-2002.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Sales | $277,692 | $416,539 | $624,807 |

| Direct Cost of Sales | $10,000 | $20,000 | $40,000 |

| Other | $3,000 | $6,000 | $12,000 |

| Total Cost of Sales | $13,000 | $26,000 | $52,000 |

| Gross Margin | $264,692 | $390,539 | $572,807 |

| Gross Margin % | 95.32% | 93.76% | 91.68% |

| Expenses | |||

| Payroll | $139,512 | $152,176 | $171,500 |

| Sales and Marketing and Other Expenses | $34,344 | $47,610 | $71,010 |

| Depreciation | $47,997 | $50,333 | $52,668 |

| Rent/Mortgage | $12,420 | $12,420 | $12,420 |

| Supplies and Equipment | $9,926 | $19,851 | $39,702 |

| Insurance | $14,459 | $21,688 | $32,533 |

| Services | $2,833 | $2,833 | $2,833 |

| Payroll Taxes | $9,947 | $10,800 | $12,600 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $271,437 | $317,711 | $395,266 |

| Profit Before Interest and Taxes | ($6,745) | $72,828 | $177,541 |

| EBITDA | $41,252 | $123,160 | $230,209 |

| Interest Expense | $1,597 | $922 | $288 |

| Taxes Incurred | $0 | $17,977 | $45,052 |

| Net Profit | ($8,342) | $53,930 | $132,201 |

| Net Profit/Sales | -3.00% | 12.95% | 21.16% |

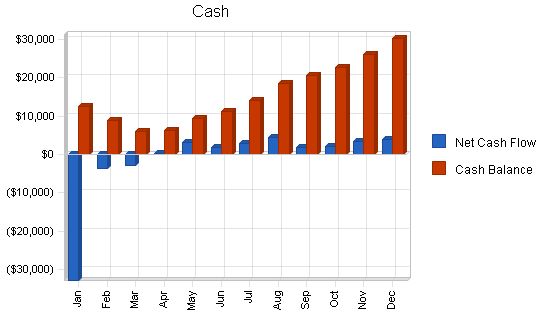

Projected Cash Flow

7.3 Projected Cash Flow

The following chart and table display our estimated cash flow for this plan.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| 2000 | 2001 | 2002 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $69,423 | $104,135 | $156,202 |

| Cash from Receivables | $194,193 | $293,703 | $440,554 |

| Subtotal Cash from Operations | $263,616 | $397,838 | $596,755 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $2,000 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $3,000 | $0 | $0 |

| Subtotal Cash Received | $268,616 | $397,838 | $596,755 |

Projected Balance Sheet

The following table provides Concrete Fabricator’s projected balance sheets for 2000-2002.

| Pro Forma Balance Sheet | |||

| 2000 | 2001 | 2002 | |

| Assets | |||

| Cash | $30,101 | $108,010 | $261,966 |

| Accounts Receivable | $37,403 | $56,104 | $84,156 |

| Other Current Assets | $8,830 | $8,830 | $8,830 |

| Total Current Assets | $76,333 | $172,944 | $354,951 |

| Long-term Assets | $507,687 | $507,687 | $507,687 |

| Accumulated Depreciation | $93,688 | $144,021 | $196,689 |

| Total Long-term Assets | $413,999 | $363,667 | $310,999 |

| Total Assets | $490,332 | $536,611 | $665,950 |

| Liabilities and Capital | 2000 | 2001 | 2002 |

| Current Liabilities | |||

| Accounts Payable | $7,910 | $13,159 | $22,063 |

| Current Borrowing | $900 | $0 | $0 |

| Other Current Liabilities | $16,785 | $10,785 | $4,785 |

| Subtotal Current Liabilities | $25,595 | $23,944 | $26,848 |

| Long-term Liabilities | $11,766 | $5,766 | $0 |

| Total Liabilities | $37,361 | $29,710 | $26,848 |

| Paid-in Capital | $3,000 | $3,000 | $3,000 |

| Retained Earnings | $458,313 | $449,971 | $503,901 |

| Earnings | ($8,342) | $53,930 | $132,201 |

| Total Capital | $452,971 | $506,901 | $639,101 |

| Total Liabilities and Capital | $490,332 | $536,611 | $665,950 |

| Net Worth | $452,971 | $506,901 | $639,101 |

Business Ratios

The following table includes Industry Profile statistics for the concrete work industry, as determined by the Standard Industrial Classifications (SIC) Index code 1799. These statistics show a comparison of industry standards and the key ratios for this plan.

| Ratio Analysis | ||||

| 2000 | 2001 | 2002 | Industry Profile | |

| Sales Growth | 42.86% | 50.00% | 50.00% | 7.50% |

| Percent of Total Assets | ||||

| Accounts Receivable | 7.63% | 10.46% | 12.64% | 34.20% |

| Other Current Assets | 1.80% | 1.65% | 1.33% | 27.20% |

| Total Current Assets | 15.57% | 32.23% | 53.30% | 67.00% |

| Long-term Assets | 84.43% | 67.77% | 46.70% | 33.00% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 5.22% | 4.46% | 4.03% | 42.20% |

| Long-term Liabilities | 2.40% | 1.07% | 0.00% | 12.30% |

| Total Liabilities | 7.62% | 5.54% | 4.03% | 54.50% |

| Net Worth | 92.38% | 94.46% | 95.97% | 45.50% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 95.32% | 93.76% | 91.68% | 33.10% |

| Selling, General & Administrative Expenses | 77.24% | 65.33% | 58.70% | 18.10% |

| Advertising Expenses | 2.52% | 3.36% | 4.48% | 0.30% |

| Profit Before Interest and Taxes | -2.43% | 17.48% | 28.42% | 3.20% |

| Main Ratios | ||||

| Current | 2.98 | 7.22 | 13.22 | 1.63 |

| Quick | 2.98 | 7.22 | 13.22 | 1.30 |

| Total Debt to Total Assets | 7.62% | 5.54% | 4.03% | 54.50% |

| Pre-tax Return on Net Worth | -1.84% | 14.19% | 27.73% | 8.60% |

| Pre-tax Return on Assets | -1.70% | 13.40% | 26.62% | 18.80% |

| Additional Ratios | 2000 | 2001 | 2002 | |

| Net Profit Margin | -3.00% | 12.95% | 21.16% | n.a |

| Return on Equity | -1.84% | 10.64% | 20.69% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 5.57 | 5.57 | 5.57 | n.a |

| Collection Days | 59 | 55 | 55 | n.a |

| Accounts Payable Turnover | 12.46 | 12.17 | 12.17 | n.a |

| Payment Days | 39 | 24 | 24 | n.a |

| Total Asset Turnover | 0.57 | 0.78 | 0.94 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.08 | 0.06 | 0.04 | n.a |

| Current Liab. to Liab. | 0.69 | 0.81 | 1.00 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $50,738 | $149,000 | $328,103 | n.a |

| Interest Coverage | -4.22 | 79.02 | 615.82 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 1.77 | 1.29 | 1.07 | n.a |

| Current Debt/Total Assets | 5% | 4% | 4% | n.a |

| Acid Test | 1.52 | 4.88 | 10.09 | n.a |

| Sales/Net Worth | 0.61 | 0.82 | 0.98 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Sales | |||||||||||||

| Single Family Housing | $8,320 | $10,920 | $12,480 | $11,180 | $12,610 | $13,790 | $11,700 | $11,700 | $12,455 | $12,870 | $13,260 | $13,114 | |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!