GFX: Gravestat Farm eXchange is a modern business entity that applies 21st century technology and practices to a traditional environment. Through live business experimentation, we have discovered that this approach gives us a competitive edge and appeals to customers. Our goal is to become a highly successful company that can expand exponentially.

We are seeking start-up funding of $110,000 to transition from experimentation to a fully operational business. This funding request includes additional investment and operating capital to implement our plan and ensure a realistic ramp-up period towards profitability.

GFX: Gravestat Farm eXchange is a home-based business owned and operated by Edward A. Graves and family, located in Lincoln County, Oklahoma. Edward’s successful business career and three years of experience in this field provide the expertise and experience necessary for success. Our plan does not require additional employees or business locations, keeping operating costs low while maximizing revenue potential. We will offer traditional products along with a unique addition through e-commerce, event attendance, and home-based sales.

Contents

1.1 Business Overview

When reviewing this business plan, it is important to break preconceptions about the nature of GFX business. GFX is a Web-centric, event vendor, and retail location resale company.

To visualize GFX, there are two ways:

- A pet store. Hobby horse owners currently have limited options when purchasing horses, either through a high-quality "breed farm" or through unscrupulous sources.

- A tack and equine supply store. No tack shop takes full advantage of the symbiotic relationship between the horse and the supply, leaving a market niche unfulfilled.

"The Triangle" between Oklahoma City, Tulsa, and Ponca City, Oklahoma is the most active horse market in the world, yet no company has applied these fundamental business practices to this market.

GFX will operate a retail location and attend equine events in Tulsa, Oklahoma City, and Purcell. Additionally, GFX will maintain a strong online presence.

GFX utilizes modern business practices and technology in a reliable market.

1.2 Personal Credit Worthiness

In terms of personal credit worthiness, it is important to note that we have an excellent credit history. We have invested heavily in developing the current GFX formula and have managed our personal finances responsibly.

While we have experienced temporary fluctuations in cash flow, we have remained dedicated to pursuing this opportunity. We hope you consider these factors when assessing our creditworthiness.

1.3 Objectives

Our first benchmark operation aims to achieve the following measurable results:

- 20 location customers, attendance at two horse events, and 500 monthly web hits resulting in $1,350/month revenue from tack & product sales ($4,500/month at 30% net).

- $600/month revenue from manufactured product sales ($1,000/month at 60% net).

- $6,000/month revenue from horse sales ($20,000/month at 30% net).

This initial achievement benchmark amounts to $7,950 net and $25,500 gross per month.

1.4 Mission

GFX: Gravestat Farm eXchange aims to consolidate and legitimize the representation and sale of a complete line of horse products and the horse itself. We prioritize the needs of pleasure horse owners and strive for complete business integrity. Our success is built on customer satisfaction, constantly seeking new product offerings, and utilizing modern technology. GFX aims to set a new standard of business in the pleasure horse industry.

Company Summary

GFX is a retail sales organization catering to the middle to upper class pleasure horse owner/buyer. It provides a legitimate and professional horse buying experience as well as a "1-Stop Shop" for horse care products.

2.1 Company Ownership

GFX will be wholly owned and privately held by Edward and Leanna Graves, most likely as an LLC entity. The final business form will be determined in consultation with a business attorney.

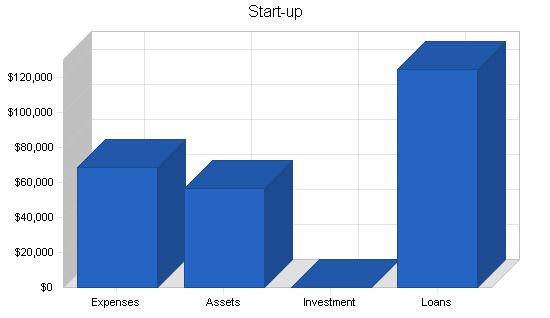

2.2 Start-up Summary

The start-up funding requirements for GFX to become operational include $68,500 in start-up expenditures, $14,500 in inventory investment, and $42,000 in operating capital for the first six months.

To fund these requirements, we are seeking a ten-year, $110,000 loan for the business, backed by the equity in the owners’ home.

Start-up Requirements

Start-up Expenses

Legal: $1,150

Business Cards: $100

Signage: $250

Manufacturing Equipment: $2,500

Consolidated Credit Card Debt: $15,000

Laptop Computer System for Office: $1,000

Tractor & Equipment: $5,000

Building: $3,500

Land Acquisition: $40,000

Total Start-up Expenses: $68,500

Start-up Assets

Cash Required: $42,000

Start-up Inventory: $14,500

Other Current Assets: $0

Long-term Assets: $0

Total Assets: $56,500

Total Requirements: $125,000

Start-up Funding

Start-up Expenses to Fund: $68,500

Start-up Assets to Fund: $56,500

Total Funding Required: $125,000

Assets

Non-cash Assets from Start-up: $14,500

Cash Requirements from Start-up: $42,000

Additional Cash Raised: $0

Cash Balance on Starting Date: $42,000

Total Assets: $56,500

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $125,000

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $125,000

Capital

Planned Investment

Private Investor: $0

Other: $0

Additional Investment Requirement: $0

Total Planned Investment: $0

Loss at Start-up (Start-up Expenses): ($68,500)

Total Capital: ($68,500)

Total Capital and Liabilities: $56,500

Total Funding: $125,000

Company Locations and Facilities

GFX will operate at our residential address on State Highway 18 in Central Oklahoma. The property includes fenced acres, a barn, brick home, mobile home, and storage shed. This location is ideal for selling horses as it is on a state highway between Oklahoma City and Tulsa, and near other cities in Oklahoma. We plan to add a tack shop and business office at this location, as well as purchase additional land for horse inventory and hay production. Business at this location is only one part of our overall operation. We will also attend horse events as a vendor and sell products through our website.

Products

GFX offers a "1-Stop Shopping" experience for horse owners by providing a complete line of horse-related products, including horses, at our location in Central Oklahoma, at horse events, and through our website.

Product Description

GFX sells three primary categories of products: riding horses, resale products, and GFX manufactured products. Riding horses are our main focus and we have established sources to purchase quality horses at reasonable prices. We differentiate ourselves from other sources by applying professional business practices and offering horses that are well-trained and in good condition. Resale products include tack and equipment from various distributors and manufacturers. GFX manufactured products include items like portable corrals and hay feeders that we can produce at our location.

Competitive Comparison

GFX stands out from competitors by offering a "1-Stop Shopping" experience and surpassing them in business practices and expertise. We understand the horse market and have the computer and web skills necessary to succeed. Our combination of products, customer service, and marketing sets us apart.

Sales Literature

GFX has the capability to create quality sales literature independently. Our website serves as a central point for all marketing efforts and showcases our products and capabilities. We can also produce display literature for events using our computer system and digital equipment.

Market Analysis Summary

GFX has access to a major market in central Oklahoma and beyond. We believe every rural household on five or more acres is a potential customer. The rural population in Oklahoma accounts for a significant number of households, and we have received positive interest from neighboring states as well. Additionally, our web marketing segment allows us to reach customers nationwide.

Strategy and Implementation Summary

GFX will implement a multi-faceted marketing approach, including website, print, event, internet, and referral strategies. We will focus on four primary product lines and sell through our home facility, horse events, and our website. Our key assets are the business skills and experience of Edward Graves and the horse knowledge of Leanna Graves. The only missing piece to bring our plan to fruition is funding.

Sales Strategy

GFX will utilize experienced sales skills to close sales with prospective customers. We will match horses to riders, showcase horses’ best aspects, and use standard sales techniques. For event and web sales, we will focus on providing a pleasurable and convenient shopping experience.

GFX offers quality riding horses and essential products in a professional and ethical business environment. We provide a personalized experience for horse owners and offer a complete range of products.

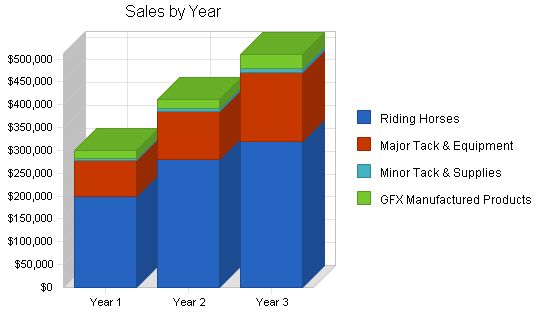

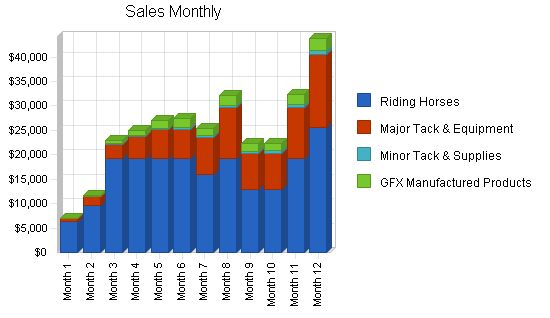

The sales forecast below is conservative and shows steady growth as GFX gains recognition. However, there are potential factors that could significantly increase sales, such as cost reduction, increased vendor discounts, and the successful implementation of a web strategy and GFX manufactured products.

Sales Forecast:

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Unit Sales | |||

| Riding Horses | 124 | 175 | 200 |

| Major Tack & Equipment | 268 | 350 | 500 |

| Minor Tack & Supplies | 410 | 600 | 1,000 |

| GFX Manufactured Products | 162 | 200 | 300 |

| Total Unit Sales | 964 | 1,325 | 2,000 |

| Unit Prices | Year 1 | Year 2 | Year 3 |

| Riding Horses | $1,600.00 | $1,600.00 | $1,600.00 |

| Major Tack & Equipment | $300.00 | $300.00 | $300.00 |

| Minor Tack & Supplies | $10.00 | $10.00 | $10.00 |

| GFX Manufactured Products | $100.00 | $100.00 | $100.00 |

| Sales | |||

| Riding Horses | $198,400 | $280,000 | $320,000 |

| Major Tack & Equipment | $80,400 | $105,000 | $150,000 |

| Minor Tack & Supplies | $4,100 | $6,000 | $10,000 |

| GFX Manufactured Products | $16,200 | $20,000 | $30,000 |

| Total Sales | $299,100 | $411,000 | $510,000 |

| Direct Unit Costs | Year 1 | Year 2 | Year 3 |

| Riding Horses | $1,120.00 | $1,120.00 | $1,120.00 |

| Major Tack & Equipment | $210.00 | $210.00 | $210.00 |

| Minor Tack & Supplies | $7.00 | $7.00 | $7.00 |

| GFX Manufactured Products | $25.00 | $25.00 | $25.00 |

| Direct Cost of Sales | |||

| Riding Horses | $138,880 | $196,000 | $224,000 |

| Major Tack & Equipment | $56,280 | $73,500 | $105,000 |

| Minor Tack & Supplies | $2,870 | $4,200 | $7,000 |

| GFX Manufactured Products | $4,050 | $5,000 | $7,500 |

| Subtotal Direct Cost of Sales | $202,080 | $278,700 | $343,500 |

5.3 Marketing Strategy:

The GFX Marketing Strategy relies on maximum exposure from minimum expenditure. Methods include:

– Effective utilization of our website to differentiate GFX from competitors.

– Cost-effective print advertising in targeted publications.

– Attendance as a vendor at local horse competition events.

– Utilizing "e-blasts" to reach potential customers.

– Leveraging positive word-of-mouth marketing.

5.3.1 Positioning Statement:

GFX offers an ethical and professional "1-Stop Shop" for pleasure horse owners/buyers, providing all their needs in a safe and comfortable environment.

5.3.2 Pricing Strategy:

GFX follows three primary pricing strategies:

1. Riding Horses: Pricing below registered bloodline prices while offering a higher level of comfort and professional business practices.

2. Resale Products: Prices set below list prices but above private sellers and auctions.

3. GFX Manufactured Products: Lower pricing compared to retail outlets while maintaining a healthy profit margin.

The overall pricing strategy is based on value.

5.4 Future Strategy:

GFX plans to open a retail location off I-44, between Oklahoma City and Tulsa, to increase tack sales and solidify its image as a unique horse sale business. Retail horse and tack sales are expected to grow, and future expansion to other locations is possible.

Management Summary:

GFX is co-managed by Edward A. and Leanna F. Graves, combining expertise in sales, marketing, distribution management, operational management, and equine affairs.

6.1 Management Team Gaps:

The management team lacks expertise in financial analysis and accounting principles. Steps will be taken to address this through continued business relationship with a CPA, personal study, and participation in seminars or classes.

The financial projections are based on conservative estimates and designed to secure the right amount of start-up funding for GFX. Continued education, counseling, and adjustments to the Financial Plan will be pursued.

7.1 Important Assumptions:

Key assumptions include 0 personnel burden, inventory turnover of 12, and no credit sales.

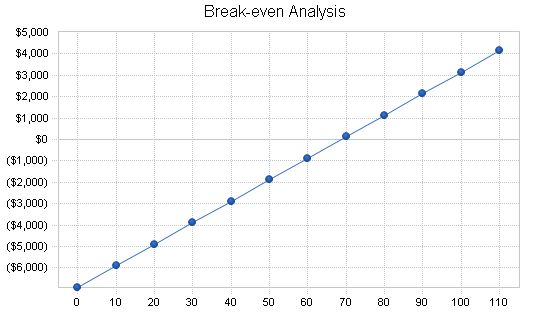

7.2 Break-even Analysis:

The break-even point has been calculated.

| Break-even Analysis | |

| Monthly Units Break-even | 69 |

| Monthly Revenue Break-even | $21,312 |

| Assumptions: | |

| Average Per-Unit Revenue | $310.27 |

| Average Per-Unit Variable Cost | $209.63 |

| Estimated Monthly Fixed Cost | $6,913 |

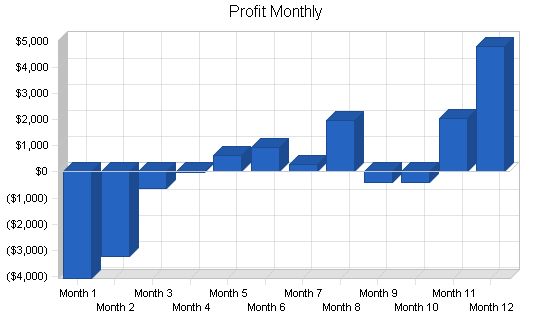

7.3 Projected Profit and Loss

Two Critical Issues regarding the following GFX P&L Statement:

- The P&L statement, from the Sales Forecast, is intended to reflect an extremely conservative projection. It does not indicate the full potential of GFX given the level of management and expertise that serves as the foundation. It has been created to demonstrate the expected minimum performance level.

- It is important to note that, being a home-based business and the sole source of income for our family, the expense portion of P&L contains virtually every conceivable expense, including groceries, medicines, gas, daily cash, revolving credit, and even fast food.

A note to the reviewer: It is simple to inflate sales projections, deflate cost of goods sold, and hide expenses for a business plan. However, as this venture is our family’s livelihood, we have chosen to present it far below the best case scenario. We hope the reviewer will consider this.

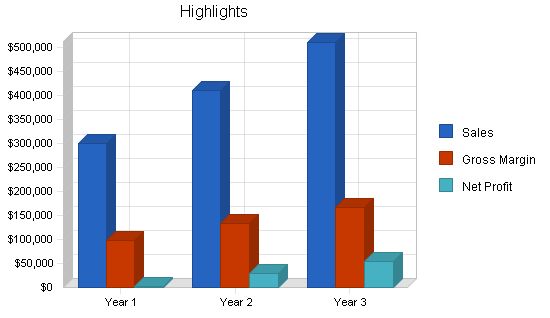

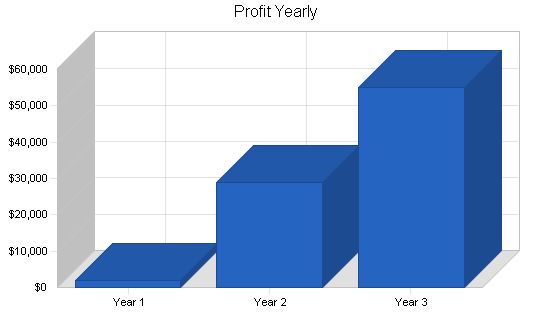

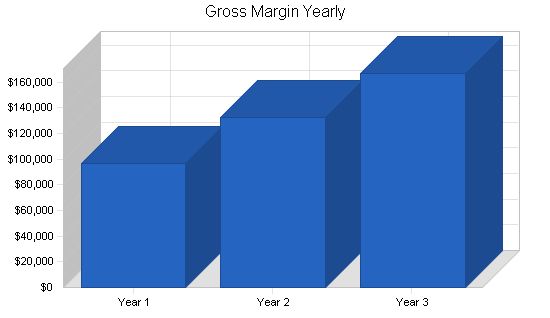

Pro Forma Profit and Loss:

Year 1 Year 2 Year 3

Sales $299,100 $411,000 $510,000

Direct Cost of Sales $202,080 $278,700 $343,500

Other $0 $0 $0

Total Cost of Sales $202,080 $278,700 $343,500

Gross Margin $97,020 $132,300 $166,500

Gross Margin % 32.44% 32.19% 32.65%

Expenses:

Payroll $0 $0 $0

Sales and Marketing and Other Expenses $70,416 $70,416 $70,416

Depreciation $0 $0 $0

Leased Equipment $1,020 $1,020 $1,020

Utilities $5,520 $5,520 $5,520

Insurance $6,000 $6,000 $6,000

Rent $0 $0 $0

Payroll Taxes $0 $0 $0

Other $0 $0 $0

Total Operating Expenses $82,956 $82,956 $82,956

Profit Before Interest and Taxes $14,064 $49,344 $83,544

EBITDA $14,064 $49,344 $83,544

Interest Expense $11,904 $10,850 $9,750

Taxes Incurred $248 $9,623 $18,756

Net Profit $1,911 $28,870 $55,038

Net Profit/Sales 0.64% 7.02% 10.79%

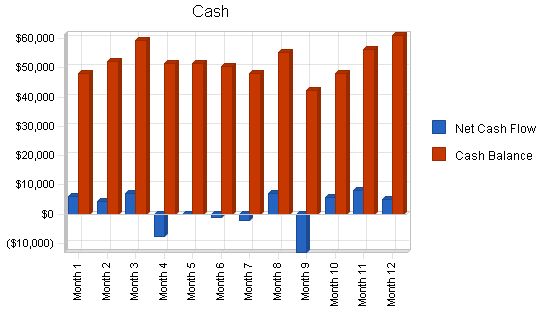

Projected Cash Flow:

The attached Cash Flow Table and Charts justify this business loan request. This loan will provide a solid foundation for GFX’s start-up and continued health. All personal and business expenses have been included to ensure that personal expenses do not hinder the business. The Cash Balance remains healthy throughout the business plan, allowing for positive business opportunities and unexpected expenses.

Pro Forma Cash Flow:

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $299,100 | $411,000 | $510,000 |

| Subtotal Cash from Operations | $299,100 | $411,000 | $510,000 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $299,100 | $411,000 | $510,000 |

| Expenditures | |||

| Expenditures from Operations | |||

| Cash Spending | $0 | $0 | $0 |

| Bill Payments | $269,122 | $408,135 | $459,562 |

| Subtotal Spent on Operations | $269,122 | $408,135 | $459,562 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $11,000 | $11,000 | $11,000 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $280,122 | $419,135 | $470,562 |

| Net Cash Flow | $18,978 | ($8,135) | $39,438 |

| Cash Balance | $60,978 | $52,844 | $92,281 |

7.5 Projected Balance Sheet

The following Projected Balance Sheet was generated by the software program used to create this business plan. We are not well-versed in its implications, so we welcome consultation on this subject. As we fill the management gap in financial analysis, we will adjust this information accordingly.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $60,978 | $52,844 | $92,281 |

| Inventory | $32,527 | $44,860 | $55,290 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $93,505 | $97,704 | $147,571 |

| Long-term Assets | |||

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $93,505 | $97,704 | $147,571 |

7.6 Business Ratios

The following Business Ratios Table was generated by the software program used to create this business plan. We are not well-versed in its purpose nor implications, so we welcome consultation on this subject. As we fill the management gap in financial analysis, we will adjust this information accordingly. The Industry Profile column contains statistics from the Standard Industry Code (SIC) #0752, Animal Specialty Services.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 37.41% | 24.09% | -2.90% |

| Percent of Total Assets | ||||

| Inventory | 34.79% | 45.91% | 37.47% | 8.20% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 31.90% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 55.90% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 44.10% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 46.094 | 32.422 | 38.251 | |

| Current Borrowing | 0.00% | 0.00% | 0.00% | |

| Other Current Liabilities | 0.00% | 0.00% | 0.00% | |

| Subtotal Current Liabilities | 46.094 | 32.422 | 38.251 | |

| Long-term Liabilities | 114,000 | 103,000 | 92,000 | |

| Total Liabilities | 160,094 | 135,422 | 130,251 | |

| Paid-in Capital | 0.00% | 0.00% | 0.00% | |

| Retained Earnings | ($68,500) | ($66,589) | ($37,718) | |

| Earnings | $1,911 | $28,870 | $55,038 | |

| Total Capital | ($66,589) | ($37,718) | $17,320 | |

| Total Liabilities and Capital | $93,505 | $97,704 | $147,571 | |

| Net Worth | ($66,589) | ($37,718) | $17,320 | |

Appendix

Sales Forecast:

Unit Sales:

Riding Horses: 0%, 4, 6, 12, 12, 10, 12, 8, 16

Major Tack & Equipment: 0%, 2, 6, 10, 15, 20, 25, 35, 50

Minor Tack & Supplies: 0%, 5, 10, 15, 20, 25, 30, 35, 40, 45, 50, 60, 75

GFX Manufactured Products: 0%, 0, 2, 5, 10, 15, 20, 15, 20, 15, 20, 25

Total Unit Sales: 11, 24, 42, 57, 72, 82, 85, 107, 93, 98, 127, 166

Unit Prices:

Riding Horses: $1,600.00

Major Tack & Equipment: $300.00

Minor Tack & Supplies: $10.00

GFX Manufactured Products: $100.00

Sales:

Riding Horses: $6,400, $9,600, $19,200, $19,200, $19,200, $19,200, $16,000, $19,200, $12,800, $25,600

Major Tack & Equipment: $600, $1,800, $3,000, $4,500, $6,000, $7,500, $10,500, $7,500, $10,500, $15,000

Minor Tack & Supplies: $50, $100, $150, $200, $250, $300, $350, $400, $450, $500, $600, $750

GFX Manufactured Products: $0, $200, $500, $1,000, $1,500, $2,000, $1,500, $2,000, $1,500, $2,500

Total Sales: $7,050, $11,700, $22,850, $24,900, $26,950, $27,500, $25,350, $32,100, $22,250, $22,300, $32,300, $43,850

General Assumptions:

Plan Month: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12

Current Interest Rate: 10.00%

Long-term Interest Rate: 10.00%

Tax Rate: 30.00%, 25.00%

Other: 0

Pro Forma Profit and Loss:

Sales: $7,050, $11,700, $22,850, $24,900, $26,950, $27,500, $25,350, $32,100, $22,250, $22,300, $32,300, $43,850

Direct Cost of Sales: $4,935, $8,100, $15,770, $16,980, $18,190, $18,350, $17,070, $21,570, $14,900, $14,935, $21,710, $29,570

Other: $0

Total Cost of Sales: $4,935, $8,100, $15,770, $16,980, $18,190, $18,350, $17,070, $21,570, $14,900, $14,935, $21,710, $29,570

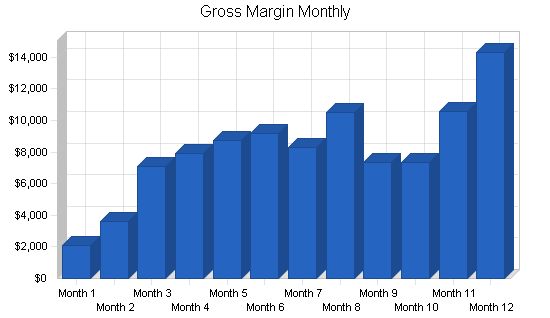

Gross Margin: $2,115, $3,600, $7,080, $7,920, $8,760, $9,150, $8,280, $10,530, $7,350, $7,365, $10,590, $14,280

Gross Margin %: 30.00%, 30.77%, 30.98%, 31.81%, 32.50%, 33.27%, 32.66%, 32.80%, 33.03%, 33.03%, 32.79%, 32.57%

Expenses:

Payroll: $0

Sales and Marketing and Other Expenses: $5,868

Depreciation: $0

Leased Equipment: $85

Utilities: $460

Insurance: $500

Rent: $0

Payroll Taxes: 15%

Other: $0

Total Operating Expenses: $6,913

Profit Before Interest and Taxes: ($4,798), ($3,313), $167, $1,007, $1,847, $2,237, $1,367, $3,617, $437, $452, $3,677, $7,367

EBITDA: ($4,798), ($3,313), $167, $1,007, $1,847, $2,237, $1,367, $3,617, $437, $452, $3,677, $7,367

Interest Expense: $1,034, $1,026, $1,019, $1,011, $1,003, $996, $988, $981, $973, $965, $958, $950

Taxes Incurred: ($1,750), ($1,085), ($213), ($1), $211, $310, $95, $659, ($134), ($128), $680, $1,604

Net Profit: ($4,082), ($3,255), ($639), ($3), $633, $931, $284, $1,977, ($402), ($385), $2,040, $4,813

Net Profit/Sales: -57.91%, -27.82%, -2.80%, -0.01%, 2.35%, 3.38%, 1.12%, 6.16%, -1.81%, -1.73%, 6.31%, 10.98%

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Sales | $7,050 | $11,700 | $22,850 | $24,900 | $26,950 | $27,500 | $25,350 | $32,100 | $22,250 | $22,300 | $32,300 | $43,850 | |

| Subtotal Cash from Operations | $7,050 | $11,700 | $22,850 | $24,900 | $26,950 | $27,500 | $25,350 | $32,100 | $22,250 | $22,300 | $32,300 | $43,850 | |

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $7,050 | $11,700 | $22,850 | $24,900 | $26,950 | $27,500 | $25,350 | $32,100 | $22,250 | $22,300 | $32,300 | $43,850 | |

| Cash Spending | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Bill Payments | $207 | $6,467 | $14,887 | $31,736 | $26,281 | $27,618 | $26,642 | $24,038 | $34,414 | $15,562 | $23,223 | $38,045 | |

| Subtotal Spent on Operations | $207 | $6,467 | $14,887 | $31,736 | $26,281 | $27,618 | $26,642 | $24,038 | $34,414 | $15,562 | $23,223 | $38,045 | |

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $917 | $917 | $917 | $917 | $917 | $917 | $917 | $917 | $917 | $917 | $917 | $917 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Net Cash Flow | $5,927 | $4,316 | $7,046 | ($7,753) | ($248) | ($1,035) | ($2,209) | $7,145 | ($13,081) | $5,821 | $8,160 | $4,888 | |

| Cash Balance | $47,927 | $52,243 | $59,289 | $51,536 | $51,288 | $50,253 | $48,044 | $55,189 | $42,109 | $47,930 | $56,090 | $60,978 | |

Pro Forma Balance Sheet

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Cash | $42,000 | $47,927 | $52,243 | $59,289 | $51,536 | $51,288 | $50,253 | $48,044 | $55,189 | $42,109 | $47,930 | $56,090 | $60,978 |

| Inventory | $14,500 | $9,565 | $8,910 | $17,347 | $18,678 | $20,009 | $20,185 | $18,777 | $23,727 | $16,390 | $16,429 | $23,881 | $32,527 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $56,500 | $57,492 | $61,153 | $76,636 | $70,214 | $71,297 | $70,438 | $66,821 | $78,916 | $58,499 | $64,359 | $79,971 | $93,505 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Assets | $56,500 | $57,492 | $61,153 | $76,636 | $70,214 | $71,297 | $70,438 | $66,821 | $78,916 | $58,499 | $64,359 | $79,971 | $93,505 |

| Liabilities and Capital | |||||||||||||

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $5,991 | $13,823 | $30,862 | $25,360 | $26,727 | $25,854 | $22,869 | $33,904 | $14,804 | $21,966 | $36,456 | $46,094 |

|

Business Plan Outline – Products – Market Analysis Summary – Strategy and Implementation Summary – Management Summary – Financial Plan – Appendix |

|||||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!