Contents

Health Spa Business Plan

SoulSpace aims to be the premier spa/salon in Raleigh, NC. Through a unique combination of services and products, they will quickly gain market share. SoulSpace will provide customers with a relaxing, rejuvenating atmosphere where all their mind and body needs can be met. The business will be set up as a partnership with Steve Long, Debby Long, and Linda Hill-Chinn owning equal portions.

Products and Services

SoulSpace offers a wide variety of mind and body healing services and products. The salon will provide hair styling services for both genders. The spa business is devoted to holistic massage, body work, and energy work, all done in a serene setting.

Location

SoulSpace has chosen Raleigh, NC for the business venture. Raleigh consistently ranks as one of the best places to live and work in the USA, frequently making top five and ten lists in Forbes, Money, and Inc. magazines. Raleigh has a highly educated population with higher average household incomes. The downtown area has undergone recent renovations and has attracted many new businesses, becoming a hot urban area.

Competitive Edge

SoulSpace’s competitive edge lies in their unique combination of services, location, and customer-centric focus. SoulSpace has an innovative training program that extensively trains employees to provide an unprecedented level of customer service. All customers will leave with their needs met beyond expectations, ensuring a high rate of return customers.

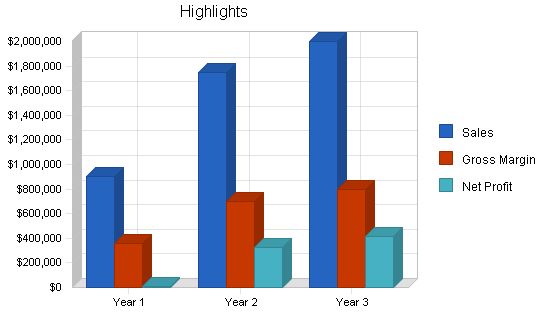

Financials

SoulSpace forecasts substantial sales revenues by year two, reaching profitability and a healthy profit before taxes. When fundraising, SoulSpace will consider options such as LLC status to replace the current partnership business formation.

SoulSpace is an exciting business that provides sought-after services not currently offered by direct competitors. It will provide a relaxing, serene setting for a variety of mind and body rejuvenation services for the booming Raleigh population.

1.1 Objectives

The objectives for SoulSpace are:

– Substantial sales revenue by end of second year.

– Profit before tax by end of second year.

– Clientele return rate of 90% by end of first year.

– Established community destination by end of first year.

1.2 Mission

SoulSpace will provide a comforting, yet stimulating atmosphere for customers to relax and reconnect with their true purpose through holistic methods including massage, body works, energy works, and hair styling. It will be a dependable destination to escape the stresses of life and rejuvenate energies, souls, and lives.

1.3 Keys to Success

The keys to success for SoulSpace are:

– Quality and skilled employees familiar with energy work and a soothing spiritual disposition.

– Establishing trust within the community to take care of each customer’s needs.

– Easily accessible location.

– Effective advertising.

SoulSpace Holistic Spa and Salon is a new destination offering hair styling, massage, body and energy work, and training in a serene setting. Services include hair styling, therapeutic massage, manicures, facials, saunas, Reiki, therapeutic touch, and complimentary products. The goal of SoulSpace is to rejuvenate lives.

2.1 Company Ownership

SoulSpace is currently a privately held partnership owned by Steve and Debby Long and Linda Hill-Chinn. The feasibility of a partnership and a limited liability partnership will be explored during fundraising.

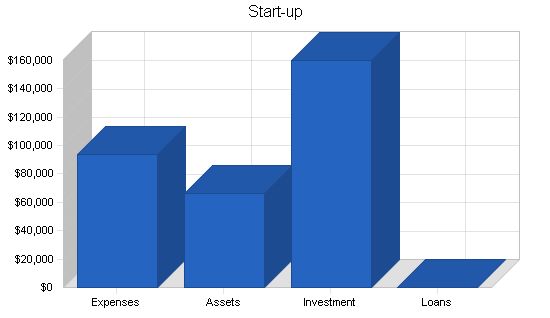

2.2 Start-up Summary

The start-up cash estimated for operational expenses during the first two months is outlined in the following table.

Start-up Funding

Start-up Expenses to Fund: $94,000

Start-up Assets to Fund: $66,000

Total Funding Required: $160,000

Assets

Non-cash Assets from Start-up: $6,000

Cash Requirements from Start-up: $60,000

Additional Cash Raised: $0

Cash Balance on Starting Date: $60,000

Total Assets: $66,000

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $0

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $0

Capital

Planned Investment

Investor 1: $66,000

Investor 2: $47,000

Investor 3: $47,000

Additional Investment Requirement: $0

Total Planned Investment: $160,000

Loss at Start-up (Start-up Expenses): ($94,000)

Total Capital: $66,000

Total Capital and Liabilities: $66,000

Total Funding: $160,000

Start-up

Requirements

Start-up Expenses

Legal: $4,000

Stationery etc.: $2,000

Brochures: $3,000

Construction/Design: $30,000

Insurance: $3,000

Rent: $20,000

Research and Development: $0

Expensed Equipment: $15,000

Other: $17,000

Total Start-up Expenses: $94,000

Start-up Assets

Cash Required: $60,000

Start-up Inventory: $6,000

Other Current Assets: $0

Long-term Assets: $0

Total Assets: $66,000

Total Requirements: $160,000

Company Locations and Facilities

Target sites for SoulSpace include downtown Raleigh in the Warehouse District and Art Districts, West Raleigh near Entertainment Sports Arena, and a rural area off route 40/440 between Raleigh and Cary. SoulSpace will need at least 4,000 square feet (sq. ft.) of space. Initial estimates put leasing between $12/sq. ft. to $28/sq. ft. (inclusive of tax and accommodations).

Contact has been made with Mary Hobbson of Grub & Ellis Real Estate for 4,200 sq. ft. at 510 Glenwood Avenue downtown Raleigh. This site is within the target priority area in part of the Warehouse District in what is now referred to as Glenwood South. The lease is $28/sq. ft., making estimated payments at $9,800/month, the most expensive of all target sites.

We also have met with Peter Pace of York Properties when shown the space available at 200 West Street in Raleigh’s Warehouse district. This space is in priority target range and will be two blocks from the Raleigh Commuter Rail Hub due to open in the next five to eight years. The location is spacious at 10,000 sq. ft., with the first floor (5,000 sq. ft.) leasing at $12.50/sq. ft. and the basement floor (5,000 sq. ft.) leasing at $8/sq. ft., averaging out to $10.25/sq. ft. for the entire 10,000 sq. ft. location. This makes this space cheaper than the other locations and has twice the space.

We have also met with David Stowe of Anthony Allenton Real Estate when shown space at the Royal Bakery on Hillsborough Street across from Meredith College. This location is within priority target and has 6,000 sq. ft. at $20.60/sq. ft. This site is extremely attractive as it offers many accommodations such as plumbing, electrical, and HVAC, which will save us tremendously on construction costs, thus counterbalancing the expense of rent, which is only $300, over our high-ended estimated budget. Also, this space is prime located on Hillsborough, 1/4 mile from the Beltline, and two miles from Highway 40. It is also the site of a future Commuter Rail Station. They have also built a large parking decking which will be free to all patrons.

Products and Services

SoulSpace will provide customers with personal beautifying and relaxational services and complimenting products, as well as training in specific forms of energy work, accessible materials on a wide range of health-related topics, and the option to purchase artwork displayed in SoulSpace. Explanations and/or consultations will be provided on all services and products if needed.

Product and Service Description

– Men and Women Hair Styling: Men’s ($30 average) and women’s ($40 average) color ($75), perm ($80), and combos ($80-$120). Selected hair care products (shampoos, conditioners, cleansers, brushes, mirrors) will be sold as well.

Competitive Comparison

There are many salons in the greater Raleigh area but no direct competitors. There are many places offering massage, but there are only ten day spas, of which only four are a spa/salon. There is one place offering energy work in Clayton (30 minutes southeast from downtown Raleigh). All energy work practitioners are private, of which there are only ten working full-time, with most of them concentrating on other alternative modalities, and an estimated ten (twenty at the very most) part-time energy practitioners. Not including Chapel Hill and Durham, the above service an estimated population of at least 800,000, with that figure growing by an estimated 6,000 persons daily.

Sales Literature

Services brochure, logo/slogan with advertising to be included, and a planned website.

Fulfillment

SoulSpace services sell themselves as a natural way to rejuvenate one’s life.

Technology

SoulSpace will sell complementing products of the highest quality that have not been created through the testing of animals and are of the latest scientific knowing for effecting the desired results for body beautification and energetic balancing maintenance.

Future Products and Services

SoulSpace will add healing touch when Steve Long earns his certification. SoulSpace will always remain involved with the best spa relaxation techniques offered and will implement them if deemed appropriate and feasible for SoulSpace clientele.

Market Analysis Summary

There are no exact competitors and few related competitors in the greater Raleigh area. There are no related competitors in the downtown Raleigh area. The space at 510 Glenwood was recommended to us by the managing realtors because they had targeted that space for a spa type tenant. By nature of the service SoulSpace will provide, success will be readily achieved.

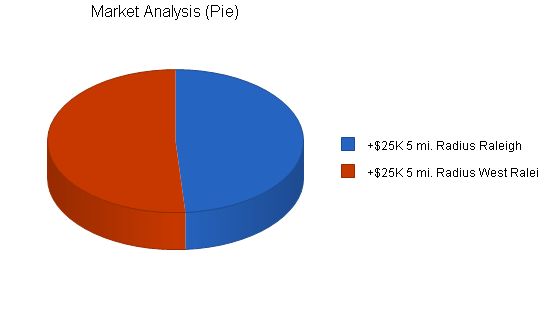

Market Segmentation

Our target market will be divided by salon customers and spa customers. Salon customers will be from every age and gender. However, since the salon and spa will be in direct association with each other, we expect that the spa market segment will greatly affect the salon market segment. Thus, our target market segment will be male and female professionals and retirees, from the age of 25, with individual and household incomes greater than $25,000.

Market Analysis:

Potential Customers: Growth: Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

+$25K 5 mi. Radius Raleigh 2% 50,500 51,510 52,540 53,591 54,663 2.00%

+$25K 5 mi. Radius West Raleigh 2% 53,000 54,060 55,141 56,244 57,369 2.00%

Total 2.00% 103,500 105,570 107,681 109,835 112,032 2.00%

Target Market Segment Strategy:

The market segments we target have money and lead stressful professional lives. Everyone needs hair styling, regardless of income, and will make an effort to afford their desired look.

Market Needs:

Successful individuals in Raleigh love to pamper themselves. Raleigh is a popular city, known for being a great place to live and do business. It has a wealthy, mobile, and growing community. The downtown area has been refurbished and is now a popular destination.

Market Trends:

The ongoing development and refurbishment of Raleigh’s Warehouse District and downtown area will continue to increase its popularity.

Market Growth:

When Forbes and Money listed Raleigh as the best place to live and do business, a population boom occurred in the late 1990s. The Triangle has one of the highest concentrations of Ph.D.s per square mile in the world. The average household income is $40,000-$60,000 and rising.

Service Business Analysis:

The retail health and beauty industry has four major types:

1. Salons: Only offer hair styling services and products.

2. Day Spas: Specialize in body health maintenance through various services and products.

3. Day Spa & Salon: Combine the services above.

4. Health & Beauty Products: Sell a wide range of merchandise products, excluding salon and spa offerings.

Main Competitors:

Our main competitors include Salon 21, Von Kekel, Soigne’, Emerald City, Image, Millennium 2000, Devine, Warren Scott, Skin Sense, and Iatria. They offer similar services but lack promotion and are mainly concentrated in North Raleigh.

Business Participants:

Industry participants offer salon and spa services. Salon services focus on hair styling, while spa services focus on body relaxation and rejuvenation, such as massage, nail, and face treatments.

Competition and Buying Patterns:

Customers choose spa and salon services based on proximity, reputation for quality, and pricing. We expect to compete mainly against other combination spa-salons.

Strategy and Implementation Summary:

Emphasize quality, originality, and dependability of service:

Differentiate ourselves from competitors by offering certified practitioners who understand individual energy systems to better meet client needs.

We bring a unique mode of relaxation and fulfillment to the community. When people are relaxed, comfortable, and happy, they can work harder and contribute positively to their homes, workplaces, and community.

Competitive Edge:

Our competitive edge comes from our unique services, outstanding location, and personalized customer interactions. We build trust and satisfaction by providing a holistic and integrative spa and salon experience.

Emphasize our name and unique services through advertising.

Focus on the convenience of our location.

Build community relationships through unique and quality service, a friendly atmosphere, and dependable services.

Promotion Strategy:

Our promotional strategy will involve advertising in local newspapers, social and health magazines, radio, television, and direct mail to households and businesses within a five-mile radius. We will also utilize the internet and form alliances with medical referral clients.

Marketing Programs:

Owner Steve Long will oversee marketing through advertising channels, while the general manager will assist with alliance advertising partnerships. We have a $10,000 advertising budget for the first year, with advertising starting one week before opening.

We position ourselves as one of the top spa-salons in the greater Raleigh area, offering a range of services not available elsewhere. We will serve a portion of the Raleigh population that is currently untapped.

Pricing Strategy:

Our pricing strategy will align with competitors, ensuring our employees receive a higher percentage of individual customer sales to maintain motivation and provide exceptional services.

Sales Strategy:

Sell SoulSpace as a uniquely desirable destination.

Build trust and loyalty through skill, courtesy, and warmth.

Create a relaxing and memorable experience for each customer.

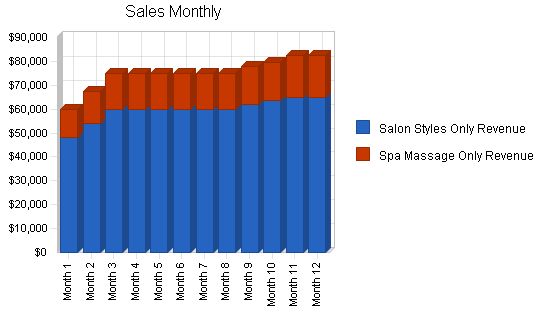

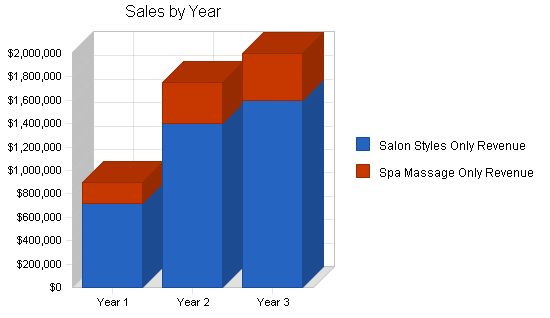

Initial sales forecasts indicate steady growth, with sales almost doubling by the end of the second year. These projections are based on minimum average estimates from salon stylings and spa massages, considering the 60% commission earnings of each stylist/therapist.

Sales Forecast

Year 1 Year 2 Year 3

Sales

Salon Styles Only Revenue $717,500 $1,400,000 $1,600,000

Spa Massage Only Revenue $182,500 $350,000 $400,000

Total Sales $900,000 $1,750,000 $2,000,000

Direct Cost of Sales

Year 1 Year 2 Year 3

Salon Styles Only Revenue $429,300 $840,000 $960,000

Spa Massage Only Revenue $109,500 $210,000 $240,000

Subtotal Direct Cost of Sales $538,800 $1,050,000 $1,200,000

5.4.2 Sales Programs

1. Our comprehensive brochure will explain the holistic nature of our services and their benefits to the customer.

2. Our website will provide detailed information about our services and their benefits.

5.5 Strategic Alliances

We will form alliances with referral practitioners, local restaurants, offices, and businesses that will generate new customers. We will also collaborate with local certified massage schools and hair styling schools.

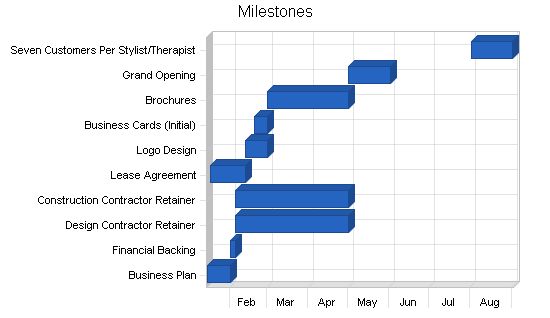

5.6 Milestones

The following table lists store milestones, implementation duties, and budgets. The milestone schedule emphasizes timely implementation based on the sales and marketing targets provided in detail in previous sections.

Milestones

| Business Plan | 1/15/2001 | 2/1/2001 | $0 | Steve | Owner |

| Financial Backing | 2/1/2001 | 2/5/2001 | $200,000 | Steve | Owner |

| Design Contractor Retainer | 2/5/2001 | 5/1/2001 | $5,000 | Steve | Owner |

| Construction Contractor Retainer | 2/5/2001 | 5/1/2001 | $20,000 | Steve | Owner |

| Lease Agreement | 1/17/2001 | 2/12/2001 | $20,000 | Steve | Owner |

| Logo Design | 2/12/2001 | 3/1/2001 | $1,000 | Steve | Owner |

| Business Cards (Initial) | 2/19/2001 | 3/1/2001 | $300 | Steve | Owner |

| Brochures | 3/1/2001 | 5/1/2001 | $3,000 | Steve | Owner |

| Grand Opening | 5/1/2001 | 6/1/2001 | $0 | Steve | Owner |

| Seven Customers Per Stylist/Therapist | 8/1/2001 | 9/1/2001 | $0 | Steve | Owner |

| Totals | $249,300 | ||||

Management Summary

The management philosophy of SoulSpace is based on respect for each employee and customer, and individual responsibility. SoulSpace’s success depends on the unique atmosphere created by fun-loving and caring employees. The management team consists of the owner, general manager, and assistant manager (if needed). We hire individuals who demonstrate qualities necessary for a nurturing environment and a willingness to learn energetic principles. We hire the ultimate "people persons."

6.1 Organizational Structure

Our team consists of 14 employees, including a general manager and an assistant manager who are also stylists/therapists.

On the salon side, there will be 10 stylists and one or two receptionists. We have room for expansion to 12-15 stylists and three receptionists. The spa side will have three massage therapists, one energy therapist, one nail specialist, and one receptionist. We have room for expansion to five to seven massage therapists and two to three energy therapists.

6.2 Management Team

Steven J. Long, co-owner, president: Founded SoulSpace in 2001. Holds a degree in psychology from NC State with a concentration in industrial/organizational communication. Reiki Master Usui Shiki Ryoho since 1996. Eight years of management experience, six in retail and two in electronic component distribution. Three years in the modeling industry, one as a model and two as an agency manager.

Deborah L. Long, co-owner: Assists Steve in general organizational planning and vision implementation. Currently the number one co-location sales manager for SpectraSite, Inc. Previous experience as an executive assistant in the sales field and holds a level two Usui Shiki Ryoho.

Linda Hill-Chinn, co-owner, CFO: Retired after 15 years as a senior national staffing specialist for the American Hospital Association and serving on their board of directors. Also managed Planned Parenthood of Chicago. Holds a Master’s degree in sociology from Brown University.

Jennifer McElravey, general manager: One of the top stylists at Mitchell’s Hair Design for nine years. Level five stylist and Salon Designer of the Year ’94-97. Received extra training at Vidal Sassoon of London. Also a level two Usui Shiki Ryoho.

6.3 Management Team Gaps

We believe our team’s experience covers the needs to make the business plan for SoulSpace successful. The assistant manager will be named from the pool of stylists/therapists hired before our opening.

6.4 Personnel Plan

The Personnel Plan below reflects our projected need at opening and through the second-year expansions.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Steve Long, Owner, President | $65,040 | $65,040 | $65,040 |

| General Manager | $60,000 | $60,000 | $60,000 |

| %100 Commissioned Employees | $150 | $156 | $156 |

| Receptionist | $15,360 | $15,360 | $15,360 |

| Receptionist | $15,360 | $30,620 | $30,620 |

| Total People | 17 | 18 | 18 |

| Total Payroll | $155,910 | $171,176 | $171,176 |

Financial Plan

The premier element in our financial plan is creating, maintaining, and improving factors that increase cash flow:

- Create visibility to generate customer flow.

- Maintain a happy employee force to minimize turnover.

- Create a brisk turnaround on retail and art products, always maintaining viable stock levels.

7.1 Important Assumptions

Our financial plan is based on the following assumptions:

- We assume access to equity capital and financing to support our financial plan.

- We assume our financial progress will be based on realistic sales and minimizing expenses.

- We assume there won’t be an economic crash that greatly affects our target market’s personal finances.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 2.50% | 0.00% | 2.50% |

| Other | 0 | 0 | 0 |

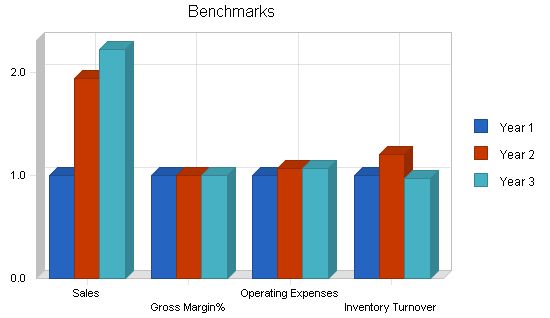

7.2 Key Financial Indicators

Our most important Key Financial Indicator is when each stylist averages seven customers per day and each therapist averages three customers per day.

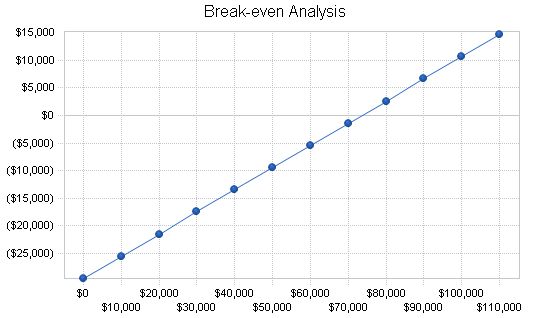

7.3 Break-even Analysis

For our Break-even Analysis, we assume estimated monthly operational costs including payroll, rent, utilities, and other running costs (excluding employee draw fund considerations). Payroll alone is estimated at about 1/2 of those costs.

The analysis shows the monthly revenue needed to break even, which is 13% less than the estimated monthly store gross. This estimation does not include revenue from other store sources and is based on an average customer spend of $36 for salon services and $60 for spa services.

Our average revenue per customer is estimated at $39. Considering our minimal assumptions, we have a monthly customer average of 1,922. Therefore, we believe our break-even figures can be easily maintained.

Break-even Analysis:

Monthly Revenue Break-even: $73,567.

Assumptions:

– Average Percent Variable Cost: 60%.

– Estimated Monthly Fixed Cost: $29,525.

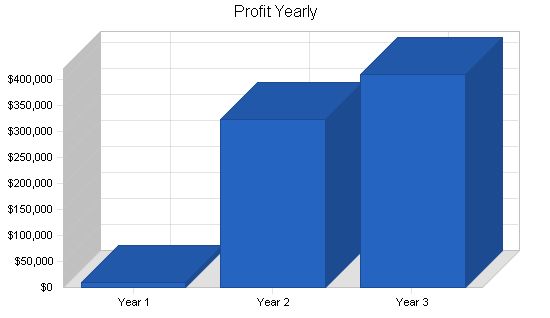

7.4 Projected Profit and Loss:

Two important assumptions with our Projected Profit and Loss statement:

1. We may need to pay out from the Draw Fund occasionally.

2. Our revenue is based on minimum estimated averages against highest expense expectations.

Pro Forma Profit and Loss

Year 1 Year 2 Year 3

Sales $900,000 $1,750,000 $2,000,000

Direct Cost of Sales $538,800 $1,050,000 $1,200,000

Other $0 $0 $0

Total Cost of Sales $538,800 $1,050,000 $1,200,000

Gross Margin $361,200 $700,000 $800,000

Gross Margin % 40.13% 40.00% 40.00%

Expenses

Payroll $155,910 $171,176 $171,176

Sales and Marketing and Other Expenses $34,000 $39,000 $41,000

Depreciation $0 $0 $0

Rent $120,000 $120,000 $120,000

Leased Equipment $0 $0 $0

Utilities $9,000 $9,000 $9,000

Insurance $12,000 $12,000 $12,000

Payroll Taxes $23,387 $25,676 $25,676

Other $0 $0 $0

Total Operating Expenses $354,297 $376,852 $378,852

Profit Before Interest and Taxes $6,904 $323,148 $421,148

EBITDA $6,904 $323,148 $421,148

Interest Expense $0 $0 $0

Taxes Incurred ($2,907) $0 $10,529

Net Profit $9,810 $323,148 $410,619

Net Profit/Sales 1.09% 18.47% 20.53%

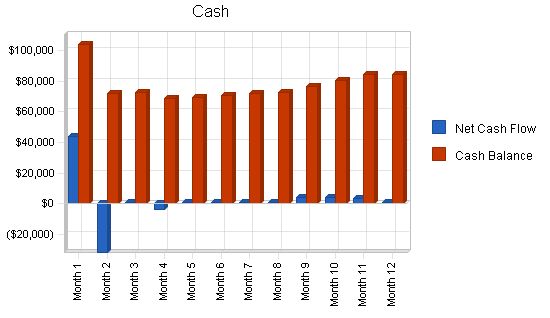

7.5 Projected Cash Flow

Considering our business is a luxury, retail-oriented business with customers who primarily pay with credit cards, our cash flow does not depend on invoices and Accounts Payable. We need minimal financing for the first year of operations, and after that, cash flow is continuous.

Pro Forma Cash Flow:

Year 1 Year 2 Year 3

Cash Received:

Cash from Operations:

Cash Sales: $900,000 $1,750,000 $2,000,000

Subtotal Cash from Operations: $900,000 $1,750,000 $2,000,000

Additional Cash Received:

Sales Tax, VAT, HST/GST Received: $0 $0 $0

New Current Borrowing: $0 $0 $0

New Other Liabilities (interest-free): $0 $0 $0

New Long-term Liabilities: $0 $0 $0

Sales of Other Current Assets: $0 $0 $0

Sales of Long-term Assets: $0 $0 $0

New Investment Received: $0 $0 $0

Subtotal Cash Received: $900,000 $1,750,000 $2,000,000

Expenditures:

Expenditures from Operations:

Cash Spending: $155,910 $171,176 $171,176

Bill Payments: $719,414 $1,263,200 $1,423,005

Subtotal Spent on Operations: $875,324 $1,434,376 $1,594,181

Additional Cash Spent:

Sales Tax, VAT, HST/GST Paid Out: $0 $0 $0

Principal Repayment of Current Borrowing: $0 $0 $0

Other Liabilities Principal Repayment: $0 $0 $0

Long-term Liabilities Principal Repayment: $0 $0 $0

Purchase Other Current Assets: $0 $0 $0

Purchase Long-term Assets: $0 $0 $0

Dividends: $0 $0 $0

Subtotal Cash Spent: $875,324 $1,434,376 $1,594,181

Net Cash Flow: $24,676 $315,624 $405,819

Cash Balance: $84,676 $400,299 $806,118

Projected Balance Sheet:

Our Projected Balance Sheet shows we will not have any difficulty meeting our debt obligations as long as our revenue projections are met.

Pro Forma Balance Sheet:

Year 1 Year 2 Year 3

Assets:

Current Assets:

Cash: $84,676 $400,299 $806,118

Inventory: $54,450 $106,111 $121,269

Other Current Assets: $0 $0 $0

Total Current Assets: $139,126 $506,410 $927,387

Long-term Assets:

Long-term Assets: $0 $0 $0

Accumulated Depreciation: $0 $0 $0

Total Long-term Assets: $0 $0 $0

Total Assets: $139,126 $506,410 $927,387

Liabilities and Capital:

Current Liabilities:

Accounts Payable: $63,316 $107,452 $117,811

Current Borrowing: $0 $0 $0

Other Current Liabilities: $0 $0 $0

Subtotal Current Liabilities: $63,316 $107,452 $117,811

Long-term Liabilities: $0 $0 $0

Total Liabilities: $63,316 $107,452 $117,811

Paid-in Capital: $160,000 $160,000 $160,000

Retained Earnings: ($94,000) ($84,190) $238,958

Earnings: $9,810 $323,148 $410,619

Total Capital: $75,810 $398,958 $809,577

Total Liabilities and Capital: $139,126 $506,410 $927,387

The following table contains important business ratios for the physical fitness facilities industry, as determined by the Standard Industry Classification (SIC) code, 7991.

Ratio Analysis:

Year 1 Year 2 Year 3 Industry Profile

Sales Growth: 0.00% 94.44% 14.29% 15.90%

Percent of Total Assets:

Inventory: 39.14% 20.95% 13.08% 3.60%

Other Current Assets: 0.00% 0.00% 0.00% 31.10%

Total Current Assets: 100.00% 100.00% 100.00% 39.00%

Long-term Assets: 0.00% 0.00% 0.00% 61.0%

Total Assets: 100.00% 100.00% 100.00% 100.00%

Current Liabilities:

Accounts Payable: 45.51% 21.22% 12.70% 34.80%

Long-term Liabilities: 0.00% 0.00% 0.00% 27.60%

Total Liabilities: 45.51% 21.22% 12.70% 62.40%

Net Worth: 54.49% 78.78% 87.30% 37.60%

Percent of Sales:

Sales: 100.00% 100.00% 100.00% 100.00%

Gross Margin: 40.13% 40.00% 40.00% 0.00%

Selling, General & Administrative Expenses: 39.37% 21.53% 18.94% 73.20%

Advertising Expenses: 1.11% 0.86% 0.85% 2.40%

Profit Before Interest and Taxes: 0.77% 18.47% 21.06% 2.70%

Main Ratios:

Current: 2.20 4.71 7.87 1.10

Quick: 1.34 3.73 6.84 0.73

Total Debt to Total Assets: 45.51% 21.22% 12.70% 62.40%

Pre-tax Return on Net Worth: 9.11% 81.00% 52.02% 3.00%

Pre-tax Return on Assets: 4.96% 63.81% 45.41% 7.90%

Additional Ratios:

Net Profit Margin: 1.09% 18.47% 20.53% n.a

Return on Equity: 12.94% 81.00% 50.72% n.a

Activity Ratios:

Inventory Turnover: 10.91 13.08 10.56 n.a

Accounts Payable Turnover: 12.36 12.17 12.17 n.a

Payment Days: 27 24 29 n.a

Total Asset Turnover: 6.47 3.46 2.16 n.a

Debt Ratios:

Debt to Net Worth: 0.84 0.27 0.15 n.a

Current Liab. to Liab.: 1.00 1.00 1.00 n.a

Liquidity Ratios:

Net Working Capital: $75,810 $398,958 $809,577 n.a

Interest Coverage: 0.00 0.00 0.00 n.a

Additional Ratios:

Assets to Sales: 0.15 0.29 0.46 n.a

Current Debt/Total Assets: 46% 21% 13% n.a

Acid Test: 1.34 3.73 6.84 n.a

Sales/Net Worth: 11.87 4.39 2.47 n.a

Dividend Payout: 0.00 0.00 0.00 n.a

Appendix:

Sales Forecast:

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Sales: $60,000 $67,500 $75,000 $75,000 $75,000 $75,000 $75,000 $75,000 $75,000 $78,000 $79,500 $82,500 $82,500

Direct Cost of Sales:

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Salon Styles Only Revenue: $28,800 $32,400 $36,000 $36,000 $36,000 $36,000 $36,000 $36,000 $36,000 $36,000 $38,100 $39,000 $39,000

Spa Massage Only Revenue: $7,200 $8,100 $9,000 $9,000 $9,000 $9,000 $9,000 $9,000 $9,000 $9,600 $9,600 $10,500 $10,500

Subtotal Direct Cost of Sales: $36,000 $40,500 $45,000 $45,000 $45,000 $45,000 $45,000 $45,000 $45,000 $45,600 $47,700 $49,500 $49,500

Personnel Plan:

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Steve Long, Owner, President: $5,420 $5,420 $5,420 $5,420 $5,420 $5,420 $5,420 $5,420 $5,420 $5,420 $5,420 $5,420 $5,420

General Manager: $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000

%100 Commissioned Employees: $10 $10 $13 $13 $13 $13 $13 $13 $13 $13 $13 $13 $13

Receptionist: $1,280 $1,280 $1,280 $1,280 $1,280 $1,280 $1,280 $1,280 $1,280 $1,280 $1,280 $1,280 $1,280

Receptionist: $1,280 $1,280 $1,280 $1,280 $1,280 $1,280 $1,280 $1,280 $1,280 $1,280 $1,280 $1,280 $1,280

Total People: 14 14 17 17 17 17 17 17 17 17 17 17 17

Total Payroll: $12,990 $12,990 $12,993 $12,993 $12,993 $12,993 $12,993 $12,993 $12,993 $12,993 $12,993 $12,993 $12,993

The following assumptions and projections show the financial outlook for the specified time period.

Date ranges from month 1 to month 12.

Plan Month: Plans for each month are indicated by the corresponding number.

Current Interest Rate: The interest rate remains consistent at 10.00% throughout the entire period.

Long-term Interest Rate: The long-term interest rate also remains constant at 10.00% for all 12 months.

Tax Rate: The tax rate starts at 30.00% in month 1 and then becomes 0.00% for the remaining months.

Other: No other costs or expenses are accounted for within the specified time frame.

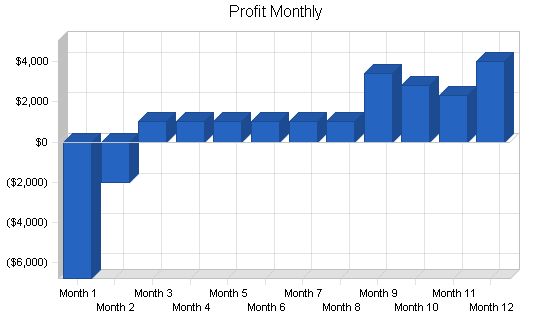

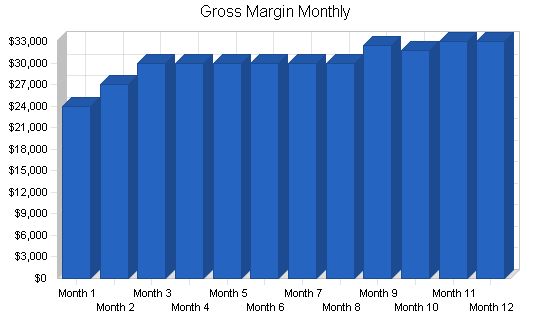

The next table displays the forecasted profit and loss statement.

Sales: The sales figures are as follows: $60,000 in month 1, $67,500 in month 2, $75,000 in month 3, and $75,000 in months 4 to 12.

Direct Cost of Sales: The costs associated directly with sales are $36,000 in month 1, $40,500 in month 2, and $45,000 in months 3 to 12.

Other: No other costs are accounted for within the specified timeframe.

Total Cost of Sales: The total cost of sales is calculated by adding the direct cost of sales to any other associated costs. The figures are the same as the direct cost of sales.

Gross Margin: The gross margin is calculated by subtracting the total cost of sales from the sales figures. The results are as follows: $24,000 in month 1, $27,000 in month 2, and $30,000 in months 3 to 12.

Gross Margin %: The gross margin percentage is obtained by dividing the gross margin by the sales and multiplying by 100. The percentage remains constant at 40.00% for all 12 months.

Expenses: The different expense categories are as follows:

– Payroll and Sales and Marketing and Other Expenses: Both are associated with a specific dollar amount for each month.

– Depreciation: No depreciation expense is incurred.

– Rent and Leased Equipment: The rent expense is consistent at $10,000 per month, while no leased equipment costs are incurred.

– Utilities and Insurance: Both expenses are set at $750 and $1,000 per month, respectively.

– Payroll Taxes: Payroll taxes are calculated by multiplying the payroll expense by 15% and allocating the amount to each month.

– Other: No other expenses are accounted for within the specified time frame.

Total Operating Expenses: The total operating expenses are obtained by summing up all individual expenses. The figures vary from month to month.

Profit Before Interest and Taxes: This figure is obtained by subtracting the total operating expenses from the gross margin. The results are as follows: ($9,689) in month 1, ($1,989) in month 2, and $1,008 in months 3 to 12.

EBITDA: Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) is the same as the profit before interest and taxes.

Interest Expense: No interest expenses are incurred throughout the entire period.

Taxes Incurred: The taxes incurred are calculated by multiplying the profit before interest and taxes by the tax rate specified for each month. The figures vary accordingly.

Net Profit: The net profit is obtained by subtracting the interest expense and taxes incurred from the profit before interest and taxes. The results are as follows: ($6,782) in month 1, ($1,989) in month 2, and $1,008 in months 3 to 12.

Net Profit/Sales: The net profit/sales percentage is calculated by dividing the net profit by the sales and multiplying by 100. The percentage varies from month to month.

Pro Forma Cash Flow

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $60,000 | $67,500 | $75,000 | $75,000 | $75,000 | $75,000 | $75,000 | $75,000 | $78,000 | $79,500 | $82,500 | $82,500 | |

| Subtotal Cash from Operations | $60,000 | $67,500 | $75,000 | $75,000 | $75,000 | $75,000 | $75,000 | $75,000 | $78,000 | $79,500 | $82,500 | $82,500 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Received | $60,000 | $67,500 | $75,000 | $75,000 | $75,000 | $75,000 | $75,000 | $75,000 | $78,000 | $79,500 | $82,500 | $82,500 | |

| Expenditures | |||||||||||||

| Expenditures from Operations | |||||||||||||

| Cash Spending | $12,990 | $12,990 | $12,993 | $12,993 | $12,993 | $12,993 | $12,993 | $12,993 | $12,993 | $12,993 | $12,993 | $12,993 | |

| Bill Payments | $2,913 | $86,527 | $61,599 | $65,784 | $60,999 | $60,999 | $60,999 | $60,999 | $61,041 | $62,384 | $66,115 | $69,056 | |

| Subtotal Spent on Operations | $15,903 | $99,517 | $74,592 | $78,777 | $73,992 | $73,992 | $73,992 | $73,992 | $74,034 | $75,377 | $79,108 | $82,049 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Spent | $15,903 | $99,517 | $74,592 | $78,777 | $73,992 | $73,992 | $73,992 | $73,992 | $74,034 | $75,377 | $79,108 | $82,049 | |

| Net Cash Flow | $44,097 | ($32,017) | $408 | ($3,777) | $1,008 | $1,008 | $1,008 | $1,008 | $3,966 | $4,123 | $3,392 | $451 | |

| Cash Balance | $104,097 | $72,080 | $72,488 | $68,711 | $69,719 | $70,727 | $71,735 | $72,744 | $76,710 | $80,833 | $84,225 | $84,676 | |

Pro Forma Balance Sheet

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |||

| Assets | Starting Balances | |||||||||||||

| Current Assets | ||||||||||||||

| Cash | $60,000 | $104,097 | $72,080 | $72,488 | $68,711 | $69,719 | $70,727 | $71,735 | $72,744 | $76,710 | $80,833 | $84,225 | $84,676 | |

| Inventory | $6,000 | $39,600 | $44,550 | $49,500 | $49,500 | $49,500 | $49,500 | $49,500 | $49,500 | $50,160 | $52,470 | $54,450 | $54,450 | |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Current Assets | $66,000 | $143,697 | $116,630 | $121,988 | $118,211 | $119,219 | $120,227 | $121,235 | $122,244 | $126,870 | $133,303 | $138,675 | $139,126 | |

| Long-term Assets | ||||||||||||||

| Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!