Contents

Gift Basket Business Plan

Introduction

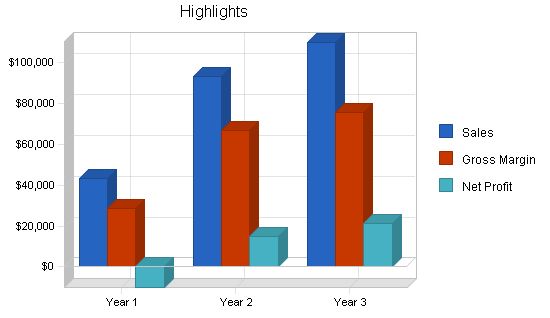

Basket of Goodies (BOG) is a premier gift basket retailer specializing in gourmet gift baskets made from high-quality ingredients. In addition to flagship baskets, BOG also offers custom baskets where customers can choose their own ingredients. BOG sells to both individuals and corporations, initially relying on word-of-mouth referrals from individuals but gradually increasing sales to corporations.

Once BOG gains momentum, it will steadily generate profits, projecting a profit by December and a net profit of $21,000 by the end of year three.

The Company

The mission of Basket of Goodies is to create the finest gift baskets. BOG operates out of Susan Presento’s home in Salem, OR, assembling products by hand using premier ingredients, preferably sourced locally. While initially a home-based business, Susan plans to hire an employee by the end of year one.

As the founder and owner, Susan’s three years of experience managing a flower shop in Salem have provided insight into the gift-giving practices of Oregonians. The primary gift baskets offered include smoked fish, fruit, pasta dinner, and picnic baskets with caviar, crackers, fruit, and smoked fish. BOG also offers custom baskets, allowing customers to choose items from a list for personalized assembly.

The Market

Gift basket purchases are highly seasonal, with more than half occurring during various holidays.

BOG’s competitive advantage is attributed to two factors: low overhead enabling reasonable prices, and a commitment to providing the highest quality product and service.

- Low overhead

- Highest quality product and service

BOG’s sales strategy focuses on acquiring individual and corporate clients through word-of-mouth referrals. Customers can place orders through the office, phone, or website.

Financials

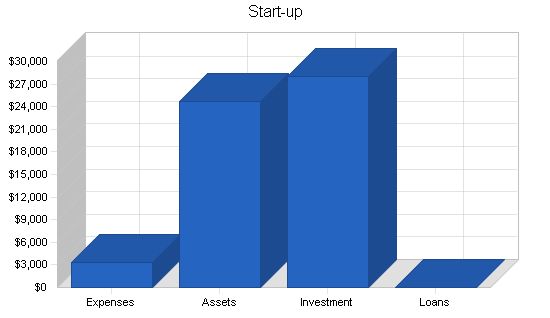

Start-up costs for BOG include office equipment, legal fees, website creation, and advertising. The most significant portion of these expenses is for home office equipment, such as a computer system, fax machine, office supplies, cellular phone, pager, broadband connection installation, and furniture. Susan will fund the total start-up expenses of $28,000 with her own equity.

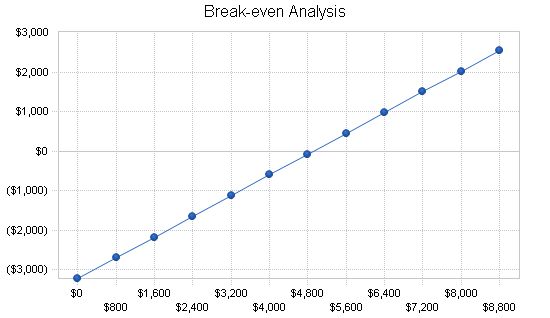

The Break-even Analysis suggests that BOG needs to sell approximately $4,900 per month to break even. BOG anticipates earning approximately $14,000 in year two and $21,000 in year three.

The mission of Basket of Goodies is to create exceptional gift baskets, attracting and retaining customers. Our goal is to exceed customer expectations through our products and services.

The objectives for the first three years of operation are:

1. Establish a home-based company that surpasses customer expectations.

2. Increase the client base by at least 20% annually through outstanding performance and word-of-mouth referrals.

3. Develop a sustainable home business that relies on its own cash flow.

Basket of Goodies, based in Salem, OR, will offer a variety of gourmet gift baskets, both standard and custom-made. We will hand-assemble the baskets using high-quality ingredients, preferably sourced locally. While initially a home-based business, Susan Presento plans to hire an employee by the end of the first year if the business meets projected goals.

Basket of Goodies is a sole proprietorship owned by Susan Presento.

Startup costs for BOG will cover office equipment, legal fees, website development, and initial advertising. The largest portion of the expenses will be allocated to office equipment, including a computer system, fax machine, office supplies, cellular phone, and pager. The recommended computer specifications are a 500 megahertz Celeron/Pentium processor, 64 megabytes of RAM (preferably 128), 6 gigabyte hard drive, and a rewritable CD-ROM for system backup. Additionally, a broadband connection will be installed, although not essential, to improve internet speed and efficiency.

To set up the home office, furniture such as a desk, chair, and bookshelf will be required. Another landline will be installed. Legal fees will cover business formation and the creation of standard client contracts. Web creation fees will be allocated for website design and development. The startup advertising will involve brochure production.

Start-up

Requirements

Expenses

Legal – $300

Stationery etc. – $100

Brochures – $200

Consultants – $1,500

Office Supplies – $100

General Supplies – $250

Website Creation – $500

Mailings – $400

Total Start-up Expenses – $3,350

Assets

Cash Required – $22,650

Start-up Inventory – $0

Other Current Assets – $0

Long-term Assets – $2,000

Total Assets – $24,650

Total Requirements – $28,000

Start-up Funding

Start-up Expenses to Fund – $3,350

Start-up Assets to Fund – $24,650

Total Funding Required – $28,000

Assets

Non-cash Assets from Start-up – $2,000

Cash Requirements from Start-up – $22,650

Additional Cash Raised – $0

Cash Balance on Starting Date – $22,650

Total Assets – $24,650

Liabilities and Capital

Liabilities

Current Borrowing – $0

Long-term Liabilities – $0

Accounts Payable (Outstanding Bills) – $0

Other Current Liabilities (interest-free) – $0

Total Liabilities – $0

Capital

Planned Investment

Investor 1 – $28,000

Other – $0

Additional Investment Requirement – $0

Total Planned Investment – $28,000

Loss at Start-up (Start-up Expenses) – ($3,350)

Total Capital – $24,650

Total Capital and Liabilities – $24,650

Total Funding – $28,000

Products

BOG sells gourmet, hand-assembled gift baskets. Their premier baskets are: smoked fish basket, fruit basket, pasta dinner basket, and picnic basket with caviar, crackers, fruit, and smoked fish. BOG also offers a custom basket where customers can choose items from a list and BOG will assemble the basket with their custom ingredients.

For customer baskets, BOG provides a list of options grouped into four categories. Customers choose two items from each category and a gift basket is made for them. BOG also offers four premier baskets and one or two seasonal specials.

Market Analysis Summary

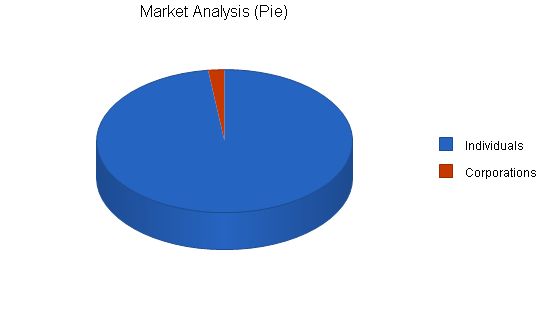

BOG targets two market segments: individuals and corporations. Both groups buy gift baskets as a gesture of goodwill, but for different reasons. Sales to individuals are highest during holidays, while sales to corporations are for events unrelated to holidays. By targeting both groups, sales will be less seasonal.

BOG differentiates themselves by using premium ingredients in their baskets. The gourmet baskets, custom option, and reasonable prices (due to low overhead) will lead to success for BOG.

4.1 Market Segmentation

BOG has two customer groups: individuals and corporate customers.

– Individuals: These customers want to give a gift basket as a gesture of goodwill. They don’t have a specific type of gift basket in mind.

– Corporate: Corporate customers buy baskets as appreciation gestures, for special events, or as thank-yous for customers. This market can be further broken down into banks, healthcare, employment gifts, real estate, apartments, special events/promotions, corporate headquarters, hotels/vacation resorts, and automobile dealerships.

Market Analysis

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Individuals | 8% | 14,258 | 15,399 | 16,631 | 17,961 | 19,398 | 8.00% |

| Corporations | 12% | 298 | 334 | 374 | 419 | 469 | 12.01% |

| Total | 8.09% | 14,556 | 15,733 | 17,005 | 18,380 | 19,867 | 8.09% |

4.2 Target Market Segment Strategy

BOG focuses on individuals and corporate customers, the largest customer segments for gift baskets. Individuals often purchase gift baskets as a thank you or to be kind. Gift baskets are a clear gift and are appreciated for their intent. Women are more likely to purchase gift baskets compared to men.

The corporate customer segment represents approximately one-third of gift basket purchasers. Corporate customers may purchase baskets for company or external gifts. This market segment has a history of purchasing gifts and is a reliable one to pursue.

4.3 Industry Analysis

Competition in the gift basket business comes in various forms:

- Similar gift basket retail stores: Several of these stores are located in Salem, offering a wide range of gift baskets, but not focusing on high-end, gourmet products.

- Nut/fruit companies: Several stores specialize in nuts and fruit baskets.

- Bath product gift basket companies: One company concentrates on bath products, appealing mainly to women.

- Regional gift basket: One retailer sells gift baskets composed of local products, particularly appealing to gift buyers for people outside the area.

- Candy gift baskets: Several candy stores offer candy gift baskets, which typically appeal to women.

- Florists: Flowers compete with gift baskets, with a higher appeal to women.

Gift basket purchases are seasonal, with a majority occurring during holidays.

Strategy and Implementation Summary

BOG’s marketing and sales strategy primarily revolves around brochures and a website. These tools familiarize customers with BOG’s products. Word-of-mouth referrals play a significant role in generating business for BOG. BOG’s customer-centric mission ensures that all efforts are dedicated to customer satisfaction.

5.1 Competitive Edge

BOG’s competitive advantage is based on low overhead costs, allowing for reasonable prices, and a commitment to providing the highest quality products and services.

- BOG operates as a home-based business, resulting in low overhead compared to retail stores. While retail stores may have higher sales due to walk-by traffic, BOG avoids the large expense of rent by operating from Susan’s home. Utilizing just-in-time inventory and assembly further reduces costs. BOG stocks some standard baskets for walk-in orders but avoids large overhead.

- BOG prioritizes offering the finest quality ingredients and ensuring 100% customer satisfaction. This commitment to quality sets BOG apart in a crowded market, ensuring long-term success.

To develop effective business strategies, perform a SWOT analysis of your business. Our free guide and template can assist you in performing a SWOT analysis.

5.2 Sales Strategy

BOG’s sales strategy targets both individual and corporate clients. Word-of-mouth referrals are expected to drive individual customer purchases. Emphasizing value and highlighting high quality during sales interactions will help BOG close deals. BOG aims to impress potential customers with the quality and pricing of their baskets, distinguishing themselves from competitors.

BOG offers multiple ways for customers to purchase baskets, including visiting the office, making a phone call, or ordering through the website. Customers can pick up the product or have it shipped via UPS. BOG believes that providing a wide range of options makes customers feel valued. The website and catalog will provide detailed information about BOG’s service offerings, targeting both individual and corporate customers.

Through marketing efforts, BOG aims to drive traffic to the website and catalog. Online browsing and ordering are particularly convenient for out-of-town customers. Corporate customers are expected to utilize the website as a catalog and place orders online for efficiency.

5.2.1 Sales Forecast

The first month will be dedicated to setting up the business, resulting in minimal sales activity. Legal and accounting matters, equipment purchases, office creation, and inventory room establishment will be prioritized. Susan will work on streamlining the assembly process and collaborating with a web designer to design and set up the website for online orders.

Sales activity is expected to increase in the second or third month. Networking efforts and direct mailing to local corporations will help raise awareness of BOG’s products and drive corporate business. As Susan’s husband assists with material acquisition, hiring an employee will not be necessary until the end of the first year.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Individuals | $33,640 | $64,575 | $78,452 |

| Corporations | $9,905 | $28,744 | $31,458 |

| Total Sales | $43,545 | $93,319 | $109,910 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Individuals | $11,484 | $18,474 | $24,124 |

| Corporations | $3,505 | $7,854 | $9,898 |

| Subtotal Direct Cost of Sales | $14,989 | $26,328 | $34,022 |

5.3 Milestones

BOG will have several milestones early on:

- Business plan completion. This will be done as a road map for the company. Although BOG doesn’t need a business plan to raise capital, it will be an indispensable tool for the ongoing performance and improvement.

- Set up office.

- Production of brochure and website.

- BOG’s 100th basket.

- BOG’s first profitable month.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business plan completion | 1/1/2001 | 1/1/2001 | $0 | Susan | Marketing |

| Set-up office | 1/1/2001 | 1/1/2001 | $0 | Susan | Department |

| Production of brochure and website | 1/1/2001 | 2/1/2001 | $0 | Susan | Department |

| BOG’s 100th basket | 3/1/2001 | 3/1/2001 | $0 | Susan | Department |

| Totals | $0 | ||||

Management Summary

BOG will be formed as a sole proprietorship, owned and operated by Susan Presento. There is no compelling need to incorporate. Incorporation would provide limited liability, but it would incur set-up costs and maintenance (tax disadvantages). A comprehensive insurance policy should cover any liability that BOG is exposed to.

Susan Presento, founder and owner, holds a communications degree from the University of Portland. During her undergraduate years, Susan worked at Nothstroms, perfecting her customer-centric perspective. After graduation, Susan managed a flower shop in Salem. It was during these three years that Susan gained insight into the gift-giving practices of Oregonians. Susan also gained valuable management experience at the florist. Susan will rely on her husband, Robert Presento, to help pick up the ingredients for her products. Additionally, Jennifer Simon, who works in the purchasing department of a large corporation, will act as a consultant regarding the purchasing habits of corporations, a niche of the industry that Susan would like to be a part of.

6.1 Personnel Plan

The staff of BOG will consist of Susan working full time. Susan’s husband, Robert, will help with inventory procurement but will not be listed on the payroll. Robert will occasionally pick up inventory on his way home from work and will not bill BOG for his work. Jennifer Simon will be a consultant for BOG, providing insight into the corporate market. By month eight, Susan will bring on board a part-time employee for the assembly of the baskets.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Susan | $24,000 | $24,000 | $24,000 |

| Part-time employee | $7,500 | $15,000 | $15,000 |

| Other | $0 | $0 | $0 |

| Total People | 2 | 2 | 2 |

| Total Payroll | $31,500 | $39,000 | $39,000 |

The following sections will outline the important financial data.

7.1 Important Assumptions

The following table details important financial assumptions for BOG.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 25.42% | 25.00% | 25.42% |

| Other | 0 | 0 | 0 |

7.2 Break-even Analysis

The Break-even Analysis indicates that BOG will need to sell approximately $4,900 in baskets per month to break even.

Break-even Analysis

Monthly Revenue Break-even: $4,915

Assumptions:

– Average Percent Variable Cost: 34%

– Estimated Monthly Fixed Cost: $3,223

7.3 Projected Profit and Loss

The table below shows projected profit and loss.

Pro Forma Profit and Loss

Year 1 Year 2 Year 3

Sales $43,545 $93,319 $109,910

Direct Cost of Sales $14,989 $26,328 $34,022

Other $0 $0 $0

Total Cost of Sales $14,989 $26,328 $34,022

Gross Margin $28,556 $66,991 $75,888

Gross Margin % 65.58% 71.79% 69.05%

Expenses

Payroll $31,500 $39,000 $39,000

Sales and Marketing and Other Expenses $1,200 $1,200 $1,200

Depreciation $655 $672 $672

Leased Equipment $0 $0 $0

Utilities $0 $0 $0

Insurance $600 $600 $600

Rent $0 $0 $0

Payroll Taxes $4,725 $5,850 $5,850

Other $0 $0 $0

Total Operating Expenses $38,680 $47,322 $47,322

Profit Before Interest and Taxes ($10,124) $19,669 $28,566

EBITDA ($9,469) $20,341 $29,238

Interest Expense $0 $0 $0

Taxes Incurred $0 $4,917 $7,261

Net Profit ($10,124) $14,752 $21,305

Net Profit/Sales -23.25% 15.81% 19.38%

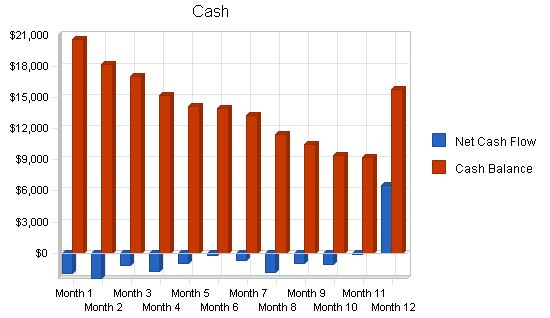

7.4 Projected Cash Flow

The chart and table below show projected cash flow.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $43,545 | $93,319 | $109,910 |

| Subtotal Cash from Operations | $43,545 | $93,319 | $109,910 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $43,545 | $93,319 | $109,910 |

Projected Balance Sheet

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $15,779 | $25,860 | $46,792 |

| Inventory | $3,507 | $6,160 | $7,960 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $19,286 | $32,020 | $54,752 |

| Long-term Assets | |||

| Long-term Assets | $2,000 | $2,000 | $2,000 |

| Accumulated Depreciation | $655 | $1,327 | $1,999 |

| Total Long-term Assets | $1,345 | $673 | $1 |

| Total Assets | $20,631 | $32,693 | $54,753 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $6,105 | $3,415 | $4,170 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $6,105 | $3,415 | $4,170 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $6,105 | $3,415 | $4,170 |

| Paid-in Capital | $28,000 | $28,000 | $28,000 |

| Retained Earnings | ($3,350) | ($13,474) | $1,278 |

| Earnings | ($10,124) | $14,752 | $21,305 |

| Total Capital | $14,526 | $29,278 | $50,584 |

| Total Liabilities and Capital | $20,631 | $32,693 | $54,753 |

| Net Worth | $14,526 | $29,278 | $50,584 |

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 114.30% | 17.78% | 17.90% |

| Percent of Total Assets | ||||

| Inventory | 17.00% | 18.84% | 14.54% | 4.60% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 37.10% |

| Total Current Assets | 93.48% | 97.94% | 100.00% | 52.80% |

| Long-term Assets | 6.52% | 2.06% | 0.00% | 47.20% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 29.59% | 10.45% | 7.62% | 33.90% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 28.00% |

| Total Liabilities | 29.59% | 10.45% | 7.62% | 61.90% |

| Net Worth | 70.41% | 89.55% | 92.38% | 38.10% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 65.58% | 71.79% | 69.05% | 0.00% |

| Selling, General & Administrative Expenses | 88.87% | 55.98% | 49.55% | 72.70% |

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 2.20% |

| Profit Before Interest and Taxes | -23.25% | 21.08% | 25.99% | 4.00% |

| Main Ratios | ||||

| Current | 3.16 | 9.38 | 13.13 | 1.81 |

| Quick | 2.58 | 7.57 | 11.22 | 1.33 |

| Total Debt to Total Assets | 29.59% | 10.45% | 7.62% | 61.90% |

| Pre-tax Return on Net Worth | -69.69% | 67.18% | 56.47% | 6.30% |

| Pre-tax Return on Assets | -49.07% | 60.16% | 52.17% | 16.60% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | -23.25% | 15.81% | 19.38% | n.a |

| Return on Equity | -69.69% | 50.38% | 42.12% | n.a |

| Activity Ratios | ||||

| Inventory Turnover | 10.80 | 5.45 | 4.82 | n.a |

| Accounts Payable Turnover | 4.10 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 42 | 27 | n.a |

| Total Asset Turnover | 2.11 | 2.85 | 2.01 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.42 | 0.12 | 0.08 | n.a |

| Current Liab. to Liab. | 1.00 | 1.00 | 1.00 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $13,181 | $28,605 | $50,582 | n.a |

| Interest Coverage | 0.00 | 0.00 | 0.00 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.47 | 0.35 | 0.50 | n.a |

| Current Debt/Total Assets | 30% | 10% | 8% | n.a |

| Acid Test | 2.58 | 7.57 | 11.22 | n.a |

| Sales/Net Worth | 3.00 | 3.19 | 2.17 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

Sales Forecast

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 |

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 Plan Month 1 2 3 4 5 6 7 8 9 10 11 12 Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Tax Rate 30.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% Other 0 0 0 0 0 0 0 0 0 0 0 0 0 Pro Forma Profit and Loss: Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 Sales $0 $0 $1,320 $2,041 $2,408 $3,418 $3,999 $4,362 $4,652 $4,772 $5,659 $10,914 Direct Cost of Sales $0 $0 $656 $815 $970 $1,579 $1,901 $1,675 $1,696 $1,697 $812 $3,188 Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Cost of Sales $0 $0 $656 $815 $970 $1,579 $1,901 $1,675 $1,696 $1,697 $812 $3,188 Gross Margin $0 $0 $664 $1,226 $1,438 $1,839 $2,098 $2,687 $2,956 $3,075 $4,847 $7,726 Gross Margin % 0.00% 0.00% 50.30% 60.07% 59.72% 53.80% 52.46% 61.60% 63.54% 64.44% 85.65% 70.79% Expenses Payroll $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $3,500 $3,500 $3,500 $3,500 $3,500 Sales and Marketing and Other Expenses $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 Depreciation $55 $55 $55 $55 $55 $55 $55 $55 $55 $55 $55 $55 Leased Equipment $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Utilities $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Insurance $50 $50 $50 $50 $50 $50 $50 $50 $50 $50 $50 $50 Rent $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Payroll Taxes 15% $300 $300 $300 $300 $300 $300 $300 $525 $525 $525 $525 $525 Other $0 $0 $0 $0 Pro Forma Balance Sheet |

|||||||||

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $22,650 | $20,635 | $18,185 | $17,009 | $15,235 | $14,189 | $13,989 | $13,289 | $11,466 | $10,507 | $9,385 | $9,228 | $15,779 |

| Inventory | $0 | $0 | $0 | $722 | $907 | $1,067 | $1,737 | $2,091 | $1,843 | $1,866 | $1,867 | $1,055 | $3,507 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $22,650 | $20,635 | $18,185 | $17,731 | $16,142 | $15,256 | $15,726 | $15,380 | $13,308 | $12,372 | $11,252 | $10,283 | $19,286 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 |

| Accumulated Depreciation | $0 | $55 | $109 | $164 | $218 | $273 | $327 | $382 | $436 | $491 | $546 | $600 | $655 |

| Total Long-term Assets | $2,000 | $1,945 | $1,891 | $1,836 | $1,782 | $1,727 | $1,673 | $1,618 | $1,564 | $1,509 | $1,455 | $1,400 | $1,345 |

| Total Assets | $24,650 | $22,580 | $20,076 | $19,567 | $17,923 | $16,983 | $17,399 | $16,998 | $14,872 | $13,881 | $12,706 | $11,682 | $20,631 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $435 | $435 | $1,767 | $1,402 | $1,528 | $2,609 | $2,615 | $2,031 | $2,314 | $2,294 | $653 | $6,105 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $435 | $435 | $1,767 | $1,402 | $1,528 | $2,609 | $2,615 | $2,031 | $2,314 | $2,294 | $653 | $6,105 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $0 | $435 | $435 | $1,767 | $1,402 | $1,528 | $2,609 | $2,615 | $2,031 | $2,314 | $2,294 | $653 | $6,105 |

| Paid-in Capital | $28,000 | $28,000 | $28,000 | $28,000 | $28,000 | $28,000 | $28,000 | $28,000 | $28,000 | $28,000 | $28,000 | $28,000 | $28,000 |

| Retained Earnings | ($3,350) | ($3,350) | ($3,350) | ($3,350) | ($3,350) | ($3,350) | ($3,350) | ($3,350) | ($3,350) | ($3,350) | ($3,350) | ($3,350) | ($3,350) |

| Earnings | $0 | ($2,505) | |||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!