Contents

Dog Obedience School Business Plan

Canine Critter College (Tri C) is a dog obedience school located in Eugene. Tri C specializes in training owners on how to effectively train and communicate with their dogs. Understanding the dog’s physical and social behavior is key to successful communication.

By emphasizing this unique approach, Canine Critter College aims to cultivate long-term, satisfied customers and steadily increase market share.

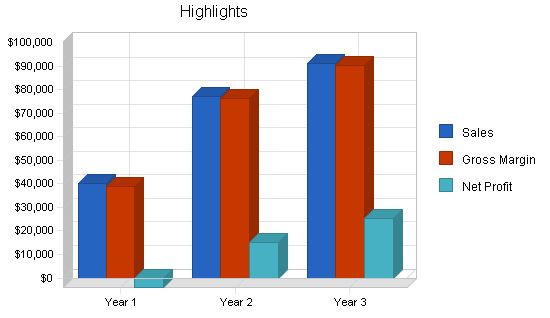

Profitability is projected to be achieved by month seven, with expected revenues of $91,000 by the end of year three.

Canine Critter College’s mission is to provide the finest dog training program available. We exist to attract and maintain customers. Our services will exceed customer expectations.

The objectives for the first three years of operation include:

1. Create a service-based company that exceeds customer expectations.

2. Increase the number of clients by 20% per year.

3. Develop a sustainable start-up business.

The keys to success are providing a reasonably priced service that customers value and a customer-centric business model.

Canine Critter College is a sole proprietorship based in Eugene, OR. It will offer three levels of obedience training in a group setting or through private lessons. It is forecasted to reach profitability by month nine and generate revenue of $91,000 by year three.

Company Ownership

Canine Critter College is a sole proprietorship founded and owned by Gerry Gestapo.

Start-up Summary

Canine Critter College will incur the following start-up costs:

– Computer system with a printer, CD-RW, Microsoft Office, QuickBooks Pro, and broadband Internet connections.

– Fax machine and copier.

– Phone line, phone, and answering machine.

– Assorted leashes, toys, and collars.

Please note that the following items will be expensed; there will be no depreciation applied to them.

Services

Canine Critter College provides dog obedience classes for groups and individuals. It offers three levels of classes:

1. Puppy Kindergarten: to teach dogs basic commands and socialization skills. It includes an introductory explanation of proper communication techniques.

2. Household Obedience Level 1: to have the entire family work with their dog in a positive and consistent manner. It aims to establish a leadership relationship with the dog. It uses the American Kennel Club’s Canine Good Citizen Test.

3. Household Obedience Level 2: to perfect standard commands and work on advanced communication techniques.

The courses establish the pet owner’s role as the leader of the pack and provide insight into canine social behavior and body language.

Market Analysis Summary

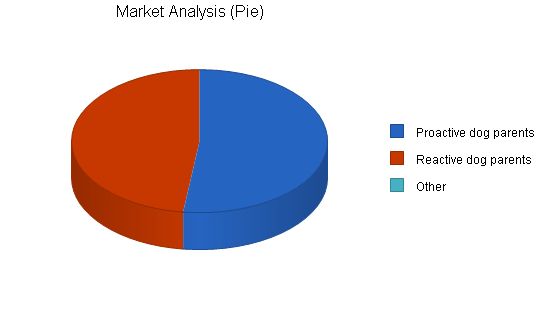

Canine Critter College targets two groups:

1. Dog owners with young dogs: well-educated individuals with an income over $60,000 who recognize the value of obedience training.

2. Dog owners with misbehaving dogs: individuals who are dealing with control issues or want more control over their dogs.

By identifying their customers’ needs, Canine Critter College aims to provide efficient and effective training solutions.

Market Analysis: Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Potential Customers: Growth 11,125 12,126 13,217 14,407 15,704 9.00%

Proactive dog parents 10,254 11,074 11,960 12,917 13,950 8.00%

Reactive dog parents 0 0 0 0 0 0.00%

Other 21,379 23,200 25,177 27,324 29,654 8.52%

Target Market Segment Strategy:

Canine Critter College will reach dog owners through a focused networking and advertising campaign.

Strategy and Implementation Summary:

The sales strategy will emphasize Canine Critter College’s philosophy of training pet owners to train their dogs. Rather than simply training the dogs themselves, Canine Critter College empowers owners to problem solve with their pets.

Marketing efforts will focus on networking and advertising.

Competitive Edge:

Canine Critter College’s competitive edge lies in its intuitive approach. Understanding canine social behavior allows owners to effectively communicate with their dogs. By explaining the reasons behind a dog’s behavior, owners are empowered to make well-reasoned decisions.

Sales Strategy:

The sales strategy will communicate Canine Critter College’s competitive edge to prospective customers. Training owners to train their animals is more effective and allows for continued growth beyond the training classes.

Prospective customers will be directed to the website for more information and offered the opportunity to sit in on a class.

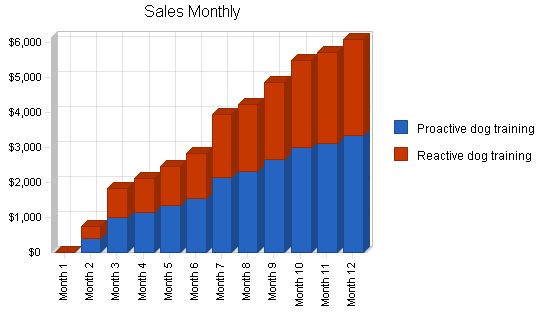

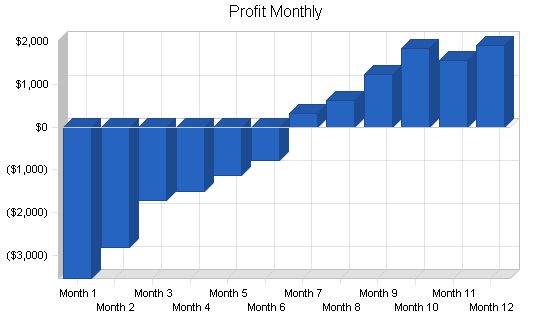

The first month will be dedicated to advertising and class development. Sales activities will begin in the second month, with profitability expected by month nine.

Sales Forecast

Year 1 Year 2 Year 3

Sales

Proactive dog training $21,975 $42,125 $49,874

Reactive dog training $18,223 $34,964 $41,395

Total Sales $40,198 $77,089 $91,269

Direct Cost of Sales

Year 1 Year 2 Year 3

Proactive dog parents $798 $421 $499

Reactive dog parents $662 $350 $414

Subtotal Direct Cost of Sales $1,460 $771 $913

Canine Critter College’s strategy will be networking and advertising. Gerry will network with local breeders as the canine training/breeding community is small. By forming relationships with breeders, they’ll act as a well-respected referral service for Canine Critter College.

Canine Critter College will advertise with the local AKC chapter and the Humane Society. Word-of-mouth referrals will become the most effective marketing strategy over time.

Milestones

Canine Critter College will have several early milestones:

– Business plan completion as a roadmap and tool for ongoing improvement.

– Office set up.

– Development of class structure.

– Profitability.

Personnel Plan

Gerry will be the sole employee.

Year 1 Year 2 Year 3

Gerry $24,000 $36,000 $36,000

Other $0 $0 $0

Total People 1 1 1

Total Payroll $24,000 $36,000 $36,000

The following sections outline important financial information.

Important Assumptions

The following table details important financial assumptions.

General Assumptions

Year 1 Year 2 Year 3

Plan Month 1 2 3

Current Interest Rate 10.00% 10.00% 10.00%

Long-term Interest Rate 10.00% 10.00% 10.00%

Tax Rate 30.00% 30.00% 30.00%

Other 0 0 0

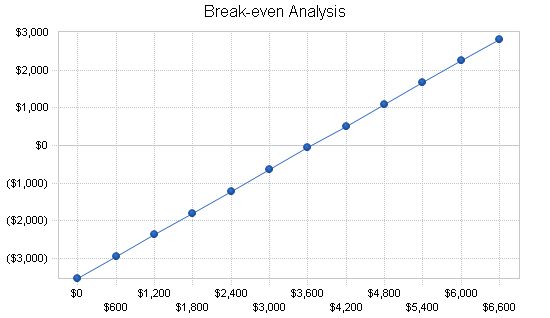

Break-even Analysis

The Break-even Analysis indicates that approximately $3,600 is needed in monthly revenue to reach the break-even point.

Break-even Analysis

Monthly Revenue Break-even: $3,668

Assumptions:

– Average Percent Variable Cost: 4%

– Estimated Monthly Fixed Cost: $3,535

Projected Profit and Loss:

The table below shows the projected profit and loss.

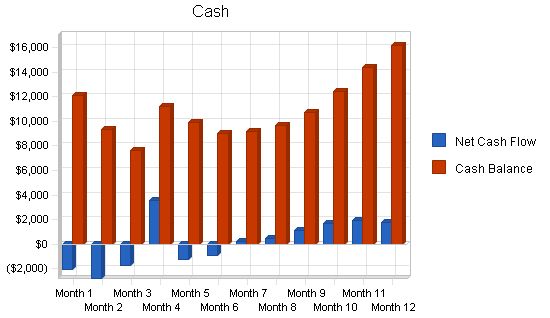

Projected Cash Flow

The chart and table below show projected cash flow.

Pro Forma Profit and Loss

[Table]

7.4 Projected Cash Flow

The following chart and table indicate projected cash flow.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | $40,198 | $77,089 | $91,269 |

| Cash Sales | $40,198 | $77,089 | $91,269 |

| Subtotal Cash from Operations | |||

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $5,000 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $45,198 | $77,089 | $91,269 |

Projected Balance Sheet

7.5 Projected Balance Sheet

The following table indicates the projected balance sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $16,168 | $29,423 | $52,876 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $16,168 | $29,423 | $52,876 |

| Long-term Assets | |||

| Long-term Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $16,168 | $29,423 | $52,876 |

7.6 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 0752, Animal Specialty Services, are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 91.77% | 18.40% | 6.64% |

| Percent of Total Assets | ||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 29.75% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 55.50% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 44.50% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 2.19% | 1.65% | 1.44% | 23.28% |

| Current Borrowing | 4.04% | 3.22% | 0.00% | 22.37% |

| Other Current Liabilities | 0.00% | 0.00% | 0.00% | 0.00% |

| Subtotal Current Liabilities | 6.24% | 4.87% | 1.44% | 45.65% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Liabilities | 6.24% | 4.87% | 1.44% | 45.65% |

| Net Worth | 93.76% | 95.13% | 98.56% | 54.35% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 61.82% | 66.82% | 73.27% | 27.10% |

| Selling, General & Administrative Expenses | 31.62% | 37.71% | 32.06% | 12.51% |

| Advertising Expenses | 0.29% | 0.39% | 0.32% | 0.29% |

| Profit Before Interest and Taxes | 30.91% | 29.11% | 41.68% | 1.91% |

| Main Ratios | ||||

| Current | 3.28 | 4.47 | 7.63 | 1.72 |

| Quick | 3.28 | 4.47 | 7.63 | 0.94 |

| Total Debt to Total Assets | 6.24% | 4.87% | 1.44% | 56.36% |

| Pre-tax Return on Net Worth | -59.11% | 62.34% | 56.58% | 5.58% |

| Pre-tax Return on Assets | -24.83% | 24.71% | 44.56% | 12.78% |

| Net Profit Margin | -9.99% | 13.10% | 24.57% | |

| Return on Equity | -59.11% | 47.38% | 49.74% | |

| Accounts Payable Turnover | 28.35 | 28.35 | 28.35 | |

| Payment Days | 13 | 12 | 12 | |

| Total Asset Turnover | 3.49 | 2.22 | 1.51 | |

| Debt to Net Worth | 0.07 | 0.03 | 0.02 | |

| Current Liab. to Liab. | 1.00 | 1.00 | 1.00 | |

| Net Working Capital | $10,186 | $25,309 | $50,395 | |

| Interest Coverage | -5.47 | 34.99 | 182.25 | |

| Assets to Sales | 0.23 | 0.29 | 0.43 | |

| Current Debt/Total Assets | 6% | 4% | 2% | |

| Acid Test | 3.28 | 4.47 | 7.63 | |

| Sales/Net Worth | 3.85 | 2.89 | 1.81 | |

| Dividend Payout | 0.00 | 0.00 | 0.00 | |

Appendix

Sales Forecast

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Proactive dog training | $0 | $400 | $1,000 | $1,145 | $1,345 | $1,545 | $2,145 | $2,312 | $2,654 | $2,987 | $3,121 | $3,321 | |

| Reactive dog training | $0 | $332 | $830 | $950 | $1,116 | $1,282 | $1,780 | $1,919 | $2,203 | $2,479 | $2,574 | $2,757 | |

| Total Sales | $0 | $732 | $1,830 | $2,095 | $2,461 | $2,827 | $3,925 | $4,231 | $4,857 | $5,466 | $5,695 | $6,078 | |

Personnel Plan

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Gerry | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0General Assumptions:

– Plan Month: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12 – Current Interest Rate: 10.00% – Long-term Interest Rate: 10.00% – Tax Rate: 30.00% – Other: 0 Pro Forma Profit and Loss: – Sales: $0, $732, $1,830, $2,095, $2,461, $2,827, $3,925, $4,231, $4,857, $5,466, $5,695, $6,078 – Direct Cost of Sales: $0, $7, $18, $21, $25, $28, $39, $42, $49, $55, $568, $608 – Other Production Expenses: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 – Total Cost of Sales: $0, $7, $18, $21, $25, $28, $39, $42, $49, $55, $568, $608 – Gross Margin: $0, $725, $1,812, $2,074, $2,437, $2,799, $3,886, $4,189, $4,808, $5,412, $5,127, $5,470 – Gross Margin %: 0.00%, 99.00%, 99.00%, 99.00%, 99.00%, 99.00%, 99.00%, 99.00%, 99.00%, 99.00%, 90.03%, 90.00% – Expenses: – Payroll: $2,000 – Sales and Marketing and Other Expenses: $80 – Depreciation: $0 – Utilities: $75 – Insurance: $130 – Rent: $800 – Payroll Taxes: 15%, $450 – Other: $0 – Total Operating Expenses: $3,535, $3,535, $3,535, $3,535, $3,535, $3,535, $3,535, $3,535, $3,535, $3,535, $3,535, $3,535 – Profit Before Interest and Taxes: ($3,535), ($2,810), ($1,723), ($1,461), ($1,098), ($736), $351, $654, $1,273, $1,877, $1,592, $1,935 – EBITDA: ($3,535), ($2,810), ($1,723), ($1,461), ($1,098), ($736), $351, $654, $1,273, $1,877, $1,592, $1,935 – Interest Expense: $0, $0, $0, $42, $41, $39, $38, $37, $36, $35, $34, $32 – Taxes Incurred: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 – Net Profit: ($3,535), ($2,810), ($1,723), ($1,502), ($1,139), ($775), $313, $617, $1,237, $1,842, $1,559, $1,903 – Net Profit/Sales: 0.00%, -383.92%, -94.17%, -71.70%, -46.27%, -27.42%, 7.97%, 14.57%, 25.48%, 33.70%, 27.37%, 31.31% Pro Forma Cash Flow: – Cash Received: – Cash from Operations: $0, $732, $1,830, $2,095, $2,461, $2,827, $3,925, $4,231, $4,857, $5,466, $5,695, $6,078 – Additional Cash Received: – Sales Tax, VAT, HST/GST Received: 0.00% – New Current Borrowing: $0, $0, $0, $5,000, $0, $0, $0, $0, $0, $0, $0, $0 – New Other Liabilities (interest-free): $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 – New Long-term Liabilities: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 – Sales of Other Current Assets: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 – Sales of Long-term Assets: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 – New Investment Received: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 – Expenditures from Operations: – Cash Spending: – Payroll: $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000 – Bill Payments: $51, $1,535, $1,543, $1,555, $1,598, $1,600, $1,603, $1,612, $1,614, $1,620, $1,641, $2,137 – Additional Cash Spent: – Sales Tax, VAT, HST/GST Paid Out: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 – Principal Repayment of Current Borrowing: $0, $0, $0, $0, $140, $140, $140, $140, $140, $140, $140, $ Pro Forma Balance Sheet Assets Starting Balances Current Assets Cash $14,200 $12,149 $9,346 $7,633 $11,173 $9,897 $8,984 $9,167 $9,645 $10,748 $12,454 $14,368 $16,168 Other Current Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Current Assets $14,200 $12,149 $9,346 $7,633 $11,173 $9,897 $8,984 $9,167 $9,645 $10,748 $12,454 $14,368 $16,168 Long-term Assets Long-term Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Accumulated Depreciation $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Long-term Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Assets $14,200 $12,149 $9,346 $7,633 $11,173 $9,897 $8,984 $9,167 $9,645 $10,748 $12,454 $14,368 $16,168 Liabilities and Capital Current Liabilities Accounts Payable $0 $1,484 $1,491 $1,502 $1,544 $1,547 $1,549 $1,559 $1,560 $1,565 $1,570 $2,065 $2,103 Current Borrowing $0 $0 $0 $0 $5,000 $4,860 $4,720 $4,580 $4,440 $4,300 $4,160 $4,020 $3,880 Other Current Liabilities $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Subtotal Current Liabilities $0 $1,484 $1,491 $1,502 $6,544 $6,407 $6,269 $6,139 $6,000 $5,865 $5,730 $6,085 $5,983 Long-term Liabilities $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Liabilities $0 $1,484 $1,491 $1,502 $6,544 $6,407 $6,269 $6,139 $6,000 $5,865 $5,730 $6,085 $5,983 Paid-in Capital $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 $15,000 Retained Earnings ($800) ($800) ($800) ($800) ($800) ($800) ($800) ($800) ($800) ($800) ($800) ($800) ($800) Earnings $0 ($3,535) ($6,345) ($8,069) ($9,571) ($10,710) ($11,485) ($11,172) ($10,555) ($9,318) ($7,476) ($5,917) ($4,014) Total Capital $14,200 $10,665 $7,855 $6,131 $4,629 $3,490 $2,715 $3,028 $3,645 $4,882 $6,724 $8,283 $10,186 Total Liabilities and Capital $14,200 $12,149 $9,346 $7,633 $11,173 $9,897 $8,984 $9,167 $9,645 $10,748 $12,454 $14,368 $16,168 Net Worth $14,200 $10,665 $7,855 $6,131 $4,629 $3,490 $2,715 $3,028 $3,645 $4,882 $6,724 $8,283 $10,186

Business Plan Outline

|

|||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!