The Executive Search & Rescue Placement Firm is an executive search firm specializing in emerging high technology companies in the metropolitan Portland market. Through a well-connected network and a predictive screening system, the firm aims to gain market share.

To achieve growth and profitability, the management goals are to have at least four of the top 10 fastest growing Oregon companies as clients and to increase the client base by 20%.

Executive is an Oregon corporation owned by Mr. Dan Bloodhound, who has over ten years of experience in the emerging company and high-tech market. The firm plans to place a wide range of executive positions, including programmers, project managers, CEOs, and CFOs, on a contingency basis.

The staff will consist of Mr. Bloodhound working full-time, a full-time secretary/receptionist in month two, a part-time generalist in month three, and a full-time account executive in month four. Four people will be sufficient for the organization’s operations.

The target market for The Executive Search & Rescue Placement Firm is the emerging company market in the Portland metropolitan area. This choice is based on Mr. Bloodhound’s network and the fact that Portland is a prime location for emerging companies.

Executive will focus on both high-technology and non-high-technology firms within the emerging market. High-tech firms make up the majority of emerging companies, but Executive will also provide services to non-high-tech companies.

The firm’s marketing strategy will involve advertising in local journals that cater to emerging businesses, particularly the Business Journal of Portland.

Contents

1.1 Objectives

The objectives for the first three years include:

- Create a service-based company that exceeds customers’ expectations.

- Utilize Executive in at least four of the top 10 fastest growing Oregon companies listed by the Business Journal of Portland.

- Increase the number of clients served by 20% through superior service.

- Achieve profitability within the first year of operation.

1.2 Mission

The Executive Search & Rescue Placement Firm’s mission is to service emerging companies with outstanding executives. We exist to attract and maintain customers. When we adhere to this maxim, everything else will fall into place. Our services will exceed customers’ expectations.

Company Summary

Executive, located in downtown Portland, is an executive search firm for emerging companies. While the majority of Executive’s clients will be high technology companies, Executive will be able to serve any type of fast-growing company.

Executives have an extensive networking system that allows for a high placement ratio. Additionally, Executive uses a sophisticated screening system that ensures long-lived placements.

2.1 Company Ownership

Executive is an Oregon Corporation founded and owned by Dan Bloodhound.

2.2 Start-up Summary

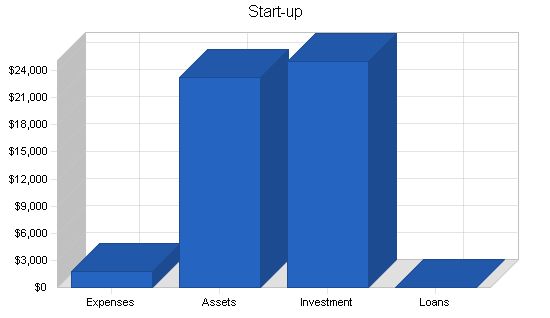

Executive will have the following start-up costs:

- Legal fees for the formation of the business form and generation and review of contracts.

- Office equipment, including desks, chairs, filing cabinets, and couches.

- Computer system, including equipment for a server and three workstations, as well as a printer, CD-RW, and a DSL connection.

- Web creation fees for the development of a website.

- Advertising costs.

Assets used for more than a year will be listed as long-term assets and depreciated using the straight-line method.

Start-up Requirements:

Legal – $1,000

Stationery etc. – $250

Brochures – $0

Website Development – $500

Insurance – $0

Rent – $0

Research and Development – $0

Expensed Equipment – $0

Other – $0

Total Start-up Expenses – $1,750

Start-up Assets:

Cash Required – $20,750

Other Current Assets – $0

Long-term Assets – $2,500

Total Assets – $23,250

Total Requirements – $25,000

Start-up Funding:

Start-up Expenses to Fund – $1,750

Start-up Assets to Fund – $23,250

Total Funding Required – $25,000

Assets:

Non-cash Assets from Start-up – $2,500

Cash Requirements from Start-up – $20,750

Additional Cash Raised – $0

Cash Balance on Starting Date – $20,750

Total Assets – $23,250

Liabilities and Capital:

Liabilities:

Current Borrowing – $0

Long-term Liabilities – $0

Accounts Payable (Outstanding Bills) – $0

Other Current Liabilities (interest-free) – $0

Total Liabilities – $0

Capital:

Planned Investment:

Dan – $25,000

Investor 2 – $0

Other – $0

Additional Investment Requirement – $0

Total Planned Investment – $25,000

Loss at Start-up (Start-up Expenses) – ($1,750)

Total Capital – $23,250

Total Capital and Liabilities – $23,250

Total Funding – $25,000

Services:

Executive will provide a wide range of placement services, specializing in the high-tech niche of emerging companies. They can place executive positions from CEO’s to CFO’s. They work on a contingency basis, meaning they are paid on placement, allowing them to work with multiple clients simultaneously. Portland has several executive search firms due to the presence of emerging technology companies.

Market Analysis Summary:

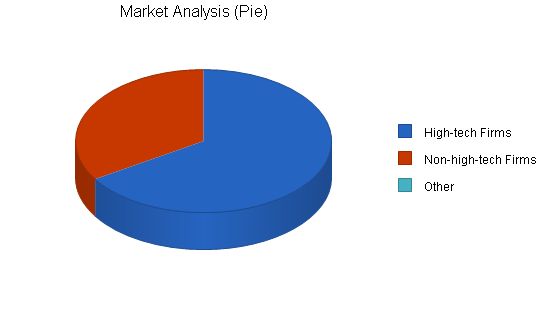

The Executive Search & Rescue Placement Firm targets the emerging company market in the Portland metropolitan area. Portland is chosen because it aligns with Dan’s network and has a thriving emerging technology sector. The market can be divided into high-tech firms and non-high-tech firms, with the former comprising the majority. However, Executive can still provide services for non-high-tech companies. Executive’s clients, being emerging companies, have high growth rates and require executive placements.

Market Segmentation:

Customers can be divided into two groups:

1. High-tech firms – These firms deal with technology, such as design or manufacturing, and represent over 80% of the top 20 fastest growing companies in Oregon.

2. Non-high-tech firms – Although smaller in number, this segment should not be neglected as there are plenty of fast-growing companies. Executive can serve this group as well.

Market Analysis

Potential Customers Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

High-tech Firms 14% 245 279 318 363 414 14.01%

Non-high-tech Firms 10% 126 139 153 168 185 10.08%

Other 0% 0 0 0 0 0 0.00%

Total 12.72% 371 418 471 531 599 12.72%

4.2 Target Market Segment Strategy

Executive is focusing on emerging companies because they require executives more frequently than stagnant companies. As a company grows, the demand for leadership increases.

The majority of emerging companies fall under the high technology category. Despite the recent economic slowdown, these companies are experiencing significant growth.

A prime example of rapid growth is eBay, a non-Oregon company. eBay’s CEO Meg Whitman, who was previously an executive at Hasboro Toys, became worth more from eBay stock in just two years than the entire Hasboro family did in over 30 years of business. While tech stocks have taken a hit, eBay has been relatively unaffected due to its profitability. This demonstrates the immense growth potential of many companies in this industry, making it an ideal time for an executive search firm to fuel this growth.

4.3 Service Business Analysis

There are two business models for executive search firms:

1. Retainer firms typically charge 30-35% of the executive’s first-year salary. They are paid regardless of finding a candidate. This setup limits the number of positions the search firm can handle simultaneously, but it ensures a focused search for the right candidate.

2. Contingency firms, on the other hand, are more common. They are compensated only when they find a suitable candidate. This model provides clients with the advantage of paying for results. However, it may sacrifice speed when the company is in urgent need of hiring.

4.3.1 Competition and Buying Patterns

Portland currently has six to ten executive search firms, which may also handle positions other than executives.

Strategy and Implementation Summary

The Executive Search & Rescue Placement Firm’s marketing strategy will rely on advertising and networking. The firm will advertise in local journals that cater to emerging businesses, primarily the Business Journal of Portland. These advertisements will target executives seeking a firm for themselves while also attracting companies as clients. Networking will be instrumental in establishing the firm’s reputation and attracting new clients. As Executive secures big clients, more business is expected to follow due to the industry’s reliance on associations and word-of-mouth.

The firm will also have a comprehensive website to provide information about Executive and its services.

5.1 Competitive Edge

Executive possesses a two-pronged competitive advantage:

1. Networking: Dan, with ten years of experience in high-tech sales in Portland, has built strong relationships within the local business community. His involvement in Chambers of Commerce, the Portland Venture group, and other organizations composed mainly of emerging companies gives him a valuable network. Unlike other search firms, Dan’s connections were made while he was part of the community, making them more valuable.

2. Sophisticated screening/interviewing systems: The firm will implement a structured behavioral interviewing system (SBI) to accurately screen candidates. SBI utilizes structured and behavioral questions that gauge applicants’ likely behavior in specific situations. This method has been proven to be statistically more predictive than other interviewing methods when implemented correctly. Dan’s industry experience allows him to develop effective interview questions based on his knowledge of the expected behaviors for the position.

5.2 Sales Strategy

Executive’s sales strategy revolves around attracting emerging companies as service providers and executives looking for job opportunities.

To attract emerging companies, Executive will emphasize its competitive advantages and demonstrate its ability to find qualified executives through its strong connections in the industry. Dan’s background in high-tech sales and personal relationships with emerging companies provide the firm with a distinct advantage.

The firm will also highlight the effectiveness of its structured behavioral interview process, signaling its capability to select successful candidates.

Having an impressive list of industry clients will further attract executives to The Executive Search & Rescue Placement Firm. The reputation and accomplishments of the clients will inspire confidence in Executive’s ability to find job placements.

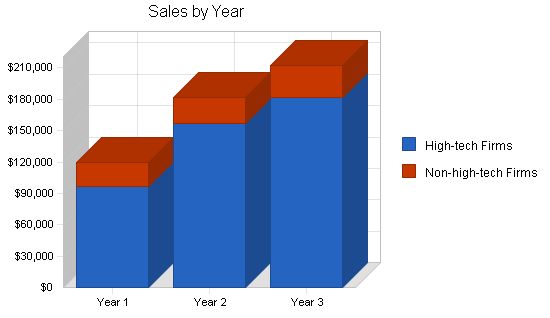

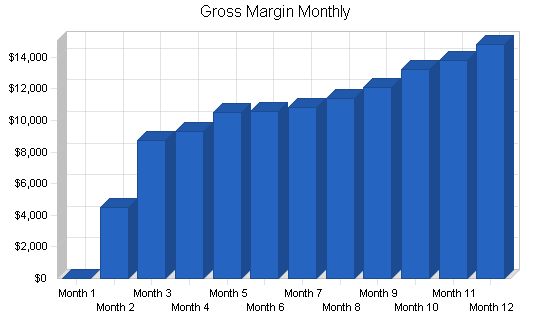

5.2.1 Sales Forecast

The first month will be dedicated to setting up the office, dealing with legal and advertising matters, and developing back-end systems.

By the second month, the office will be fully operational, allowing Dan to work with emerging clients and conduct screenings for specific positions.

Sales are expected to steadily grow from the second month. A surge in sales is anticipated by the fourth month, prompting the onboarding of an account executive to manage the increased workload.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| High-tech Firms | $96,730 | $156,478 | $181,547 |

| Non-high-tech Firms | $22,930 | $25,654 | $31,254 |

| Total Sales | $119,660 | $182,132 | $212,801 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| High-tech Firms | $0 | $0 | $0 |

| Non-high-tech Firms | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $0 | $0 | $0 |

5.3 Milestones

The Executive Search & Rescue Placement Firm will have several milestones early on:

- Business plan completion. This will be done as a road map for the organization. While we do not need a business plan to raise capital, it will be an indispensable tool for the ongoing performance and improvement of the company.

- Set-up office.

- Development of the structured behavioral interview processes.

- Bringing on an account executive.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business Plan Completion | 1/1/2001 | 2/1/2001 | $0 | Dan | Marketing |

| Office Set-up | 1/1/2001 | 2/1/2001 | $0 | Dan | Department |

| Structured Behavioral Interview Development | 1/1/2001 | 2/1/2001 | $0 | Dan | Department |

| Bringing on an Account Executive | 1/1/2001 | 4/1/2001 | $0 | Dan | Department |

| Totals | $0 | ||||

Management Summary

The Executive Search & Rescue Placement Firm is owned by Dan Bloodhound. Dan received his undergraduate degree from the University of Portland, majoring in communications and computer science. Dan spent his first three years at a then emerging company called Tektronix. At Tektronix Dan did business-to-business sales. This experience was particularly valuable as it was his first introduction to sales in an emerging company. At the end of the three years, Dan was longing for a position that offered him more responsibility, so he moved to Mentor Graphics and took on a supervisory role in the sales department. The Mentor Graphics position was valuable because it gave Dan more interaction with the other departments in the company. Dan was responsible for coordinating the sales program with the different departments.

After Mentor Graphics, Dan fell into a wonderful opportunity at Timberline Software that provided him with even more responsibility within the company. The new responsibilities that Dan had, coupled with being introduced to an new sector in the high-tech community became quite an asset for Dan. He finally decided with his experience in the emerging business industry, in addition to his incredible network of colleagues, it made perfect sense to start his own executive search firm.

6.1 Personnel Plan

The staff will consist of Dan working full time. Executive will hire a full-time secretary/receptionist in month two, a part-time generalist in month three, and a full-time account executive in month four. From month four until the foreseeable future, the organization will be able to survive with a four person headcount.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Dan | $30,000 | $35,000 | $40,000 |

| Secretary/Receptionist | $16,500 | $18,000 | $18,000 |

| Part-time Employee | $8,000 | $9,600 | $9,600 |

| Account Executive | $28,800 | $38,400 | $40,000 |

| Total People | 4 | 4 | 4 |

| Total Payroll | $83,300 | $101,000 | $107,600 |

Financial Plan

The following sections will outline important financial information.

7.1 Important Assumptions

The following table details some of the important financial assumptions.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 25.42% | 25.00% | 25.42% |

| Other | 0 | 0 | 0 |

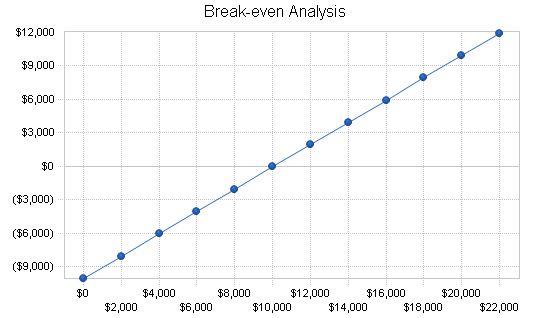

7.2 Break-even Analysis

The Break-even Analysis indicates what is needed in monthly revenue to break even. The sales forecasts are based on the company receiving the commission spread out over the entire year as opposed to a lump sum.

Break-even Analysis:

Monthly Revenue Break-even: $10,052

Assumptions:

– Average Percent Variable Cost: 0%

– Estimated Monthly Fixed Cost: $10,052

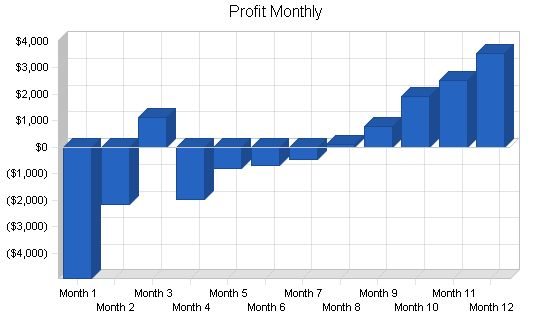

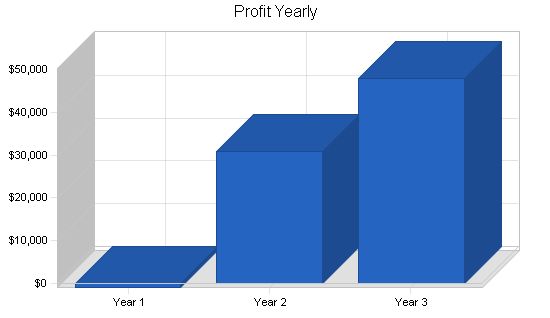

Projected Profit and Loss:

The table below shows projected profit and loss.

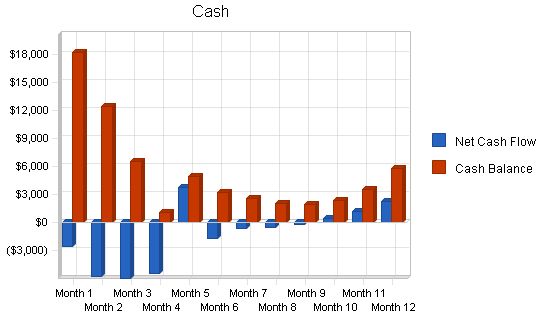

Projected Cash Flow:

The chart and table below indicate projected cash flow.

| Year 1 | Year 2 | Year 3 | |

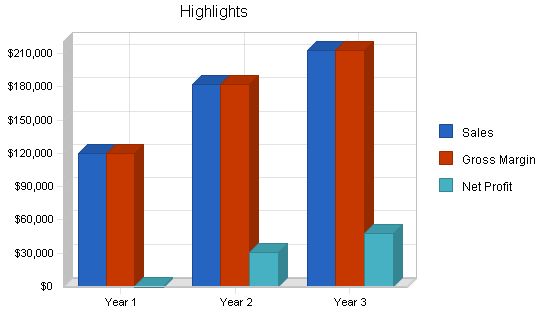

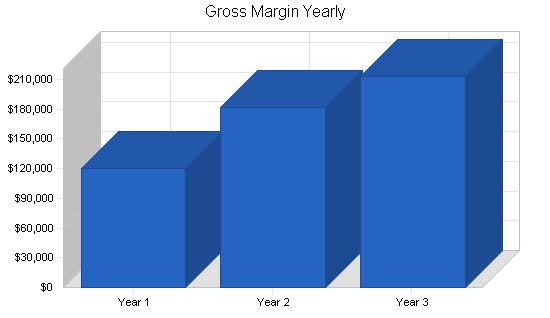

| Sales | $119,660 | $182,132 | $212,801 |

| Direct Cost of Sales | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Total Cost of Sales | $0 | $0 | $0 |

| Gross Margin | $119,660 | $182,132 | $212,801 |

| Gross Margin % | 100.00% | 100.00% | 100.00% |

| Expenses | |||

| Payroll | $83,300 | $101,000 | $107,600 |

| Sales and Marketing and Other Expenses | $2,400 | $2,400 | $2,400 |

| Depreciation | $828 | $828 | $828 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $2,100 | $2,100 | $2,100 |

| Insurance | $1,500 | $1,500 | $1,500 |

| Rent | $18,000 | $18,000 | $18,000 |

| Payroll Taxes | $12,495 | $15,150 | $16,140 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $120,623 | $140,978 | $148,568 |

| Profit Before Interest and Taxes | ($963) | $41,154 | $64,233 |

| EBITDA | ($135) | $41,982 | $65,061 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $0 | $10,289 | $16,326 |

| Net Profit | ($963) | $30,866 | $47,907 |

| Net Profit/Sales | -0.80% | 16.95% | 22.51% |

Pro Forma Cash Flow

7.5 Projected Balance Sheet

The following table will indicate the projected balance sheet.

Pro Forma Balance Sheet

7.6 Business Ratios

The following table outlines some important ratios from the Human Resources and Executive Search Consulting industry. The final column, Industry Profile, details specific ratios based on the industry’s NAICS code, 541612.

Ratio Analysis

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $0 | $4,500 | $8,704 | $9,308 | $10,485 | $10,583 | $10,832 | $11,379 | $12,068 | $13,199 | $13,803 | $14,799 | |

| Direct Cost of Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Gross Margin | $0 | $4,500 | $8,704 | $9,308 | $10,485 | $10,583 | $10,832 | $11,379 | $12,068 | $13,199 | $13,803 | $14,799 | |

| Gross Margin % | 0.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | |

| Expenses | |||||||||||||

| Payroll | $2,500 | $4,000 | $4,800 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | |

| Sales and Marketing and Other Expenses | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | |

| Depreciation | $69 | $69 | $69 | $69 | $69 | $69 | $69 | $69 | $69 | $69 | $69 | $69 | |

| Leased Equipment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Utilities | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | $175 | |

| Insurance | $125 | $125 | $125 | $125 | $125 | $125 | $125 | $125 | $125 | $125 | $125 | $125 | |

| Rent | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | |

| Payroll Taxes | 15% | $375 | $600 | $720 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $4,944 | $6,669 | $7,589 | $11,269 | $11,269 | $11,269 | $11,269 | $11,269 | $11,269 | $11,269 | $11,269 | $11,269 | |

| Profit Before Interest and Taxes | ($4,944) | ($2,169) | $1,115 | ($1,961) | ($784) | ($686) | ($437) | $110 | $799 | $1,930 | $2,534 | $3,530 | |

| EBITDA | ($4,875) | ($2,100) | $1,184 | ($1,892) | ($715) | ($617) | ($368) | $179 | $868 | $1,999 | $2,603 | $3,599 | |

| Interest Expense | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Taxes Incurred | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Net Profit | ($4,944) | ($2,169) | $1,115 | ($1,961) | ($784) | ($686) | ($437) | $110 | $799 | $1,930 | $2,534 | $3,530 | |

| Net Profit/Sales | 0.00% | -48.20% | 12.81% | -21.07% | -7.48% | -6.48% | -4.03% | 0.97% | 6.62% | 14.62% | 18.36% | 23.85% | |

Cash flow and balance sheets are essential financial statements for businesses. They provide crucial information about a company’s financial health, liquidity, and profitability. Analyzing these statements can help businesses make informed decisions about their operations and future growth.

The pro forma cash flow statement provides a detailed breakdown of the cash received and spent during a specific period. It includes sections for cash received from operations, such as cash sales and receivables, as well as additional cash received from sources like sales tax and new investments. On the expenditure side, it includes categories such as cash spending and bill payments.

The net cash flow is the difference between cash received and cash spent. This figure indicates whether the company has positive or negative cash flow during the period. Positive cash flow is essential for a business’s sustainability and growth. It allows businesses to cover expenses, invest in growth opportunities, and repay debt.

The cash balance indicates the amount of cash the business has on hand at the end of each month. It represents the company’s liquidity and ability to meet its financial obligations. Maintaining an adequate cash balance is crucial for businesses to cover short-term expenses, manage emergencies, and seize investment opportunities.

The pro forma balance sheet provides an overview of a company’s assets, liabilities, and equity at a specific point in time. It includes sections for current assets, such as cash and accounts receivable, as well as long-term assets like property and equipment. On the liabilities side, it includes categories like accounts payable and long-term debt.

Total assets represent the value of all the resources owned by the company, while total liabilities represent the company’s debts and financial obligations. The difference between total assets and total liabilities is the company’s net worth or equity. It represents the value of the company’s assets that would remain if all liabilities were paid off.

Analyzing the balance sheet allows businesses to assess their financial position, solvency, and overall health. It helps stakeholders understand the company’s ability to meet its financial obligations and its capacity for future growth.

Understanding and interpreting these financial statements is essential for businesses to make informed decisions, secure financing, and attract investors. By following sound financial management practices and regularly reviewing and analyzing cash flow and balance sheets, businesses can improve their financial performance and achieve their strategic objectives.

Business Plan Outline

- Executive Summary

- Company Summary

- Services

- Market Analysis Summary

- Strategy and Implementation Summary

- Management Summary

- Financial Plan

- Appendix

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!