How to Make Sense of Your Small Business Financial Statements

Your business assesses its financial strength by referring to the income statement (also known as profit and loss statement or P&L) and bank account for the basics.

However, businesses often overlook the balance sheet and cash flow statement, which are the most powerful financial tools in the accounting arsenal.

These three financial statements provide a comprehensive view of any business and are essential components of a business plan.

So, what role does each of these financial statements play, and how do you interpret the data they produce? Here’s an overview of how they can help you keep track of your company’s financial position.

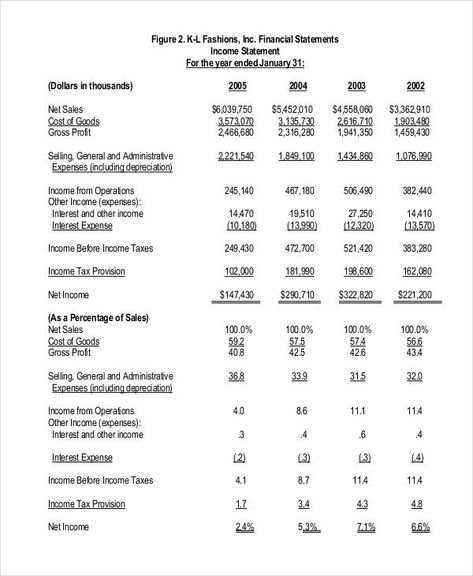

The income statement (profit and loss or P&L)

Think of the income statement as your business’s report card.

This statement provides an overview of your business’s profitability over time by breaking down the revenue generated and expenses incurred.

A well-maintained income statement shows your business’s profitability and highlights steps to increase profitability, such as focusing on more profitable product lines or reducing unnecessary expenses.

Investors also use the income statement to assess the level of risk involved in extending credit or venture capital to your business.

Here’s an example of an income statement from LivePlan:

The balance sheet

Think of the balance sheet as a window into your business’s financial strength.

While investors also pay attention to the income statement, the balance sheet is their preferred starting point for assessing your business’s fiscal health.

The balance sheet summarizes key financial information on a specific date, providing insight into your company’s stability and liquidity, which are crucial factors for sustaining the business without external financing.

Here’s an example of a balance sheet from LivePlan:

Components of the balance sheet:

– Business assets: What does your business have? This includes what your business owns or controls, such as bank accounts or financed vehicles.

– Liabilities: What does your business owe? This includes debts like loans and outstanding credit card payments.

– Owner’s equity: What is left over for the owner(s)? This represents the business’s assets after paying off all liabilities.

The balance sheet provides information on the net value of your business, current and long-term debt, asset management, and comparative data on cash, accounts payable/receivable, equity, inventory, and retained earnings.

Creating a balance sheet can be intimidating, so it’s recommended to have an accountant’s assistance or use tools like LivePlan to generate it.

The cash flow statement

Does your business have enough cash to stay afloat?

Cash flow issues are a common cause of business failure, as cash doesn’t flow in and out of the business at the same rate. Profitability doesn’t guarantee sufficient cash flow.

To understand and manage your business’s cash flow, you’ll need to maintain a cash flow statement, which shows the flow of cash in and out on a daily, weekly, or monthly basis.

The cash flow statement can be a simple spreadsheet or a more dynamic report generated with accounting software like QuickBooks or LivePlan.

The formula to calculate your end balance is:

Operational Costs + Asset Investments + Financing = Cash Balance

Operational costs represent your net income and losses, minus regular expenses.

Asset investments show inflows and outflows from long-term business investments.

Financing represents cash received from business loans, lines of credit, stock sales, or other capital infusions.

In addition to helping you gauge your business’s ability to cover expenses and maintain a positive cash flow, the cash flow statement informs financial decisions like acquiring additional capital or purchasing inventory.

For lending purposes, include the cash flow statement in your business plan to show your ability to manage cash and address cash flow gaps.

The bottom line

Although the cash flow statement is often considered the most important financial statement for small businesses, it’s essential to view all three financial statements holistically.

Understanding your financial data is crucial for making informed financial, investment, and management decisions for your business.

Don’t hesitate to seek help from professionals or free resources like SCORE to gain a better grasp of your financial data.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!