Electronic Detectives, Inc. helps lawyers identify, acquire, restore, and analyze electronic data in litigation. Our certified forensic experts specialize in acquiring data from NT, Novell, Unix, and Linux servers and PCs. As testifying experts, we will shape the field of electronic discovery.

The Company

Electronic Detectives is a limited liability corporation registered in Delaware for tax purposes. Our main offices are in Portland, Oregon. Our main clients are law firms requiring identification, restoration, and analysis of electronic data.

Private investors will own 47% of our company’s shares, with the remaining owned by senior management. All other financing will come from loans.

The Services

Electronic Detectives has experts versed in all commercial operating systems such as Unix, Linux, and Novell. We assist in 30(b)(6) depositions and go on-site to inventory data and look for hidden sources. Our firm maintains recorded chains-of-custody to protect our clients. Detailed written reports, presentations, and analyses support our conclusions. We offer expert testimony in federal and state court.

The Market

The electronic evidence gathering business is a new segment of the detective industry. Market data is unavailable, but the profitability of Computer Forensics of Bellevue, WA shows the growth potential. With explosive growth of 40% per year and record returns on net worth of 65%, the market has high demand and growth capacity. This is an excellent market to enter and establish a defensible position based on customer satisfaction and reputation.

Financial Considerations

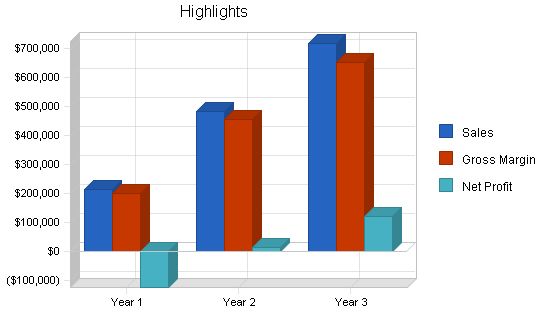

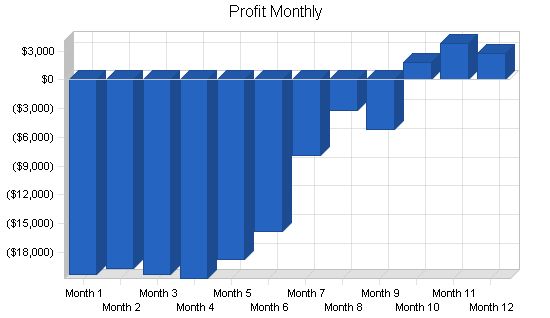

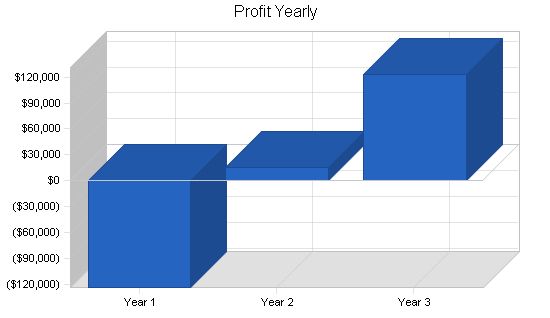

We expect monthly profits by November of the first year and yearly profits by year three. Electronic Detectives has secured a $60,000 credit line for flexibility. Six projects per month will cover costs. Cash flow will remain positive over the next three years, allowing us to pay off our loans.

Contents

1.1 Objectives

The three year goals for Electronic Detectives are:

- Achieve break-even by year two.

- Establish 40 law firm clients by end of year three.

- Establish minimum 95% customer satisfaction rate.

- Achieve project completion time of 10 days or less.

1.2 Keys to Success

Electronic Detectives’ keys to long-term survival and profitability are:

- Attracting the best talent in the computer science field and establishing close contacts with institutions and firms conducting the latest R&D in computer security.

- Maintaining close contact with clients and establishing a well-functioning long-term relationship to generate repeat business and reputation.

- Establishing procedures to ensure rapid, accurate retrieval of information and client processing.

1.3 Mission

Electronic Detectives’ mission is to create a new standard in the detective industry. With the widespread use of computers and the Internet for communication and data storage, much of the required court evidence is now retained electronically. Currently, few companies offer investigative services for institutions and firms that require accurate retrieval of such information. Electronic Detectives intends to lead the way in establishing standards for customer service, accurate recovery, timeliness, and professionalism to gain significant market share and a strong position in the industry.

Company Summary

Electronic Detectives is a limited liability corporation registered in Delaware for tax purposes. The company has a limited number of private investors and does not plan to go public. It is based in Portland, Oregon, and has a computer forensics lab, conference rooms, and office spaces. Services will be offered starting in January 2003.

Main clients of the company will be law firms requiring identification, restoration, and analysis of electronic data. The firm offers a variety of services to reduce costs for clients and overall legal fees.

2.1 Company Ownership

The company will have several outside private investors who will own 47% of the company’s shares. The rest will be owned by the senior management, including Mr. David Radcliffe (20%), Mrs. Julie Walters (10%), Mr. Brad Rinke (15%), and Mr. William Orcott (7%). All other financing will come from loans.

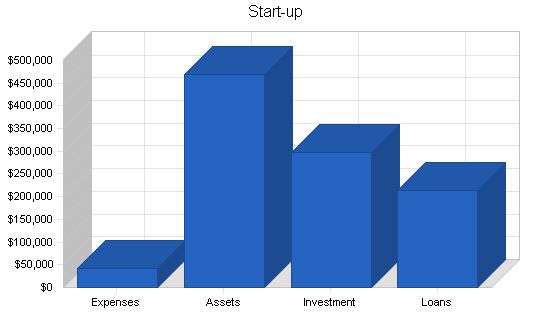

2.2 Start-up Summary

Total start-up requirements are $510,750, including a cash account of $341,550 to cover initial operating expenses before achieving break-even. The majority of financing comes from investors, who are providing $297,000. There is also current borrowing of $50,000, along with long-term borrowing of $120,000.

Electronic Detectives offers computer forensics services in four phases: identifying pertinent data, acquiring and restoring data, analyzing data, and producing reports and presentations for clients and relevant courts. The company is experienced in all commercial operating systems and can assist with 30(b)(6) depositions, on-site data inventory, and chain-of-custody documentation. They provide detailed written reports, presentations, and analyses, as well as expert testimony in federal and state court.

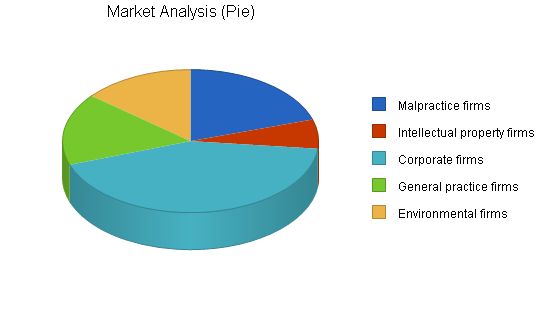

The target market for Electronic Detectives is large law firms specializing in environmental, corporate, malpractice, intellectual property rights, and general law. These firms have high demand and profit margins. The market analysis shows potential for growth, as evidenced by competitors experiencing 40% annual growth and high pre-tax returns on net worth. However, as new entrants join the market, this growth opportunity will diminish, making it crucial for Electronic Detectives to establish a reputation and niche in the industry.

During its first three years, Electronic Detectives will focus on acquiring contracts with West coast law firms that have at least 20 employees and a respectable reputation of 15 years. This strategy aims to secure long-term contracts with satisfied customers who can afford their services and generate positive word-of-mouth marketing. The company will specifically target law firms specializing in intellectual property rights, corporate and business law, environmental law, general practice, and malpractice. The Market Analysis table includes all relevant law firms in California, Oregon, and Washington.

Market Analysis

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Malpractice firms | 2% | 103 | 105 | 107 | 109 | 111 | 1.89% |

| Intellectual property firms | 6% | 34 | 36 | 38 | 40 | 42 | 5.42% |

| Corporate firms | 4% | 220 | 229 | 238 | 248 | 258 | 4.06% |

| General practice firms | 2% | 84 | 86 | 88 | 90 | 92 | 2.30% |

| Environmental firms | 7% | 72 | 77 | 82 | 88 | 94 | 6.89% |

| Total | 3.86% | 513 | 533 | 553 | 575 | 597 | 3.86% |

4.2 Service Business Analysis

The electronic evidence gathering business is an offshoot of the detective industry and it is a new segment. Gathering market data is impossible for this new segment. However, examining the profitability of our competitor, Computer Forensics of Bellevue, WA, will provide an idea of the growth potential of this untapped market.

Computer Forensics has been in business for four years and has experienced explosive growth of 40% per year. The company achieved record pre-tax returns on net worth of 65%. This indicates the high demand and overall growth capacity of the market. Therefore, entering this market now and establishing a defensible position based on customer satisfaction and reputation before more competitors enter is recommended.

Within this new market, the existing rivalry among firms is low. Currently, demand exceeds available services and competing firms concentrate on growing their client base instead of market share. However, the threat of new entrants is high, guaranteeing an influx of new competitors to the market.

That is why Electronic Detectives plans to be the first to market with comprehensive services, creating industry standards in customer satisfaction and thoroughness. Suppliers, especially specialty software companies producing file encryption/decryption software, have a significant influence on this market. While our firm anticipates creating some software in-house, the majority will come from the open market. Therefore, our success depends on the capability of our suppliers.

4.2.1 Competition and Buying Patterns

There are three competitors within our geographical operating area: Computer Forensics of Bellevue, WA; Techno Solutions of Pasadena, CA; and Booth & Anderson Business Consultants of Los Angeles, CA.

Of these three competitors, only Computer Forensics is a direct threat. Techno Solutions focuses on providing the same services for companies investigating internal fraud and computer misuse, while Booth & Anderson offers electronic investigation as just one service among many.

Currently, Computer Forensics is experiencing rapid expansion to meet high demand. Direct competition is not expected for some time, but this may change when more new entrants appear.

One advantage of operating in this market is that clients tend to be relatively price insensitive as long as they receive professional and satisfying experiences. Therefore, we expect to charge a significant profit margin.

Strategy and Implementation Summary

Electronic Detectives’ strategy is to capitalize on clients’ demand for top-quality work with an emphasis on thoroughness in investigations. We aim to create industry standards of excellence and establish a highly defensible market position, allowing for a higher profit margin than competitors.

5.1 Sales Strategy

Initially, sales will be handled by Mr. Radcliffe and Mr. Orcott, who have extensive industry contacts. Mrs. Walters will handle administrative tasks, including customer service and billing. As the company grows, a permanent sales force will be added to handle all aspects of the sales strategy.

In most cases, we anticipate that projects will last about ten days from permission to go on site. This will ensure quick turnaround and customer satisfaction. We intend to develop close customer relationships by having the same people involved in developing, scoping, selling, and fulfilling each job.

To develop effective business strategies, perform a SWOT analysis of your business. Our free guide and template can help you learn how to perform a SWOT analysis.

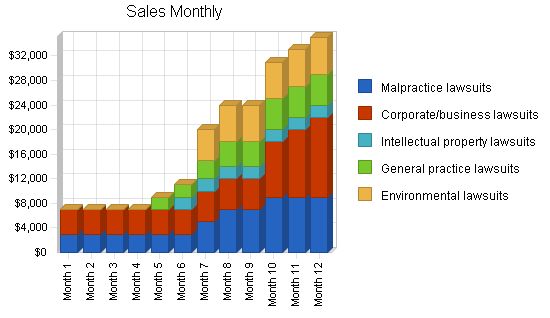

5.1.1 Sales Forecast

Sales are based on the various contract projects we anticipate acquiring in different market segments. Revenues are calculated based on average costs per project, considering estimated time and complexity, plus an undisclosed profit margin. The company does not have significant direct costs of sales.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Malpractice lawsuits | $64,000 | $100,000 | $135,000 |

| Corporate/business lawsuits | $72,000 | $156,000 | $225,000 |

| Intellectual property lawsuits | $14,000 | $60,000 | $120,000 |

| General practice lawsuits | $30,000 | $75,000 | $100,000 |

| Environmental lawsuits | $35,000 | $90,000 | $135,000 |

| Total Sales | $215,000 | $481,000 | $715,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Row 1 | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $0 | $0 | $0 |

To attract clients, Electronic Detectives will offer free consultations or initial contracts at reduced prices to promising firms. These promotions will build our reputation. Mr. Radcliffe and Mrs. Walters will travel to six trade shows and conventions across the Midwest and Western part of the country, where we will have booths to advertise our services. Finally, we will set up cold calls to potential clients and place half and full page advertisements in publications such as Nation Law Journal, The Journal of Corporate Law, and Eisley’s Law Review.

Management Summary

The company will have four officers, including our president, Mr. David Radcliffe. Our operations will include an operations chief, Mr. Brad Rinke, and two other forensics analysts. Legal issues will be handled by our in-house lawyer, Mr. Orcott, and finances and general admin by Mrs. Walter.

We plan to hire additional computer forensic analysts as we get more contracts.

6.1 Personnel

Mr. David Radcliffe is a former special agent of the FBI. During his twenty years with the bureau, he worked in various departments. Starting in 1981, he transferred to and eventually headed the FBI’s electronic information investigation branch. In 1985, Mr. Radcliffe received an MBA in information systems from the University of Washington.

Mr. Brad Rinke graduated from Penn State University with a bachelor’s degree in forensic sciences in 1975. From 1978-1988, he worked with the California State Patrol as a forensic investigator. In 1992, Mr. Rinke received a master’s degree in computer science from the University of Southern California. For the past ten years, he has worked with Symantec, Inc. identifying and developing computer programs to fight viruses and worms.

Mr. William Orcott is a graduate of the Stanford School of Law. For the past eight years, he has worked with White, Curley, & Pineda, a top law firm in Los Angeles specializing in intellectual property lawsuits. Mr. Orcott will serve as the legal advisor for Electronic Detectives and will also be the senior evidence custodian, maintaining the evidence locker inventory.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Mr. Radcliffe – President | $36,000 | $45,000 | $60,000 |

| Mrs. Walters – CFO | $36,000 | $45,000 | $60,000 |

| Mr. Rinke – Operations Manager | $36,000 | $45,000 | $45,000 |

| Mr. Orcott – Law Consultant | $36,000 | $45,000 | $45,000 |

| Computer Forensics Analyst | $36,000 | $40,000 | $45,000 |

| Computer Forensics Analyst | $36,000 | $40,000 | $45,000 |

| Computer Forensics Analyst | $0 | $40,000 | $40,000 |

| Computer Forensics Analyst | $0 | $0 | $0 |

| Total People | 0 | 0 | 0 |

| Total Payroll | $216,000 | $300,000 | $340,000 |

Our financial plan anticipates two years of negative profits as we gain sales volume. We have budgeted enough investment to cover these losses and have an additional credit line of $60,000 available if sales do not match predictions.

7.1 Important Assumptions

We assume approximately 75% of sales will be on credit with average interest rates of 10%. These assumptions are considered to be conservative in case our predictions are erroneous.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

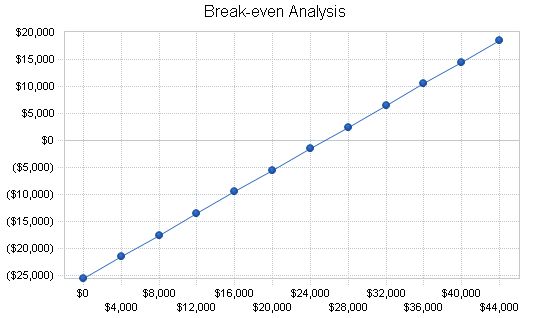

7.2 Break-even Analysis

Our break-even analysis is based on the assumption that our gross margin is 100%. In other words, we will have insignificant direct cost of sales. Since each project will be of different scope, length, and complexity, it is difficult to assign an average per unit revenue figure. However, it is conservatively believed that during the first three years, average profitability will be about $5,000. This is because we will be dealing with smaller companies at first that have smaller projects. We expect that about six projects per month will guarantee a break-even point.

Break-even Analysis:

Monthly Revenue Break-even: $25,483

Assumptions:

– Average Percent Variable Cost: 0%

– Estimated Monthly Fixed Cost: $25,483

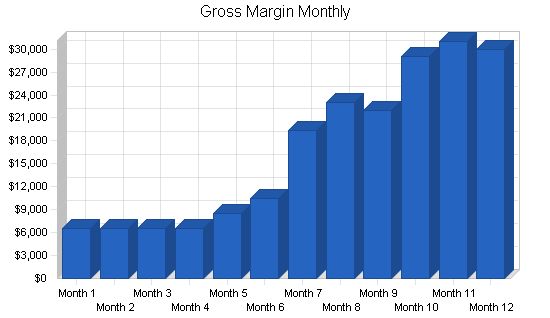

Projected Profit and Loss:

The table below details our revenues and costs. We anticipate higher expenses for marketing and advertising in comparison to other companies as we aim to increase sales. It is evident that monthly profits are projected to commence in November 2003, with annual profitability expected by 2005.

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $215,000 | $481,000 | $715,000 |

| Direct Cost of Sales | $0 | $0 | $0 |

| Other Costs of Sales | $15,800 | $25,000 | $65,000 |

| Total Cost of Sales | $15,800 | $25,000 | $65,000 |

| Gross Margin | $199,200 | $456,000 | $650,000 |

| Gross Margin % | 92.65% | 94.80% | 90.91% |

| Expenses | |||

| Payroll | $216,000 | $300,000 | $340,000 |

| Sales and Marketing and Other Expenses | $30,000 | $50,000 | $50,000 |

| Depreciation | $2,400 | $2,500 | $2,500 |

| Rent | $24,000 | $24,000 | $28,000 |

| Utilities | $6,000 | $6,000 | $6,000 |

| Insurance | $12,000 | $14,000 | $15,000 |

| Travel | $8,200 | $12,000 | $12,000 |

| Payroll Taxes | $0 | $0 | $0 |

| Other | $7,200 | $10,000 | $10,000 |

| Total Operating Expenses | $305,800 | $418,500 | $463,500 |

| Profit Before Interest and Taxes | ($106,600) | $37,500 | $186,500 |

| EBITDA | ($104,200) | $40,000 | $189,000 |

| Interest Expense | $17,000 | $15,150 | $11,450 |

| Taxes Incurred | $0 | $6,705 | $52,515 |

| Net Profit | ($123,600) | $15,645 | $122,535 |

| Net Profit/Sales | -57.49% | 3.25% | 17.14% |

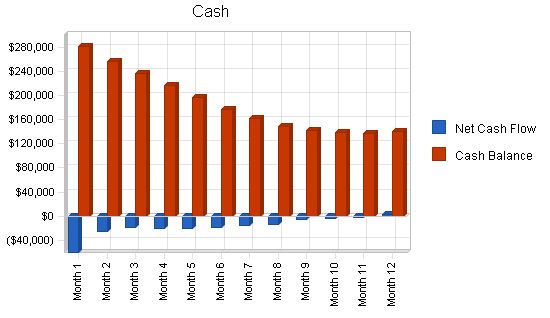

Projected Cash Flow:

The following is our cash flow chart and diagram. We do not expect to have any short-term cash flow problems even though we will be operating at a loss for the first two years. Our short-term SBA loan of $50,000 will be repaid in two equal payments in 2004-2005. Our $120,000 long-term loan will be paid off in ten years.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $53,750 | $120,250 | $178,750 |

| Cash from Receivables | $111,075 | $298,673 | $481,641 |

| Subtotal Cash from Operations | $164,825 | $418,923 | $660,391 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $13,000 | $0 |

| Subtotal Cash Received | $164,825 | $431,923 | $660,391 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $216,000 | $300,000 | $340,000 |

| Bill Payments | $150,401 | $163,019 | $242,805 |

| Subtotal Spent on Operations | $366,401 | $463,019 | $582,805 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $25,000 | $25,000 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $12,000 | $12,000 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $366,401 | $500,019 | $619,805 |

| Net Cash Flow | ($201,576) | ($68,096) | $40,586 |

| Cash Balance | $139,974 | $71,878 | $112,464 |

7.5 Projected Balance Sheet

The following is the projected balance sheet for Electronic Detectives.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $139,974 | $71,878 | $112,464 |

| Accounts Receivable | $50,175 | $112,252 | $166,861 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $190,149 | $184,130 | $279,325 |

| Long-term Assets | |||

| Long-term Assets | $128,000 | $128,000 | $128,000 |

| Accumulated Depreciation | $2,400 | $4,900 | $7,400 |

| Total Long-term Assets | $125,600 | $123,100 | $120,600 |

| Total Assets | $315,749 | $307,230 | $399,925 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $13,549 | $13,385 | $20,545 |

| Current Borrowing | $50,000 | $25,000 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $63,549 | $38,385 | $20,545 |

| Long-term Liabilities | $120,000 | $108,000 | $96,000 |

| Total Liabilities | $183,549 | $146,385 | $116,545 |

| Paid-in Capital | $297,000 | $310,000 | $310,000 |

| Retained Earnings | ($41,200) | ($164,800) | ($149,155) |

| Earnings | ($123,600) | $15,645 | $122,535 |

| Total Capital | $132,200 | $160,845 | $283,380 |

| Total Liabilities and Capital | $315,749 | $307,230 | $399,925 |

| Net Worth | $132,200 | $160,845 | $283,380 |

7.6 Business Ratios

We have included industry standard ratios from the detective agency industry to compare with ours. There may be significant differences, especially in sales growth, financing ratios, long-term asset investments, and net worth. However, our projections indicate a healthy company that will achieve long-term profitability.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 123.72% | 48.65% | 7.51% |

| Percent of Total Assets | ||||

| Accounts Receivable | 15.89% | 36.54% | 41.72% | 29.53% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 41.06% |

| Total Current Assets | 60.22% | 59.93% | 69.84% | 74.47% |

| Long-term Assets | 39.78% | 40.07% | 30.16% | 25.53% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 20.13% | 12.49% | 5.14% | 34.85% |

| Long-term Liabilities | 38.00% | 35.15% | 24.00% | 17.54% |

| Total Liabilities | 58.13% | 47.65% | 29.14% | 52.39% |

| Net Worth | 41.87% | 52.35% | 70.86% | 47.61% |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!