Vette Kat Harbour Bed & Breakfast is a charming B&B located overlooking Vette Kat Harbour on a beautiful Caribbean island. This LLC of Kayman St. Lucia will reside in the St. Lucia’s home, which is the centerpiece for the entire B&B experience. Guests can choose from up to seven rooms with a centralized living room, private garden patio, and the Buccaneer Culinary Centre on the property.

The unassuming white building adorned with flags of many nations is the Vette Kat Harbour Bed & Breakfast. Inside, guests are greeted by a staff member who takes their bags and leads them to a cozy alcove for Passion Fruit tea and delicate biscuits.

The exquisite interior features an 18th Century portrait, a French courtyard, and crystal and silver on nearby tables. Fragrant flowers, rich fabrics, and amethyst-studded ceilings showcase the owner’s art and antique collection.

The personalized approach to serving guests at this inn consistently earns it high ratings from readers of Travel + Leisure magazine. Breakfast can be enjoyed in-room or in the Terrace Room overlooking the garden. Guests can also have an unforgettable picnic packed for them if they decide to explore the countryside or seaside. Attention to detail is the hallmark of this magical place.

In terms of competition, Vette Kat Harbour Bed & Breakfast stands out from other hotels in the area. While other hotels are fairly standard chain establishments, this B&B offers a more beautiful and elegant home in a quiet street, in a small town, by the sea.

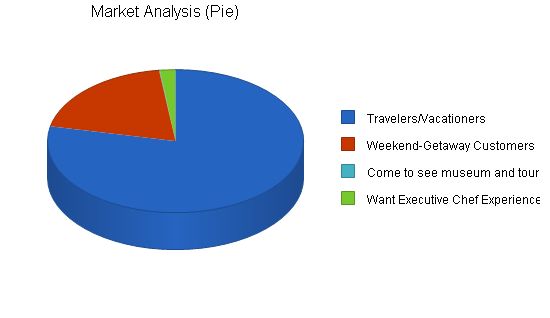

As for target groups, the B&B attracts weekenders from the region who want to relax or engage in planned activities. It also appeals to travelers sailing through the area who prefer B&Bs over hotels or staying on their boats. In addition, the B&B offers an executive chef experience. Although there may be customers who don’t fit into these categories, the classification is fairly accurate.

Vette Kat Harbour Bed & Breakfast has two competitive edges that set it apart. The first is its unwavering attention to detail and customer service. The mission of the St. Lucia’s is to ensure that their customers have the finest stay, which is evident in the breakfast offerings that include Starbucks Authorized and Certified Training System of Coffee and Tazo Tea service. Full barista services with Cafe Au Lait and a selection of four daily coffees are available. The Tazo collection offers eight tea options per day. The breakfast menu ranges from traditional simple pleasures to gourmet exotic entrees and heart-healthy options endorsed by the American Heart Association. The B&B also offers a rare island style culinary experience.

The second competitive edge is the unique facility itself, which features Tiffany lamps, original gas and solid-silver fixture lamps, and antiques. The historical stories of Executive Chef Kayman’s foods, dishes, and cooking from around the world add to the allure.

The management team of Vette Kat Harbour B&B plays a crucial role in executing the strong business model. Kayman, with an MBA and extensive experience as a chef, marketing VP, and B&B GM, brings valuable skills and unique talents to the establishment. Assisted by prominent presidents, executive chefs, and industry magnates, Kayman’s fame, TV exposure, and radio appearances contribute to the success of the B&B. His step-son, Max Nevis, and wife, Jenné Sequa, both trained chefs, also provide support. The profitability of the B&B is projected to start in month three and reach a respectable profit by the end of year one.

With its amazing facility and the expertise of Kayman St. Lucia, Vette Kat Harbour B&B is poised to serve the inter-island community and be a profitable venture.

The Vette Kat Harbour Bed & Breakfast aims to exceed customer expectations and increase visitors throughout the year. They also strive to increase their client base by 10% annually and achieve a 50% occupancy rate by Year 5. The goal is to develop a sustainable business that surpasses set data and maintains an average customer comment card score of 92 or above. Additionally, they aim to establish the Buccaneer Culinary Centre, which will contribute to the Bed and Breakfast operation and maintain an average customer comment card score of 85 or above. The Vette Kat Harbour Bed & Breakfast is committed to operating as a green establishment and aims to be a lighthouse in the region. They also aim to contribute to the community and receive awards in recognition of their efforts.

The mission of the Vette Kat Harbour B & B is to be the preferred Bed and Breakfast Inn in the area, providing a contemporary, world-class experience for guests and colleagues. The inn offers a romantic and culinary oasis, with interiors that are described as both grand and whimsical.

To achieve success, the Vette Kat Harbour Bed & Breakfast aims to position itself as the best B & B in the region among tourists and local patrons within a 120-mile radius. They also prioritize sound financial management, strong referral engines and B & B Association connections for room bookings, automated digital calendars and room booking systems, and unique experiences and services for their guests.

The Vette Kat Harbour Bed & Breakfast is a luxurious and quaint establishment with seven individual rooms, some with private baths. It features a central living room/socializing area, a garden patio, outdoor BBQ area, and a Buccaneer Culinary Centre. The Privateer Suite offers a unique lodging experience with its own kitchen, living room, outdoor sitting area, and separate entrance. The location is within walking distance from the shore on a quiet small town street, with elegant neighboring properties.

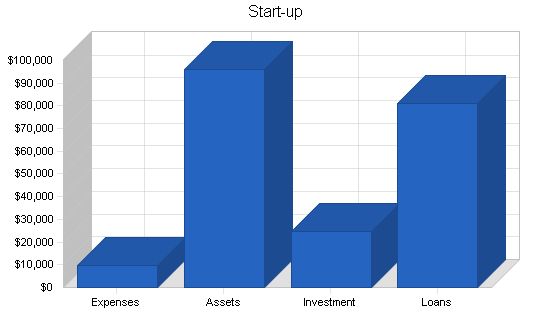

The Vette Kat Harbour Bed & Breakfast is owned by Kayman St. Lucia and operates as an LLC. Start-up expenses include home office equipment, wireless Internet network access, website creation, advertising, association dues, furnishings and linens, pest control program, tableware, signage, and safety programs. Additionally, a budget of $32,000 is allocated for initial furnishings, and there is a breakdown of bed and room linen expenses and equipment and furnishings expenses.

Kayman St. Lucia plans to invest $25,000 in the start-up of the B & B and seeks additional funding through a bank and the SBA with an Island Economic Development loan package.

The Vette Kat Harbour Bed & Breakfast is an attractive B & B that offers travelers a relaxed setting for a weekend getaway or family occasions. It has a large central gathering room, an upstairs covered patio, and outside gardens for socializing. Customers receive personal attention from Kayman St. Lucia and his family.

The B&B provides a gourmet breakfast feast and can accommodate any dietary restrictions. It overlooks the beautiful Caribbean island harbor of Vette Kat and is comfortable and casual.

Bed and Breakfasts have been established in Europe for years and were introduced in the United States in the late 1960s. There are now over 20,000 B&Bs, up from about 2,000 in 1979. The industry is maturing with increasing room numbers, occupancy rates, and associations. Word-of-mouth recommendations are critical for business growth.

The Vette Kat Harbour Bed & Breakfast is the first B&B on the island, with few others on neighboring isles.

The B&B targets two main groups: those seeking a weekend getaway and travelers/sailors in the area who prefer B&Bs over hotels. There are also customers interested in themed weekends offered by Chef Kayman.

The customers can be broadly divided into three groups: weekend getaway customers from the region, travelers/vacationers, and those interested in experiencing Executive Chef Service provided by Chef Kayman.

Potential Customers

– Travelers/Vacationers: 9% growth

– Weekend-Getaway Customers: 9% growth

– Come to see museum and tour: 8% growth

– Want Executive Chef Experience: 5% growth

– Total: 8.92% growth

4.2 Target Market Segment Strategy

The Vette Kat Harbour Bed & Breakfast will target three customer groups:

1. Association membership and advertising: Join B&B associations and chambers of commerce for visibility.

2. Website: Have a full-service website for information and reservations.

3. Other Advertising: Use rest areas, billboards, and lifestyle magazines for additional exposure.

4. Events: Host Caribbean history and themed events on the grounds.

4.2.1 Marketing Strategy

Specific strategies for marketing the Vette Kat Harbour Bed & Breakfast include:

1. Print Ads: Limited space ads in local newspapers.

2. Press Releases: Utilizing local papers and magazines for releases and new art showcases.

3. Unique Artist and Historic Gallery in House: Displaying local artwork for sale.

4. Designer Postcard: Holding a local contest for postcard designs.

5. Apparel: Producing embroidered apparel with the B&B name.

6. Gourmet Dinners and Guest Speakers: Hosting acclaimed chefs for special dinners.

7. Grand Opening: Offering door prizes and loss leader pricing on high volume products.

8. Trade Shows, Chamber of Commerce meetings and Fairs: Participating in regional events.

9. Word of Mouth: Providing excellent service to encourage positive recommendations.

10. Monthly Events: Hosting themed events and specials.

All marketing decisions will be carefully considered for returns generated.

4.3 Competition and Buying Patterns

Competition comes in the form of other B&Bs and hotels/motels:

– B&Bs differentiate through unique features and personal service offerings.

– Hotels/motels are more standardized and less focused on personal interaction.

Overall, B&B guests are looking for a unique and pampering experience.

Strategy and Implementation Summary

Sales strategy for the Vette Kat Harbour Bed & Breakfast includes:

– Breakfasts and Dinners: Offering gourmet meals.

– Personal attention in regard to calls of inquiry: Spending time on the phone with potential customers.

– Very detailed website: Providing comprehensive information and online reservations.

5.1 SWOT Analysis

Strengths: Knowledgeable staff, state-of-the-art technology, beautiful facility, and unique culinary offerings.

Weaknesses: Lower priced local competition, loyalty card programs, and superior signage and networking.

5.2 Competitive Edge

Competitive advantages for the Vette Kat Harbour Bed & Breakfast:

1. Attention to personalized service: Offering personal concern to enhance the B&B experience.

2. Uniqueness and beauty of the facility: Providing a beautiful setting and outdoor patio.

5.3 Sales Strategy

Sales strategy for the Vette Kat Harbour Bed & Breakfast includes:

– Sales strategy regarding breakfasts and dinners: Focus on high-quality, unique culinary offerings.

– Personal attention in regard to calls of inquiry: Spending time on the phone to convert inquiries into customers.

– Very detailed website: Providing comprehensive information for decision-making.

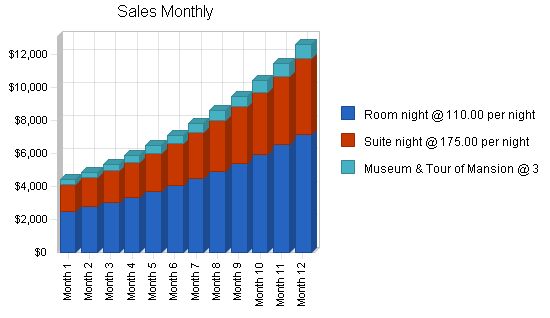

5.3.1 Sales Forecast

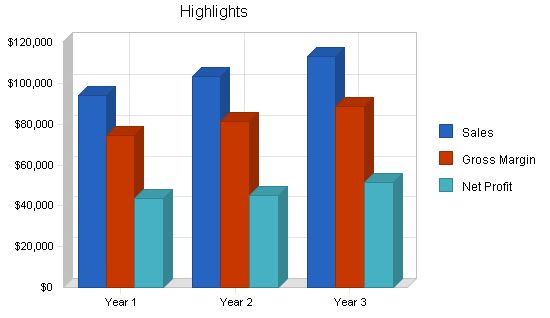

First year occupancy rates estimated at 15% with a gradual increase month-by-month and year-by-year.

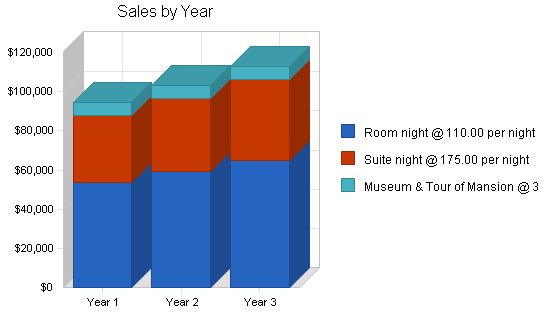

Sales Forecast

Year 1 Year 2 Year 3

Sales

Room night @ 110.00 per night $53,653 $59,018 $64,920

Suite night @ 175.00 per night $34,151 $37,566 $41,323

Museum & Tour of Mansion @ 3.00 pp $6,415 $6,600 $6,800

Total Sales $94,219 $103,184 $113,043

Direct Cost of Sales

Year 1 Year 2 Year 3

Room night @ 20.00 cost $5,520 $5,796 $6,085

Suite night @ 30.00 cost $3,240 $3,402 $3,572

Museum and Tour of Mansion $480 $500 $520

Subtotal Direct Cost of Sales $9,240 $9,698 $10,177

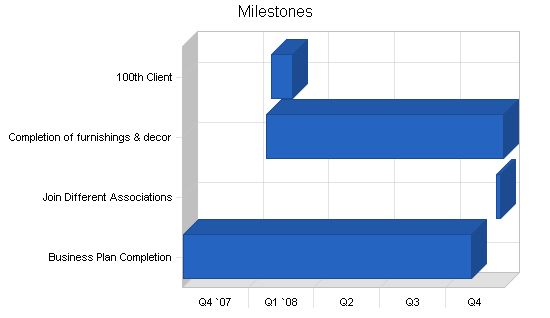

5.4 Milestones

The Vette Kat Harbour Bed & Breakfast will have several milestones early on:

1. Business plan completion: This will serve as a roadmap for the organization. While not necessary for raising capital, it will be essential for the ongoing performance and improvement of the company.

2. Joining different associations: This is the announcement to the world that the B & B is open for business.

3. Completion of facility renovations.

4. Our 100th client.

Milestones:

– Business Plan Completion: 10/1/2007 – 11/6/2008, $2,800 budget, Jenné Sequa (Manager), Business (Department)

– Join Different Associations: 12/10/2008 – 12/16/2008, $2,400 budget, Kayman St. Lucia (Manager), Marketing (Department)

– Completion of furnishings & decor: 12/20/2008 – 1/25/2008, $32,000 budget, Kayman St. Lucia (Manager), Design (Department)

– 100th Client: 2/1/2008 – 3/1/2008, $400 budget, Dominica Martlet (Manager), Marketing (Department)

– Totals: $37,600 budget

Web Plan Summary:

– Nevis Associates and Antigua Associates will build an e-commerce enabled platform and website for the Vette Kat Harbour Bed & Breakfast. SuperInn will be used for advanced room booking software and full credit card integration.

– The website will feature the photography of Jenné Sequa and Kayman St. Lucia, with a simple yet elegant design.

– Search Engine strategies will be provided for linking into 2000+ search engines, including AOL, MSN, Yahoo!, and Google, via WebPosition Gold.

– Limited Google AdWords and Overture Networks SEO strategies will be used.

– Local linking via BBB and COC will take place, as well as BBOnline and ABBA.

– The website will also be linked to various promotional schemes for local events.

Website Marketing Strategy:

– The market strategy for the Vette Kat Harbour Bed & Breakfast focuses on recognition of expertise by consumers.

– The strategy includes informing the existing customer base of the Internet presence and encouraging word-of-mouth recommendations.

– Search engine marketing, banner advertising, and affiliate programs will also be utilized.

Management Summary:

– The Vette Kat Harbour Bed & Breakfast is owned and operated by Kayman St. Lucia as an LLC.

– Kayman has a degree in Culinary Arts, an MBA in Restaurant Management, and certification as a licensed hotel manager.

– He has 21 years of food service experience and has previously managed a successful Bed & Breakfast in Philadelphia and a resort in Florida.

– Jenné Sequa, Kayman’s wife, will assist with day-to-day operations and has experience in Human Resources, accounting, payroll, and banquet chef.

Personnel Plan:

– Kayman St. Lucia will continue working for his current employer initially and will not take a salary from Vette Kat Harbour B&B until September.

– Jenné Sequa will handle day-to-day operations, front desk, and bookkeeping and will begin taking a salary in month three.

– Part-time help will be employed for housekeeping, landscaping, and maintenance chores.

– The following sections will provide important financial information.

Important Assumptions:

– General assumptions for the Vette Kat Harbour Bed & Breakfast, including current interest rate, long-term interest rate, tax rate, and other factors.

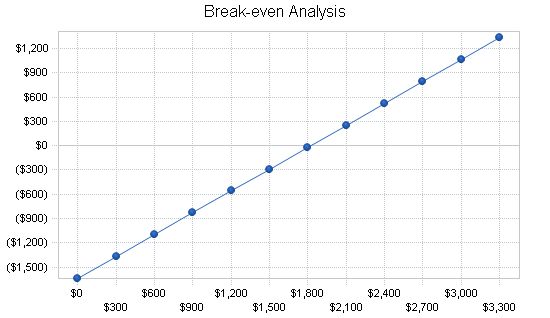

Break-even Analysis:

– The Break-even Analysis shows the monthly revenue required to break even, taking into account utility and advertising costs.

| Break-even Analysis | |

| Monthly Revenue Break-even | $1,820 |

| Assumptions: | |

| Average Percent Variable Cost | 10% |

| Estimated Monthly Fixed Cost | $1,642 |

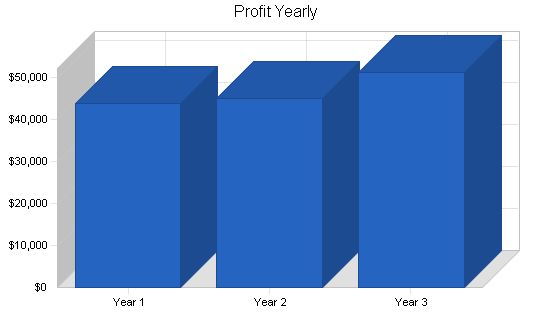

8.3 Projected Profit and Loss

The table indicates modest projected profits.

Pro Forma Profit and Loss

Sales

Year 1: $94,219

Year 2: $103,184

Year 3: $113,043

Direct Cost of Sales

Year 1: $9,240

Year 2: $9,698

Year 3: $10,177

Other

Year 1: $10,320

Year 2: $12,320

Year 3: $14,320

Total Cost of Sales

Year 1: $19,560

Year 2: $22,018

Year 3: $24,497

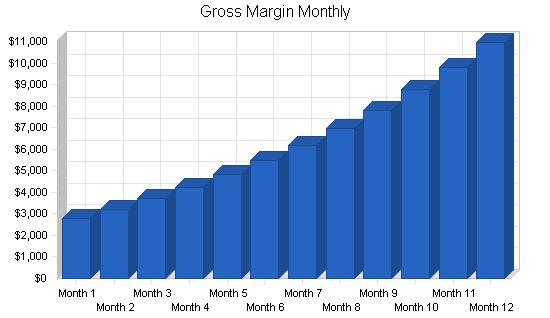

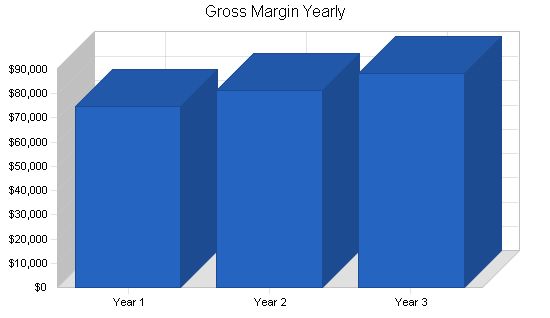

Gross Margin

Year 1: $74,659

Year 2: $81,166

Year 3: $88,546

Gross Margin %

Year 1: 79.24%

Year 2: 78.66%

Year 3: 78.33%

Expenses

Payroll

Year 1: $0

Year 2: $0

Year 3: $0

Sales & Marketing & Other Expenses

Year 1: $6,500

Year 2: $10,000

Year 3: $10,000

Depreciation

Year 1: $1,200

Year 2: $1,200

Year 3: $1,200

Annual web and Assoc fees

Year 1: $1,200

Year 2: $1,600

Year 3: $1,700

Utilities

Year 1: $7,200

Year 2: $7,600

Year 3: $7,800

Payroll Tax

Year 1: $0

Year 2: $0

Year 3: $0

Insurance

Year 1: $3,600

Year 2: $4,800

Year 3: $5,000

Total Operating Expenses

Year 1: $19,700

Year 2: $25,200

Year 3: $25,700

Profit Before Interest and Taxes

Year 1: $54,959

Year 2: $55,966

Year 3: $62,846

EBITDA

Year 1: $56,159

Year 2: $57,166

Year 3: $64,046

Interest Expense

Year 1: $4,639

Year 2: $4,225

Year 3: $3,793

Taxes Incurred

Year 1: $6,542

Year 2: $6,726

Year 3: $7,677

Net Profit

Year 1: $43,779

Year 2: $45,015

Year 3: $51,376

Net Profit/Sales

Year 1: 46.46%

Year 2: 43.63%

Year 3: 45.45%

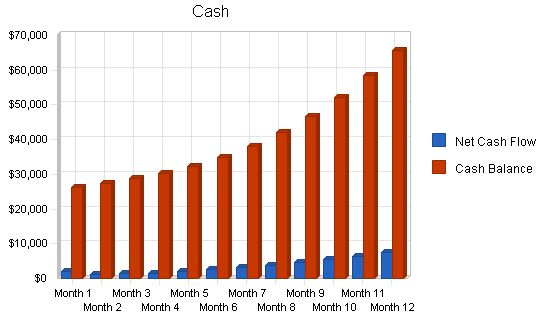

8.4 Projected Cash Flow

The following chart and table display projected cash flow.

Pro Forma Cash Flow:

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | $94,219 | $103,184 | $113,043 |

| Cash Sales | $94,219 | $103,184 | $113,043 |

| Subtotal Cash from Operations | $94,219 | $103,184 | $113,043 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $12,248 | $13,414 | $14,696 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $106,468 | $116,598 | $127,739 |

| Expenditures | |||

| Expenditures from Operations | |||

| Cash Spending | $0 | $0 | $0 |

| Bill Payments | $45,254 | $56,845 | $60,357 |

| Subtotal Spent on Operations | $45,254 | $56,845 | $60,357 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $12,248 | $13,414 | $14,696 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $7,200 | $7,200 | $7,200 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $64,703 | $77,459 | $82,253 |

| Net Cash Flow | $41,765 | $39,139 | $45,486 |

| Cash Balance | $65,765 | $104,904 | $150,390 |

8.5 Projected Balance Sheet:

The following table shows the projected balance sheet. It’s worth noting that excessive funds are initially reported as being raised. This is a contingency and safety fund, which can be placed into the SBA PE bank’s savings fund or a mutually accessible program with a good rate for cost-effectiveness and prudence.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Cash | $65,765 | $104,904 | $150,390 |

| Inventory | $847 | $889 | $933 |

| Other Current Assets | $13,667 | $13,667 | $13,667 |

| Total Current Assets | $80,279 | $119,460 | $164,990 |

| Long-term Assets | $56,000 | $56,000 | $56,000 |

| Accumulated Depreciation | $1,200 | $2,400 | $3,600 |

| Total Long-term Assets | $54,800 | $53,600 | $52,400 |

| Total Assets | $135,079 | $173,060 | $217,390 |

| Liabilities and Capital | |||

| Current Liabilities | |||

| Accounts Payable | $2,333 | $2,499 | $2,653 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $2,333 | $2,499 | $2,653 |

| Long-term Liabilities | $74,010 | $66,810 | $59,610 |

| Total Liabilities | $76,343 | $69,309 | $62,263 |

| Paid-in Capital | $24,840 | $24,840 | $24,840 |

| Retained Earnings | ($9,883) | $33,896 | $78,911 |

| Earnings | $43,779 | $45,015 | $51,376 |

| Total Capital | $58,736 | $103,751 | $155,128 |

| Total Liabilities and Capital | $135,079 | $173,060 | $217,390 |

| Net Worth | $58,736 | $103,751 | $155,128 |

8.6 Business Ratios:

The business ratios reflect both a cross-sectional analysis and time-series analysis of the company’s risk and profitability. The cross-sectional analysis compares our firm’s ratios with those of the hotel and motel industry (NAICS code 72110) averages. It’s important to note that there are significant differences in the ratios, particularly in terms of leverage. This difference is due to the inclusion of larger hotel chains in the industry averages, which have higher capital costs and investments in long-term assets. Additionally, Vette Kat Harbour B & B has lower SG&A costs compared to other hotels and motels due to providing fewer services.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 9.52% | 9.55% | 7.24% |

| Percent of Total Assets | ||||

| Inventory | 0.63% | 0.51% | 0.43% | 1.35% |

| Other Current Assets | 10.12% | 7.90% | 6.29% | 24.20% |

| Total Current Assets | 59.43% | 69.03% | 75.90% | 29.12% |

| Long-term Assets | 40.57% | 30.97% | 24.10% | 70.88% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 2.33% | 2.5% | 2.65% | 16.94% |

| Current Borrowing | 0% | 0% | 0% | NA |

| Other Current Liabilities | 0% | 0% | 0% | NA |

| Subtotal Current Liabilities | 2.33% | 2.5% | 2.65% | NA |

| Long-term Liabilities | 74.01% | 66.81% | 59.61% | 26.60% |

| Total Liabilities | 76.34% | 69.31% | 62.26% | 43.54% |

| Net Worth | 23.66% | 30.69% | 37.74% | 56.46% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!