Electronics Retailer Business Plan

Safe Current is a small business unit of The Cleveland Illuminating Company (TCIC), an electric utility. Safe Current, led by Brian Henderson, has identified three key factors for its sustainability:

1. Ensure 100% customer satisfaction: Repeat customers and customer referrals are valuable.

2. Design and sell meaningful power protection products.

3. Implement strict financial controls. This is important because Safe Current must be financially independent while fulfilling its financial and accounting responsibilities to TCIC’s shareholders.

Products:

Safe Current offers two main products, surge arrestors and surge protectors. These products, sold under the Safe Current brand name, are made by a contract manufacturer.

– Surge Arrestors: Mounted on houses or businesses near the meter, these provide protection from external electrical surges.

– Surge Protectors: Industrial-grade equipment that safeguards individual or groups of appliances against internal electrical spikes.

Management:

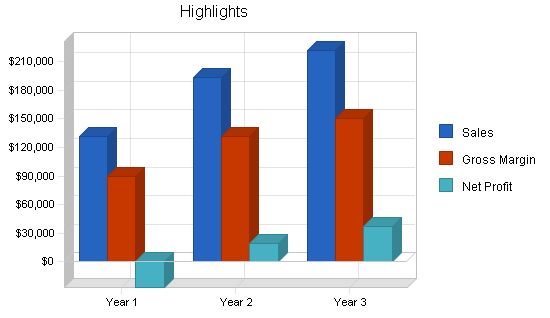

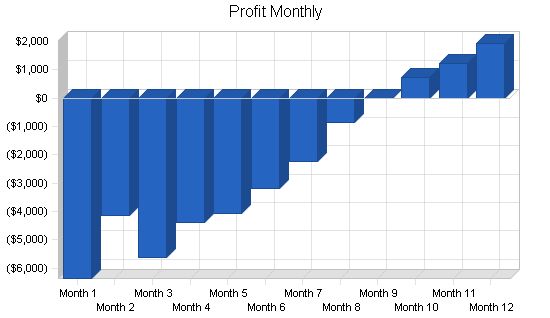

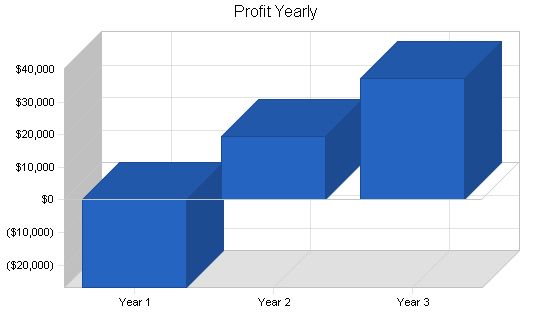

Brian holds an MBA from Case Western Reserve University and has experience as an assistant project manager at ATT and in the value-added services department at Allegheny Power. Safe Current is projected to achieve impressive sales and respectable net profit in years two and three.

Contents

1.1 Objectives

- Develop a profitable product for TCIC unregulated from core power generation business services.

- Achieve profitability within one year.

- Use this business as a successful model for future ventures.

1.2 Mission

Develop surge protectors and arrestors for consumers that offer safety and value. Safe Current will leverage the strength of The Cleveland Illuminating Company to build brand recognition. Exceed customer expectations with innovative, useful products and ensure complete customer satisfaction.

1.3 Keys to Success

- Offer 100% customer satisfaction.

- Design and sell meaningful, valuable power protection products.

- Employ strict financial controls.

Company Summary

Safe Current is an unregulated subsidiary of The Cleveland Illuminating Company that sells directly to businesses and consumers. It will operate as a stand-alone business, leveraging TCIC’s existing resources and goodwill.

Safe Current will be located on site at TCIC, using an office within the complex and sharing TCIC’s computer network and phone connections. It will have its own customer service department, while sales calls will be handled by TCIC’s call center. Safe Current will also utilize TCIC’s billing system, order fulfillment, and shipping departments, paying a flat rate (10%) for these services.

The Cleveland Illuminating Company has created Safe Current to increase shareholder returns outside the government-regulated rates available to electric utilities.

2.1 Company Ownership

Safe Current is a wholly owned subsidiary of TCIC.

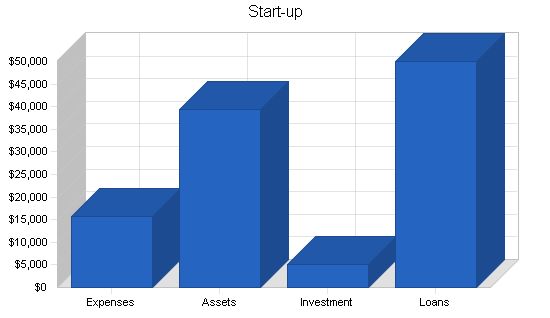

2.2 Start-up Summary

Safe Current will leverage TCIC’s existing resources and pay a set overhead fee for the resources used. The equipment needed includes:

- Five computer stations, one laser printer; Microsoft Office, Access, and proprietary software used by TCIC; network connection to TCIC.

- Five office furniture setups.

- A five-extension phone system.

Start-up Funding

Expenses to Fund: $15,600

Assets to Fund: $39,400

Total Funding Required: $55,000

Assets

Non-cash Assets from Start-up: $17,500

Cash Requirements from Start-up: $21,900

Additional Cash Raised: $0

Cash Balance on Starting Date: $21,900

Total Assets: $39,400

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $50,000

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $50,000

Capital

Planned Investment

TCIC: $5,000

Other: $0

Additional Investment Requirement: $0

Total Planned Investment: $5,000

Loss at Start-up (Start-up Expenses): ($15,600)

Total Capital: ($10,600)

Total Capital and Liabilities: $39,400

Total Funding: $55,000

Start-up

Requirements

Start-up Expenses

Stationery etc.: $100

Brochures: $2,000

Website development: $5,000

Furniture: $1,500

Expensed Equipment: $7,000

Total Start-up Expenses: $15,600

Start-up Assets

Cash Required: $21,900

Start-up Inventory: $0

Other Current Assets: $3,000

Long-term Assets: $14,500

Total Assets: $39,400

Total Requirements: $55,000

Market Analysis Summary

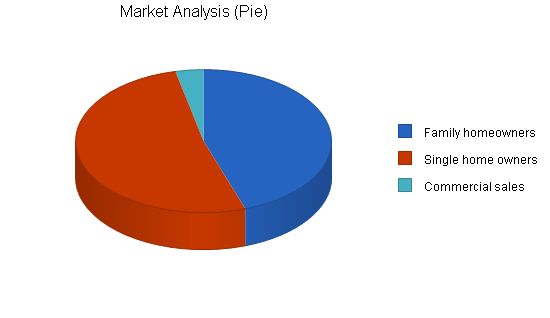

Safe Current has identified three distinct market segments. The first segment is family home owners, typically with children, and the second is single home owners.

These two segments have been chosen because families with children typically have a large number of electronic devices, and single home owners often adopt technology using lots of gadgets in their home.

The third segment is commercial businesses that have equipment they want protected. Competition is very limited for surge arrestors as they require electric utility installation. There is some competition with surge protectors, but the competitive products are consumer level and offer different levels of quality and protection compared to Safe Current’s industrial level products.

3.1 Market Segmentation

Safe Current has segmented the market into three distinct groups.

Family home owners

– 69% have at least one child.

– Median household income: $77,000.

– Eat out 2.3 times a week.

– 58% of the families have two incomes.

– 63% have cable TV.

– 49% have a broadband Internet connection.

Single home owners

– Ages 25-40.

– 71% are professionals.

– Median household income: $62,000.

– Eat out 2.7 times a week.

– 72% have cable TV.

– 71% have a broadband Internet connection.

Commercial sales

– Small to mid-size businesses with expensive electronic equipment that needs protection. Commercial sales are not industry specific. All businesses, regardless of type, have equipment that can be protected.

Market Analysis

Year 1 Year 2 Year 3 Year 4 Year 5

Potential Customers Growth CAGR

Family homeowners 8% 143,545 154,311 165,884 178,325 191,699 7.50%

Single home owners 8% 165,987 179,266 193,607 209,096 225,824 8.00%

Commercial sales 6% 11,254 11,929 12,645 13,404 14,208 6.00%

Total 7.71% 320,786 345,506 372,136 400,825 431,731 7.71%

3.2 Target Market Segment Strategy

Safe Current targets groups with multiple vulnerable electronic devices, such as family and single homeowners. These segments already appreciate TCIC’s safety reputation and offer easy business solicitation due to their existing customer relationship.

Safe Current sells surge arrestors and surge protectors, similar yet distinct products. Surge arrestors are exclusive to utilities and are sold and installed as a package. Surge protectors, on the other hand, are sold by various retailers such as hardware and electronics stores.

Safe Current, operating within the regulated utility industry, benefits from the assets of its parent company, The Cleveland Illuminating Company, without any return caps.

3.3.1 Competition and Buying Patterns

For surge arrestors, Safe Current faces minimal competition since their installation is tied to electric utilities. Buying the equipment separately and paying for installation is more expensive than getting the package directly from the utility.

In the surge protector market, Safe Current competes with hardware stores, mass merchants, do-it-yourself stores, computer retailers, and electronic retailers. Safe Current’s industrial-grade products offer higher protection than most consumer units.

3.4 Products

Safe Current offers surge arrestors and surge protectors to protect electronic devices from power surges. Surge protectors divert extra electricity into the ground wire, while surge arrestors provide protection at the outside meter. Both products offer different levels of protection against surges from various sources, including lightning and high power electrical devices.

Surge arrestors cost $235, including installation, and can only be installed by utilities. Surge protectors cost $50 and offer a higher level of protection when used with a surge arrestor. Safe Current outsources production to leverage its relationships with contract manufacturers and TCIC resources.

Strategy and Implementation Summary

Safe Current’s competitive edge stems from its association with The Cleveland Illuminating Company, a trusted electric utility with decades of brand equity. Safe Current also benefits from TCIC’s vendor connections and buying power, as well as its exclusive ability to install house arrestors.

The marketing strategy focuses on communicating that Safe Current’s products provide affordable insurance against appliance damage. This message will be conveyed through bill inserts, a comprehensive website, and direct mail to TCIC’s customer database.

Safe Current’s sales strategy highlights its affiliation with TCIC, a reputable and reliable utility. Leveraging TCIC’s brand equity allows Safe Current to build trust with customers.

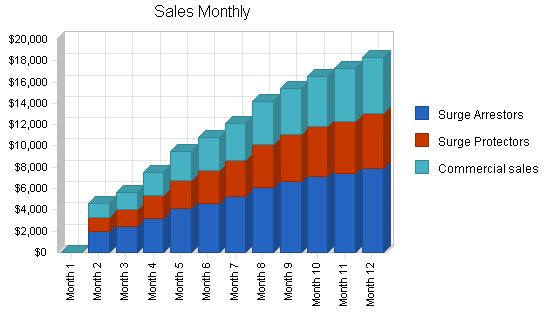

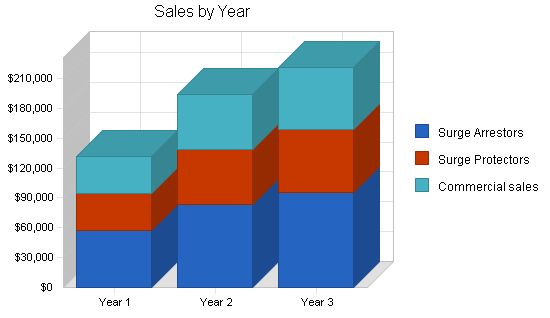

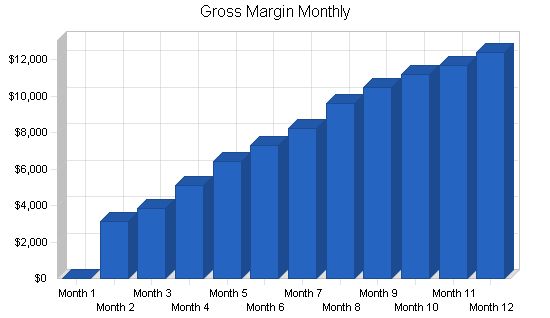

The sales forecast serves as a realistic goal-setting and tracking tool. It has been developed conservatively to ensure sustainable sales growth.

Note: This review has eliminated redundant phrases and enhanced clarity and conciseness without altering the original meaning.

Sales Forecast

Sales

Surge Arrestors: $56,841 (Year 1), $83,434 (Year 2), $95,454 (Year 3)

Surge Protectors: $37,515 (Year 1), $55,066 (Year 2), $63,000 (Year 3)

Commercial sales: $37,515 (Year 1), $55,066 (Year 2), $63,000 (Year 3)

Total Sales: $131,871 (Year 1), $193,567 (Year 2), $221,453 (Year 3)

Direct Cost of Sales

Surge Arrestors: $15,915 (Year 1), $23,362 (Year 2), $26,727 (Year 3)

Surge Protectors: $14,256 (Year 1), $20,925 (Year 2), $23,940 (Year 3)

Commercial sales: $12,380 (Year 1), $18,172 (Year 2), $20,790 (Year 3)

Subtotal Direct Cost of Sales: $42,551 (Year 1), $62,459 (Year 2), $71,457 (Year 3)

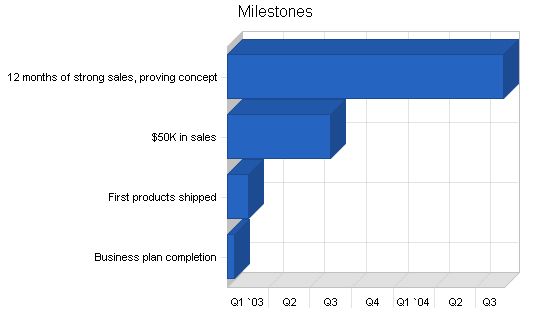

4.4 Milestones

Safe Current has identified quantifiable milestones as goals that the organization will work toward to ensure business sustainability. The following table outlines these milestones with their expected completion dates. A graphical representation of this information is also provided in the chart below.

Milestones:

– Business plan completion: 1/1/2003 – 1/15/2003, $0 budget, Manager: Brian, Department: Startegic development

– First products shipped: 1/1/2003 – 2/15/2003, $0 budget, Manager: Brian, Department: Operations

– $50K in sales: 1/1/2003 – 8/15/2003, $0 budget, Manager: Brian, Department: Sales

– 12 months of strong sales, proving concept: 1/1/2003 – 8/30/2004, $0 budget, Manager: Brian, Department: Operations

Web Plan Summary:

Safe Current’s website will serve as a marketing and sales tool, providing product information and allowing customers to purchase products and schedule installation appointments for surge arrestors. The website will be periodically updated to encourage repeat visits.

5.1 Website Marketing Strategy:

Safe Current will market their website through search engine submission and by including the website URL on all printed materials.

5.2 Development Requirements:

The website will be developed by TCIC’s internal web development team for $5,000.

Management Summary:

Brian Henderson has a Bachelors of Science in business and marketing from the University of Pittsburgh and an MBA from Case Western Reserve University. He has experience in direct marketing and selling commercial businesses value-added services.

6.1 Personnel Plan:

Safe Current will have a small team consisting of a Project Manager and 4 Customer Service Agents. Billing, sales, and order fulfillment will be handled by TCIC’s existing organization, with a 10% fee for these services.

Personnel Plan:

– Project Manager: Brian

– Customer Service Agents: 4

The following sections provide important financial information.

7.1 Important Assumptions:

The table below outlines important financial assumptions.

General Assumptions:

– Plan Month: 1, 2, 3

– Current Interest Rate: 10.00%

– Long-term Interest Rate: 10.00%

– Tax Rate: 30.00%

– Other: 0

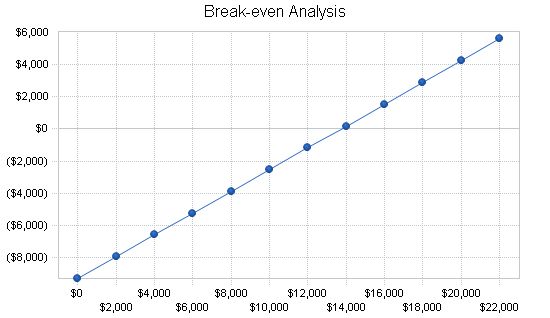

7.2 Break-even Analysis:

The Break-even Analysis determines the monthly revenue needed to reach the break-even point.

Break-even Analysis:

Monthly Revenue Break-even: $13,732.

Assumptions:

– Average Percent Variable Cost: 32%.

– Estimated Monthly Fixed Cost: $9,301.

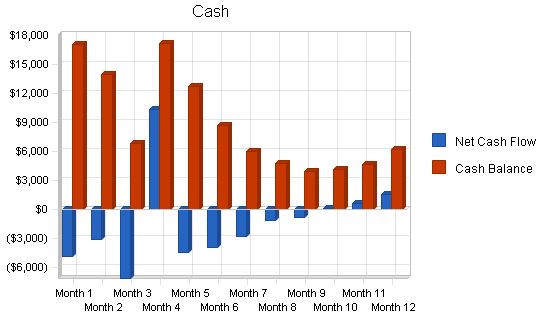

7.3 Projected Cash Flow:

The chart and table below display projected cash flow.

Review:

Pro Forma Cash Flow

Year 1 Year 2 Year 3

Cash Received

Cash from Operations

Cash Sales $131,871 $193,567 $221,453

Subtotal Cash from Operations $131,871 $193,567 $221,453

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $0 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $15,000 $0 $0

Subtotal Cash Received $146,871 $193,567 $221,453

Expenditures

Year 1 Year 2 Year 3

Expenditures from Operations

Cash Spending $85,400 $74,400 $66,500

Bill Payments $69,962 $101,544 $116,462

Subtotal Spent on Operations $155,362 $175,944 $182,962

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $0 $0 $0

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $7,200 $7,813 $7,878

Purchase Other Current Assets $0 $0 $0

Purchase Long-term Assets $0 $0 $0

Dividends $0 $0 $0

Subtotal Cash Spent $162,562 $183,757 $190,840

Net Cash Flow ($15,691) $9,810 $30,614

Cash Balance $6,209 $16,019 $46,633

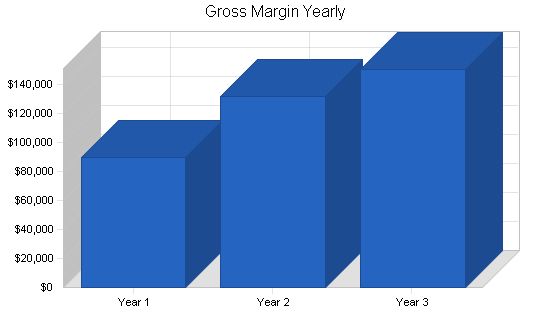

7.4 Projected Profit and Loss

The following table presents projected profit and loss.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $131,871 | $193,567 | $221,453 |

| Direct Cost of Sales | $42,551 | $62,459 | $71,457 |

| Other Costs of Goods | $0 | $0 | $0 |

| Total Cost of Sales | $42,551 | $62,459 | $71,457 |

| Gross Margin | $89,320 | $131,108 | $149,996 |

| Gross Margin % | 67.73% | 67.73% | 67.73% |

| Expenses | |||

| Payroll | $85,400 | $74,400 | $66,500 |

| Sales and Marketing and Other Expenses | $6,000 | $8,000 | $10,000 |

| Depreciation | $1,404 | $1,404 | $1,404 |

| Rent | $6,000 | $6,000 | $6,000 |

| Utilities | $0 | $0 | $0 |

| Insurance | $0 | $0 | $0 |

| Payroll Taxes | $12,810 | $9,675 | $9,975 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $111,614 | $99,479 | $93,879 |

| Profit Before Interest and Taxes | ($22,294) | $31,629 | $56,117 |

| EBITDA | ($20,890) | $33,033 | $57,521 |

| Interest Expense | $4,610 | $3,889 | $3,105 |

| Taxes Incurred | $0 | $8,322 | $15,904 |

| Net Profit | ($26,904) | $19,418 | $37,109 |

| Net Profit/Sales | -20.40% | 10.03% | 16.76% |

7.5 Business Ratios

The following business ratios detail both ratios specific to Safe Current as well as ratios specific to the general industry. Variances in Safe Current’s ratios relative to the industry’s can be explained by the fact that Safe Current is able to leverage the valuable assets of TCIC, an electric utility, to achieve above market margins. As a small business unit of an electrical utility, it is normal for business ratios to be different from the competition.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 46.78% | 14.41% | 8.79% |

| Percent of Total Assets | ||||

| Inventory | 22.53% | 23.67% | 15.38% | 17.86% |

| Other Current Assets | 10.42% | 7.46% | 4.24% | 43.53% |

| Total Current Assets | 54.52% | 70.94% | 85.47% | 77.93% |

| Long-term Assets | 45.48% | 29.06% | 14.53% | 22.07% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 29.51% | 20.71% | 13.67% | 31.98% |

| Long-term Liabilities | 148.65% | 86.96% | 38.28% | 20.70% |

| Total Liabilities | 178.16% | 107.67% | 51.96% | 52.68% |

| Net Worth | -78.16% | -7.67% | 48.04% | 47.32% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 67.73% | 67.73% | 67.73% | 20.85% |

| Selling, General & Administrative Expenses | 88.10% | 54.09% | 50.95% | 6.60% |

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 0.49% |

| Profit Before Interest and Taxes | -16.91% | 16.34% | 25.34% | 1.44% |

| Main Ratios | ||||

| Current | 1.85 | 3.43 | 6.25 | 1.96 |

| Quick | 1.08 | 2.28 | 5.13 | 1.15 |

| Total Debt to Total Assets | 178.16% | 107.67% | 51.96% | 57.62% |

| Pre-tax Return on Net Worth | 119.55% | -898.84% | 155.82% | 3.71% |

| Pre-tax Return on Assets | -93.44% | 68.95% | 74.86% | 8.76% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | -20.40% | 10.03% | 16.76% | n.a |

| Return on Equity | 0.00% | 0.00% | 109.07% | n.a |

| Activity Ratios | ||||

| Inventory Turnover | 10.91 | 7.80 | 7.00 | n.a |

| Accounts Payable Turnover | 9.23 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 30 | 28 | n.a |

| Total Asset Turnover | 4.58 | 4.81 | 3.13 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.00 | 0.00 | 1.08 | n.a |

| Current Liab. to Liab. | 0.17 | 0.19 | 0.26 | n.a |

|

Month 1, Month 2, Month 3, Month 4, Month 5, Month 6, Month 7, Month 8, Month 9, Month 10, Month 11, Month 12 Plan Month: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12 Current Interest Rate: 10.00% Long-term Interest Rate: 10.00% Tax Rate: 30.00% Other: 0 Pro Forma Profit and Loss: Sales, Direct Cost of Sales, Other Costs of Goods, Total Cost of Sales, Gross Margin, Gross Margin %, Expenses, Payroll, Sales and Marketing and Other Expenses, Depreciation, Rent, Utilities, Insurance, Payroll Taxes, Other, Total Operating Expenses, Profit Before Interest and Taxes, EBITDA, Interest Expense, Taxes Incurred, Net Profit, Net Profit/Sales Pro Forma Cash Flow: Cash Received, Cash from Operations, Cash Sales, Subtotal Cash from Operations, Additional Cash Received, Sales Tax, VAT, HST/GST Received, New Current Borrowing, New Other Liabilities (interest-free), New Long-term Liabilities, Sales of Other Current Assets, Sales of Long-term Assets, New Investment Received, Subtotal Cash Received, Expenditures, Expenditures from Operations, Cash Spending, Bill Payments, Subtotal Spent on Operations, Additional Cash Spent, Sales Tax, VAT, HST/GST Paid Out, Principal Repayment of Current Borrowing, Other Liabilities Principal Repayment, Long-term Liabilities Principal Repayment, Purchase Other Current Assets, Purchase Long-term Assets, Dividends, Subtotal Cash Spent, Net Cash Flow, Cash Balance |

||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!