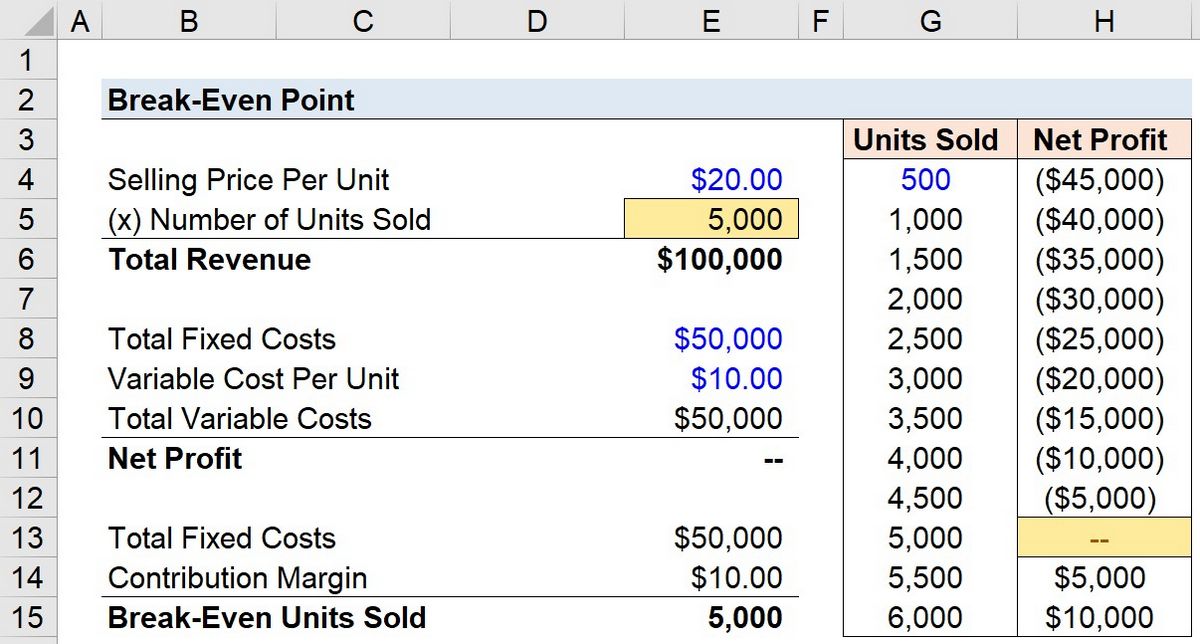

Break-Even Calculator

A break-even analysis tells you the amount you need to sell to cover your business costs. This analysis is useful if your products or services have associated costs, such as buying materials. Each product you sell incurs an additional cost – the materials for production. Therefore, selling more increases your expenses.

What you need to calculate your break-even point

To calculate your break-even point (where sales cover expenses), you need three key numbers.

- Average Per-Unit Revenue: The average money you receive for each product or service sold. Include discounts or special offers. If your company sells multiple products or services, calculate the average selling price for all of them.

- Average Per-Unit Cost: The cost to deliver your product or service. For reselling, it’s the purchase cost. For manufacturing, include materials costs. Exclude salaries. For services, include costs like paper or travel expenses.

- Monthly Fixed Costs: The expenses that exist regardless of sales, such as rent and insurance. For a simpler estimate, use regular running costs like payroll and normal expenses.

Once you know these numbers, use the calculator above. Enter your values to determine the number of units (products) you need to sell per month to cover costs. The calculator will also show the total revenue needed to cover fixed costs and delivery costs.

Your break-even point is where the chart line intersects the zero line.

If you have questions about calculating your break-even point, please contact us on Twitter or Facebook.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!