Furniture Import Business Plan

Poppi Designs, an importer of Italian furniture in New York, aims to minimize competition by targeting specific niches that are not served by larger furniture retailers. With the expertise of Luca de Febonio in Italy, the company will have control over the importation process. Three keys to success for Poppi Designs are establishing high-quality relationships with vendors and customers, ensuring reliable and timely delivery, and maintaining a reliable administration.

Poppi Designs will target three market segments: specialty retailers, designers, and unfinished furniture retailers. The market is based on the actual product and the service provider, with less emphasis on brand equity. The ability to choose from a variety of manufacturers is advantageous for Poppi Designs.

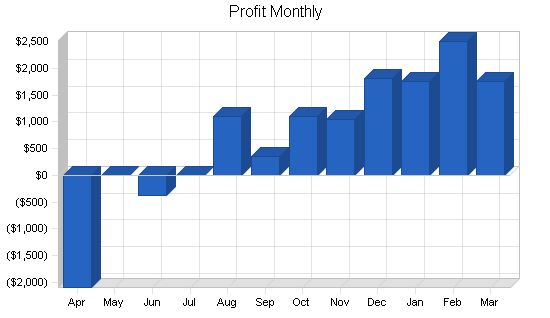

The sales strategy for Poppi Designs involves direct sales calls on all market segments, except interior designers. The owner, Kate Jackson, will personally make sales calls due to her background and knowledge of the products and competitors. Poppi Designs plans to achieve profitability by month two and expects sales to double from year one to year three.

Objectives:

1. Implement efficient administrative machinery to allow the owner to focus on sales and major accounts.

2. Concentrate efforts on selected market sectors.

3. Improve reliability and timeliness of shipments from Italy.

Mission:

Poppi Designs aims to supply market niches for chairs and other furniture items that are not well served by domestic manufacturers. The owner utilizes her background and contacts in Italy to tailor products to the needs of these market niches.

Keys to Success:

1. Offer high-quality items that are not widely available.

2. Ensure reliable and timely deliveries.

3. Maintain a reliable administration to serve customers, prepare accurate billing, and closely monitor expenses and accounts receivable.

Company Summary

Poppi Designs imports furniture from Italy with minimal overhead and focuses on niche markets in New England. Previously, they tried to compete with larger manufacturers and import houses but now target smaller segments that are not well-served by those companies. Poppi leverages the owner’s interior design background to cater to designer clientele.

2.1 Company Ownership

Poppi Designs is equally owned by Kate Jackson from Wenham, New York and Luca de Febonio from Rome, Italy. Kate brings 20 years of design experience and knowledge of the U.S. market while Sr. de Febonio has 25 years of furniture manufacturing and shipping experience in Italy. Ms. Jackson handles daily management, sales, and development, while Sr. de Febonio is responsible for manufacturing, quality control, and shipping to the U.S.

2.2 Company History

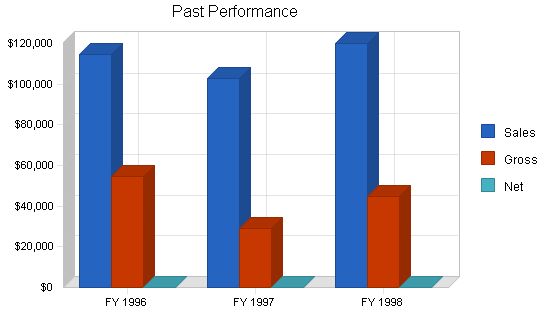

Initially, Poppi established a showroom in High Point, N.C., the furniture buying capital of the U.S. However, due to economic factors, the venture was unsuccessful. As the country recovered, the furniture market became more global and competitive. Poppi realized the need to find its own niche and decided to focus on a smaller geographic region and specific market segments. Additionally, they started warehousing to meet customer demand and have since seen steady sales growth.

Past Performance:

Sales:

– FY 1996: $114,541

– FY 1997: $102,946

– FY 1998: $120,000

Gross Margin:

– FY 1996: $54,653

– FY 1997: $29,229

– FY 1998: $45,000

Gross Margin %:

– FY 1996: 47.71%

– FY 1997: 28.39%

– FY 1998: 37.50%

Operating Expenses:

– FY 1996: $56,349

– FY 1997: $34,192

– FY 1998: $40,000

Collection Period (days): 0

Inventory Turnover:

– FY 1996: 5.00

– FY 1997: 5.00

– FY 1998: 6.00

Balance Sheet:

Current Assets:

– Cash: $0

– Accounts Receivable: $0

– Inventory: $0

– Other Current Assets: $0

– Total Current Assets: $0

Long-term Assets:

– Long-term Assets: $0

– Accumulated Depreciation: $0

– Total Long-term Assets: $0

Total Assets: $0

Current Liabilities:

– Accounts Payable: $0

– Current Borrowing: $0

– Other Current Liabilities: $0

– Total Current Liabilities: $0

Long-term Liabilities: $0

Total Liabilities: $0

Paid-in Capital: $0

Retained Earnings: $0

Earnings: $0

Total Capital: $0

Total Capital and Liabilities: $0

Other Inputs:

– Payment Days: 0

– Sales on Credit: $0

– Receivables Turnover: 0.00

2.3 Company Locations and Facilities:

Poppi works out of the owner’s home. Warehouse space is shared with primary finishers in Plainview, New York, where Flair Finishers provide a small showroom.

Products:

Poppi Designs’ product line includes over 200 items such as chairs, stools, dressers, bookshelves, mirrors, screens, side tables, dining tables, and lounges. To stock all these items is not feasible, but they can be purchased by special order. Poppi focuses on a limited number of items suitable for the targeted market sectors and keeps a stock ready for immediate delivery.

3.1 Competitive Comparison:

A notable competitor in the targeted retail outlets is Chapman International. Chapman’s catalog is excellent and in color. All items in the catalog are available immediately, unfinished, from stock in Delaware. The following is a price comparison:

Chapman Item Raw Finished Premium Finish Poppi Item Raw Finished

Renaissance "A" $197 $235 $270 156A $202 $264

Renaissance "S" $165 $195 $220 155S $177 $234

Splat Side $132 $150 $175 152S $150 $206

Celestial "S" $127 $145 $170 150S $191 $247

Celestial "A" $162 $190 $225 151A $219 $281

Poppi’s finished prices are higher than Chapman’s. The Renaissance model is the closest comparison. The other two models from Chapman have less substance compared to Poppi’s chairs.

Price competitiveness is important, especially considering the retailer’s margin. Poppi’s higher quality chairs can compensate for the price difference. However, pricing is only one aspect of competition. Chapman’s excellent catalog and immediate availability may attract customers if Poppi faces delivery issues.

A price comparison was also performed for unfinished chairs targeted for the designer market. Columbia and Atlantic, major New York furniture import houses, were chosen for comparison:

Columbia’s Item#382S and 382A: $255 and $283 respectively (raw)

Atlantic’s Item#7616S & A: $275 and $295 respectively (raw)

Poppi Designs’ equivalent: $217 and $290 (raw)

Comparing finished prices is difficult due to the range of finish options. Poppi’s finished, upholstered price of $417 and $490 for the side and arm chair respectively compares with Columbia’s prices of $448 and $482 and Atlantic’s prices of $490-605 (depending on the finish type) for the side chair and $525-645 for the armchair.

3.2 Sourcing:

Poppi Designs’ products are imported from Italy through Luca de Febonio, an agent who receives a 7% commission. Luca is also a 50% owner of Poppi Designs. He coordinates production schedules with local factories and handles all matters until the goods are ready for shipment. Payment is made directly to the producing factories at the prevailing exchange rate for Italian Lira.

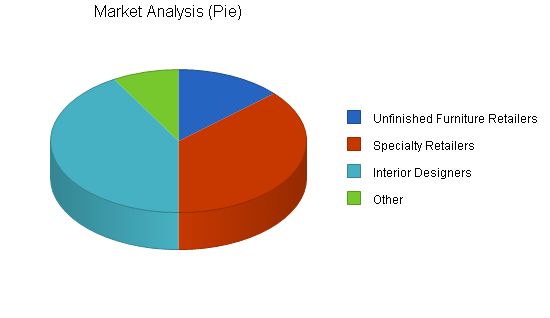

Market Analysis Summary:

Poppi Designs targets several market niches to be successful. The identified promising areas are Specialty Retail, Designers, and Unfinished Furniture Retailers. Specialty Retail accounts for nearly 80% of present sales, but efforts in marketing the other two customer groups will increase.

4.1 Market Segmentation:

According to U.S. government statistics, there are over 17,000 furniture outlets nationwide, falling into various categories:

1. High-end: Carry furniture by top manufacturers, selling at high prices.

2. Middle Range: Target up-market buyers with slightly lower prices.

3. Mass Merchandisers: Sell furniture with broad appeal and high volume at lower quality and prices.

4. Low-end: Sell chairs with virtually no hand work, often requiring assembly by the purchaser.

5. Unfinished Furniture Outlets: Vary in quality and offer finishing options.

6. Specialty Retailers: Combine antiques and reproductions, avoiding items available at larger retailers.

7. Designer Market: Designers buy unfinished chairs and have them finished for higher profits.

The last three market sectors, Unfinished Furniture Outlets, Specialty Retailers, and Designers, are attractive to Poppi’s products. Each segment is expected to grow at a steady rate of 2% per year.

Market Analysis

1998 1999 2000 2001 2002

Potential Customers Growth CAGR

Unfinished Furniture Retailers 2% 16 16 16 16 0.00%

Specialty Retailers 2% 44 45 46 47 48 2.20%

Interior Designers 2% 50 51 52 53 54 1.94%

Other 1% 10 10 10 10 10 0.00%

Total 1.63% 120 122 124 126 128 1.63%

4.2 Target Market Segment Strategy

Due to limited resources, Poppi Designs will avoid the middle- and high-end furniture segments. The company will focus on underserved segments of the Designer and Unfinished Furniture markets to diversify its customer base. Established connections with Italian manufacturers will help source rarely available products in strong demand.

4.2.1 Market Needs

Customer needs across the three segments are similar. Unfinished furniture outlets require furniture that can be finished by customers or on-site finishers. Designer stores require unfinished furniture that can be easily finished and allow for premium pricing. Specialty retailers have shown a need for antique-looking furniture that can be met by special finishes.

The most attractive market areas for Poppi Designs are:

– Unfinished Furniture Outlets: Select sellers of unfinished furniture located within an hour’s drive from Poppi’s offices.

– Specialty Retailers: Outlets with a mix of antique and reproduction furniture located within an hour’s drive of Boston.

4.3.1 Industry Participants

Large manufacturers headquartered in High Point, North Carolina dominate the furniture business. Local manufacturers specialize in specific wood or style. Poppi’s products do not usually compete with domestic products coming out of the South. Smaller importers are preferred by specialty outlets for a more unique line.

4.3.2 Distribution Patterns

Most furniture outlets require customers to order furniture instead of supplying off the showroom floor. Large institutional buyers negotiate directly with manufacturers. Poppi Designs plans to sell directly to the design trade and offer discounts to small and large retailers. Selling full container loads directly to big buyers is also considered.

4.3.3 Competition and Buying Patterns

Brand names are not important to consumers. The buying decision depends on the salesman and the chair being in front of the buyer. Poppi’s chairs must be available in retail outlets, as many specialty outlets only carry chairs from one supplier.

4.3.4 Main Competitors

Chapman is the most frequently seen competitor selling to Poppi’s targeted outlets. Chapman products are produced in Italy and imported by a firm in Delaware. Although Chapman chairs have a full-color catalog, they are inferior in quality to Poppi’s chairs.

Strategy and Implementation Summary

Poppi Designs will differentiate itself by offering a specific line of solid, hand-carved furniture to selected customer segments in limited geographic areas. Established connections with Italian manufacturers will provide unique products. Kate Jackson’s industry experience and selling skills will contribute to sales penetration.

5.1 Competitive Edge

Poppi will utilize its connections with Italian manufacturers to offer unique products in selected U.S. markets. Kate Jackson’s industry experience will also contribute to sales penetration.

The pricing, promotion, and distribution strategies for Poppi Designs are as follows.

5.2.1 Pricing Strategy

List price is charged to the designer segment. A 12% discount is offered to the retail segment, and a 36% discount is offered for full container orders.

5.2.2 Promotion Strategy

Direct mail in the form of postcard-sized mailings will be used to identify interested interior designers. Promotional strategies such as offering a free armchair for every five side chairs purchased will help retailers decide to carry Poppi’s products.

5.2.3 Distribution Strategy

Poppi Designs plans to sell directly to retailers. Selling directly to consumers via classified ads requires further study.

5.3 Sales Strategy

Direct sales calls will be made on all target market segments except interior designers. Kate Jackson will handle these sales calls and a full-time team member will be hired to assist. Sales calls will be scheduled to achieve three or four calls per day.

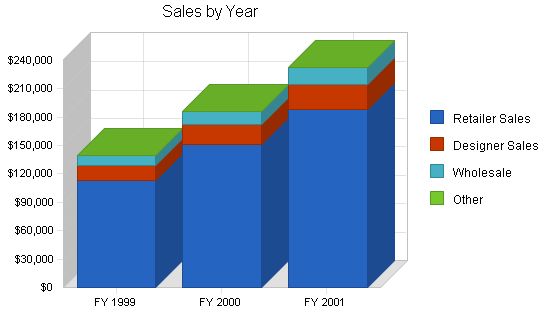

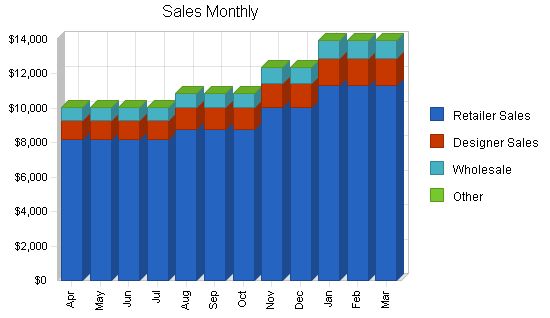

5.3.1 Sales Forecast

Sales projections assume reasonable success from marketing efforts. Unit sales of chairs are projected to be 900, 1200, and 1500 in 1998, 1999, and 2000 respectively. Monthly unit sales will gradually increase from 65 monthly in April-July 1998 to 90 units by January 1999. Sales will be primarily to retailers, with smaller percentages going to wholesalers and the design trade.

Sales Forecast

| Sales Forecast | |||

| FY 1999 | FY 2000 | FY 2001 | |

| Sales | |||

| Retailer Sales | $113,040 | $150,720 | $188,400 |

| Designer Sales | $16,020 | $21,360 | $26,700 |

| Wholesale | $10,260 | $13,680 | $17,100 |

| Other | $0 | $0 | $0 |

| Total Sales | $139,320 | $185,760 | $232,200 |

5.4 Strategic Alliances

As a result of High Point, North Carolina, Poppi Designs has developed alliances with showrooms in both Columbus, Ohio and New York. These showrooms will display Poppi chairs in May of 1998.

Poppi has also established an alliance with Mercator Upholstery in Boston. Mercator services the high-end design trade with upholstered chairs. They will display Poppi chairs in their upholstery facilities, allowing designers and clients to make unique chair selections. Poppi plans to pursue similar alliances with other upholsterers, such as Hondius Upholstery.

Management Summary

Poppi Designs is managed by the owner and one other member. The owner’s primary focus is on sales, while the other team member handles administrative functions.

6.1 Management Team Gaps

A new team member is needed to handle administrative tasks, allowing the owner to concentrate on new sales, existing accounts, and company strategy.

New team member duties:

1. Enter and maintain financial entries in the computerized accounts.

2. Invoice, bill, and expedite past-due accounts over the phone.

3. Organize paperwork related to orders for shipments from Italy.

4. Prepare the landed cost for each imported item.

5. Answer customer calls and communicate with the owner.

6.2 Personnel Plan

To free up the owner’s time for sales, a capable individual must be added to handle administration.

| Personnel Plan | |||

| FY 1999 | FY 2000 | FY 2001 | |

| Admin. Assist. | $19,992 | $24,000 | $24,000 |

| Owner | $24,000 | $30,000 | $35,000 |

| Other | $0 | $0 | $0 |

| Total People | 2 | 2 | 2 |

| Total Payroll | $43,992 | $54,000 | $59,000 |

The owner’s private resources will be used to finance any monthly cash-flow shortage. Establishing a bank relationship is advisable to support potential sales growth. An overdraft line of credit of $15,000-20,000 would provide a cushion.

7.1 Important Assumptions

Payroll burden is calculated at 12.65%, including social security, unemployment, and worker’s compensation. Payables will reach one month’s operating expenses, while accounts receivable are assumed to be 45 days.

Inventory turnover reflects the impact of container shipments on inventory levels. Monthly inventory calculations account for projected sales and new stock arrivals.

| General Assumptions | |||

| FY 1999 | FY 2000 | FY 2001 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 0.00% | 0.00% | 0.00% |

| Long-term Interest Rate | 0.00% | 0.00% | 0.00% |

| Tax Rate | 25.42% | 25.00% | 25.42% |

| Other | 0 | 0 | 0 |

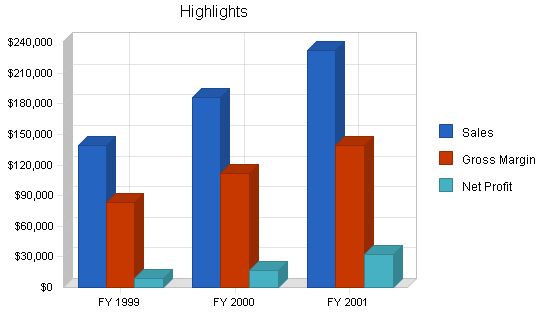

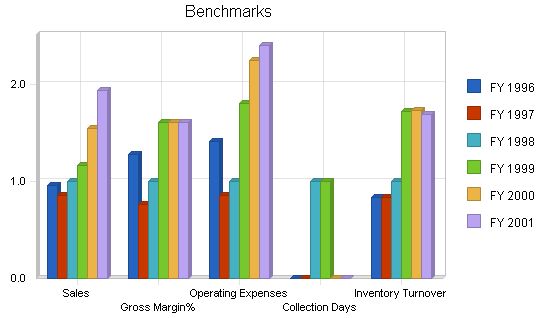

7.2 Key Financial Indicators

The following chart outlines key financial indicators for fiscal years 1996-2001.

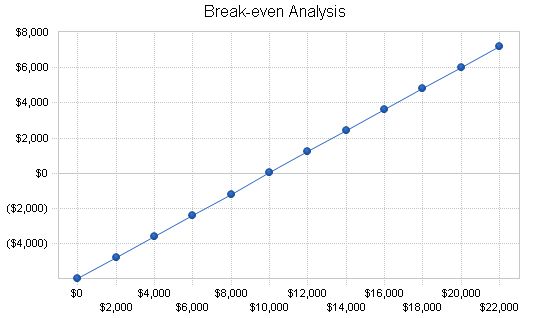

Break-even Analysis:

Our break-even analysis is summarized below:

Note: The chart and table display the break-even analysis information.

Break-even Analysis

Monthly Revenue Break-even: $9,979

Assumptions:

– Average Percent Variable Cost: 40%

– Estimated Monthly Fixed Cost: $5,987

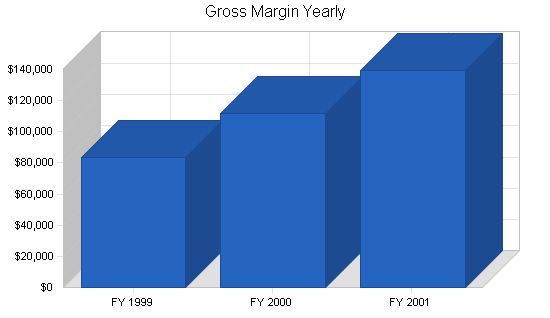

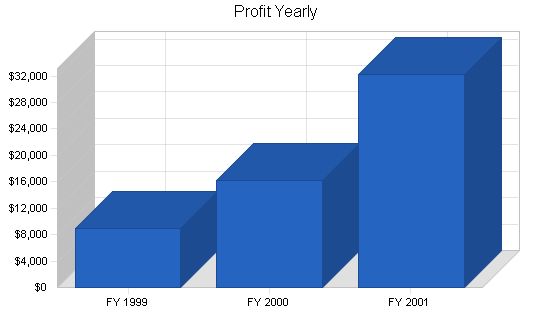

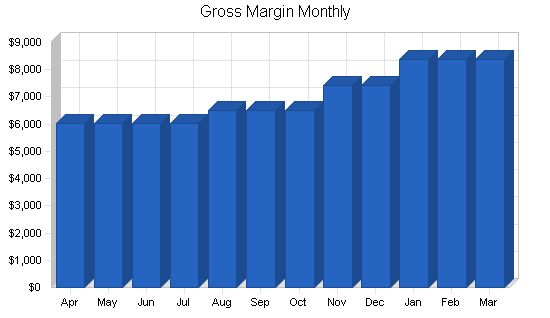

7.4 Projected Profit and Loss

When determining a projected profit and loss statement, various factors must be considered, as shown in the table below.

Pro Forma Profit and Loss

FY 1999 FY 2000 FY 2001

Sales $139,320 $185,760 $232,200

Direct Cost of Sales $55,728 $74,304 $92,880

Other $0 $0 $0

Total Cost of Sales $55,728 $74,304 $92,880

Gross Margin $83,592 $111,456 $139,320

Gross Margin % 60.00% 60.00% 60.00%

Expenses

Payroll $43,992 $54,000 $59,000

Sales and Marketing and Other Expenses $17,320 $17,320 $17,320

Depreciation $0 $0 $0

Leased Equipment $0 $0 $0

Utilities (Telephone) $6,000 $6,000 $6,000

Insurance (Liability/Fire) $1,500 $1,500 $1,500

Rent (Warehouse) $0 $4,800 $4,800

Payroll Taxes $3,036 $6,199 $7,464

Agent Commission $0 $0 $0

Other $0 $0 $0

Total Operating Expenses $71,848 $89,819 $96,084

Profit Before Interest and Taxes $11,744 $21,638 $43,237

EBITDA $11,744 $21,638 $43,237

Interest Expense $0 $0 $0

Taxes Incurred $2,786 $5,409 $10,989

Net Profit $8,958 $16,228 $32,247

Net Profit/Sales 6.43% 8.74% 13.89%

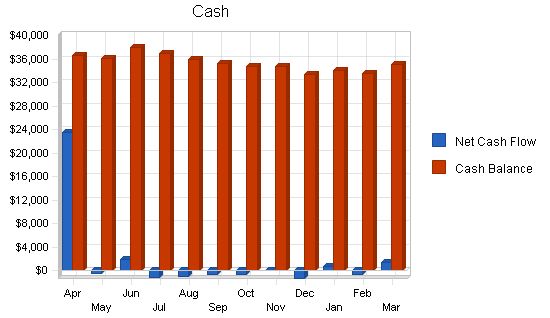

7.5 Projected Cash Flow

Our projected cash flow is outlined in the following chart and table.

Pro Forma Cash Flow

FY 1999 FY 2000 FY 2001

Cash Received

Cash from Operations

Cash Sales $0 $0 $0

Cash from Receivables $128,486 $178,949 $225,389

Subtotal Cash from Operations $128,486 $178,949 $225,389

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $5,000 $0 $0

Sales of Other Current Assets $21,000 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $0 $0 $0

Subtotal Cash Received $154,486 $178,949 $225,389

Expenditures

Expenditures from Operations

Cash Spending $43,992 $54,000 $59,000

Bill Payments $76,502 $116,146 $140,907

Subtotal Spent on Operations $120,494 $170,146 $199,907

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $0 $0 $0

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $12,000 $12,000 $12,000

Purchase Other Current Assets $0 $0 $0

Purchase Long-term Assets $0 $0 $0

Dividends $0 $0 $0

Subtotal Cash Spent $132,494 $182,146 $211,907

Net Cash Flow $21,992 ($3,197) $13,482

Cash Balance $34,992 $31,795 $45,277

Projected Balance Sheet

Assets

Current Assets

Cash $34,992 $31,795 $45,277

Accounts Receivable $20,434 $27,245 $34,056

Inventory $6,130 $8,173 $10,217

Other Current Assets $0 $0 $0

Total Current Assets $61,556 $67,213 $89,550

Long-term Assets

Long-term Assets $3,000 $3,000 $3,000

Accumulated Depreciation $3,000 $3,000 $3,000

Total Long-term Assets $0 $0 $0

Total Assets $61,556 $67,213 $89,550

Liabilities and Capital

Current Liabilities

Accounts Payable $8,234 $9,664 $11,753

Current Borrowing $0 $0 $0

Other Current Liabilities $15,000 $15,000 $15,000

Subtotal Current Liabilities $23,234 $24,664 $26,753

Long-term Liabilities

$173,000 $161,000 $149,000

Total Liabilities $196,234 $185,664 $175,753

Paid-in Capital $10,000 $10,000 $10,000

Retained Earnings ($153,636) ($144,678) ($128,450)

Earnings $8,958 $16,228 $32,247

Total Capital ($134,678) ($118,450) ($86,203)

Total Liabilities and Capital $61,556 $67,213 $89,550

Sales Growth 16.10% 33.33% 25.00% 6.12%

Percent of Total Assets

Accounts Receivable 33.20% 40.53% 38.03% 26.55%

Inventory 9.96% 12.16% 11.41% 40.47%

Other Current Assets 0.00% 0.00% 0.00% 20.71%

Total Current Assets 100.00% 100.00% 100.00% 87.73%

Long-term Assets 0.00% 0.00% 0.00% 12.27%

Total Assets 100.00% 100.00% 100.00% 100.00%

Current Liabilities 37.75% 36.69% 29.88% 35.88%

Long-term Liabilities 281.04% 239.54% 166.39% 10.04%

Total Liabilities 318.79% 276.23% 196.26% 45.92%

Net Worth -218.79% -176.23% -96.26% 54.08%

Percent of Sales

Sales 100.00% 100.00% 100.00% 100.00%

Gross Margin 60.00% 60.00% 60.00% 13.68%

Selling, General & Administrative Expenses 40.25% 46.58% 43.37% 5.84%

Advertising Expenses 4.31% 3.23% 2.58% 0.69%

Profit Before Interest and Taxes 8.43% 11.65% 18.62% 1.61%

Main Ratios

Current 2.65 2.73 3.35 2.22

Quick 2.39 2.39 2.97 0.98

Total Debt to Total Assets 318.79% 276.23% 196.26% 50.20%

Pre-tax Return on Net Worth -8.72% -18.27% -50.16% 5.00%

Pre-tax Return on Assets 19.08% 32.19% 48.28% 10.03%

Additional Ratios

Net Profit Margin 6.43% 8.74% 13.89% n.a.

Return on Equity 0.00% 0.00% 0.00% n.a.

Activity Ratios

Accounts Receivable Turnover 6.82 6.82 6.82 n.a.

Collection Days 44 47 48 n.a.

Inventory Turnover 10.30 10.39 10.10 n.a.

Accounts Payable Turnover 9.80 12.17 12.17 n.a.

Payment Days 29 28 27 n.a.

Total Asset Turnover 2.26 2.76 2.59 n.a.

Debt Ratios

Debt to Net Worth 0.00 0.00 0.00 n.a.

Current Liab. to Liab. 0.12 0.13 0.15 n.a.

Liquidity Ratios

Net Working Capital $38,322 $42,550 $62,797 n.a.

Interest Coverage 0.00 0.00 0.00 n.a.

Additional Ratios

Assets to Sales 0.44 0.36 0.39 n.a.

Current Debt/Total Assets 38% 37% 30% n.a.

Acid Test 1.51 1.29 1.69 n.a.

Sales/Net Worth 0.00 0.00 0.00 n.a.

Dividend Payout 0.00 0.00 0.00 n.a.

Appendix

Sales Forecast

Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar

Sales

Retailer Sales $8,164 $8,164 $8,164 $8,164 $8,792 $8,792 $8,792 $10,048 $10,048 $11,304 $11,304 $11,304

Designer Sales $1,157 $1,157 $1,157 $1,157 $1,246 $1,246 $1,246 $1,424 $1,424 $1,602 $1,602 $1,602

Wholesale $741 $741 $741 $741 $798 $798 $798 $912 $912 $1,026 $1,026 $1,026

Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Sales $10,062 $10,062 $10,062 $10,062 $10,836 $10,836 $10,836 $12,384 $12,384 $13,932 $13,932 $13,932

Direct Cost of Sales

Retailer Sales $3,266 $3,266 $3,266 $3,266 $3,517 $3,517 $3,517 $4,019 $4,019 $4,522 $4,522 $4,522

Designer Sales $463 $463 $463 $463 $498 $498 $498 $570 $570 $641 $641 $641

Wholesale $296 $296 $296 $296 $319 $319 $319 $365 $365 $410 $410 $410

Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Subtotal Direct Cost of Sales $4,025 $4,025 $4,025 $4,025 $4,334 $4,334 $4,334 $4,954 $4,954 $5,573 $5,573 $5,573

Personnel Plan

Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar

Admin. Assist. $1,666 $1,666 $1,666 $1,666 $1,666 $1,666 $1,666 $1,666 $1,666 $1,666 $1,666 $1,666

Owner $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000

Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total People 2 2 2 2 2 2 2 2 2 2 2 2

Total Payroll $3,666 $3,666 $3,666 $3,666 $3,666 $3,666 $3,666 $3,666 $3,666 $3,666 $3,666 $3,666

General Assumptions

| General Assumptions | |||||||||||||

| Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | Feb | Mar | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | |

| Long-term Interest Rate | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | |

| Tax Rate | 30.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||||||||||||

| Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | Feb | Mar | ||

| Sales | $10,062 | $10,062 | $10,062 | $10,062 | $10,836 | $10,836 | $10,836 | $12,384 | $12,384 | $13,932 | $13,932 | $13,932 | |

| Direct Cost of Sales | $4,025 | $4,025 | $4,025 | $4,025 | $4,334 | $4,334 | $4,334 | $4,954 | $4,954 | $5,573 | $5,573 | $5,573 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $4,025 | $4,025 | $4,025 | $4,025 | $4,334 | $4,334 | $4,334 | $4,954 | $4,954 | $5,573 | $5,573 | $5,573 | |

| Gross Margin | $6,037 | $6,037 | $6,037 | $6,037 | $6,502 | $6,502 | $6,502 | $7,430 | $7,430 | $8,359 | $8,359 | $8,359 | |

| Gross Margin % | 60.00% | 60.00% | 60.00% | 60.00% | 60.00% | 60.00% | 60.00% | 60.00% | 60.00% | 60.00% | 60.00% | 60.00% | |

| Expenses | |||||||||||||

| Payroll | $3,666 | $3,666 | $3,666 | $3,666 | $3,666 | $3,666 | $3,666 | $3,666 | $3,666 | $3,666 | $3,666 | $3,666 | |

| Sales and Marketing and Other Expenses | $4,610 | $1,610 | $610 | $1,610 | $610 | $1,610 | $610 | $1,610 | $610 | $1,610 | $610 | $1,610 | |

| Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Leased Equipment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Utilities (Telephone) | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | |

| Insurance (Liability/Fire) | $0 | $0 | $1,500 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Rent (Warehouse) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Payroll Taxes | 13% | $253 | $253 | $253 | $253 | $253 | $253 | $253 | |||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!