Contents

Roller Skate Rink Business Plan

McKenzie Roller Rink is a modern facility offering recreational skating to individuals as well as catering to group gatherings. The rink has been at its present location for five years and was previously known as Roller Kingdom. McKenzie Roller Rink has taken over the business due to mismanagement, without any capital outlay. The rink is located in Eugene, Oregon and has excellent access to major roads and interstates.

With upgraded facilities, McKenzie Roller Rink will provide a unique recreational opportunity to the Lane County area. A concessions area will serve a wide variety of food choices. Party rooms are available for large groups including civic organizations, church groups, and school functions. With a dedicated staff, McKenzie Roller Rink aims to provide excellent customer service and foster continued growth in loyal customers. The target market for McKenzie Roller Rink includes local groups seeking a facility for their parties and functions.

By prioritizing customer service, McKenzie Roller Rink will differentiate itself from other recreational options in the area and establish a welcoming atmosphere for our target market. Building lasting relationships with civic groups, church groups, and school groups is important to us. We will also be actively involved in community activities. Our website will cater to various customers seeking recreational alternatives, providing information on our operating hours, facilities, and costs.

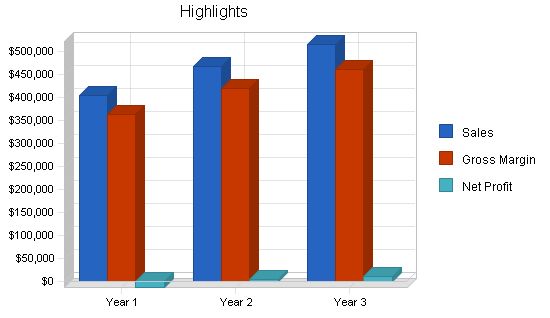

Our management philosophy is based on responsibility and mutual respect. Employees at McKenzie Roller Rink will work in an environment that encourages creativity and fun. Alongside a team of 10 employees, Don Jones, the majority owner with extensive experience in this field, will actively participate in the day-to-day operations. David Barkley and Paul Robins, the other two owners, will provide strong leadership for the company. McKenzie Roller Rink aims to achieve first-year sales exceeding $400,000, with a projected increase of 5-9% for year two.

McKenzie Roller Rink provides recreational skating to the public and private bookings for group activities. With excellent party facilities and concessions that offer a variety of food choices, McKenzie Roller Rink is dedicated to providing a first-class skating facility that promotes family-centered activity. Customer service is a priority to maintain a positive and fun atmosphere. Safety for patrons is a top priority and employees are considered valuable assets.

The objectives of McKenzie Roller Rink are to increase sales to over $1 million by the third year, bring the gross margin back up to above 90% and maintain that level, and increase customer approval ratings by 20% by the second year.

The keys to success in this business are marketing, increasing interest in skating as a recreational activity; providing attractive facilities for individual and group activities; and delivering exceptional customer service to create a desire for repeat visits.

McKenzie Roller Rink is a new enterprise that has taken over an existing facility previously leased by Roller Kingdom. The building was upgraded five years ago by the owners of Roller Kingdom, but they went out of business due to mismanagement. McKenzie Roller Rink has negotiated a lease with the building owners and took over the business with no capital outlay. With an aggressive management style and marketing plan, McKenzie Roller Rink plans to offer a unique recreational opportunity for families, civic organizations, schools, and church youth groups.

McKenzie Roller Rink is a privately-held C corporation majority-owned by President Don Jones. There are two part owners, David Barkley, our attorney, and Paul Robins, our public relations and marketing consultant. Neither owns more than 15%, but both actively participate in management decisions.

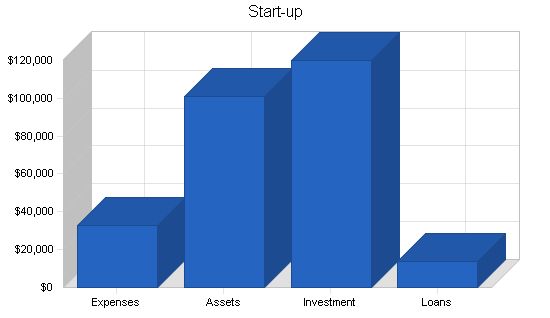

The start-up costs for McKenzie Roller Rink amount to $43,000, primarily for building renovation and new equipment purchases. These costs will be financed by direct owner investment and our other two independent investors.

Start-up Requirements

Start-up Expenses

Legal: $1,500

Stationery etc.: $500

Brochures: $1,000

Consultants: $1,500

Insurance: $2,000

Rent: $4,000

Renovations: $10,000

Expensed Equipment: $10,000

Website: $2,500

Total Start-up Expenses: $33,000

Start-up Assets

Cash Required: $94,000

Start-up Inventory: $5,000

Other Current Assets: $2,000

Long-term Assets: $0

Total Assets: $101,000

Total Requirements: $134,000

Start-up Funding

Start-up Expenses to Fund: $33,000

Start-up Assets to Fund: $101,000

Total Funding Required: $134,000

Assets

Non-cash Assets from Start-up: $7,000

Cash Requirements from Start-up: $94,000

Additional Cash Raised: $0

Cash Balance on Starting Date: $94,000

Total Assets: $101,000

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $0

Accounts Payable (Outstanding Bills): $14,000

Other Current Liabilities (interest-free): $0

Total Liabilities: $14,000

Capital

Planned Investment

Don Jones: $70,000

David Barkley: $35,000

Paul Robins: $15,000

Additional Investment Requirement: $0

Total Planned Investment: $120,000

Loss at Start-up (Start-up Expenses): ($33,000)

Total Capital: $87,000

Total Capital and Liabilities: $101,000

Total Funding: $134,000

Products and Services

McKenzie Roller Rink is a state of the art roller rink providing a unique recreational opportunity to the Lane County region. A concessions area will serve a variety of food choices and party rooms are available for small and large groups such as church youth groups, school functions, and civic organizations. With a dedicated staff, McKenzie Roller Rink is ready to provide excellent customer service and aims for continued growth in dedicated customers.

Market Analysis Summary

McKenzie Roller Rink will focus on local markets including civic groups, school groups, and church groups. Special focus will be placed on large group activities such as parties and school functions.

4.1 Market Segmentation

Our market segmentation is broken into three groups: civic organizations, school groups, and church groups. Parties with over ten people will be considered a group. We intend to create a wholesome family atmosphere and encourage families to consider skating as a recreational option. Additionally, we will target the greater Lane County area to encourage individual activity (groups under ten).

Market Analysis:

Year 1 Year 2 Year 3 Year 4 Year 5

Group Activity 15% 10,000 11,500 13,225 15,209 17,490 15.00%

Family Activity 10% 5,000 5,500 6,050 6,655 7,321 10.00%

Individual Activity 10% 7,000 7,700 8,470 9,317 10,249 10.00%

Total 12.36% 22,000 24,700 27,745 31,181 35,060 12.36%

4.2 Target Market Segment Strategy

Our choice of target markets is strategic. We believe that with the right facility and marketing plan, skating still has great potential as a recreational activity. Youth groups of all kinds are always planning activities and we intend to provide a safe, well-supervised facility that is fun. Additionally, groups attending the facility will introduce it to their families, expanding awareness of McKenzie Roller Rink as an entertainment option.

The closest skating facility is over 50 miles away, making us the only skating facility in the greater Lane County area. Without direct competition, our target market is all segments of Lane County. We are looking for customers who value a top-notch facility and excellent customer service. Safety is a priority, and all activity in our facility will be closely monitored.

4.3 Service Business Analysis

We are a skating facility serving the greater Lane County area. Our target markets include groups looking for recreational alternatives for parties and other functions, families looking for fun activities to do together, and individuals seeking a great facility for skating. Parents can trust us to provide a safe place for their kids.

4.3.1 Competition and Buying Patterns

Recreational consumers appreciate safe and fun facilities. Although we do not have direct competition, we still need to gain the public’s trust and business through an aggressive marketing plan, as consumers have alternative forms of entertainment. Indirect competition comes from other recreation activities in the area, such as bowling alleys, movie theaters, and restaurants. Based on our focus group sessions, our target markets value quality facilities, customer service, and wholesome family fun.

Strategy and Implementation Summary

Differentiate and fulfill the promise:

We must differentiate ourselves from other recreational opportunities in the area and establish a logical and viable alternative for our target market.

Build a relationship-oriented business:

Develop long-term relationships with civic groups, school groups, church groups, and the community as a whole. Be supportive and active in community activities.

Focus on target markets:

Concentrate our efforts on what our facilities have to offer small and large groups. Also, target the outlying markets in Lane County.

Emphasize customer service and support:

Our services must not only be marketed and sold but also delivered effectively. We need to provide a top-notch facility that is customer-friendly.

The marketing strategy is the core of our main strategy. It emphasizes customer service, building relationships with civic groups, church groups, and school groups, and providing an attractive facility that encourages repeat visits.

To develop effective business strategies, perform a SWOT analysis of your business. Use our free guide and template to learn how.

5.2 Sales Strategy

We need to sell our quality facilities as a recreational entertainment option that is affordable and fun. Customer service and safety are key selling points. Skating is an activity that can accommodate large groups and individuals, and we aim to provide a quality experience for our customers.

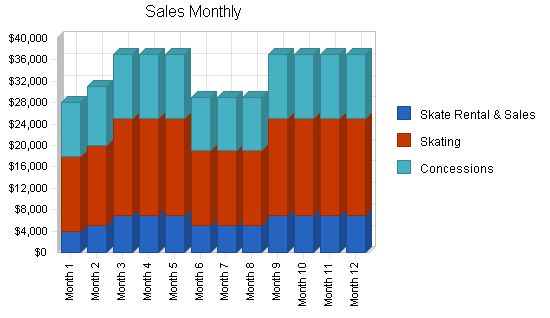

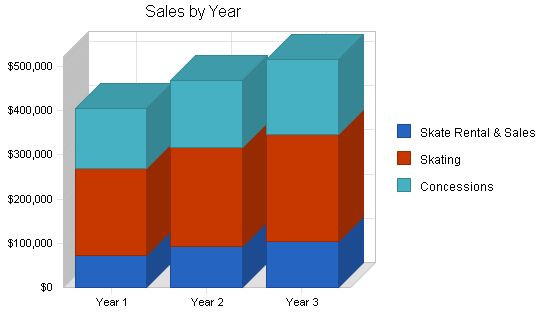

5.2.1 Sales Forecast

The important elements of the sales forecast are shown in the table below. Sales are projected to reach approximately $515,000 in the third year. The forecast takes into account a slowdown during the summer due to school vacations and other summer recreational opportunities for our customers. Concessions will contribute significantly to our revenue, and we will strive to continually improve our food choices.

Sales Forecast:

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| $73,000 | $92,000 | $105,000 | |

| $197,000 | $225,000 | $240,000 | |

| $135,000 | $150,000 | $170,000 | |

| $405,000 | $467,000 | $515,000 | |

Competitive Edge:

McKenzie Roller Rink has no direct competition from another roller rink. We will work hard to provide a quality product and attract new customers who are looking for a recreational option. With our top-notch facility and friendly staff, we aim to become the preferred choice for families, groups, and the general public.

Milestones:

Mr. Jones will handle the business plan and Web plan, Mr. Robins will be responsible for contracting with vendors and new equipment, and Mr. Barkley will handle the accounting plan.

| Milestones | |||||

| Start Date | End Date | Budget | Manager | Department | |

| 1/10/2003 | 1/20/2003 | $1,000 | Don Jones | Majority Owner | |

| 2/1/2003 | 2/15/2003 | $2,500 | Paul Robins | Administrator | |

| 2/29/2003 | 3/15/2003 | $1,000 | David Barkley | Accounting | |

| 4/20/2003 | 6/15/2003 | $3,000 | Ken Wise | Consultant | |

| 4/5/2003 | 4/30/2003 | $1,000 | Paul Robins | Administrator | |

| 5/6/2003 | 6/5/2003 | $1,000 | Paul Robins | Administrator | |

| 6/8/2003 | 7/2/2003 | $1,000 | Don Jones | Majority Owner | |

| $10,500 | |||||

Web Plan Summary:

The McKenzie Roller Rink website will provide detailed information about our facility, hours of operation, and costs. It will be designed to appeal to a wide range of consumers and will include a database to support future marketing efforts. We will track user traffic to determine the effectiveness of our web marketing.

Website Marketing Strategy:

We will target individuals and families looking for a recreational activity. Our website will showcase our facilities through photographs, provide information on our operating hours, highlight the benefits for large and small groups, and showcase our concessions area.

Development Requirements:

The McKenzie Roller Rink website will be developed using AOL Web services as the hosting provider. We will work with a contracted designer to create a simple and informative site, including a logo and graphics. An initial investment of $1,000 will be made for the implementation of the site. We will handle the maintenance ourselves and may explore additional features such as newsletters and market research reports.

Management Summary:

Our management philosophy is based on responsibility and mutual respect. Our team of 10 employees, including the majority owner and two partial owners, is dedicated to providing a fun and creative environment. Don Jones, with his experience in running ice skating rinks, will play an active role in the day-to-day operations of the rink. David Barkley and Paul Robins, with their successful business backgrounds, complement the team and bring sound business experience.

Personnel Plan:

We will maintain a workforce of no more than nine full and part-time employees. Total employment will remain stable throughout the first year.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| $42,000 | $44,000 | $46,000 | |

| $36,000 | $38,000 | $40,000 | |

| $30,000 | $32,000 | $34,000 | |

| $10,800 | $12,000 | $13,500 | |

| $10,800 | $12,000 | $13,500 | |

| $10,800 | $12,000 | $13,500 | |

| $21,600 | $23,000 | $24,500 | |

| $21,600 | $23,000 | $24,500 | |

| $21,600 | $23,000 | $24,500 | |

| 9 | 9 | 9 | |

| $205,200 | |||

The financial plan includes a 5% growth rate for 2004 and does not rely on credit lines to support cash flow. We anticipate average daily sales of over $1,000 throughout the year.

Important Assumptions:

Our financial plan is based on several assumptions, including a slow-growth economy without a major recession, no direct competitors for several years, and access to sufficient equity capital and financing.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| 1 | 2 | 3 | |

| 8.00% | 8.00% | 8.00% | |

| 15.00% | 15.00% | 15.00% | |

| 30.00% | 30.00% | 30.00% | |

| 0 | 0 | 0 | |

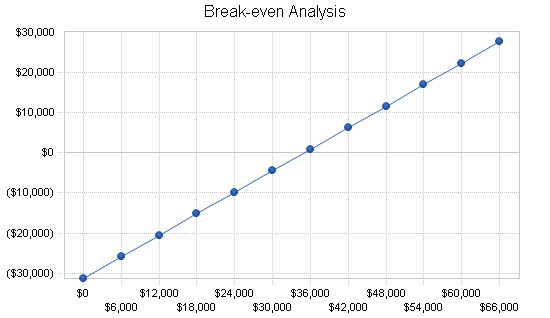

Break-even Analysis:

Our Break-even Analysis is shown below.

Break-even Analysis

Monthly Revenue Break-even: $35,022

Assumptions:

– Average Percent Variable Cost: 11%

– Estimated Monthly Fixed Cost: $31,332

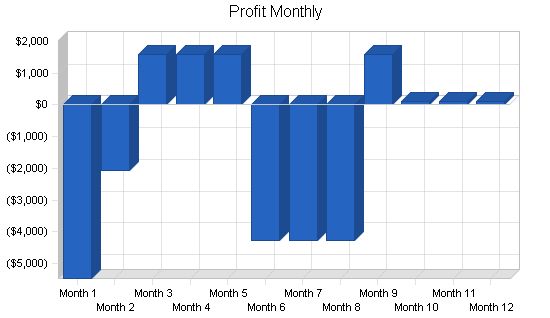

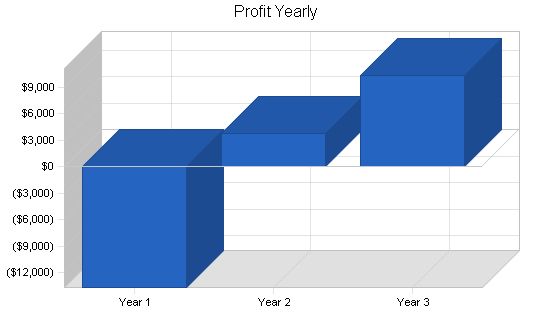

Projected Profit and Loss

The key assumption in the Projected Profit and Loss statement is steady growth into 2006. The increase in gross margin relies on an aggressive marketing approach, which is critical.

Detailed month-by-month assumptions for profit and loss can be found in the appendix.

Pro Forma Profit and Loss:

| Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $405,000 | $467,000 | $515,000 |

| Direct Cost of Sales | $42,680 | $46,840 | $53,100 |

| Other Costs of Goods | $0 | $0 | $0 |

| Total Cost of Sales | $42,680 | $46,840 | $53,100 |

| Gross Margin | $362,320 | $420,160 | $461,900 |

| Gross Margin % | 89.46% | 89.97% | 89.69% |

| Expenses | |||

| Payroll | $205,200 | $219,000 | $234,000 |

| Sales and Marketing and Other Expenses | $50,000 | $60,000 | $65,000 |

| Depreciation | $0 | $0 | $0 |

| Rent | $42,000 | $45,000 | $48,000 |

| Utilities | $12,000 | $14,000 | $14,000 |

| Insurance | $12,000 | $14,000 | $16,000 |

| Payroll Taxes | $30,780 | $32,850 | $35,100 |

| Other | $24,000 | $30,000 | $35,000 |

| Total Operating Expenses | $375,980 | $414,850 | $447,100 |

| Profit Before Interest and Taxes | ($13,660) | $5,310 | $14,800 |

| EBITDA | ($13,660) | $5,310 | $14,800 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $0 | $1,593 | $4,440 |

| Net Profit | ($13,660) | $3,717 | $10,360 |

| Net Profit/Sales | -3.37% | 0.80% | 2.01% |

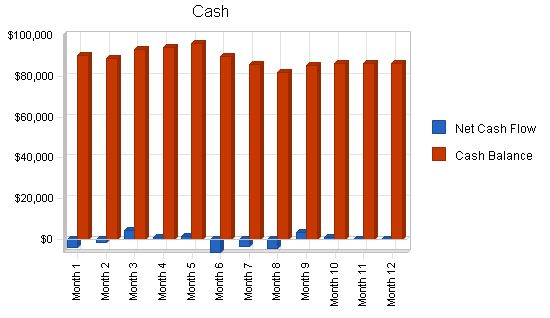

Projected Cash Flow:

8.4 Projected Cash Flow

The following table and chart illustrate McKenzie Roller Rink’s cash flow situation. Cash Flow will be negative for year one as we start up the business and create awareness about our facility. We have planned for this with enough extra cash to keep a positive cash balance.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | – | – | – |

| Cash from Operations | $405,000 | $467,000 | $515,000 |

| Cash Sales | $405,000 | $467,000 | $515,000 |

| Subtotal Cash from Operations | $405,000 | $467,000 | $515,000 |

| Additional Cash Received | – | – | – |

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $405,000 | $467,000 | $515,000 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | – | – | – |

| Cash Spending | $205,200 | $219,000 | $234,000 |

| Bill Payments | $207,429 | $243,718 | $269,060 |

| Subtotal Spent on Operations | $412,629 | $462,718 | $503,060 |

| Additional Cash Spent | – | – | – |

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $412,629 | $462,718 | $503,060 |

| Net Cash Flow | ($7,629) | $4,282 | $11,940 |

| Cash Balance | $86,371 | $90,653 | $102,593 |

8.5 Projected Balance Sheet

The balance sheet is solid. We can meet our debt obligations as long as we achieve our objectives.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $86,371 | $90,653 | $102,593 |

| Inventory | $4,114 | $4,515 | $5,118 |

| Other Current Assets | $2,000 | $2,000 | $2,000 |

| Total Current Assets | $92,485 | $97,168 | $109,711 |

| Long-term Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $92,485 | $97,168 | $109,711 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $19,145 | $20,111 | $22,294 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $19,145 | $20,111 | $22,294 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $19,145 | $20,111 | $22,294 |

| Paid-in Capital | $120,000 | $120,000 | $120,000 |

| Retained Earnings | ($33,000) | ($46,660) | ($42,943) |

| Earnings | ($13,660) | $3,717 | $10,360 |

| Total Capital | $73,340 | $77,057 | $87,417 |

| Total Liabilities and Capital | $92,485 | $97,168 | $109,711 |

| Net Worth | $73,340 | $77,057 | $87,417 |

8.6 Business Ratios

The Business Ratios for this plan are shown below for comparison with the industry profile ratios based on the Standard Industrial Classification (SIC) code 7999, Roller Rinks.

To stay on track, we need to:

- Achieve gross margins at or above 88%.

- Do not rely on credit lines to meet cash requirements.

- Have month-to-month annual comparisons indicating an increase of 5% or greater.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth |

Personnel Plan: Don Jones: 0%, $3,500 per month David Barkley: 0%, $3,000 per month Paul Robins: 0%, $2,500 per month Part Time: 0%, $900 per month (repeated three times) Full Time: 0%, $1,800 per month (repeated three times) Total People: 9 (repeated as a heading) Total Payroll: $17,100 (repeated as a heading) General Assumptions: Plan Month: 1 through 12 Current Interest Rate: 8.00% (repeated twelve times) Long-term Interest Rate: 15.00% (repeated twelve times) Tax Rate: 30.00% (repeated twelve times) Other: 0 (repeated twelve times) Pro Forma Profit and Loss: Sales: $28,000, $31,000, $37,000 (repeated nine times) Direct Cost of Sales: $3,800, $3,400, $3,740 (repeated nine times) Other Costs of Goods: $0 (repeated nine times) Total Cost of Sales: $3,800, $3,400, $3,740 (repeated nine times) Gross Margin: $24,200, $27,600, $33,260 (repeated nine times) Gross Margin %: 86.43%, 89.03%, 89.89% (repeated nine times) Expenses: (repeated as a heading) Payroll: $17,100 (repeated twelve times) Sales and Marketing and Other Expenses: $4,000, $4,500, $3,000, $5,000 (repeated twelve times) Depreciation: $0 (repeated twelve times) Rent: $3,500 (repeated twelve times) Utilities: $1,000 (repeated twelve times) Insurance: $1,000 (repeated twelve times) Payroll Taxes: 15%, $2,565 (repeated twelve times) Other: $500, $2,000, $3,000 (repeated twelve times) Total Operating Expenses: $29,665, $31,665, $30,165, $31,665, $33,165 (repeated nine times) Profit Before Interest and Taxes: ($5,465), ($2,065), $1,595, $95 (repeated twelve times) EBITDA: ($5,465), ($2,065), $1,595, $95 (repeated twelve times) Interest Expense: $0 (repeated twelve times) Taxes Incurred: $0 (repeated twelve times) Net Profit: ($5,465), ($2,065), $1,595, $95 (repeated twelve times) Net Profit/Sales: -19.52%, -6.66%, 4.31%, 0.26% (repeated twelve times) Pro Forma Cash Flow: |

|||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Cash Sales | $28,000 | $31,000 | $37,000 | $37,000 | $37,000 | $29,000 | $29,000 | $29,000 | $37,000 | $37,000 | $37,000 | $37,000 |

| Subtotal Cash from Operations | $28,000 | $31,000 | $37,000 | $37,000 | $37,000 | $29,000 | $29,000 | $29,000 | $37,000 | $37,000 | $37,000 | $37,000 |

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Received | $28,000 | $31,000 | $37,000 | $37,000 | $37,000 | $29,000 | $29,000 | $29,000 | $37,000 | $37,000 | $37,000 | $37,000 |

| Cash Spending | $17,100 | $17,100 | $17,100 | $17,100 | $17,100 | $17,100 | $17,100 | $17,100 | $17,100 | $17,100 | $17,100 | $17,100 |

| Bill Payments | $14,518 | $15,544 | $15,630 | $18,667 | $18,305 | $18,210 | $15,484 | $16,165 | $16,260 | $19,036 | $19,805 | $19,805 |

| Subtotal Spent on Operations | $31,618 | $32,644 | $32,730 | $35,767 | $35,405 | $35,310 | $32,584 | $33,265 | $33,360 | $36,136 | $36,905 | $36,905 |

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Spent | $31,618 | $32,644 | $32,730 | $35,767 | $35,405 | $35,310 | $32,584 | $33,265 | $33,360 | $36,136 | $36,905 | $36,905 |

| Net Cash Flow | ($3,618) | ($1,644) | $4,270 | $1,233 | $1,595 | ($6,310) | ($3,584) | ($4,265) | $3,640 | $864 | $95 | $95 |

| Cash Balance | $90,382 | $88,738 | $93,007 | $94,241 | $95,836 | $89,526 | $85,941 | $81,676 | $85,316 | $86,181 | $86,276 | $86,371 |

Pro Forma Balance Sheet:

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 |

| $90,382 | $88,738 | $93,007 | $94,241 | $95,836 | $89,526 | $85,941 | $81,676 | $85,316 | $86,181 | $86,276 | $86,371 |

Business Plan Outline

- Executive Summary

- Company Summary

- Products and Services

- Market Analysis Summary

- Strategy and Implementation Summary

- Web Plan Summary

- Management Summary

- Financial Plan

- Appendix

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!