Mixed Greens Salad Gardens (MGSG) is a new company meeting a need for quality salad greens. Located near Eugene, MGSG attracts a steady flow of customers. They grow and distribute exotic salad greens to restaurants and individual consumers in Blue River, Oregon, serving the southern Willamette Valley. MGSG aims to exceed customer expectations, increase production efficiency by 10% annually, and develop a sustainable farm business.

MGSG sells a spring mix of salad field greens, including red leaf, arugula, radicchio, mustard greens, endive, and chicory. These greens are used in salad mixtures purchased by end consumers and restaurants.

MGSG targets two markets: individual customers and restaurants. Individual customers can purchase greens from MGSG at the Tuesday and Saturday Farmer’s Markets. This segment has 12,000 potential customers and is growing at 12%. The second market, local restaurants, has 28 potential customers and consistent demand throughout the year.

MGSG’s competitive edge lies in quality and flexibility. Only high-quality greens are accepted, while imperfect greens go to a not-for-profit food bank. The farm is designed for easy crop changes and scaling to meet demand.

MGSG is led by Heidi Ponic, who gained experience in growing at a greenhouse and a grass seed company before enrolling in Oregon State University’s Master of Horticulture Program. Her master’s degree equipped her with the skills needed to develop her own farm business.

1.1 Objectives

The objectives for the first three years of operation include:

– Create a product-based company that exceeds customers’ expectations.

– Use Mixed Greens’ lettuce products in at least 20% of Eugene’s top restaurants.

– Increase production efficiency by 10% annually.

– Develop a sustainable farm that relies on its own cash flow.

1.2 Mission

Mixed Greens Salad Gardens’ mission is to provide high-quality salad greens. We exist to attract and retain customers. By adhering to this maxim, everything else will fall into place. Our services will exceed customer expectations.

Mixed Greens Salad Gardens, located in Blue River, OR, grows and sells exotic field greens. We offer a wide variety of greens, including red leaf, arugula, radicchio, mustard greens, endive, and chicory. We sell our greens at farmer’s markets and directly to restaurants.

The business will be based at Heidi Ponic’s home, with the office and greenhouse located on her adjoining 20 acres of land.

2.1 Company Ownership

Mixed Greens Salad Gardens is a sole proprietorship owned by Heidi Ponic. Heidi will fund the business with a $50,000 investment. Family member O.G. Tylthe will also invest $10,000, with an exit/repayment scheduled for year five.

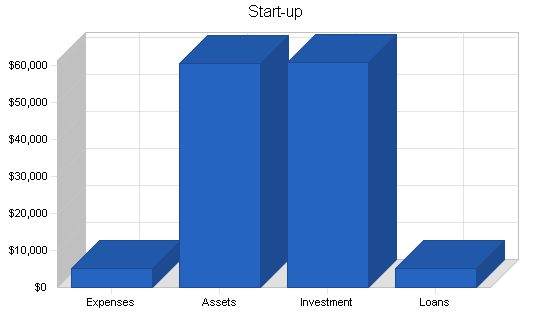

2.2 Start-up Summary

Mixed Greens Salad Gardens’ start-up costs will include the necessary equipment for the home-based office, the construction of the greenhouse, and other essentials for growing.

The home office equipment will be the largest expense, including a computer system, fax machine, office supplies, cellular phone, and pager. The computer should have a 500 megahertz Celeron/Pentium processor, 64 megabytes of RAM (preferably 128), 6 gigabyte hard drive, and a rewritable CD-ROM for backup. The office will also require furniture, including a desk, chair, and bookshelf, to transform a standard room into an office. An additional landline will be required.

The greenhouse will require a 25′ x 100′ poly carbonate structure, a ventilation system, a heater, a mister system, supplemental lighting, a fertilizer injector, pruners, pots, trays, soil, seeds, and chemicals.

Please note that $20,000 of the $25,300 long-term assets will be depreciated straight-line over 27.5 years (real estate), while the remaining $5,300 will be depreciated over a seven-year straight-line schedule.

Start-up:

Requirements

Expenses

Legal: $300

Stationery: $200

Insurance: $200

Utilities Upgrades: $150

Rent: $250

Expensed Computer Equipment: $3,500

Other: $500

Total Start-up Expenses: $5,100

Assets:

Cash Required: $34,700

Start-up Inventory: $0

Other Current Assets: $500

Long-term Assets: $25,300

Total Assets: $60,500

Funding:

Start-up Expenses to Fund: $5,100

Start-up Assets to Fund: $60,500

Total Funding Required: $65,600

Non-cash Assets from Start-up: $25,800

Cash Requirements from Start-up: $34,700

Additional Cash Raised: $0

Cash Balance on Starting Date: $34,700

Total Assets: $60,500

Liabilities and Capital:

Liabilities

Current Borrowing: $5,000

Long-term Liabilities: $0

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $5,000

Capital:

Planned Investment

Heidi Ponic: $50,000

Investor 2: $10,000

Other: $0

Additional Investment Requirement: $600

Total Planned Investment: $60,600

Loss at Start-up (Start-up Expenses): ($5,100)

Total Capital: $55,500

Total Capital and Liabilities: $60,500

Total Funding: $65,600

Products:

MGSG sells a spring mix of salad field greens including red leaf, arugula, radicchio, mustard greens, endive, and chicory. These greens are used in salad mixtures purchased by consumers and restaurants. While the greens are washed at the farm, they are not certified washed and patrons are advised to wash them before use.

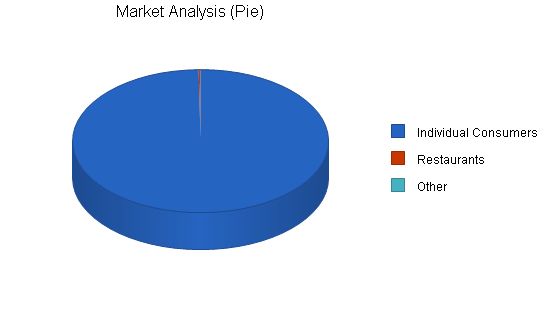

Market Analysis Summary:

MGSG targets two types of customers: individual consumers and restaurants. The consumer market is seasonal, so during the off-season, all production is allocated to wholesale restaurant distribution. In spring and summer, MGSG serves both the consumer market through farmer market stands and the restaurants through direct distribution.

Market Segmentation:

Mixed Greens Salad Gardens has two types of customers:

1. Individual Consumers: These are people who appreciate healthier and tastier alternatives to iceberg lettuce. They are more likely to cook at home, enjoy fine dining, and belong to a higher socio-economic class.

Market Analysis:

Individual Customers – 12% Growth

Year 1: 12,000

Year 2: 13,440

Year 3: 15,053

Year 4: 16,859

Year 5: 18,882

CAGR: 12.00%

Restaurants – 8% Growth

Year 1: 28

Year 2: 30

Year 3: 32

Year 4: 35

Year 5: 38

CAGR: 7.93%

Other – 0% Growth

Year 1: 0

Year 2: 0

Year 3: 0

Year 4: 0

Year 5: 0

CAGR: 0.00%

Total – 11.99% Growth

Year 1: 12,028

Year 2: 13,470

Year 3: 15,085

Year 4: 16,894

Year 5: 18,920

CAGR: 11.99%

4.2 Target Market Segment Strategy

Mixed Greens Salad Gardens’ target market segment strategy is fairly easy. Our two customer groups purchase from distinct locations, making it easy to target them individually.

Individuals: These customers buy MGSG products from different farmer markets in Eugene, OR. The main one is “The Farmers Market,” held downtown twice a week in the spring, summer, and early autumn. Additionally, there are smaller farmer markets in outlining communities. Setting up a booth in these markets provides a steady flow of interested customers, including some restaurants who go there for certain ingredients.

Restaurants: MGSG will target these customers by introducing MGSG and their products to the restaurants through meetings with the buyers. Eugene has about 25-30 restaurants that use field greens in their salads, and MGSG aims to form long-term relationships with them.

MGSG faces three types of competitors:

Supermarkets: These stores sell salad greens mix to consumers. They offer convenience but have lower quality and variety compared to MGSG and local farmers. Their prices are usually 15% higher.

Buying patterns are based on customer desires. Lower-end restaurants and individuals who are less concerned about quality prefer buying greens from supermarkets. Others appreciate the difference in quality and visit the farmers market regularly.

Strategy and Implementation Summary

MGSG will aggressively court farmer markets to secure booth space. They will also pursue local restaurants with consistent greens needs, providing top-notch service to build long-term relationships.

5.1 Competitive Edge

Mixed Greens Salad Gardens’ competitive edge lies in quality and flexibility. Heidi’s extensive educational background and practical experience enable her to create a superior product. MGSG’s commitment to perfection distinguishes them from the competition.

A combination of quality and flexibility provides a sustainable competitive advantage for MGSG.

To develop effective business strategies, perform a SWOT analysis of your business. Learn how to perform a SWOT analysis with our free guide and template.

5.2 Sales Strategy

MGSG’s sales strategy focuses on visibility, consistency, and strategic relationships.

Visibility: MGSG will generate visibility by creating a colorful and distinct booth that stands out among other farmers. This will increase recognition and make it easier for repeat customers to identify MGSG’s product.

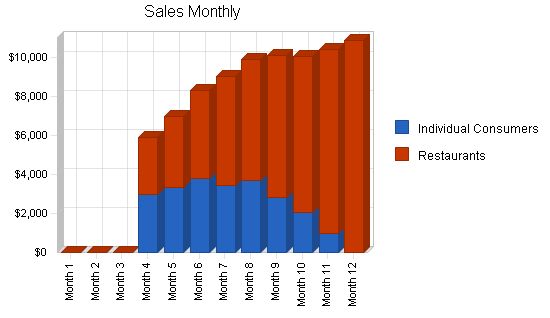

5.2.1 Sales Forecast

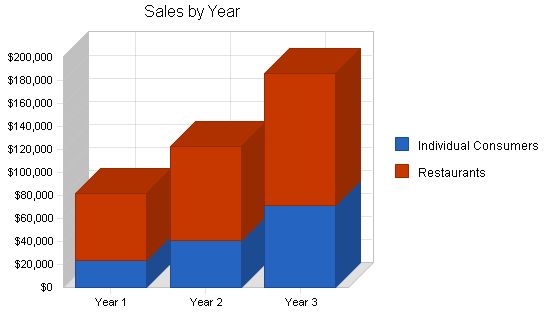

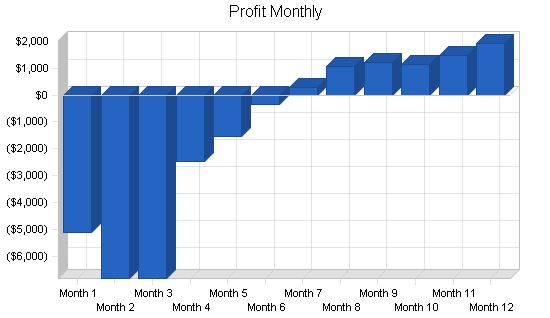

The first month will involve setting up the greenhouse. Sales activity will begin in month three when the first greens are ready. Sales and production will steadily increase until month nine, when consumer sales will decrease due to the closing of farmer markets. From month nine to 16, MGSG will see an increase in restaurant sales to compensate for the decline in consumer sales. By month 17, restaurant sales will slightly decrease to accommodate the ramping up of consumer sales.

Sales Forecast:

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Individual Consumers | $23,154 | $40,519 | $70,908 |

| Restaurants | $58,558 | $81,981 | $114,774 |

| Total Sales | $81,712 | $122,500 | $185,682 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Individual Consumers | $2,778 | $4,862 | $8,509 |

| Restaurants | $7,027 | $9,838 | $13,773 |

| Subtotal Direct Cost of Sales | $9,805 | $14,700 | $22,282 |

5.3 Milestones

MGSG will have several milestones early on:

- Business plan completion. This will be done as a road map for the organization. While we do not need a business plan to raise capital, it will be an indispensable tool for the ongoing performance and improvement of the company.

- Greenhouse set-up.

- First batch of greens sold.

- The end of the consumer season and the ramping up of the restaurant supply cycle.

Milestones:

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business Plan Completion | 1/1/2001 | 1/1/2001 | $0 | Heidi | N/A |

| Greenhouse Setup | 1/1/2001 | 2/1/2001 | $0 | Heidi | N/A |

| First Batch of Greens Sold | 4/1/2001 | 4/1/2001 | $0 | everyone | N/A |

| End of the Consumer Season and the Ramping up of the Restaurant Supply Cycle | 9/1/2001 | 9/1/2001 | $0 | everyone | N/A |

| Totals | $0 | ||||

Management Summary

Heidi Ponic, founder and owner, first became interested in growing vegetables at the age of five. Heidi pursued her love for plants by obtaining a biology degree at the University of Washington. Throughout her last three years at Washington, she worked in a greenhouse that grew many different types of annuals. Upon graduation, Heidi went to work for a large grass seed manufacturer. Although the growing of grass seed proved to be far less interesting than most other plants, she was determined to get management experience, a skill set that she lacked. After two years at Willamette Seed Company, she enrolled in Oregon State University’s Master of Horticulture program.

Having gone through the three years of the Master’s program, she realized two things: she needed to create a job/company for herself, and she should follow her passion and grow vegetables. These realizations were the final catalyst to pursue her lifelong dream of running her own greenhouse operation.

Heidi’s educational training and her passion create the ideal combination for an owner of a start-up company.

6.1 Personnel Plan

The staff will consist of Heidi working full time. While Heidi will spend most of her time managing the operation, she will also spend a few hours a week tending to the plants. In addition to the general management required for the production of the greens, Heidi will be setting up strategic relationships with local restaurants. Mixed Greens Salad Gardens will hire two full-time gardeners beginning in the middle of the first month and will hire a part-time helper by month four. The gardeners will be primarily responsible for raising the field greens, while the part-time help will assist in staffing the farmers market booth for the consumer selling of the greens.

Personnel Plan:

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Heidi | $24,000 | $24,000 | $24,000 |

| Gardener | $16,650 | $17,500 | $18,500 |

| Gardener | $16,650 | $17,500 | $18,500 |

| Part-time Helper | $0 | $9,000 | $9,500 |

| Part-time Helper | $6,750 | $0 | $9,000 |

| Total People | 4 | 5 | 6 |

| Total Payroll | $64,050 | $68,000 | $79,500 |

The following sections outline important financial information.

7.1 Important Assumptions

The following table highlights some important financial assumptions.

General Assumptions:

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 25.42% | 25.00% | 25.42% |

| Other | 0 | 0 | 0 |

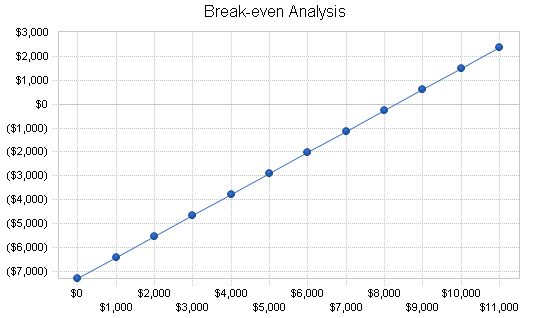

7.2 Break-even Analysis

The Break-even Analysis below indicates the monthly sales needed to break even.

Break-even Analysis

Monthly Revenue Break-even: $8,294

Assumptions:

– Average Percent Variable Cost: 12%

– Estimated Monthly Fixed Cost: $7,299

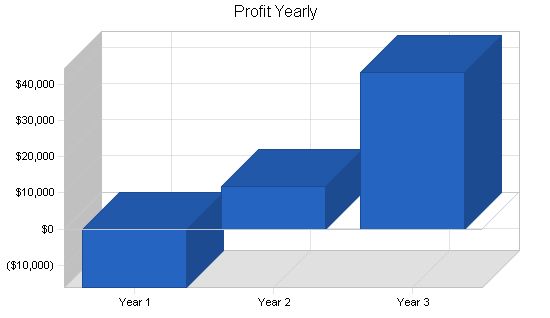

7.3 Projected Profit and Loss

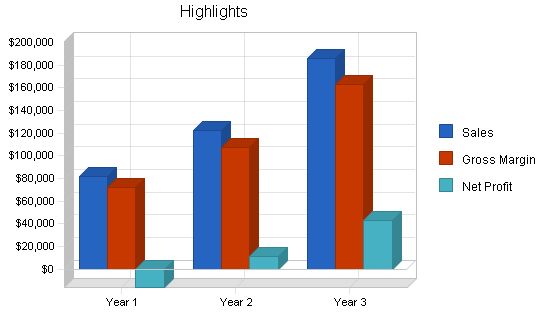

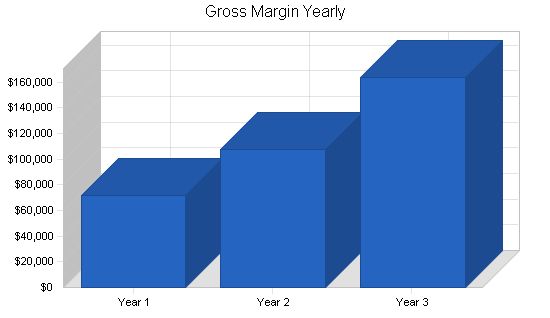

The following table shows the projected profit and loss. Our losses are evident at start-up, but we become profitable in July.

Pro Forma Profit and Loss

Year 1 Year 2 Year 3

Sales $81,712 $122,500 $185,682

Direct Cost of Sales $9,805 $14,700 $22,282

Other $0 $0 $0

Total Cost of Sales $9,805 $14,700 $22,282

Gross Margin $71,906 $107,800 $163,400

Gross Margin % 88.00% 88.00% 88.00%

Expenses

Payroll $64,050 $68,000 $79,500

Sales and Marketing

and Other Expenses $0 $0 $0

Depreciation $2,532 $2,532 $2,532

Leased Equipment $0 $0 $0

Utilities $3,000 $3,000 $3,000

Insurance $2,400 $2,400 $2,400

Rent $6,000 $6,000 $6,000

Payroll Taxes $9,608 $10,200 $11,925

Other $0 $0 $0

Total Operating Expenses $87,590 $92,132 $105,357

Profit Before Interest and Taxes ($15,683) $15,668 $58,043

EBITDA ($13,151) $18,200 $60,575

Interest Expense $370 $140 ($20)

Taxes Incurred $0 $3,882 $14,758

Net Profit ($16,053) $11,646 $43,305

Net Profit/Sales -19.65% 9.51% 23.32%

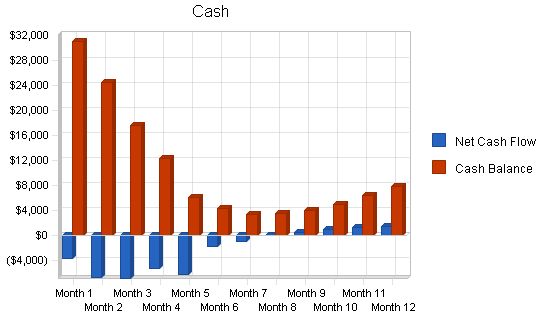

7.4 Projected Cash Flow

The following chart and table show the projected cash flow.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $32,685 | $49,000 | $74,273 |

| Cash from Receivables | $36,451 | $67,222 | $101,685 |

| Subtotal Cash from Operations | $69,136 | $116,223 | $175,958 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $69,136 | $116,223 | $175,958 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $64,050 | $68,000 | $79,500 |

| Bill Payments | $29,537 | $40,751 | $59,778 |

| Subtotal Spent on Operations | $93,587 | $108,751 | $139,278 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $2,400 | $2,400 | $800 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $95,987 | $111,151 | $140,078 |

| Net Cash Flow | ($26,851) | $5,072 | $35,879 |

| Cash Balance | $7,849 | $12,920 | $48,800 |

7.5 Projected Balance Sheet

The following table indicates the projected balance sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $7,849 | $12,920 | $48,800 |

| Accounts Receivable | $12,576 | $18,854 | $28,578 |

| Inventory | $1,438 | $2,156 | $3,268 |

| Other Current Assets | $500 | $500 | $500 |

| Total Current Assets | $22,363 | $34,430 | $81,145 |

| Long-term Assets | |||

| Long-term Assets | $25,300 | $25,300 | $25,300 |

| Accumulated Depreciation | $2,532 | $5,064 | $7,596 |

| Total Long-term Assets | $22,768 | $20,236 | $17,704 |

| Total Assets | $45,131 | $54,666 | $98,849 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $3,084 | $3,373 | $5,051 |

| Current Borrowing | $2,600 | $200 | ($600) |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $5,684 | $3,573 | $4,451 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $5,684 | $3,573 | $4,451 |

| Paid-in Capital | $60,600 | $60,600 | $60,600 |

| Retained Earnings | ($5,100) | ($21,153) | ($9,507) |

| Earnings | ($16,053) | $11,646 | $43,305 |

| Total Capital | $39,447 | $51,093 | $94,398 |

| Total Liabilities and Capital | $45,131 | $54,666 | $98,849 |

| Net Worth | $39,447 | $51,093 | $94,398 |

7.6 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the SIC code 0161, Lettuce Farms, as part of Vegetables and Melons, Not Elsewhere Classified, are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 49.92% | 51.58% | -4.60% |

| Percent of Total Assets | ||||

| Accounts Receivable | 27.87% | 34.49% | 28.91% | 12.90% |

| Inventory | 3.19% | 3.94% | 3.31% | 14.40% |

| Other Current Assets | 1.11% | 0.91% | 0.51% | 28.90% |

| Total Current Assets | 49.55% | 62.98% | 82.09% | 56.20% |

| Long-term Assets | 50.45% | 37.02% | 17.91% | 43 |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Heidi | 0% | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 |

| Gardener | 0% | $700 | $1,450 | $1,450 | $1,450 | $1,450 | $1,450 | $1,450 | $1,450 | $1,450 | $1,450 | $1,450 | $1,450 |

| Gardener | 0% | $700 | $1,450 | $1,450 | $1,450 | $1,450 | $1,450 | $1,450 | $1,450 | $1,450 | $1,450 | $1,450 | $1,450 |

| Part-time Helper | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Part-time Helper | 0% | $0 | $0 | $0 | $750 | $750 | $750 | $750 | $750 | $750 | $750 | $750 | $750 |

| Total People | 0 | 3 | 3 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | |

| Total Payroll | $3,400 | $4,900 | $4,900 | $5,650 | $5,650 | $5,650 | $5,650 | $5,650 | $5,650 | $5,650 | $5,650 | $5,650 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

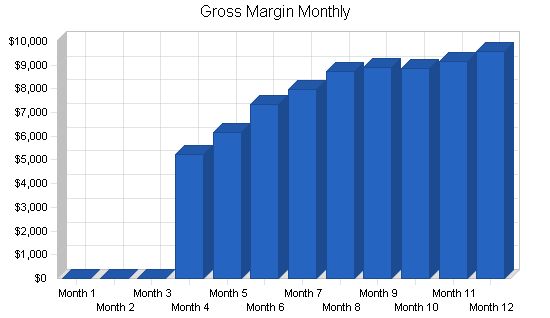

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $0 | $0 | $0 | $5,930 | $7,008 | $8,334 | $9,046 | $9,932 | $10,105 | $10,050 | $10,412 | $10,895 | |

| Direct Cost of Sales | $0 | $0 | $0 | $712 | $841 | $1,000 | $1,086 | $1,192 | $1,213 | $1,206 | $1,249 | $1,307 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $0 | $0 | $0 | $712 | $841 | $1,000 | $1,086 | $1,192 | $1,213 | $1,206 | $1,249 | $1,307 | |

| Gross Margin | $0 | $0 | $0 | $5,218 | $6,167 | $7,334 | $7,960 | $8,740 | $8,892 | $8,844 | $9,163 | $9,588 | |

| Gross Margin % | 0.00% | 0.00% | 0.00% | 88.00% | 88.00% | 88.00% | 88.00% | 88.00% | 88.00% | 88.00% | 88.00% | 88.00% | |

| Expenses | |||||||||||||

| Payroll | $3,

Pro Forma Cash Flow: Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 — | — | — | — | — | — | — | — | — | — | — | — Cash Received | | | | | | | | | | || Cash from Operations | | | | | | | | | | || Cash Sales | | $0 | $0 | $0 | $2,372 | $2,803 | $3,334 | $3,618 | $3,973 | $4,042 | $4,020 | $4,165 | $4,358 Cash from Receivables | | $0 | $0 | $0 | $0 | $119 | $3,579 | $4,231 | $5,015 | $5,445 | $5,963 | $6,062 | $6,037 Subtotal Cash from Operations | | $0 | $0 | $0 | $2,372 | $2,922 | $6,913 | $7,850 | $8,987 | $9,487 | $9,983 | $10,227 | $10,395 Additional Cash Received | | | | | | | | | | || Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 New Current Borrowing | | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 New Other Liabilities (interest-free) | | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 New Long-term Liabilities | | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 Sales of Other Current Assets | | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 Sales of Long-term Assets | | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 New Investment Received | | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 Subtotal Cash Received | | $0 | $0 | $0 | $2,372 | $2,922 | $6,913 | $7,850 | $8,987 | $9,487 | $9,983 | $10,227 | $10,395 Expenditures | | | | | | | | | | || Expenditures from Operations | | | | | | | | | | || Cash Spending | | $3,400 | $4,900 | $4,900 | $5,650 | $5,650 | $5,650 | $5,650 | $5,650 | $5,650 | $5,650 | $5,650 | $5,650 Bill Payments | | $50 | $1,507 | $1,723 | $1,775 | $3,310 | $2,836 | $2,988 | $3,011 | $3,132 | $3,058 | $3,024 | $3,120 Subtotal Spent on Operations | | $3,450 | $6,407 | $6,623 | $7,425 | $8,960 | $8,486 | $8,638 | $8,661 | $8,782 | $8,708 | $8,674 | $8,770 Additional Cash Spent | | | | | | | | | | || Sales Tax, VAT, HST/GST Paid Out | | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $ |

||||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!